Overnight, macro markets had a hawkish surprise from the FOMC Dots, and right after that Mt. Gox officially announced a delay by up to a year.

And in all that BTC has barely budged.

For us this is a sign that positioning in the market is light, which limits the chances of a sharp near-term move.

In any case, other macro markets have latched onto the hawkish FOMC Dots forecasting 2 less cuts in 2024 and a higher terminal rate as a signal for a broad-based risk off.

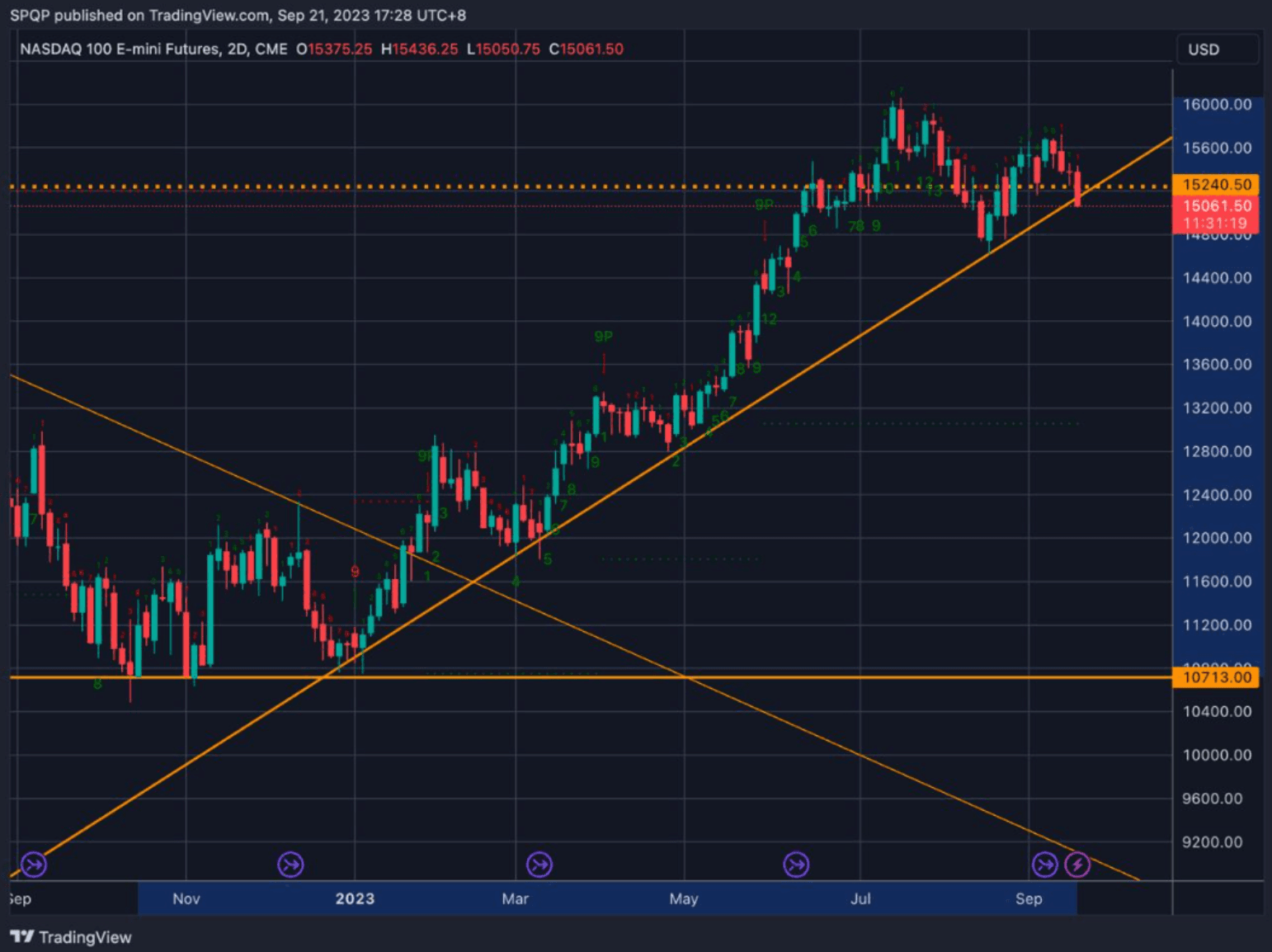

While we are not sure the Dots really mean very much, US equity (Chart 1 – Nasdaq) and rates markets (Chart 2 – 10 year yield) have broken some very key levels on the back of this, and reflexivity can take over with the bearish thesis from here.

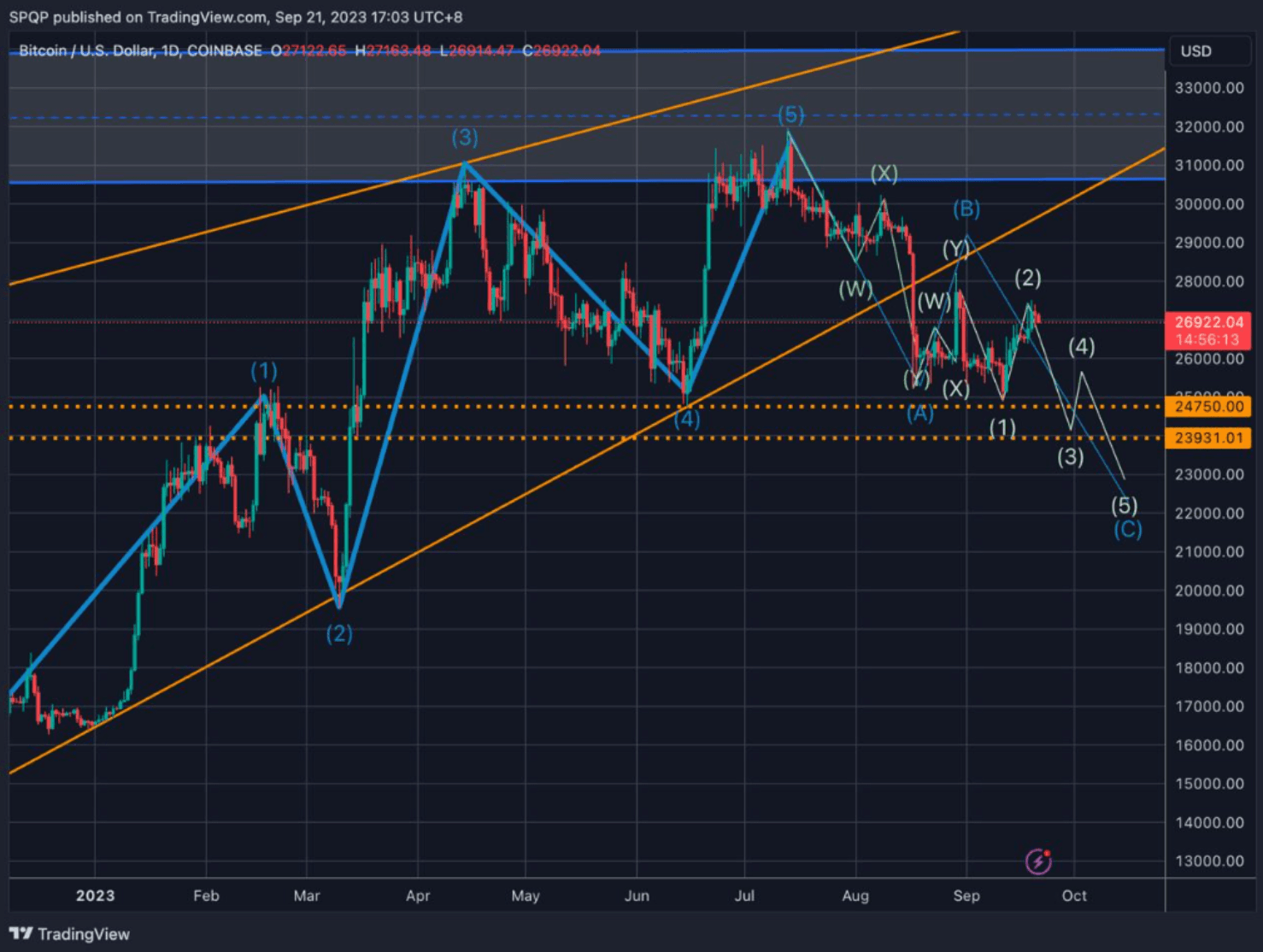

If we are right, then this macro move could seep into crypto markets and take BTC lower with it (Chart 3), albeit with a lower beta as compared to other very stretched macro markets like the NASDAQ.