QCP Market Update 14 Feb 2023

Happy Valentine’s Day (and CPI Day) to all ❤️

We are now clearly in the post-FTX regime where BTC has a higher beta to macro news than crypto news.

The collapse of FTX, the most retail friendly crypto exchange last November, has led to a rapid shift in retail interest towards DeFi and NFTs, of which leverage is much lower and where BTC plays no part.

Instead, there is growing institutional interest from TradFi, with CME now the second largest venue for BTC futures OI with a 17% share, and where these CME-trading institutions are largely macro-driven.

What is clear since FTX is that there has been a clear and concerted push from the US authorities not just towards the regulation of crypto, but also the restriction of the crypto industry.

The SEC's goal now seems to be to restrict the size of the industry such that any misstep by them (like FTX) will not have future consequences.

In the case of Binance, killing their on and off-ramp banking channel earlier this month, and now their stablecoin channel as well, will severely impede its ability to facilitate large volume transactions in future.

Furthermore, the folks at the SEC seem to have mastered the act of dropping the dreaded “S” word every now and again, like their own version of nuclear deterrence.

With the "security" threat renewed once again, whether this is justified or not, the subsequent decline of ETHBTC to the year's lows makes sense as only BTC has been given the all-important “security clearance" by them.

As the regulatory hammer is still out against the industry (possibly until the 2024 election), the upside on crypto's market cap looks even more subdued from that perspective now.

Hence, today's CPI print is crucially important to decide the extent of downside for crypto.

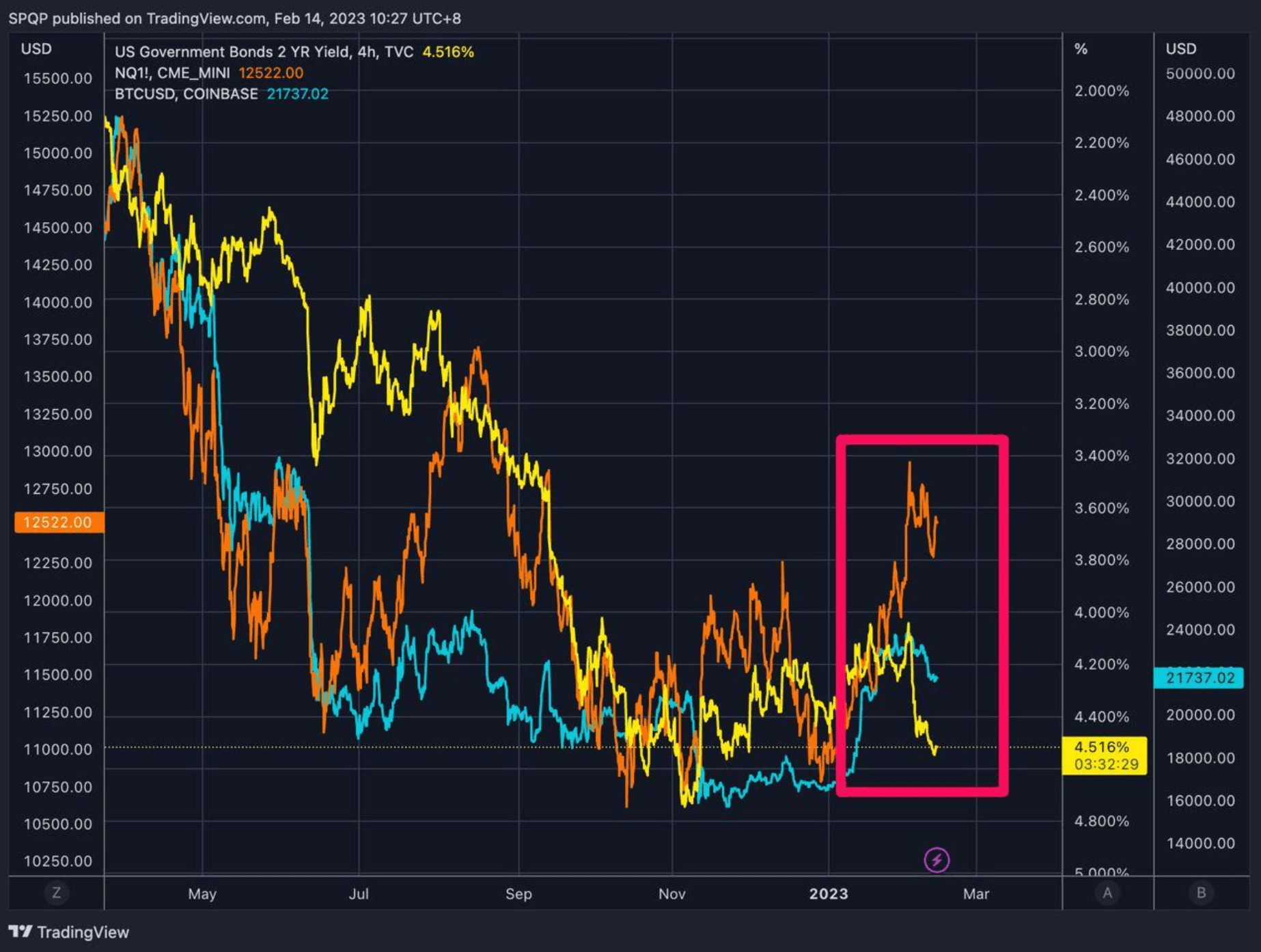

Macro markets have diverged significantly leading into the print - with rates and equities heading in opposite directions and BTC caught in the middle (Chart below).

In the rates market, we are now pricing a 5.2% terminal rate followed by a 30bp cut by December 23, a monumental step-up from the 4.9% terminal and 50bp cut just 2 weeks ago.

Risk assets have clearly not adjusted to this increase in rate expectations, and we expect today's print to bring all markets in line - whether it is an outsized equities sell-off (on a number higher than expected) or a rates rally (on a number lower than expected).

A high number for today however is now baked into consensus.

The consensus expectation now is:

- 0.5% m/m increase in Headline CPI

- 0.4% m/m increase in Core CPI

- 6.2% y/y increase in Headline CPI

- 5.5% y/y increase in Core CPI

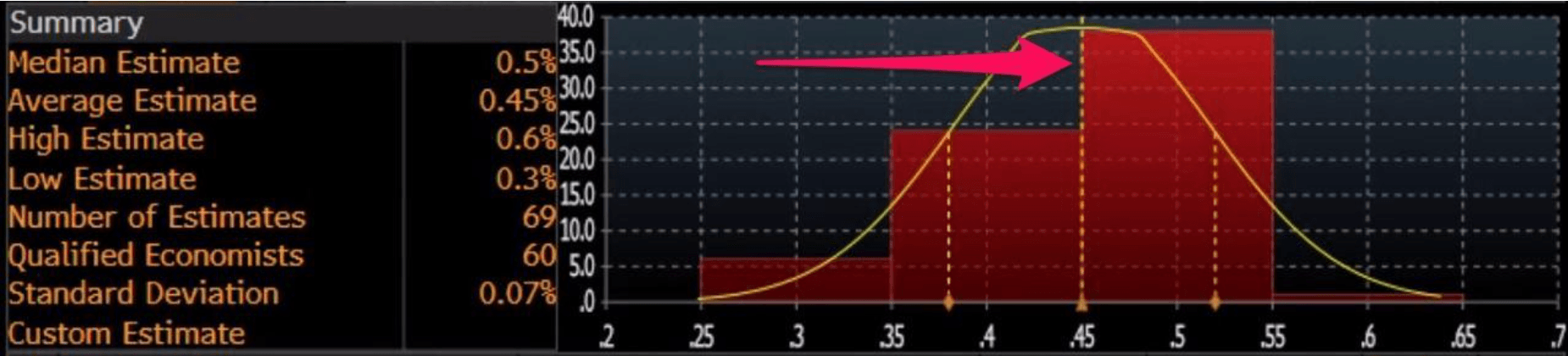

In particular, the median forecast for headline M/M has settled at 0.5%, which is by a knife's edge of just 1-2 forecasters! (Chart below) This reduces the chances for an upside surprise on that basis.

However, we are still sticking with our call for an upside surprise, albeit with less certainty on a M/M basis now.

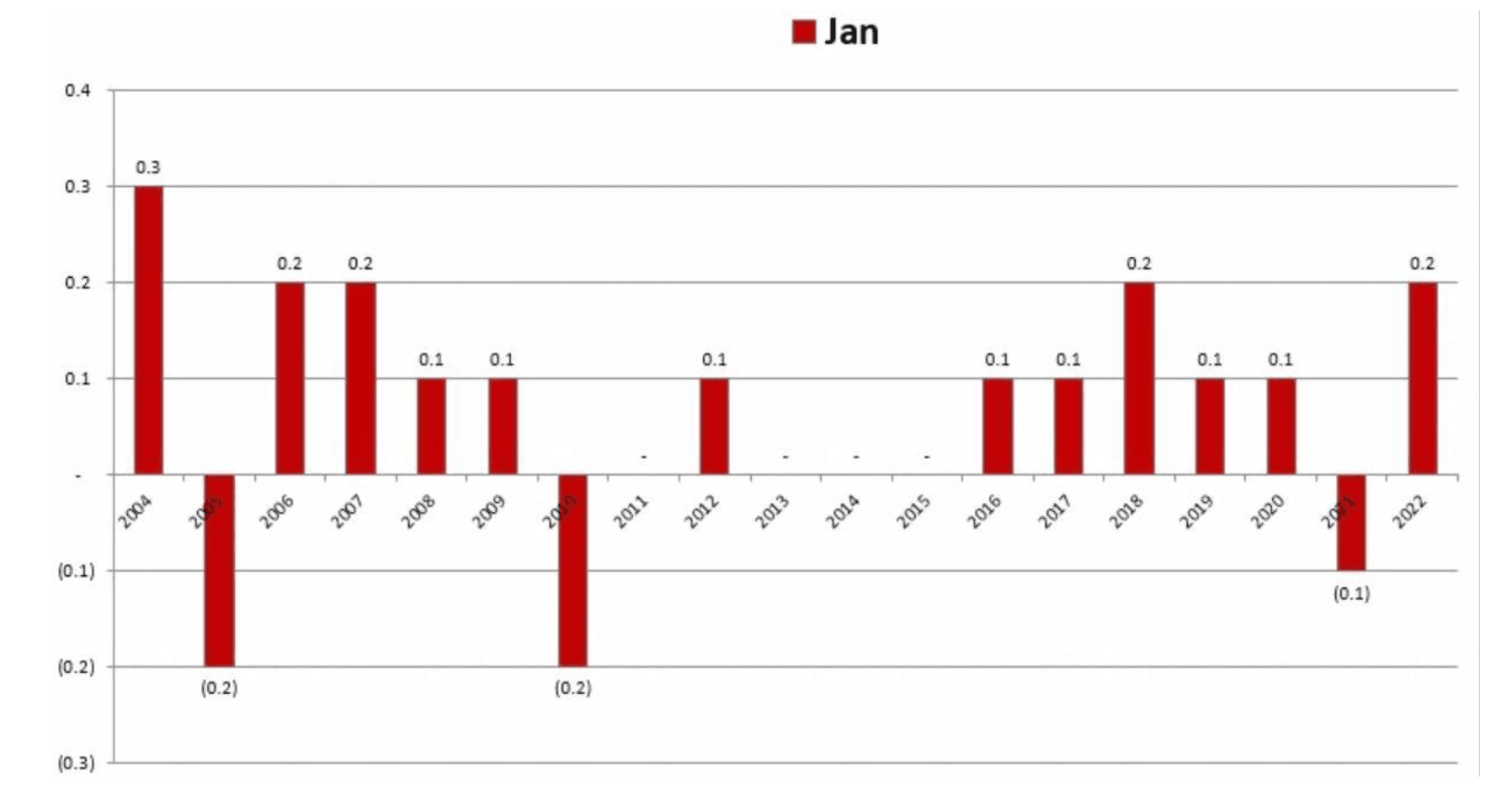

We think the January seasonal adjustments still do not fully take into account the strength of annual price adjustments - as seen from the seasonality of Jan CPI beats/misses - where 6 out of 7 past Januarys have seen a higher-than-expected CPI (Chart below).

We believe a 0.6% M/M on headline and especially on core would be enough to scare markets (and the Fed), and trigger a revision higher to their dot plot at the March FOMC meeting on 22 March.

On a 0.6% M/M we would expect BTC to break 20k going into the March meeting.

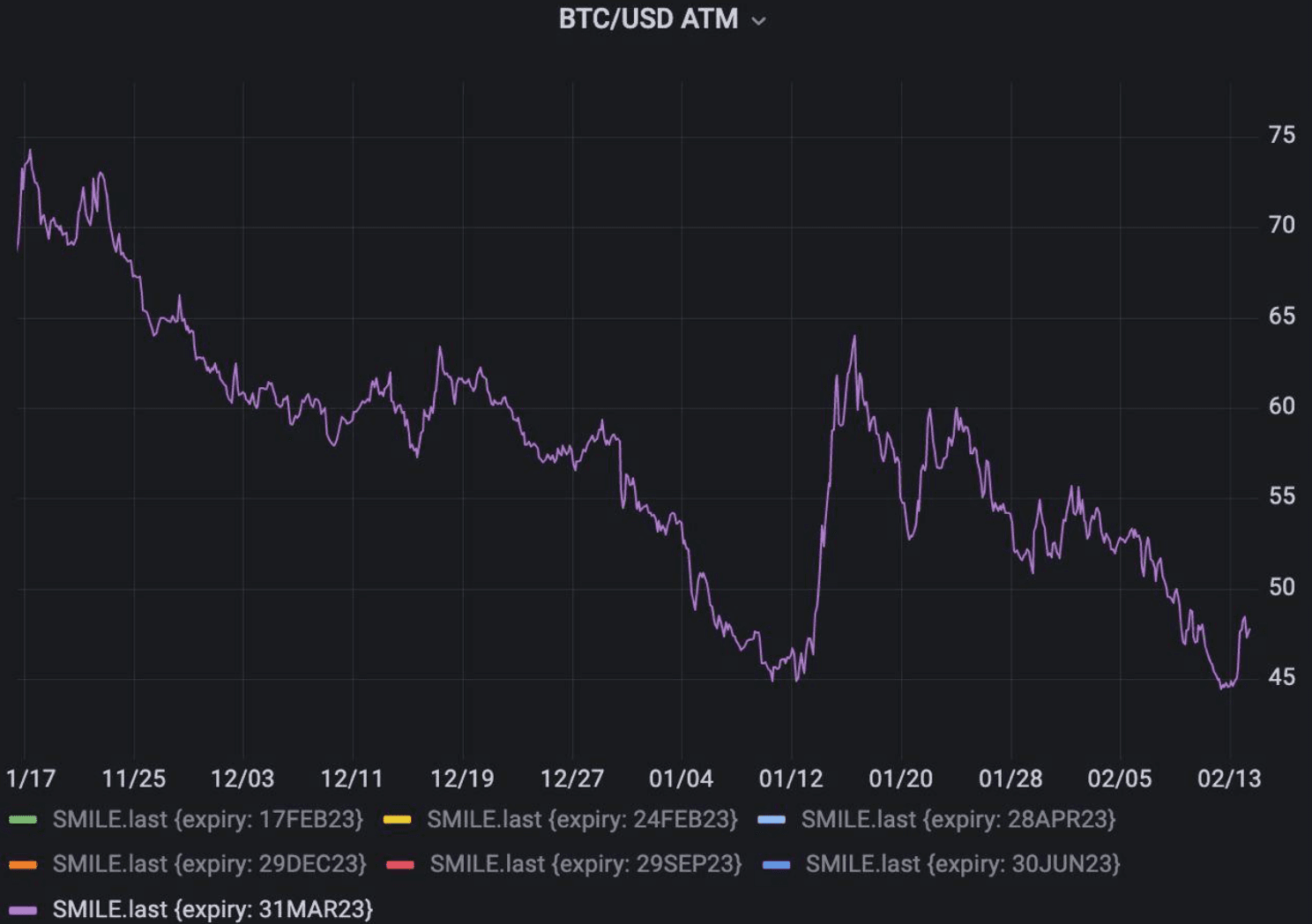

On that basis, our view is BTC March puts look extremely cheap as a limited loss structure into today's print, with March ATM implied volatility still hovering at complacency levels of <50 (Chart below).

Disclaimer

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. your DPT service provider if your DPT service provider’s business fails.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.