What a week it has been! Since our last post, BTC continues to hold above the key 36k level while ETH rallied past 1900 to 2100 overnight.

ETH's outperformance over BTC overnight can be attributed to Blackrock's 19b-4 filing with NASDAQ for an Ethereum Trust, which will herald Blackrock's filing for a spot ETH ETF in the near future. We expected a similar playbook to when Blackrock first submitted an application for a spot BTC ETF.

There has been a flurry of activity across numerous venues as participants continue to bet on the spot BTC ETF approval, as well as fear of missing out (FOMO) starting to kick in.

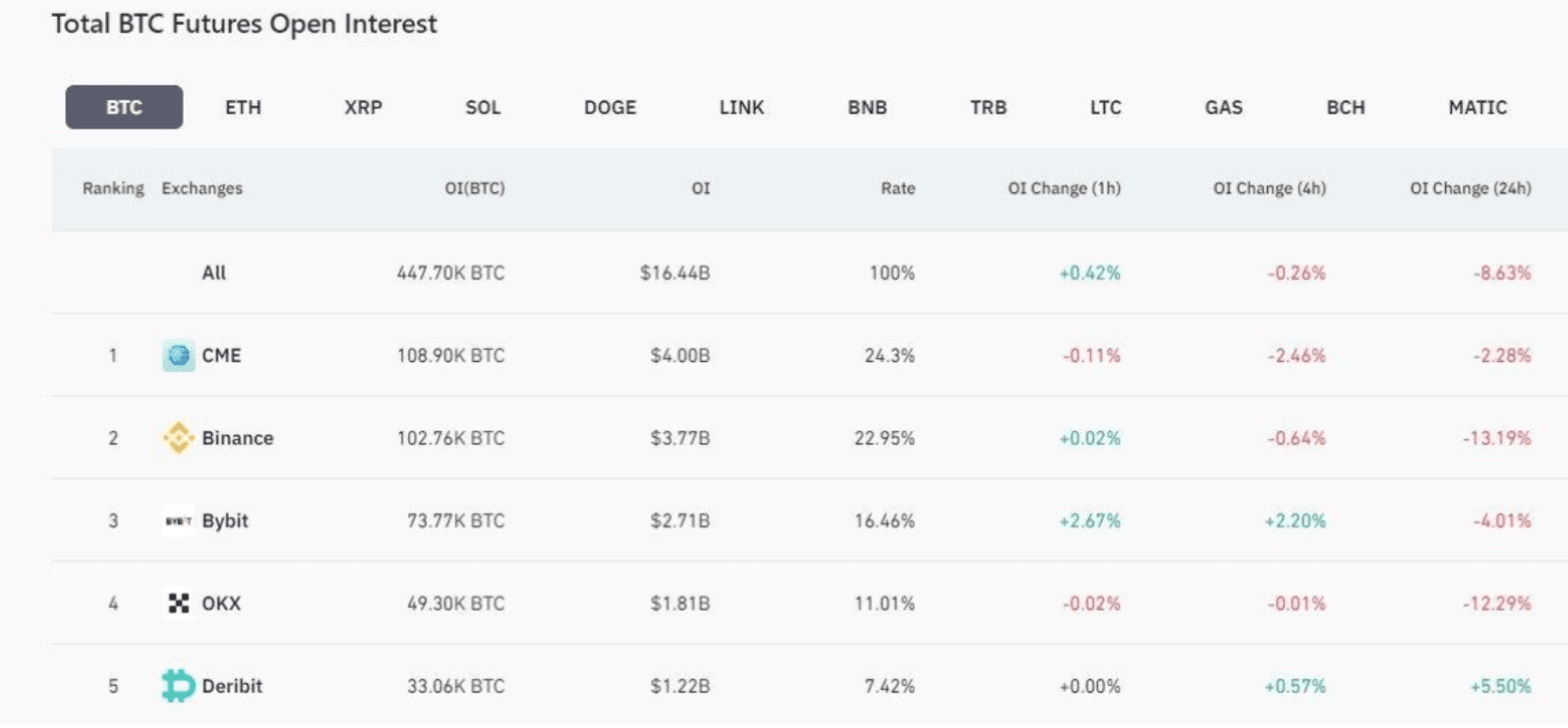

BTC futures open interest on CME has overtaken Binance, a sign that institutions are serious about getting their feet wet and are betting on a potential spot ETF approval (Chart 1).

Perp funding continues to be elevated, while term forwards and risk reversals continued their grind higher throughout the week.

While we expect the approval for a spot BTC ETF to be delayed till Jan 2024, a new narrative surrounding a spot ETH ETF should be enough fuel for animal spirits to take hold once again with crypto prices steadily grinding higher towards the end of the year.

Macro developments have also been supportive of risk assets. Job data in the US has for the longest time pointed to a strong US economy, whilst soft data has alluded otherwise. November's NFP print however, was not only lower, but even came below consensus!

With the macro picture now turning slightly rosier in the short term as rate pause expectations are firmly in place, we expect crypto prices to stay supported. Dips will be swiftly bought into as FOMO traders try to get onto the train.

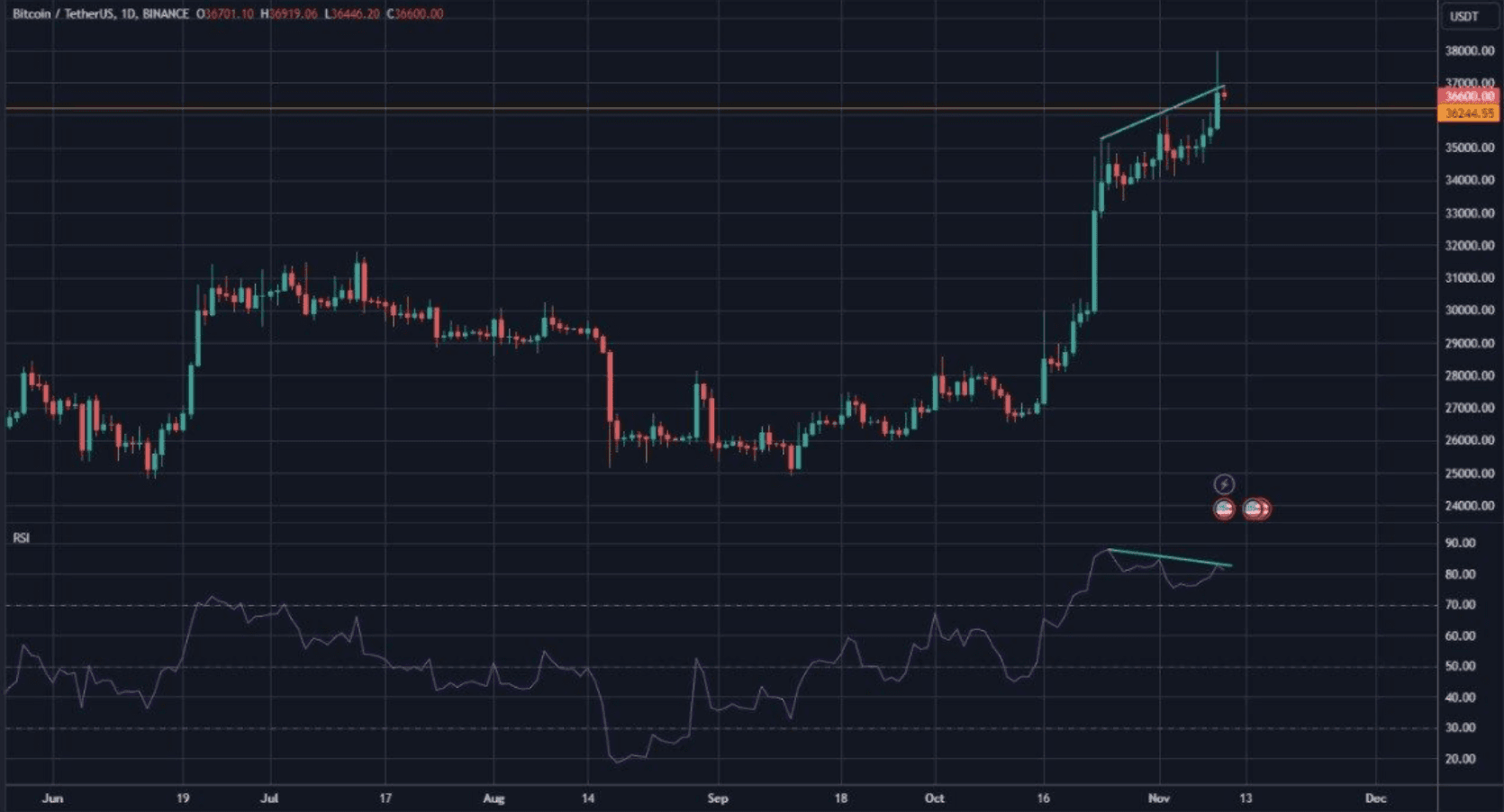

However, caution is still warranted as we are at crucial resistance levels, and BTC is printing a triple bear divergence with the RSI which has been a reliable signal for momentum stalling (Chart 2).