TLDR

- Umee is a cross chain lending platform built out on the Cosmos SDK and secured via Tendermint consensus. It differentiates itself from other money markets because it allows users to deposit staked assets as collateral on Cosmos and borrow against it for other assets on other chains, and vice versa. Hence, the staking yield of the collateral asset can be used to pay off your loan (self repaying), used to create a leveraged position, or to DCA into a specific asset over time.

- Umee sounds similar to Alchemix but rather than using Yearn vaults to generate yield, they use the staking rewards for the collateral asset to create more complicated strategies.

- They are expected to launch in February 2022 and are airdropping $UMEE tokens. They are also backed by many large funds and will be natively integrated into the Keplr wallet for ease of use.

Umee Overview

Umee is a cross chain lending platform that is built out on the Cosmos SDK and secured via Tendermint BFT consensus. They offer cross chain lending using staked and unstaked assets across Cosmos and Ethereum. To manage both network’s assets, they have built out a Universal Capital Facility which will manage every networks’ assets - facilitating users' UX to just 1 capital facility. This capital facility allows for cross chain lending between any IBC enabled Zone with Ethereum and will eventually support any other EVM chain. By design, all Cosmos Zones are their own layer 1 blockchain and must have its own validator set. Because of this, these Cosmos Zones force token holders to make a tradeoff - stake their token to secure the network or use their tokens to chase yield on farms, until Umee.

Umee will be able to support cross chain communication between any Cosmos Zone and Ethereum. The communication between Umee and other Cosmos Zones will be done via IBC, so any Cosmos Zone can interact with Umee as long as they have IBC channels established between them. For Ethereum, Umee will communicate to it through the Gravity Bridge. The Gravity Bridge is a bidirectional bridge between Cosmos and Ethereum. Akin to many of the other frameworks Cosmos has built out, the Gravity Bridge can be customized to a Zone’s particular needs. The bridge has been in production for multiple years and it is a fork of the well audited Gravity Bridge ( the software is open source and used by many chains which fragments liquidity across each instance).

The Gravity bridge is what allows Umee to bring assets cross-chain as it will allow collateral tokens to exist as both ERC-20 tokens and native Cosmos tokens. This is the key infrastructure between the two and what enables cross chain lending between them and allows Umee to interface with multiple bridging solutions to create a universal crypto hub.

Umee Core Components

Universal Capital Facility

The Universal Capital Facility (UNC) is one of the core components to the Umee Network. Users will first deposit assets to Umee and if they want to participate in the borrow/lending activities, they will go through the UNC. The UNC will be built out on both Ethereum and Cosmos - Ethereum will be using Solidity and Cosmos will be built off of Go modules.

The tokenomics of Umee very closely resemble that of Aave, as do their modules on Ethereum. Let's dive deeper into the 2 types of collateral that will be used in the UNC:

uToken Collateral - liquid non-staked collateral tokens

When a user deposits an asset, they will receive a uToken in return at at 1:1 exchange rate with the asset deposited. These uTokens are initially minted on Umee and can be bridged over to Ethereum as ERC-20 tokens. When a user deposits an asset on one blockchain, the uTokens they receive in return will be minted and used as the collateral tokens to borrow the assets on another chain.

Example: Deposit $ATOM to Umee and receive uATOM in return. Those uATOMs will be bridged over to Ethereum using the Gravity Bridge and exist as ERC-20 tokens. Borrow against these positions on Ethereum or Cosmos.

meTokens - illiquid staked collateral tokens

Users will receive meTokens for any staked borrow position. This allows for unique strategies such as borrowing against your position while concurrently earning yield in (example 1) or to repay the interest from borrowed positions (Example 2). Let's give an example of each below:

Example 1:

Kenzie deposits $ATOM and stakes her $ATOM to receive meATOM. She can borrow against it on Ethereum to borrow $USDC while continuously earning staking rewards. She can do this strategy to take advantage of yield opportunities on Ethereum or she can use the borrowed $USDC to buy more $ATOM until she reaches her desired leverage. Note, the $ATOM is staked on a Cosmos validator and is subject to a 21 day unbonding period and it will not be liquid until the unbound period is over. During this process of unstaking, the users holding meTokens will not be earning staking rewards. When the staking period is completed, a user can swap their meTokens for uTokens, which can be immediately sold for the native asset.

Example 2:

Chad wants to take out a ‘self repaying’ loan. He deposits his $ATOM and stakes it on the platform and receives meATOM in return. The rewards from the staked Atom will be immediately liquidated for DAI and used to pay off the interest of another borrowing position he has open. For example, he can earn 10% on his staked ATOM and borrow DAI for 8% and can essentially borrow DAI for ‘free’ (hence self repaying loan) while also capturing another 2% for himself. Chad can also choose not to borrow, in which case, the rewards from his staked Atom will also be liquidated as they accrue into DAI or another stablecoin of his choosing. If he wants to unbond his position, he will also have to go through the 14-21 day unbonding process. During this process of unstaking, the users holding meTokens will not be earning staking rewards. When the staking period is completed, a user can swap their meTokens for uTokens, which can be immediately sold for the native asset.

Risks and Other Considerations

Given you are depositing assets to be staked, the collateral must be delegated to a validator. If you deposit Atom tokens to be staked, Umee will delegate the Atom to an Atom validator. They will initially choose the most reputable validators for a given asset and these validators will be rotated and rebalanced by Umee. The allocations will be decided through governance. However, all validators are subject to slashing events, regardless of how reputable they might be. If you deposit Atom to be staked and there is a slashing event, the staked Atom you deposited will also be slashed - this will reflect in your meToken balance. The meTokens that exist on Ethereum as ERC-20s, will also experience the slashing event via the Gravity Bridge. All staked collateral positions are subject to slashing events.

Note, the Gravity Bridge is a key component in Umee’s architecture. Without it, Umee would not be able to cross-chain with Ethereum. Even though it uses its own gravity bridge implementation, it is a lot of maintenance to uphold a bridge, let alone expand its use cases and addressable markets. Although it has been audited, Umee runs the risk of fragmented liquidity if the Cosmos ecosystem sees another bridging solution such as Axelar become the dominant bridge. This concept can be seen by Osmosis’s choice to not maintain a bridge compared to Sifchain. Although having a bridge is useful, it is clear that Osmosis has been able to ship more features faster.

Another risk for Umee is that some lending protocols that are co-located on the same chain may provide a better UX for end users. For instance, if a lending protocol were to launch on Osmosis, it would be able to compose with its liquidity without interacting over IBC (a few steps even with interchain accounts). Of course, there is always liquidation risk as with any lending platform so be sure to manage your positions wisely.

Another factor to consider is liquid staking derivatives. There are some projects such as Quicksilver who are working on liquid staking derivatives, which can reduce the demand to borrow against staked collateral given the utility seen by stETH and others might be found elsewhere (more flexibility on what you do with your staked collateral). On top of liquid staking, market participants may find more utility for their assets in farming opportunities, especially given the long awaited launch of Superfluid Staking and Interfluid Staking on Osmosis, that will allow users to earn both staking yield, farming incentives, and fees all at once. On top of this, a lending protocol can launch atop Osmosis and compose with this existing liquidity; thus, LPs would be able to borrow against their deposited liquidity and get even more capital efficiency and APRs. Although these are not necessarily risks with Umee itself, they present competing solutions and highlight the risks (both from a features and security perspective) of maintaining their own bridge.

Lending Platform Overview

To better understand Umee, let's dive deeper into some other lending platforms offered today. Below, the report will cover Abracadabra, Alchemix, Kava and Umee. We will compare and contrast these lending platforms in the chart and table below. This is a rough estimate on the 4 selected protocols and we will have the full details in the table.

Lending Protocols Table

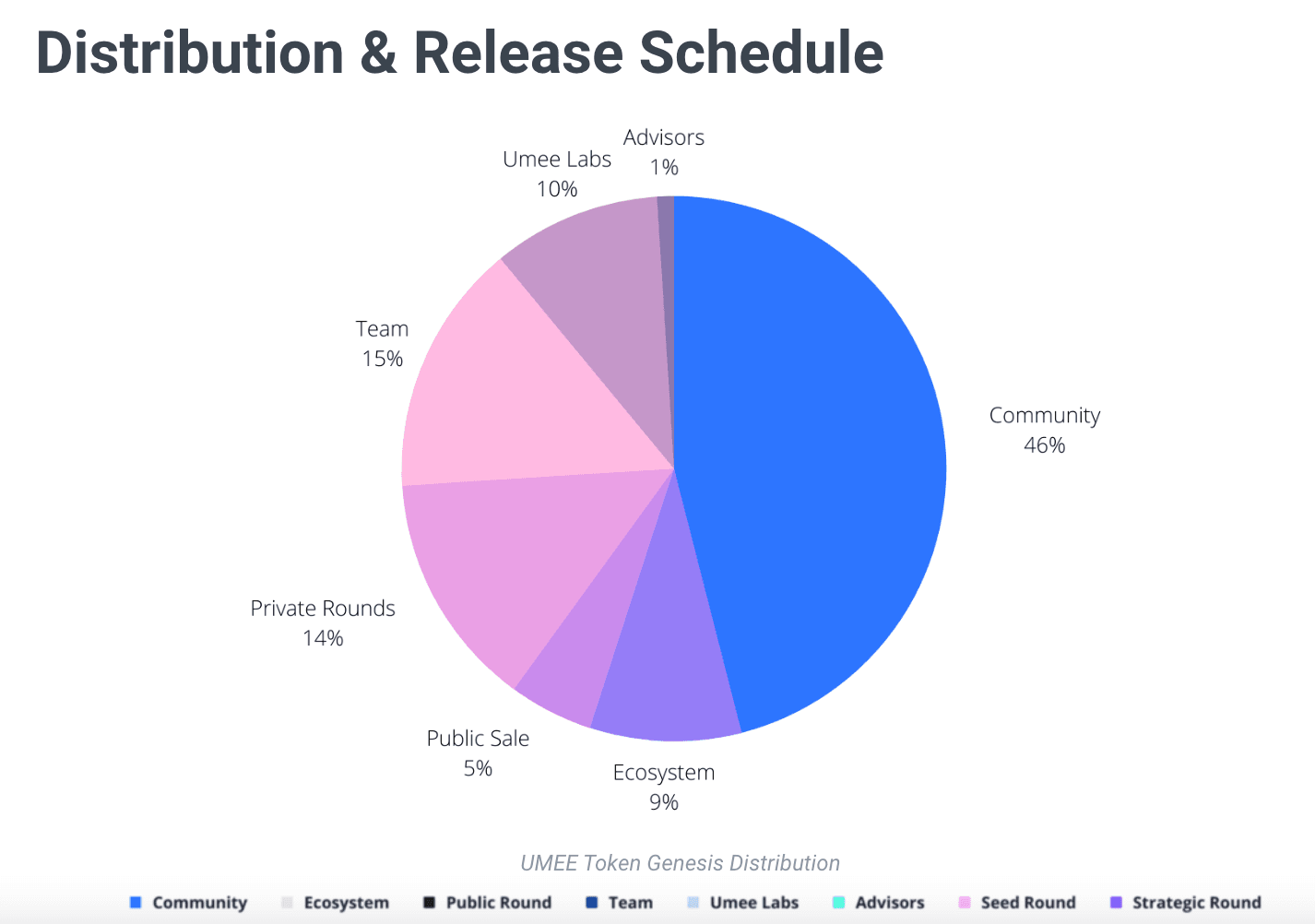

Umee Tokenomics and Funding

Umee will have a token, UMEE, that will be used for network fees on the Umee blockchain, to secure the chain through PoS consensus, governance and for buy-and-burns of the Umee token. There will be 10 billion UMEE tokens. The floor inflation rate will be 7% and increased or decreased to achieve 67% of tokens staked with a max inflation rate of 20% (similar to ATOM). The dynamic inflation rate is used to properly secure the Umee blockchain, given the staking mechanism is the ultimate security mechanism that guarantees the security of the network.

Umee is backed by large funds and raised 2 rounds - a seed round and strategic round. The seed round was raised at a $50M valuation ($0.005/token) in Q1 2021 and led by Polychain and included investors such as Coinbase Ventures, Ideo Colab, Tendermint, ConsenSys Ethereal Ventures, Alameda, CMS, Brian Kelly Capital Management and Argonautic Ventures.

In Q3 of 2021, they raised a 2nd round of funding at a $500M valuation ($0.05/token) to onboard ecosystem partners.

There is no UMEE token out at the time of writing, if there are claims to a token then it is a scam and you should not interact with it. The airdrop will occur in the next couple of months. The token distribution will be as follows:

Roadmap

Keplr recently implemented Umee into its wallet. This will allow for Umee users to borrow/lend tokens, delegate, stake, and vote on Umee governance proposals on the Keplr web app and mobile native interface in a non-custodial fashion. Other things on the roadmap include the following:

- 2021 December: Umee Base Functionality Deployment on Testnet

- 2022 January - Onward: Security Audits

- 2022 February: Umee Base Functionality Deployment on Mainnet and Token Launch

- 2022 March: Umee Lending Facility Upgrades

- 2022 April - Onward

- Protocol developments on top of Umee: meTokens, staking curves, defi debt protocols

- Umee Polygon Lending and Borrowing Application

- Umee Arbitrum Lending and Borrowing Application

- Umee Optimism Lending and Borrowing Application

- Umee Solana Lending and Borrowing Application

- Umee Binance Smart Chain Lending and Borrowing Application

- Interest rate instruments and other new financial primitives

Key Takeaways

- A cross chain lending protocol is missing in the IBC ecosystem and Umee can be well positioned to bring a cross-chain lending platform to the Cosmos and beyond. As of now, Cosmos Zones require token holders to make a large tradeoff - stake their token to secure the network or chase the promising yields out there on cross chain defi applications. Umee can provide a better solution for many of these $ATOM and broader IBC token holders to earn yield/speculate while securing the network of their desired Zone. There are a number of competing solutions out there so it will be interesting to closely monitor the traction of Umee in the coming quarters.

- Umee is also experimenting with cross-chain interest rate swaps which is a huge addressable market. If Umee is able to offer these capabilities, then they can become the cross-chain lending Hub of the Cosmos ecosystem, similar to how Osmosis is the Hub for liquidity.

- They are expected to launch mainnet in February 2022 and will be releasing more updates soon in the coming months.