Macro Update 31 Aug 2022

Fed Chair Powell's Jackson Hole speech last Friday was clearly directed at markets - just 1300 words that took him 8 minutes to read. If the goal was better communication with markets however, the Fed has failed again. Instead of looking to the broader rate path, or the terminal rate, markets are back to trading the 21 Sep FOMC odds - whether they will hike 50bp or 75bp.

Worse still, Powell has effectively handed this policy decision to the 2 Sep NFP and the 13 Sep CPI - which basically means investors are now all at the craps table, betting on over or under.

We have not looked at NFP this year at all, relegating it to our 2nd tier data series behind all the various inflation releases. However after last month's blowout print, we now assign a 25/75 importance to the upcoming NFP/CPI to decide the Sep FOMC.

If we are now all relegated to degenerate gamblers at the table therefore - it probably helps to handicap the odds, starting with Friday's NFP.

- Markets are already pricing a 90% chance of a 75bp hike - which seems rather high, considering neither of these pieces of data are out yet. We think this is because markets understand the Fed wants to hike 75bp, to make up for the 2-month intermeeting period between the last FOMC in July.

- We think a sizable Friday NFP miss will force markets to bring pricing back to ~60% into CPI.

A CPI Y/Y at least in-line or lower than last month, or another flat or negative M/M print will allow the Fed to downshift to 50bp hikes from Sep onwards.

Handicapping NFP

This is the noisiest and most unpredictable dataset out there, which makes it unfortunate for investors (or fortunate for traders) that the market still places such emphasis on it.

Fortunately, there is seasonality behind these data releases, due to the imperfect seasonal adjustments that are applied to the released numbers. Therefore acknowledging this month's NFP's importance, and the existence of data patterns - here are the odds for Friday:

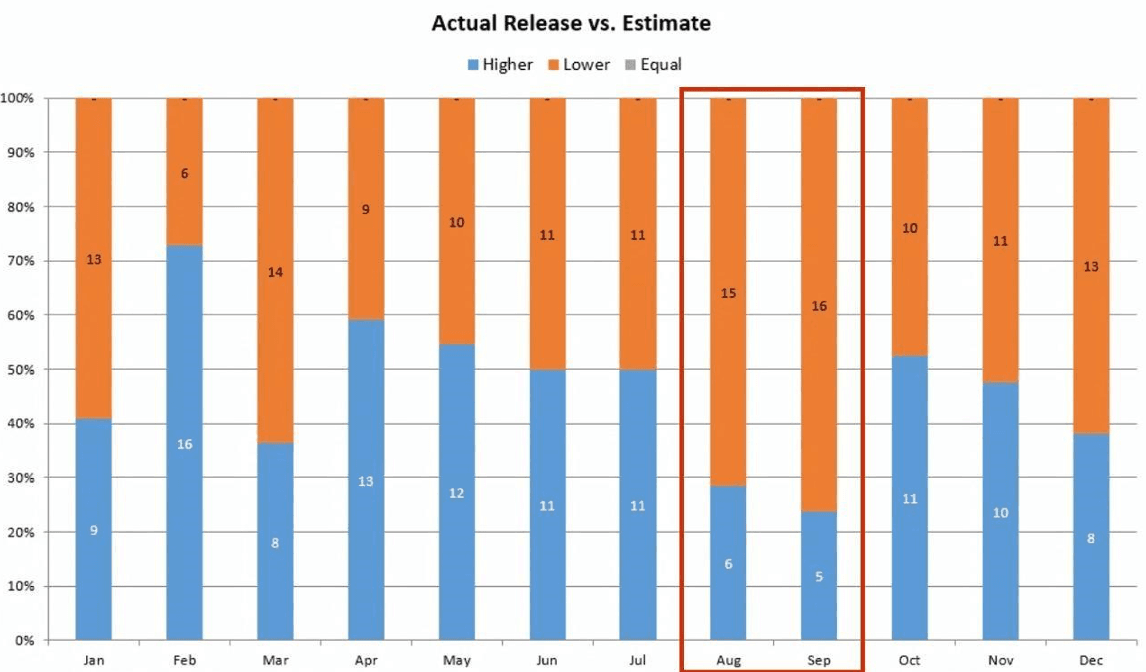

- Aug job numbers (released this Friday) and Sep job numbers (released in Oct) have the weakest seasonality of all - i.e. they miss consensus expectations most (Chart 1). This has been amplified by the Covid shock which has blown out numbers since 2020.

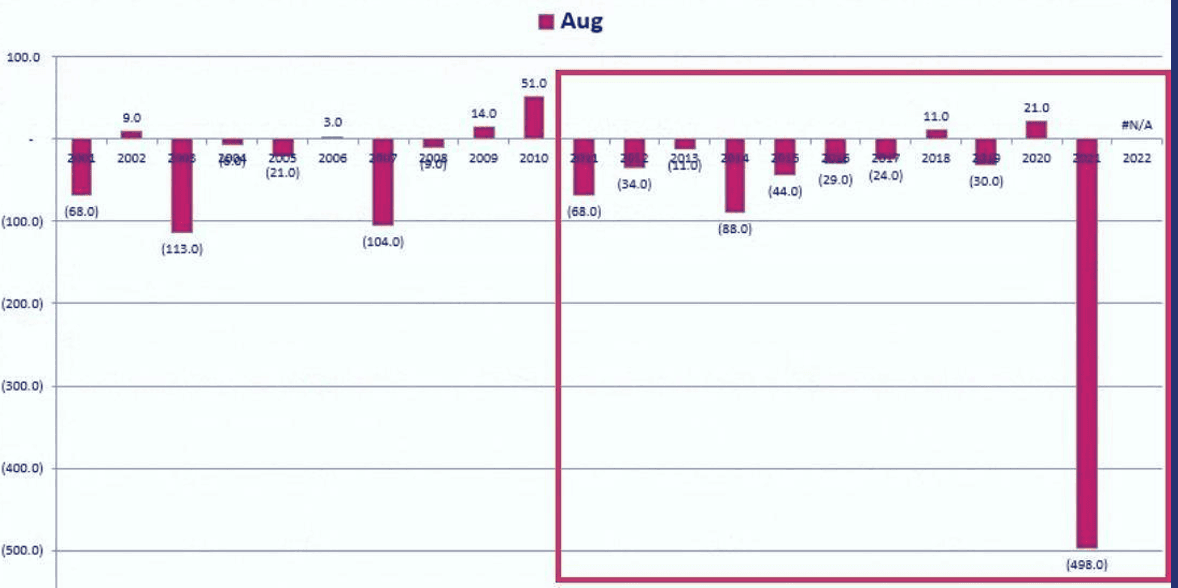

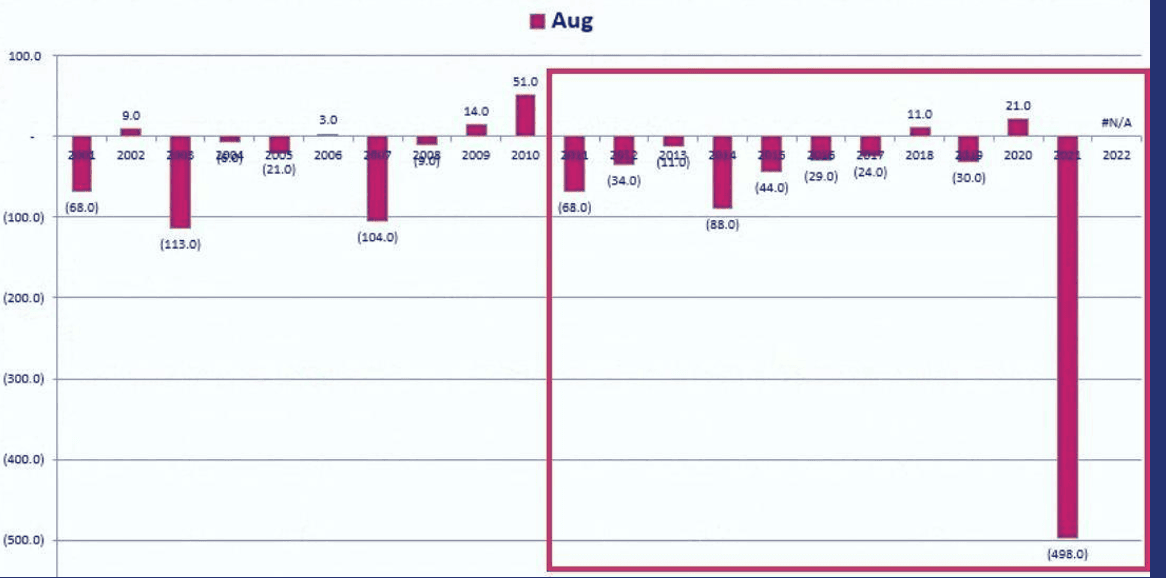

- In fact, Aug numbers have missed expectations 9 of the last 11 years, including last year which missed by 500k! (Chart 2).

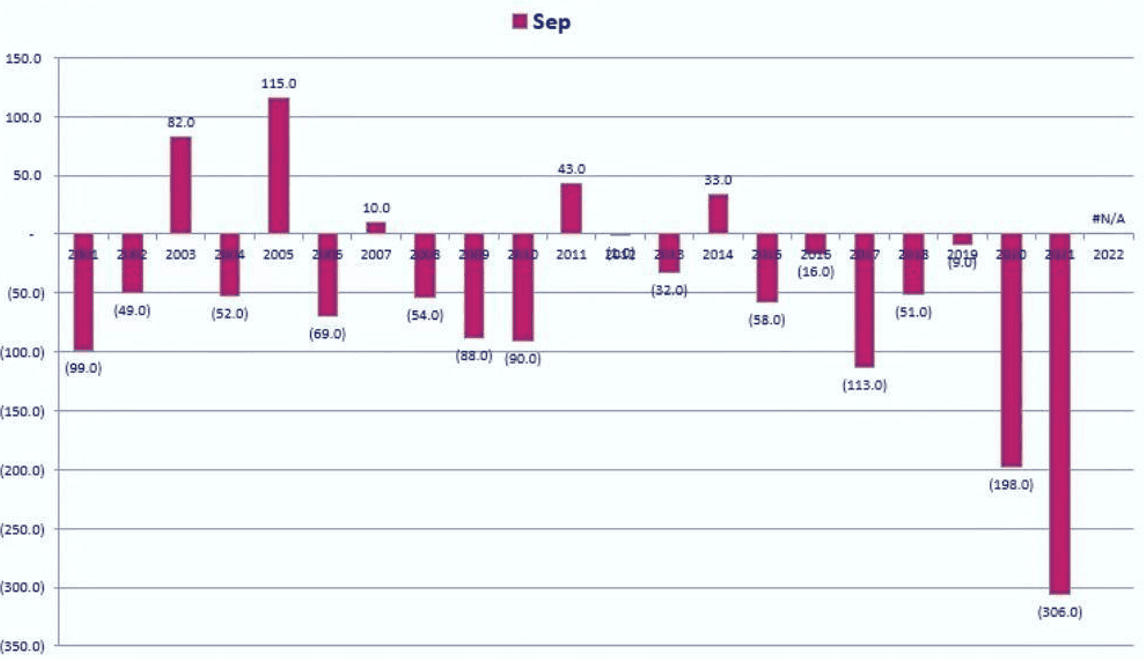

- Last year's Aug miss came after last Jul's numbers blew out expectations as well, the same upside blow-out we witnessed last month (Chart 3).

- As an aside, Sep's numbers are as bad seasonally as Aug, which would support a potential Fed downshift at the Sep FOMC meeting (Chart 4)

However, this year NFP numbers have been exceptionally strong, beating expectations on every release thus far bar one - a shocking statistic that has never happened before outside the Covid-affected 2020. (Chart 5)

Typically the beat/miss of these releases follow Sine wave patterns related to their data seasonality (Chart 6).

Finally, knowing their propensity to leak data, the White House press secretary was asked about the upcoming jobs number yesterday, and responded saying "we’re expecting job numbers to cool off a bit as we - we’re going into transition. We’re expecting job numbers to not be at the high growth rate we’ve seen these past several months as part of that transition." Trades As a result of this, we think the Sep FOMC is overpriced at this point. As the highest beta, best risk reward trades, we look to receive the Oct Fed Funds Futures (FFV2), or long EURUSD, or long 2y Treasuries against the high, or long ETH 2wk call spreads.