TLDR

Silo Finance is a money markets protocol that introduces a new design model to isolate risks while retaining capital efficiency. They are able to do this through some of their flagship features such as an isolated two-asset "Silos" for each market on the platform and using a dynamic interest rate to better handle utilization of a given market.

Their isolated markets design would ensure scalability in the number of markets they can support, without introducing long tail risks to the entire ecosystem.

They will be using Protocol Owned Liquidity (POL) to seed liquidity in the Silos and give more ownership to the community.

Silo Finance originated from ETHGlobal 2021 hackathon in September and built Silo Finance from the ground up (not a fork).

The project is backed by some notable seed investors and the Genesis Token Auction will be held from December 6th to December 9, 2021.

Silo Finance Overview

Silo Finance creates secure and efficient money markets for all token assets through a permissionless, risk-isolating lending protocol. The design was made to combat the risks associated with shared-pool lending protocols such as Cream and Aave where the protocol’s creditworthiness is directly exposed to the lending services of riskier long-tail assets. By default, shared-pool designs are exposed to the risks of every asset in the pool, leading to limited markets (Aave or Compound) or more risky pools where the risk is bundled in N number of assets (see Rari). In short, the shared-pool model makes a tradeoff between the support of longer-tailed assets and the overall safety of deposits.

Silo Finance seeks to achieve secure, efficient, and permissionless money markets by:

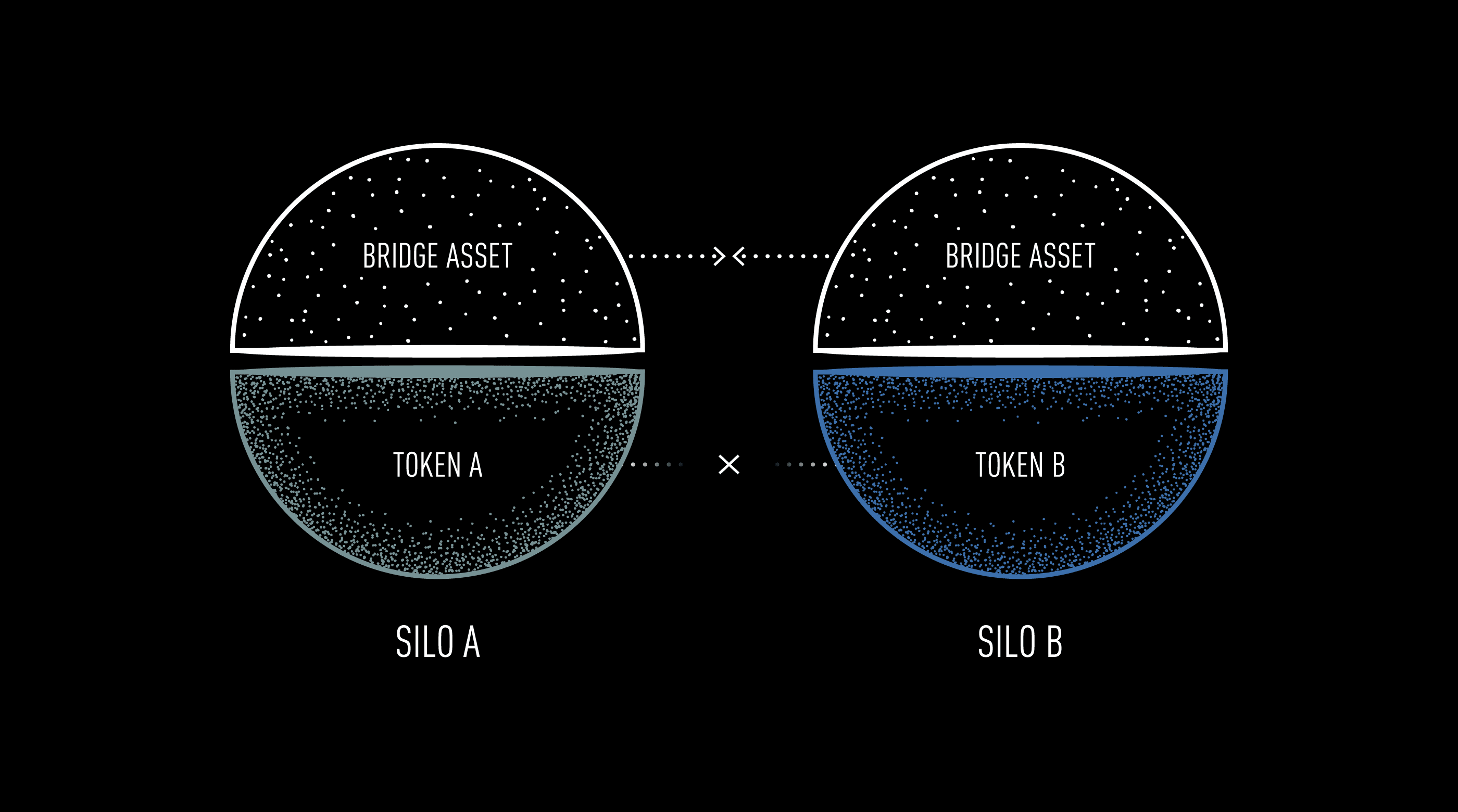

- Compartmentalizing risk through design (isolated two-asset Silo)

- Whitelisting any token assets without excessive reliance on governance (permissionless)

- Being highly liquid and fluid

- Ensuring liquidity constraints are set by the market, not governance. An asset's ability to be used as collateral is only determined by its ability to find counter-parties.

- Concentrating & bridging liquidity so that any token is accepted as collateral

- For a collateral token to be used to borrow another, the process requires creating two positions. Given the ‘Bridge Asset’ is ETH (see below), the user’s exposure to ETH is minimized but the exposure to the long and short is maximized.

Protocol Owned Liquidity

Silo Finance will initially need to attract a large amount of liquidity to incentivize users and achieve sustainable growth of the protocol. Rather than rent out the liquidity through traditional liquidity mining programs, Silo Finance will be established as a market maker through Protocol Owned Liquidity (POL) and attract lenders and borrowers of all collateral asset types, inclusive of riskier long-tail assets. POL ensures the protocol achieves fast growth, retains controls and flexibility, and lessens market volatility during the early days after protocol launch.

Smart Contracts Audits

Silo Finance is not a generic fork of another lending/borrowing protocol but was built on an entirely new design framework. The decision to build out the protocol from the ground up mitigates significant security risks and enables the protocol to make better design choices. This statement does not intend to put down generic forks, but they often oversimplify deeply complicated systems and don't lead to any meaningful innovations. Silo Finance is a fundamentally new approach to mitigating risk and creating scalable money markets. Given they are dealing with completely new smart contracts and risk parameters, the team has committed to one security audit with Quantstamp and a community review with C4. Both security audits will take place in January 2022.

Money Markets Landscape

Token Vesting & Allocation Schedule

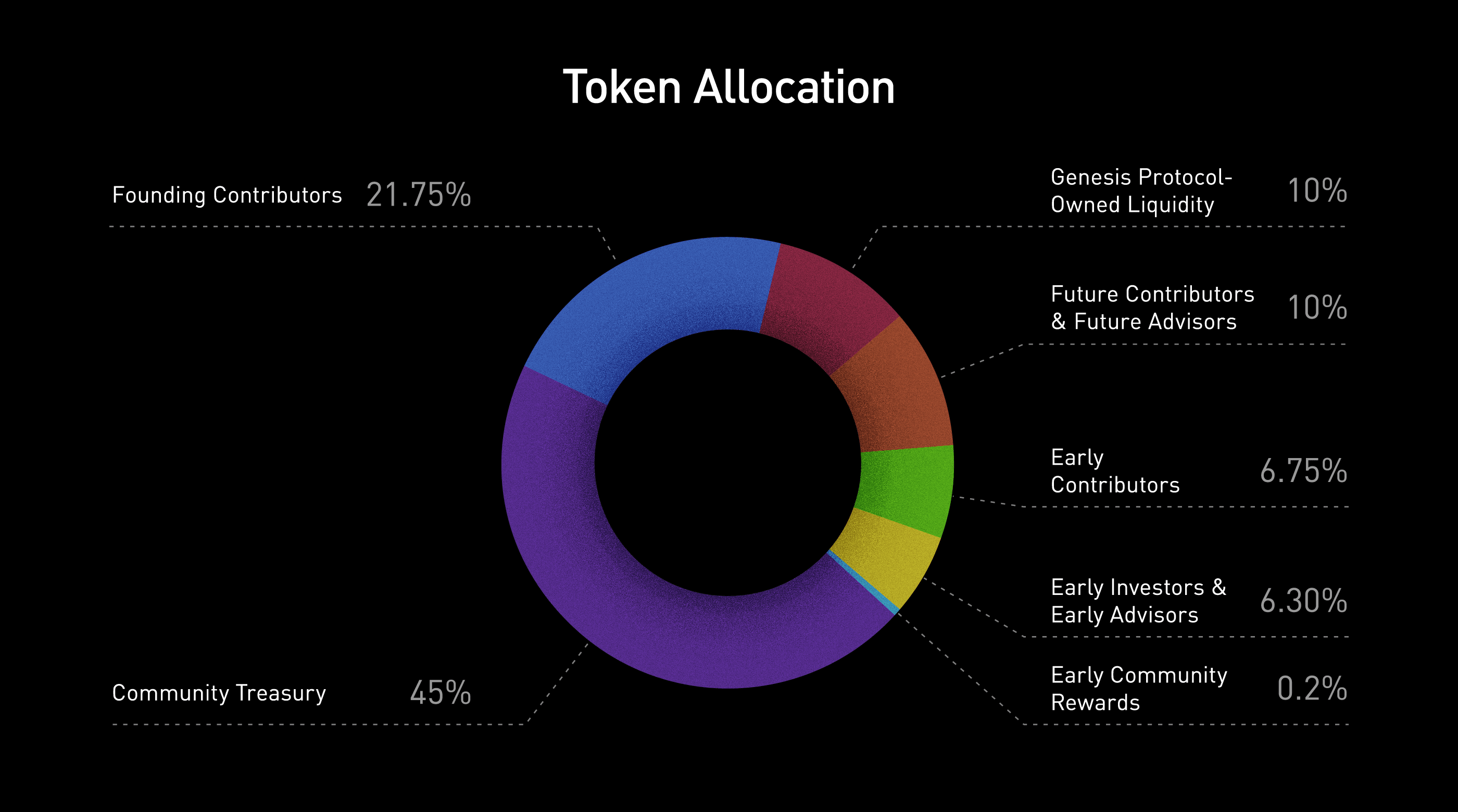

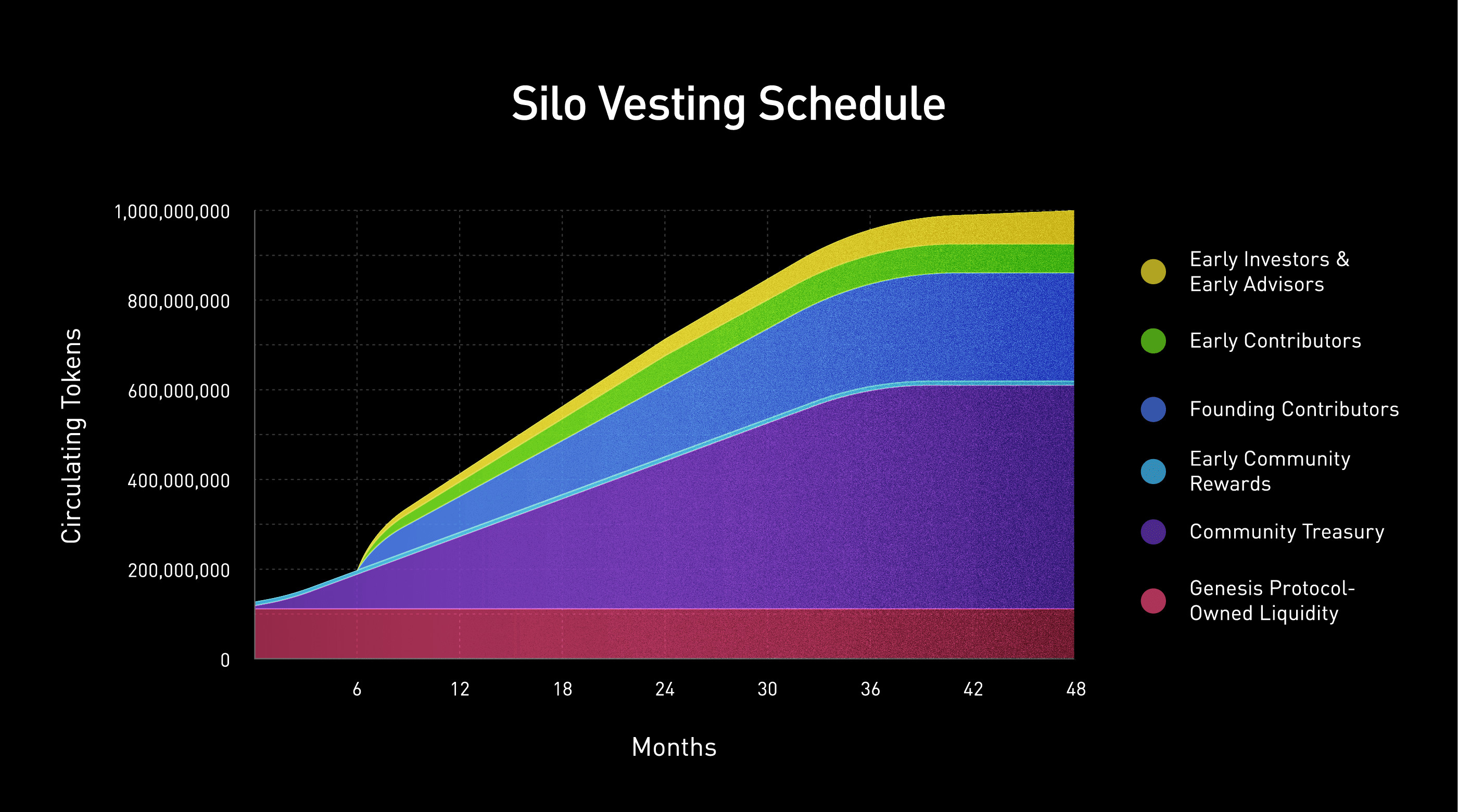

Silo Protocol will offer 10% of its total token supply to the community through a public batch auction conducted on the Gnosis Auction platform. For the first 6 months, almost 100% of Silo’s circulating supply will come from the genesis event. Over the next 4 years, 1B $SILO tokens will be minted.

Schedule Summary

Genesis Protocol-Owned Liquidity (10%)

- Distributed in the public auction & claimable immediately after the auction

Community Treasury (45%)

- Linear vesting for 3 years & controlled by the community through governance

Early Contributors (6.75%)

- Linear vesting for 4 years with 6-month cliff starting after TGE

Founding Contributors (21.75%)

- Linear vesting for 3 years with 6-month cliff starting after Token Generation Event (TGE)

Early Community Rewards (0.2%)

- Airdropped to community members in January 2022

Early Investors & Early Advisors (6.30%)

- Linear vesting for 2 years with 6-month lock starting after TGE

Future Contributors & Future Advisors (10%)

- Linear vesting for 4 years with 1-year cliff starting after joining the DAO

How To Get Involved

Key Information

Genesis Token Auction will be held from 3:00 PM UTC, December 6, 2021 to 3:00 PM UTC, December 9, 2021.

Whitelist is open for the duration of Auction: https://whitelist.silo.finance

$SILO Token Address:

$SILO Token God Mode:

Auction Information

- Purpose: Raise Protocol Owned Liquidity (POL) for Silo DAO

- Platform: Gnosis Auction

- Model: Batch Auction (All winners pay one single price per token)

- Start Date: 3:00 PM UTC, December 6, 2021

- End Date: 3:00 PM UTC, December 9, 2021

- Order Cancellation: Orders can be canceled anytime before 3:00 AM UTC, December 7, 2021 (first 12 hours of the auction)

- Accessing Auction: The link will be provided after the auction goes live

- Auctioned Token: 100 million $SILO

- Bidding Token: ETH

- Minimum Price per Token: $0.10 denominated in ETH

- Minimum Amount per Order: $200 denominated in ETH

- Wallet Requirement: MetaMask Wallet or WalletConnect for mobile wallets

- Whitelist your wallet address to participate

- Restricted Countries: United States, Afghanistan, Cuba, North Korea (DPRK), Iran, Iraq, Libya, Lebanon, Somalia, Sudan, Syria, and Yemen.

How The Batch Auction Works

The token batch auction allocates tokens starting with bidders with the highest bids down until all 100M $SILO tokens are assigned to bids.

Here is how bids are filled and the clearing price is calculated:

- Once the auction begins, bidders can place limit orders.

- At the end of the auction, the token’s clearing price is calculated.

- The smart contract sorts bids from highest to lowest price. Bids include a limit order for the token price and the number of tokens to buy.

- Bids are gathered by the smart contract and sorted from highest to the lowest bid. The smart contract works back from the highest bid, adding each bid’s amount of tokens until 100M $SILO tokens is reached.

- The price of the bid that reaches 100M tokens $SILO tokens to sell is selected as the final clearing price for all participants.

- Bidders who specified a maximum price in their limit order that is equal to or greater than the final clearing price receive tokens at the clearing price.

- Bidders that specified a maximum price in their limit order that is less than the final clearing price do not receive the tokens being auctioned, but they can still withdraw their ETH amounts.

Key Takeaways

It will be well positioned for having stablecoins of all risk types to build out liquidity with isolated risks for the depositors. Seems like it can be the natural home for stablecoins of all different risk preferences. Silo’s isolated pools framework removes the issue of bringing down the credit worthiness of the entire protocol when long-tail assets are added. For example, $MIM and $RAI have different methods of backing. Although $MIM may be less backed, Silo is built to support the user’s risk appetite without putting other assets at risk and without sacrificing scalability. In short, it enables opportunities for long-tail asset pools and enhances the ability to create permissionless money markets for any risk asset.

Through its 2-asset-styled pools and bridging asset mechanism, Silo allows for deeper pools that reduce fragmentation of liquidity (as seen w/ Kashi). Note, that they have not exclusively specified what they will be using as their bridge asset.

Risks & Other Considerations

- Currently, the $SILO token is just a governance token and does not have any explicit utility within the protocol. It will be used for Silo DAO governance for proposals that include influencing pool parameters, movement of DAO-owned liquidity, and other decisions. There are no further utility/incentives built into the $SILO token (at the time of writing), and the community will decide on the token design.

- The bridging asset is not currently defined, but the whitepaper currently points towards $ETH as a bridging asset. The choice of bridging asset may influence the successful execution of the protocol.

- Given the lack of attention towards the auction, there’s an increased possibility of a low distribution amongst token recipients. This may result in a high concentration of $SILO holdings by a few players resulting in more centralized decision-making regarding the governance of the DAO.

- The valuation of the seed round is undisclosed and Silo Finance has no VC backers as of now. There are no clear benchmarks to price a bid for the auction so we are unsure of what a “fair price” is or what may be a good entry.

Overall, there are some risk factors to consider. Once these have been evaluated, it’ll be interesting to keep track of the project given a number of reasons:

- The team has a strong background and built out Silo Finance as finalists in ETHGlobal2021

- Strong seed backers

- Unique value proposition for the borrowing/lending protocol in balancing scalability and security

- Has the potential to make money markets truly permissionless

- Given the growing demand for stablecoins and other assets that have a spectrum of risk, a scalable and secure money markets destination will be in high demand