Executive Summary: Solana, Tailwinds, and Risks

Tailwinds

More enterprise adoption for Solana Virtual Machine (SVM)

Solana’s reputation will continue to strengthen if more institutional players recognize Solana’s improving tech stack (TPS on the higher-end of blockchain peers, downtime issues addressed, cost-effective on-chain storage) and decide to openly partner and utilize Solana’s chain. A few illustrations of this adoption are: Visa introducing Solana as a settlement layer to boost cross-border USDC payments, and Solana Pay, a new payment system on Shopify (partnership with Mastercard). Solana’s key value proposition is its cost-effectiveness and speed vs the rest of the market (Transactions Per Second or TPS ~3,000, 30 times the TPS of Ethereum and L2s).

Solana developers are executing their Firedancer vision. Developers’ interest in SVM is increasing.

Firedancer is arguably one of the most exciting upgrades for Solana. It will likely promote significant optimizations to the validator client and should function much more effectively than the current Solana Labs client.

As of now, the crypto narrative is primarily 97% Ethereum Virtual Machine (EVM) and 3% SVM. If the SVM continues to take a cut of EVM’s market share, the Firedancer upgrade and improved hardware/bandwidth efficiencies could help expedite the adoption of SVM.

Growth of JitoSOL and other liquid staking tokens

Jito Labs is Solana’s latest “success story” in the liquid staking landscape. The growth of JitoSOL, with over 2.4M SOL staked over the course of the year, has been an impressive feat for the Solana ecosystem, benefitting many of the dApps within. Ethereum has over 40% of staked ETH deposited in liquid staking protocols, and in contrast, Solana only has about 3-4% of staked SOL. If Solana’s staked SOL manages to grow even a small fraction of their staked SOL in LSDs, this could help promote the total TVL of Solana’s ecosystem. Solana’s staking yield is currently double the yield of Ethereum, with close historical risk statistics (price drawdowns).

More consumer-facing applications recognizing Solana’s edge

Solana has proven to be the most usable chain when it comes to building consumer-facing applications. The blockchain offers a fully-fledged tech stack that is optimized for retail adoption. Solana’s cNFTs are suited for large-scale NFT mints that are optimized to offer the lowest possible costs, while the local fee markets aim to eliminate unnecessary congestion in the network, and the high TPS environment offers the speed needed to drive these applications.

Native Token launches for Solana-centric Protocols

The crypto community has often wondered why most Solana DeFi applications have not launched their respective native token. The answer is simple. Protocols would often want to hit a certain threshold in user base and activity before launching tokens. The tokenomic history of DeFi protocols has demonstrated that the native token can often be overinflated and based on pump-and-dump schemes. However, native token issuance for DeFi protocols tends to be a sine-qua-non step in a DeFi protocol lifecycle.

Risks

SOL price dumps to post-FTX levels if Galaxy chooses to liquidate their SOL holdings entirely and in a small time interval

If Galaxy offloads FTX/ Alameda’s entire SOL position in a small interval of time, the SOL price may react negatively as it is sold into the open market (also assuming that a % of SOL holdings may be OTC-ed). If SOL’s price retraces to post FTX’s level, this may cause a panic in the market,

Further network halts taint Solana’s reputation

Solana has maintained a 100% uptime year-to-date, which is a very positive record for the network. If the network experiences any network halts in the future, this would negatively impact Solana’s reputation and confidence in its recent tech upgrades.

A lack of bridging infrastructure and native assets

Despite the notable developments within the Solana ecosystem studied in this report, there is still a lack of liquidity on-chain, a lack of native asset support, and not enough bridging infrastructure in place. Furthermore, the ecosystem still has to break its track record of bridge “exploits”.

Macro

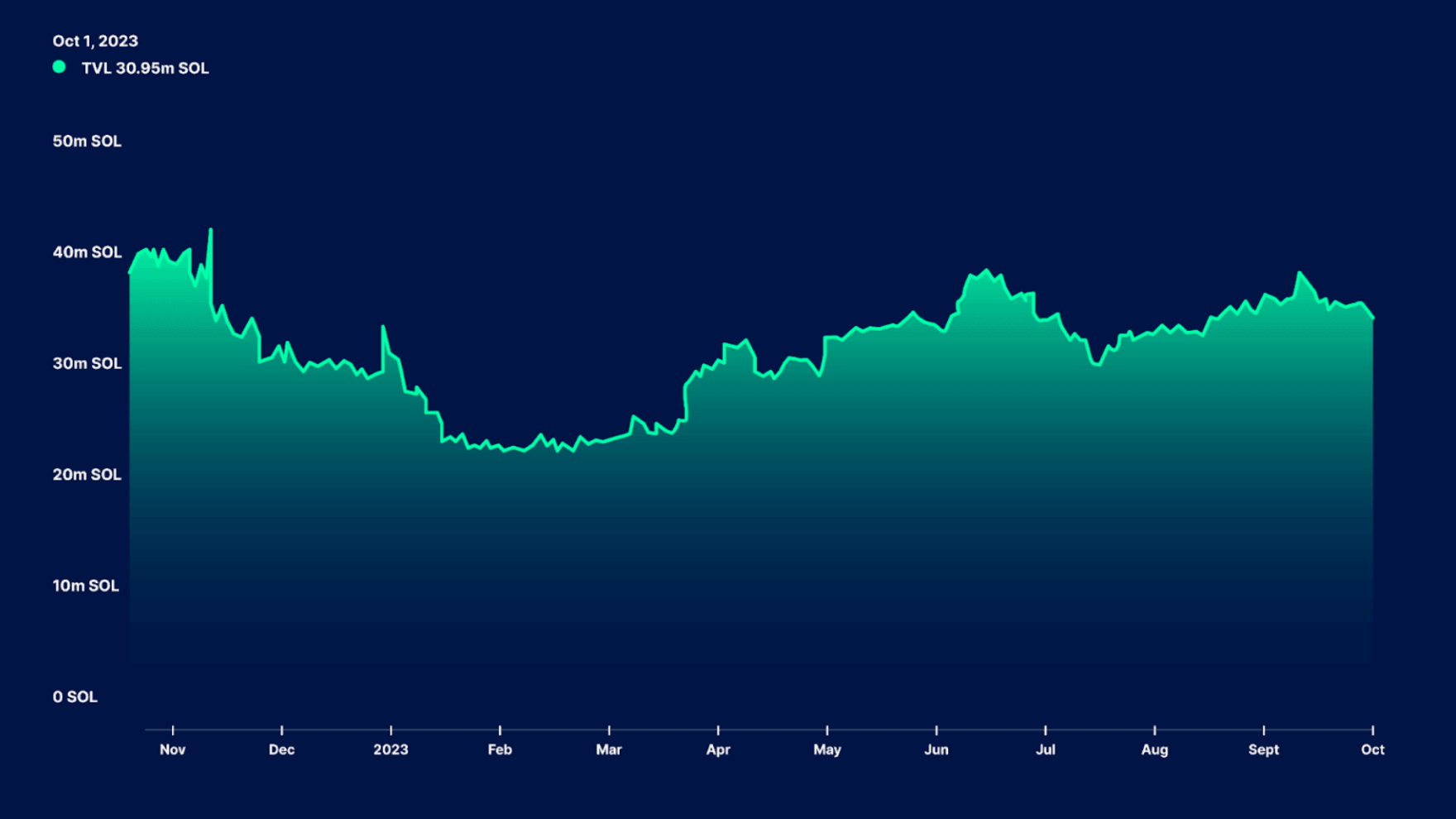

TVL

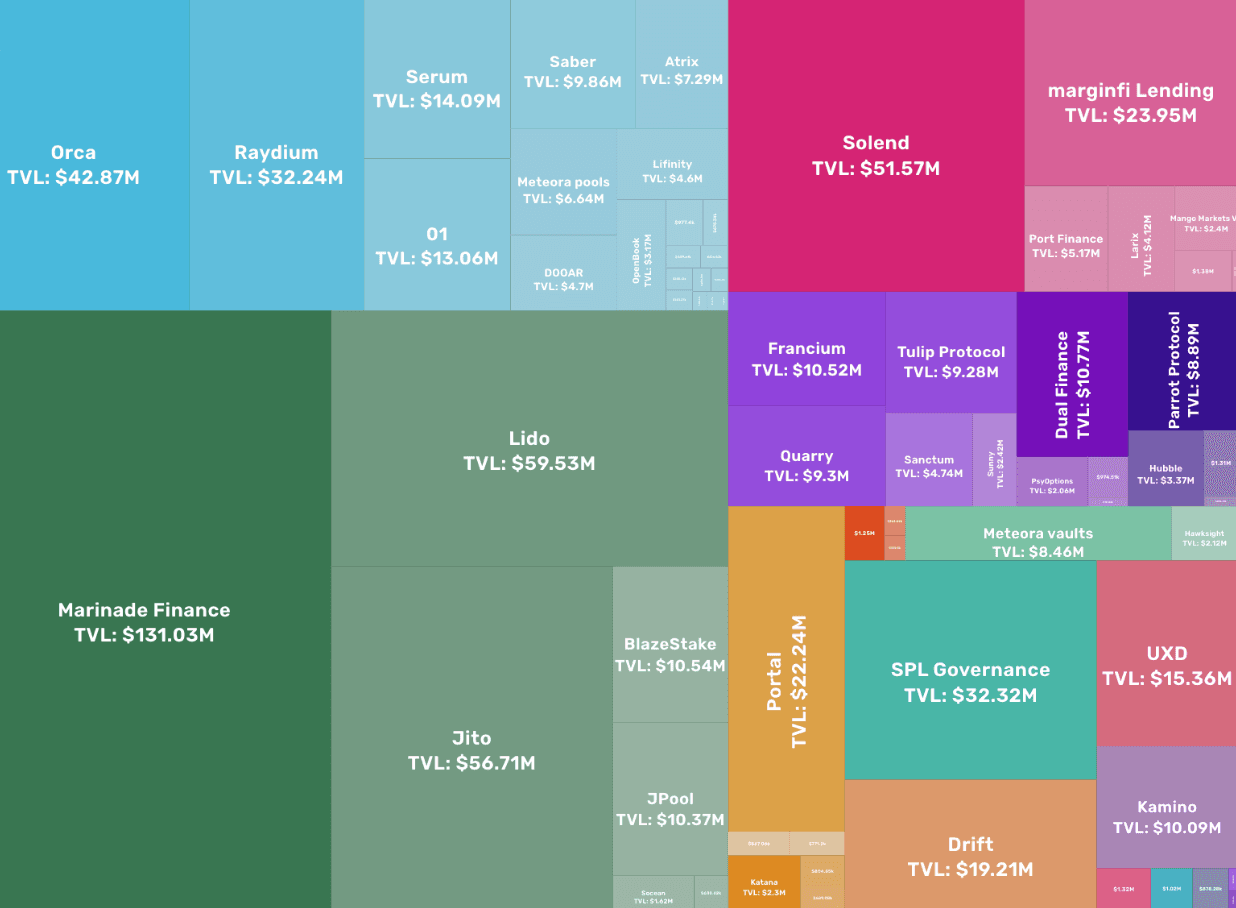

Solana’s TVL is at 30.95M SOL, compared to 25.12M SOL at the start of the year. Since the start of the year, Solana’s TVL has almost doubled, both in SOL and USD values, with a consistent upward trajectory as seen in the charts.

Solana has dealt with some pressing issues in the past, the FTX/ Alameda saga, downtime issues with network halts, spam transactions congesting the network, etc. However, most of the issues have been resolved with improvements in their tech stack, which we will delve into later in this report. It is worth noting that Solana has maintained a 100% uptime year-to-date.

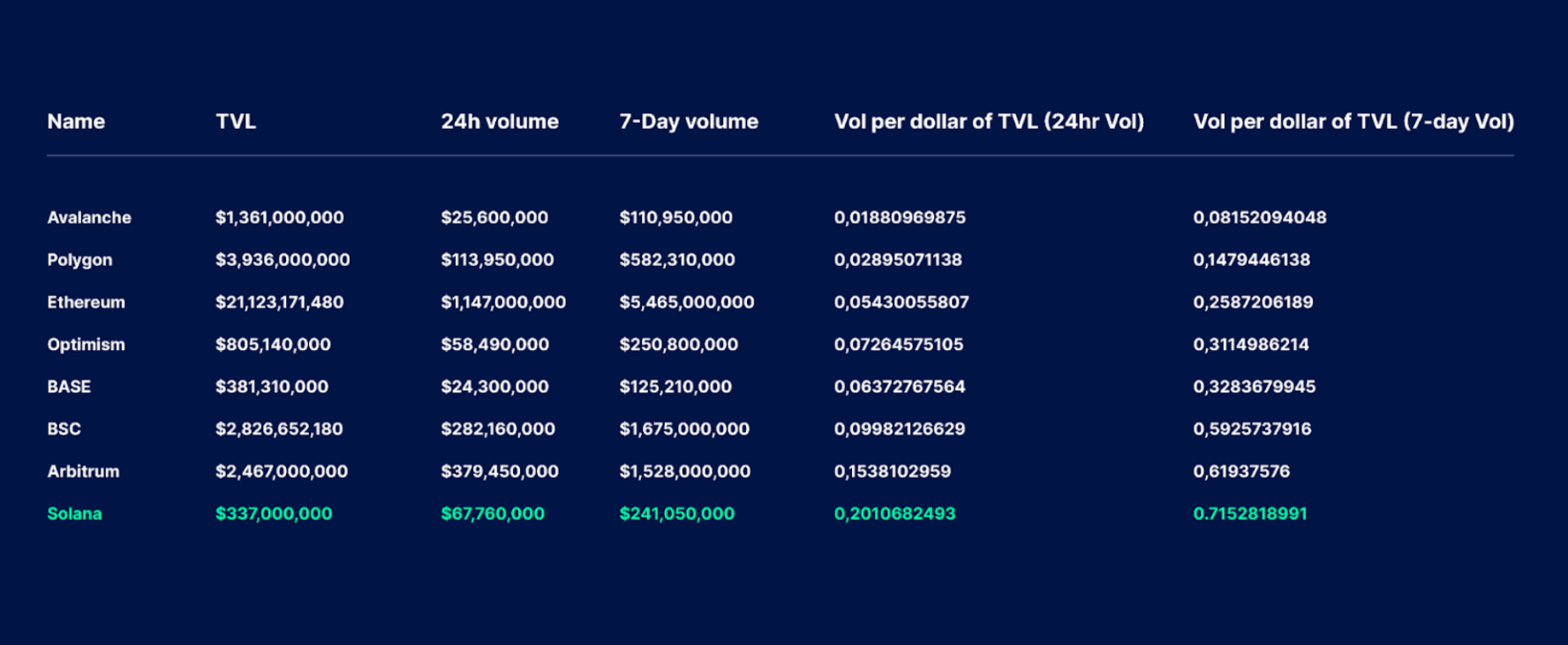

DeFi Velocity

Volume per dollar of TVL (DeFi Velocity) can be used to measure chain activity and adoption, as TVL can often be misinterpreted without accounting for nuances of user behavior. Solana is still one of the more actively used chains in terms of DeFi velocity, with a ratio of 0.71 for volume per dollar of TVL (in the last 7 days).

Volume per dollar of TVL can be thought of as “for every dollar of liquidity, how much is transacted”. Taking Solana as an example, for every dollar of liquidity, it is transacted almost 0.71x on a weekly basis (as of 2 Oct 2023). Solana has also delivered the highest DeFi velocity in the last 24 hours and 7 days, vs peers such as Arbitrum, Binance, Base, Optimism, Ethereum, etc. Interestingly,some chains are reporting higher TVL numbers, but far lower DeFi velocity than Solana’s, suggesting lower economic activity on-chain.

Let’s zoom out and consider DeFi velocity across chains on a monthly basis for a longer-term view.

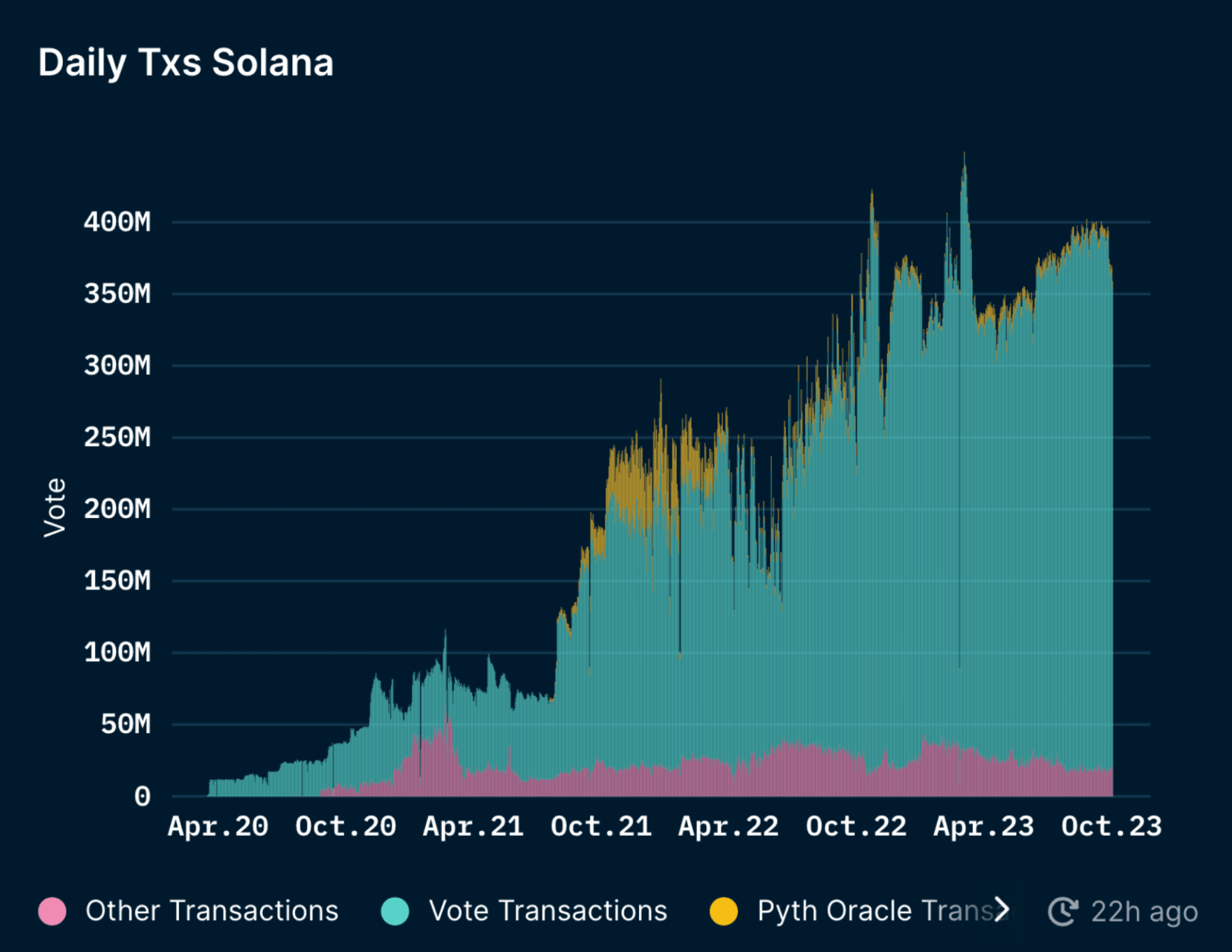

Daily Transactions

Daily transactions on Solana have stayed relatively stable this year, with an increase in vote transactions. Transactions on Solana are a combination of vote and non-vote transactions. Vote transactions are linked to a voting account that is owned by a validator, and includes configuration, registration, vote collection, and new vote signing.

Decentralization

By Client Diversity

Having a diverse set of clients is important to reduce the single failure point in any given blockchains.

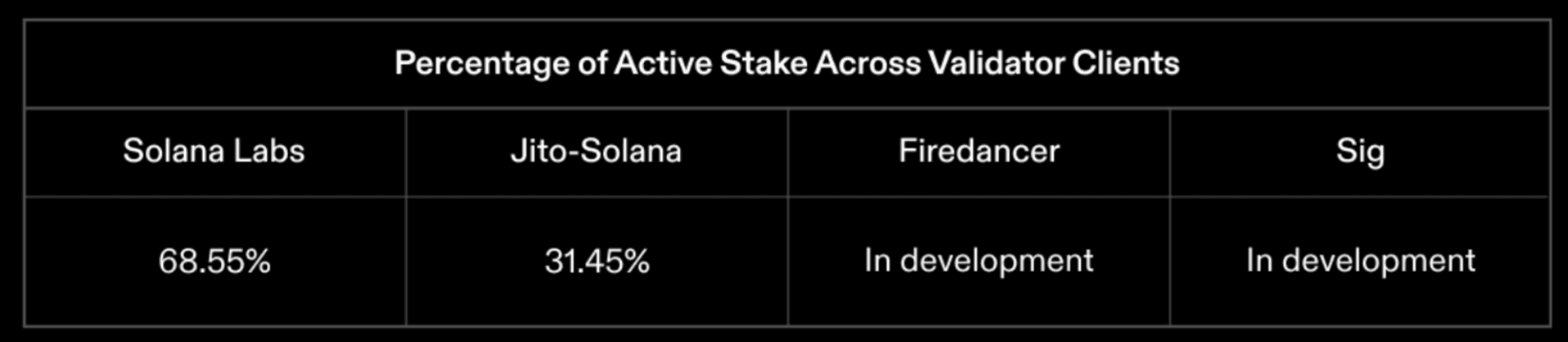

Solana has more than 4 different validator client implementations for the Solana network in development. Besides Solana Labs, there is a growing percentage of stake run through the Jito-Solana Client, which is nearly represents a third of total stake. The quantity of validators using Jito has nearly doubled since Solana Foundation’s last Validator Health report in March.

Currently, there are several efforts to create additional full or light validator clients on Solana including Jito Labs, Firedancer, Sig, and Tinydancer. More individual details on the validator clients can be found in Solana Foundation’s latest report on the network’s Validator Health.

By Region

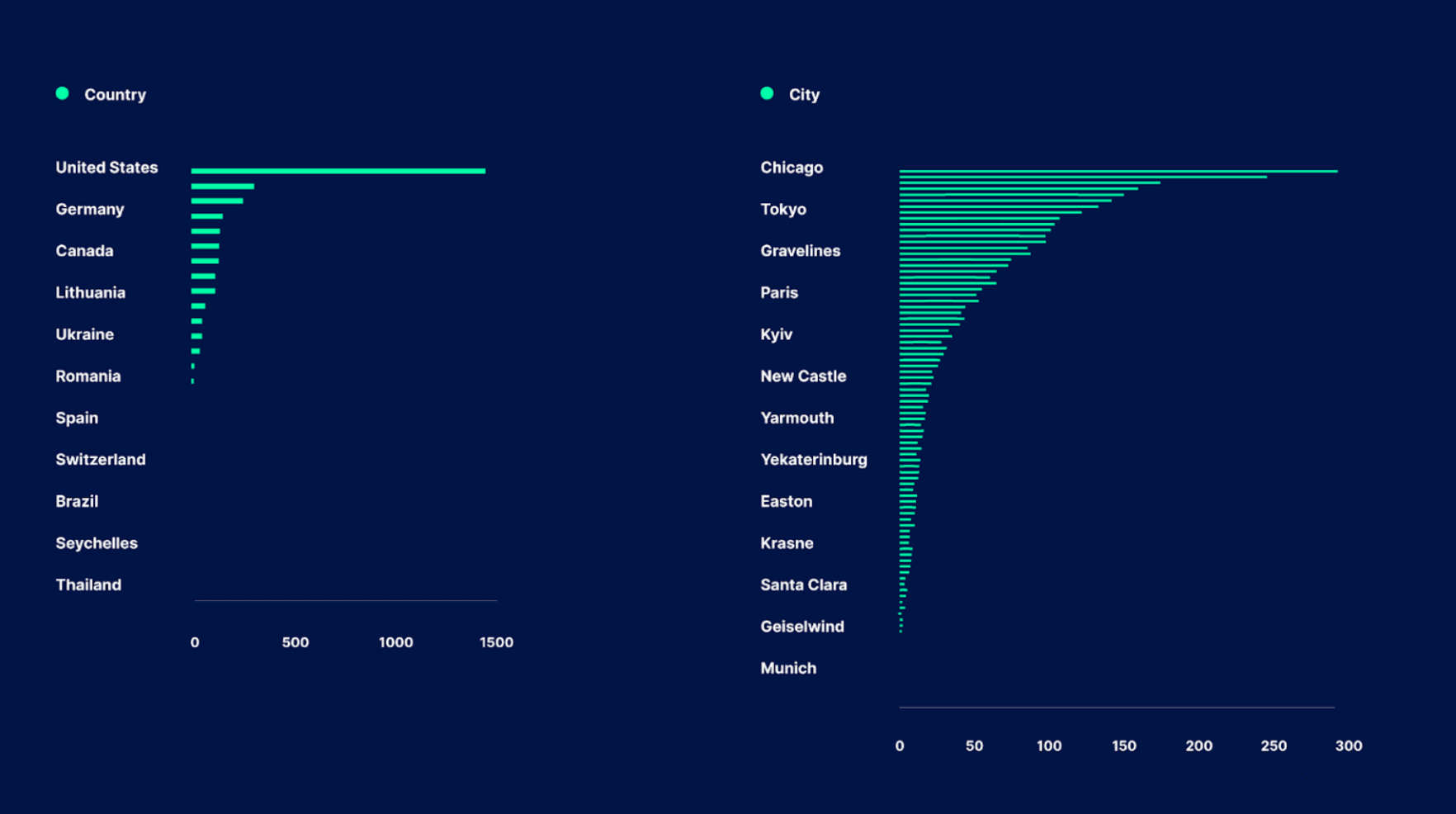

There are a total of 2,919 nodes spread out within 31 countries and 211 cities worldwide. The country ranking by number of nodes is led by the US, followed by Germany, Canada, and Lithuania. The US hosts 1,370 nodes, almost half of the total nodes. The geographical concentration of the US might represent a slight risk, but it is worth noting that the nodes are spread-out across different clusters of validators in the US.

Nakamoto Coefficient

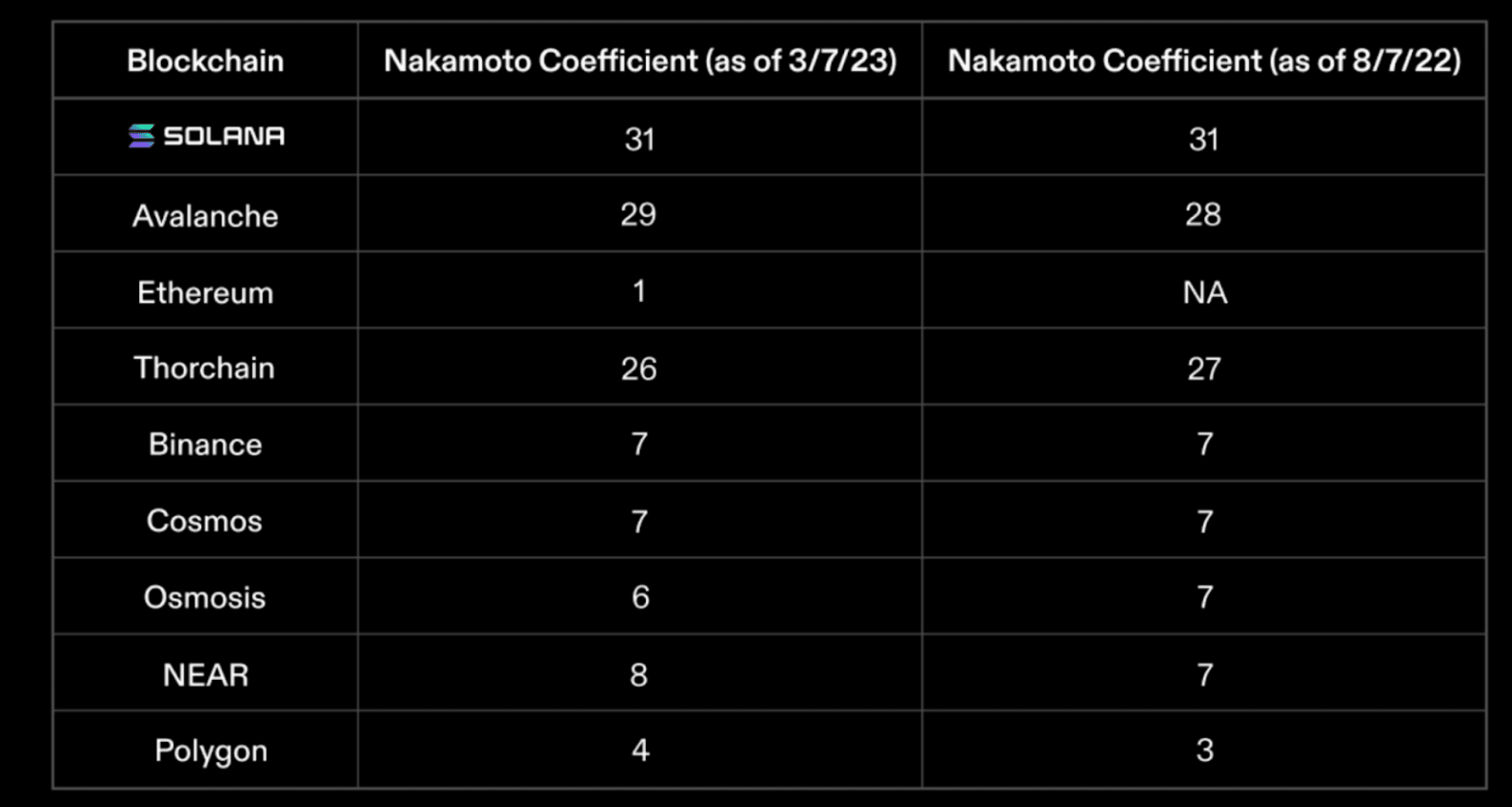

The Nakamoto Coefficient is a measure of the smallest number of independent entities that can act collectively to shut down a blockchain. According to this framework, the higher the coefficient, the more decentralized the blockchain. On a typical Proof-of-Stake network (like those listed below on Nakaflow), the Nakamoto Coefficient is defined by the percentage of node operators that, together, control more than one-third (33.33%) of all stakes on the network. Solana’s Nakamoto Coefficient has grown consistently since the chain’s inception and has remained relatively stable at 30-31% over the past year. However, it must be highlighted that the Solana Foundation controls ~20% of the stakes and in turn delegates to small-to-medium-sized validators.

When it comes to measuring decentralization, the Nakamoto Coefficient alone does not suffice. Other metrics like geographic diversity, data center ownership, and validator client diversity should also be taken into account. Client diversity is being pushed forth by Firedancer upgrade, with Jump Crypto’s “Firedancer” client, which we will look into later in the report.

Catalysts / Drivers / Risks

Alameda / FTX SOL Sell-Offs

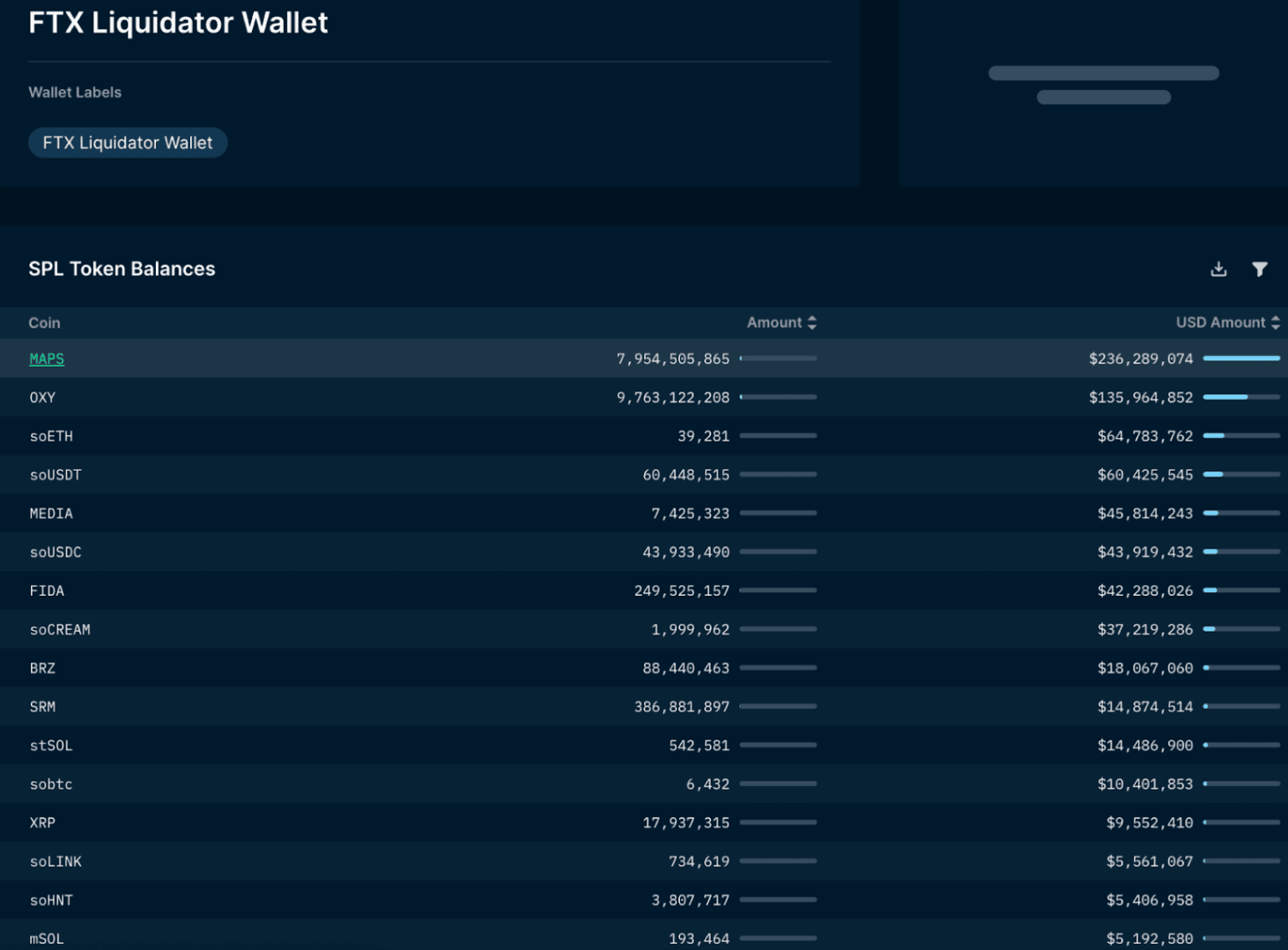

SOL happens to be FTX’s largest holding with over 71.8M SOL or approximately $1.16B worth of SOL locked and held. This represents ∼17% of SOL’s circulating supply (as we write), and ∼13% of its total supply. One disclaimer is that not all accounts are known, which could potentially change some data points. Special thanks to SolanaFM for the data-points.

What we know:

- FTX and Alameda hold ∼$1.3B in assets, consisting of SOL, BTC, ETH, APT, etc.

- Hot Wallets:

- 9uyDy9VDBw4K7xoSkhmCAm8NAFCwu4pkF6JeHUCtVKcX

- 6wEMcwrcF5AP9jpHWQcPxHXciWA2g217Qq81CTWjbgBw

- 6b4aypBhH337qSzzkbeoHWzTLt4DjG2aG8GkrrTQJfQA

- Total SOL in Hot wallets: 6.98M SOL

- Staking Wallets

- There are 3 main staking wallets (equaling ~65M SOL)

- Total stake account balance: 61M SOL

- Locked staked: 52M SOL

- And there’s an additional 3.8M SOL that is unlocked.

- Total stake account balance: 61M SOL

- There are 3 main staking wallets (equaling ~65M SOL)

- Galaxy Digital is facilitating the selling of Alameda / FTX holdings, though when this process will happen is still unclear. A weekly limit of $100M of coins sold weekly has been specified and designed to cap price volatility (including hedges).

What we don’t know:

- The locked staked portion of 52M SOL is vested until 2027, with a 7.5M SOL unlock on one of assumed Alameda / FTX’s accounts on 1 March 2025. However, FTX liquidators have the right to completely liquidate all of FTX / Alameda’s SOL holdings, despite it being locked/staked.

- We are unable to map out the exact value of SOL that could hit the market, as Galaxy Digital could be OTC-ing as much of the holdings as they can. Galaxy Digital can also choose to sell in batches, liquidate the SOL book entirely, or use other alternative methods that we may or may not be able to verify on-chain. Another point to note is that OTC-ing the SOL from FTX / Alameda would likely take away some of the buying pressure from the market.

Ecosystem Highlights

Solana’s adoption has gained positive momentum recently:

- September 2023: Visa introduces settlement of USDC on Solana. This one is quite notable if we consider a future architecture for payments and other use cases made of public blockchains interacting with private (or public) financial entities.

- September 2023: MakerDAO’s founder is considering Solana SVM as Maker’s new native chain. This is part of Maker’s “Endgame” upgrade plan, which is expected to take 2-3 years and will have 5 stages.

- August 2023: Solana Pay integrated with Shopify.

- June 2023: Tensor NFT has launched its compressed NFT marketplace, and has taken most of the NFT market share on Solana. Tensor and Magic Eden make up almost 90% of the entire Solana NFT trading volume.

- From April 2023 on: Backpack wallet on Solana gains adoption as users find it more seamless to interact with the wallet infrastructure. Backpack Wallet also comes with a multitude of plugins like Jito Staking, Solend, and Drift Protocol, as well as games that users can interact with directly on the wallet interface.

Developments and Partnerships

Solana’s State Compression

State Compression is a solution on-chain that lowers storage costs significantly. It refers to storing the bulk of data (e.g. NFT data in this case) off-chain, and keeping their “footprints” on-chain using Merkle Trees. This compression-friendly data structure allows developers to store a smaller bit of data on-chain and updates directly in the Solana ledger, cutting data storage whilst still maintaining Solana’s base layer.

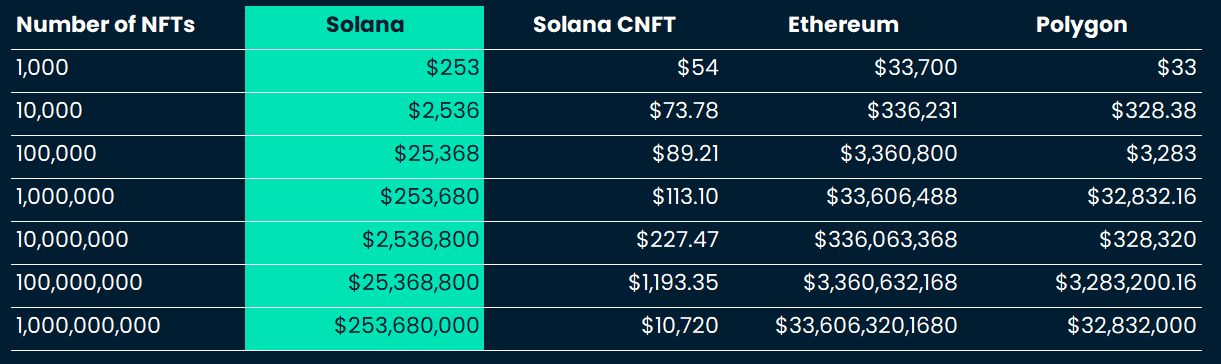

Diving deeper into the costs of minting NFTs with and without the state compression technology, the cost of minting 1M NFTs pre and post-cNFTs on Solana alone would have cost $253k pre-cNFT and only $113 with state compression enabled. Comparatively, a similar collection size would cost $33.6M on Ethereum and $32.8k on Polygon.

Interestingly enough, minting a collection would have actually been significantly cheaper on Polygon versus Solana were it not for the state compression upgrade. It is clear that Solana has gained a significant edge in compression technology, which drastically reduces minting and transaction costs for NFTs.

For an in-depth write-up on NFT compression and how the technicalities work, check out this piece by Helius.

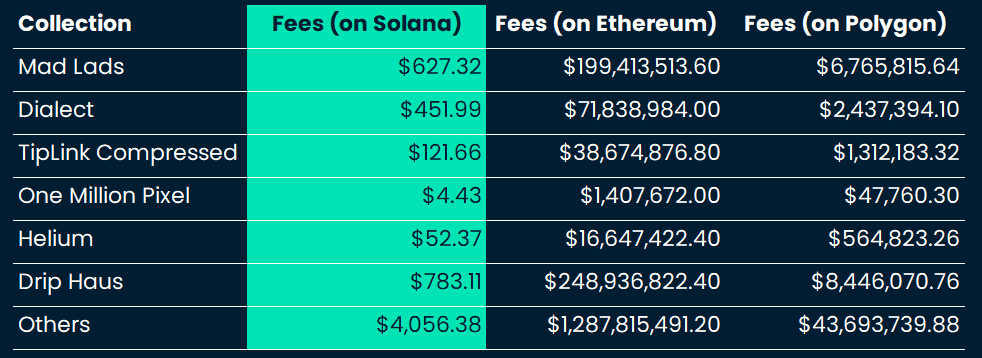

Solana’s state compression technology is used across the ecosystem, with many projects benefiting from the upgrade. In summary, Drip Haus and Mad Lads have emerged as two of the top collections in the compressed NFT space, with 7.4M and 5.9M NFTs minted in total respectively.

Note: Fees are estimated values depending on the price of each asset at a given timeframe. The above fees were calculated based on the prices of Solana, Ethereum, and Polygon on 2 October 2023.

Here are some interesting use cases of Solana’s state compression so far:

- DRiP

- DRiP recently reached a milestone where it minted its 1 millionth Solana NFT - and is crowned as the largest collection of NFTs across all chains.

- For context, DRiP offers free NFTs every week for its users. A community of artists on Solana creates the NFTs, and minting this scale of NFTs is only possible thanks to Solana’s State Compression.

- Mad Lads

- Mad Lads is the first xNFT (Executable NFT) collection, which is a new token standard that allows for the tokenization of code.

- In short, xNFT can be represented as a dApp, and users can access it directly from their wallets. It is quite similar to a plugin function on Google Chrome. To add, xNFT is also a programmable and dynamic asset and only runs exclusively on the Solana blockchain using the React xNFT framework. In contrast, regular NFTs are static and non-programmable.

- Backpack is the wallet and platform that supports Mad Lads. Backpack is where Mad Lads NFTs were first minted and managed and serves as the execution environment for xNFTs.

- Crossmint

- Crossmint is an NFT infrastructure for developers to build NFT applications seamlessly.

- Dialect

- Dialect is a messaging platform on Solana that has gained popularity by leveraging the platform’s compression abilities, enabling creators to mint and distribute their NFTs to users on the platform.

- To understand the technical components of what makes minting in-app stickers possible at such a scale, refer to Solana’s case study here on Dialect.

- Essentially, the introduction of State Compression has reduced the infrastructure costs (provisioning and storing of the “texts” or in this case NFTs, and costs of the goods) to almost negligible numbers.

- Dialect dropped its first NFT collection and allowed users to claim zero fees. This in comparison, would have never been possible objectively on Ethereum or any other L1/L2s.

DePIN Narrative

The DePIN narrative falls under the state compression technology as it benefitted highly from it. DePin stands for Decentralized Physical Infrastructure Networks. We’ve seen an explosion of DePIN networks over the years, from mapping to energy to logistics, and more, and some that are exclusive to Solana. Solana Foundation’s dePIN lead Kuleen Nimkar, also stated that dePINs are reshaping traditional infrastructure models, providing an opportunity analogous to today’s gig economy. Over time, we could see people gaining additional income by contributing hardware to dePIN protocols.

Helium

Helium is a decentralized wireless network that powers individual hotspots in more than 170 countries, and it offers 5G services to some cities in America. Helium started building its own hotspot in the initial stages of the network development and then pivoted to open-sourcing its hardware spec.

Helium mints each hotspot as NFTs - enabled by Solana’s state compression technology. Minting an NFT costs fractions of a penny on the dollar compared to an uncompressed token. Helium represents one of the first DePIN businesses. An example of this is Hivemapper, a decentralized mapping network that recently started using Helium to verify the location of each driver.

Hivemapper

Hivemapper is a decentralized mapping network that essentially builds and distributes its own hardware dashcams. Hivemapper also controls the entire manufacturing and distribution process, which gives it full autonomy over its supply chain.

Hivemapper offers tokens to drivers who install “dashcams”, and collects mapping data as they drive around.

Render Network

Render Network enables individuals to contribute unused GPU power to help projects render motion graphics and visual effects. It recently announced its expansion from Polygon to the Solana blockchain.

QUIC

QUIC replaced UDP (User Diagram Protocol), Solana’s previous transaction propagation protocol. Solana previously adopted a raw UDP-based protocol to handle transaction messaging from clients to the lead validator client. UDP couldn’t handle some transaction filtration within the network, which led to network downtime in the past.

QUIC is currently utilized as the default transaction ingestion protocol, which allows for greater control over data flow, to avoid issues like spamming the network. QUIC is designed for fast asynchronous communication like UDP but with sessions and flow control like TCP (Transmission Control Protocol). This upgrade provided more control over network traffic and is more optimized for data ingestion, which has addressed Solana’s downtime issues. Since the deployment of QUIC, Solana has maintained a 100% uptime year-to-date.

Local Fee Markets

Priority fees were introduced to the Solana network on top of existing flat base fees. Local fee markets allow any user to send priority fees to validators. Previously, users had to spam transactions to the network in order to ensure that their transactions were prioritized, causing network congestion. Moreover, the amount of invalid or duplicated messages sent by users or algorithms could also lead to an increase in total cost. It was clear that priority fees became important for block inclusion and transaction queue ordering. Priority fees simply increase the cost of spamming the network.

Priority fees can also be used as a proxy to measure activity that happens within the network. An increase in priority fees (as a % of total fees) can also be attributed to a growth in economic activity on the network (i.e. a huge NFT mint, DeFi activity, etc.).

Currently, priority fees are calculated based on the amount of computing resources that a transaction is expected to require. For instance, a simple transaction for a DeFi activity would require a lower total priority fee compared to a big NFT mint that is happening at the same time, hence, it will be dynamically adjusted based on the type of transactions that are taking place.

Liquid Staking on Solana

Liquid Staking is one of the most important economic activities for DeFi and has even flipped lending as the leading category across several DeFi metrics. As seen on Ethereum, almost $20.22B worth of ETH is staked in liquid staking protocols (i.e., Lido, RocketPool, etc.), and this represents about 40% of the total ETH staked (see Nansen article on Mapping the Ethereum landscape). On Solana, however, only about 3-4% of staked SOL sits in Solana’s liquid staking protocols. There is a huge opportunity for Solana to tap into its liquid staking landscape as a means to increase capital efficiency for its tokens, and in return, grow the total TVL and ecosystem.

How does staking on Ethereum compare with staking on Solana? We looked into the liquid staking yield on Lido across both chains, as well as historical average volatility, max drawdown, and risk-reward ratios. At the moment, for very close risk profiles, Solana’s staking yield is almost double Ethereum’s.

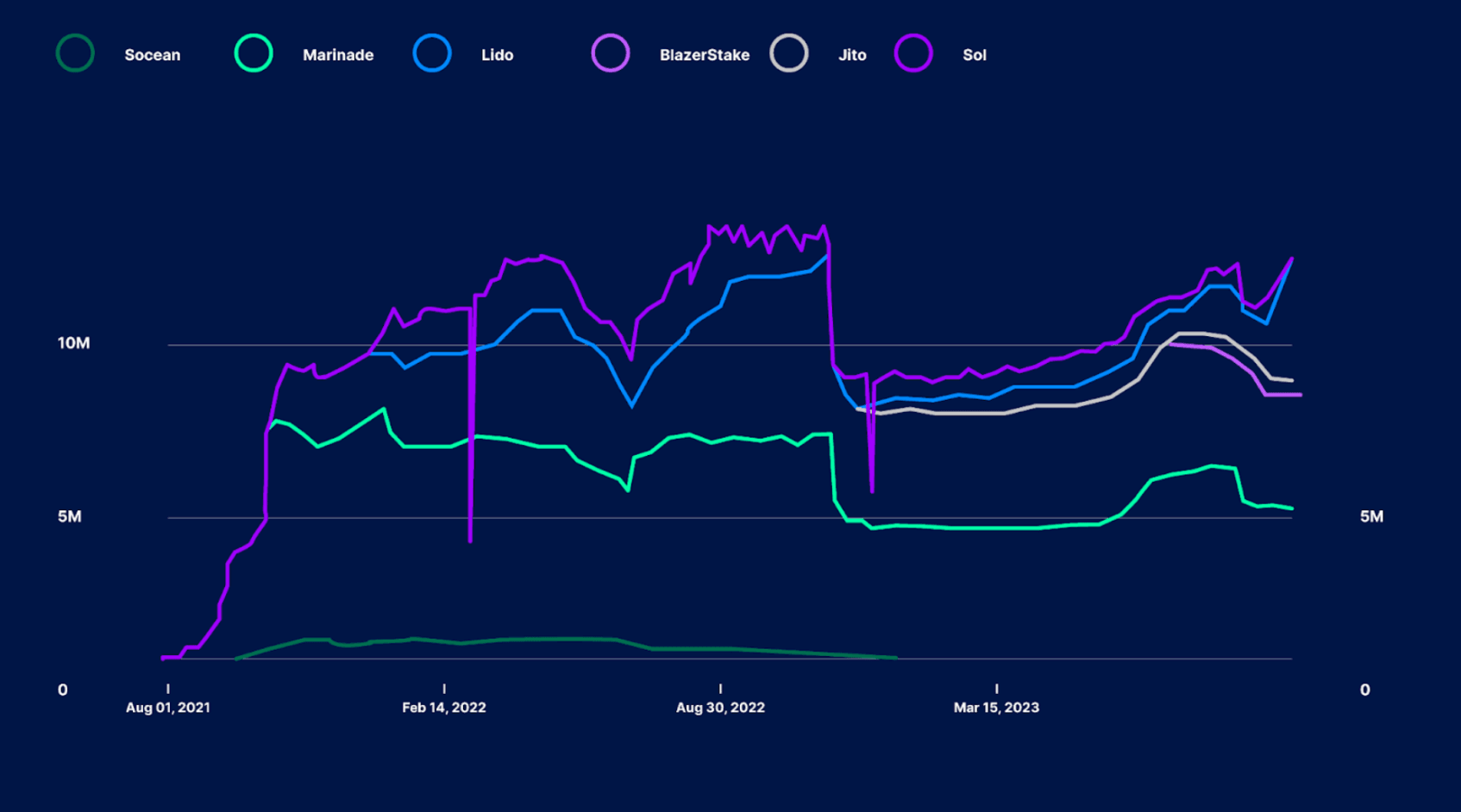

In total, 295.7M SOL are staked on the network but with still very minimal use of liquid staking derivatives. The liquid staking landscape on Solana has taken a hit during FTX, falling from 12.8M SOL in TVL at its peak, to as low as 5M during the crash. However, liquid staking activity has fully recovered since, rising to levels seen in pre-FTX days (~12M+ SOL).

We have also witnessed new entrants for liquid staking protocols, like Jito, a staking service provider, which amassed over $44.86M (2.3M SOL) in TVL since its launch in late November. Moreover, cross-Liquid Staking Derivatives (LSD) and DeFi use cases are significantly increasing, with certain DeFi protocols allowing users to deposit their SOL LSD tokens and use them as trading collateral (on perps) or to borrow/lend in lending platforms.

Marinade Finance still takes on the majority of the market share in Solana’s liquid staking landscape with over 5.47M SOL staked, followed by Lido and Jito. It is worth noting that more liquid staking protocols like Marinade, Socean, Lido, BlazeStake, Jito, etc. are starting to emerge, and are all offering differentiated rewards programs to attract more users to stake SOL.

Marinade’s new program, Marinade Native, allows users to seamlessly delegate stake authority while maintaining withdrawal rights. Marinade Earn was also announced as part of their incentives program, and will be taking place from October 1, 2023 to January 1, 2024. Users who hold mSOL or Marinade Natives stake will earn 1 MNDE/SOL staked over the course of the program period (~3 months). There is also a referral system where referrers can earn 1 MNDE/SOL from their unique referral link.

Speaking of the “new kid on the block”, Jito has hit an ATH TVL of $57.5M on October 2, 2023 and currently has 2.4M SOL staked - in up-only trend since launch. TVL has seen a 100% increase, rising from 740k SOL to 1.62M SOL over Q3.

Jito is Solana’s first staking product that includes MEV rewards. Users can stake their Solana tokens in exchange for the LSD token JitoSOL.

JitoSOL has two main benefits:

- JitoSOL provides additional rewards to users from MEV transactions that happen on Solana.

- Jito stakes with validators that run software explicitly designed to improve network performance.

The top programs by JitoSOL deposits are at >750k SOL, with respective market shares:

- Marginfi - 250k

- Drift Protocol - 225k

- Squads Protocol - 146k

- Orca - 51k

- And 30 other programs

BlazeStake is another new player “on the block”, and has experienced a >10x TVL increase since inception, from $631k to $10.68M as we write. SolBlaze launched its native token, BLZE, and plans to roll out new features for its platform including BLZE Gauges while also launching an incentive program for staking. The estimated APY for staking on SolBlaze’s platform is ~9.37% (~2.13% from BLZE).

Hyperledger Solang

Solana is known for its Rust or C programming language for smart contracts. Hyperledger Solang was introduced recently to allow developers from EVM chains to deploy their dApps on Solana without needing to learn a new language. Hyperledger Solang lowers the barrier to entry for developers and makes Solana a much more accessible chain to build on. However, it is still unclear as to how much this would impact the developer activity on Solana.

Upcoming catalysts

Emerging Solana DeFi applications

Phoenix

Phoenix is a decentralized limit order book on Solana, supporting markets for spot assets. Phoenix is built by the Ellipsis Labs team, who recently closed a $3.3M round led by Electric Capital. Phoenix is essentially betting on the growth of Solana native assets. The Phoenix program is the entryway to their DEX, and the team believes that market creation should be permissionless. All market events (limit order placed, limit order canceled, fills, etc.) are written on-chain, so it's easy for traders to query the full live and historical state of all Phoenix markets.

Drift Protocol

Drift Protocol is a derivatives exchange on Solana. Drift v2 has recently done over $1B in cumulative volume, with $4.9M in open interest. Drift’s TVL has increased by >50% in the last month itself (denominated in both USD and SOL). Overall, Drift Protocol has experienced strong growth across all metrics.

Apart from the high-level statistics, Drift has also introduced CONNECT, an open-source Metemask snap, allowing users of Metamask wallets to bridge from EVM chains to Solana. Furthermore, Drift is also proposing future support for permissionless prediction markets, which is still in the initial stages of discussion.

Squads Protocol

Squads Protocol just launched its new platform and is a comprehensive multisig platform exclusive to the Solana ecosystem. Squads Protocol has secured $600M in assets, and $950M in total transaction volume.

Kamino Finance

Kamino is an automated liquidity solution that allows users to earn yield on their assets by providing liquidity to concentrated liquidity market makers (CLMMs). In Q3, Kamino Finance has facilitated over $1B in trading volume, and the protocol has generated $1.25M in fees for its depositors. Kamino Finance’s v2 is highly anticipated and is scheduled to be in Q4.

Point System for DeFi Protocols

A point system allows protocols to test out different incentive mechanisms, so protocols can gauge what works and what doesn’t. So far, the point system has largely been tried and tested by NFT protocols, spearheaded by Tensor and Blur. We have yet to see how much adoption these point systems will generate for Solana DeFi applications.

MarginFi

MarginFi, a borrowing and lending market, has led the point system on Solana DeFi, which has started a network effect as other protocols have followed through. The point system was inspired by renowned NFT platforms like Blur and Tensor’s playbook but revamped and applied to DeFi protocols. Several Solana DeFi protocols have started to push out their own points program after MarginFi, including Cypher, Solend, and Jito.

MarginFi’s system has launched a similar point system as Swell Network, where each dollar lent out is equivalent to accumulating 1 point a day, and each dollar borrowed is equivalent to 4 points per day. Borrowing earns more points as it is the main driver of a lending protocol’s success. The leaderboard for top MarginFi accounts with accumulated points can be found here.

Possible strategy (not financial advice):

- Lend stables

- Borrow stables against lent stables

- Loop for max points

- Be wary of APR differences between lend & borrow

Cypher

Cypher experienced an explosive TVL growth earlier this year, but then experienced platform security vulnerabilities. Despite a fallback due to the exploit, Cypher has since resolved most of its issues and has restarted operations.

Cypher’s point system allocates to trading, borrowing and lending on the platform. For collecting points on spot and perp:

- Perp markets

- Maker volume: 20 points per $ of volume

- Taker volume: 15 points per $ of volume

- Spot Markets

- Maker volume: 10 points per $ of volume

- Borrowing/ lending markets

- Borrowing: 5 points per $ borrowed each day

- Lending: 1 point per $ lent each day

Possible strategy (not financial advice):

- Trade volume points

- Can farm points by buying spot SOL and hedging with a SOL short

- Be wary of trading fees and borrow/lend APR difference

Solend

Solend is taking a unique approach where Solend Points have a minimum rewards pool, and are segregated by “Seasons”. Season 1 will start with 100k SLND and will grow when they onboard more partners and secure deals.

- Borrowing/ lending markets

- 10M points are distributed each day proportionally to supplies and borrows. Borrows are 2x the supplies.

- Margin trading

- Each $ of margin trading volume earns 10 points

Possible strategy (NFA):

- Trade on any Margin pools

Deposit and borrow in the main pool, looping is possible

Jito

Jito launched Jito Points on Sep 28 for users to compound their jitoSOL asset.

The bonus/ point breakdown is as follows:

- 1.5x points for LP-ing in any JitoSOL/xSOL pairs

- 2.5 points for JitoSOL/SOL LPs

- 3.5x points for JitoSOL/ USDC and other volatile pairs

Possible strategy (NFA):

- Providing JitoSOL liquidity on these integrated protocols:

- Kamino Finance

- Meteora

- Orca

- Raydium Protocol

- Drift Protocol

Firedancer: Wen >1M TPS?

Firedancer is a Solana validator client developed by Jump Crypto, that aims to further reduce latency time and improve client diversity for Solana. In order to effectively process its goal of 1M transactions per second, the network would need to scale load balancing. Firedancer leverages both hardware- and software-based upgrades to scale load balancing. In this report, we won’t be diving into further details on Firedancer and its implementation.

There will be a component-by-component release of Firedancer.

- The implementation of the QUIC transaction propagation protocol marks the first step of Firedancer development. The result of “fd_quic” presented a 1M transaction propagation throughput in performance tests.

- The goal is to recreate each component of the Solana architecture to fully achieve Firedancer’s potential. QUIC marks the first step in recreating each validator component, and the release date of the full-fledged technology is still unknown at this stage.

Solana has developed a series of impressive technological feats, met critical challenges, and pioneered potential future directions for infrastructure, applications, and even partnerships with traditional financial stack. While Solana has grappled with various technical and network challenges in the past, the robustness of its tech stack and the commitment to improvements, like the implementation of QUIC, have largely lessened concerns.

Solana’s growing TVL, leading DeFi velocity, and stable monthly transaction figures underscore the chain’s potential to be a hub for diverse economic activity. Decentralization metrics, such as the Nakamoto Coefficient, shed light on the chain’s commitment to creating a more distributed ecosystem.

The ecosystem has been buoyed by various partnerships and technical advancements. From the promising state compression technology, which significantly reduces costs for NFT minting, to the anticipation around Firedancer and its potential to further optimize the Solana experience, the chain continues to innovate. The integration with Metamask Snaps and developments like Hyperledger Solang also hint at Solana's endeavors to become more EVM-friendly.

Solana's journey thus far is emblematic of the broader blockchain evolution — filled with promise, punctuated by challenges, but constantly evolving. As with any emerging technology, the path forward is uncertain. The upcoming liquidation of FTX/Alameda’s SOL holdings by Galaxy represents a potential point of volatility on the timeline for Solana. Yet, the commitment to innovation, adaptation, and user-centricity displayed by Solana hints at a promising trajectory for this blockchain contender.