We are into the final quarter of the year, and crypto markets have taken off like a rocket. In the past 2 weeks, BTC has rallied 15% and up a staggering 9% in the last 3 days!

This comes after a lackluster Q3 (-12% in BTC), which coincided with this year’s Supermoon cycle (from a high of 31,500 at the start of the 3-month cycle on 4 Jul, we ended the cycle last week near the lows at 26,500).

Does this strong bounce mark the start of the long awaited Q4 rally?

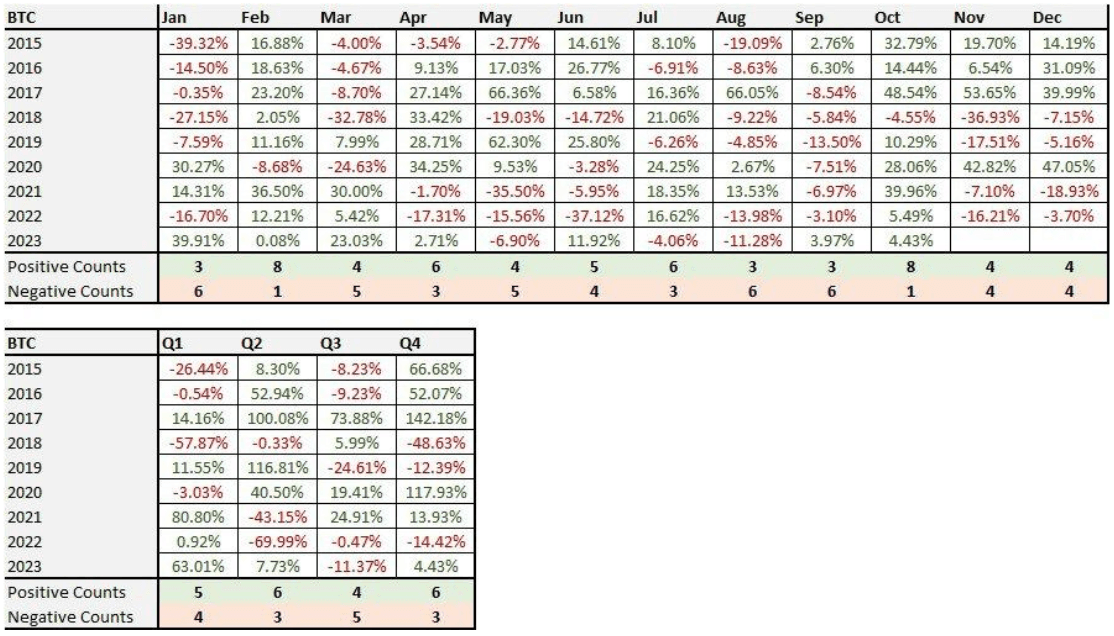

Seasonality would argue YES - October is the strongest month on record for BTC, even though Q4 overall has mixed results (Chart 1).

However, we are not fully convinced by this move, and we think that BTC might test super key 25k support sometime in the final quarter of 2023. Four reasons why:

This aggressive bounce has been due almost entirely to exogenous factors thus far and might not have the momentum to sustain.

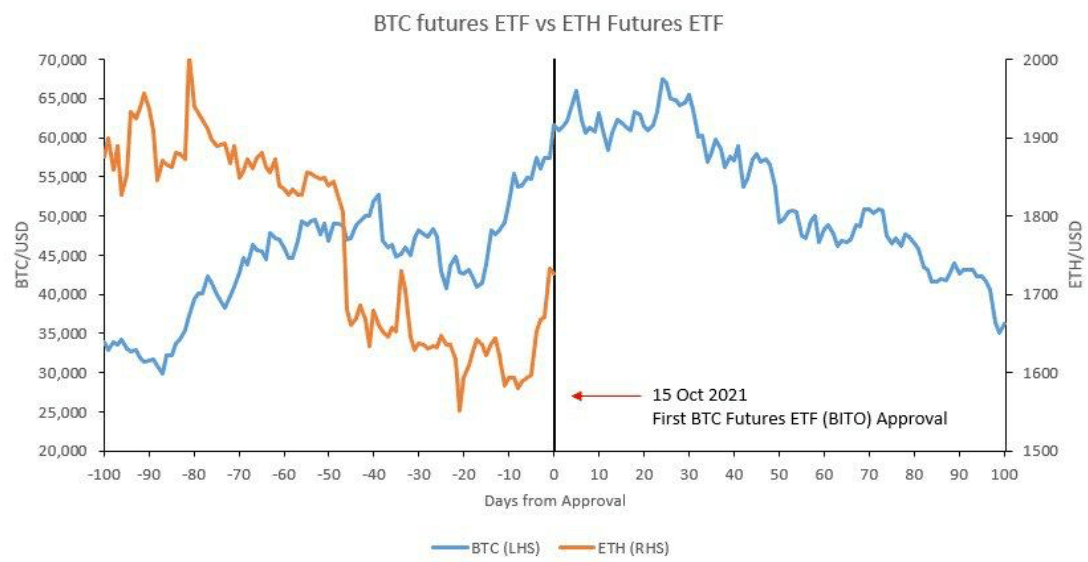

It began with excitement over the impending SEC approvals for the first ETH futures ETFs, then the lower than expected core PCE inflation, and finally the (literally) eleventh hour continuing resolution (CR) deal over the weekend that keeps the US government open 45 more days to Nov 17.In relation to the ETH futures ETF - we all remember full well that after much anticipation for the BTC futures ETF 2 years ago, the launch marked an all-time high in BTC of 69k roughly 25 days after the SEC approval and within the same month ETF trading began! (Chart 2)

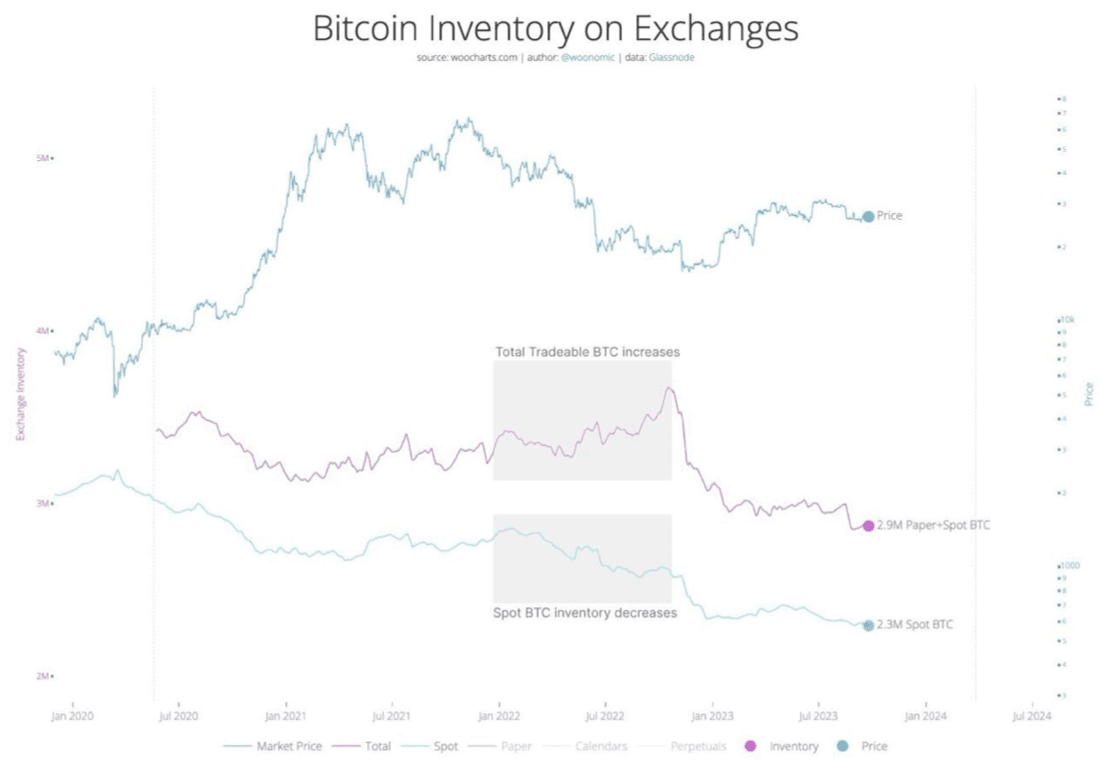

There is good reason for this. As prominent on-chain analysts have pointed out, a futures ETF can merely result in synthetic coin being added without an actual impact on spot supply (Chart 3). Source: Chart 2We would even go further to say a futures-only ETF is arguably detrimental to spot price - as it potentially directs demand away from the spot market into a synthetic market.

Source: Chart 2We would even go further to say a futures-only ETF is arguably detrimental to spot price - as it potentially directs demand away from the spot market into a synthetic market. Source: Chart 3

Source: Chart 3While the deal to keep the government open is headline positive in the very near-term, a CR is ironically medium-term bearish as it merely kicks the can (45 days), but at a very high goodwill cost for the chief negotiators on each side.

We would argue that shutting down the government would have been better medium-term for markets, as we set a tradeable low on shutdown headlines.

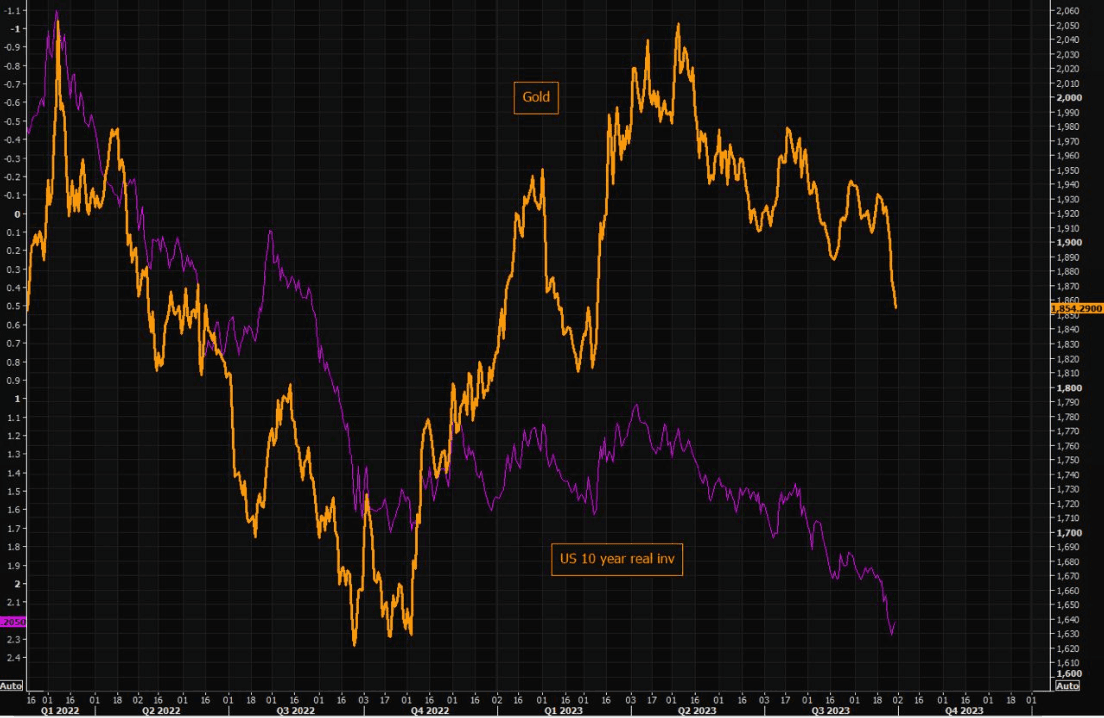

Historically there have been 5 government shutdowns since 1995 and the S&P 500 traded positive during each one with an average return of 3.2%. In the most recent shutdown, which was the longest in the last 30 years, equities traded more than 10% higher by the end.We think the real market leaders are Real yields and Gold (Chart 4). If this deal re-ignites the upward move in real yields again, then there will be much more pain for risk markets to the downside. A break of 14,500 in Nasdaq or 4250 in S&P 500 will be a move that BTC cannot ignore.

We are taking advantage of this rally to buy downside hedges. We expect the 29-30k resistance to hold on the topside, and with front-end vols still trading in the low 30s, it provides cheap optionality for any sharp downside reversal move.