This was a hawkish meeting, there's no 2 ways about it.

While volume crushing fatigue has set in as the Christmas/New year interval approaches, markets will no doubt have to react to this in a bearish way - either with a slow bleed into year-end, or with another January/Q1 sell-off like we saw this year.

The hawkishness came not from Powell, but from the unprecedented consensus within the committee towards getting rates above 5% and holding it there for all of 2023.

This means that while Powell's press conference might have had dovish undertones, such as an implicit endorsement of a possible 25bp hike the next time they meet in February, we’re watching out for every other FOMC member now pushing back against this 2-month rally, which threatens to upend their resolve in tightening financial conditions.

To that end, we have now seen crude oil up 10% and natural gas up 30% from the early Dec lows. Remember energy disinflation was a big driver of the headline CPI slowdown - so any further MoM rally will be a big negative, especially as the winter season begins.

Misled Inflation Optimism?

One thing we would like to point out that markets are missing is the 2023 CPI weight update next month.

"Effective with the February 2023 release of CPI data for January 2023, BLS will update weights annually for the Consumer Price Index based on a single calendar year of data, using consumer expenditure data from 2021."

As we've been writing, there has been a giant inflation tug-of-war between goods and services, and this weight change will tip the balance even more in favour of services.

Context of this weight shift being that the prior biannual weight change reflected a stark shift towards goods during the pandemic as services were all closed. Following over a year of full reopening, spending patterns have shifted back to services, and the CPI weights need to reflect this.

The only reason markets are so sanguine about the FOMC's rate forecast is because they are certain the Fed have got it wrong again - this time in underestimating the magnitude of the inflation slowdown.

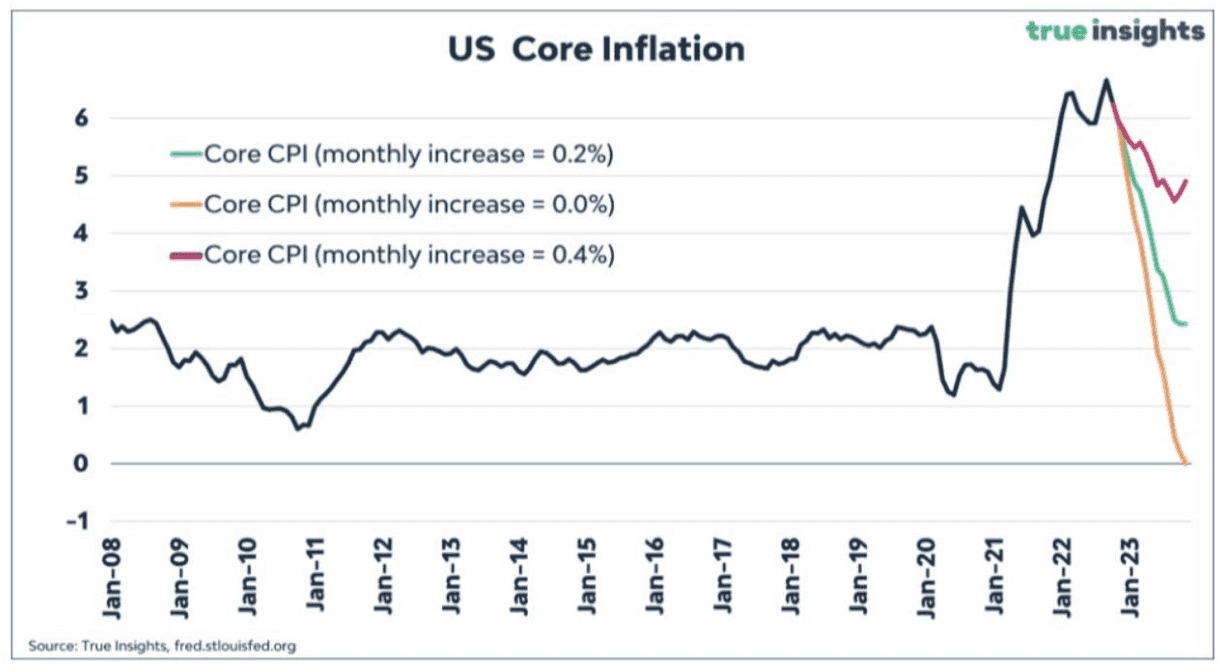

After all, even a constant 0.2% MoM increase in Core CPI for the next year will bring us to ~3% by next year-end (Chart 1).

Our issue though is that this pace will still be too slow for the FOMC's liking, and even for signalling effects, they will want to have positive real rates by Q2, which means nominal rates above 5% by Q1, even if the inflation track is indeed downward.

Dates to Mark

The upcoming macro dates to mark in the upcoming calendar until the next FOMC therefore are all the inflation releases. Thanks to the Fed, whatever we're trading now, we're just trading inflation (and wage) prints.

23 Dec - Nov Core PCE (Fed's preferred inflation indicator) 3 Jan - ISM Manufacturing (2nd tier data but 1st big release of the year - Prices paid component) 4 Jan - FOMC Dec Meeting Minutes 5 Jan - NFP (Avg hourly earnings focus) 12 Jan - Dec CPI 13 Jan - U.Mich Inflation expectations (2nd tier) 18 Jan - PPI 26 Jan - Q4 GDP 27 Jan - Dec Core PCE 1 Feb - FOMC Rate Decision (without projections) 3 Feb - NFP (Avg hourly earnings focus)

Macro Markets

In last night's last quadruple witching of the year - we had the 2nd largest options expiry of all time with over $4 trillion worth of options rolling off!

This means after the close of this gamma window, things will really start to move, and we are wary that it will be to the downside.

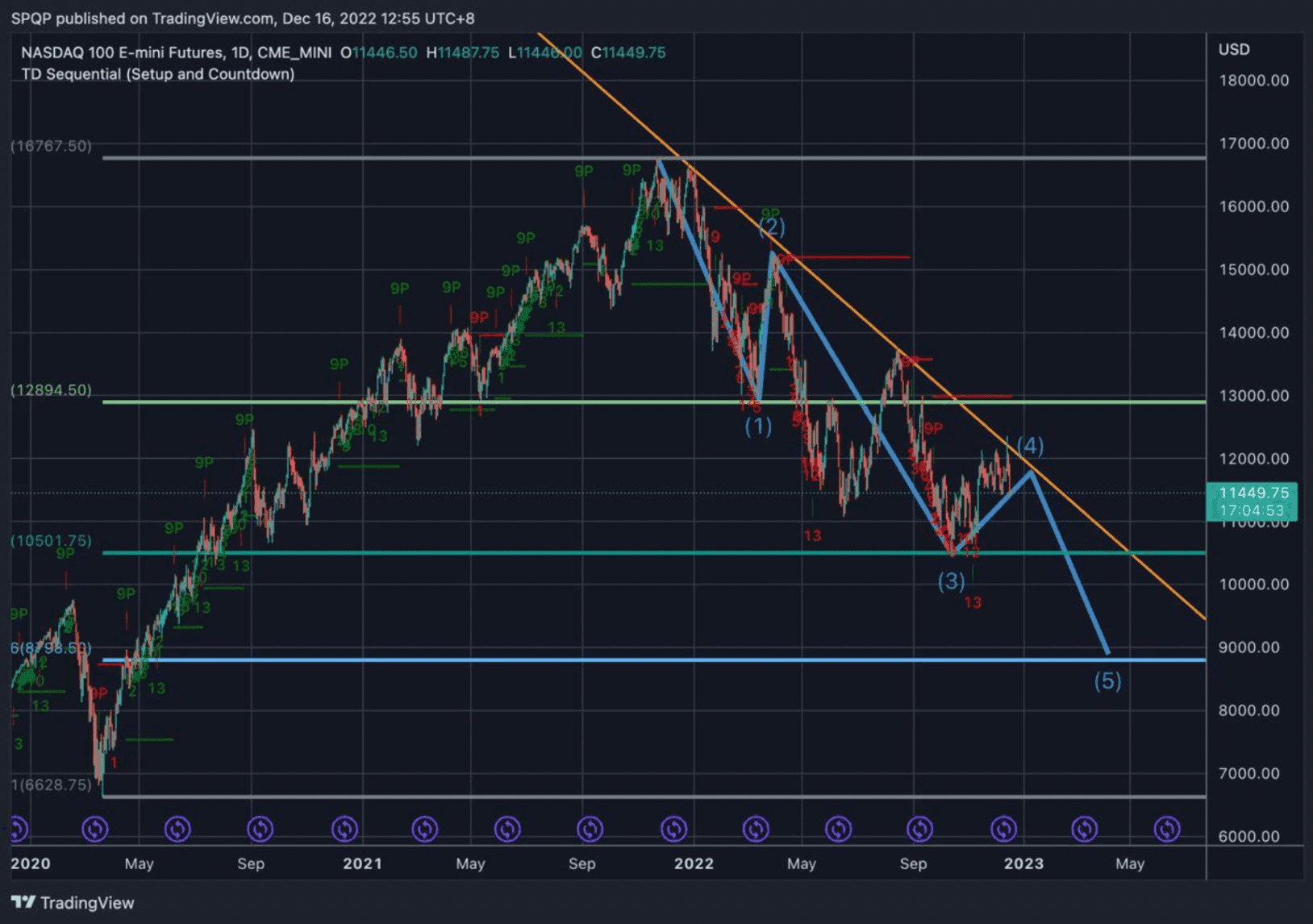

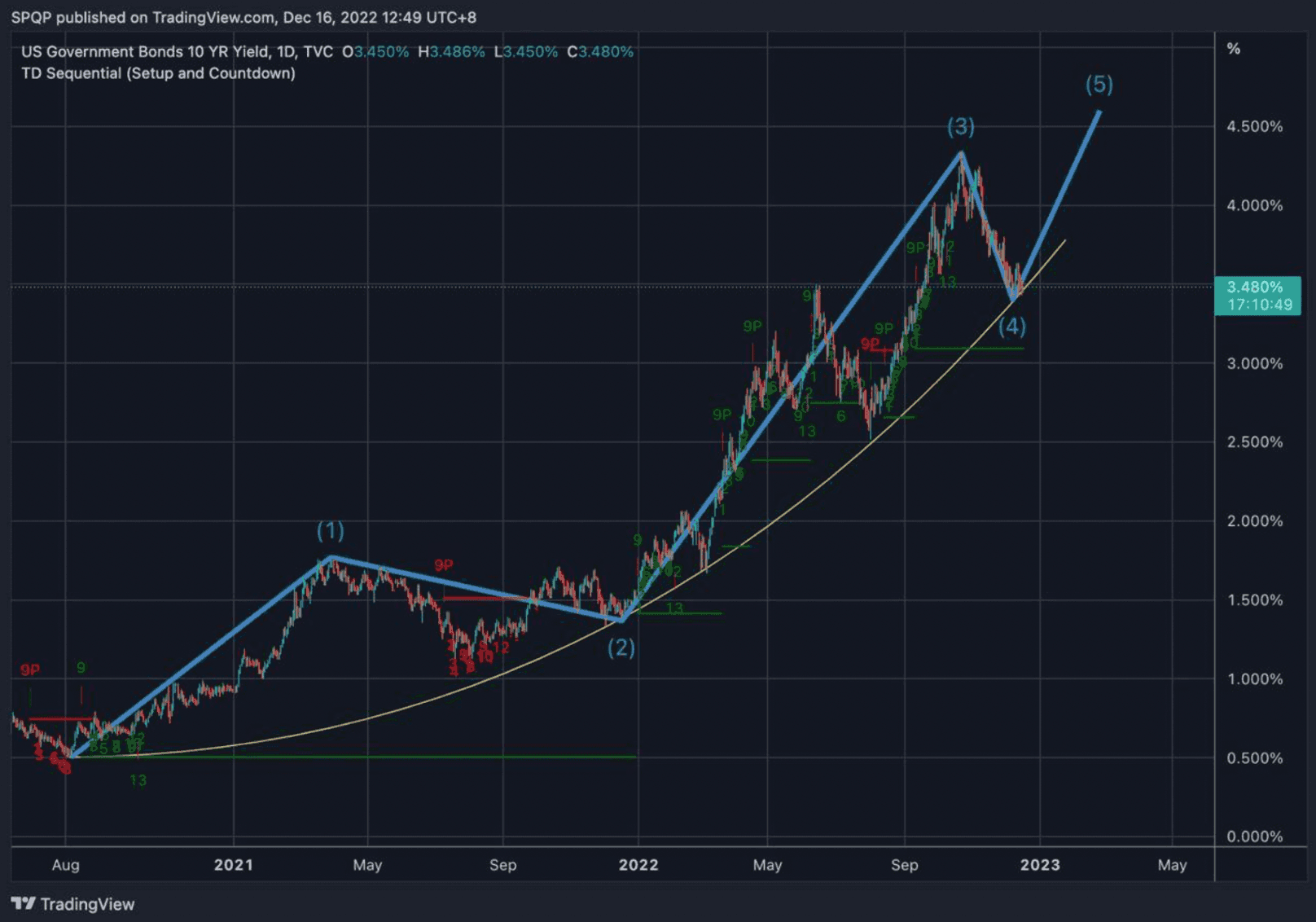

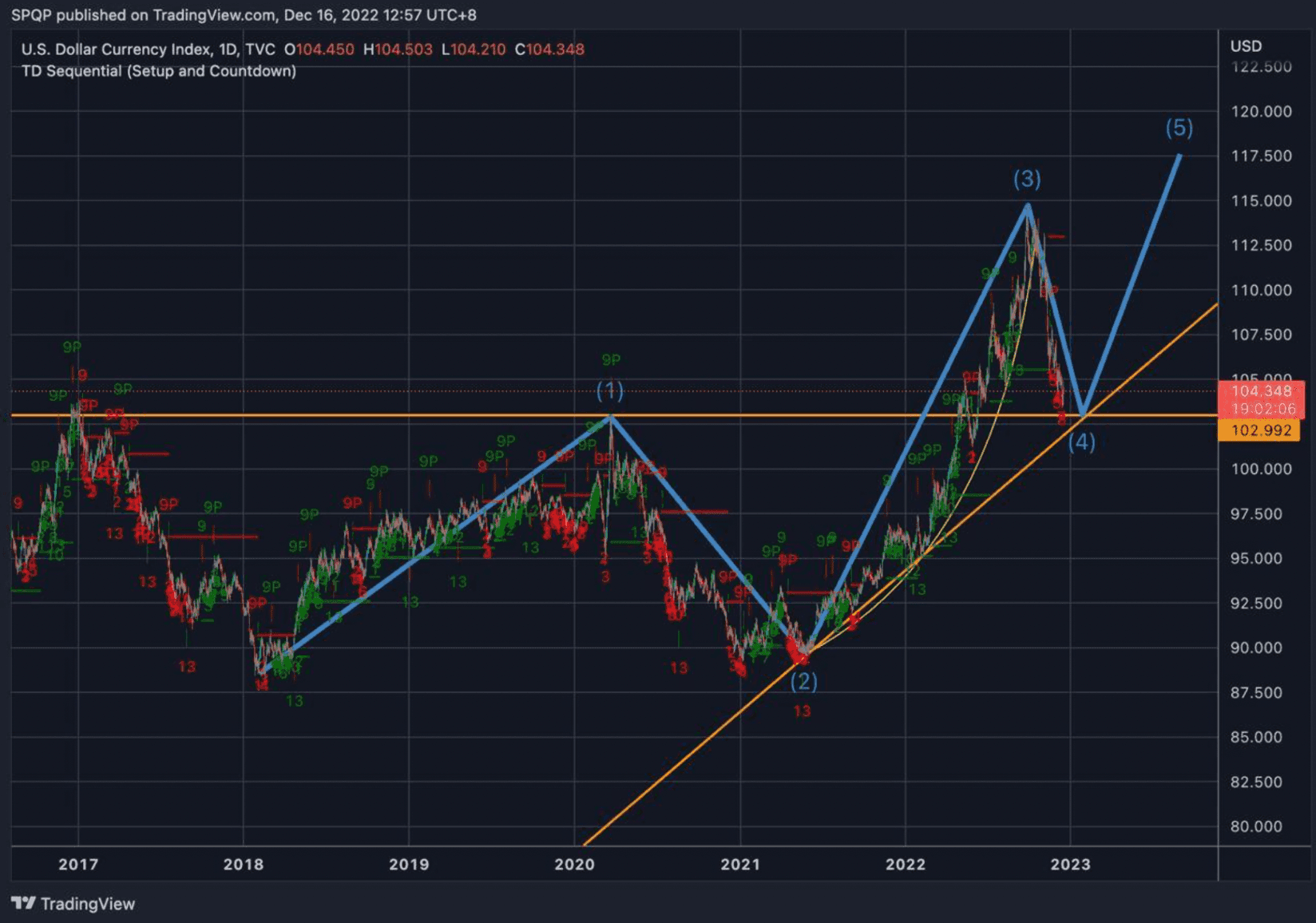

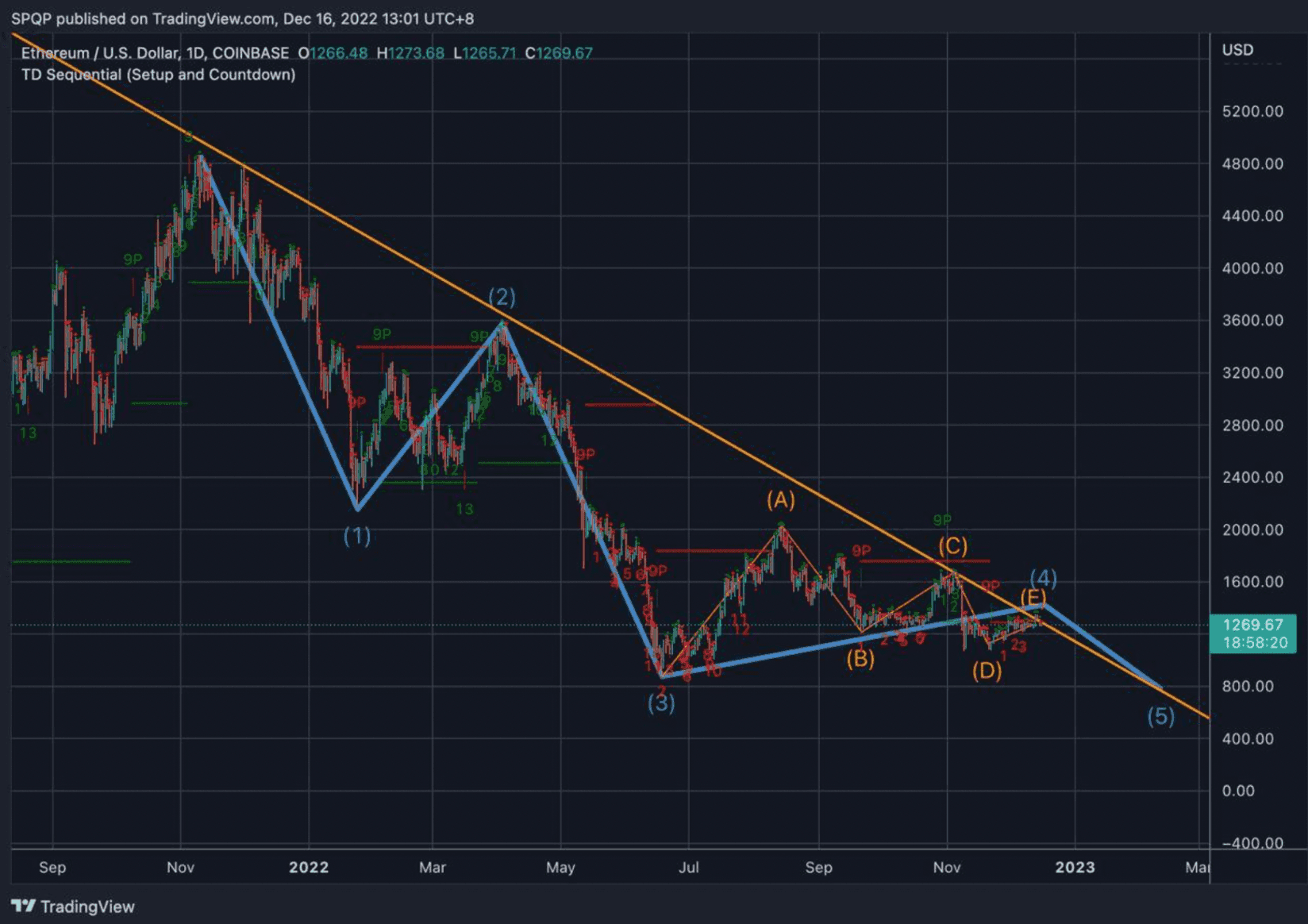

As we've been writing, this Q4 rally has set up the perfect 4th wave, with a final 5th wave lower incoming for all markets

- S&P/Nasdaq (Chart 2):

- 2yr/10yr (Chart 3):

- USD (Chart 4):

- BTC/ETH (Chart 5):

In particular, ETH has played out a textbook perfect corrective ABCDE 4th wave triangle, and is primed for the final 5th wave lower.

We think the key to everything is the USD, as the financial world is perpetually synthetically short USDs and USD rates. Any rally in the USD will therefore put pressure on every sector, starting with the most leveraged ones.

Not only is the financial world synthetically short USDs, but also short USD gamma - which means any rally will drive further real money USD buying as financing costs go up, especially in local currencies or assets (commodities/coins etc).

Crypto Markets

Its business as usual in the options markets as front-end implied vol continues to stay suppressed, even as realized vol underperforms drastically, even if intraday vol remains high on the low spot liquidity out there.

While we have been running vol curve steepeners, we will soon look to accumulate front-end downside, in-line with our view of a final wave 5 sell-off to come.

In our view, this trade is best structured with {sell 3m/6m calls + buy 1m/3m put} calendar risk reversals in both BTC and ETH, akin to the ones we put on at the start of the year that outperformed particularly well.