TLDR

- Ethereum is the most used chain

- The data shows a growing number of users on the Arbitrum and Optimism ecosystem

- There was an increase in ETH staking, most likely in preparation for the highly anticipated Ethereum Merge event

- There was a large proportion of stablecoin holdings

- The main protocol deposits are centered around blue-chip protocols like Curve, Convex, Frax, Balancer, etc.

Introduction

This report aims to do a deep-dive into the Top 25 Wallets on DeBank. The goal of the report is to analyze the behavior and activities of the top wallets to find new farms / tokens / protocols. DeBank is currently the only platform with a Web3 Social Ranking feature, hence, we referenced DeBank’s ranking to obtain the Top 25 wallets. We also utilized Nansen’s wallet profiler feature and Apeboard to cross-reference our findings.

Methodology

To begin the report, we came up with the following criteria for data collection:

- The first step is to identify wallet addresses based on Debank’s social ranking.

- The calculation process of the "Web3 Social Ranking" is based on public data and rules to ensure users' sovereignty.

- Each address will be evaluated with a “Social Score” which is composed of two parts: “Basic Score” and “Weighted Score”.

### Step 1: Computation of the Basic Score

#### Basic Score factors:

- ETH balance,

- Effective DeBank followers (A valid "Follower" must have at least $1000 balance),

- Ethereum NFT

- NFT amount

- DeFi (participated [protocols](https://debank.com/protocol)(balance>1000$), participated amount)

- Address age

- Profile integrity (only counts for DeBank-supported NFT & DeFi protocols)

#### User scope: Any user that meets any of the below requirements will be evaluated with a score:

- Participated in at least one DeFi protocol

- Has at least one NFT

- Has at least 1 “Following or Follower” on DeBank / bound with at least one social medium account on DeBankStep 2: Computation of the “Social Score

- Weighted Score: In addition to the “Basic Score”, “Weighted Score” is also an important component that affects a user’s ranking. It represents a user’s social influence; if two users have the same “Basic Score”. The higher the weighted score of the wallet, the higher the wallet ranks.

- User ranking: “Basic Score” and “Weighted Score” are added up as the final “Social Score” (100 points). All users are ranked by the “Social Score”.

- Displayed users: Only the top 100k users on the "Web3 Social Ranking" will be displayed.

Next, we want to identify the percentage of their assets on each individual chain in relation to their whole portfolio (e.g: 50% on Ethereum, 20% on Arbitrum, 30% on BSC).

We will cross-check main asset holdings and protocol deposits on Nansen’s Wallet Profiler tool, Apeboard, and Debank. Note that the links below will be directed to Apeboard and Nansen’s WP for each address mentioned below.

Lastly, we want to observe the general investment behaviors based on their overall on-chain activities.

Note that we are planning to post a follow-up report which will touch on the specific farms and protocols with step-by-step instructions on how to leverage the opportunities mentioned in this report.

Top Wallets

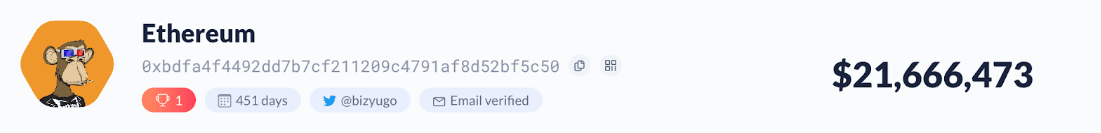

Ethereum (0xbdfa4f4492dd7b7cf211209c4791af8d52bf5c50)

Wallet Size: $21.6mm Debank Followers: 23k Smart Money on Nansen? No

Chain breakdown:

- 46% on Ethereum (~$10mm)

- 44% on Avalanche (~$9mm)

- 5% on Arbitrum (~$1mm)

- 3% on BSC (~$589k)

- 2% on Fantom (~$348k)

Wallet Holdings: $804k

- VOLT (~$331k)

- BIT (~$46k)

- SHIB (~$45k)

- BNB (~$40k)

- & more

Protocol Deposits:

- $3.5mm -- Farming YUSD, USDC, USDT, YETI -- Supplied WBTC.e and USDC -- Borrowed YUSD

- $3.5mm -- Farming USDC, USDT.e, WBTC.e, YUSD, USDt + WAVAX, WAVAX, zJoe, xPTP, VTX, USDC -- Locked VTX until 2022/09/13

- $2.3mm -- Staking USDT + WBTC + ETH, ETH + CVX, Silo + FRAX, FXS + cvxFXS, ETH + CRV, cvxCRV -- Locked CVX until 2022/ 08/ 11

- $1.9mm -- Supplied WAVAX, WBTC.e, WETH.e, LINK.e, AAVE.e, USDt -- Borrowed USDC

- $1.1mm -- Supplied LINK, WBTC, REN, UNI, SNX, CRV, SUSHI, ETH -- Borrowed USDC

- $873k -- Farming LUSD -- Supplied ETH -- Borrowed LUSD

Maple Finance - $805k -- Farming USDC

Key highlights:

- This wallet initially had 20% of its overall wallet portfolio in Fantom. This has been reduced to 2%.

- This wallet is primarily on Ethereum and Avalanche.

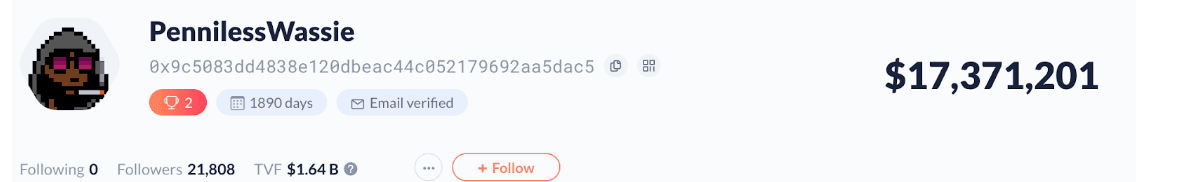

PennilessWassie (0x9c5083dd4838e120dbeac44c052179692aa5dac5)

Wallet Size: $17.3mm Debank Followers: 21k Smart Money on Nansen? Yes

Chain breakdown:

- 96% on Ethereum (~$16.7mm)

- 2% on Arbitrum (~$410k)

- 1% on Optimism (~$224k)

Wallet Holdings: $83k

- sUSD

- ETH

Protocol Deposits:

Frax - $7mm -- Farming FXS + Frax -- Locked FXS until 2026/04/30

Convex - $4.7mm -- Locked CVX until 2022/06/30 -- Staked PUSd + DAI + USD + USDT

Liquity - $3mm -- Supplied ETH -- Borrowed LUSD -- Farming LUSD -- Staked LQTY

Curve - $1.5mm -- Locked CRV until 2026/05/28

Key highlights:

- Primarily in ETH (~$16.7mm)

- Mostly farming in blue-chip protocols like Curve, Convex, Frax

- Largest position in Frax (farming FXS + Frax)

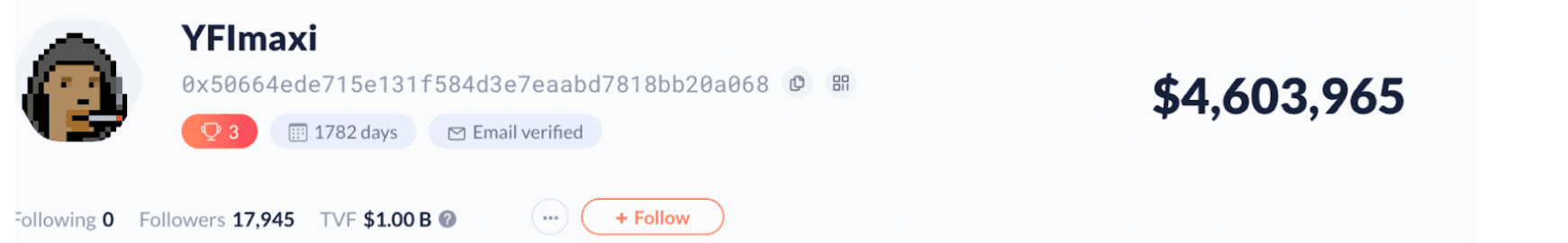

YFIMaxi (0x50664ede715e131f584d3e7eaabd7818bb20a068)

Wallet Size: $4.6mm Debank Followers: 17k Smart Money on Nansen? Yes

Chain breakdown:

- 86% on Ethereum (~$3.9mm)

- 7% on Harmony (~303k)

- 2% on DFK (~$93.6k)

- 2% on Polygon (~$87k)

- 2% on Avalanche (~$92k)

- 2% on Arbitrum (~$70k)

Wallet Holdings: $2mm

- LDO (~$994k)

- ETH (~$271k)

- 1USDC (~$248k)

- FRAX (~$215k)

- & more

Protocol Deposits:

Across V2 - $487k -- LP ETH (400 ETH)

Balancer V2 - $455.9k -- Farming LDO + ETH

Fixedforex - $356.3k -- Locked KP3R until 2025/07/17

Curve - $127k -- Locked CRV until 2024/09/12 -- Vesting CRV -- LP DAI + USDC + USDT + TUSD, DAI + USDC + USDT + BUSD

Key highlights:

- Primarily on ETH

- Has a substantial of their wallet portfolio in Harmony (7%)

- Mostly ETH staking and has a big position of LDO in wallet holdings

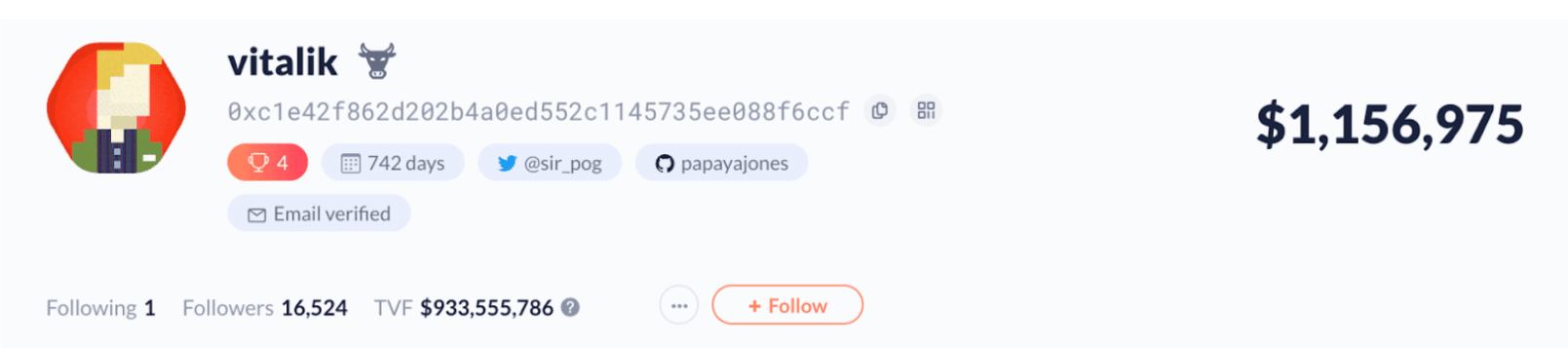

Vitalik (0xc1e42f862d202b4a0ed552c1145735ee088f6ccf)

Wallet Size: $1.1mm Debank Followers: 16k Smart Money on Nansen? No

Chain breakdown:

- 84% on Ethereum (~$973k)

- 13% on Arbitrum (~$154k)

- 2% on Optimism (~$28k)

Wallet Holdings: $47k

- LDO (~$31k)

- & more

Protocol Deposits:

LIDO - $649k -- Staked wstETH and stETH

Inverse Finance - $144k -- Supplied WBTC, ETH, SUSHI, YFI -- Borrowed ETH

GMX - $71k -- Staked GLP, esGMX

Key highlights:

- Primarily on the Ethereum ecosystem

- Has a substantial of their wallet portfolio in Arbitrum (13%), specifically farming GLP and esGMX on GMX

- Largest wallet holding in LDO and staked wstETH and stETH

Miyazaki (0xdb9d281c3d29baa9587f5dac99dd982156913913)

Wallet Size: $2.7mm Debank Followers: 6k Smart Money on Nansen? No

Chain breakdown:

- 56% on Polygon (~$1.5mm)

- 33% on Fantom (~$902k)

- 9% on Cronos (~$234k)

- 2% on Ethereum (~$48k)

- 1% on Metis (~$19k)

Wallet Holdings: $76k

- ETH (~$42.8k)

- QI (~$15k)

Protocol Deposits:

Giddy (on Polygon)- $750k -- Farming DAI

QiDAO (on Polygon) - $700k -- Locked QI until 2026/03/17

Beefy Finance (on Fantom)- $616k -- Farming beFTM, BIFI

SpookySwap (Fantom)- $207k -- Farming WFTM + beFTM

Key highlights:

- Primarily on the Polygon and Fantom ecosystem

Locked a large position (~$700k) of QI in QIDAO until 2026/03/17

Wallet Size: $397k Debank Followers: 9014 Smart Money on Nansen? No

Chain breakdown:

- 49% on Ethereum (~$196k)

- 46% on Arbitrum (~$183k)

- 3% on Polygon (~$12k)

Wallet Holdings:$63k

- ETH (~$55k)

- & more

Protocol Deposits:

TreasureDAO - $165k -- Staked MAGIC

Aave v2 - $127k -- Supplied ETH -- Borrowed FRAX and USDC

Magic Dragon DAO - $15k -- Staked MAGIC

Key highlights:

- Primarily on the Ethereum and Abritrum ecosystem

- Highly active in the TreasureDAO ecosystem (staking MAGIC on several platforms)

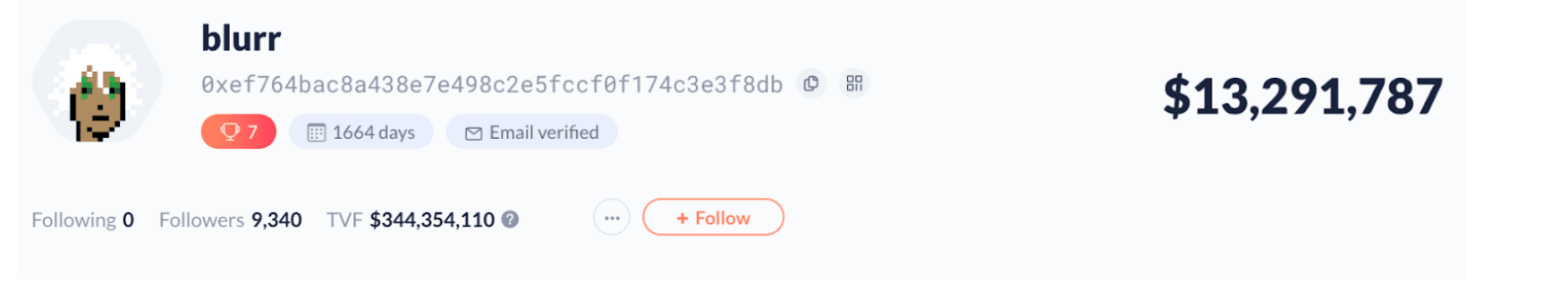

Blurr (0xef764bac8a438e7e498c2e5fccf0f174c3e3f8db)

Wallet Size: $13mm Debank Followers: 9340 Smart Money on Nansen? Yes

Chain breakdown:

- 97% on Ethereum (~$12mm)

- 2% on Fantom (~$235k)

- 1% on Metis (~$100k)

Wallet Holdings:$1mm

- USDI (~$704k)

- WFTM (~$222k)

- Metis (~$100k)

- NDX, UNI, SOCKS

- & more

Protocol Deposits:

Euler - $7.2mm -- Supplied wstETH and DAI -- Borrowed ETH and WBTC

Aave V2 - $3.7mm -- Supplied DAI, UST(Wormhole), stETH -- Staked AAVE

Angle Protocol - $316k -- Farming agEUR + ANGLE -- Locked ANGLE until 2026/04/16

Gnosis - $315k -- Locked GNO until 2023/02/16

Key highlights:

- Primarily on the Ethereum ecosystem

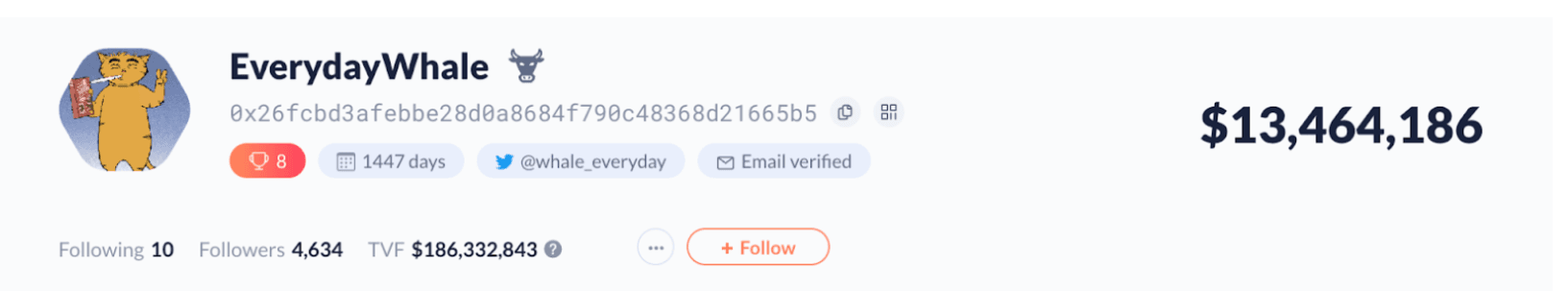

Everyday Whale(0x26fcbd3afebbe28d0a8684f790c48368d21665b5)

Wallet Size: $13mm Debank Followers: 4634 Smart Money on Nansen? No

Chain breakdown:

- 92% on Ethereum (~$12.4mm)

- 4% on Polygon (~$487k)

- 2% on BSC (~$234k)

- 2% on Fantom (~$226k)

Wallet Holdings:$1.2mm

WBTC on Ethereum, Polygon, Arbitrum, and Optimism MKR & more

Protocol Deposits:

MakerDAO - $5mm -- Supplied wstETH -- Borrowed DAI

BadgerDAO - $3mm -- Earning yield on ibBTC + renBTC + WBTC + sBTC, BADGER, CVX

Uniswap v3 - $1.7mm -- WBTC + USDC -- rETH + ETH -- ETH + CRV -- CVX + ETH -- 1INCH + ETH -- LDO + ETH -- LQTY + ETH -- & more

Babylon Finance - $432k -- Staked ETH and BABL

Aave AMM - $340k -- Supplied ETH, UNI, YFI, LINK -- Borrowed USDT

Ellipsis (on BNB) - $234k -- Farming BTCB + renBTC -- Locked EPX

Curve (on Fantom) -$216k -- Farming BTC + renBTC

Curve (on Polygon) - $215k -- LP WBTC + renBTC

Balancer V2 (on Polygon) - $215k -- LP WBTC + renBTC

Balancer V2 - $214k -- LP WBTC + renBTC + sBTC

Key highlights:

- Primarily on the Ethereum ecosystem

- Main asset is WBTC

- Mainly farming BTC-backed assets, ETH, and stables

BoredApe(0x188c30e9a6527f5f0c3f7fe59b72ac7253c62f28)

Wallet Size: $4mm Debank Followers: 10429 Smart Money on Nansen? Yes

Chain breakdown:

- 89% on Ethereum (~$3.8mm)

- 5% on Arbitrum (~$224k)

- 3% on Avalanche (~$132k)

- 3% on Optimism (~$112k)

Wallet Holdings:$4mm

- USDC ($3.2mm)

- ETH ($311k)

- APE ($83k)

- PAXG

- & more

Protocol Deposits:

GMX (on Arbitrum) - $128k -- Staked GLP, GMX, esGMX

Aave V3 (on Avalanche) - $90k -- Supplied WAVAX

Uniswap V3 (on Optimism) - $58k -- LP WETH + USDC

GMX (on Avalanche) - $41k -- Staked GLP, GMX, esGMX

Key highlights:

- Mostly holding & farming stables

- Significant portion of their portfolio in stables holding (USDC and ETH ~4mm)

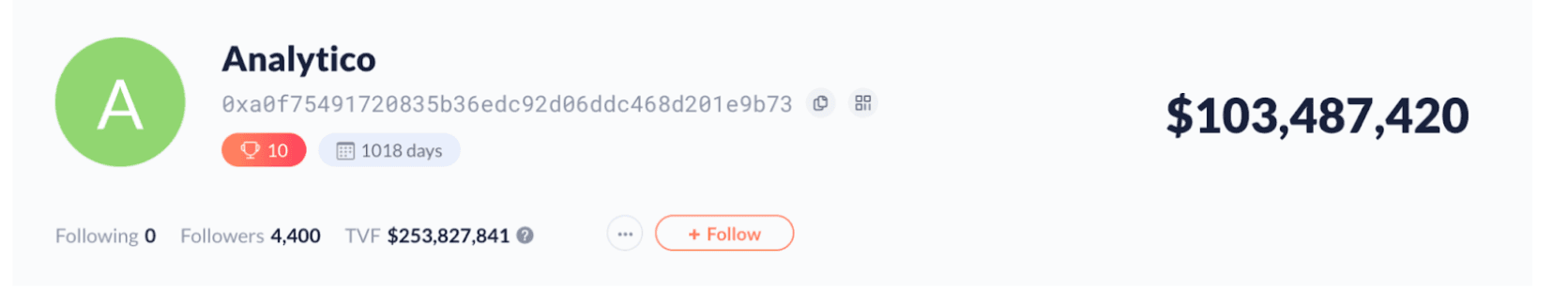

Analytico (0xa0f75491720835b36edc92d06ddc468d201e9b73)

Wallet Size: $103.4mm Debank Followers: 4400 Smart Money on Nansen? Yes

Note that this wallet is also an Airdrop Pro wallet with over $23mm in Airdrops (not including recent L2 + APE airdrops).

Chain breakdown:

- 100% on Ethereum (~$103mm)

Wallet Holdings:$31mm

- USDC - $10mm

- ETH

- rETH

- WETH

- WBTC

- SWISE

- KP3R

- & more

Protocol Deposits:

Maple Finance - $20.5mm -- Farming USDC and ETH

Aave V2 - $17.7mm -- Supplied USDC and ETH -- Borrowed sUSD -- Staked AAVE

Convex - $15.2mm -- Staked ETH + stETH, CRV + cvxCRV, cvxCRV -- Locked CVX until 2022/10/06

Ankr - $4.6mm -- Staked ankrETH

Alchemix V2 - $3.4mm -- Staked aIUSD

Saddle Finance - $3.1mm -- Farming sUSD + DAI + USDC + USDT

Uniswap V3 - $2.8mm -- LP ETH + sETH2, rETH2 + sETH2

RAILGUN - $2.7mm

-- Staked RAILArmor - $876k -- Farming arNXM + ETH, ETH + ARMOR

Key highlights:

- 100% on the Ethereum ecosystem

- Main wallet holdings are stables, ETH and WBTC - a large portion of their portfolio is in spot holdings.

- Mostly farming stables on blue-chip protocols Airdrop Pro & Private Sale Investor wallet (Nansen Smart Money tags)

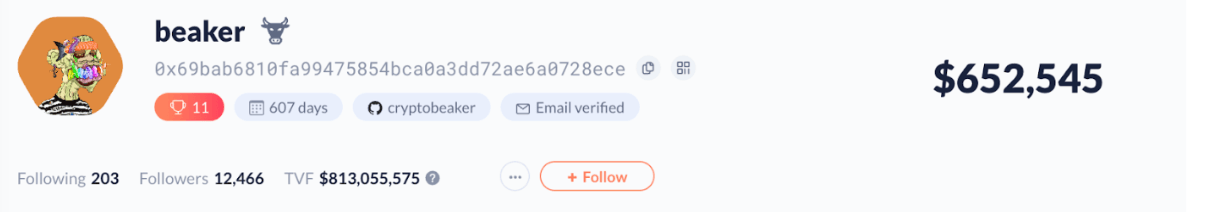

Beaker(0x69bab6810fa99475854bca0a3dd72ae6a0728ece)

Wallet Size: $657k

Debank Followers: 12k

Smart Money on Nansen? Yes

Chain breakdown:

- 80% on Ethereum (~$525k)

- 16% on Avalanche (~$102k)

- 2% on Polygon (~$12k)

- 2% on Arbitrum (~$15k)

Wallet Holdings: $51k

- oSQTH

- DAI

- & more

Protocol Deposits:

Aave V2 - $366k -- Supplied ETH, stETH, WBTC, UNI, MKR, Aave, etc. -- Borrowed FRAX, GUSD, ETH, BUSD, FEI, WBTC

Rari Capital - $69k -- Supplied APE, ETH -- Borrowed USD, APE

Aave V3 - $67k -- Supplied WETH.e, WAVAX, WBTC.e, USDC -- Borrowed USDt, USDC, WBTC.e, WETH.e

Key highlights:

- Primarily on the Ethereum and Avalanche ecosystem

- Majority of assets are in lending platforms

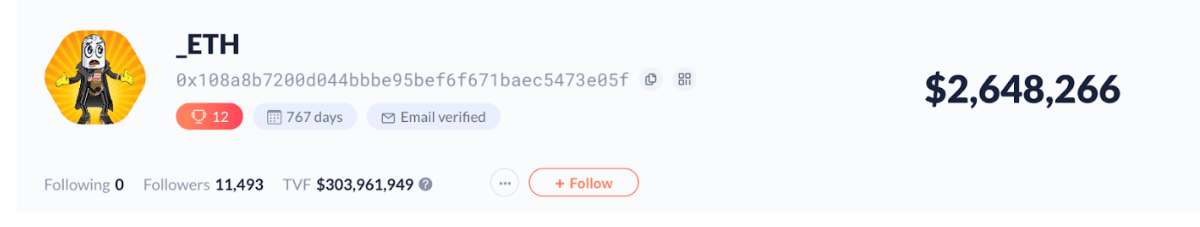

_ETH(0x108a8b7200d044bbbe95bef6f671baec5473e05f)

Wallet Size: $2.6mm

Debank Followers: 11k

Smart Money on Nansen? Yes

Chain breakdown:

- 78% on Ethereum (~$2mm)

- 11% on BSC (~$285k)

- 10% on Avalanche (~277k)

Wallet Holdings: $306k

- ALPACA

- DOG

- SPICE

- TRU

- EPX

- & more

Protocol Deposits:

Sushiswap - $1mm

-- Staked xSUSHIOlympusDAO - $351k -- Staked OHM

Trader Joe - $266k -- Staked JOE -- LP WAVAX + FORT

Balancer V2 - $251k -- Locked BAL + ETH until 2022/10/06

Alchemix - $203k -- Farming tALCX -- Supplied DAI -- Borrowed aIUSD

PancakeSwap - $120k -- Earning yield on Cake

Key highlights:

- This wallet is mainly on the Ethereum ecosystem, with 11% on BSC and 10% on Avalanche.

- Half of their portfolio is on Suhiswap (~$1mm), staking xSUSHI

- Legendary NFT Collector (Nansen Label)

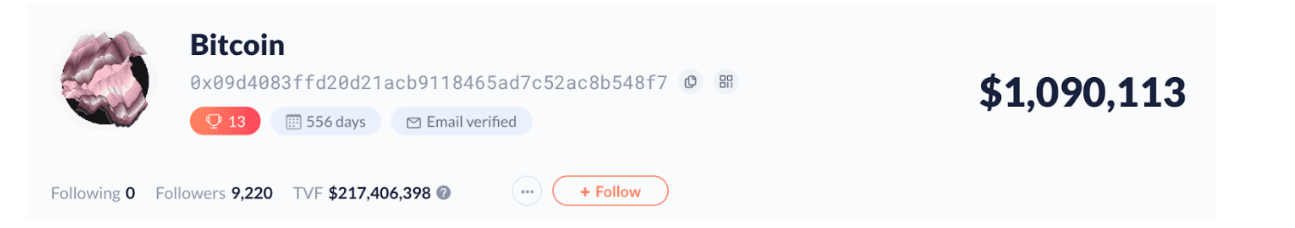

Bitcoin (0x09d4083ffd20d21acb9118465ad7c52ac8b548f7)

Wallet Size: $1mm Debank Followers: 9k Smart Money on Nansen? No

Chain breakdown:

- 94% on Ethereum (~$1mm)

- 5% on Arbitrum (~$50k)

- 1% on Fantom (~$19k)

Wallet Holdings: $399k

- ETH

- RDPX

- & more

Protocol Deposits:

Convex - $560k -- Locked CVX until 2022/06/30 -- Staked FXS + cvxFXS

Fixedforex - $47k -- Locked KP3R until 2026/01/08

LooksRare - $32k -- Earning yield on LOOKS -- Staked LOOKS

Dopex - $24k -- Farming DPX

Key highlights:

- Primarily on the Ethereum & Arbitrum ecosystem

- Mostly spot holding ETH

- Locked most of their assets on Convex, Fixedforex, and Liquid Driver

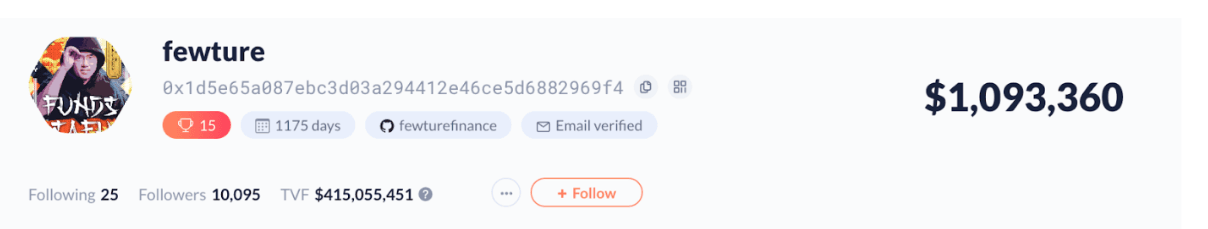

Fewture (0x1d5e65a087ebc3d03a294412e46ce5d6882969f4)

Wallet Size: $1mm Debank Followers: 10k Smart Money on Nansen? Yes

Chain breakdown:

- 79% on Ethereum (~$861k)

- 21% on Optimism (~$231k)

Wallet Holdings: $41k

- ETH

- AGLD

- OP

- & more

Protocol Deposits:

Curve - $366k -- Locked CRV until 2026/06/11 -- LP DAI + USDC + USDT

Convex - $300k -- Staked CRV + cvxCRV -- Locked CVX until 2022/10/06

SharedStake - $160k -- Staked ETH

Synthetix - $135k -- Supplied SNX -- Borrowed sUSD

Curve (on Optimism) - $87k -- Farming sUSD + DAI + USDC + USDT

Key highlights:

- Primarily on the Ethereum & Optimism ecosystem

- Main holding is ETH, also staking it on SharedStake - presumably for the merge

- LP-ing and farming stables on Curve (mainnet and Optimism)

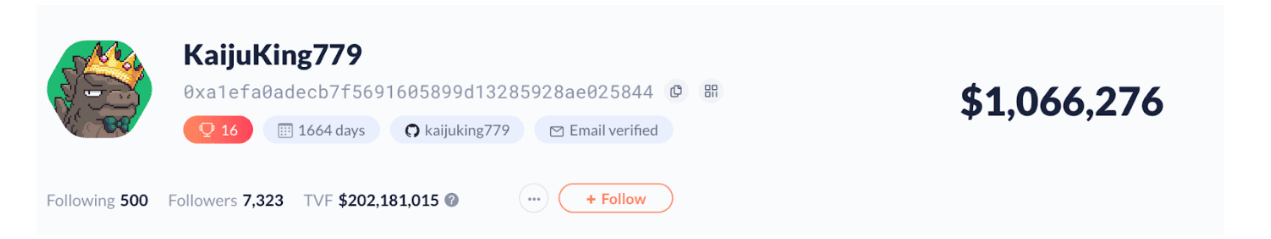

KaijuKing779 (0xa1efa0adecb7f5691605899d13285928ae025844)

Wallet Size: $1mm Debank Followers: 7.5k Smart Money on Nansen? No

Chain breakdown:

- 54% on Ethereum (~$577k)

- 11% on Avalanche (~$112k)

- 10% on Fantom (~$107k)

- 8% on BSC (~$90k)

- 8% on Polygon (~$86k)

- 7% on Arbitrum (~$71k)

- 1% on Gnosis Chain (~$11k)

Wallet Holdings: $276k

- fUSDT

- USDC

- MATIC

- FTM

- ETH

- & more

Protocol Deposits:

Aave V2 - $192k -- Supplied USDC + ETH -- Borrowed KNC, ENJ, MANA -- Staked AAVE

Aave V1 - $49k -- Supplied USDC -- Borrowed YFI

Alpha Homora V2 (on Avalanche) -- Leveraged Farming WAVAX + DAI.e, USDC.e + WAVAX, WAVAX + USDT.e

Alpha Homora V2 - $47k -- Leveraged Farming on USDC + ETH, ETH + USDT

Frax Finance - $46k -- Farming FXS + FRAX

Uniswap V3 - $41k -- LP ETH + ZRX, ETH + ENS

Beefy (on BSC) - $41k -- Earning yield on BAT + WBNB, TWT + WBNB

SushiSwap - $36k -- Farming YGG + ETH, NFTX + ETH, RARE + ETH

NFTX - $36k -- Farming SBLAND + ETH, WIZARD + ETH

Beefy - $34k -- Earning yield on MAGIC + WETH, WETH + USDC, WETH + MIM

Bancor V3 - $26k -- Deposited ENJ and AMP -- Staked BNT

Key highlights:

- Diversified on 7 chains, mostly farming and earning yield on different protocols

- Mainly spot holding stables and large-cap tokens Primarily farming ETH

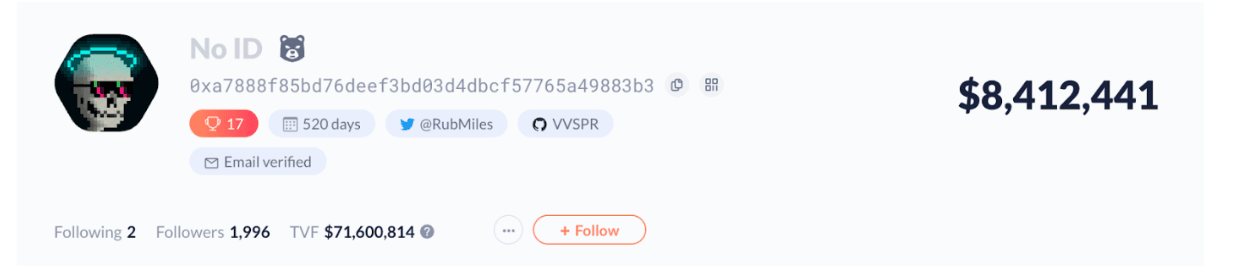

Unnamed (0xa7888f85bd76deef3bd03d4dbcf57765a49883b3)

Wallet Size: $8.3mm Debank Followers: 1996 Smart Money on Nansen? No

Chain breakdown:

- 80% on Ethereum (~$6mm)

- 11% on Optimism (~$921k)

- 8% on Cronos (~$702k)

Wallet Holdings: $2.3mm

- USDC

- ETH

- sUSD

- SDT

- BURROW

- UST (Wormhole)

Protocol Deposits:

Aave V2 - $3mm -- Supplied USDC -- Borrowed CRV, SNX, BAL, CVX

StakeDAO - $1.5mm -- Farming CRV -- Locked SDT until 2026/06/11

MM.Finance (on Cronos) - $636k -- Farming WCRO + MUSD, MUSD + MMF, WCRO + USDT

Synthetix (on Optimism) - $559k -- Supplied SNX -- Borrowed sUSD

1inch - $76k -- Governance

Key highlights:

- Primarily on the Ethereum ecosystem.

- Mainly in stables and blue-chip protocols like Aave V2, Synthetix

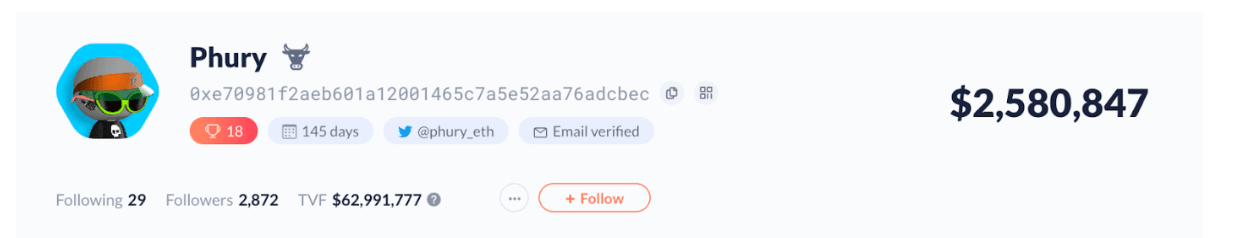

Phurry (0xe70981f2aeb601a12001465c7a5e52aa76adcbec)

Wallet Size: $2.5mm Debank Followers: 2872 Smart Money on Nansen? No

Chain breakdown:

- 56% on Polygon (~$1mm)

- 26% on Fantom (~$661k)

- 15% on Ethereum (~$374k)

- 2% on Arbitrum (~$50k)

- 1% on Avalanche (~26k)

Wallet Holdings: $298k

- USDC

- WFTM

- ETH

- WETH

Protocol Deposits:

Giddy (on Polygon) - $674k -- Farming WETH, WMATIC, DAI, AAVE, SUSHI

QiDao (on Polygon) - $603k -- Locked QI until 2026/05/10

Beefy (on Fantom) - $500k -- Earning yield on BIFI, BTC + ETH, beFTM, BOO, WFTM + BEETS, WFTM + MULTI, binSPIRIT -- Farming beFTM

StakeDAO - $168k -- Farming ETH + sETH -- Locked SDT

Beefy (on Polygon) - $161k -- Earning yield on beQI, BIFI, QUICK, WMATIC + QI

QiDAO (on Fantom) - $63k -- Supplied BTC -- Borrowed miMATIC -- Farming WFTM + QI

Beefy (on Arbitrum) - $44k -- Earning yield on BIFI

Beefy (on Avalanche) - $26k -- Earning yield on QI + WAVAX

Key highlights:

- Mainly on the Polygon and Ethereum ecosystem

- Primarily farming and earning yield on Beefy Finance and QiDao

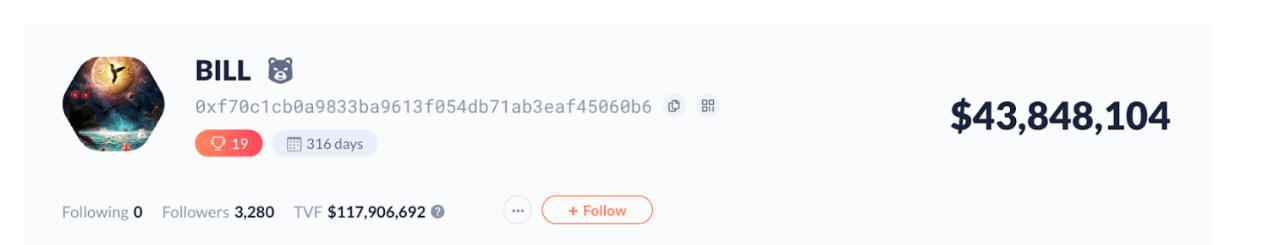

BILLL (0xf70c1cb0a9833ba9613f054db71ab3eaf45060b6)

Wallet Size: $43.8mm Debank Followers: 3280 Smart Money on Nansen? No

Chain breakdown:

- 95% on Ethereum (~$41mm)

- 5% on Avalanche (~$2mm)

- 15% on Ethereum (~$374k)

- 2% on Arbitrum (~$50k)

- 1% on Avalanche (~26k)

Wallet Holdings: $31.9k

- USDC

- ETH

- WBTC

- WETH

Protocol Deposits:

Convex - $8mm -- Staked FRAX + FPI, ETH + sETH, CRV + cvxCRV -- Locked CVX until 2022/ 09/15

Platypus (on Avalanche) - $2.1mm -- Farming WBTC.e

Maker - $1.1m -- Supplied USDC and DAI -- Borrowed DAI

Concentrator - $221k -- Farming CRV + cvxCRV -- Locked cvxCRV

Uniswap V3 - $164k -- LP ETH + sETH2

Key highlights:

- Mainly spot holding USDC and ETH (~$17mm and $8mm respectively)

- Biggest position is in Convex (~$8.1mm) staked in various pools

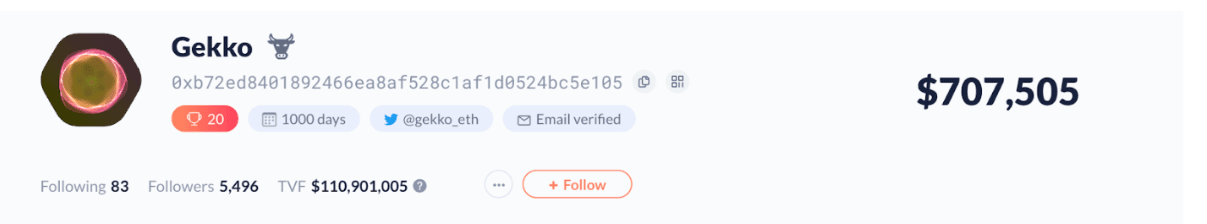

Gekko (0xb72ed8401892466ea8af528c1af1d0524bc5e105)

Wallet Size: $709k Debank Followers: 5496 Smart Money on Nansen? Yes

Chain breakdown:

- 38% on Ethereum (~$271k)

- 36% on Optimism (~$254k)

- 8% on Polygon (~$53k)

- 9% on Avalanche (~$60.7k)

- 10% on Aurora (~$68k)

Wallet Holdings: $167k

- ETH

- LINK

- UNI

- BADGER

- & more

Protocol Deposits:

Uniswap V3 (on Optimism) - $249k -- LP USDC + DAI

Trisolaris (on Aurora) - $67k -- Farming NEAR + WETH, AURORA + NEAR, AURORA + TRI -- LP PULP + PLY

Vector (on Avalanche) - $53k -- Farming WETH.e + WAVAX

Aavegotchi (on Polygon) - $45k -- Farming GHST-WETH

BadgerDAO - $45k -- Earning yield on ibBTC + renBTC + WBTC + sBTC

Aave V2 - $36k -- Staked AAVE

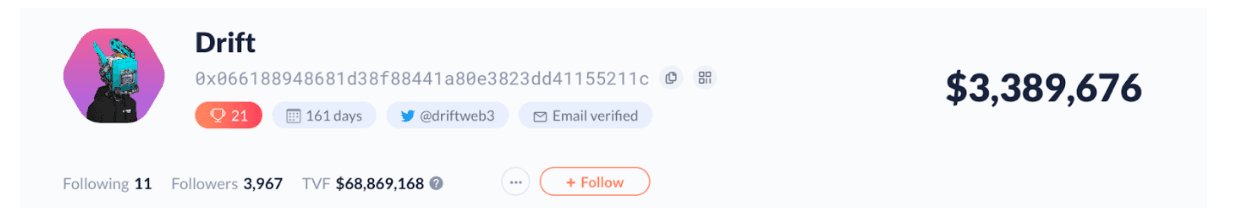

Drift (0x066188948681d38f88441a80e3823dd41155211c)

Wallet Size: $3.3mm Debank Followers: 3968 Smart Money on Nansen? No

Chain breakdown:

- 43% on Fantom (~$1.4mm)

- 29% on Polygon (~$975k)

- 26% on Ethereum (~$887k)

- 2% on Metis (~$84k)

Wallet Holdings: $1.7mm

- BTC

- WETH

- BIFI

- USDC

- WBTC

- QI

Protocol Deposits:

QiDAO (on Polygon) - $644k -- Locked QI

Beefy (on Fantom) - $391k -- Earning yield on beFTM and BIFI

Giddy (on Polygon) - $294k -- Farming WETH, USDC + GDDY, GDDY

Abracadabra - $119k -- Staked sSPELL

Agora Defi - $83k -- Supplied Metis

Key highlights:

- This wallet is largely diversified across various chains, but primarily has their holdings on Fantom (~$1.4mm) with $391k deposited on Beefy Finance, earning yield on beFTM and BIFI

- Large wallet holding of $1.7mm (relative to their overall portfolio), mainly spot holding BTC, WETH, BIFI, and USDC

Ngmi (0x7532a9e3e9475337c8a907428e35932a20959fdf)

Wallet Size: $764k Debank Followers: 5285 Smart Money on Nansen? Yes

Chain breakdown:

- 68% on Ethereum (~$520k)

- 31% on Arbitrum (~$234k)

- 1% on Avalanche (~$5107)

Wallet Holdings: $355k

- USDC

- DAI

- FXS

- ETH

- FDT

Protocol Deposits:

GMX (on Arbitrum) - $177k -- Staked GLP and esGMX

Convex - $89k -- Staked FXS + cvxFXS, cvxCRV, CVX

Redacted Cartel - $59k -- Staked BTRFLY

Dopex (on Arbitrum) - $31k -- Farming RDPX + WETH

JonesDAO (on Arbitrum) - $22k -- Farming JONES + WETH, JONES

Key highlights:

- This wallet is primarily on the Ethereum and Arbitrum ecosystem

- Mainly spot holding USDC, DAI, FXS, and ETH

- Largest staked position on GMX in Arbitrum

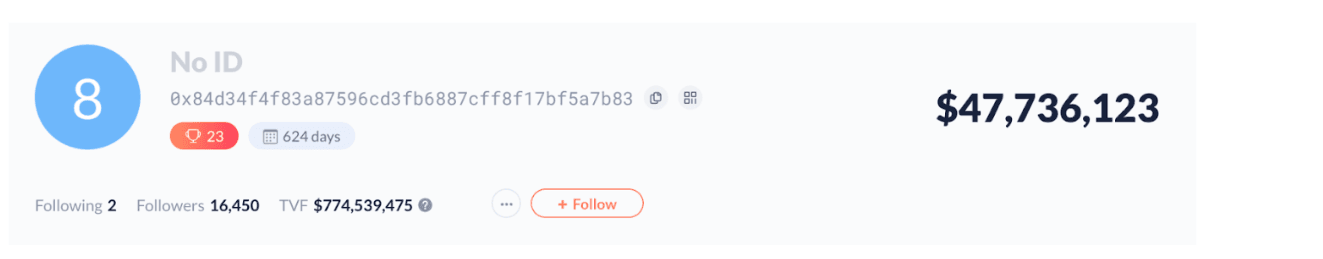

Alameda Research(0x84d34f4f83a87596cd3fb6887cff8f17bf5a7b83)

Wallet Size: $47.7mm Debank Followers: 16.4k Smart Money on Nansen? Yes

Chain breakdown:

- 51% on Avalanche ($24mm)

- 49% on Ethereum ($23mm)

Wallet Holdings: $24mm

- USDC - $10mm

- USDT - $8mm

- USDT.E - $5mm

Protocol Deposits:

Echidna (on Avalanche) - $9.1mm -- Staked USDt -- Farming PTP + ecdPTP

Uniswap V3 - $8.8mm -- LP FTX + ETH

SushiSwap - $4.8mm -- Staked xSUSHI

Key highlights:

- Exclusively on the Ethereum and Avalanche ecosystem

- 100% in stables for spot holdings ($24mm) which is equivalent to half of their portfolio

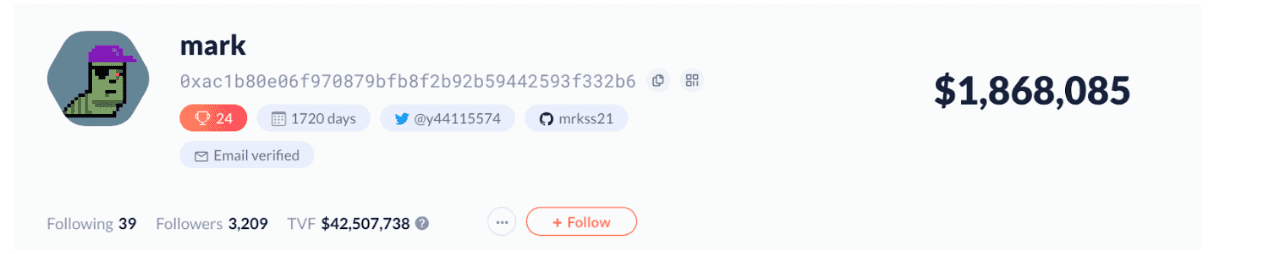

Mark (0xac1b80e06f970879bfb8f2b92b59442593f332b6)

Wallet Size: $1.8mm Debank Followers: 3209 Smart Money on Nansen? No

Chain breakdown:

- 86% on Fantom ($1.6mm)

- 9% on BSC ($164k)

- 4% on Ethereum ($74k)

Wallet Holdings: $1mm

- fUSDT

- BUSD

- USDT

- BNB

- BBTC

- USDC

- ETH

Protocol Deposits:

Tomb Finance (on Fantom) - $812k -- Farming USDC, BTC, ETH

Uniswap V3 - $21k -- LP USDC + ENS

Key highlights:

- Primarily on the Fantom ecosystem ($1.6mm) and 86% of overall portfolio

- Mostly holding stables on Fantom and BSC, and farming stables + large caps on Tomb Finance ($812k)

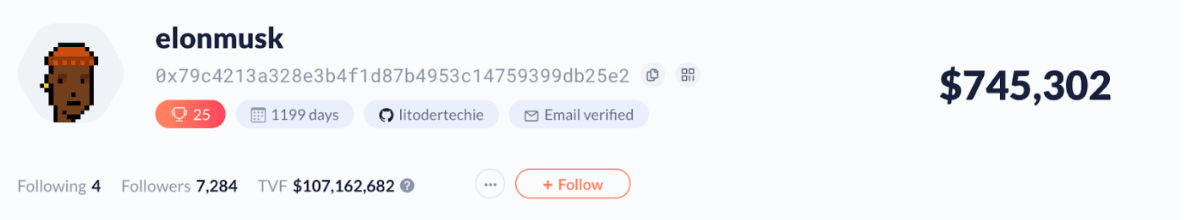

Elonmusk (0x79c4213a328e3b4f1d87b4953c14759399db25e2)

Wallet Size: $745k Debank Followers: 7284 Smart Money on Nansen? Yes

Chain breakdown:

- 34% on Gnosis Chain ($255k)

- 22% on Optimism ($167k)

- 21% on Ethereum ($156k)

- 17% on Polygon ($129k)

- 5% on Arbitrum ($36k)

Wallet Holdings: 16k

- SWISE

- sETH (on OP)

- WETH

- ETH (on OP)

- & more

Protocol Deposits:

Hop Protocol (on Gnosis) - $255k -- Farming USDC + hUSDC, USDT + hUSDT, WETH + hETH, WXDAI + hDAI

Hop Protocol (on Optimism) - $139k -- LP WETH + hETH and DAI + hDAI

Aave V3 (on Polygon) - $105k -- Supplied WETH, USDC -- Borrowed USDC

Notional - $58k -- Farming ETH + DAI + USDC

Instadapp Lite - $47k -- Earning yield on ETH

Hop Protocol (on Polygon) - $23k -- Farming WETH + hETH and WMATIC + hMATIC

Aave V3 (on Arbitrum) - $20k -- Supplied WETH -- Borrowed USDC

Lyra (on Optimism) - $18k -- LP sUSD

Uniswap V3 - $16k -- LP ETH + BUNNY, SWISE + sETH2

Indexed - $16k -- Staked USDT, WBTC, AAVE -- Farming CC10 + ETH

Hop Protocol (on Arbitrum) - $13k -- LP WETH + hETH

Key highlights:

- Diversified across various chains, however, main position is in Hop Protocol (on Gnosis) farming stables

This wallet is mainly farming for stables and large cap tokens on Hop Protocol on Gnosis, Optimism, Polygon, and Arbitrum

Vfat (0x87616fa850c87a78f307878f32d808dad8f4d401)

Wallet Size: $775k

Debank Followers: 5633

Smart Money on Nansen? Yes

Chain breakdown:

- 60% on Ethereum - $466k

- 12% on Arbitrum - $93k

- 7% on Fantom - $51k

- 6% on Gnosis Chain - $49k

- 3% on Polygon - $22k

- 1% on Moonriver - $10k

- 1% on Harmony - $6k

- 1% on Optimism - $11k

- 1% on Avalanche - $9k

Wallet Holdings: 192k

- USDC

- IOTX

- ETH

- HND

- OP

Protocol Deposits:

Frax Finance - $309k -- Farming aIUSD + FEI + FRAX + LUSD and FRAX + ETH

Dopex (on Arbitrum) - $85k -- Farming DPX + WETH

Aladdin - $55k -- Staked ALD

Eth2 - $36k -- Staked ETH

FloorDAO - $26k -- Staked FLOOR

ZoomSwap (on IoTeX) - $19k -- Farming MCN + WIOTX and ZM

Hundred Finance (on Fantom)- $17k -- Locked HND until 2026/04/012

Beethoven X (on Fantom)- $14k -- Farming WFTM + BEETS, WFTM + BELUGA, WFTM + CRE8R -- Staked fBEETS

Key highlights:

- Primarily on the Ethereum ecosystem (60% of overall portfolio) with protocol deposits diversified across various chains

- Mostly farming stables and staking ETH

General Observations Based on Top Wallet Activities

Ethereum is the most used chain

Most of the wallets that we’ve analyzed had the majority (>80%) of their assets on Ethereum. Some of the outliers were wallets that were generally more diversified in terms of chain breakdown.

A growing number of users on the Arbitrum and Optimism ecosystem

Out of the 25 wallets, 14 wallets have >5% of their portfolio on Arbitrum, while 7 wallets have >1% of their portfolio on Optimism. Generally, the wallets that are diversified on Arbitrum trend towards the top few wallets on the social rankings with a portfolio size of >$1mm.

A rise in Stablecoins holding

Most wallets are still looking to de-risk their positions and prefer to either hold spot or farm stables. The most common stablecoins we’ve seen in most portfolios are USDC, USDT, FRAX. For example, Wallet 22 has a portfolio size of $47mm and has half of their position in USDC spot.

An increase in ETH Staking

Due to the speculative nature of the Ethereum merge in the coming months, most wallets are also stacking up on ETH. A few wallets are staking ETH and receiving stETH on Lido, while others are buying stETH at a current 5% discount rate in the hopes of swapping it 1:1 for ETH post-merge.

Farming activities are less prevalent, but still active on Fantom

Notable wallets like Top 1: Ethereum (0xbdfa4f4492dd7b7cf211209c4791af8d52bf5c50) have decreased their exposure to the Fantom ecosystem as of recently. This wallet initially had 20% of their overall wallet portfolio in Fantom. This has been reduced to 2% at the time of writing. Although farming activities on Fantom are less significant among the top 25 holders, there are still a few recurring farms that have been mentioned throughout the report.

Main protocol deposits for wallets that are primarily yield farming on the Fantom ecosystem include Beefy Finance, SpookySwap ,Tomb Finance, and QiDAO. On Beefy Finance, wallets are mostly farming beFTM and BIFI. Similarly on SpookySwap, wallets are farming WFTM + beFTM. On Tomb Finance, however, wallets are mostly farming stables, BTC, and ETH.