Where is TradFi heading in crypto?

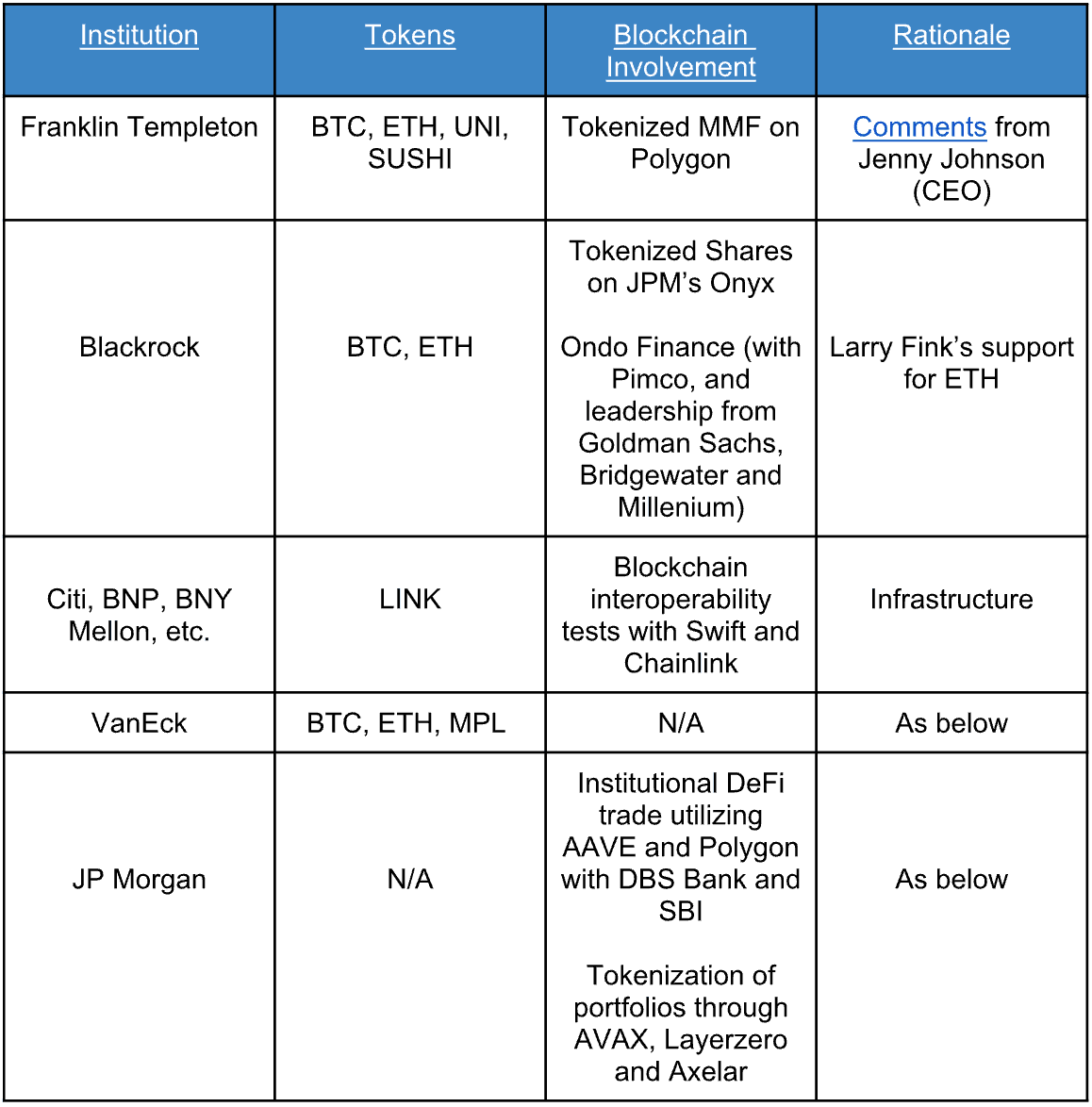

- Aside from the Bitcoin Spot ETF participants, we all know that the institutions are already in, but exactly how involved are they? We examine what tokens and narratives that they are they fond of in this non-exhaustive summary:

Source: Chart 1

VanEck

- It is common knowledge that VanEck has their own Bitcoin Spot ETF, with plans for an Ethereum Spot ETF, and have been sharing crypto-native communications on Twitter.

○ However, not many have heard about other assets they are interested in

- in particular, $MPL (of Maple Finance)

- In the past on Maple’s “The Debt Stack” podcast, Matthew Sigel, Head of Digital Assets Research at VanEck, commented that parabolic profit opportunities over the next 1-2 years are in buying and holding BTC, ETH and some open source tokens like MPL.

- He added that he loves what Maple are doing and that they are also keeping an eye on RWA protocols.

JP Morgan

- Jamie Dimon of JP Morgan is known to be bitcoin’s harshest critic, labeling it a ‘pet rock’ and would close it down if he was the government. The irony in all of this is that since 2016, JP Morgan has been involved with blockchain application, with ~60 POCs on a soft fork of a private ETH-based blockchain known as Quorum, although JPM has since sold it off to Consensys in 2020.

- Tyrone Lobban, MD and Head of Blockchain Launch at Onyx by JPM, has been working with Quorum and following that, Onyx since 2018.

- JP Morgan, DBS Bank and SBI also executed Singapore’s first institutional DeFi trade comprising of Singapore Government Securities Bonds, Japanese Government Bonds, JPY and SGD through AAVE on Polygon.

- JP Morgan has also utilized Avalanche’s subnets, and crosschain communication protocols such as Axelar and Layerzero, to test the tokenization and trading of portfolios.

Perhaps Jamie Dimon does not like bitcoin per se, but in their actions, JP Morgan seems to think they would be remiss if they were to ignore blockchain technology and asset class entirely.

L2 Summer in Cancun Dencun?

Ethereum sets timeline for final Dencun testnet

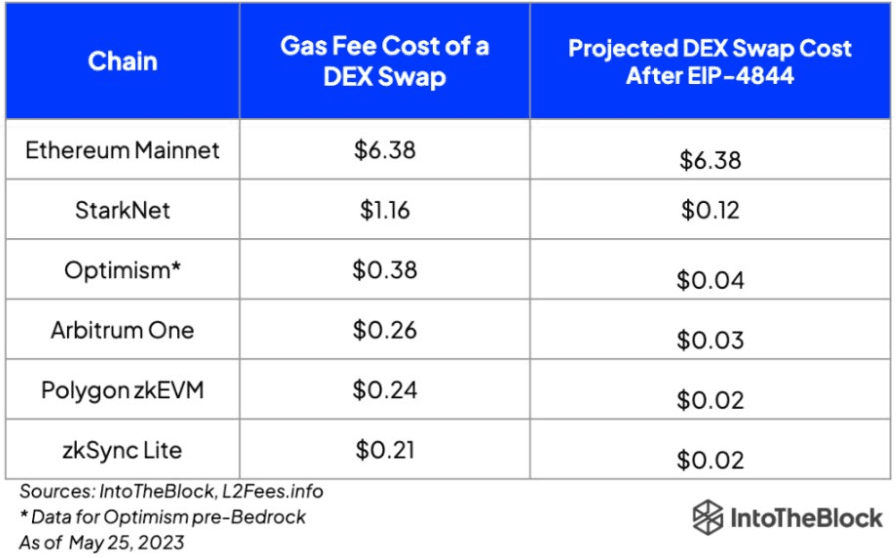

We have previously mentioned on many occasions on the looming launch (and delays of the Dencun testnet). We postulate that the Dencun upgrade on mainnet could be the spark to facilitate attention, capital inflow and activity within the ETH L2 space, and potentially replicate the recent Solana Summer in end-2023 / early-2024. Why we think this is because:

- Dencun testnet on Sepolia and Holesky testnets on 30 January and 7 February respectively are on track for mainnet upgrade in late-February or early-March

- The Dencun (protodanksharding) upgrade will essentially reduce gas fees for ETH L2s significantly, hence our postulation on a potential Defi Summer / Solana Summer-like activities within the ETH L2 space.

Source: Chart 2

Eigenlayer raises ETH limits once again

- Eigenlayer restakers have recently earned airdrops such as Altlayer ($ALT), and would expect more airdrops to come

- Therefore, we expect the rate of inflow, and inflow of staked ETH into Eigenlayer to be massive, due to the reopening of its ETH limits, where users hope to secure more airdrops to come. This is because:

- This massive inflow will not just be limited to Eigenlayer and its integrated LST protocols, but other auto-restaking protocols such as Kelp, Eigenpie, etc.

- Users have been depositing their ETH into such protocols, to not only get Eigenlayer points, but points for these protocols as well, for future airdrops.

- Eigenlayer is removing its 200k ETH limits on its LSTs, and lifting maximum caps for every single LST on the protocol. The window will be open from 5 February to 9 February, with an additional 33% cap on restaking points that users can earn.

HydroFi launches on 31 January

- Hydro is the liquid staking protocol of the Injective Ecosystem, and will be opening their pools on 31 January

- Similar to the strategy of MilkyWay (liquid staking on Celestia), users who hope to secure an airdrop from Hydro, will be waiting to stake their $INJ to the protocol