Introduction

Tapioca is building the first omnichain money market with LayerZero message passing. Tapioca aims to introduce a censorship-resistant, over-collateralized CDP-based stablecoin called usd0 which is the first omnichain stablecoin. usd0 utilizes the LayerZero OFTV2 (Omnichain Fungible Token V2) standard to offer a stablecoin that can be teleported across many chains without a bridge - no more fees, slippage, or long wait times. usd0 teleports from within the tokens contract, just like sending tokens between wallets and smart contracts on Ethereum.

Short Recap of LayerZero

LayerZero is a modular and highly customizable cross-chain messaging protocol that works via a Relayer and an Oracle, rather than a blockchain with an intermediate consensus layer like Polkadot's Relay Chain. This means there are no middlemen involved, unlike in competing solutions (Nomad, Wormhole, etc), where these middlemen, also known as bridges, have resulted in billions of dollars of lost user funds as they become high-value targets with no way to reach high enough economic security.

To execute a message, a Relayer passes it between a LayerZero application and “endpoints" on each chain (e.g: Ethereum to Avalanche), which function like mailboxes. An Oracle confirms that the message is valid.

Security

Tapioca uses LayerZero "Pre-Crime" to enhance its security measures. This technology allows Tapioca to set rules on cross-chain messages, and if these rules are violated, the message will be rejected. Tapioca employs Chainlink as its LayerZero Oracle instead of the "default LayerZero configuration," which is commonly used by immature LayerZero apps which led to looming security concerns. Tapioca uses a 4/7 multisig with a 30-day time lock on its LayerZero configuration. In the future, Tapioca plans to release its "Pearlayer" relayer, which will replace the LayerZero default Relayer and introduce immutability.

Omnichain Fungible Tokens (OFT)

LayerZero's "Omnichain Fungible Tokens" is a key innovation of LayerZero. These tokens include OFT20s, which are an omnichain super standard of ERC-20s, and OFT1155s and OFT771s, which are Omnichain NFTs. The token contract itself includes a transfer function, allowing any OFT to send tokens from one chain to another. As a user, you won't notice the difference between a traditional bridge, but you no longer need to worry about liquidity being on both sides of a bridge, the bridge's fee, the bridge's security, etc.

Enabling Cross-Chain Asset Composability

As a protocol, Tapioca is trying to push OFT adoption with all of its assets, including usd0 being an OFT. What they are trying to achieve with the OFT implementation is to enable seamless composability of any asset on any chain. Take for example GMX’s GLP, Tapioca’s “tGLP” is an OFT20 version of GLP that allows GLP to exist on any chain. Tapioca’s tETH unifies ETH into one asset between Ethereum Mainnet, Arbitrum, and Optimism. This liquidity unification results in higher capital efficiency as lenders and borrowers utilizing ETH can do so with one giant liquidity pool.

Read our full report on Cross Messaging Protocols here.

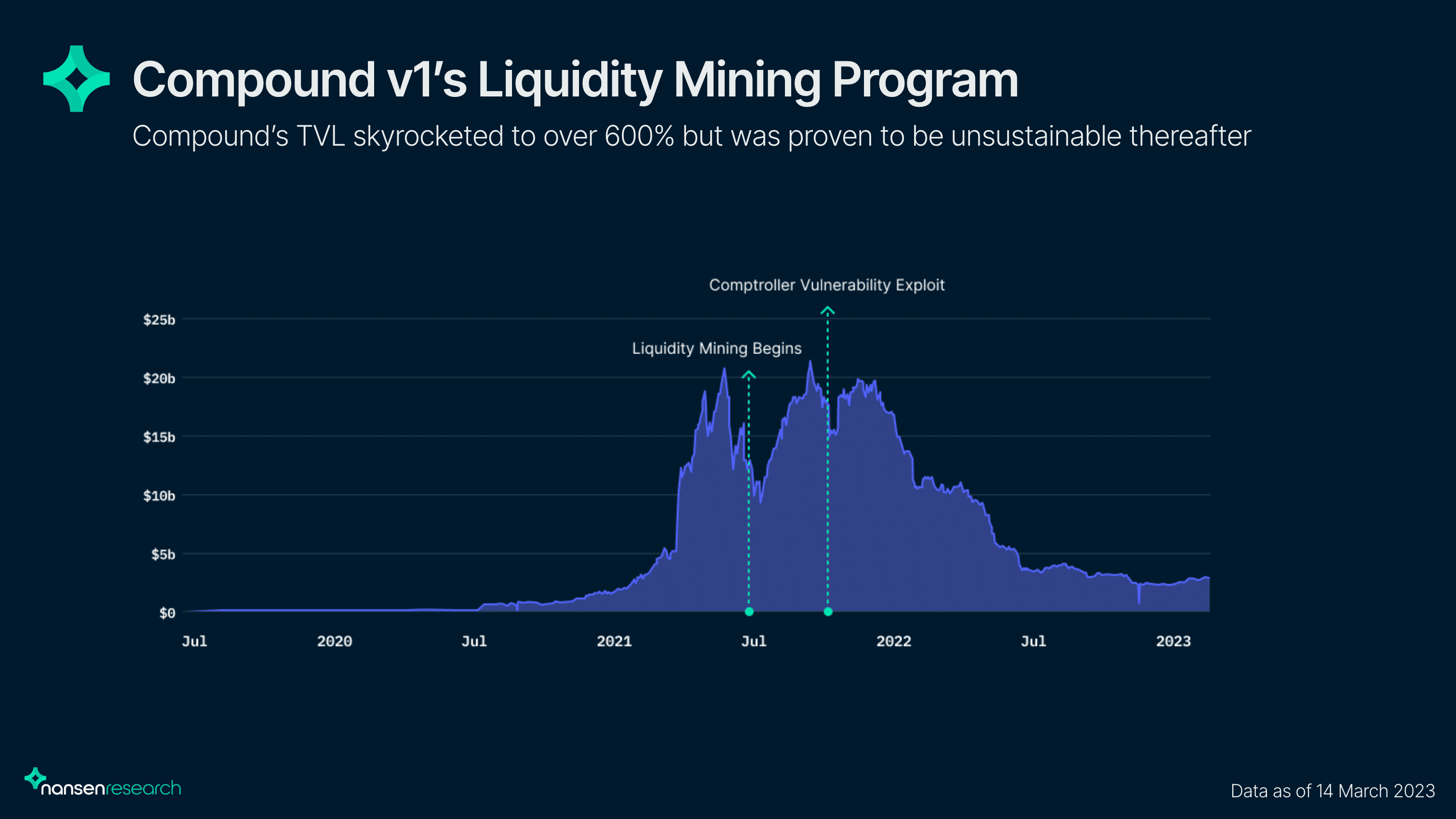

The Downfall of Liquidity Mining

Liquidity Mining was spearheaded by the launch of Compound V1 during the DeFi Summer of 2020. Liquidity Mining incentivized users to lend liquidity by receiving a reward token (e.g: COMP for Compound). When the liquidity mining program launched, Compound’s TVL skyrocketed over 600%. Despite the initial rise in TVL, the majority of the users did not keep their emitted COMP tokens and dumped them on the open market.

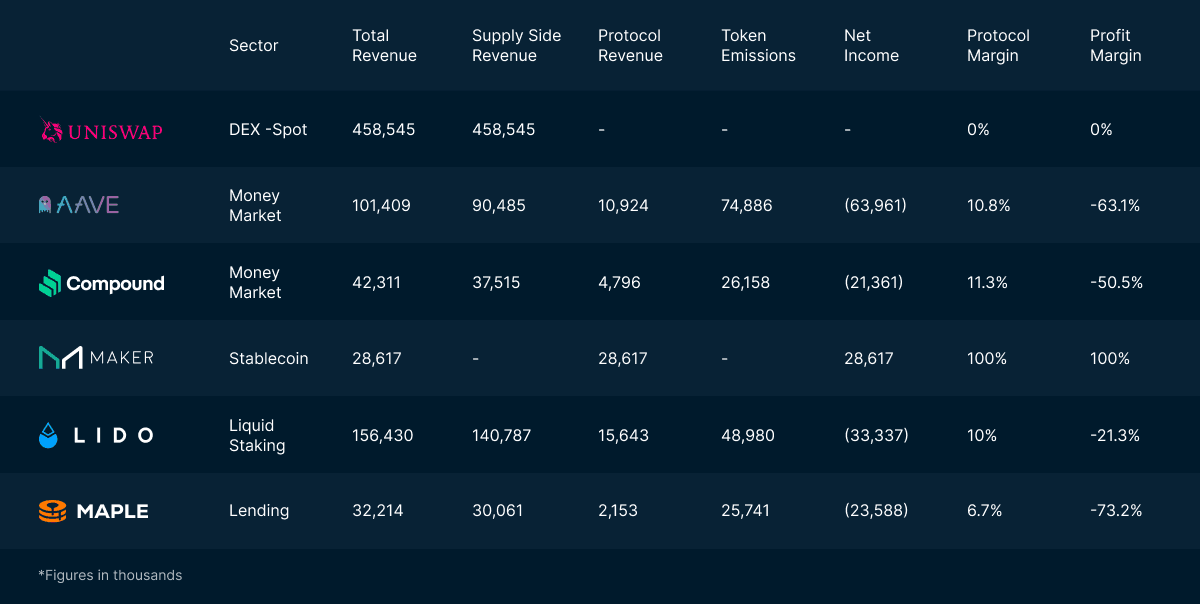

Overall, DeFi protocols are generally extremely unprofitable. Take the example of Aave and MakerDAO:

Aave generates over $101m in annualized total revenue - which is great! However, Aave also paid out $74m in AAVE token incentives to rent their liquidity. This resulted in a net profit margin of -63.1%. Although Maker was the sole profitable DeFi protocol when it came to its profit margin of 100%, the $28.6m in annualized revenue is paid directly to the DAO as there is no reward token with dividend payouts for token holders.

DAO Share Options (DSO): A New Way to Tackle Liquidity Mining

So… How is Tapioca seeking to solve the issue of liquidity mining and offer a way for DAO stakeholders to have a share in the protocol's success?

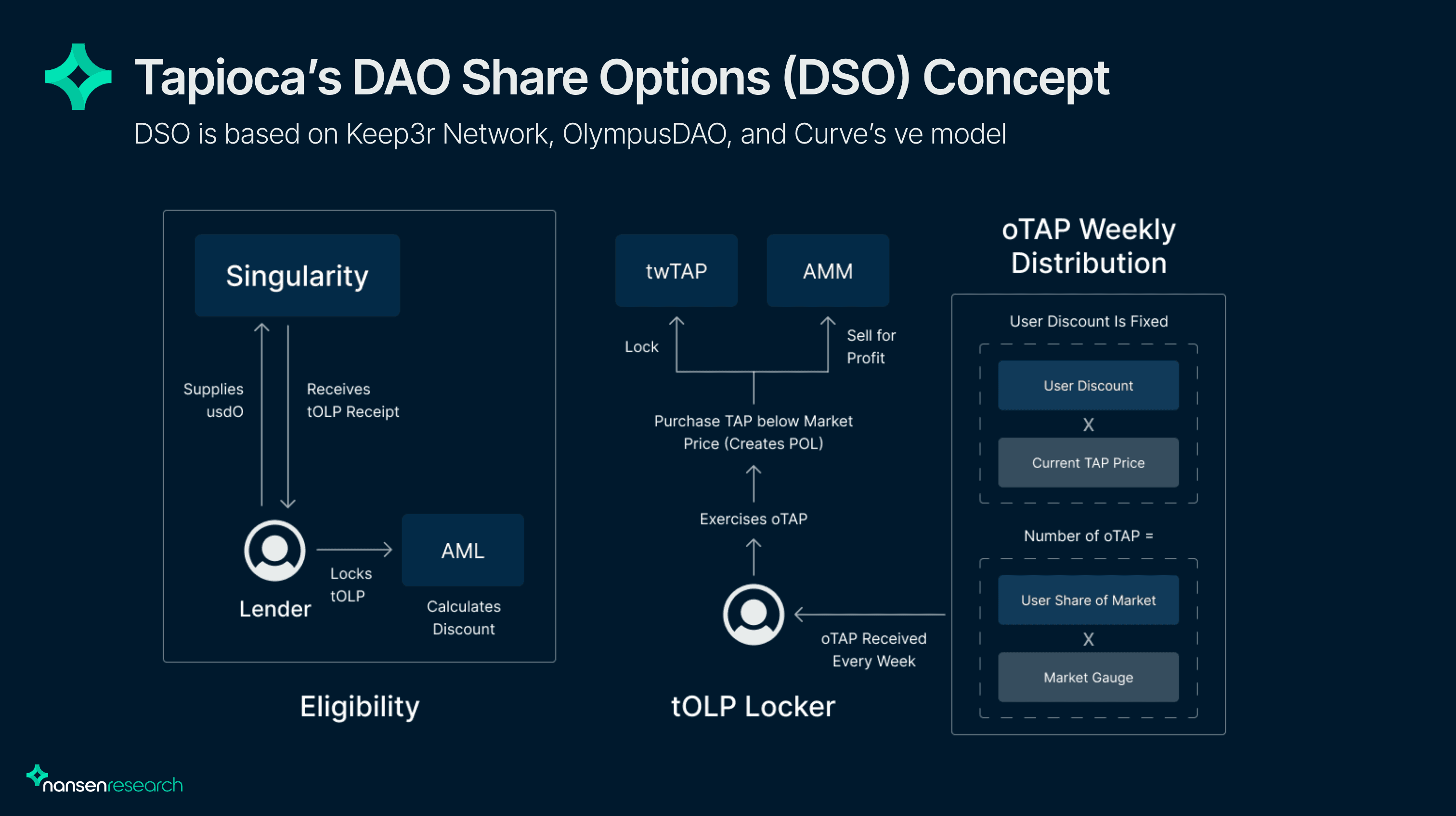

TapiocaDAO introduced a new system called DAO Share Options (DSO), which is based on concepts from Keep3r Network, OlympusDAO, and Curve's veCRV model. But how does it work? OlympusDAO created a Protocol Owned Liquidity (POL) system and is widely known for its memetic (3,3) model, in which gamified demand for the OHM token via ridiculously high yields - however, this turned out to be unsustainable and a complete failure.

Andre Cronje with Keep3r Network created OLM, or Options Liquidity Mining with rKP3R and oKP3R in 2021. The system went under the radar and was abandoned with Andre Cronje leaving the space. OLM utilized a call option with a fixed 50% discount and one-month expiry as an incentive. This was the base concept for Tapioca’s DSO (and oTAP). Although OLMs was fitting to tackle the issue of liquidity mining, it was never quite popularized as options was still rather nascent in crypto.

Lastly, Curve popularized escrowing with veCRV. Users would lock their CRV for a period of time to receive a fixed amount of veCRV in return. Escrow your 100 CRV for 4 years? Get 100 veCRV, escrow it for 1 year? Get 25 veCRV. However, this system also has questionable sustainability, and if revenues fall for a sustained period can cause significant issues for the protocol.

In simpler terms, these three systems created DSO: POL + Call Options + Escrowing = Tapioca’s DSO.

How do all of these concepts work in practice?

- Tapioca’s token economy starts with Tapioca’s Omnichain Lending and Borrowing engine, Singularity (based on Kashi). Once a lender lends their usd0 in a Singularity market, such as a GLP/usd0, the lender can lock their lending position’s receipt token in order to receive a tOLP (Tapioca Omnichain Lock Position Receipt) which enables the lender to receive oTAP rewards in the DSO program.

- When a lender chooses the length of time to lock in their liquidity, Tapioca uses the Average Magnitude Lock (AML) to measure the value of the lock. This system determines the discount that will be applied to the oTAP call options, ranging from 5% to 50%. This means that a lender who locks in their position can receive a discount - up to half of the current market value of Tapioca's TAP token - guaranteeing a profit instead of just receiving free “worthless” tokens.

- AML is dynamic meaning they will either get a higher or lower option discount depending on the length of the lock and the current economic situation Tapioca is in.

- Negative economic growth: Larger discount levels for shorter lock times.

- Positive economic growth: Smaller discount levels for longer lock times.

- The discount level is then fixed for every weekly epoch that the lender’s liquidity is locked for (e.g: if a user received a 50% discount according to AML and their tOLP is locked for 1 month, they receive a 50% discount of TAP each week for the month. The only variable is the lender's tOLP’s share of the market which can increase or decrease the number of oTAP call options they receive for the weekly epoch).

- The tOLP locker can exercise their oTAP and purchase TAP below market price. The TAP can then be sold for a profit or locked for twTAP.

DSO aims to benefit lenders/LPs as they are able to receive call options that they can redeem to sell for profits. On the other hand, investors also benefit from the lack of emissions of the TAP token and the floor price set for TAP via option expiries and strike prices. The big takeaway, however, is that there will be more protocol-owned liquidity for Tapioca from the redemptions of the call options, which will benefit all parties of the platform, including the protocol itself. With this escrowing mechanism in place, borrowers are guaranteed access to deep supply of capital to borrow and use for leverage. This creates more fees for the DAO overall.

One benefit of using POL with Tapioca is that the protocol controls the liquidity of its stablecoin and token LP pairs. As a result, the DAO does not need to incentivize or bribe liquidity. Additionally, Tapioca shares yield from its LP pairs with twTAP lockers. This creates a flywheel effect based on the yield from users trading TAP and usd0.

A note that tOLP, twTAP, and oTAP are all Layer Zero ONFT721s which means that these assets are transferable. Once the escrow duration has ended, users can burn the NFT to receive the underlying assets. Tapioca has hinted at creating secondary marketplaces for users to trade their locked positions.

Tokens

TAP

TAP can be thought of as the governance token for TapiocaDAO. TAP has a fixed supply of 100m. There are no emissions of TAP itself, nor does TapiocaDAO feature any liquidity mining programs. According to their docs, the issuance of TAP will require a much longer time frame to reach near-full distribution than what is typically seen in DeFi token economies. The estimate to reach near full distribution of TAP is 8+ years due to the DAO Share Options (DSO) model. Inflation for the token is expected to be less than the majority of tokenomics in the market. The biggest takeaway is no one gets TAP for free, and you can always estimate a price floor of TAP based on call option discounts.

The TAP token utilizes the OFT20 v2 (Omnichain Fungible Token) standard. The TAP can be transferred to any EVM or any non-EVM network via minting & burning directly from its token contract.

Holding TAP, like CRV, is not designed to be economically beneficial. This prompts users to lock TAP for twTAP as all protocol revenue (from borrow fees, mint fees, liquidation fees, performance fees, etc.) will go to twTAP lockers. Secondarily, half of the yield from DAO-owned LP pairs of usd0 and TAP go to twTAP lockers, enabling a dual yield stream.

It is designed so that the more users mint and utilize usd0, the better for twTAP holders. As more usd0 is minted, there are more loans opened, and more trading of usd0. Trading of usd0 and users accessing lending, borrowing, and leverage features of Tapioca should increase yields for twTAP lockers.

twTAP

twTAP is TapiocaDAO’s governance and locked token, comparable to veCRV. It utilizes Tapioca’s Time-Weighted Average Magnitude Lock (twAML) system. It is represented as an Omnichain NFT that is transferable. twTAP lockers receive all protocol revenue from platform fees that are generated from borrowing, lending, and leverage from over 20+ chains, as well as 50% of Arrakis Vault manager fees (DAO-owned LP which is currently mainly on Uniswap v3). The fees are distributed to twTAP lockers in tETH on a weekly basis.

How does twTAP locking differ from Curve’s ve model?

Curve's veCRV arguably can create misalignment for protocol users due to the fixed lock times and heavy reliance on revenue for it to sustain. For example, locking CRV for 4 years may have been attractive during the height of the Curve Wars, but may not be as attractive now.

twTAP has a variable output multiplier for lock time which can change from 0.1 to 1.0. The demand for locking TAP pushes this multiplier up and down. Meaning, you could lock 100 TAP for a year and receive 100 twTAP at one point, but if twTAP yields are too attractive and many users are locking, it can push that ratio down to 10 twTAP for the input of 100 TAP.

oTAP

oTAP is an American call-option of TAP that lenders receive for locking their lent liquidity.

Each lender's oTAP strike price is set each weekly epoch. Meaning if a user’s lent liquidity is locked for 20 weeks, while the discount level remains fixed as well as the expiry on the call options at one week, the TAP price can change which changes what the strike price can be. For example, if a lender has a 50% discount on their call options, and week 1 TAP is $1.00, they can buy TAP at $0.50. If week 2 TAP is $5.00, they can buy TAP at $2.50, and so on and so forth.

A price floor is achieved via the strike price of a call option, which is where call options improve upon the bonding model. Bonding is like a 50% coupon, no matter the price of the item, you get 50% off. As oTAP is a call option with a set strike price, if a lender receives a 50% discount on TAP which is currently trading at $2.00 meaning their strike price is $1.00, and TAP falls to $1.00, the lender oTAP is now OTM or “out of the money,” or unprofitable to exercise, and will be left to expire (one week) unless TAP rebounds to make the option profitable again.

TapiocaDAO acquires POL through lenders who escrowed their lending positions exercising their oTAP call options. As users purchase TAP at a discounted price from the DAO, this becomes permanent liquidity.

usd0

usd0 is TapiocaDAO’s omnichain over-collateralized stablecoin. usd0 can only be collateralized by network tokens like ETH, MATIC, AVAX, and liquid staking derivatives such as Lido’s stETH, Rocket Pool’s rETH, and LSD’s LP pairs like stETH/ETH.

usd0 can be compared to Abracadabra’s MIM, but we will break down the differences for both MIM and usd0 based on:

- Minting Style

- Peg Mechanism

- Liquidity mechanism

Although USD0 can be compared to MIM due to Tapioca's use of Bentobox (Yieldbox or Bentobox V2) and Kashi, it has improved upon the limitations of MIM.

Minting Style usd0 is a native LayerZero Omnichain Fungible Token, therefore it can mint and burn from chain to chain without any bridges.

MIM is minted through a 5/10 multisig and manually supplied to Abracadabra’s “Cauldron’s” (Kashi Markets). This has heavy implications for decentralization, whereas usd0 is immutably minted when users supply collateral. This also removes the issue of Abracadabra’s cauldrons being quickly depleted by whales as usd0 can be minted at any time with accepted collateral.

Peg Mechanism usd0 has variable interest rates in the “Big Bang” markets where usd0 is minted and variable mint fees to mint usd0 based on the usd0 peg. If usd0 is below the peg, the mint fee goes up, if usd0 is above the peg, the mint fee goes to zero. This is designed to create natural arbitrage and keep a tighter peg to the US dollar. Also having variable interest rates will allow Tapioca to dynamically match supply to demand. Abracababra’s Cauldron has fixed rates that Abracadabra can adjust via governance.

usd0 also supports “flash minting” which mints usd0 in a flash loan, this helps liquidations and keeps a tighter peg. With a typical flash loan, you’re borrowing lenders' capital, but with a flash mint, Tapioca as a protocol mints the usd0 in the transaction.

Abracadabra has more risky pairs and is known for offering inexpensive leverage on high-risk tokens like UST, LUNA, FTT, and wMEMO. This certainly worked in Abracadabra’s favor during the height of Terra, but in current times has heavily damaged MIM’s reputation as a risky stablecoin that has a high chance of losing peg. On the other hand, usd0 will be minted by highly liquid network tokens and liquid staking derivatives which should make for much safer collateral assets.

Liquidity mechanism usd0 also doesn’t utilize Curve or bribing or heavy incentive emissions like Abracadabra with its SPELL governance token to attract sufficient liquidity for frictionlessly trading MIM, it utilizes POL and Uniswap V3 via Arrakis Vaults for low friction swaps of usd0 on many chains. The ability to have a built-in mechanism to earn a yield on usd0 is a key part of Tapioca - offering an isolated ecosystem around usd0 similar to Frax.

With these attractive assets like GLP creating a lot of borrow-side demand on usd0, this enables users to mint and lend to earn real yield in return - all on the same protocol with no reliance on outside protocols. MIM has to rely on external protocols for yields and adoption of MIM, which is why the main use case for MIM has remained cheap leverage on risky assets.

Bentobox V2 (Yieldbox)

Through Yieldbox strategies, Tapioca’s Singularity markets can offer dual simultaneous usage of liquidity. But what does that mean?

Yieldbox essentially keeps assets productive, users can borrow against an asset while the asset is being lent out those funds are being used in two different ways simultaneously.

This means users can generate a yield from borrowers while borrowers' collateral is put to work in strategies. Take for example Stargate ETH, a borrower can supply Stargate ETH as collateral to borrow usd0, and the Stargate ETH is kept earning more STG which is then compounded for more Stargate ETH. This offers a yield stream from the borrower's debt, and the collateral, simultaneously.

Singularity and Big Bang

Both Singularity and Big Bang are based on BoringCrypto’s Kashi, which is in use on Abracadabra, and was recently deprecated by SushiSwap.

Singularity Singularity is Tapioca’s lending and borrowing engine, like a traditional Aave or Compound. Singularity is purpose-built for borrowing against and leveraging yield-bearing assets, such as GLP or TriCrypto. Users can supply their usd0 to borrowers utilizing these attractive yield-bearing assets.

Singularity can achieve better utilization rates of assets like ETH than Aave as Aave uses a predefined maximum and minimum interest rate which linearly moves between the two. This creates extremely low utilization of assets like ETH. Singularity (Kashi) on the other hand has completely dynamic interest rates, that are based on the utilization of an asset (borrowed/lent). Singularity also offers isolated markets, whereas Aave’s collateral assets are shared in one large pool. Typically, forks of Aave and Compound add a risky asset into the pool which can cause a death spiral, as what was seen with Cream, Rari, Venus, Agora, Agave, etc.

Big Bang Big Bang is where usd0 is minted. Big Bang will feature network tokens like ETH, MATIC, AVAX, BNB, and liquid staking derivatives like Lido stETH, Rocket Pool rETH, etc. Big Bang features variable interest rates that utilize a “debt ratio” against ETH. The higher an asset's debt is in comparison to ETH, the higher the interest rate will climb for that asset.

Big Bang also features liquidation improvements based on Avi Eisenberg’s CRV/USDC loan that caused Aave to incur a bad debt. Tapioca utilizes Dynamic Liquidation Incentives and Dynamic Closing Factors which allow liquidators to liquidate more and more of a user's collateral with a higher and higher penalty as the loan gets more and more unhealthy.

Tokenomics

TAP’s Valuation(s) Pre-LBP:

- The seed FDV was $44m or $0.44 per TAP

- 8% of supply (8m TAP tokens)

- 18-month linear vest

- 8% unlock at TGE

- No VCs

- Pre-seed FDV was $22m or $0.22 per TAP

- 3% of supply (3m TAP tokens)

- 24-month linear vest

- 6% unlock at TGE

- No VCs

Tapioca (and Pearl Labs, the core contributors to Tapioca) have completed both rounds and raised $4.1m. Tapioca purposefully included no venture capital groups in their raise, and no single investor owns more than 1% of the supply of TAP.

Some investors include:

- CryptoCondom

- DCF God

- SmallCapScientist

- VFat

- Barry Fried

- Blocmates

- Captain Rational

- Jones DAO

LBP details:

- There will be 5m TAP tokens (5% of supply) distributed during the LBP event which will last for 72 hours.

- The LBP starts at $3.52 and gradually decreases with $0.88 being the “fair price”. Not that with LBPs, there is no guarantee that it will reach $0.88 and that the limited liquidity in an LBP can create inflated valuations which will place market participants at risk.

- The starting price as noted by Balancer is set to be 4x the “fair value”. The fair value is 2x the price for the seed round.

- There are no vesting periods for LBP participants and they will also get the first allocation into the option airdrop. Everyone who participates in the LBP will get oTAP airdrop pro rata – the oTAP airdrop amount will be >=30% of the amount that you purchased TAP tokens. E.g: If you buy 10k TAP in the LBP, you will receive 3000 oTAP. This oTAP will feature a 50% discount against the final LBP price.

- TAP is sold for USDC, and users can contribute from any chain Stargate is on, the LBP will be hosted on Arbitrum however. The market will effectively decide what is deemed a fair price.

- The initial circulating supply is estimated to be 7.16m TAP (3.8m TAP from LBP will be immediately available to LBP participants, up to 2.5m TAP from oTAP and 820k for financial contributors).

Competitor Analysis

How does Tapioca differ from Radiant?

Radiant is a fork of Geist that is currently only on Arbitrum, which is itself a fork of AAVE V1. Radiant states they will be “truly omnichain” on their V2 release, but currently use LayerZero’s Stargate to bridge borrowed assets to other chains. Tapioca uses LayerZero message passing, one of the first major protocols to do so since Stargate, and currently on its test net already enables borrowing and lending between multiple chains.

Tapioca is also hosted on Arbitrum, however has “proxy” contracts on other chains, such as Optimism, Ethereum Mainnet, and Polygon, which allows users to communicate with Tapioca from any of the four chains- borrow, lend, and leverage up between all four chains.

Geist, and by extension, Radiant, is known for hyperinflationary emissions to create high yields, whereas Tapioca focuses on sustainability and real yields. Tapioca is custom code and based on Bentobox and Kashi which BoringCrypto only has ever licensed to SushiSwap and Abracadabra before Tapioca.

Radiant has amassed a large TVL, but as with Geist and inflationary protocols like Olympus, the sustainability outlook of retaining this liquidity is incredibly bleak with history. Radiant also has the inability to support collaterals like GLP, and other “riskier” assets as AAVE V1 uses a shared liquidity pool for all collateral which forces these Aave (and Compound) forks to only support blue chip assets like ETH, WBTC, USDC, etc. Generally, when venturing out from these assets, massive exploits occur (such as Lodestar recently, and Cream more notably). AAVE V1’s interest rates are also extremely inefficient, and the utilization of assets is where real yield is produced.

While Radiant can continue to capture capital providers with hyperinflation of RDNT, if these emissions are lowered as they plan in their V2, the usual outcome is token price goes up, and TVL goes down. This is the same system as described with Compound but to a much higher scale of inflation. Geist for example attracted $4b in TVL, and now sits with less than $40m. Another Geist fork, Blizz, attracted $1b in TVL, to end with less than $10m until it was hacked.

Risks

- Execution Risks

- TapiocaDAO has many different moving parts that are individually complex in nature. The DSO model is innovative to help spearhead the concept of omnichain lending by combining options and protocol-owned liquidity, however, there has yet to be proof of execution.

- LBP valuations

- No VCs but pre-seed and seed angel investors have token unlocks after LBP event which could cause a massive dump in prices. If LBP has high valuation, the 8% and 6% of seed and pre-seed unlock could result in price dump.

- Competitors taking market-share

- Radiant v2 has already established product-market fit despite their hyperinflationary token emissions. Radiant v2 will introduce omnifungible token standard migration (ERC-20 to OFT) which will make cross-chain fee sharing much easier. They are also introducing dynamic liquidity which will realign values and only redirect emissions for users that are providing value to the protocol. Ultimately, the product that will amass the most users and liquidity will win.

Conclusion

Tapioca is a fresh and innovative omnichain money-market. While the omnichain narrative is arguably just starting out, Tapioca is well established as one of the pioneering protocols leveraging LayerZero’s technology.

It will be interesting to see how Tapioca’s team executes the core technologies mentioned in the product, namely the DSO concept that took inspiration from other innovative protocols like Keep3r Network, OlympusDAO, and Curve.