BTC and ETH vols

It has been awhile since we've seen demand for gamma as bid as it was this week, with market participants clawing at every offer.

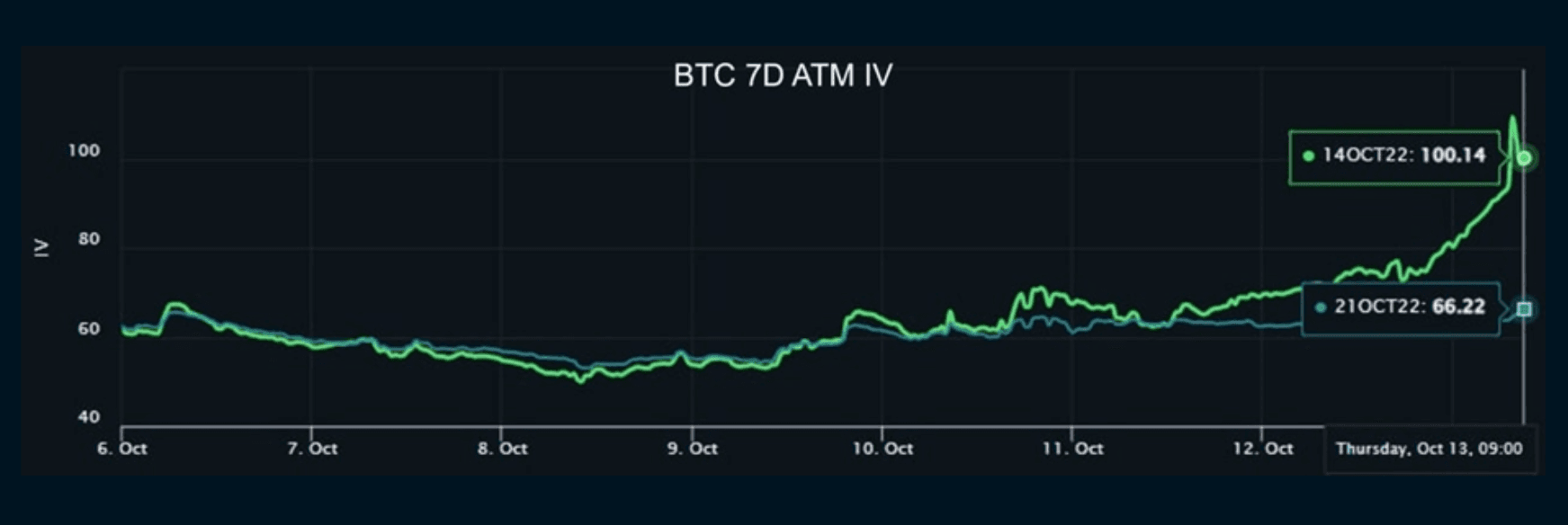

Naturally, this has shot front end vols through the roof with ATM vols for near dated expiries trading above 100 vols for BTC (Chart 1) and 120 vols for ETH (Chart 2).

Chart 1

Chart 2

CPI and its impact on BTC price

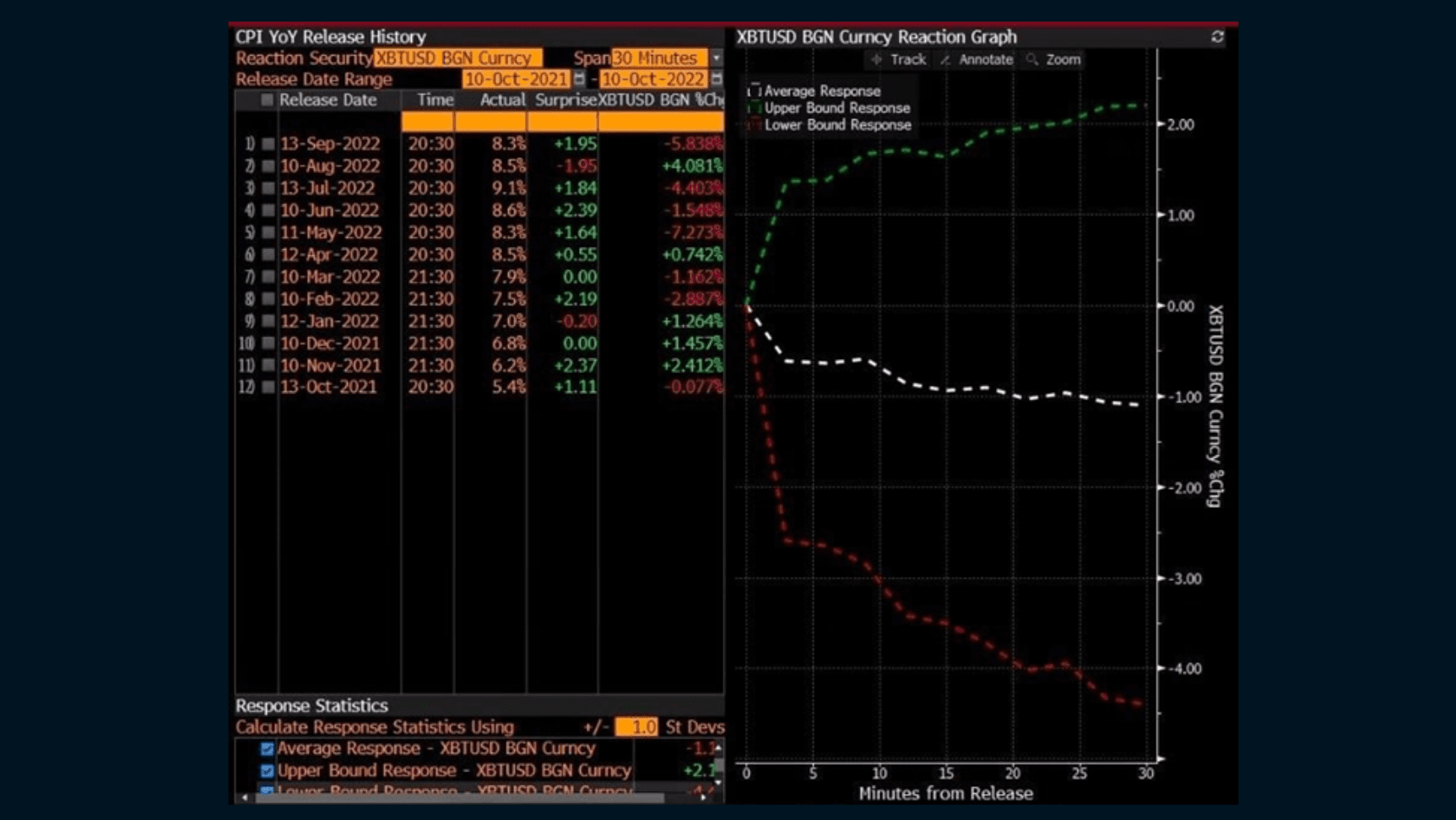

This vol demand is not foundationless. Looking back at all the CPI releases this year, and its impact on BTC price, we can see why gamma is bid into tonight's release.

When CPI came in higher than expected, BTC has fallen an average of 4% in the 30 minutes following the release. This includes a 5% fall last month, and up to 7% like in Apr this year (Chart 3).

Chart 3

Conversely, when CPI was lower than consensus, BTC has gained an average of 2%, including in Aug when it rallied 4% on a weaker-than-expected reading (Chart 3).

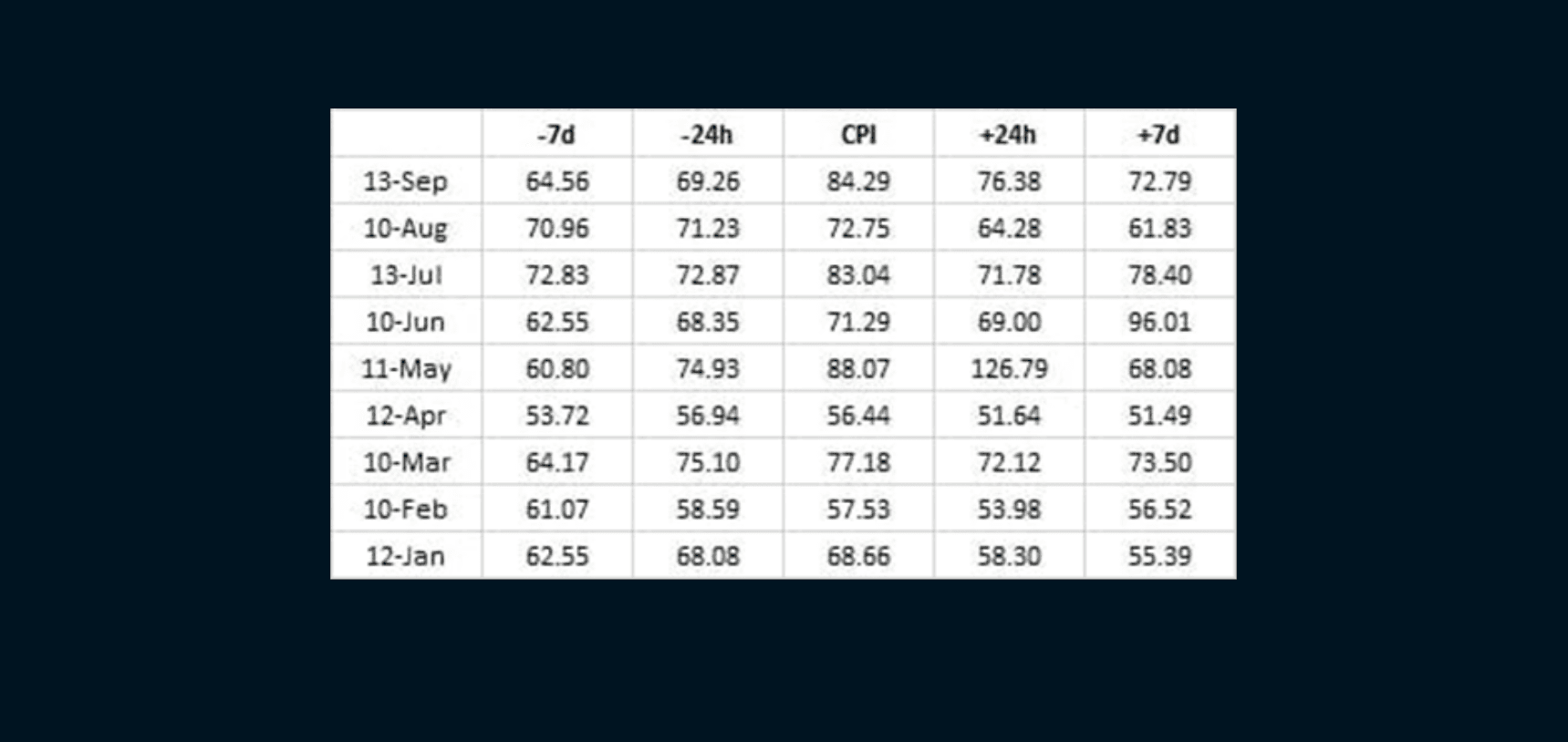

It is worth noting that 1W ATM vols in BTC have historically been bid into CPI, coming off shortly after - likely a function of "buying the rumor, selling the news" (Chart 4).

Chart 4