Introduction

In turbulent market conditions and a bearish macro-economic outlook, many are taking refuge in stablecoins. There is a wide choice of stablecoins, many of which have different use cases and designs. As a result of these differences, stablecoins have different risk profiles. The purpose of this report is to assess the risks and pitfalls of some of the major stablecoins to help the reader make a more informed decision if storing some of their capital in stablecoins.

The following stablecoins are examined:

| Centralized | Over-collaterized | Algorithmic |

|---|---|---|

| USDT | DAI | UST |

| BUSD | RAI | FRAX (under collaterized) |

| USDC | MIM |

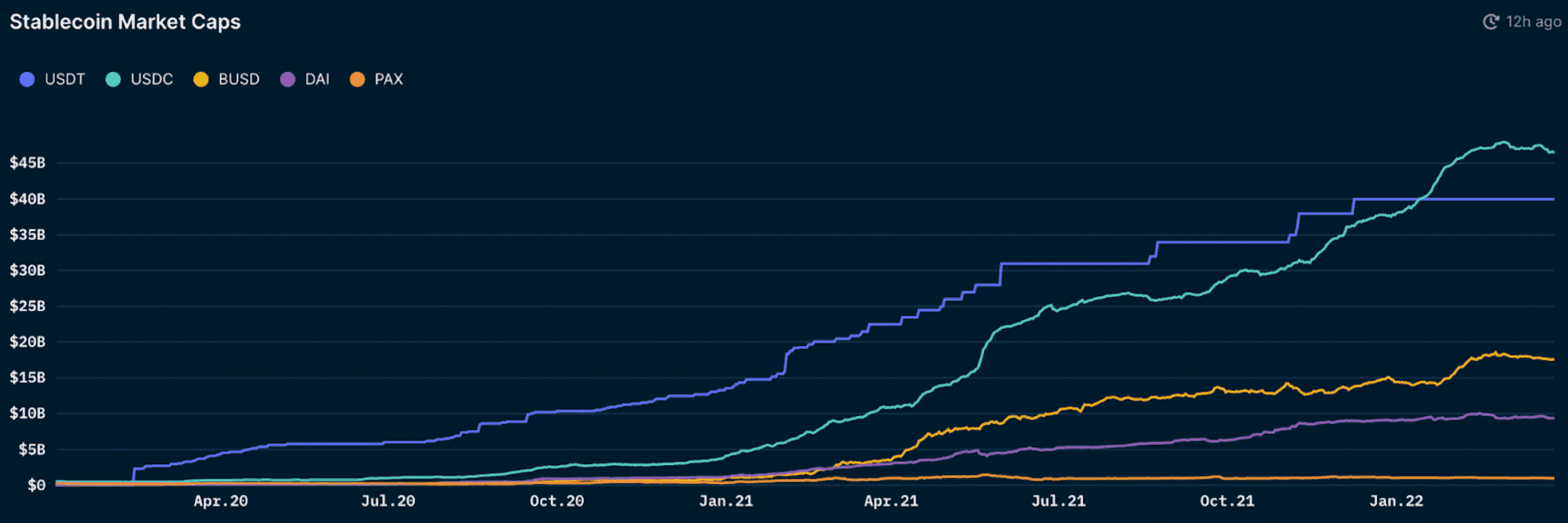

The Nansen Data shows the largest stablecoins by Market Cap (excluding UST). The centralized stablecoins USDC, USDT, and BUSD dominate the market. UST and DAI are by far the largest ‘decentralized’ stablecoins. *Note that UST does not appear on the dashboard but Terra integration is coming soon.

Centralized Stablecoins

USDC

Market Cap: $52.4bn Chains Deployed on: 8 chains

USDC is a fully collateralized stablecoin issued by Circle that is fully backed by cash, cash equivalents and US Treasuries. They aim to always have each USDC redeemable 1:1 for USD. To check on their monthly attestations from a 3rd party regarding the reserve balances backing USDC, head here to view them.

Many believe USDC is the most risk averse stablecoin in terms of peg and reserve backing. However, it makes certain trade-offs - trusted 3rd parties and censorship risk. Of course, Circle, the parent company, is a centralized company incorporated in the United States. With that, comes the regulation of the US government and censorship risk involved with any transaction involving USDC - which includes nearly every DeFi protocol on most chains.

Again, USDC is issued by regulated financial entities in the US and is governed by Centre (a consortium of members including Coinbase, Circle, and many others) who set the standards for USDC - technical, policy and financial standards. In terms of regulation in the US, USDC is treated as a stored value instrument which is regulated under state money transmission laws. As it stands today, Circle is under the oversight of 46 individual state regulators and counting. Thus far, Circle has done well with the frequent examinations that each of them conduct. Using USDC involves many trusted 3rd parties who are subject to regulation in the United States.

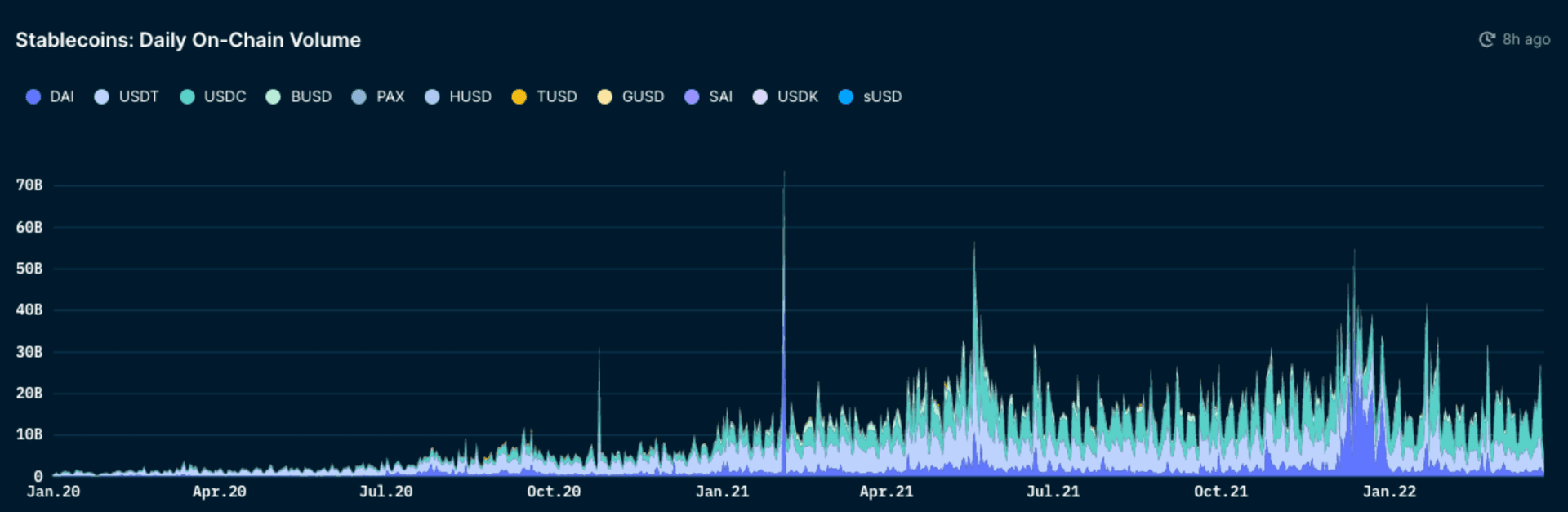

In terms of crypto adoption, we can see that USDC is becoming the de-facto stablecoin choice for most centralized and decentralized exchanges. Using Nansen’s Stablecoin Master, we can see that a majority of daily on-chain volume is settled in USDC.

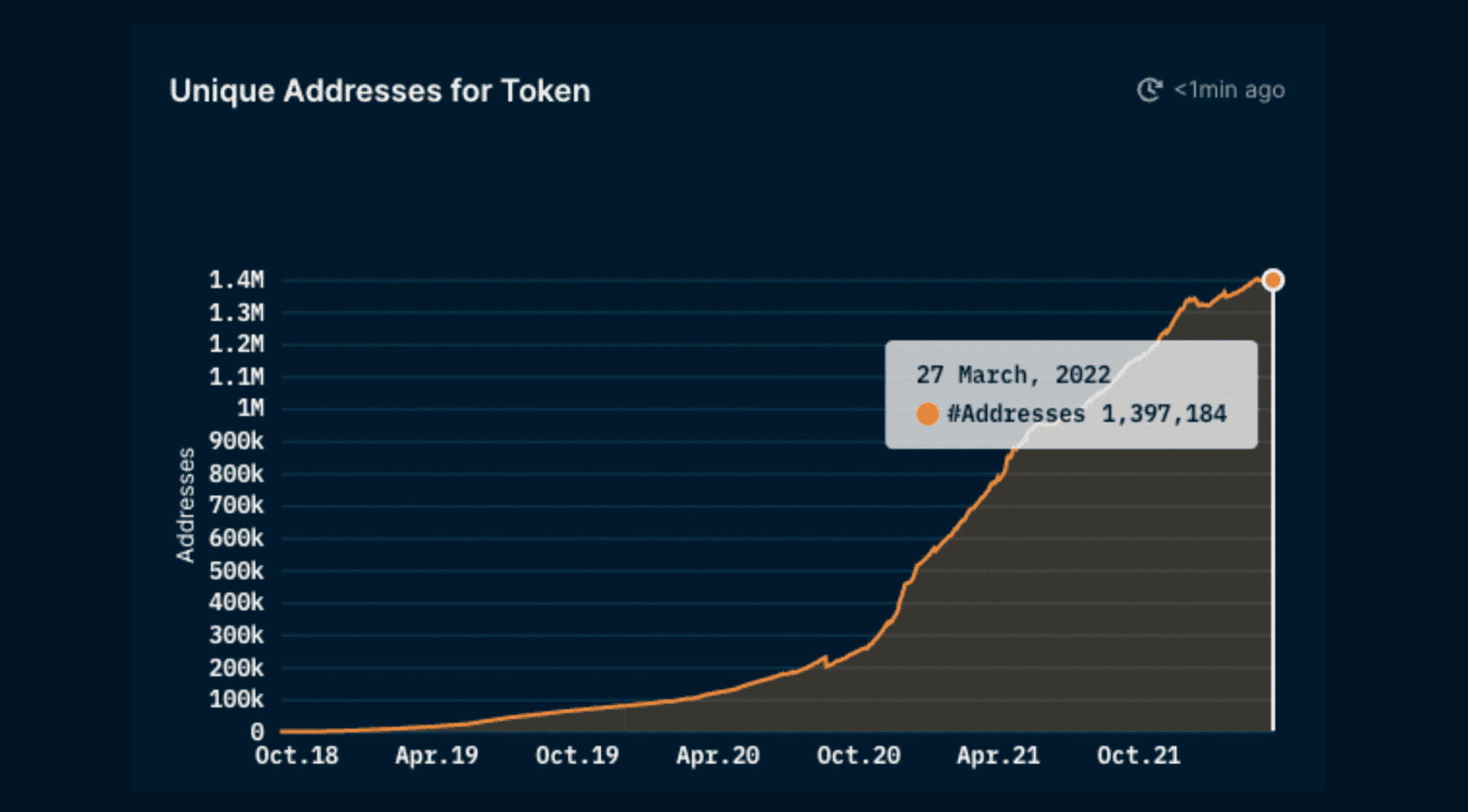

Outside of volumes, we can also look into the number of unique addresses for USDC on Ethereum. Using Token God Mode, we are able to see that nearly 1.4 million unique addresses hold USDC. These on-chain data points are a testament to the trust that a large number of DeFi users have for transacting and holding USDC.

Outside of censorship risk, where does that leave Circle the company in terms of its credibility of properly backing USDC? In terms of funding, we can see that they have raised 4 rounds of investment, which includes a $50m investment led by Goldman Sachs. If you are happy to take on the censorship risk, then having the 2nd largest bank in the world backing your company may be a good sign that proper reserve backing measures are taking place. Of course, this is in addition to the monthly attestations from the accounting firm Grant Thornton, who ensures all USDC tokens are backed by cash and short duration treasuries.

Takeaway

USDC has seen enormous growth over the past year due to its more transparent and regulated approach compared to USDT. Of course, there is a censorship risk given it is a centralized stablecoin which poses risks to users. However, the market has shown that USDC is the preferred stablecoin today and it continues to gain market share in the stablecoin economy.

USDT

Market Cap: $82bn Chains Deployed on: 10 chains

Similar to USDC, Tether is a fiat backed stablecoin that is supported on many chains today. Tether itself is the oldest stablecoin today, having originated in 2014 it remains the largest stablecoin with over $82b issued today. Although it is the oldest, Tether still faces much scrutiny around its backing.

Similar to USDC, Tether is backed by a combination of financial instruments - cash, treasuries, bonds, loans, commercial paper and other investments. However, the actual backing of Tether with cash equivalents is only around ~40%. The other 60% of financial assets are in commercial paper, other investments, secured loans, among other assets - these are certainly riskier than USDC’s backing given Tether exposes USDT holders to more underlying credit risks as well as Chinese or other foreign commercial paper. Commercial paper is a type of short-term debt that companies issue to fund short term endeavors. They are unsecured and have a short term life span with an average maturity of 30 days.

Tether’s commercial paper has an average duration of 141 days with a credit rating of A-2; although satisfactory, A-2 is more susceptible to adverse effects in the economic climate than A-1. Although not perfect, the A-2 rating is satisfactory for short term issue credit ratings. Again, there is slight risk here although the market is clearly stating they are not worried. To add, many people can point to the irony of fractional reserve banking and compare it to Tether, but this is not the correct comparison - USDT is not as safe as USD and its portfolio of underlying assets appears to be more risky than that of USDC or PAX.

Clearly there have been many issues in the past, but they have improved their level of transparency as can be seen with their reports. The number of regulatory issues and the backing of Tether in past times is beyond the scope of this paper, which only assesses the risk of USDT today. Tether is still susceptible to its underlying basket of assets and has underlying credit risk that other stablecoins like USDC or PAX do not face (or much less likely to face based on their reserves). If there happens to be a volatile macro downturn, then Tether can face issues of being undercollateralized. Again, this is just speculation and Tether could also trade at a discount until the underlying risk is priced in and it achieves its peg once more.

Outside of underlying credit risk, users of USDT are susceptible to censorship risk. USDT is centralized and can be frozen by Tether. Like all centralized stablecoins, this is a risk holders take on. Although the frozen accounts have many times been hackers or other bad actors, Tether is a centralized company and must act according to the legal jurisdiction in which they reside.

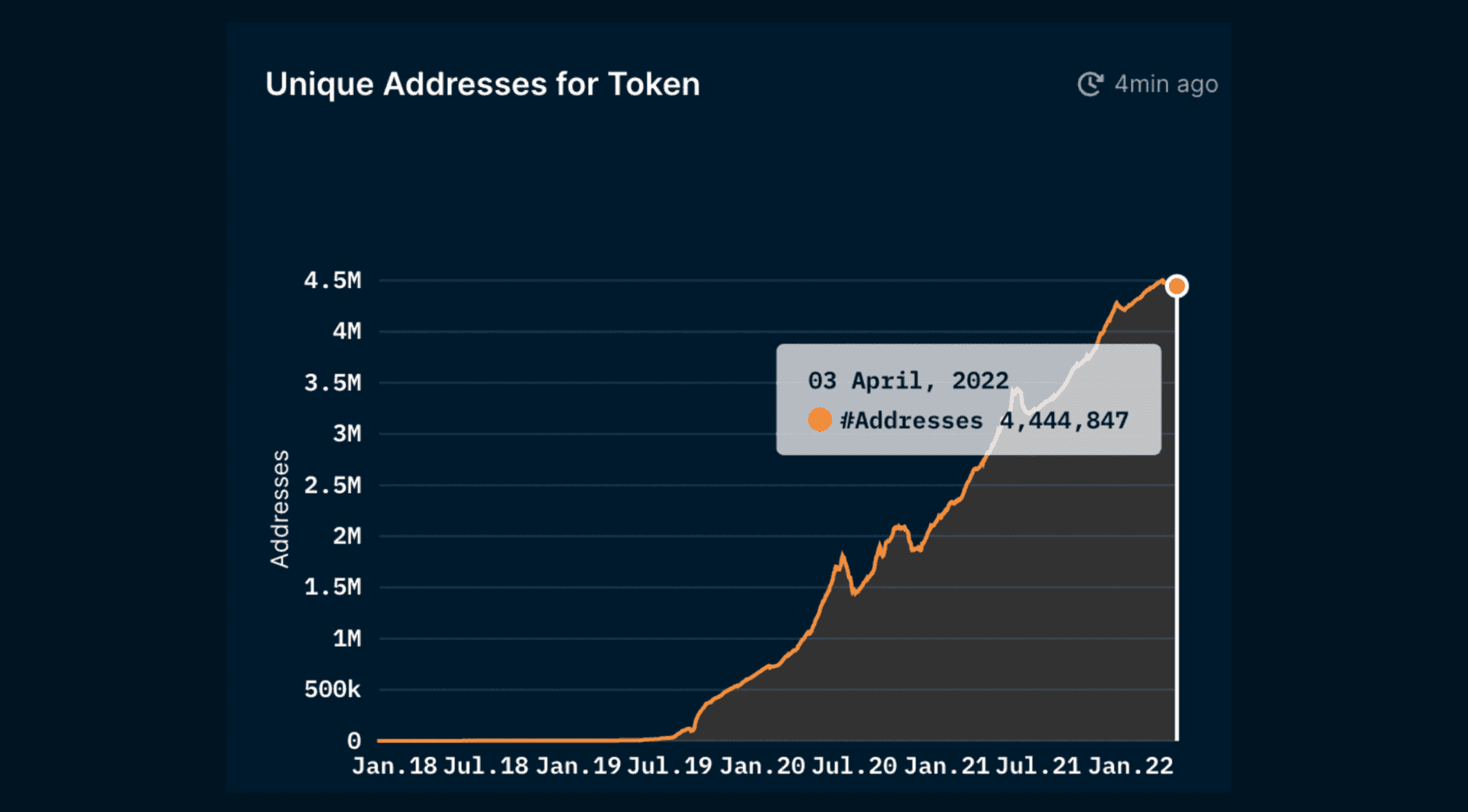

Further, a lot can be said about Tether’s risk based on the market alone. Today, over 4.4 million addresses hold Tether on Ethereum. On CEXs, USDT remains the most popular stablecoin on Binance, OKX, Kucoin, Huobi, amongst others.

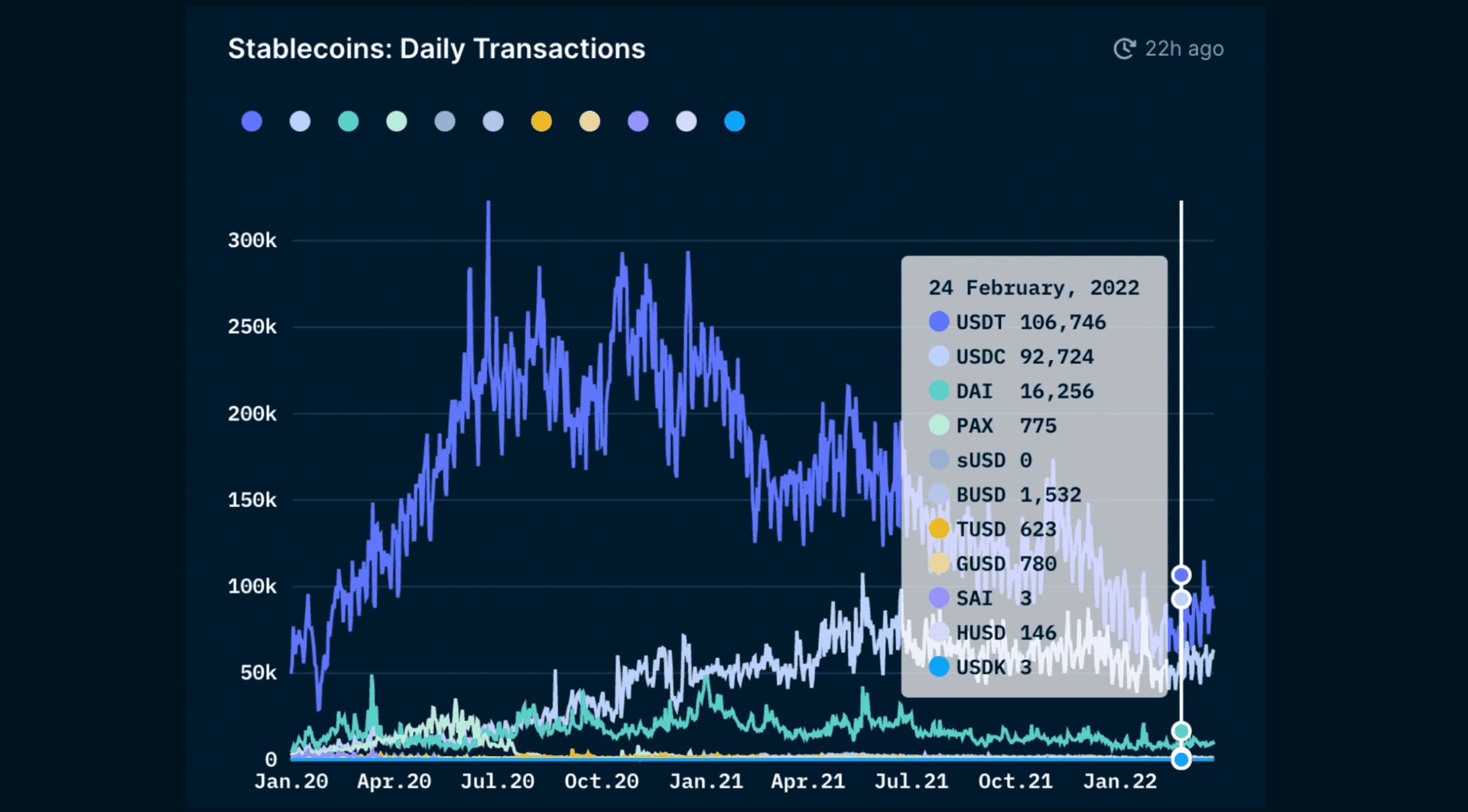

Having peaked in June 2020 for the number of daily transactions sent, USDT is losing market share to USDC and other stablecoins.

Takeaway

Tether is the oldest stablecoin and has proven its utility through its $82b market cap. USDT is likely riskier than USDC or BUSD, but it has done a lot to improve its transparency and regulatory framework to be a trustworthy stablecoin. Although it has had controversial transparency issues with regulators in the past, it has proven itself through their many transparency initiatives over the last year. There is definitely more underlying risk with its basket of reserves backing USDT and that is shown by its decreasing market share against other centralized stablecoins. As with other centralized stablecoins, there is always the risk of censorship.

BUSD

Market Cap: $17.7B

BUSD is the 3rd largest stablecoin by market cap and was created through a partnership between Paxos and Binance. Paxos is the issuer of BUSD and they are regulated under the New York Department of Financial Services. Paxos laid the regulatory framework to be extremely compliant with regulatory agencies, which has allowed it to onboard companies like Binance to issue their own stablecoins using Paxos’ regulated stack as the sole issuer.

Paxos maintains extremely high standards for backing BUSD. All BUSD is 100% backed by cash (via insured bank accounts) and treasury bills. Paxos releases monthly attestations for all of their stablecoins here. Note, they have multiple stablecoins that are all backed by their own cash or treasury bills such as USDP or BUSD. When interacting with BUSD, you are not taking on any external risk from Binance, solely from Paxos. If you trust Paxos, then BUSD is the safest centralized stablecoin based on underlying risk of the assets backing the stablecoin. BUSD is mainly used on Binance, with over $16.5b on Binance wallets tagged on the Ethereum blockchain.

Takeaway

Again, as with all centralized stablecoins, BUSD faces censorship risk given it is regulated by the New York Department of Financial Services. As for underlying credit risk of the assets backing BUSD, Paxos takes the safest approach in comparison to Circle or Tether. In terms of stablecoin risk for centralized stablecoins, we order them below from lowest to highest risk:

Centralised Stablecoin Relative Risk (least risky to most risky):

- BUSD (Paxos & Binance)

- USDC (Circle)

- USDT (Tether)

Over-Collateralized

Dai

Market Cap: ~$10bn Maker TVL: $16bn Number of chains deployed on: 12 chains (with over 1m Dai)

Dai is a stablecoin issued by MakerDAO - a battle-tested and relatively decentralized DeFi 1.0 protocol. Dai is an overcollateralized stablecoin backed by collateral approved by MakerDAO.

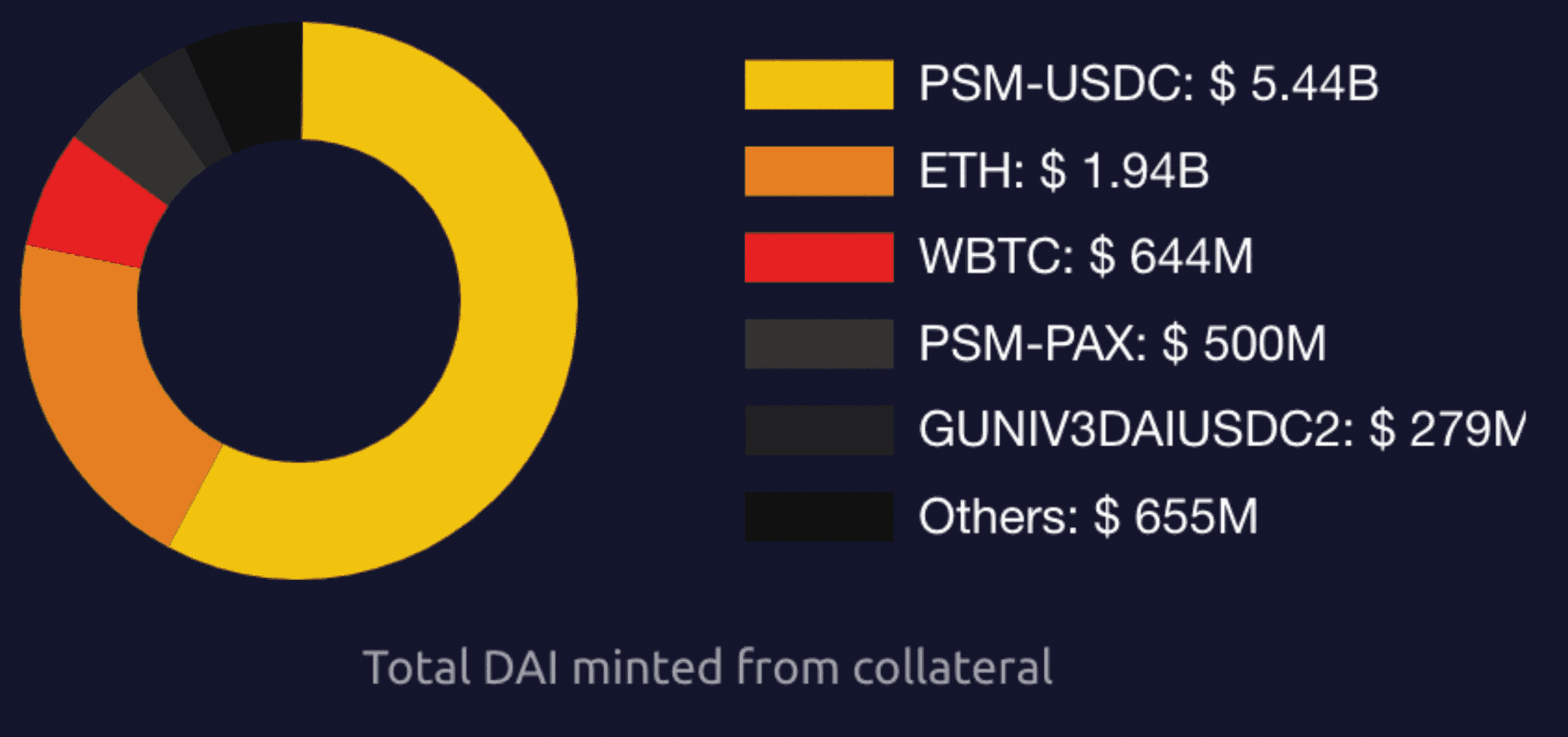

The following graph shows the collateral composition of Dai

As can be seen, the majority of Dai is backed by USDC, with ETH, WBTC and Paxos notable collateral as well. Dai has been criticized for its strong reliance on USDC - and has been referred to as ‘wrapped USDC’ by some of its critics.

MakerDAO is known for its conservative approach to onboarding new collateral types for Dai. This may be attributed to ‘Black Thursday’ black swan event that caused Dai to lose its peg, and MKR minted to compensate LPs. This has had the effect of making the community highly risk-averse. Due to this, and the over-collateralization requirements, Dai’s growth has slowed. However, the community’s risk aversion has pushed it towards strong reliance on centralized stablecoins which exposes it to potentially catastrophic censorship risk.

Nansen Data

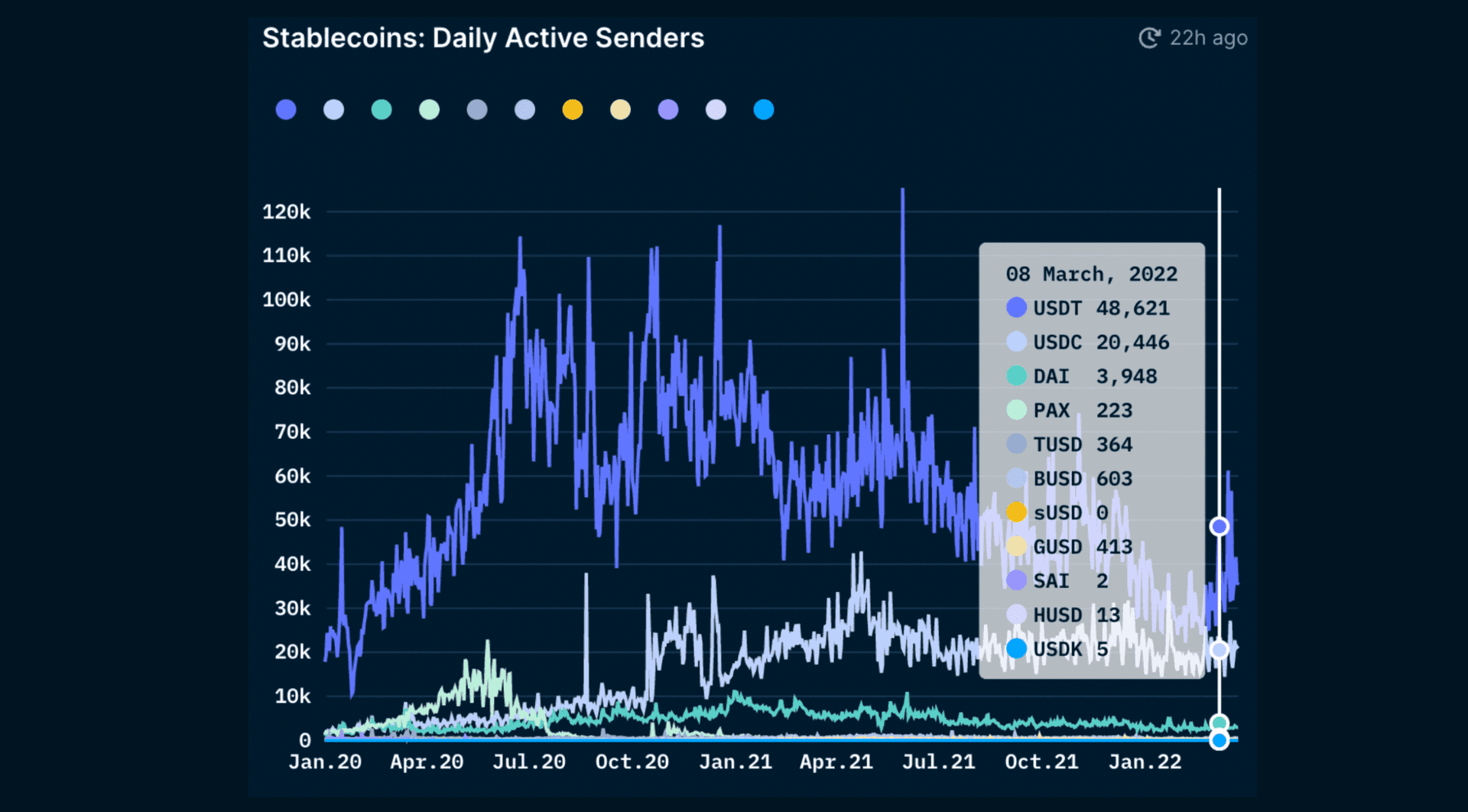

Here it can be seen that although Dai trails USDC and USDT significantly (which have ~5x and ~12x more daily senders) it is still 6.5x greater than the next closest stablecoin (BUSD)

Similarly, although Dai trails USDC and USDT (by 5.7x and 6.5x respectively), it still sees significant usage and almost 11x more than the next most transacted stablecoin (BUSD).

Risks

With an apparent end to the bull market, Maker now has reduced vault demand and increasing demand for Dai. In order to maintain the peg, Maker has needed to onboard more non-interest bearing USDC with the effect of reducing protocol revenues and increasing counterparty risk in Circle.

Circle Risk

- Circle can freeze USDC and can be compelled to do so by regulators.

- In the case of Dai, they would need to freeze all or a significant proportion of the USDC in Maker. This means Dai cannot be censored directly, but underlying USDC can be censored. However, this would be a drastic measure to freeze all the USDC backing Dai.

- A worst case scenario would see all centralized coins backing Dai freezing their tokens in Maker. This would leave Dai with 30% (note that this would actually be less in such drastic market conditions as the price of ETH and BTC would likely fall significantly).

- It is worth noting that this worst-case scenario is highly unlikely, and that in the event that it occurs at least some proportion of the collateral backing Dai will remain (ETH, WBTC).

- It arguably diversifies some risk from holding USDC, as it has more forms of collateral backing it like ETH and BTC.

Key Development: D3M

Dai Direct Deposit Module (D3M) is an interesting new development in Maker that enables it to inject Dai liquidity on demand to secondary lenders. Due to high demand for Dai in bear market conditions, D3M will mint Dai directly to the secondary lending market so borrow rates stabilize. In addition, when there is a lack of demand for Dai and excess liquidity, then the interest rate for depositors will go down. This is to ensure that there is a healthy equilibrium for Dai on secondary markets.

Future of DAI

Real World Assets

- Dai has had difficulty scaling due to MakerDAO’s conservative and slow nature, and the over-collateralization requirement.

- Maker is focusing on onboarding real-world assets which should provide another way to back Dai and diversify the collateral base. However, this is still in its infancy and many difficulties still exist with this.

- Maker is a pioneer in exploring and leveraging RWA in DeFi. It has financed invoices from Centrifuge. While there are still considerable uncertainties around this, and it is still in its infancy - there are some promising developments such as Societe Generale applying for a $20m loan.

- This would involve OFH Tokens which are security tokens representing covered bonds backed by home loans, with a 0% rate, maturing in 2025, and worth approximately $54m.

- It is apparent that Maker is seen as the most stable and safe DeFi protocol by institutions - due to its well-defined governance processes and risk-averse community.

- Maker is making efforts to be a compliant protocol going forward, which has put it at odds with many in the DeFi community but could be a prudent move in future-proofing the protocol.

- However, this has been criticized as onboarding centralized assets that can be frozen immediately by the government and confiscated forever.

- Maker will delegate credit underwriting to protocols such as Centrifuge and Maple. This could make Maker akin to a ‘central bank’ of crypto.

- Ultimately, Maker aims for Dai to be backed primarily by RWA, ETH, and BTC.

Arguably, Maker’s efforts at onboarding real-world assets are what will bring DeFi to the next level. However, they bring an additional layer of centralization and legal complexity to the protocol. The answer to critics of real-world assets being centralized and subject to government control is that Maker should provide a better alternative to banks and is a demonstration of the benefits of blockchain technology. In addition, collateral in the form of cryptocurrencies is volatile, and diversification of collateral should be considered healthy.

Takeaway

Dai is clearly over-reliant on USDC. However, its collateral composition extends beyond USDC with approximately 30% in censorship resistant cryptocurrencies. In addition, MakerDAO itself is a highly decentralized protocol, which makes the protocol itself more censorship resistant than issuers of other ‘decentralized’ stablecoins.

MIM

Market Cap: $1.86bn Abracadabra TVL: $3.25bn Number of chains deployed on: 5 chains

MIM (Magic Internet Money) is a stablecoin backed by a wide range of interest-bearing tokens. Abracadabra is an excellent example of composability in DeFi, as it leverages multiple protocols in offering a more efficient lending protocol than MakerDAO for example.

In order to borrow MIM, a user will need to deposit their (whitelisted) token. These include yield-bearing tokens which are key to MIM’s value proposition.

A user can therefore:

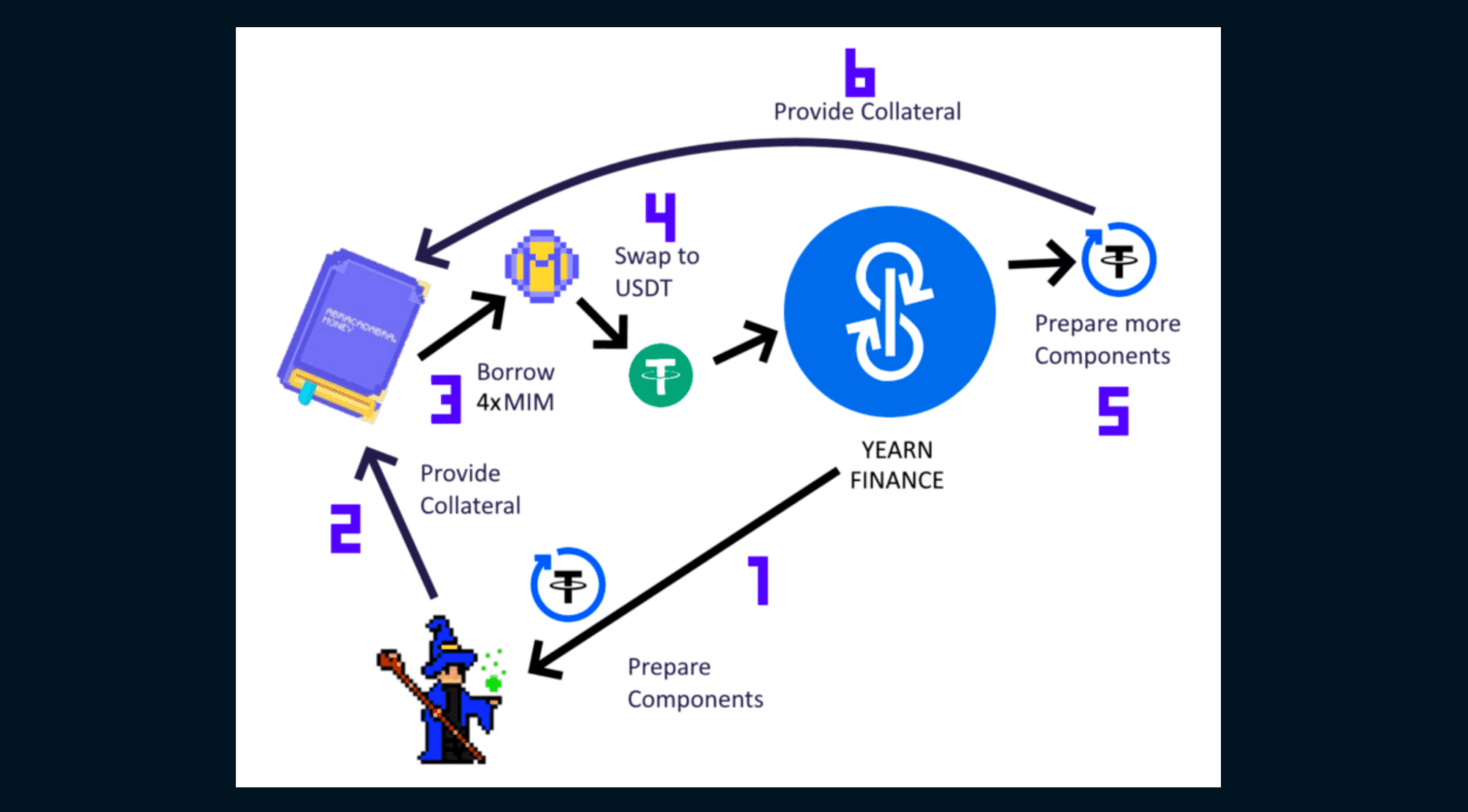

- Deposit 1000 USDC into a Yearn vault. They will receive 1000 yvUSDC.

- The yvUSDC can then be used in Abracadabra to borrow MIM.

- This will enable the user to unlock liquidity on their yield-bearing asset, which can be used to purchase other assets, and/or participate in leveraged yield farming.

- For example, the user could convert the MIM to USDC, and put it into a Yearn vault to earn more.

Below is a diagram demonstrating the leveraged looping that Abracadabra makes possible.

Abracadabra essentially enables you to do more with your assets, both yield bearing and non-yield bearing.\

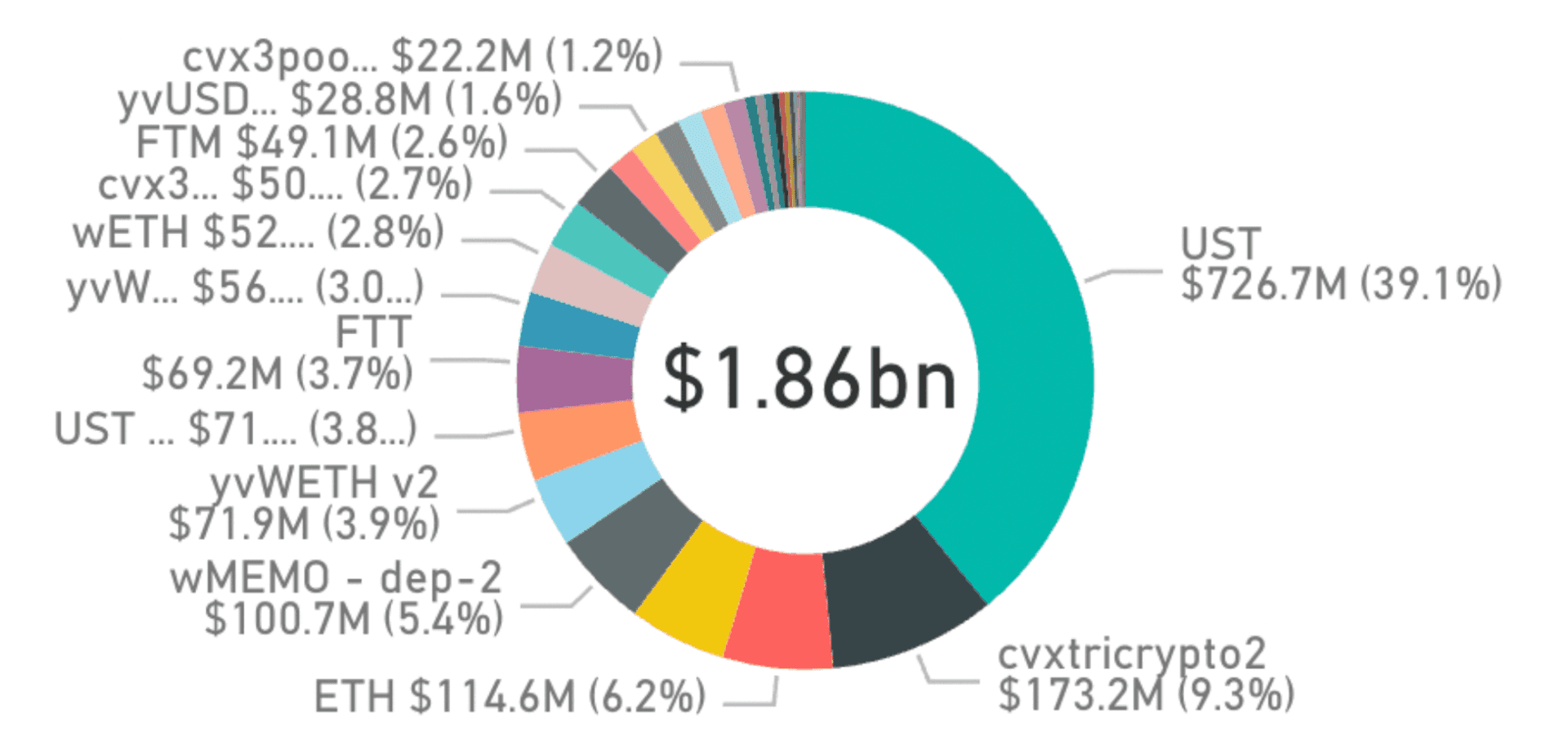

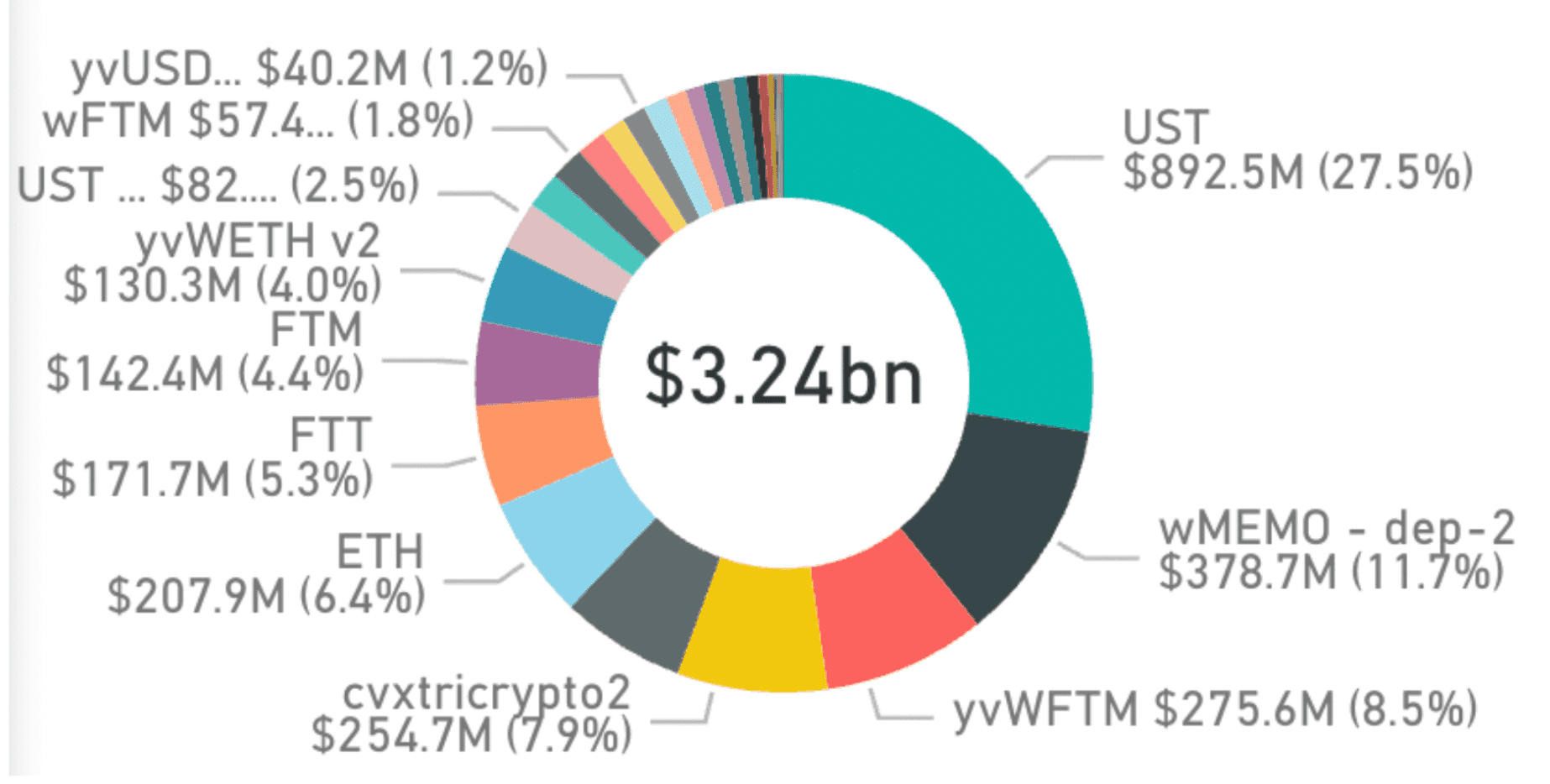

MIM Borrowed by Collateral

As shown on the graph, UST is the primary capital type for MIM.

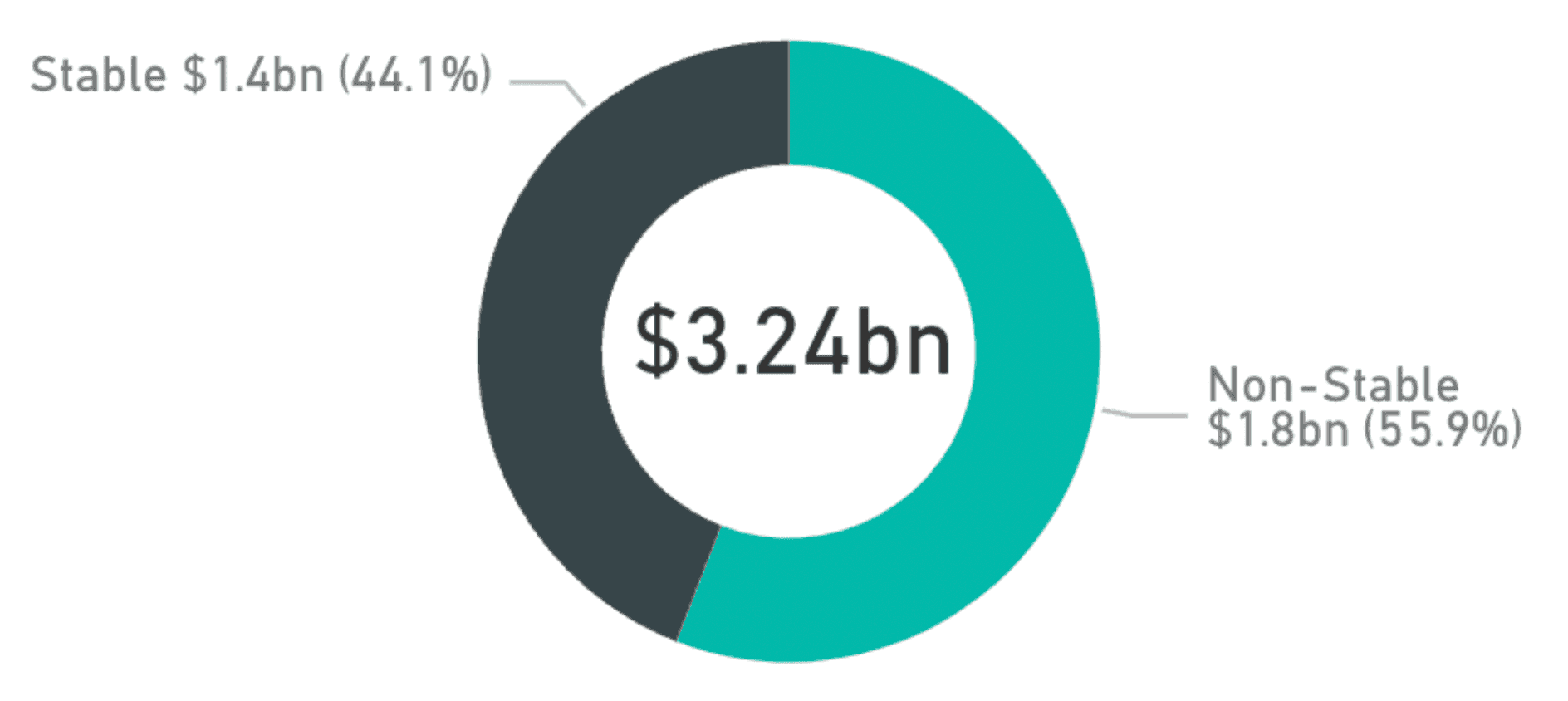

Collateral by Collateral Type

In addition, the above graph shows that most collateral backing MIM is unstable.

Collateral by Cauldron

This data indicates that the risk profile of MIM collateral is relatively high.

Risks

- MIM reduces risk by using isolated lending positions, so users can select which specific vaults they will borrow from. Regardless, there is still risk in that if one of the primary assets backing MIM becomes insolvent, there could be a depeg event.

- Abracadabra interacts with 18 various assets and protocols, which results in 18 different risk vectors. This risk increases as the protocol adds more assets and protocols.

- If protocols that play a significant role in Abracadabra such as Curve, Convex, and Yearn get hacked, this would affect a number of cauldrons potentially resulting in the MIM collateralization ratio falling and a depegging event.

- Furthermore, a black swan event for USDC and USDT would also have a negative impact - however, this would be ecosystem wide and not confined to Abracadabra.

- The majority of MIM liquidity is in the MIM-3CRV pool, which is composed of 86.5% MIM which is an unhealthy ratio.

- Abracadabra is governed by a 6 of 10 multisig which is a questionable level of decentralization. In addition, several of these signatories are affiliated with Wonderland projects.

- Another interesting point is that despite FTM being the largest vault by TVL, CVX tricrypto (a yield-bearing token on the liquidity pool of ETH, WBTC and USDT through Convex and Curve), and cvx3pool vaults generate the highest fees for Abracadabra.

First Test

The ‘Sifugate’ scandal created a FUD storm for Abracadabra and MIM. It transpired that Abracadabra founder Daniele Segestalli had knowingly given a serial scammer 0xSifu direct management of the treasury of Wonderland. This resulted in a crisis in confidence in Daniele, and in effect Abracadabra. This resulted in enormous outflows of MIM and MIM fud that threatened to depeg the stablecoin. However, MIM retained its peg. This was the first major stress-test of MIM and it performed very well under the circumstances.

Insurance

Risk Harbor provides insurance for MIM depeg in the event that MIM falls below $0.95 for more than 1 hour.

Takeaway

At present, MIM is a stablecoin for the more degen audience. It is very useful for making the most of your assets - however, this utility comes with some additional risk compared to a stablecoin like Dai. Nonetheless, MIM performed remarkably well during periods of extremely high FUD, proving that the protocol is resilient. Having a large portion of one’s stable portfolio in MIM could be considered risky given the riskier nature of its collateral. However, it remains a great tool for degen leverage strategies.

RAI

Market Cap: $62m Reflexer TVL: $152m Chains deployed on: Ethereum

Rai is a stablecoin issued by Reflexer that is 100% backed by ETH. Reflexer is a decentralized platform which enables users to use their crypto collateral to issue reflex indexes like Rai. Note that Rai is their only product now. To generate Rai, ETH is deposited into a safe which must maintain a collateralization ratio of 145%. Rai is designed to be stable - but not pegged to anything. This is similar to how the US Dollar is considered stable, yet is pegged to nothing. However, in reality, Rai follows the USD, and has consistently remained around ~$3. Reflexer prides itself on governance minimization, or ‘ungovernance’ with the view that the more human interaction the greater the potential for points of failure.

Maker Fork

Rai is a fork of Multi-collateral Dai (MCD) with several modifications. This is referred to as GEB.

Audits

Reflexer was audited 3 times - by Openzeppelin, QuantStamp, and Solidified.

Differences with MCD include:

- An autonomous feedback mechanism that changes the incentives of system participants when required.

- Insurance option for SAFEs

- Fixed and increasing discount auctions for selling collateral

- Several parameters in the system are automatically adjusted.

- A set of contracts that bound control over parameters that are governed in the long run

- The possibility to send stability fees at once to multiple addresses

- The ability to dynamically switch between surplus auctions and other types of strategies meant to remove surplus from the system

- Two prices for each Collateral type: one for generating debt, the other used when liquidating SAFEs

Rai’s key value proposition is that it is crypto native in that it is entirely backed by ETH. Therefore, Rai is over-collateralized by an underlying asset backing that is censorship resistant. This makes it an attractive proposition to decentralization maximalists and those concerned with dollar-pegged coins.

Note that the minimum Rai one can mint is 1129 (approx $3400).

Reflexiveness of Rai

If Rai is above redemption price, the redemption rate is positive and the redemption price increases. This makes it unprofitable to mint Rai and the collateralization ratio of the SAFEs falls. This means that additional collateral is needed to avoid liquidations, resulting in buy pressure for Rai.

If Rai is above the redemption rate, it is profitable to generate SAFEs - the Reflexer equivalent of Maker’s vaults). This incentivizes minting and selling Rai which puts downward pressure on price. Essentially, the protocol pays minters either by devaluing Rai or by self repaying everyone's loans.

In addition, if ETH price goes up there will be more borrowing power which will mean the price of Rai will go down when it is minted. To offset this, the Rai redemption rate becomes positive in order to drive the redemption price higher.

This makes Rai reflexive to movements in the price of ETH.

Governance Minimized

Rai was designed from the ground up to become governance minimized as time moves on. It is only backed by ETH and mostly managed by code.

- Rai has proved resilient in turbulent market conditions e.g. May 2021 crash, 2022 bear market etc.

- Its price has been barely affected by movements in ETH and has remained around $3 .

- Reflexer Labs uses a multisig to control the protocol. This introduces some level of centralization risk. This will be phased out as the protocol develops.

- Ultimately, it is likely that Reflexer will move to an immutable protocol with zero human involvement, like Liquity.

Scalability

In its current iteration, Rai is relatively unscalable. This is because it can only be minted by the overcollateralization of ETH. This means that while it may become one of the most censorship resistance stablecoins, it will be unlikely to ever achieve significant stablecoin market share like USDC.

Risks

The Reflexer team does not appear overly engaged at the moment. While this could be completely untrue, their Twitter and Medium are relatively very inactive which can be a bear signal. Granted that Rai is mostly autonomous, it is still a low-cap stablecoin and proper marketing is clearly necessary. It is unusual why this is not being properly developed. However, this can also be explained by the protocol’s focus on ‘ungovernance’ and lack of human involvement.

Takeaway

Rai remains a small cap stablecoin that has (so far) failed to achieve large-scale adoption. This can be in part attributed to it being a relatively new protocol, however, a big contributing factor is the fact that only overcollateralized ETH can be used to mint Rai. This is not capital efficient - however, it arguably creates a highly censorship resistant stablecoin. Reflexer have sought to minimize governance to achieve a properly decentralized stablecoin, and have arguably done a good job so far. However, the team needs to market Rai more effectively as public communications are relatively infrequent.

Overcollateralized Stablecoins Relative Risk (least risky to most risky):

- Rai

- Dai

- MIM

Algorithmic

UST

UST Market Cap: $16.7bn LUNA Market Cap: $39.4bn Planned BTC backing: $3bn in the near future, could reach up to $10bn eventually Chains deployed on: Truly native only on Terra Luna, however available in some (bridged) version on all larger chains

UST is a stablecoin built on the Terra protocol, which uses a combination of open market arbitrage incentives and decentralized oracle voting to track the price of one USD. It is native on the Terra blockchain and can even be used to pay gas fees.

Using a two token model, LUNA, Terra protocol’s native token, absorbs the price volatility of Terra:

- When UST is trading above $1 peg

- UST demand is too high compared to supply and users are incentivized to mint new UST by burning LUNA. This increases the supply of UST and should bring its price down (while the opposite should happen to LUNA).

- UST trading below $1 peg

- UST demand is too low compared to supply and users are incentivized to burn existing UST to mint LUNA. This decreases the supply of UST and should bring its price up (while the opposite should happen to LUNA).

Source: Terra Docs

Starting out as a fully algorithmic stable coin, backed only by LUNA, concerns about UST depegging have led to efforts to back UST with Bitcoin. Plans have been announced to start off with $3bn worth of Bitcoin and the first batches have already been acquired. It has been stated that the backing could reach up to $10bn worth of Bitcoin eventually.

UST, Terra and Anchor

Anchor is a project that kickstarted the Terra ecosystem (together with Mirror and CHAI), and is where the overwhelming majority of UST is parked (>12bn out of 16.75bn). Without getting too deep into Anchor in this report, you can find the key takeaways of Anchor below:

- At its core, Anchor is a borrowing platform

- Borrowers deposit yield generating / staked tokens (bLUNA, bETH, wasAVAX currently supported) and can borrow UST against these assets

- Lenders can deposit UST and earn interest that is fueled by borrowing rates from borrowers and the staking rewards from the interest bearing tokens the borrowers deposited

- Anchor guarantees lenders a fixed rate of close to 20% APR on your UST deposits (Anchor rate)

- With markets taking a hit and yields drying up, the 20% APR have become more and more attractive and the UST deposits have skyrocketed compared to the collateral that borrowers have brought in

- The Anchor rate is not self-sustainable - in order to continue paying lenders 20% APR, the Anchor yield reserve had to be topped up externally but still continues to fall

Anchor has been a major driver for the Terra ecosystem and a big factor in UST adoption.

One of the major concerns regarding UST is that the unsustainable Anchor rate will have to be lowered at some point and the positive effects it had on Terra and especially UST will reverse - leading to a UST bank run and it being unable to hold its peg, since it is a purely algorithmic stable coin. As mentioned above, efforts to back UST with BTC have since been started, but many investors still prefer to limit their UST exposure to a minimum.

Nansen Data

Terra is not (yet) supported by the Nansen dashboards.

Risks

In general, the risk of UST being hacked is relatively small, since it is a blockchain native asset on Terra. Most people are more concerned about the risk of a depeg in conjunction with an unsustainable Anchor rate than a hack (see section above). It has had quite substantial depegs in the past, but always managed to recover so far.

With more and more exploits of various bridges, be wary while handling wrapped UST on other chains.

UST as well as other stablecoins face risk of regulations, as governments and law makers are starting to crack down on crypto. If regulators decide to move against stablecoins, it might be harder to regulate than purely centralized coins like USDT or USDC. However, in reality Terraform Labs has significant control over the Terra ecosystem, making it centralized in reality.

While regulators may not be able to directly seize UST or stop it from functioning, they could still target validators or the Terra Foundation/Terraform Labs. The latter would not stop UST from working but could create enough uncertainty about UST and LUNA in the market for a lasting depeg of the algo-stable.

Future

All signs point to Terra wanting to make UST the largest stable coin and integrate it deeper into the Defi space, within the Terra ecosystem as well as on other chains. To achieve this, they have a number of incentive programs and partnerships, one initiative would be the launch of a 4-pool on Curve which is discussed here and has sent the prices of FXS and BTRFLY soaring, both of which are to collaborate in this effort.

Takeaway

UST is by far the largest unbacked algorithmic stable coin that managed to survive and keep its peg for so long.

The economic flywheel of

- Topping up the Anchor yield reserve to keep the APY at 20%

- Driving UST adoption (which accrues value to LUNA as well) through the very attractive Anchor APY

- Using the value accrual of LUNA and the additional attention and funding it attracts to top up the yield reserve and additionally buy BTC (and in the future also other assets) to back UST and increase trust in UST in the process seems to work for now.

- However, in difficult market conditions the 20% yield on Anchor is clearly extremely unsustainable, especially with the vast growth in Anchor deposits.

Whether Terra will collapse first or manage to keep things running and build up their BTC reserve is a heated discussion that has been going on for some time in the DeFi space. Also, whether $3bn worth of BTC in a custodial wallet is enough to successfully create trust to back $19bn UST is to be determined.

Further info: About the Terra Protocol — Terra Docs documentation Terra Flipside Crypto Terra TVL - DefiLlama TerraUSD price, UST chart, and market cap | CoinGecko

FRAX

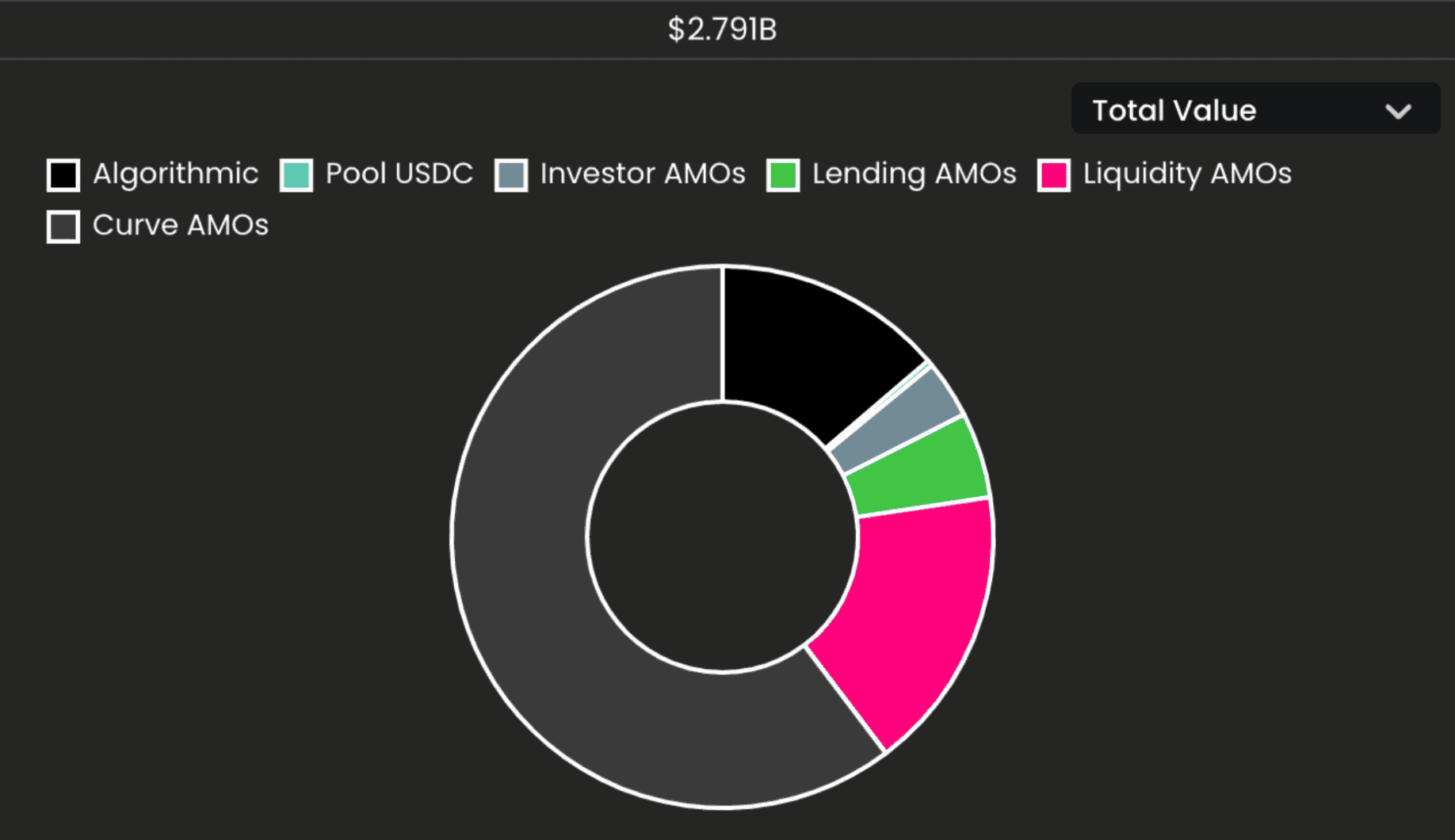

Market Cap: $2.79bn Collateralization ratio: 85.50% Number of chains deployed on: 12 chains

Frax is the first fractional-algorithmic stablecoin protocol, currently implemented on Ethereum and 11 other (EVM compatible) chains. The stablecoin FRAX is undercollateralized, ~85% of the supply is backed by USDC and the rest is algorithmically backed by FXS (the Frax protocol’s governance token). The ratio of collateralized and algorithmic depends on the market's pricing of FRAX. If FRAX is trading at above $1, the protocol decreases the collateral ratio. If FRAX is trading at under $1, the protocol increases the collateral ratio.

Frax has a two token model, and the governance token FXS accrues fees, seigniorage revenue, and excess collateral value. In short this can be interpreted as FXS getting the upside and downside of FRAX depegging in both directions and helping to dampen fluctuations and keeping FRAX around a tight peg around $1.

The collateral of FRAX is supplied in USDC upon minting, but Frax does not let their collateral sit idle. They use a certain portion of it in automated market operations (AMOs) to earn yield for the protocol (over 400k/day in the last week) and supply liquidity for FRAX at the same time - all while making sure that the collateralization ratio or peg is unaffected. The majority of their treasury is deployed on Curve and used to farm on Convex.

Frax is the single largest CVX holder and uses its CVX to influence emissions and boost their FRAX pool on curve and incentivize deep liquidity in addition to the liquidity they add themselves. Consequently, the Frax pool is the second largest stable pool on Curve after the 3crv pool and this deep liquidity helps to keep price fluctuations of FRAX to a minimum.

Nansen Data

Due to their active partnership management, there are new opportunities for FRAX usage on a regular basis. This has driven FRAX adoption quite a bit, and the protocol has steadily gained adoption.

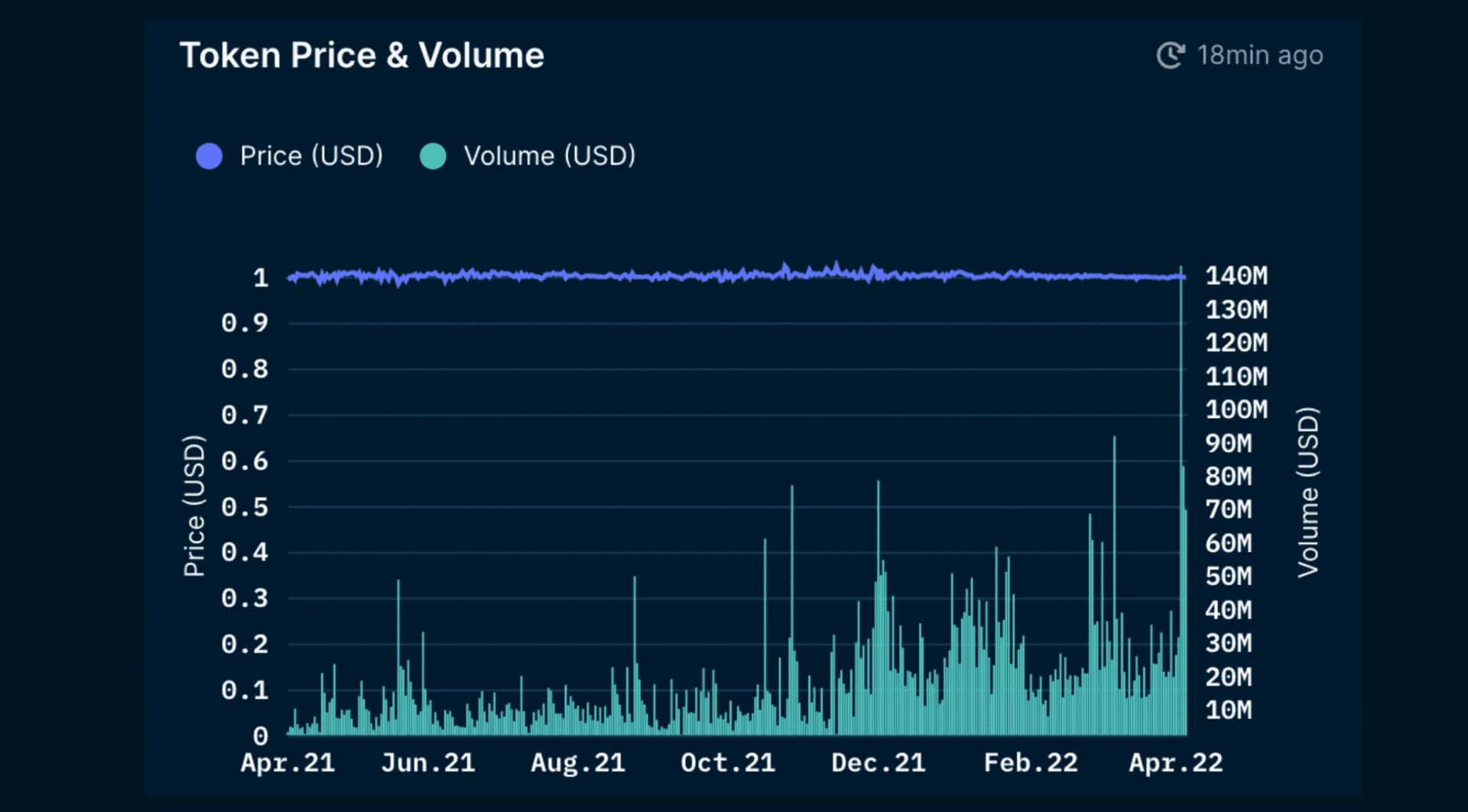

FRAX volume has been steadily increasing and is now at a large multiple (>20x) compared to a year ago as of April 5th. Furthermore, the history of the FRAX peg has been impressive, even compared to some of the larger stable coins backing it.

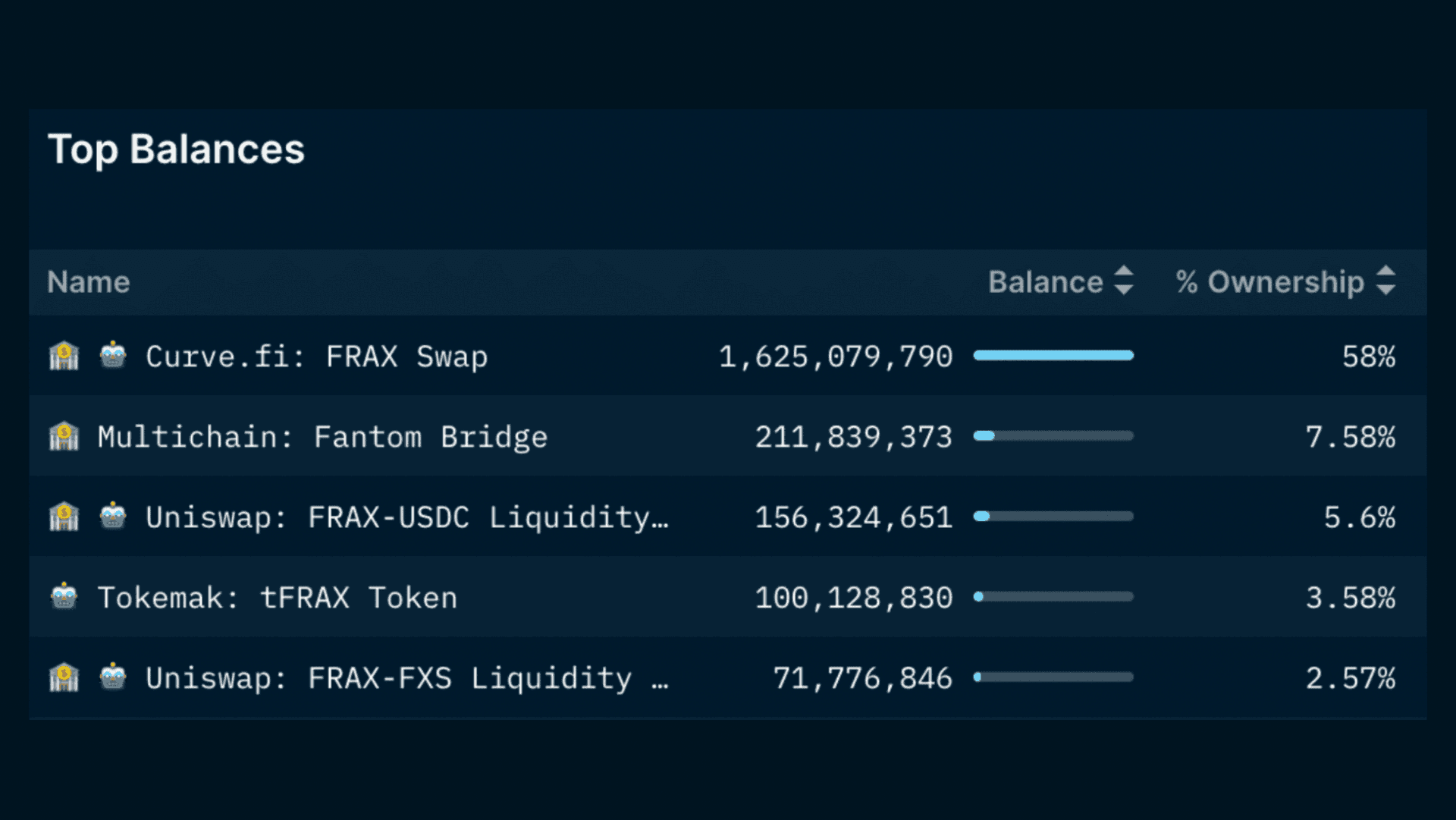

The majority of the tokens are in the FRAX Curve pool, providing deep liquidity for swaps and making it quite hard to de-peg from $1.

Risks

It makes sense to divide the risk into that which is associated with Frax itself and the risk of the underlying assets and products it employs.

Depegging

The depegging risk within Frax itself seems manageable, since it is largely (~85%) backed by stables and has FXS (~$2b market capitalization) to cushion the fall if FRAX should really trade significantly below peg. The same principle applies analogously if FRAX should trade significantly above peg.

Example:

- FRAX collateralization ratio (CR) is 85%, FRAX price drops to 0.95$

- You can redeem FRAX for the CR of $USDC and FXS (0.85USDC + 0.15$ worth of FXS)

- Arbitrageurs will buy FRAX to redeem for a profit until the peg is returned

- This will likely put sell pressure on FXS

Smart contract risk

Frax has been audited by Certik and Trail of Bits and did not have a hack since inception. However, compared to other major stable coins, Frax has quite a few moving parts and the audits have not been without critical / severe findings.

Risk of underlying assets and smart contracts

In addition to the risks mentioned above, Frax inherits the risks and downsides of the underlying assets and products it uses. Most notably all the risks associated with

- USDC: Currently USDC is the main collateral used for minting and redeeming FRAX.

- Curve / Convex: Most of FRAX supply is on Curve and the majority of the FRAX treasury is deployed there as well.

- DAI and USDT: As the majority of FRAX and the treasury is deployed in the frax-3crv pool. If anything happens to the 3crv pool, FRAX will not get away unscathed and might not be able to ensure the CR.

Future

Short term: Frax wants to double down on partnerships to drive adoption as can be seen in their announcement to collaborate with Terra and launch a 4-pool with UST, USDC and USDT on Curve, leading to an 80% price increase in FXS.

Long term: Frax's end vision is to build the first crypto native version of the CPI called the Frax Price Index (FPI) governed by FXS and FPIS (Frax Price Index Share) holders. While FRAX is pegged to USD, FPIS seeks to be a permissionless unit of account that maintains purchasing power (similar to CPI it would be pegged to the prices of a product and service basket rather than any existing currency). FPI and FPIS just launched recently, with FPIS being airdropped to FRAX ecosystem participants (e.g. FXS stakers).

Takeaway

FRAX often has attractive yield opportunities compared to USDC, USDT and DAI, while arguably not having considerably larger risk. Frax seems like a very DeFi native stablecoin which is actively trying to gain adoption through partnerships, bribes and implementing its vision - definitely an interesting project to watch for good (stable) farming opportunities.

However, it has to be noted that risk and centralization considerations are currently not limited to Frax alone but also all the underlying assets and protocols. Frax can currently only be as decentralized and censorship resistant as USDC and as safe as Curve and Convex. Also a failure of USDT would not leave FRAX unscathed.

Further info: Nansen's Token God Mode Frax Finance How Frax beats the Rest — jackchong.eth

Algorithmic Stablecoins Relative Risk (least risky to most risky):

- FRAX

- UST