QCP Market Update

In the blink of an eye, the first month-end option expiry of 2023 is here.

Market conditions are drastically different from the bearishness we saw in Q4 2022. The options market in its current state makes it seem like FTX never happened at all!

The following are some key observations:

- BTC risk reversals traded into positive territory (Calls more expensive than Puts) across multiple tenors last week for the first time since 2021 (Chart below).

This is extremely unusual as BTC typically has persistent Put skew largely due to miner/treasury hedging activity. It also shows how quickly market sentiment has flipped from bearish to bullish - a microcosm of what has been happening in macro markets as well.

- ETH implied volatility (IV) has fallen in general, indicating complacency as the market prices out the fear of prices collapsing (Chart below).

One would expect the ETH end-Mar IV to remain very high in light of the Shanghai Upgrade, which would see more than 16m ETH being unlocked.

Anecdotally, we're also seeing FOMO set in from flows on the trading desk, with many chasing the top side by buying high delta calls and going long spot this week.

What could shake the market from its gravy train?Firstly, momentum to the topside needs to fade - and we think that with the big bad FOMC looming in a week's time, the market would be a little more cautious.

With that said, the upcoming FOMC on 1 Feb is just a statement followed by a Powell press conference - and the market has been signalling to the Fed that talk is cheap.

Which means we once again have to fall back on CPI to show us the way.

And here is where it gets potentially worrisome. The next CPI, released on 14 Feb, Valentine's Day next month, has the potential to break the heart of the bulls.

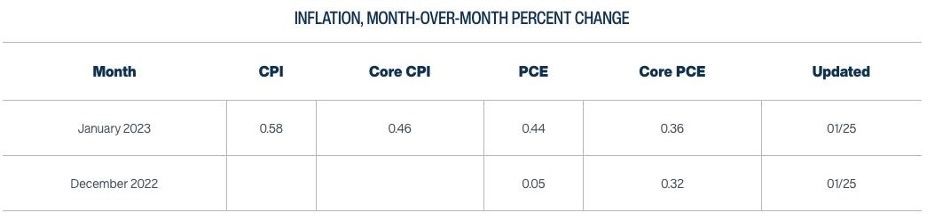

The Cleveland Fed's inflation Nowcast model is tracking at a whopping 0.58% M/M - which means 0.6% M/M officially if they're right (Chart below).

Core is not any better at 0.46% M/M or 0.5% M/M officially.

That is a massive number and throws a complete curveball at the market's optimistic view on inflation, as we outlined before here:

Nevertheless, this model is based on a daily Nowcast, which means there is potential for it to be revised significantly lower as we approach month-end.

This is certainly something the market will begin tracking more closely into the FOMC next week.

- Besides Equities, Gold and USD price action have also been leading/driving crypto prices.

What worries us here is that the USD is starting to show massive positive divergence, as price trades in an ending diagonal pattern (Chart below).

This is the same setup we saw in BTC/ETH in Dec - and as we witnessed there, any breakout to the topside will therefore be extremely sharp and violent.

For Gold, the $1890-$1900 support level is key. Gold should keep above this level for the crypto uptrend to hold (Chart below).

Disclaimer

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. your DPT service provider if your DPT service provider’s business fails.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.