TLDR

General observations

- In 2022, overall stablecoin supply declined from $164.2b to $142.2b (-13.4%)

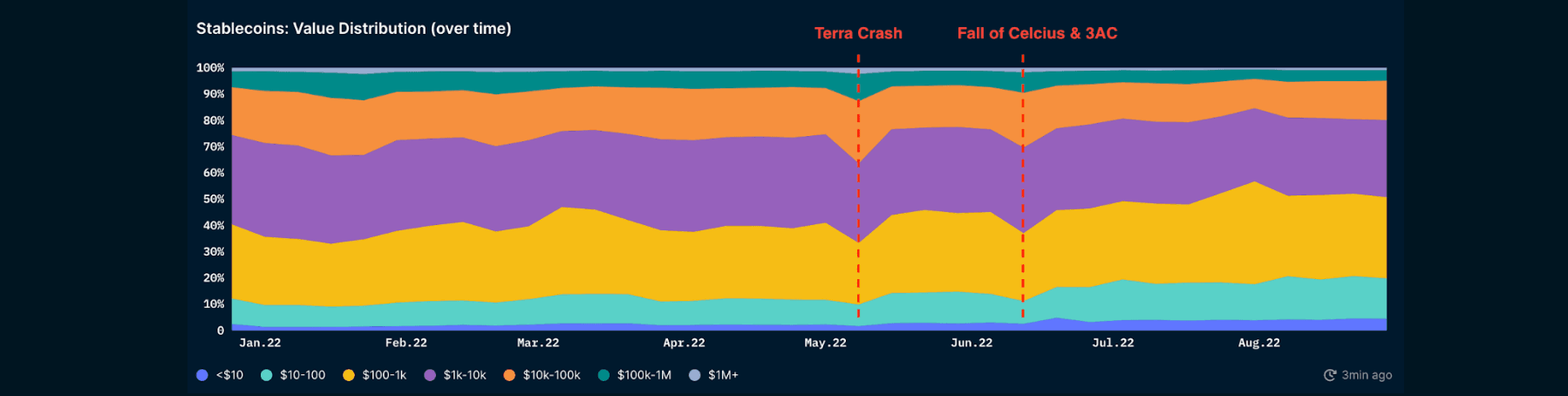

- Spikes in the number of larger transactions (>$100k in value) during volatile events such as the fall of Terra and entities like Celsius and 3AC.

- Since 2022, the share of smaller transaction sizes (<1k) has climbed substantially, whereas the opposite is true for larger transaction sizes (>1k).

USDC

- Circle declared on August 9 that the company will comply with US sanctions by blacklisting addresses identified as unlawful by the US. This was met with strong opposition by the industry.

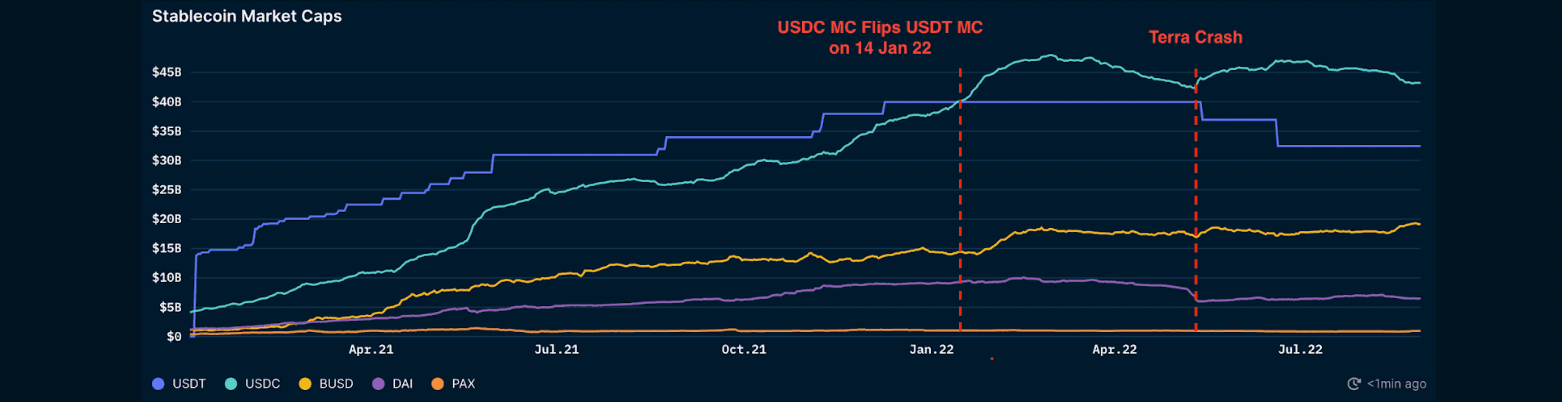

- On 14 Jan 2022, market cap of USDC flipped USDT on the Ethereum blockchain.

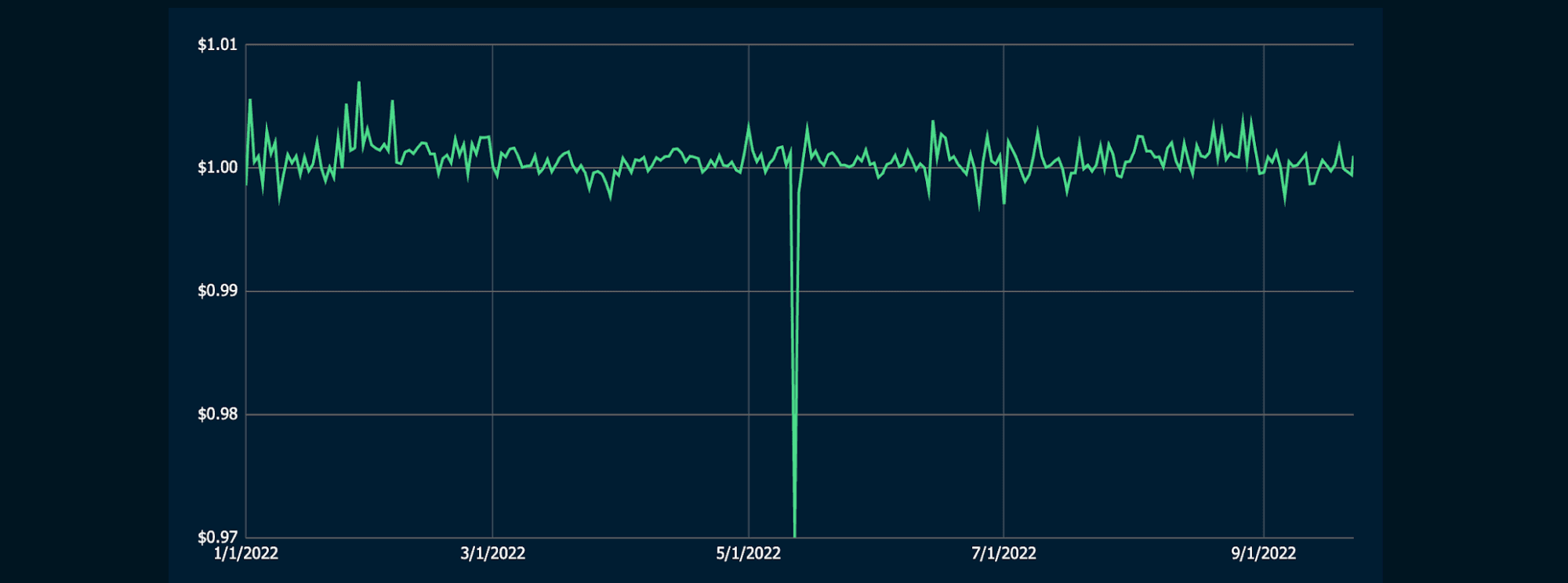

- Market cap of USDC peaked in July 2022, but has since been on a downtrend, possibly due to Circle’s compliance with US sanctions.

- USDC market cap declined by 4.22% since its announcement to comply in early August.

- USDC leads in terms of being the go-to stablecoin for on-chain transactions.

- Throughout 2022, there has been a lower proportion of USDC borrowed on Aave from August as compared to the increasing proportion of USDC being deposited.

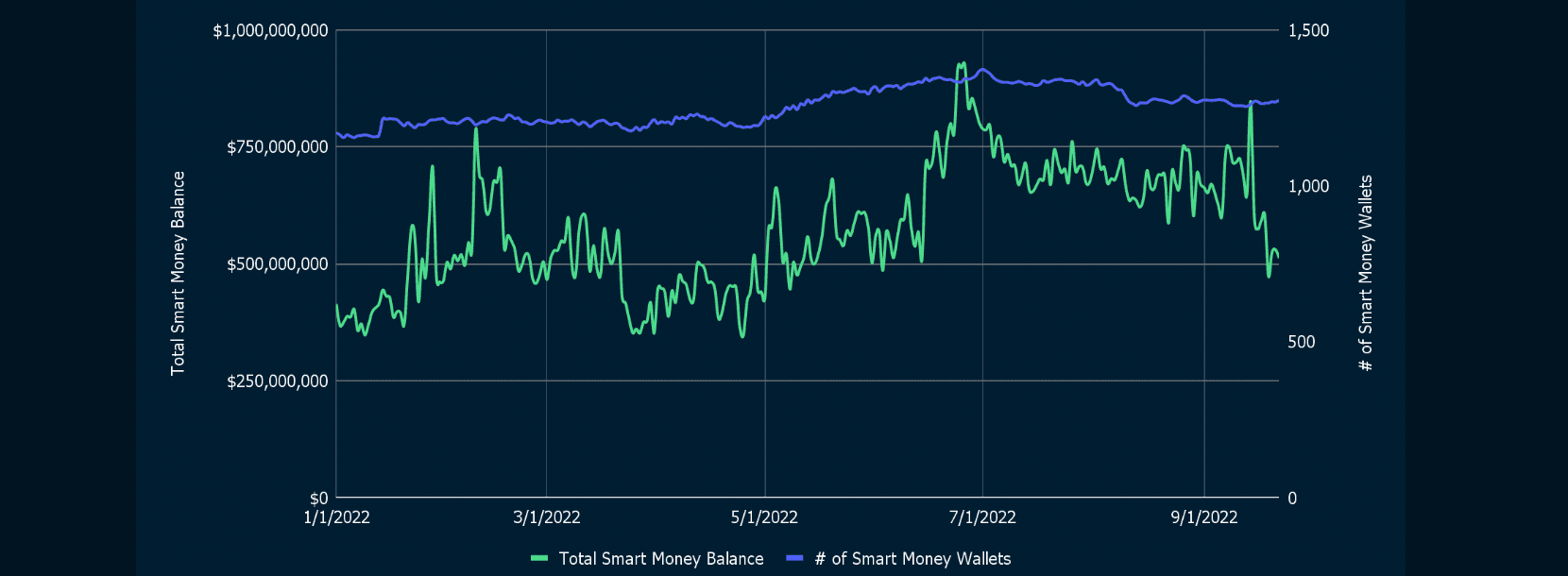

- Significant increase in Smart Money USDC holdings since the Terra crash (64% increase as of 14 Sept 2022). However since 14 Sept, Smart Money USDC holdings have plummeted by 39.4% as of 22 Sept 2022.

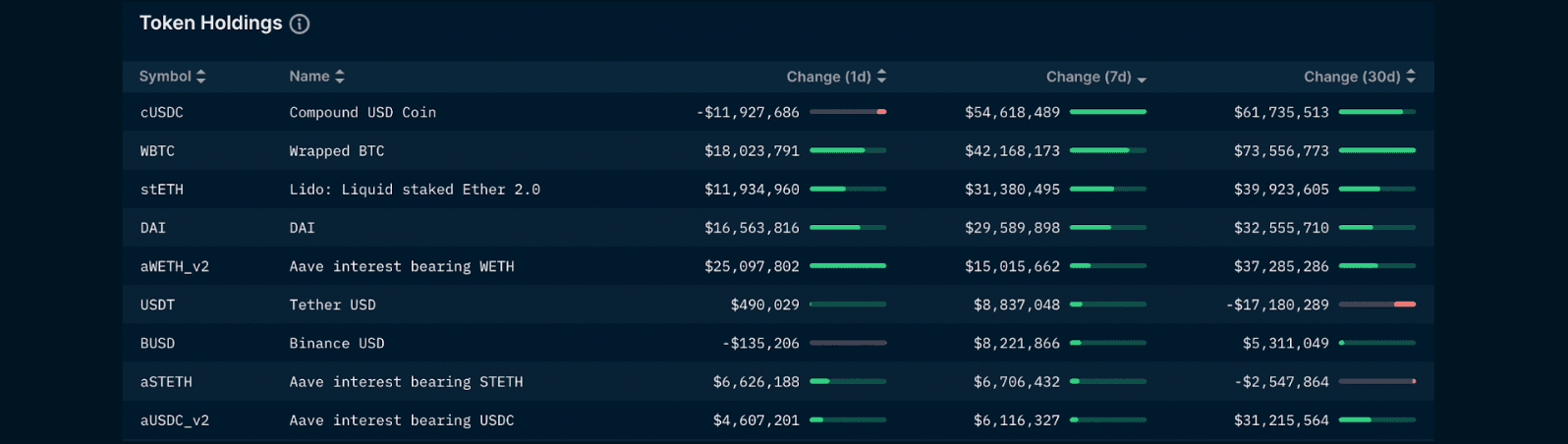

- On Compound, Smart Money holdings in cUSDC saw the largest increase (USDC deposited into Compound) as compared to cDAI and cUSDT holdings, reflecting higher investor confidence in USDC’s ability to maintain its peg and serve as a reliable form of collateral.

USDT

- Tether has been ordered to disclose records about the accounts it has in CEXs such as Bitfinex and Bittrex as part of a lawsuit alleging Bitfinex and Tether manipulated markets for their own benefit.

- Unlike Circle, Tether will not freeze Tornado Cash addresses while it awaits orders from US law authorities.

- Compared to USDC, USDT has a slight lead in terms of number of transactions on Ethereum.

- Proportion of USDT borrows on Aave have greatly outpaced that of USDT deposits since the start of the year (44.7% vs. 26% respectively). This could either imply two different things: (1) investors have a greater preference for USDT when it comes to trading (e.g. deeper liquidity on DEXs with lower price slippage); or (2) that there could be doubts around USDT's ability to maintain its 1:1 peg (e.g. if USDT depegs, their collateral value drops. Or investors could sell USDT + buy token X, which is effectively short USDT and long Token X). This differential in proportion of USDT borrows vs. USDT deposits on Aave accelerated after the Terra crash in May as well as Circle’s sanctions compliance debacle (borrows grew by 109% and deposits grew by 56.6% since Aug 7).

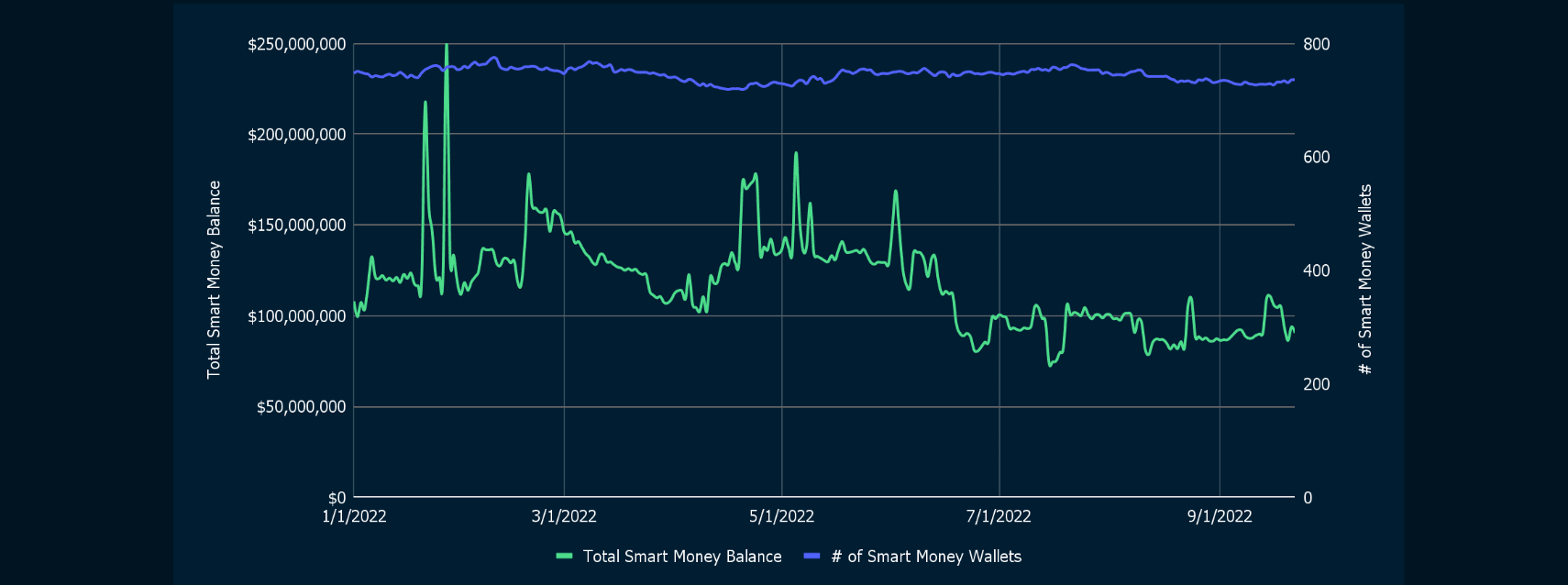

- Slight decrease in both the number of Smart Money wallets holding USDT and total Smart Money USDT balance in 2022.

DAI

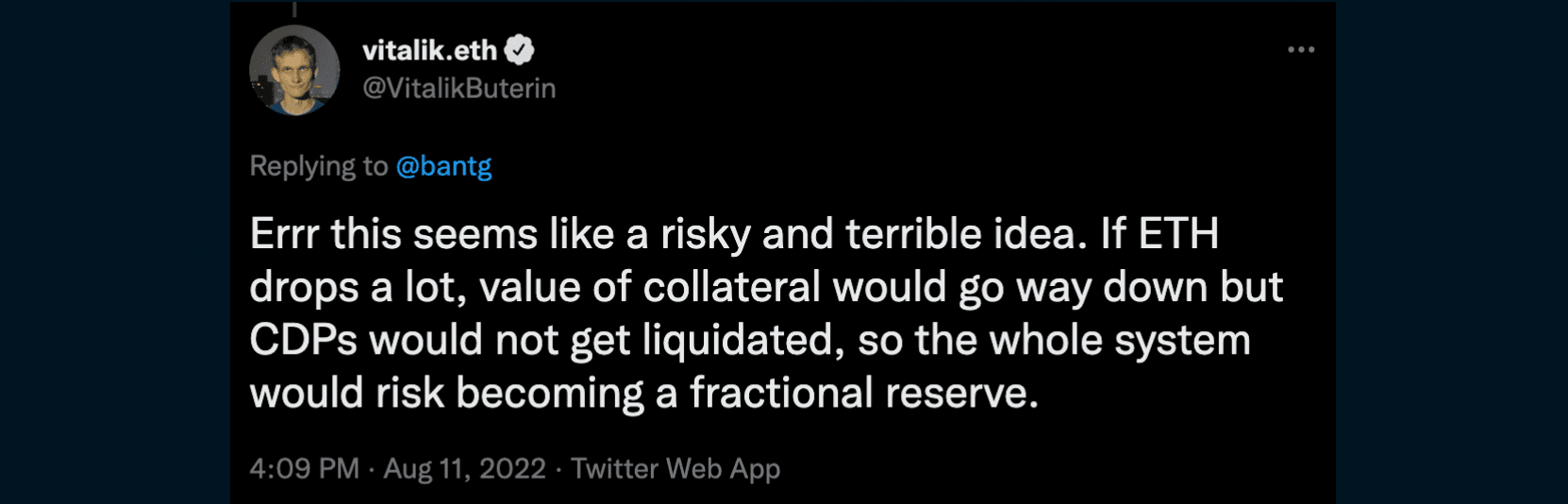

- MakerDao’s decision to swap USDC for ETH as DAI’s collateral is off the table.

- DAI borrows are more popular on Compound than on Aave.

- Proportion of DAI deposits on Compound Finance outweigh the proportion of DAI borrows. Similarly, this could either imply two different things: (1) investors have a lower preference for DAI when it comes to trading (e.g. lower liquidity on DEXs with higher price slippage); or (2) investors are more confident in DAI’s ability to maintain its 1:1 peg (e.g. Allowing collateral levels to remain stable leading to lower likelihood of liquidations)

- Number of Smart Money wallets holding DAI has remained roughly constant throughout the year, yet the overall Smart Money balance has since fallen dramatically to levels slightly below those recorded at the start of the year.

Fei USD

- Fei will reimburse all victims of the Rari Capital exploit.

HUSD

- The HUSD depeg was due to the closure of multiple market maker accounts, which exacerbated liquidity issues.

Introduction

Keeping in mind the significance of stablecoins and how they underpin the entire industry, let's take a quick look at how the major stablecoin projects have fared.

We will focus on key stablecoins such as USDT, USDC, DAI, FRAX, and BUSD for this analysis since the most liquid trading pairs are frequently denominated in these currencies.

Catching up on recent events…

USDT

Looking at Tether’s Past

Tether has long been scrutinized for the transparency of its reserve holdings. The firm had guaranteed investors that it would submit an audited report back in 2017, but this was only done in 2022.

Tether also struck a $18.5 million settlement with the New York attorney general's office in 2021 after being accused of making public misrepresentations about their reserves. Tether has neither admitted nor denied the allegations.

Furthermore, prior to appointing BDO Italia (separate legal entity from BDO in the US) as its auditors, Tether engaged accounting firm MHA Cayman to conduct quarterly attestations in February 2021. Tether did not disclose the reason for the change in auditors.

Recap of Tether FUD

- USDT reserves were not fully liquid

- Their audit shows a significant amount of their assets are liquid.

- Tether holds China property debt. e.g. Evergrande Debt

- Debunked in one of Tether’s statements in 2021.

- Majority of Tether’s commercial paper holdings were predominantly risky Chinese debt

- They have responded that they did not hold any Chinese commercial paper in its reserves.

- USDT reserves were predominantly held in US Treasuries.

- Vast majority of commercial paper held by Tether is in A-2 and above rated issuers.

- Tether had unsecured loans to borrowers

- = Limited information publicly available on Tether’s unsecured loans. Lack of clarity on what constitutes their corporate debt holdings, and whether they are secured vs. unsecured

- Celsius bankruptcy filings revealed that Tether had an over collateralized outstanding $840m loan of USDT to Celsius which was backed by 130% of the loan value in Bitcoin as collateral.

Audits and attestations do not always forecast insolvency. Voyager Digital received a clean audit opinion with no "going concern" before declaring bankruptcy in July of this year.

Tether ordered to produce documents showing backing of USDT

Tether was ordered to disclose records (e.g. general ledgers, balance sheets, income statements, etc.) and share details about the accounts it has in crypto exchanges such as Bitfinex and Bittrex as part of a lawsuit alleging Bitfinex and Tether manipulated markets for their own benefit.

Tether resists wallet blacklisting trend.

On August 8, the US Treasury Department barred all Americans from using Tornado Cash, citing the platform’s role in laundering more than $7 billion in digital money since 2019, including $455 million stolen by the notorious North Korean hacker group, Lazarus. As part of the sanctions list, the government also included 38 Ethereum addresses linked with tornado cash.

With this, USDC issuer - Circle CEO Jeremy Allaire then declared on August 9 that the company will comply with US sanctions by blacklisting these addresses identified as unlawful by the US.

Tether, on the other hand, has decided to buck this approach. Tether has stated that it will not freeze Tornado Cash addresses while it awaits orders from US law authorities. Do note that Tether is not a US based entity, hence it is not legally obligated to comply with US regulations.

It remains to be seen whether Tether will eventually blacklist these addresses when explicitly instructed to do so by the authorities.

Attestation report for more transparency and peace of mind

*Audits are typically more thorough than other types of attestation. The attestations for some crypto companies sign off on the numbers provided by the company’s management for a specific date and time without testing the transactions before or after that date. That process can make the reports more vulnerable to being used to paint an unduly rosy picture. (WSJ, 27 Aug 2022)

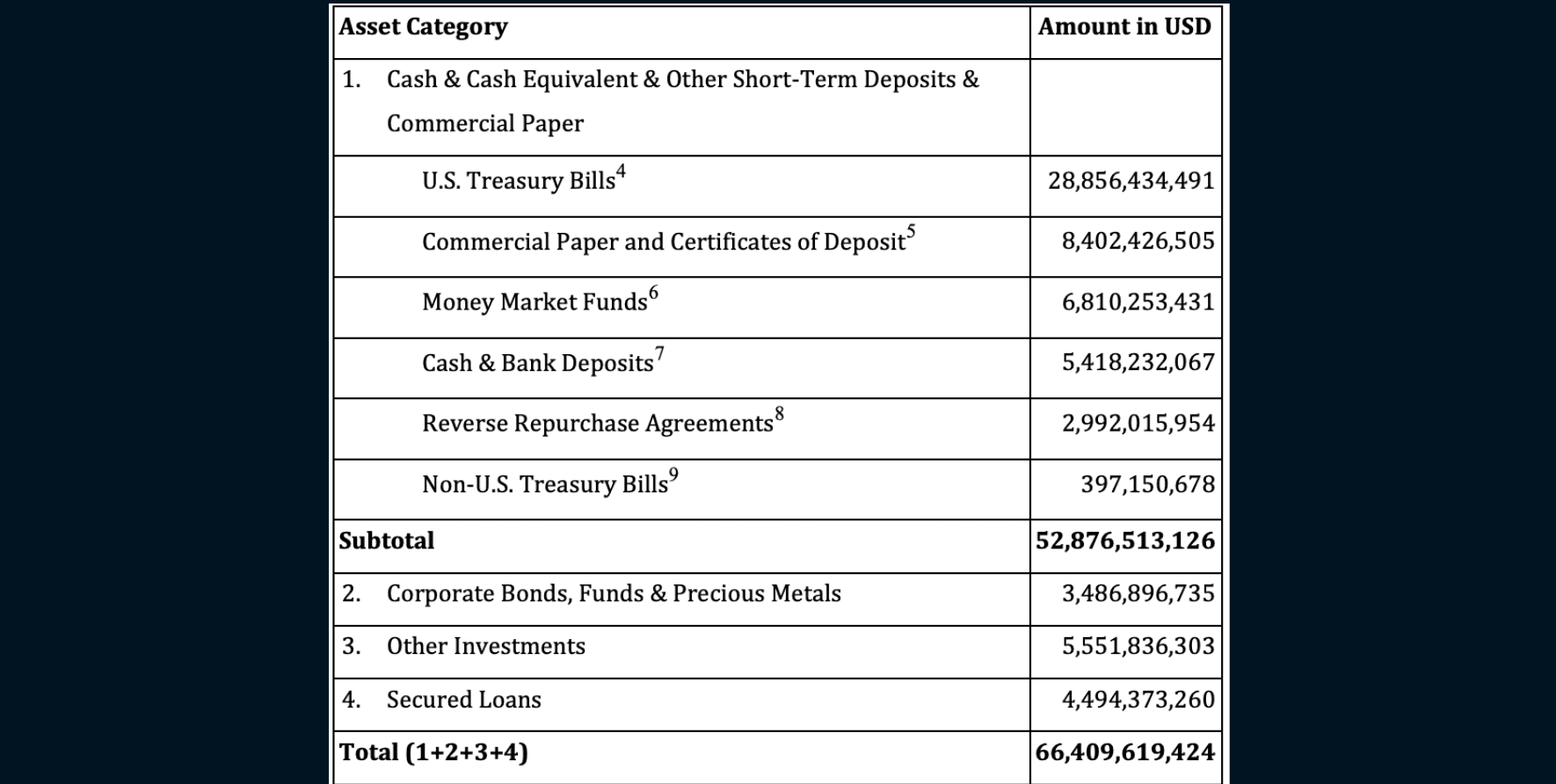

On 10 August, Tether provided a quick overview of its financial status in an attestation report from accounting firm BDO.

Highlights:

- Total assets slightly exceed total liabilities

- TA ($66.4bn) vs TL ($66.2bn)

- Secured loans are fully backed by liquid assets.

- Valuation based on normal trading conditions, which does not reflect extraordinary market conditions e.g. custodians and counterparties experiencing illiquidity issues.

- Zero provisions for credit losses were included in its statements.

- Tether does not provide any assurance in respect to their assessment of the company’s asset valuation processes.

- Tether is involved in 3 ongoing legal cases. No provision has been made.

- Tether is the only major stablecoin to include digital tokens as a significant part of its reserves.

Tether has declined to comment on what the $5.6b “other investments” consist of. No breakdown of the assets is given. E.g. Fiat / Crypto

Maturity of CP and CD

At least 44b of Tether’s assets are backed by liquid assets and Tether's CDs and CPs are also mostly shorter term. Lower potential liquidity risks, unless there is a significant withdrawal event, as witnessed in May this year when the USDT momentarily depegged during Terra’s collapse.

In the most recent market drawdown that served as a barometer for stress-testing, Tether executed more than $10bn in withdrawals in two days without any issues

BUSD

Introducing monthly reserves reports

Paxos leads the industry by becoming the first issuer to disclose full monthly reserve holdings backing USDP and BUSD stablecoins.

Find their monthly holdings data here.

Quick refresher of BUSD

- BUSD is issued by Paxos. - Both token and company are fully regulated by the New York State Department of Financial Services (NYDFS).

- BUSD is fully backed by cash and cash equivalents, such as short term 90d T-bills.

- BUSD reserves are fully segregated in bankruptcy remote accounts In case Paxos goes insolvent, the reserves will be returned to rightful owners.

- Highest fiat backing for all major stablecoins

- BUSD is 1:1 fully redeemable with the US dollar. - Users can easily purchase and withdraw BUSD via the SWIFT network.

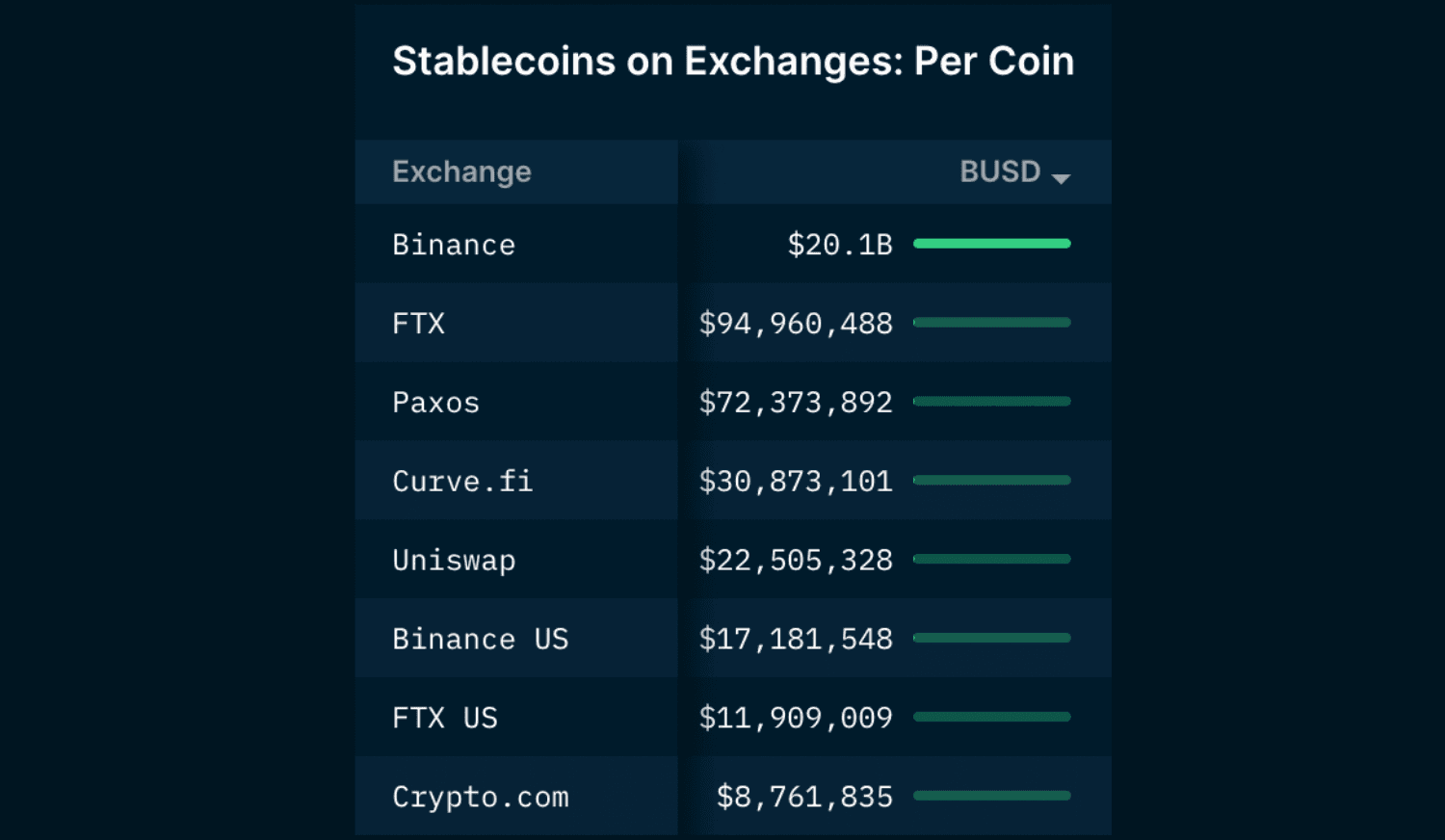

Binance offers zero maker fees for all BUSD trading pairs and zero transaction fees when trading four stablecoin trading pairs with BUSD.

USDC

Sanctions backfires?

The industry, which is known to advocate censorship resistance, was outraged by Circles' decision to comply with US sanctions. We will see how USDC has been affected by this drastic choice later in the report.

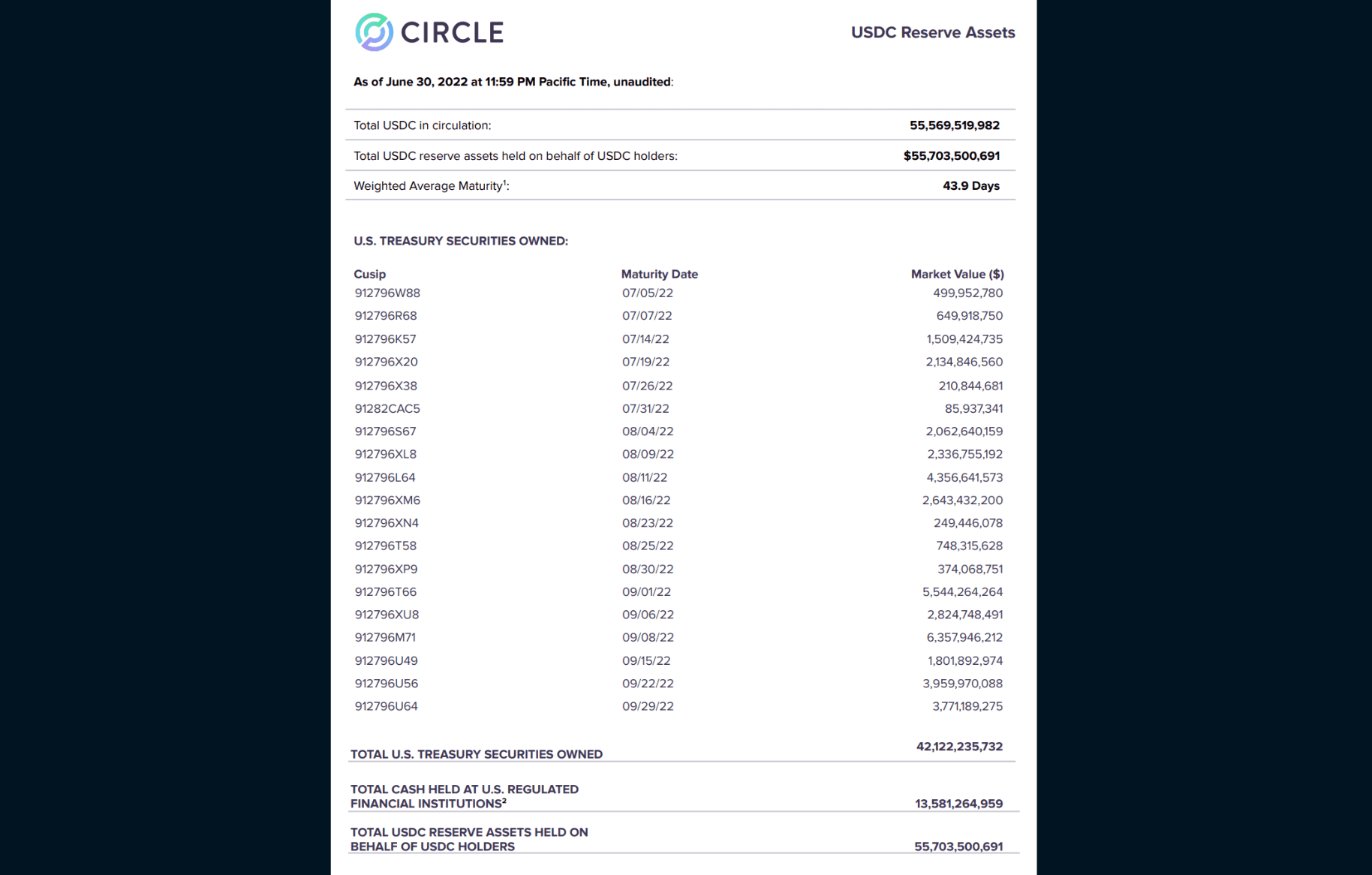

Reserve report

Circle’s detailed report shows only cash and short term US treasuries backing the USDC stablecoin.

As part of offering more extensive independent confirmation of the reserves, Circle's auditor Grant Thornton will disclose additional facts (e.g. maturity dates, market values of each T-bill in Circle’s portfolio) concerning Circle's reserves beginning in July 2022.

Binance to stop supporting USDC

Binance will convert customer holdings in (USDC, USDP, TUSD) into its own stablecoin BUSD on September 29 to “enhance liquidity and capital efficiency” for users. Spot, future and margin trading pairs with USDC, USDP and TUSD will also be removed.

Given that there are $20.5bn USD in circulation, with 98% ($20.bn) resting in Binance's own wallets, it's likely a strategic move to drive wider adoption of Binance's own stablecoin in order to achieve a larger market share.

DAI

DAI is predominantly backed by USDC (~50% backed by USDC). Circle’s decision to sanction tornado cashed-wallets has also led to censorship concerns in MakerDAO's own stablecoin DAI.

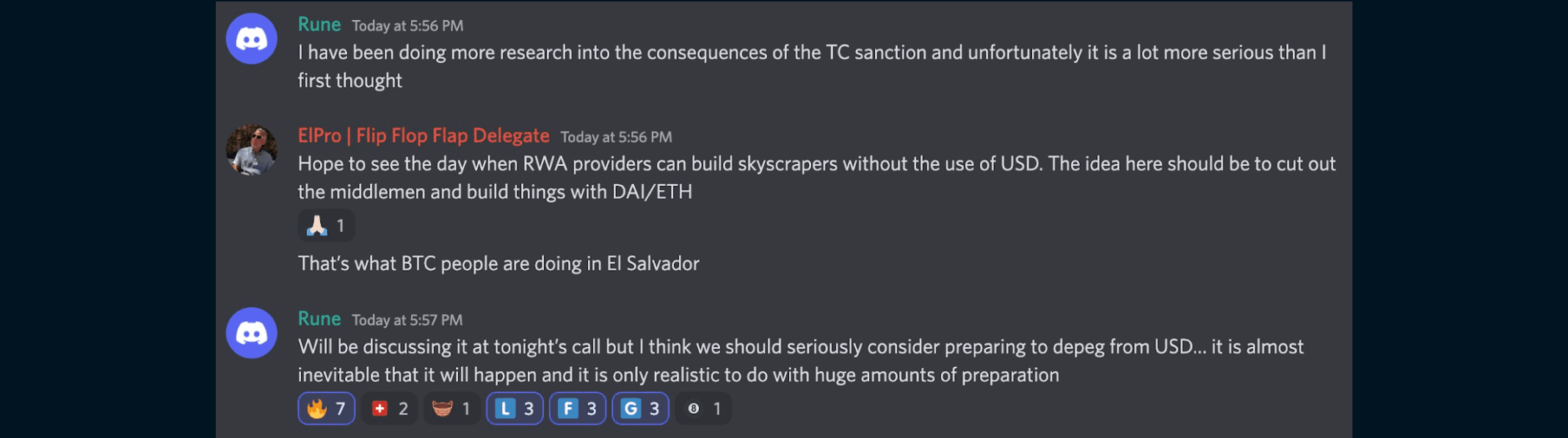

Swap USDC for ETH as DAI’s collateral?

Discussions on swapping Maker's USDC collateral for ETH and pegging DAI to another reference currency were being floated on MakerDAO's governance forums during the week of August 11, 2022. However, given the recent UST de-peg incident, the idea drew significant criticism. MakerDAO saw ~$400m in redemptions after the idea was brought up - equivalent to 5% of DAI's outstanding supply. In the end, the idea was subsequently shelved amidst the uproar.

Time to depeg?

Following the US sanctions against Tornado Cash, MakerDAO founder Rune Christensen revealed that the DAO is considering depegging DAI from USD.

FRAX

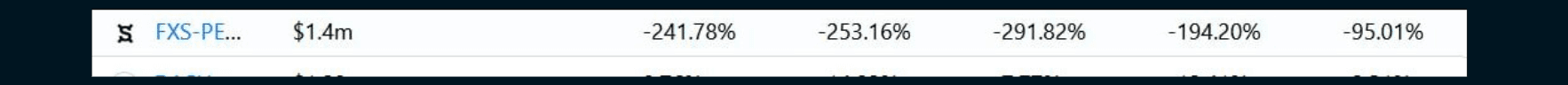

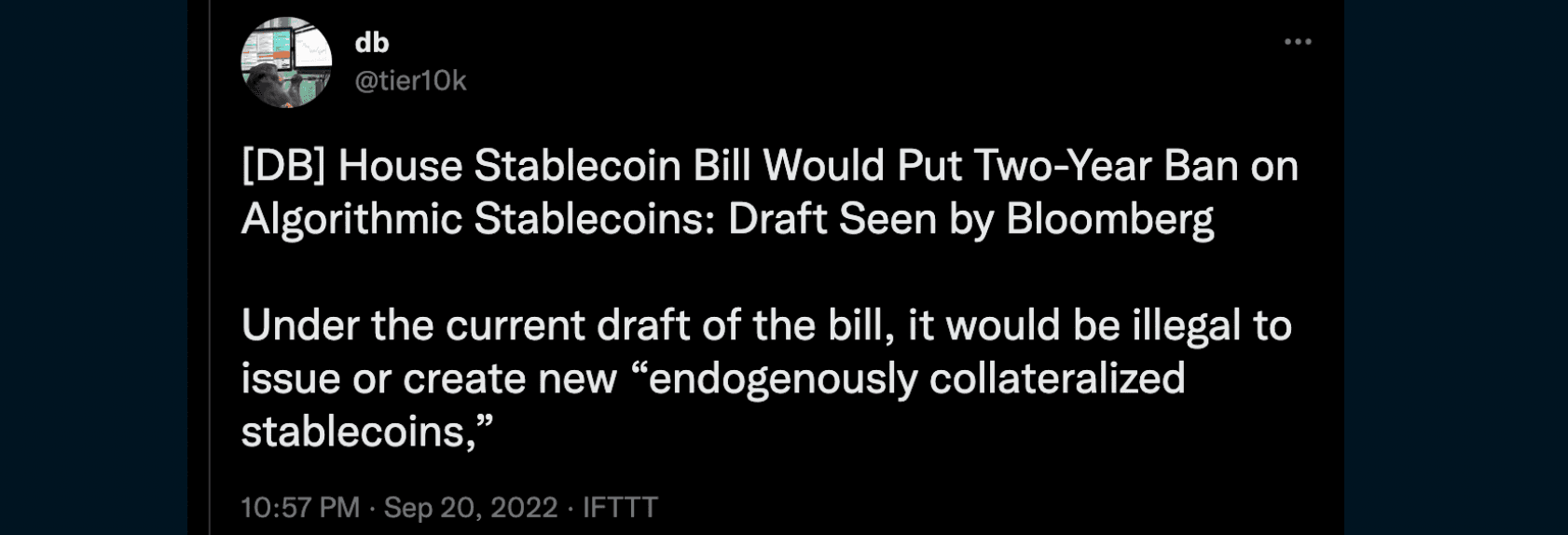

Insider trading observed

FXS-PERP funding rates were extremely negative just days before the Stablecoin Bill announcement, possibly indicating that insiders were trading the negative news related to the bill.

Fraxlend launching soon

Fraxlend was recently launched on Github on August 11. It is a permissionless lending platform that allows anyone to create two token markets. Users can also borrow against their staked ETH on Fraxlend. With the recent controversy with Fei Protocol, Fraxlend appears to have indirectly received a fair amount of hype on social media.

With the successful launch of Fraxlend, this could be another demand and revenue driver for FRAX.

Find out more about Fraxlend here.

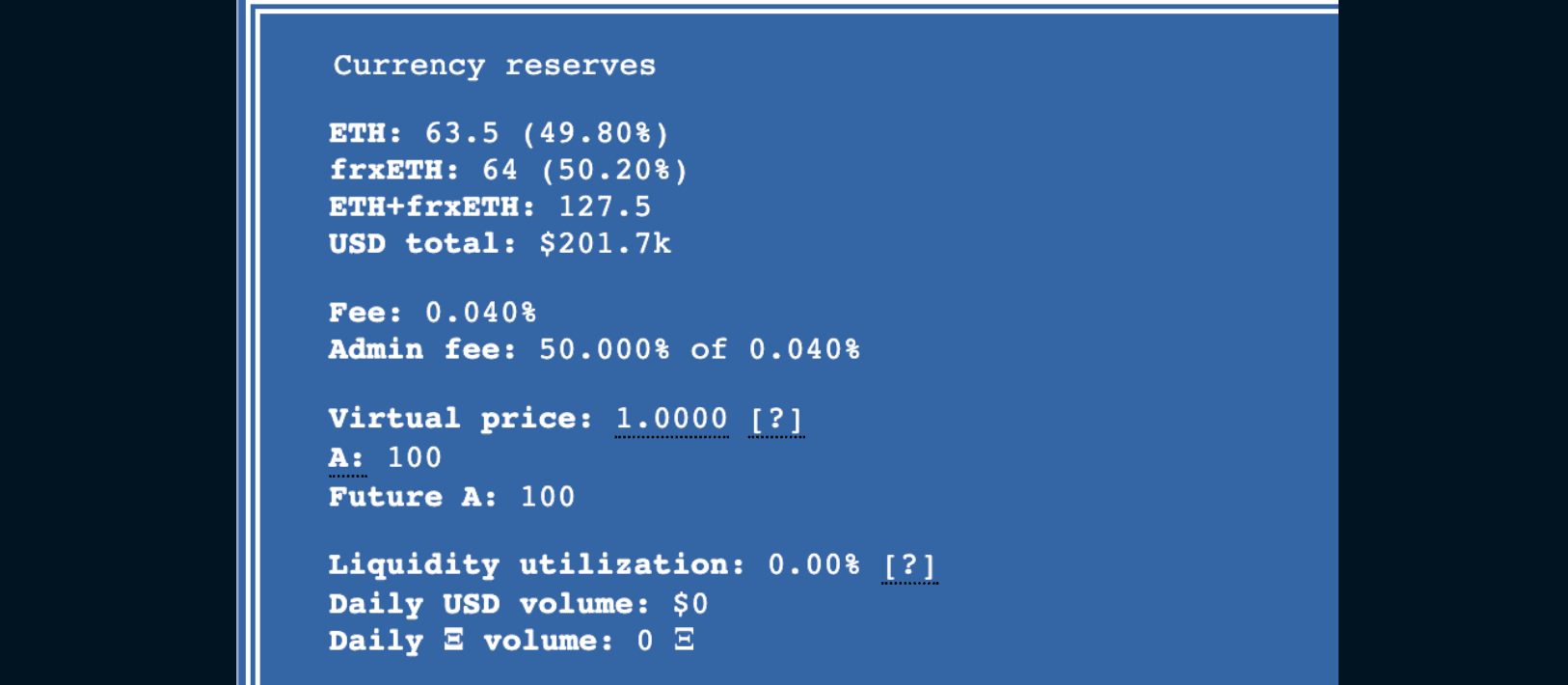

frxETH for liquid staking

Lido is the undisputed leader in liquid staking, and Frax wants a piece of the action. The frxETH contract was built recently and is currently being tested on Curve.

4 new Convex-Frax pools

Fei USD

Ready to call it quits

In Tribe DAO’s recent proposal, the challenging macro environment and “specific challenges” such as the Rari Capital’s Fuse hack have subjected the DAO to be in a “suboptimal position”. With this, Fei protocol is looking to close down.

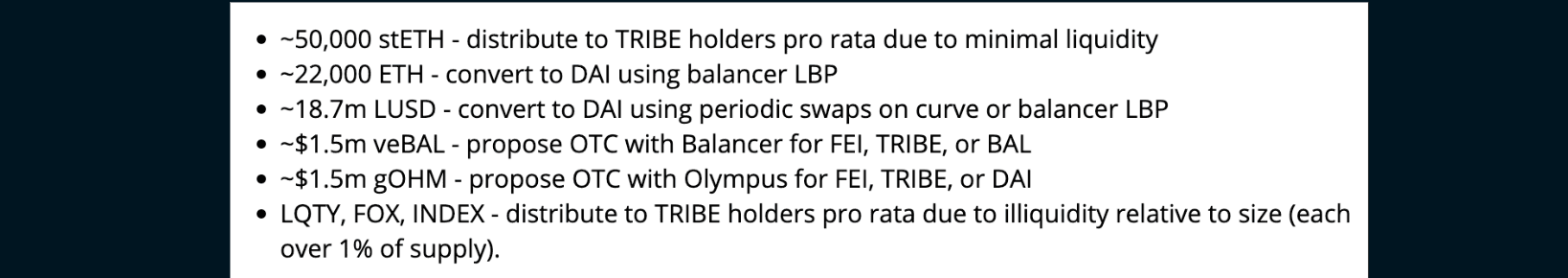

If the proposal is passed,

- All Fei will be swapped for DAI

- Fei’s Protocol controlled value will be unwinded from its farming strategies and distributed to TRIBE holders.

- Fuse hack victims receive some form of compensation.

Recap of the FEI - Rari Capital mess

- In 2021, Fei labs raised $1.3b USD in ETH to build FEI USD.

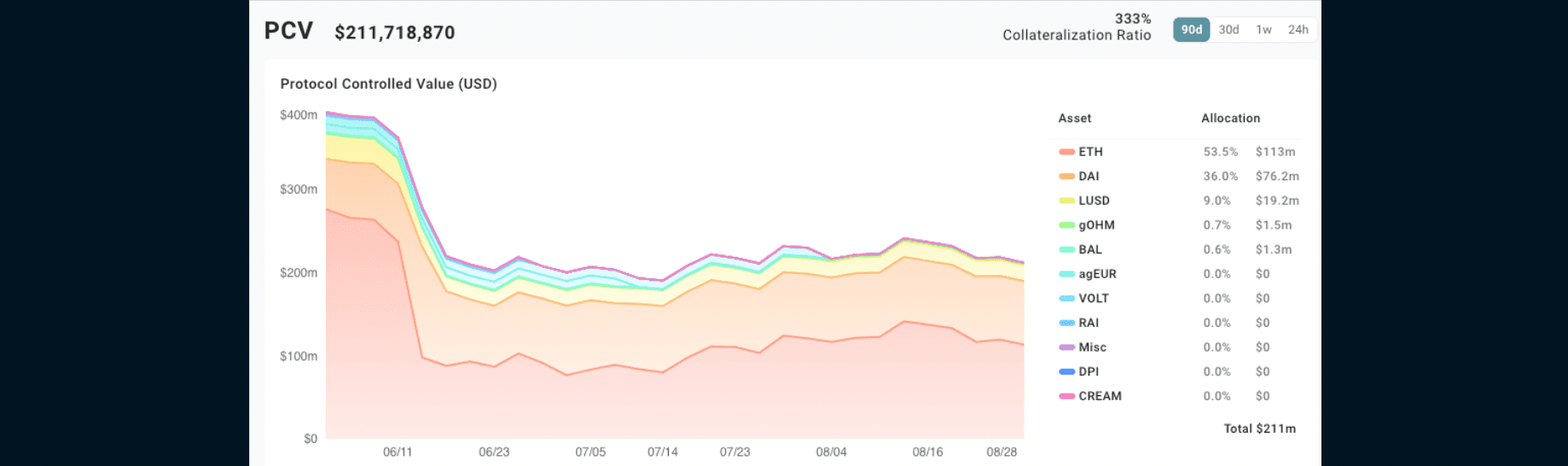

- The ETH that was raised belongs to the protocol itself. Or what they termed as “Protocol controlled value” (PCV).

This design is different from centralized stables like USDC which is backed by US Cash and equivalents. FEI is solely backed by crypto, including ETH and other assets.

Source: Fei analytics

- In Dec 2021, Fei protocol merged with Rari capital.

- Rari Capital allows users to create permissionless lending pools called Fuse pools.

- Fei provides Fuse pools with initial liquidity as part of its “liquidity as a service” offering.

- On April 2022, Rari’s Fuse pool were hacked for $80m

- In May, a proposal to pay back those that lost money in the hack was passed by Tribe DAO. 75.03% voted in favor of making the victims whole again.

- Soon after, another vote was passed to cancel the proposal to pay back the losses of those who lost funds in the previous exploit. A stark contrast in attitude from May.

- CEO of Rari Capital announced that he would resign in June this year.

Fuse exploit compensation?

The uproar around the compensation scheme stems from promises to compensate victims with 88.9m unvested TRIBE tokens valued at approximately $16 million, a far cry from the $80+m lost in the breach.

Fei will reimburse all victims of the Rari Capital exploit

On 19th September 2022, the vote was passed and executed.

HUSD

Pegged the depeg

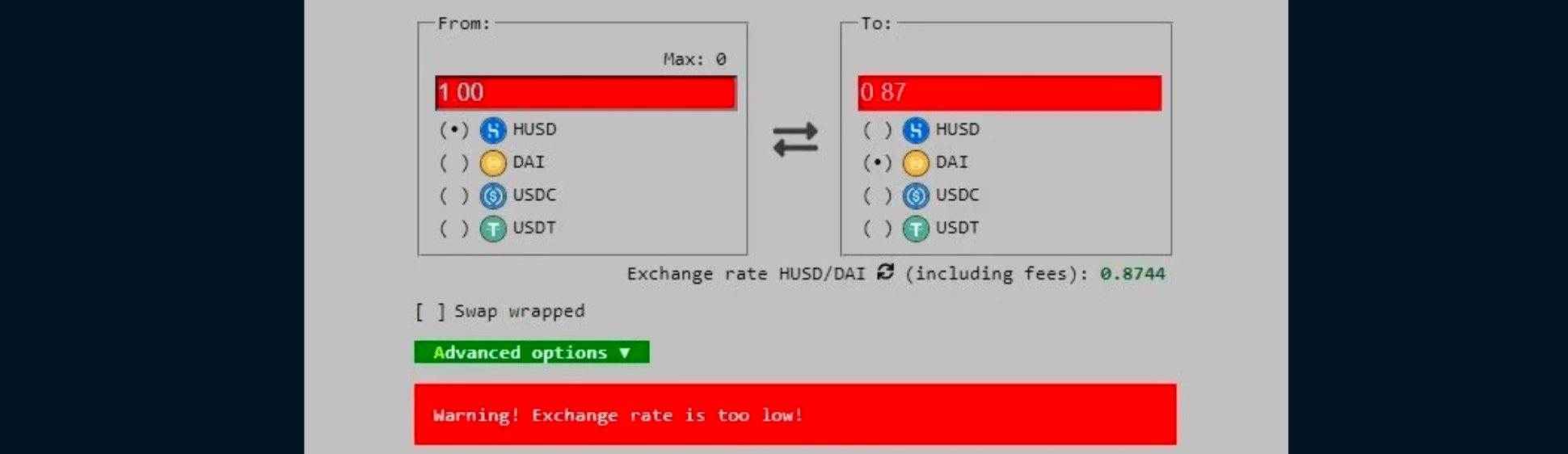

HUSD lost its peg earlier this month due to severe liquidity concerns. Curve's HUSD/3crv pool ratio became severely imbalanced, forcing prices to plunge. FTX has also stated that the HUSD token will no longer be considered a USD stablecoin and accepted as margin.

However, HUSD managed to repeg soon after. According to Huobi, the depeg was caused by a decision to close market maker accounts in several regions to comply with regulations and the difference in banking hours between various regions caused a liquidity problem, causing HUSD to lose its dollar peg.

This episode, together with Huobi's founder's previous intention to sell his stake in the company for $3b, poses significant concerns for HUSD holders down the road.

Curve USD

crvUSD launching in September

One of the Curve devs bought about $1m worth of CRV possibly in anticipation of the Curve stablecoin release.

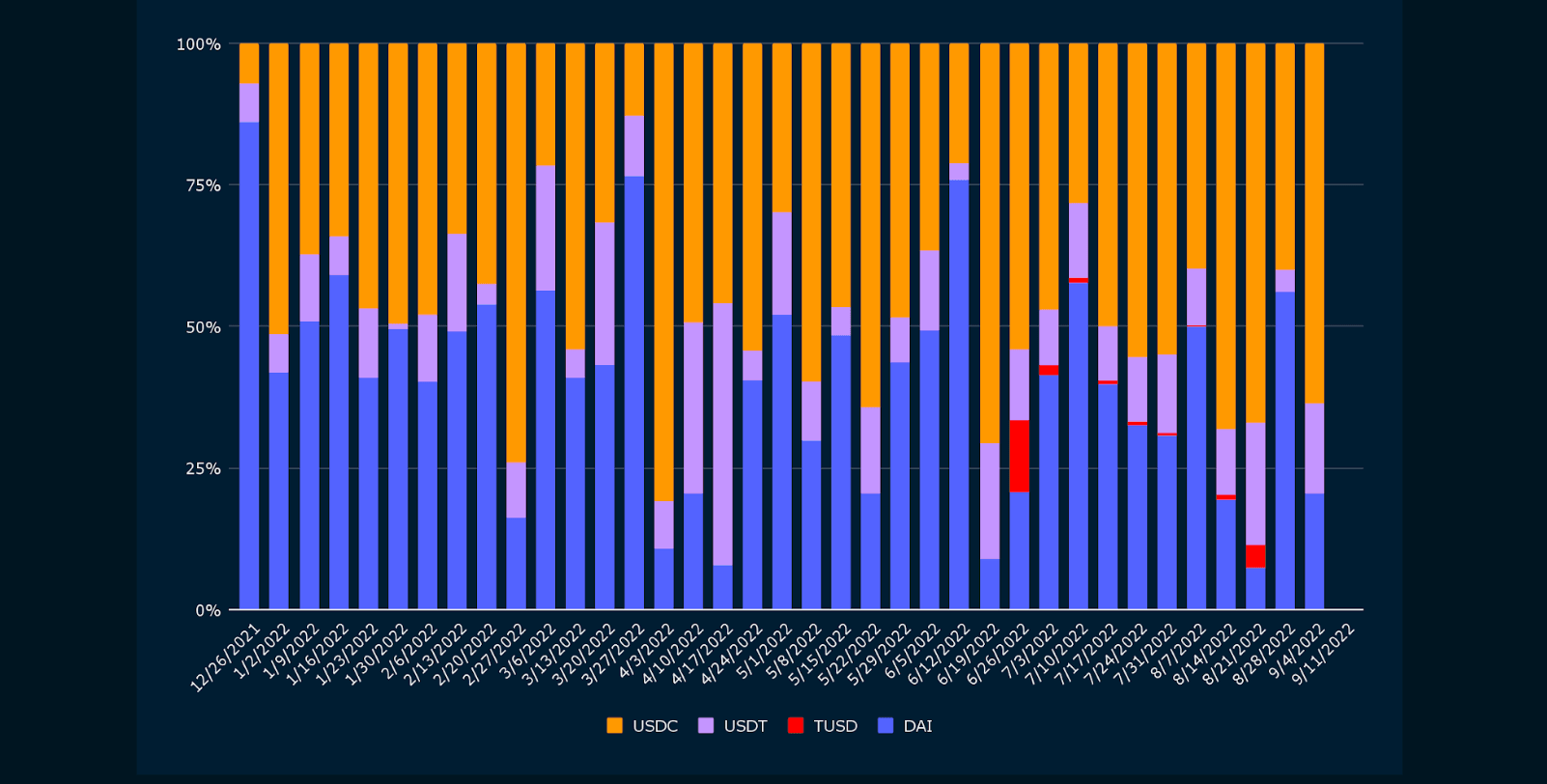

Stablecoin market cap

- 14 Jan 2022, market cap of USDC flips USDT on the Ethereum blockchain.

- Possibly attributed to the FUD surrounding Tether’s reserves.

- Market cap of USDC peaked in July 2022, but has since been on a downtrend.

- Downtrend likely to be due to Circle’s compliance with US sanctions to blacklist wallets linked to Tornado cash.

- Overall stablecoin supply declined from $164.2b to $142.2b today (*-13.4%)

USDC Market Cap

| Date | USDC | USDT | BUSD | DAI | USDP |

|---|---|---|---|---|---|

| Aug 1 | 54.5b | 65.9b | 17.9b | 6.9b | 0.87b |

| Aug 26 | 52.2b | 67.6b | 19.2b | 6.5b | 0.95b |

Source: Coingecko

Circle’s USDC market cap declined by 4.22% since its announcement to comply in early August. In contrast, the majority of the other major stablecoins less DAI, probably for reasons coupled to USDC, experienced slight growth in their market caps.

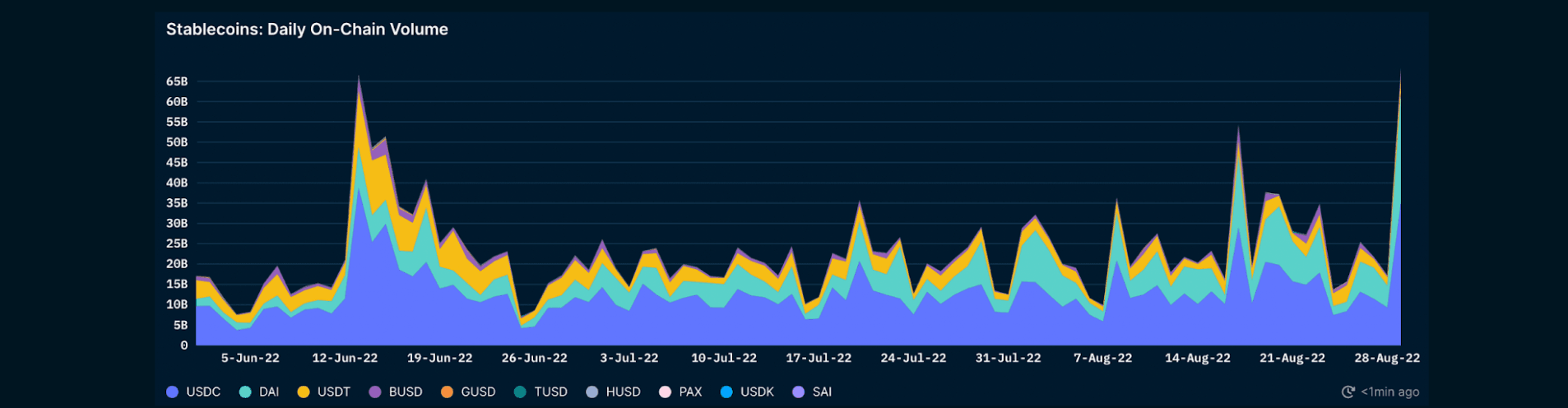

Daily on-chain volumes

USDC leads in terms of being the go-to stablecoin for on-chain transactions. Despite USDC's sanction controversy, USDT failed to flip USDC in terms of stablecoin transfer volume.

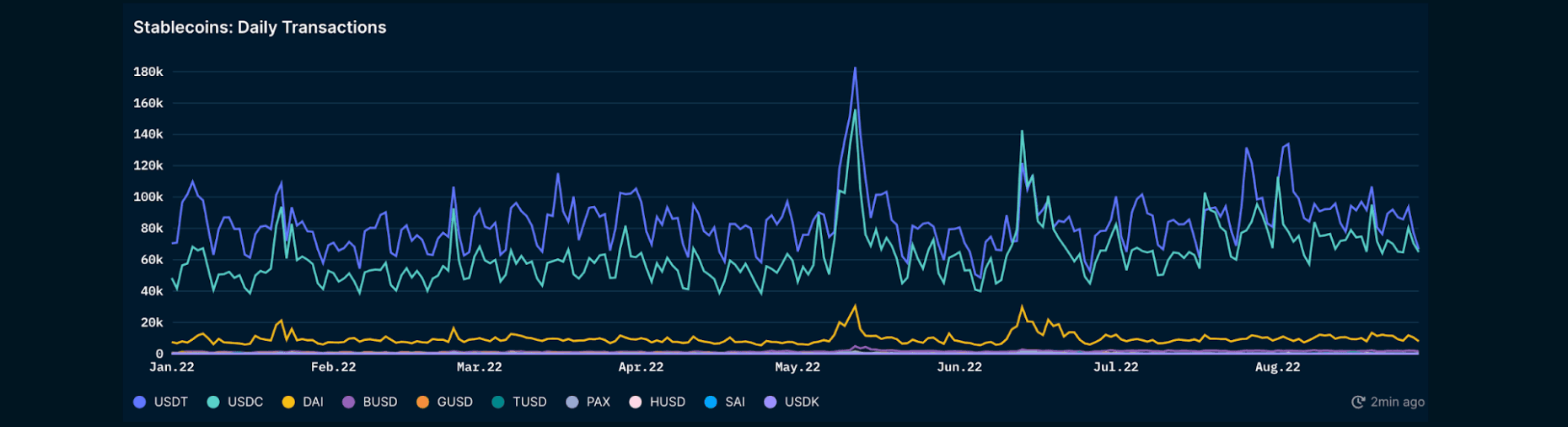

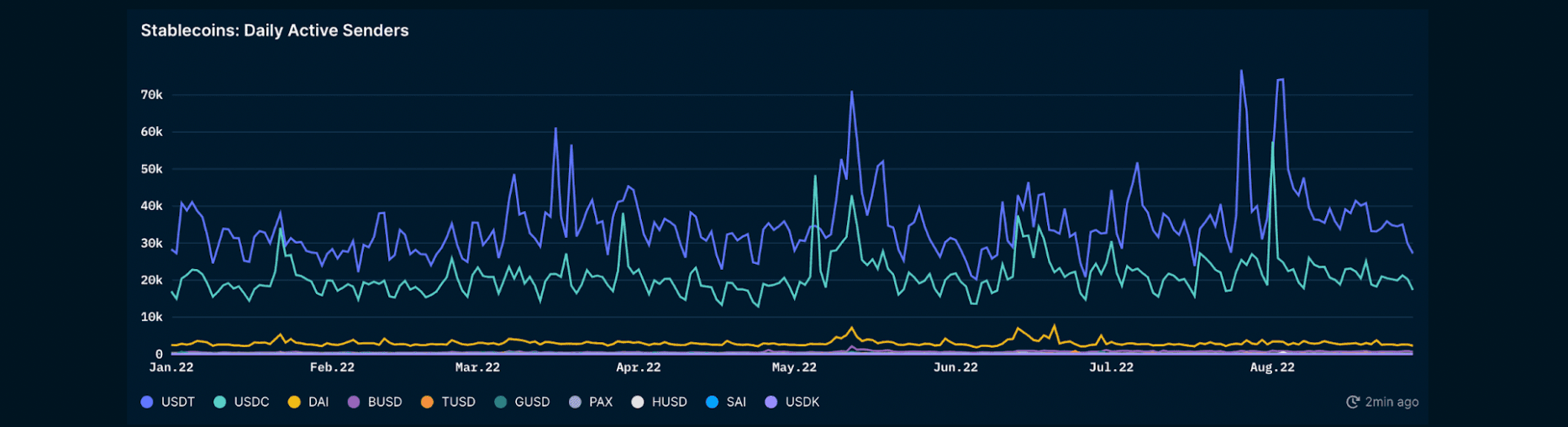

Daily number of transactions

Despite USDC leading in terms of on-chain transfer volume, USDT has a slight lead in terms of number of transactions on Ethereum. This could suggest that USDC was the preferred choice for bigger players or larger sized trades.

The daily active senders data aligns with this observation as shown by the significantly higher number of senders using USDT as compared to USDC and DAI.

Transaction value distribution

This chart represents token transfers of stable coins split by the number of daily transactions in each transaction range. e.g. 28% of the total number of transactions had a value per transaction of USD 1k-10k on 21 August.

We do see spikes in the number of larger transactions (>$100k in value) during volatile events such as the fall of Terra and entities like Celsius and 3AC.

| Transaction Size | % Change |

|---|---|

| <$10 | 71.4% |

| $10 - $100 | 80.5% |

| $100 - $1k | 17.8% |

| $1k - $10k | -14.7% |

| $10k - $100k | -22.2% |

| $100k - $1m | -32.1% |

| $1m | -39.4% |

Since 2022, the share of smaller transaction sizes (<1k) has climbed substantially, whereas the opposite is true for larger transaction sizes (>1k).

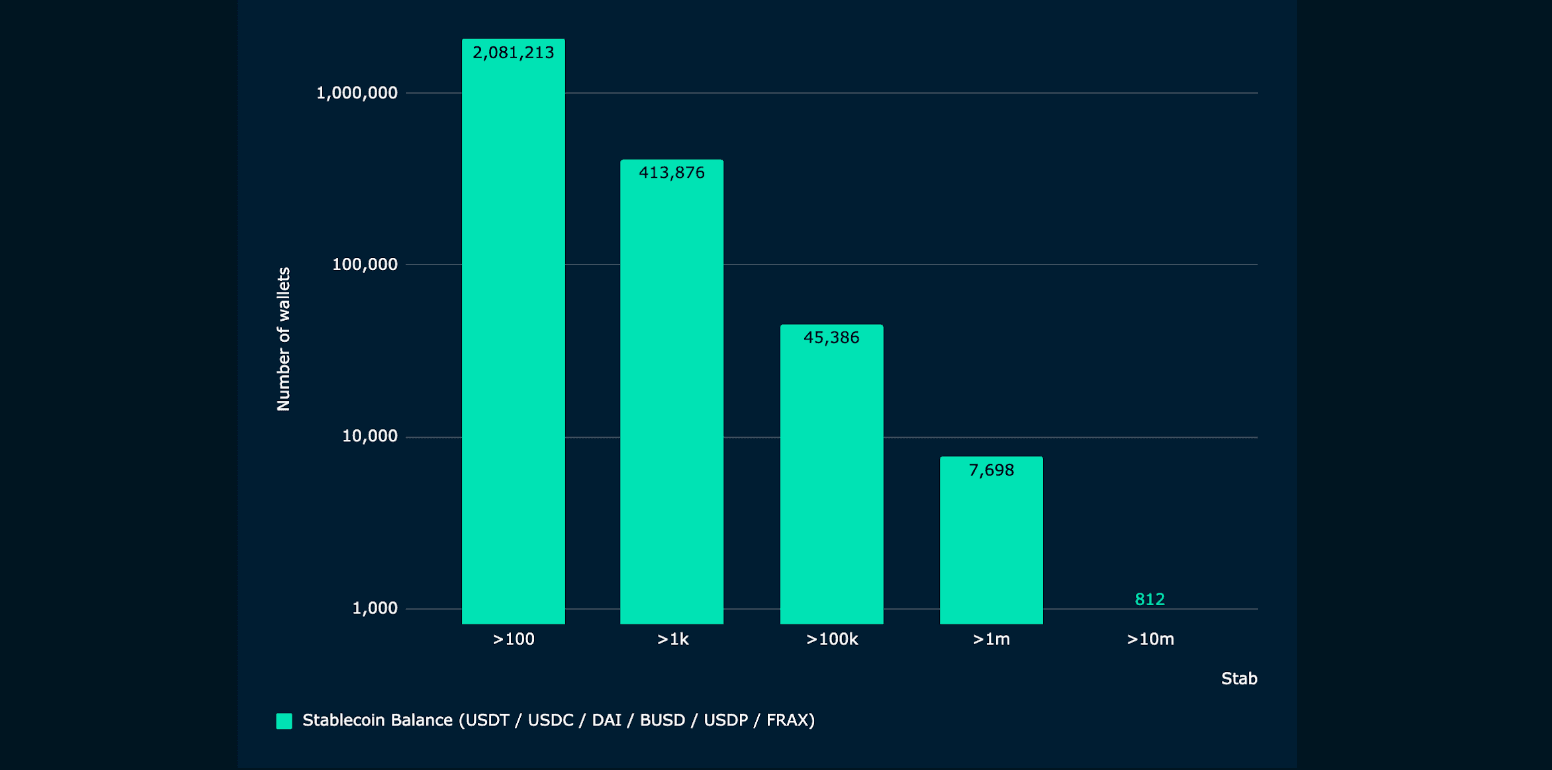

Wallet Stablecoin Balance Distribution on Ethereum

Money Markets

It is often assumed that more sophisticated investors use lending platforms such as Aave and Compound. As a result, examining their activity on these lending platforms may yield some insights into their stablecoin inclination.

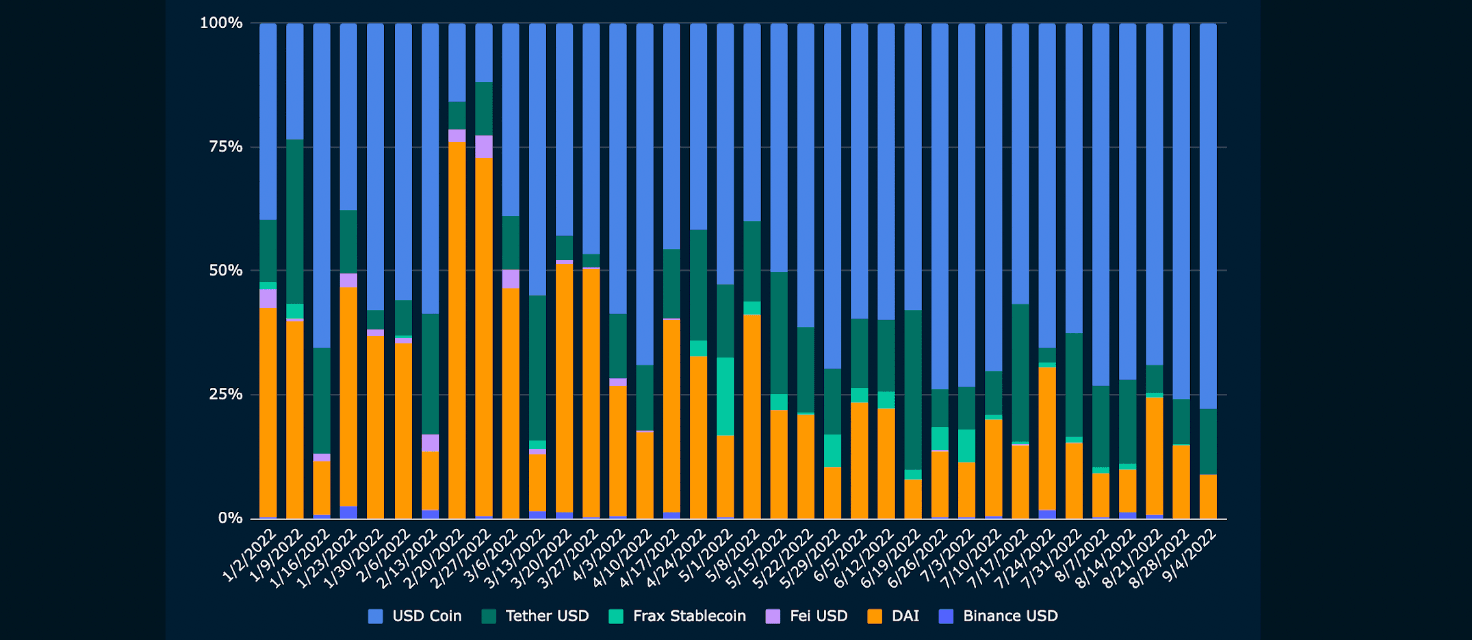

AAVE

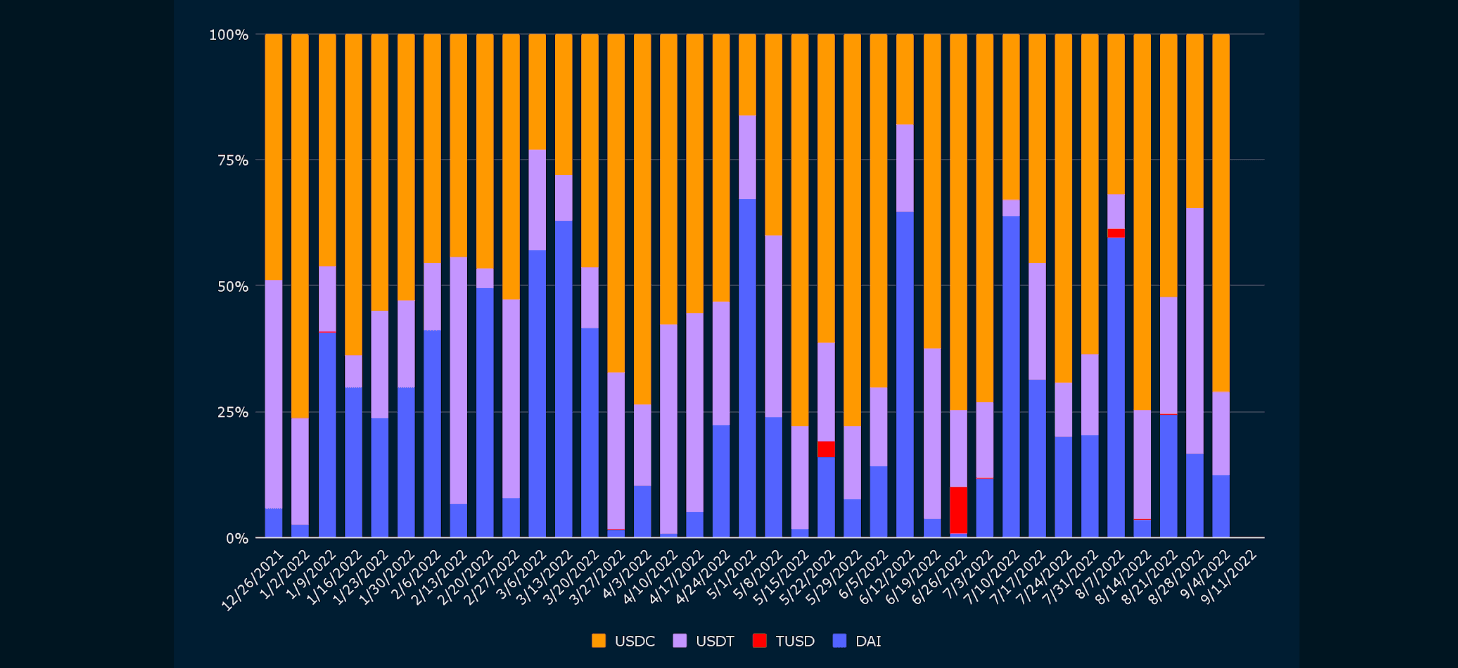

Deposit chart proportions

- USDC deposits have become increasingly popular on Aave since the start of the year. % of USDC deposited vs all stablecoins rose from 39.7% to 77.7%.

- Proportion of USDT deposited vs all stablecoins peaked at 33.3% from 9 to 16 Jan 2022, nowhere near USDC’s dominance.

Borrow chart proportions

- Proportion of USDT borrowed vs all stablecoins have generally increased since the start of the year (27.4% to 44.7%)

- Proportion of USDT borrows on Aave have greatly outpaced that of USDT deposits since the start of the year (44.7% vs. 26% respectively). This could either imply two different things: (1) investors have a greater preference for USDT when it comes to trading (e.g. deeper liquidity on DEXs with lower price slippage); or (2) that there could be doubts around USDT's ability to maintain its 1:1 peg (e.g. if USDT depegs, their collateral value drops. Or investors could sell USDT + buy token X, which is effectively short USDT and long Token X). This differential in proportion of USDT borrows vs. USDT deposits on Aave accelerated after the Terra crash in May as well as Circle’s sanctions compliance debacle (borrows grew by 109% and deposits grew by 56.6% since Aug 7).

- Similarly, we noticed a lower proportion of USDC borrowed from August as compared to the increasing amount of USDC being deposited.

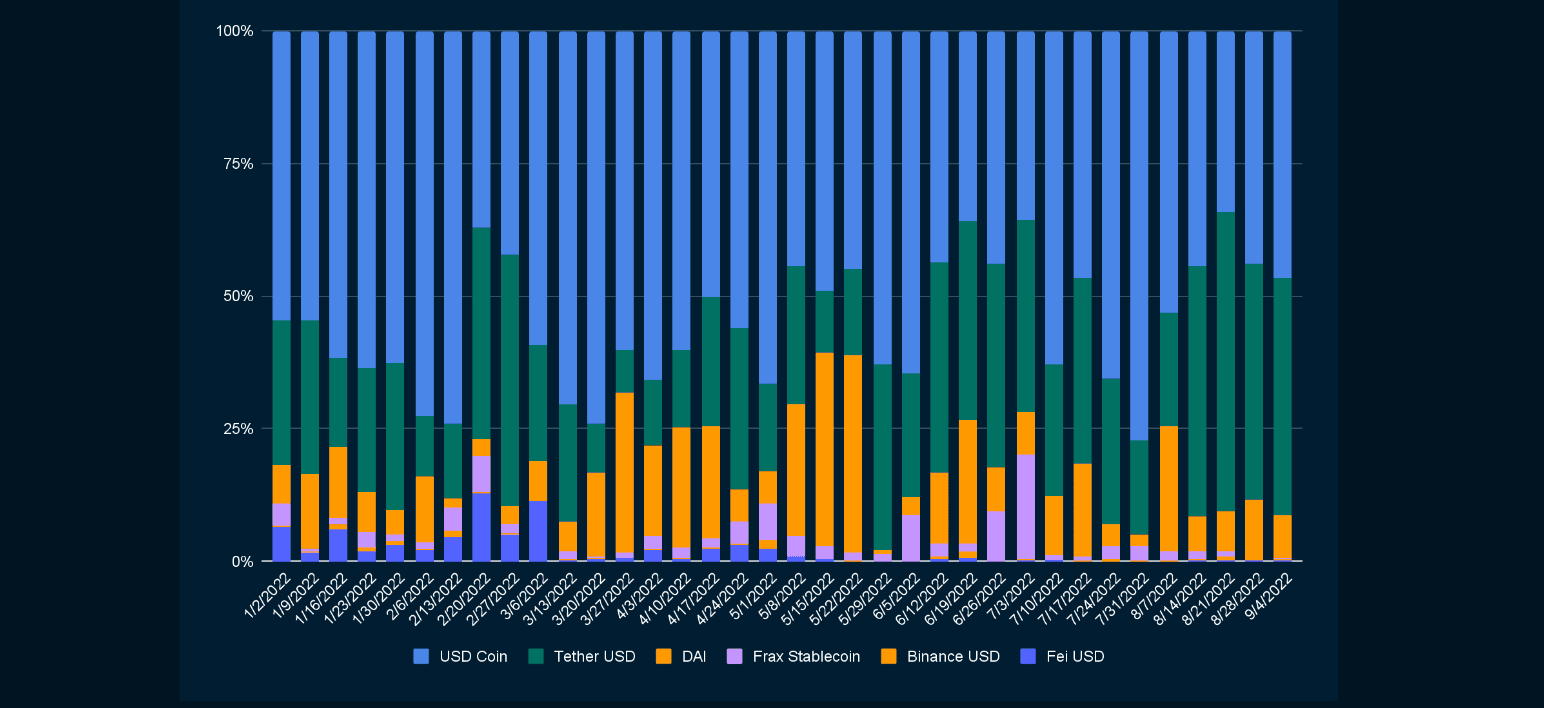

Compound Finance

Deposit chart proportions

- Similar to what we witnessed on Aave, the proportion of USDC and DAI deposits on Compound have slightly increased and decreased respectively since the start of the year.

- Apart from a few spikes in USDT deposits, proportion of USDT deposits vs total stablecoins have been relatively low as compared to both USDC and DAI.

Borrow chart proportions

- Proportion of DAI borrows on Compound are significantly higher than Aave. Likely attributed to deeper liquidity on Compound ($574m) vs Aave ($262m).

- Compound also recently launched institutional borrowings, which could potentially drive greater borrow volumes.

- Proportion of DAI deposits outweigh the proportion of DAI borrows. Similarly, this could either imply two different things: (1) investors have a lower preference for DAI when it comes to trading (e.g. lower liquidity on DEXs with higher price slippage); or (2) investors are more confident in DAI’s ability to maintain its 1:1 peg (e.g. Allowing collateral levels to remain stable leading to lower likelihood of liquidations)

Nansen Data Highlights

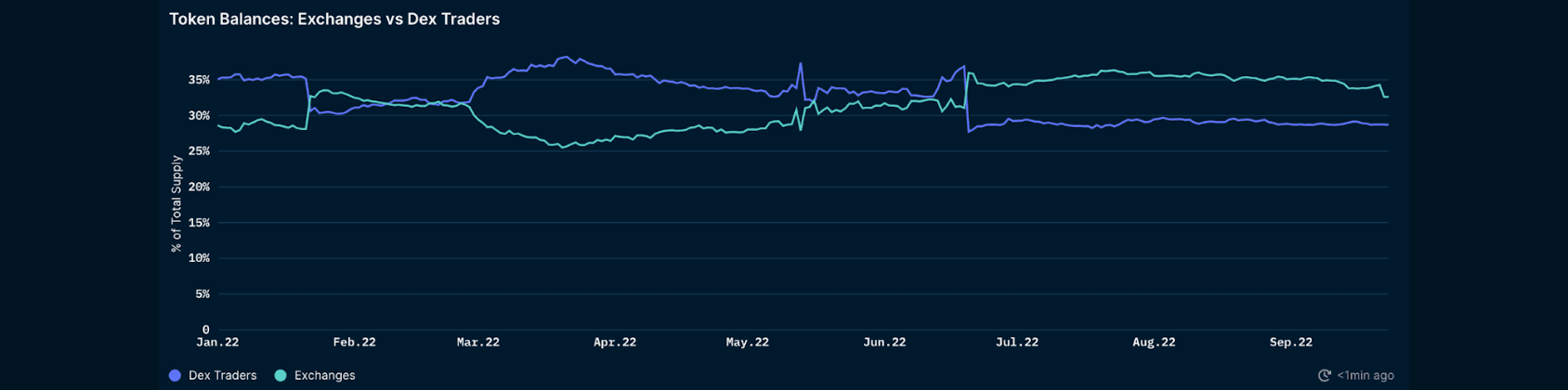

USDT

- Since mid June 2022, there has been an increase in the total supply of USDT on exchanges. (31% to ~35%). Possibly due to traders started taking on new positions as well as swapping USDT for USDC.

- Slight decrease in both the number of Smart Money wallets holding USDT and total Smart Money USDT balance in 2022.

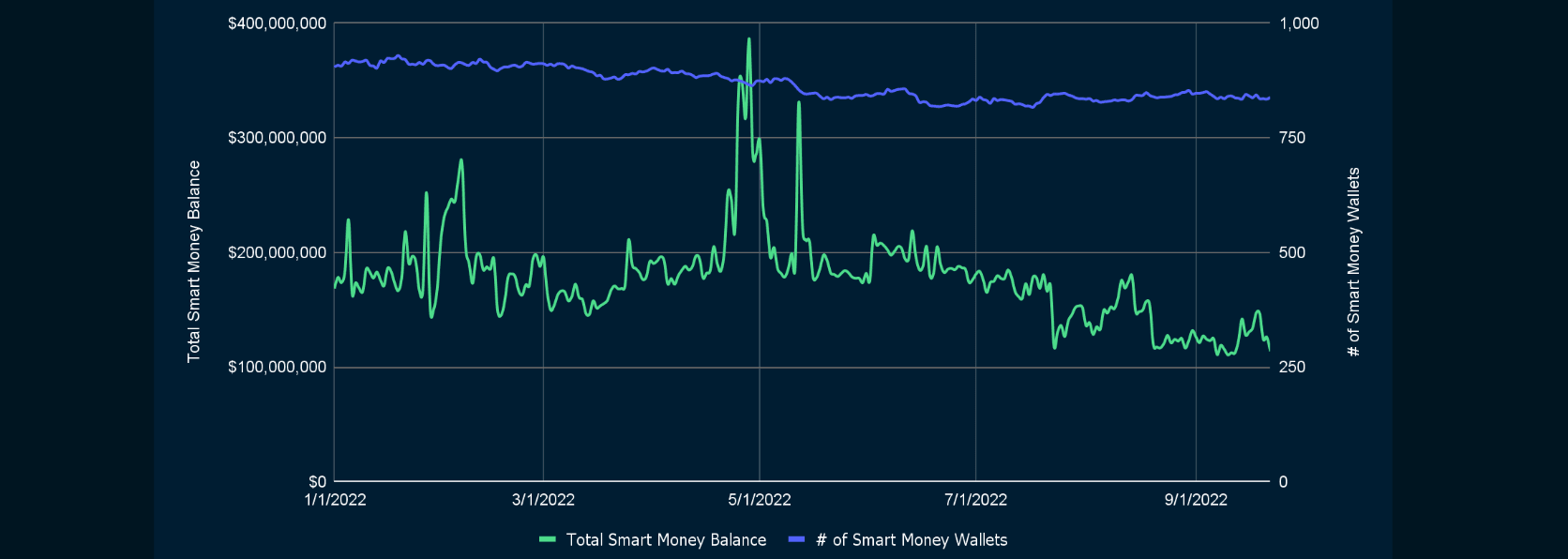

USDC

- In comparison to USDT, the total supply of USDC on exchanges has dropped considerably since May. (25% to ~15%). This increase in USDC holdings is primarily due to the Terra crash, in which investors flocked to USDC.

- This is further observed in the significant increase in the number of both Smart Money wallets and total Smart Money USDC balance since the start of 2022.

- Significant increase in Smart Money USDC holdings since the Terra crash (64% increase as of 14 Sept 2022). However since 14 Sept, Smart Money USDC holdings have plummeted by 39.4% as of 22 Sept 2022.

- Furthermore, we see the largest increase in cUSDC Smart Money holdings (USDC deposited into Compound) as compared to cDAI and cUSDT holdings, reflecting investor’s confidence in USDC’s ability to maintain its peg and serve as a reliable form of collateral.

- With Circle’s decision to comply with US sanctions, this trend could possibly change as we note that investors have been dumping more than $1.6b in USDC for USDT since Circle’s announcement. This is of course, assuming that Tether doesn't follow in the footsteps of Circle and comply with US sanctions.

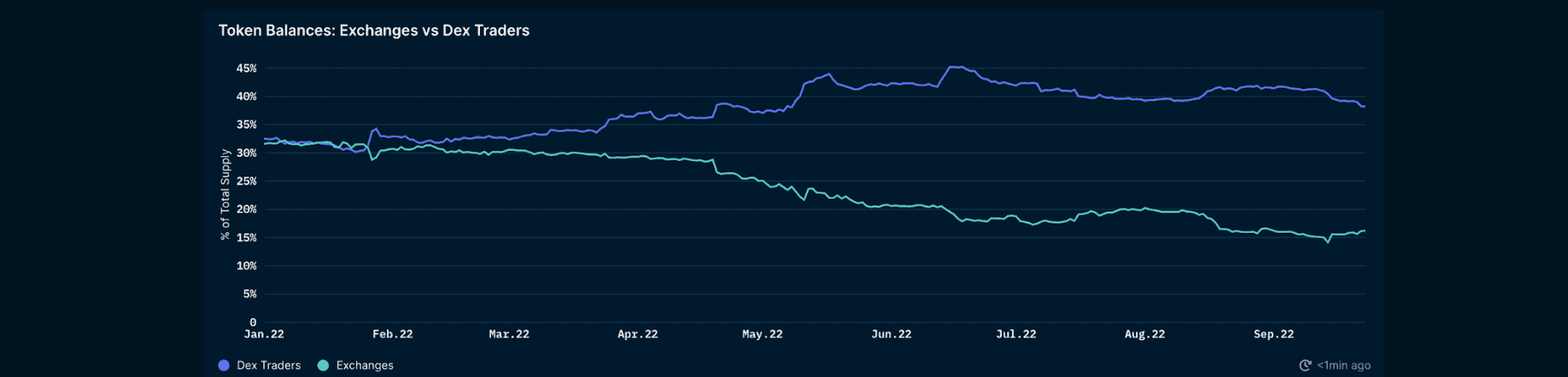

DAI

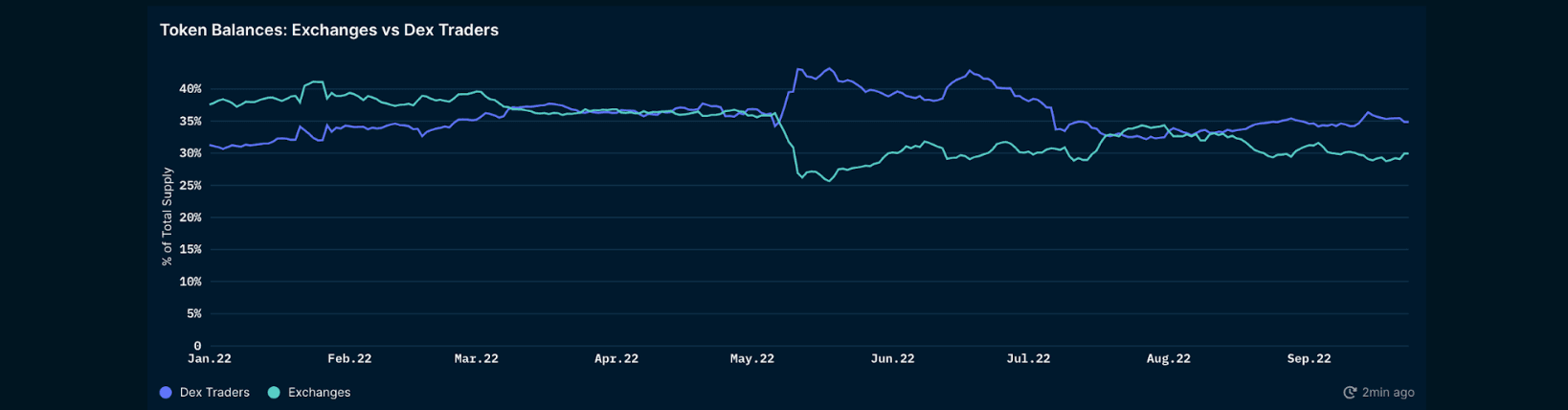

- Unlike USDT and USDC, which experienced considerable volatility, DAI has remained relatively stable, with Dex traders holding approximately 35% of total supply on average since the start of 2022, excluding the increased volatility experienced during the Terra crisis.

- Despite the fact that the number of Smart Money wallets holding DAI has remained roughly constant throughout the year, the overall Smart Money balance peaked on 27 January at $250m but has since fallen dramatically to levels slightly below those recorded at the start of the year.

- DAI’s peak was possibly due to investors rushing to swap out their MIM tokens for alternative stablecoins when it was revealed that the CFO of Wonderland was Micahel Patryn, co-founder of the fraudulent crypto exchange QuadrigaCX.

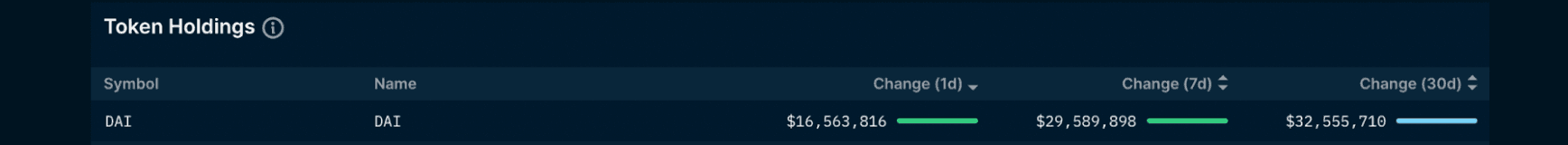

- On a positive note, in the past 1d/7d/30d, we also saw positive inflow of DAI into Smart Money wallets.

Overall Smart Money stablecoin holdings change

| Stablecoin | Change 7d | Change 30d |

|---|---|---|

| USDC | $84,750,407 | $89,163,305 |

| USDT | -$3,322,665 | -$29,127,280 |

| DAI | $1,929,443 | $7,310,959 |

| aUSDC | $33,885,327 | $44,530,142 |

| cUSDC | $29,633,485 | $30,660,015 |

| aUSDT_v2 | $545,151 | $629,877 |

Data as of 12 Sept 2022

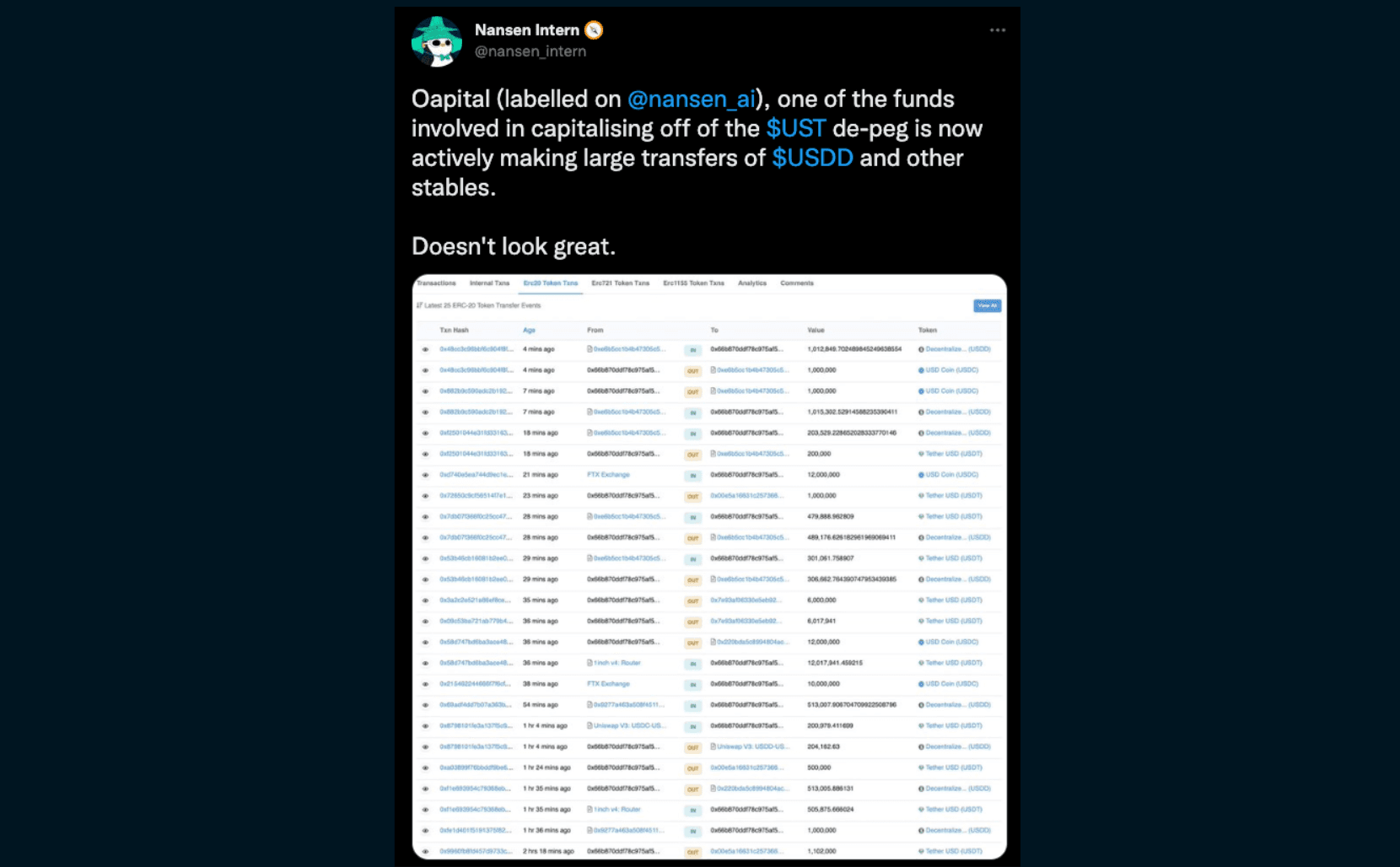

Just as what we’ve seen during the UST demise, having a proper risk management system is equally important in protecting capital. This is where Nansen smart alerts come in. For example, you could create smart alerts that track huge token outflows / inflows in Curve stablecoin pools, to keep track of pool imbalance that could affect the stablecoin’s peg.

Smart alert templates

- Curve 3pool (USDT / USDC / DAI)

- Frax pool (FRAX / USDC)

- Frax 3crv pool (Frax / USDT / USDC / DAI)

- USDD pool (USDD)

- USDN pool (USDN)