The Markets

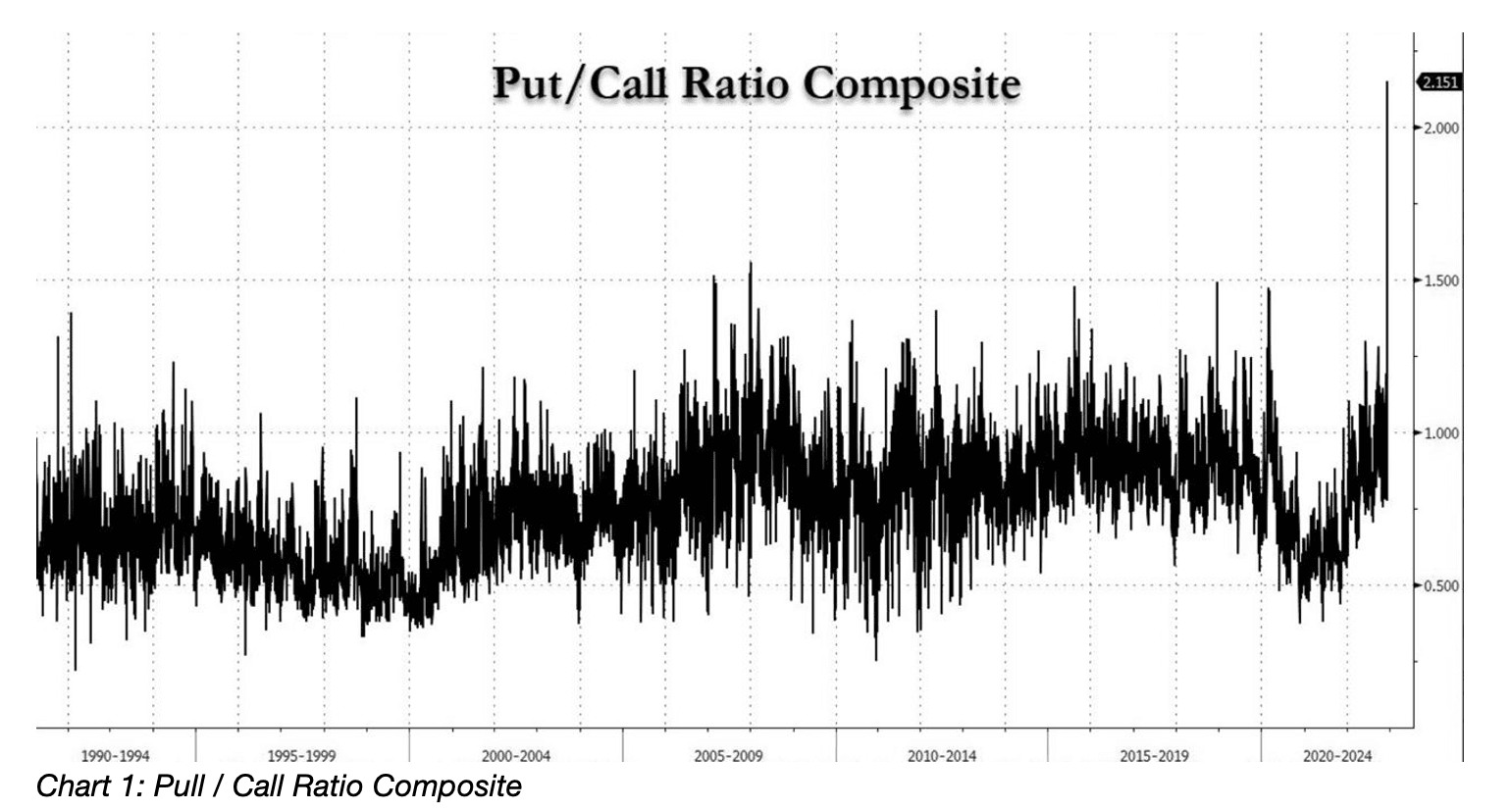

Tonight's CPI is being treated by markets as another watershed event, even if the Fed is only looking at it as just another in a series of prints to formulate their policy. In macro markets, options hedging for this week's CPI and FOMC are at record levels. For example, equities were up over 1% yesterday but at the same time VIX surged over 7% - the first time this has happened since 1997! Furthermore, the composite Put/Call ratio right now across equities and bond markets is through the roof, in a series going back over 30 years (Chart 1).

Never have we seen this level of fear in a rally, and in a set of events, which is happening right now. However, the crypto options market has not followed in the same way, with the BTC vol curve still comparatively steep into this week's events. We expect this is due to the unusually low liquidity right now, with many taking a step back to assess the fastmoving developments in the crypto space in recent weeks.

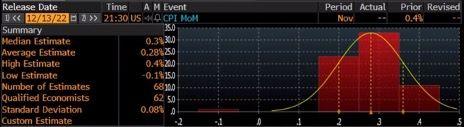

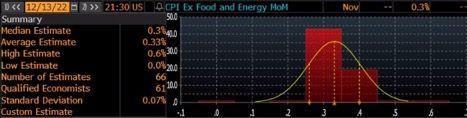

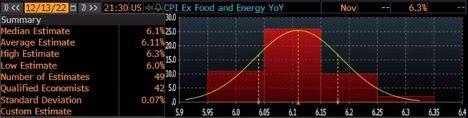

For CPI, charts below show the distribution of forecasts, with the following medians:

CPI MoM - 0.3% (Chart 2)

Source: Chart 2: CPI MoM Median – 0.3%

Source: Chart 2: CPI MoM Median – 0.3%Core CPI MoM - 0.3% (Chart 3)

Source: Chart 3: Core CPI MoM Median – 0.3%

Source: Chart 3: Core CPI MoM Median – 0.3%CPI YoY - 7.3% (Chart 4)

Source: Chart 4: CPI YoY Median – 7.3%

Source: Chart 4: CPI YoY Median – 7.3%Core CPI YoY - 6.1% (Chart 5)

Source: Chart 5: Core CPI YoY Median – 6.1%

Source: Chart 5: Core CPI YoY Median – 6.1%

The wisdom of the masses suggests that core CPI MoM would print at-or-above median, as economists are split between 0.3% and 0.4%, while headline MoM has downside risks on the same basis, and YoY forecast distributions are perfectly evenly split.

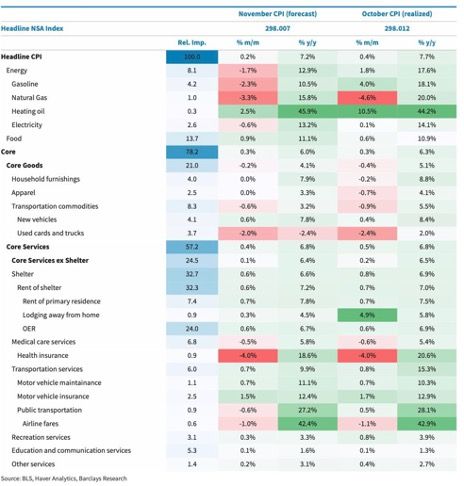

The tug of war happening in this print can be seen in the continued divergence between goods and services inflation - with goods pulling back sharply but services remaining persistently high. Looking at the weights in the index, it is evident why there is so much focus on rent as it comprises 32% of the entire index (Chart 6).

Finally, a point of caution to note. In this game of fine margins, we also must factor in rounding errors in the print. For example, 0.34% vs. 0.35% is just 1 basis point apart, but will show up as 0.3% or 0.4% in the print and cause the market to unnecessarily jump.

All things considered, this is always a tough one to call, but we are leaning towards it being a print that is stronger than expected and that will keep the Fed on the pedal towards >5% rates later this week. We certainly hope events will prove us wrong but are of the belief that the inflation slowdown being extrapolated from last month's print is too fast - considering the state of wages and lagging component of CPI rent.