Executive Summary

TIA is one of our highest-conviction bets in the modular blockchain space, driven by a long-term valuation thesis that extends beyond a few months. Our thesis is simple: Celestia is best positioned to scale rollups, and TIA is a direct, underpriced bet on the exponential growth of rollups and blockspace demand.

Celestia is prioritizing key scalability upgrades—maxed-out blobs, single-slot finality, and faster block times, making it the most optimized DA layer for rollups today. With $43.58B in rollup-secured value and expanding support for Ethereum, Solana, and Bitcoin L2s, its addressable market is rapidly growing. The recent 8MB block size expansion has already doubled usage, with further scaling improvements like compact blobs and node sharding in development. Long-term, Celestia’s goal of 1GB/s throughput positions it as the premier infrastructure for rollup adoption at Visa-scale capacity. With a ~$2B market cap, TIA remains undervalued relative to its role in the modular blockchain future.

Intro to Celestia

Most of the readers have likely already heard of Celestia, have been airdropped it, and at this point, there are likely two main camps of people (if not, you can read about it here). Those who:

- Still don’t quite understand the need for it, but keep witnessing Celestia’s buzz in new announcements.

- Understand Celestia but don’t see the reason to hold TIA.

We’d like to lay out the arguments of the third camp, the one that sees TIA as a non-consensus bet at today’s prices and expects Celestia and TIA to play a pivotal part in a rollup-centric future, creating significant demand for Celestia’s blockspace, and tailwinds for the TIA asset. In the long run, we feel that TIA’s current $2b valuation is undervalued relative to its market positioning, momentum, and future catalysts.

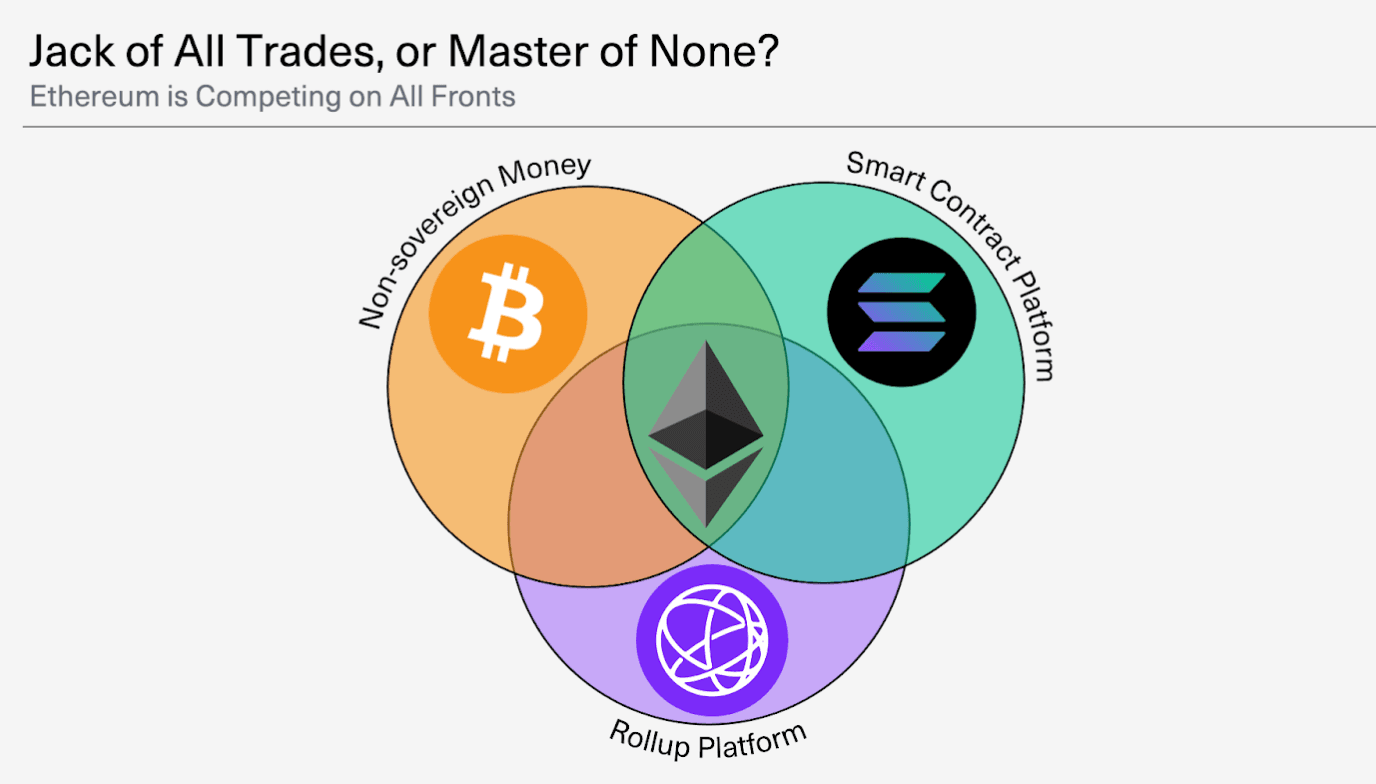

Our long-term thesis is simple: the number of layer 2s will continue to grow, and the amount of data they consume will grow exponentially, which will create a lot of demand for Celestia’s Data Availability layer (DA). In other words, we believe that, at its core, Celestia can serve rollups better than Ethereum, and TIA can serve as an index bet on the direct growth of rollups rather than ETH. We assume this as ETH is split between many directions, both in its community and core roadmap, where it has competitors on all sides - BTC as a form of money, Solana for smart contracts and performance, and Celestia as being the best rollup platform.

Celestia is simply optimizing for rollups and prioritizing what Ethereum is working on on a long-term timeframe, but shipping these key features today - maxing out blobs, shorter block times, single-slot finality, and interoperability natively baked into their roadmap. Not only are they shipping all these key features and much more, but the addressable market is not just rollups that settle to Ethereum; they are going to support Solana L2s, Bitcoin L2s/L3s, and zkApps on top of its current support of Base/Arbitrum. We are also seeing confirmation from the market with over $822m in total value secured (TVS) from the likes of Movement, Manta and Eclipse alongside many other emerging L2s/L3s using Celestia in the backend. In short, we believe Celestia/ TIA is a sleeping giant that is underpinning some of the most exciting projects today with strong positive momentum across usage metrics, short-term drivers, and market-wide tailwinds.

Lets dive in below.

Why TIA?

On one hand, many people understandably think of data availability (DA) as too technical and confusing, and hence, retail will opt for cute pictures of dogs rather than TIA the token. However, most investors who have bought NVIDIA over the last few years are certainly not all AI hardware and chip experts and are still up many multiples. Despite the analogy, there is a degree of truth here. TIA simply needs a key narrative to simplify its thesis rather than the many confusing or convoluted takes we see on crypto Twitter. Like Deepseek making waves across the AI space in terms of its exponential cost reduction to run AI models, TIA achieves something similar in terms of scalability for rollups, by giving them access to an abundance of blockspace. This allows for many more roll-ups to scale to the orders of billions of transactions. From the application side, they can create fundamentally new products and applications due to the scale of TIA and a clear roadmap for continuing to scale.

Product Market Fit

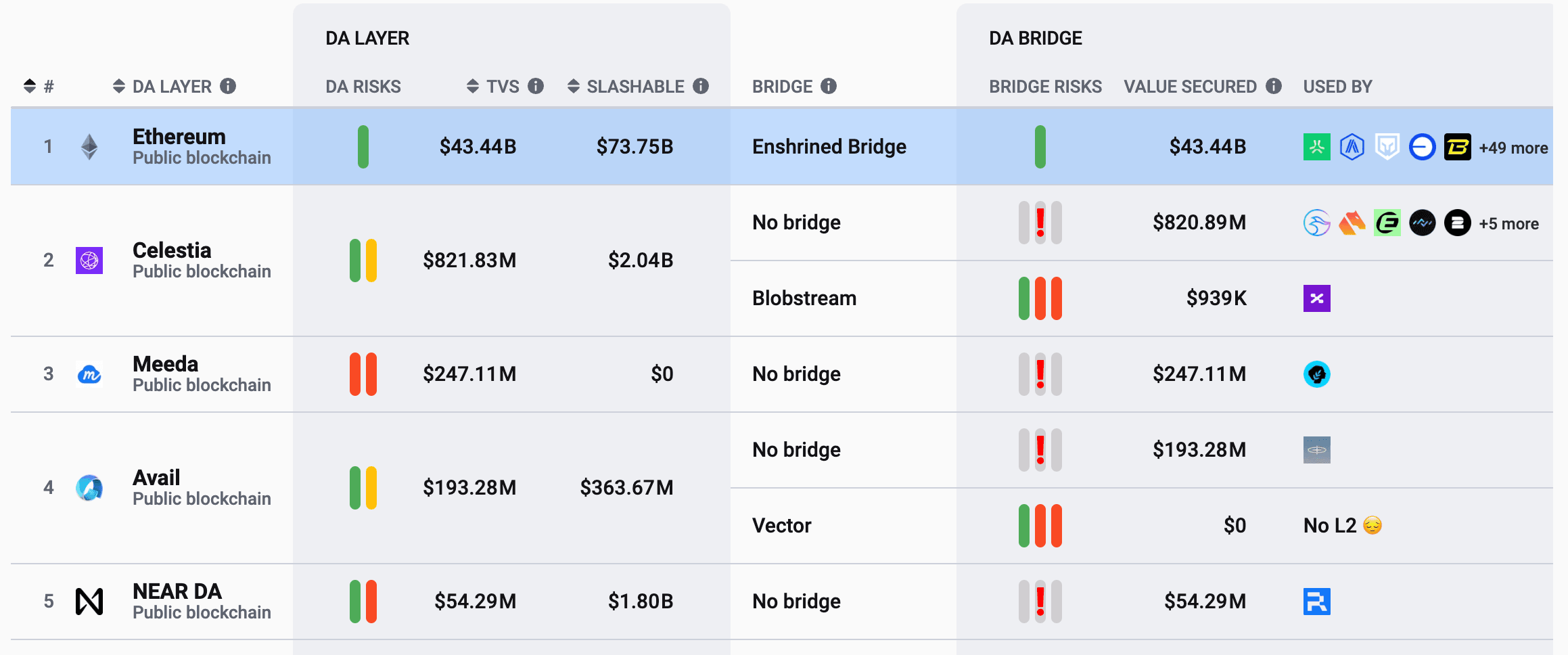

With over $822m in TVS and being the most secure DA layer, Celestia secures the most value and is used by most chains (outside of Ethereum).

Celestia’s usage is driven by some of the most exciting L2s today, including Eclipse, Movement, Manta Pacific, Derive, K2, Orderly Network, and many others.

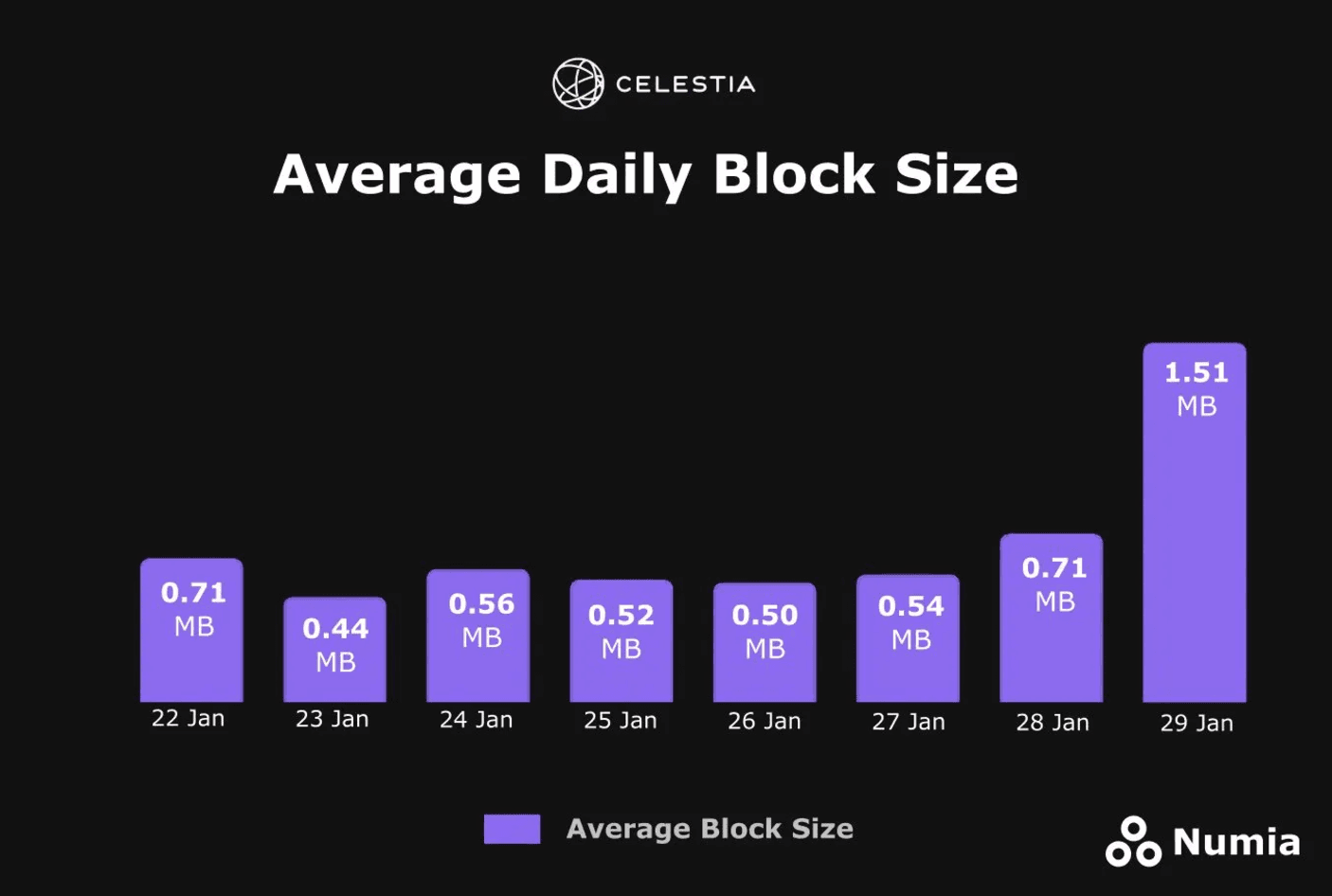

As for current usage, they launched their block size update yesterday to 8 MB blocks and have already seen an average block size increase of over 2x since.

Their biggest block was 7.24mb, comprising mainly Eclipse transactions. Their target goal is to scale beyond 1 GB/s data throughput, which would further remove crypto's ultimate scaling bottleneck and imply the scale of multiple Visa networks in parallel. In short, we are seeing a positive trend in block space demand, which is driving fees to TIA and a clear roadmap to scale in the short to medium term.

The Addressable Market of DA

Celestia is not just aiming to become a highly optimized performant chain, nor a gaming chain, an AI chain, or any flavor of the week for blockchain use cases. Instead, it has built the technology to power any of the above with tons of scalability and all the censorship resistance of a layer 1. This means you can build your onchain NASDAQ or a P2P payments platform on top of the same DA layer. As mentioned before, they are framework agnostic, with initial support for the most popular rollups today, such as OP Stack and Arbitrum rollups, but they are quickly expanding to support Bitcoin, Solana, and zk-native apps via Mina. All of these rollups that build on Celestia would come with all of the out-of-the-box guarantees of a censorship resistance L1, plus native interoperability, no bottlenecks on state growth, and many of the core features that make it the ultimate home for rollups/apps to scale. At present, there is over $43.58 B value secured by rollups today, according to L2beat, accounting for canonical, native, and external tokens. It’s clear that Celestia will eventually be able to power multiple concurrent networks at Visa-scale with a well-defined roadmap to achieve it (more on this later). The real question now isn’t how, but which apps will actually drive us there.

Celestia Ecosystem

Celestia already has a very comprehensive ecosystem that stretches from end-user applications to other layers of the stack. To name a few:

- Astria

- Succinct

- Conduit

- Abstract

- Dymension

- Argus

- Mina

- Movement

- Eclipse

- Noble

We expect this number of apps to grow exponentially as projects come to realize you get access to all of the tooling, scalability, and interoperability out of the box with Celestia for a fraction of the costs and a very defined roadmap to help apps ship to their user base.

Catalysts for Celestia

Year-to-date (YTD) price action shows some underperformance of TIA relative to BTC. As of January 29th, it was down just under 20%, sitting around $4.01 with an MC of ~$2b and an implied FDV of $4.4b.

However, most altcoins are down quite considerably. Even some of the fastest movers, like VIRTUAL, are down nearly 50% YTD. In spite of the weakness displayed in alts over the last few weeks, our time horizon is much larger than short-term trading trends for TIA, and we see many notable catalysts that support this thesis for a higher valuation in the future.

Short-Term Drivers:

- Core features on the roadmap to further scale across consensus, DA and zk light clients for tapping into any ecosystem:

- Consensus:

- Content addressable mempool upgrade vs the out of the box Tendermint mempool propagation. (testing phase)

- Compact blobs to reduce the bandwidth required to gossip a block. (implementation phase)

- Faster CometBFT block propagation to create improvements to bandwidth utilization by increasing throughput. (research phase)

- Node sharding for nodes to process data blobs in parallel for much cheaper (upcoming phase)

- And many others here

- Data Availability

- Blob pruning (testing phase)

- More efficient DAS: Shwap (implementation) to increase sampling efficiency and reduce storage requirements by up to 15 times (implementation phase)

- And many others here

- Blobstream

- Delivers ZK light client attestations of Celestia to any ecosystem, allowing them to scale seamlessly with high-throughput L2s and L3s.

- Base L3s, Arbitrum One (completed phase)

- Ethereum L2s (completed phase)

- Mina zkApps (implementation phase)

- Bitcoin L2s and L3s (design phase)

- Solana L2s (upcoming phase)

- Delivers ZK light client attestations of Celestia to any ecosystem, allowing them to scale seamlessly with high-throughput L2s and L3s.

- Consensus:

- Fully onchain gaming worlds like Argus are coming online

- Astria is building a decentralized sequencing layer for EVM-based rollups on Celestia. This is just one example of the maturing infrastructure available for Celestia rollups today.

- Verifiable web applications via Chopin allow more transparency for users, provide better security authentication systems, and reward users while still delivering on the UX. This truly builds on some of the original premises of the crypto industry to create less trust and more verifiable applications in everyday life while bringing forth the sense of ownership to the web (not just DeFi)

- Celestia’s unrestricted block space opens the door for fundamentally new experiments that are not possible anywhere else, even on the most centralized/scalable networks. By redefining the tradeoffs of blockchain scalability, Celestia expands what’s possible for many apps/chains, such as gaming worlds and verifiable apps.

Long-Term Drivers:

- Developers and builders continue to shift their focus solely on the Celestia ecosystem. Mainly developers and teams that were previously focused on the Cosmos ecosystem have now increasingly shifted gears with Binary Builders now joining.

- L2s continue to grow in terms of number of chains and in their demand for block space.

- Scaling to 1 GB/s data throughput would be able to “deliver the capacity of many Visa networks in parallel”.

We believe that many of the key catalysts will increasingly attract new developers, chains, and applications to build on top of the most scalable technology stack today. Both the main risk and opportunity here is simply finding a narrative that sticks in a much broader and very obvious trend of increased block space demand. With its fundamentally new use cases and its broadened scope, Celestia is positioned well for an ever growing crypto market. Given its down ~80% from ATH, we increasingly like these levels for TIA and are looking to DCA on a multi-month timeframe. It has now weathered some of the most anticipated investor unlocks and has seen many months of consolidation after its initial run-up post TGE. We are not obsessing over entry prices as we firmly believe in TIA as a long term project and not as a simple rotation.

Can the Team Deliver?

The Celestia white paper was written in 2019, and the team has been shipping for 6 years. Celestia has delivered on the original Cosmos vision of a world of “thousands of interconnected blockchains” and has provided a superior framework to create what they call, “unstoppable applications”. So far, they have executed their vision quite well, from the core protocol design to constant feature releases. Given the Celestia blockchain doesn't have any smart contracts and only provides consensus and data availability, it can be very scalable and trust-minimized, which powers many of the apps built on top of it. Additionally, the ecosystem of apps and builders continue to grow everyday spanning shared sequencing layers, zk light clients, rollups and much more.

As for the team, they have a stellar background from many top projects within the crypto space. Mustafa famously hacked the iPhone at 17, Nick White cofounded Harmony blockchain, another cofounded Fuel and the list goes on. With its roots stemming from the BTC block wars and the foresight of L2 expansion, we believe that the team is set to execute on its vision with things only heating up with end user applications picking up steam.

Risks

The significant risk is that rollups do not take off and monolithic L1s such as Solana or Sui can infinitely scale and there is no need for other types of scaling solutions such as rollups that leverage DA solutions like Celestia. With chains like Solana even pivoting to their rollup roadmap via network extensions, it is safe to say that this risk is invalidated, with even Vitalik noting this very clearly in his blog. Celestia shifts the mindset from scarce block space to abundant block space, but it still needs users and applications. The real risk isn’t Celestia itself—it’s whether crypto moves beyond its current niche of use cases such as a cyclical memecoin casino. If it doesn’t, Celestia’s big blocks could stay primarily empty. At the same time, it must also attract some of that existing/future activity to ensure a vibrant ecosystem.

Celestia is positioning itself as the premier DA layer for the expanding rollup ecosystem, with $822M in TVS and usage by leading L2s like Eclipse, Movement, and Manta Pacific. TIA can serve as a direct index bet on rollup adoption, distinct from ETH, and benefits from growing block space demand, which is evident in its recent block size increase to 8MB, with peak blocks reaching 7.24MB.

With a $2b market cap, we believe TIA is undervalued relative to its role in crypto’s scaling landscape. It offers superior performance over alternative DA solutions while expanding to support Bitcoin, Solana, and zkApps. Key catalysts include scaling to 1GB/s throughput, increasing rollup adoption, and a robust roadmap for technical improvements such as compact blobs and zk light clients.

While the primary risk is insufficient rollup adoption, current trends indicate growing demand for Celestia’s infrastructure, making TIA a high-upside bet on the modular blockchain future.