The Artificial Intelligence (AI) narrative has become the single hottest topic of conversation in the past weeks. With the emergence of ChatGPT, an AI chatbot that OpenAI released in late November 2022, AI's possibilities are truly remarkable. Although the concept of AI is not new, the introduction of ChatGPT3 marked an inflection point for the industry. More market participants in Web3 are also starting to associate Microsoft earnings with AI coins, hence the narrative only seems to get stronger.

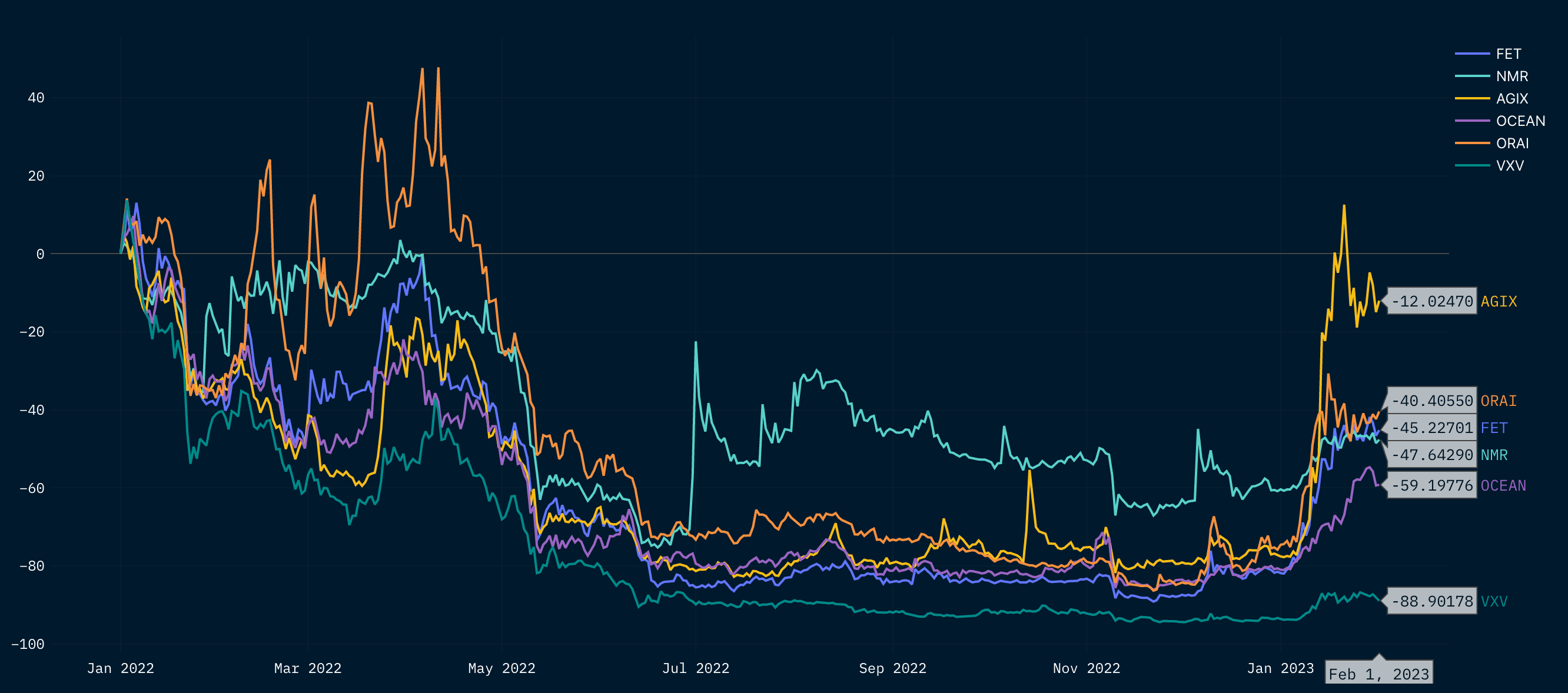

How do these tokens fare compared to the start of 2022?

- AGIX outperformed (from Jan 1 2022-current date) compared to the other tokens in the basket, followed by ORAI, NMR, FET, and VXV

- Generally the entire AI basket is trending upwards; tokens are starting to breakout as the narrative gains traction, giving potential for price discovery

- The trend is as follows for narrative trading the “AI-basket”: when one token pumps, the subsequent pumps. Hence, it is worth looking into certain narratives and researching all the tokens within the similar basket

- NMR has been relatively stagnant in terms of price performance, no large breakouts

- VXV performance still flat, no large bounce/ breakout observed compared to the other tokens in the basket

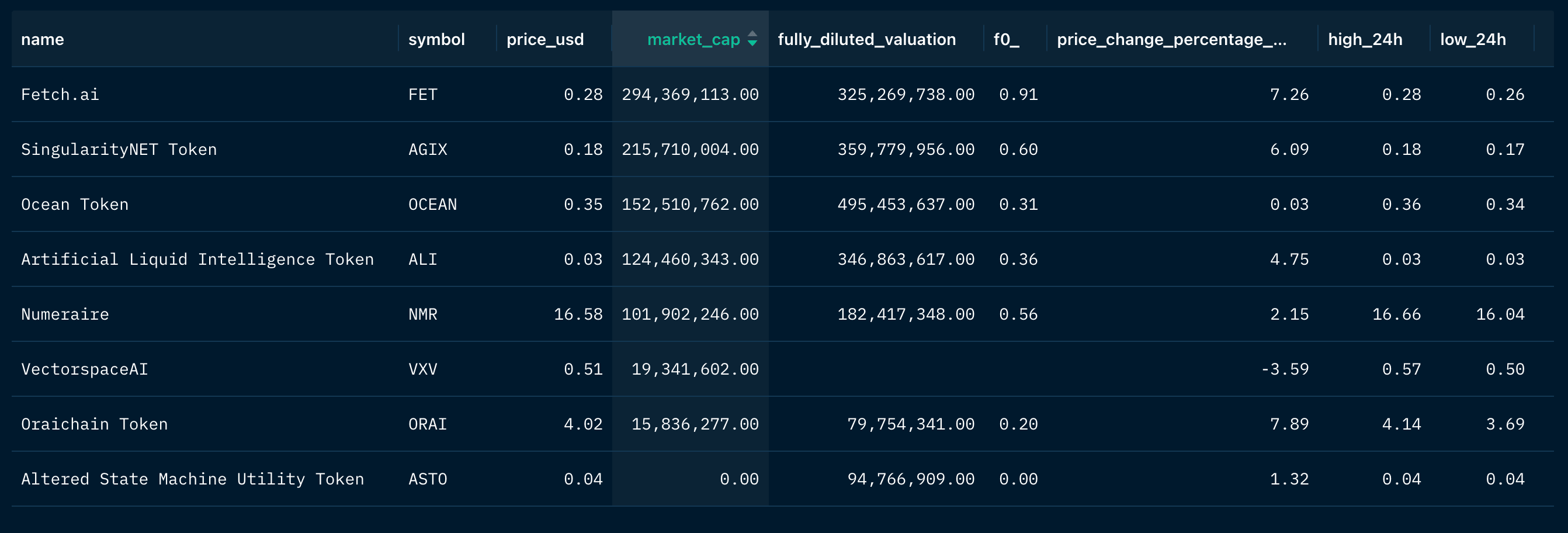

Projects ranked by market cap:

Note that the percentage change in price is measured on a 24H timeframe.

Fetch AI (FET)

Fetch AI was founded in 2017 and launched in Feb 2019 on Binance Launchpad via IEO. This platform aims to be an open-sourced decentralized machine-learning platform that allows users to access AI in their datasets. Currently, Fetch is connected to the Cosmos IBC protocol and is interoperable in nature; however, most of its trading volumes remain on CEXs.

The network is divided into three distinct layers. The bottom layer represents a consensus network including smart contracts and machine learning libraries. The upper layer AEA implements various functions and applications through skill modules. The middle layer represents an open-source framework where AEAs in the upper layer can search for the right datasets.

Bull case:

- Founders have the technical background to execute its vision. They’ve also partnered with many top institutions in the AI field. These include companies such as Bosch, Festo, and Telekom Innovation Laboratories, as well as blockchain projects such as IOTA and Conflux and medical companies like Pfizer, GE Healthcare, etc.

- Betting on the success of the Cosmos IBC ecosystem; If the Cosmos vision takes off, Fetch AI can benefit from both the IBC and AI narratives.

Bear case:

- The project has been operating for close to 6 years. Based on the progress we’ve seen over the years from this team, they have yet to deliver a killer application.

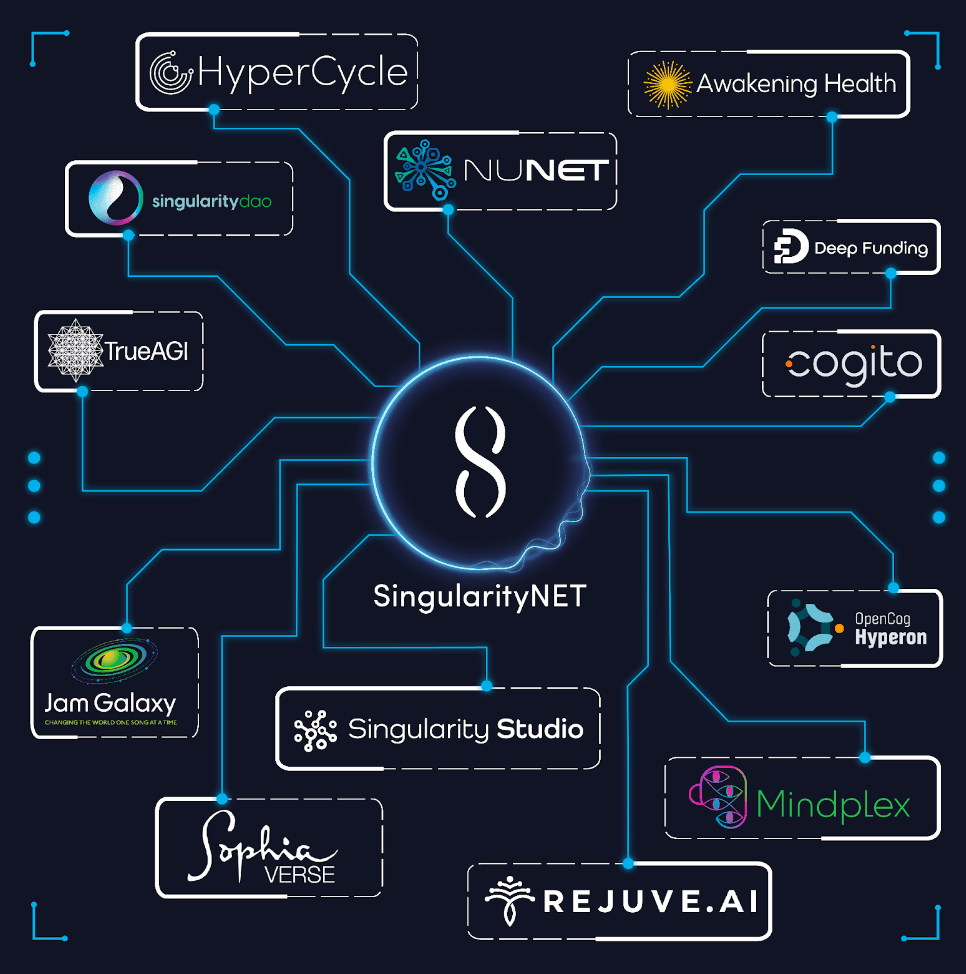

SingularityNet (AGIX)

SingularityNet is bootstrapping an ecosystem that will help fuel the platform with AI-related services and compound more value to their existing AGIX token. Singularity has chosen the Cardano blockchain as one of its main partners and blockchain.

The platform first launched in 2017 and completed its ICO in December of the same year, raising $36m in just under 1 minute.

Bull case:

- Compounding effects through the expansion of AI services deployed atop of SingularityNet. SingularityNet manages to build the richest AI-services ecosystem in the blockchain space and takes monopoly. Overall, it is still early days for products built using crypto and AI and SingularityNet has first-mover advantages if they deliver as promised.

Bear case:

- This project was launched in 2017 at the peak of the market cycle. Five years later, the platform is still in beta and has no functional product.

- An overarching emphasis on the Cardano partnership/ ecosystem could lead to dire circumstances if the network effect does not sustain and other L1s take charge.

- Already listed on Binance and core exchanges; not much price upside left.

Ocean Protocol (OCEAN)

Ocean Protocol is a stack of decentralized data-sharing technologies. The protocol is currently deployed on several chains including Ethereum, Polygon, Binance Smart Chain (BSC), Polkadot, Energy Web Chain, and Moonriver. The main demographic that Ocean Protocol intends to attract are AI startups that are in need of high-quality datasets and toolings.

Since its inception, Ocean Protocol has undergone four iterations.

Ocean v2 introduced a Compute-to-Data feature that allows data users to run models on private data. What this allows is the exchange of data while allowing data to stay with the sole data provider. This allows possibilities for data consumers to run compute jobs on data to train AI models. Data providers will approve AI algorithms to run on their data and the compute-to-data will help with data preservation & privacy.

Ocean v3 developed “data tokens” that help with the transactional aspect of Ocean, as well as a data marketplace called the Ocean Market.

Ocean v4 launched Data NFTs. When a user publishes a dataset on Ocean, an NFT is minted that represents proof of their claim - essentially a base IP.

Bull case:

- Ocean Protocol appears to be connected with xprize, a foundation with Elon Musk as one of its backers. Elon Musk has also expressed enthusiasm for the AI space and developments this year.

Bear case:

- Already listed on Binance and core exchanges; Binance perps are also live.

- Lack of product development causing other data-sharing technologies to take monopoly and market share.

- It has been close to 6 years since bootstrapping the project and there hasn’t been any visible product-market fit and growth. Ocean has gone through 4 funding rounds with the seed round in Jan 2018, raising $4.37m (~$0.093 per OCEAN). At its peak, seed investors wereup 20x. The pre-launch happened in November 2018, raising $18.61m (~$0.23 per OCEAN), network launch in April 2019 raised $1.75m (~$0.25 per OCEAN). The IEO was in May 2019 raising $6m (~$0.12 per OCEAN).

Numeraire (NMR)

Numeraire was founded in December 2015 as a company that manages hedge funds based on the results of stock predictions by data scientists. Data scientists with profitable trades are rewarded with the NMR token. Currently, Numeraire offers two apps: Numerai Signals and Numerai Tournament.

The Numerai Tournament is a weekly contest that takes into account all the predictions made by data scientists and distributes NMR tokens to the winners. Data scientists will have to submit their predictions through a staking mechanism. Participants will have to stake to whichever prediction “vaults” they agree with, and their portion will be burned if it’s incorrect.

Numeraire did not conduct a token sale but instead distributed 1m NMR to a pool of 1.2k active users on the platform. In 2019, Numerai reduced its supply cap from 21m to 11m. Tokens are also burned on a weekly basis through the tournaments held by the team.

Bull case:

- As more and more AI solutions appear, AI hedge funds could potentially be a big hit. Numeraire follows a simple mechanism involving both participants and data scientists, which will be hard for newer projects to replicate. For platforms to compete, they’d have to essentially attract both data scientists and market participants to their platform.

Bear case:

- NMR is already listed on Binance, not many upsides when it comes to short-term catalysts.

Artificial Liquid Intelligence (ALI)

Alethea AI introduced CharacterGPT which uses natural language processing (NLP) to generate AI characters. This is made possible through their text-to-character technology.

Bull case:

- Builds on the Generative AI narrative using LLM models. Alethea is spearheading a character AI feature that seems quite distinct from what other AI companies are building. - As long as they capture an edge on the generative AI front (i.e: text-to-character) and continue building on various content creation strategies, they will be well-positioned for the near future.

- Not listed on Binance yet; still has upsides if Binance decides to list more AI-based tokens.

Bear case:

- The text-to-character model doesn’t work as expected; or if other companies decide to build a better model that has better visuals, technology, and performance functions compared to Alethea.

Other highlights/ lower-cap AI-tokens:

- Vector Space AI

- Orai chain

- Deep brain

- Image Generation AI

Key Takeaways

- The AI space will be an important space to keep an eye on, as the narrative will only grow more in importance. However, it is still unclear how AI tokens will play a role in this sector.

- The intersection between blockchain and AI is not clearly defined yet; still has plenty of room for success and failures.

- The market leaders today for blockchain x AI are projects that have been in the space since 5-6 years ago. Other newer services and companies may step in and take market-share if older projects fail to innovate.

- Most of these projects have gone through several funding rounds and are poised to come out as potential market-winners. However, execution has been relatively stagnant over the past few years. The current momentum and hype for AI may offer a renewed sense of purpose.