TLDR

Over the last 2 years, there has been an unprecedented amount of venture investing in crypto. Most VCs investing in these tokens are subject to vesting, which can be tracked on-chain using Nansen’s suite of products.

However, outsiders are largely unaware of vesting schedules, exposing them to risks of increased supply and sell pressure from early investors who are up considerable amounts on their initial investments.

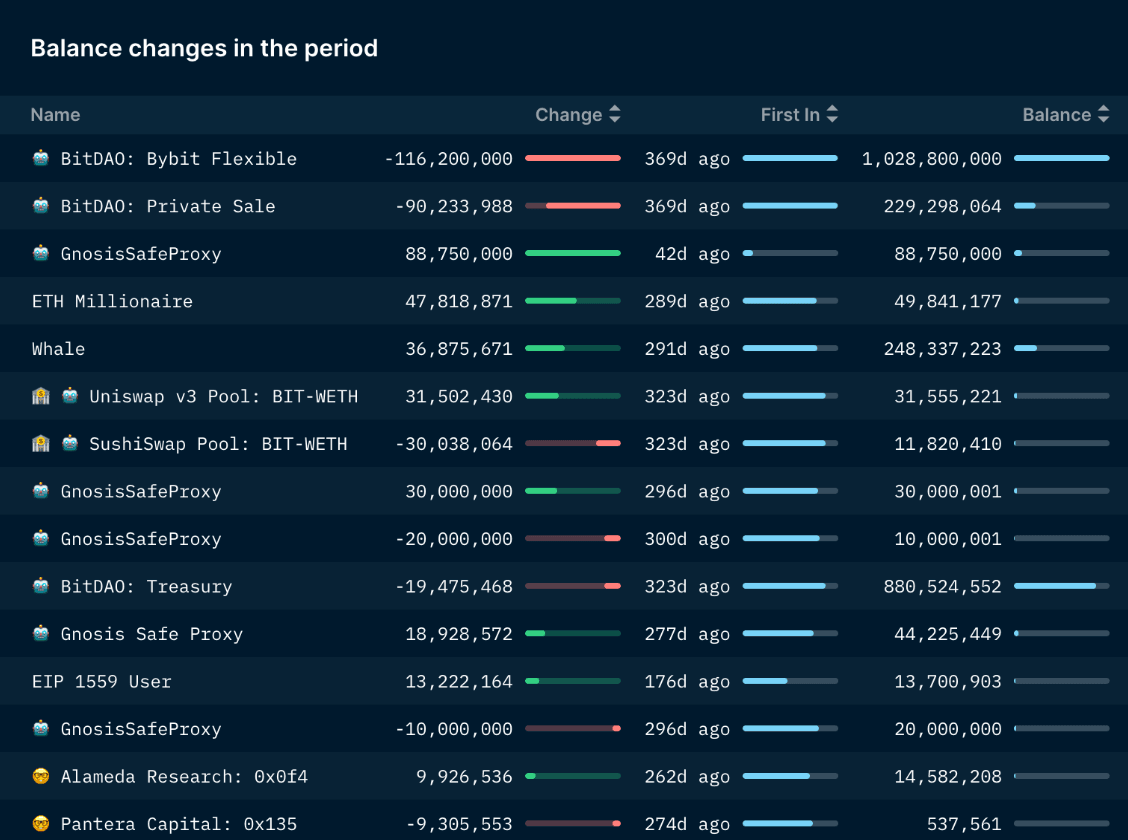

An analysis of 5 tokens with vesting unlocks in June found that most funds and whales are adopting a strong risk-off approach by significantly reducing their altcoin positions. In some cases, these entities are removing their entire holdings of specific tokens such as DODO. Therefore, we've built a Vesting Unlocks dashboard to keep track of these vesting schedules and their activities in real-time.

Introduction

This month’s featured unlocks span across the Ethereum ecosystem. The 5 opportunities the report covers include BitDAO, Yield Guild Games, Vega, DoDo and Woo Network.

Unlock Report Series

This series will go over curated unlock opportunities, private sale investors' behavior, potential shorting opportunities and key takeaways for each project.

To fully take advantage of the information offered in this monthly series, users should consider adding smart alerts to their Nansen accounts so they can monitor the vesting contracts and smart money wallets in real-time. This report already provides links to sample smart alerts the Alpha team has curated for each project and any reader is welcome to add the preset smart alerts to their accounts or fine-tune them to their preferences.

There are risks and opportunities associated with each of the tokens this report covers. These highlighted vesting schedules and unlocks should be used in tandem with our vesting unlocks dashboard that is exclusive to Alpha subscribers. This dashboard allows users to drill down on specific tokens, vesting contracts, investors and much more. Note, it is not guaranteed that wallets are selling if they send funds to a CEX but it is what this report will constitute as selling or the intent to sell. However, using ‘Wallet Profiler For Token’, a user can track the flow of tokens from a vesting contract. If there are 3 or more hops in between the vesting contract and a CEX deposit wallet, it can be tracked intuitively using Nansen’s Wallet Profiler For Token.

All of the information presented is based on on-chain data - there is no reliance on any 3rd party information including scheduled unlocks, whitepapers, official statements, etc. If the report references any 3rd party information, the corresponding links will be provided and the connection to the on-chain data found using Nansen. Many of the ‘Unlock Schedules’ do not have sources and it is unclear how accurate these schedules are. This report is meant to be an on-chain source of truth for what is going on under the hood and contextualize the behaviors of investors for members to better position themselves in these markets.

| Token | Chain | MC | FDV/MC | Perp/Futures Market | 24h Trading Volume | |

|---|---|---|---|---|---|

| BIT | Ethereum | $500m | High - 8.9x | ByBit | $2.8m |

| YGG | Ethereum | $50m | High - 11.3x | OKX | $7.2m |

| VEGA | Ethereum | $32m | Low - 3.1x | N/a | N/a |

| DODO | Ethereum | $43m | Low - 2.7x | Binance | $7m |

| WOO | Ethereum | $178m | Low - 2.8x | Phemex | $40m |

*the perpetual markets are prioritized by the 24hr volumes from Coingecko Sources: Coingecko, Data as of June 29th, 2022

BitDAO (BIT)

(Website / Twitter) Data as of July 5, 2022

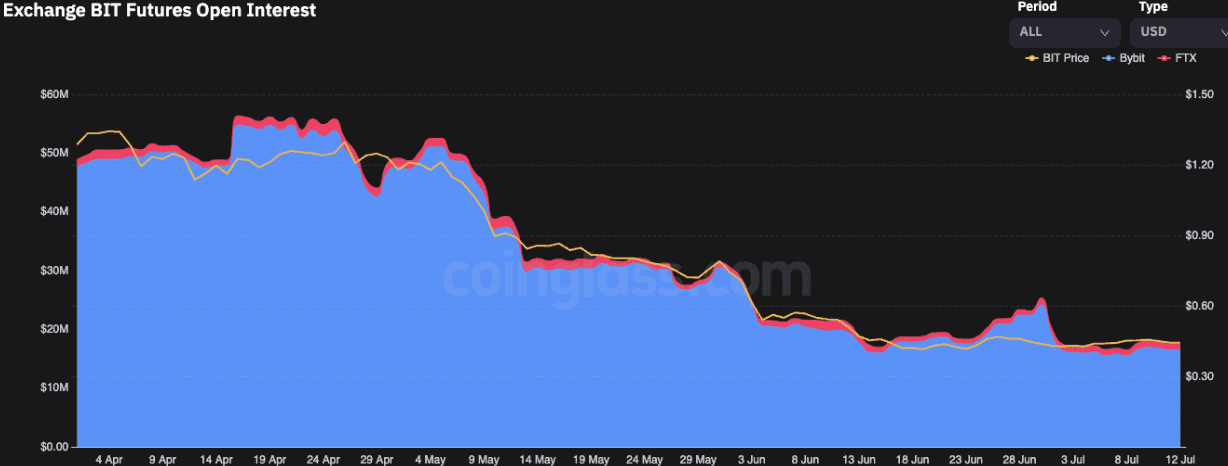

MC: $507.9m FDV: $4.5b FDV/MC: 8.92x Chain: Ethereum Next Expected Unlock Type: Private Sale unlock % of Total Supply Unlocked: 5% Next Expected Token Release Date: July 14-15th Futures Platform (24h Trading Volume in USD): ByBit - $2.59m (Data as of July 11th, 2022) Smart Alert: Template

Token Movements (last 3 months)

Vesting Schedule and Recipients

The private sale vesting contract sends funds to investors linearly on a monthly basis - usually on the 14th or 15th of each month, for 12 months in total. The vesting is expected to end on 14 October 2022.

These patterns have been tracked since October 2021 using the Wallet Profiler for Token for Pantera found here - which is one of the private round investors.

Known investors in the private rounds

- Peter Thiel, Founders Fund, Pantera Capital, Dragonfly Capital, Alan Howard, Jump Capital, Spartan Group, Fenbushi Capital and Kain Warwick.

Historical Investor Behavior

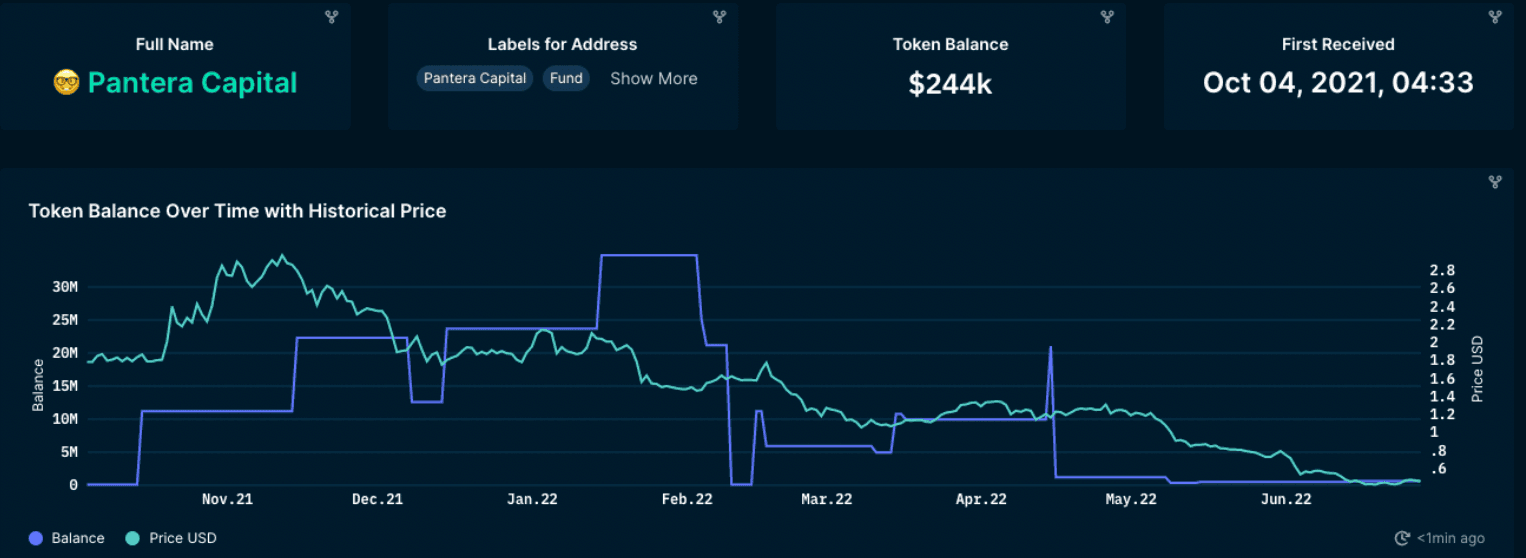

Pantera Capital

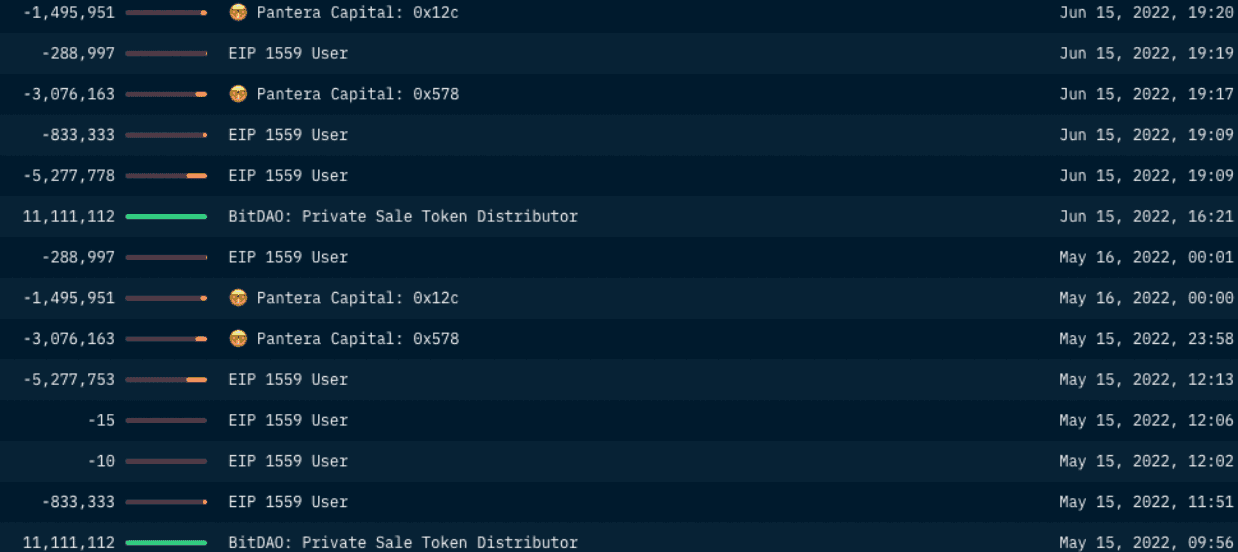

Pantera is often a large recipient of the BitDAO vesting. The analysis observed outflows of BIT tokens to several other wallets from the initial recipient wallet here. Diving deeper, the on-chain data reveals that after 1 transfer, the BIT tokens are then sent to either ByBit or FTX - presumably to sell. This is all done within 48 hours after initially receiving the tokens. Pantera is often a seller of BIT tokens and usually does so within the first couple of days - the 14-16th of each month. This can be tracked using a Nansen smart alert on this wallet for BIT.

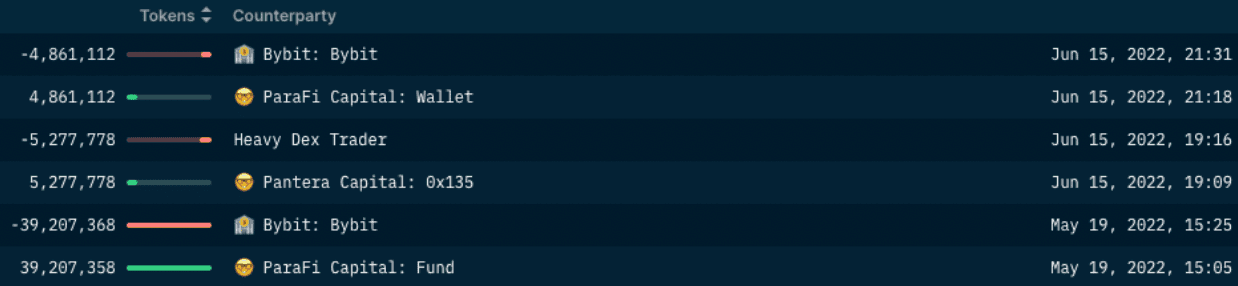

Spartan Group They are also private sale investors and they tend to sell as well. However, they usually sell tokens using DEXs instead of CEXs (e.g. ByBit or FTX). They tend to sell BIT into Sushiswap or Uniswap pools in exchange for USDC. One of their wallets here holds $1.7m in BIT but it also sells with its latest sale being May 14th.

Contrary to the data observed with Pantera above, Spartan Group typically trades the BIT tokens in batches of 100k to 200k over a longer period of time. For instance, on December 23, 2021, Spartan Group received 4.3 million BIT tokens. However, they gradually exchanged those tokens for USDC in phases, from January to March 2022.

Private Sale Investor A private sale investor currently holds $1.4m in BIT tokens. It also tends to sell tokens into USDC through various DEXs like Sushiswap or Uniswap. Track the wallet here.

ByBit ByBit owns an extremely large percentage of the supply, with a 12-month cliff, followed by a 24-month linear vesting period. More information regarding vesting schedules for BitDAO can be found here. This wallet received $50m worth of BIT from the ByBit flexible wallet which does not have a vesting schedule expressed in their documentation.

Takeaway

The FDV of BitDAO is very large, with a $4.5b valuation given the total supply - however, most of it is in their native token BIT stored in their treasury which can be tracked here. Based on the on-chain data, many of the private sale investors are constantly reducing their BIT token holdings. Although some wallets may be holding a portion of allocated BIT tokens, the data shows consistent sell pressure on BIT each time it unlocks monthly. Coupled with the low trading liquidity of BIT tokens on platforms such as FTX and ByBit, the constant selling pressure might create even more downward pressure on prices.

| Unlock Date | BIT 1W Change Since Unlock Date | BTC 1W Change Since Unlock Date |

|---|---|---|

| 15 Apr 2022 | 8.6% | -0.5% |

| 15 May 2022 | -6.0% | 0.75% |

| 15 Jun 2022 | -9.1% | -9.95% |

Yield Guild Games (YGG)

(Website / Twitter) Data as of July 5, 2022

MC: $56.5m FDV: $643.4m FDV/MC: 11.3x Chain: Ethereum Next Expected Unlock Type: N/a % of Total Supply Unlocked: N/a Next Expected Token Release Date: N/a Futures Platform (24h Trading Volume in USD): OKX - $6.3m (Data as of July 11th, 2022) Smart Alert: Template

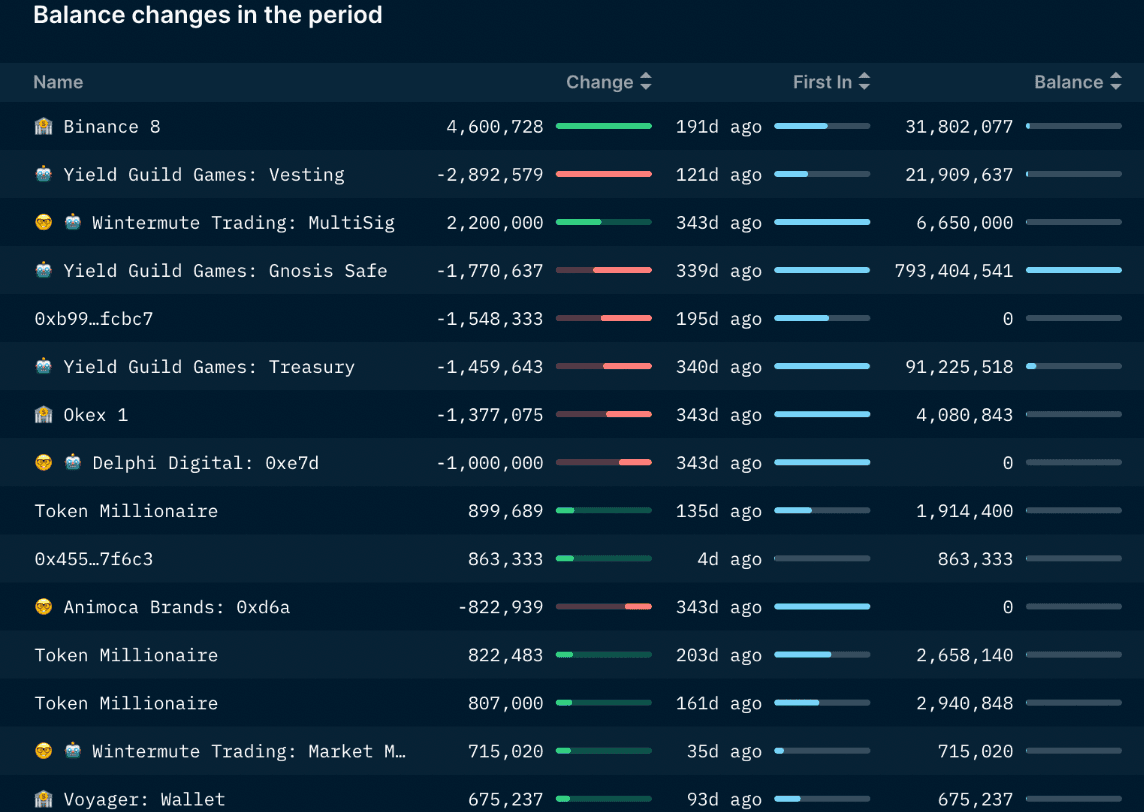

Token Movements (last 3 months)

Known investors in the private rounds

- Delphi Digital, BlockTower, Scalar Capital, Youbi Capital, Ascensive Assets, gumi Cryptos, Animoca Brands, Dialectic, Sparq Ventures, Bitscale Capital, Flamingo DAO, A16z, Kingsway Capital, Infinity Ventures Crypto, Atelier Ventures, Parafi Capital, Fabric Ventures, SevenX Ventures, Tagus Capital and Gabriel Leydon

- Seed Round and Second round

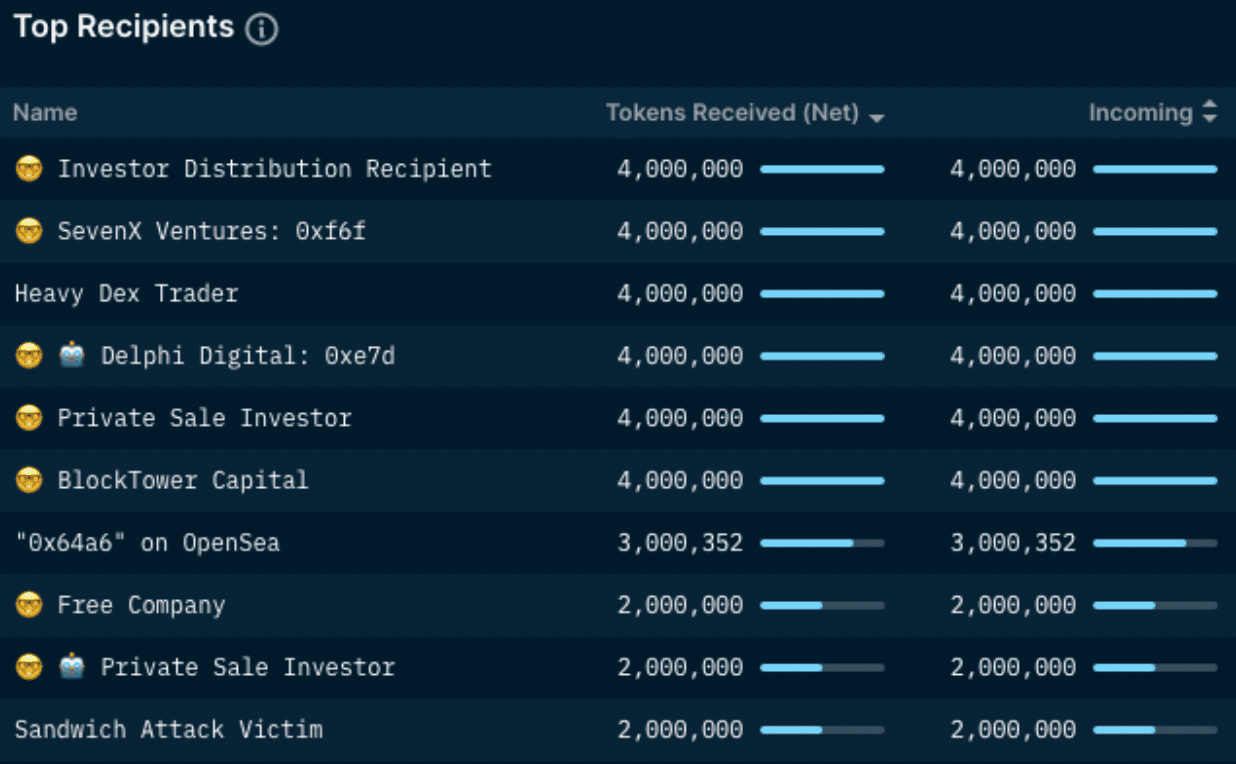

- Top Recipients of Disperse contract

- Contains seed investors + flows of their tokens

- Vesting Contract 2 (active)

- Still releases smaller amounts of tokens that are often being sold

Historical Investor Behavior

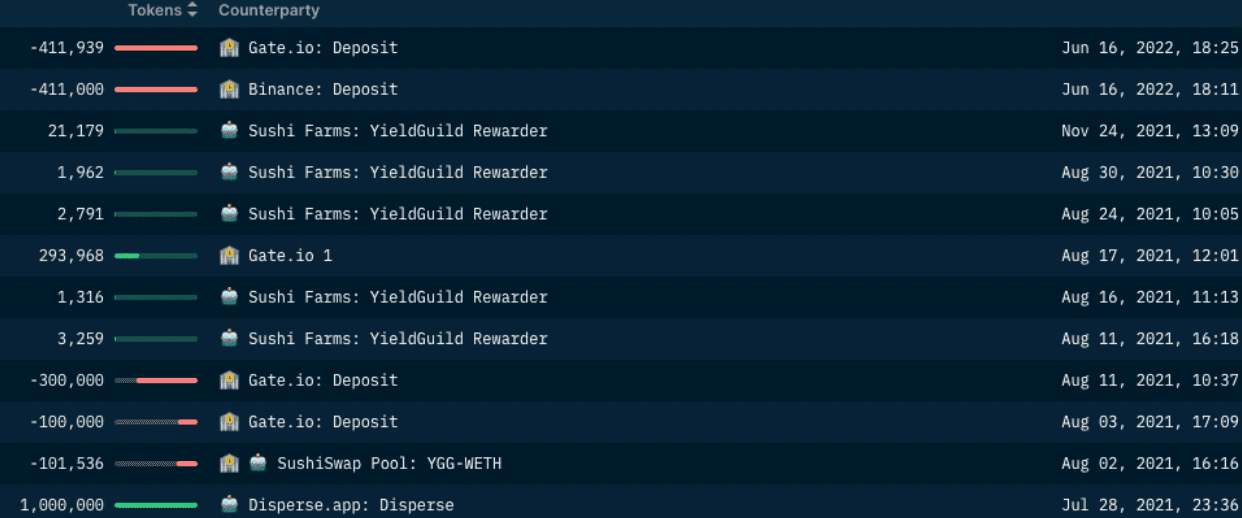

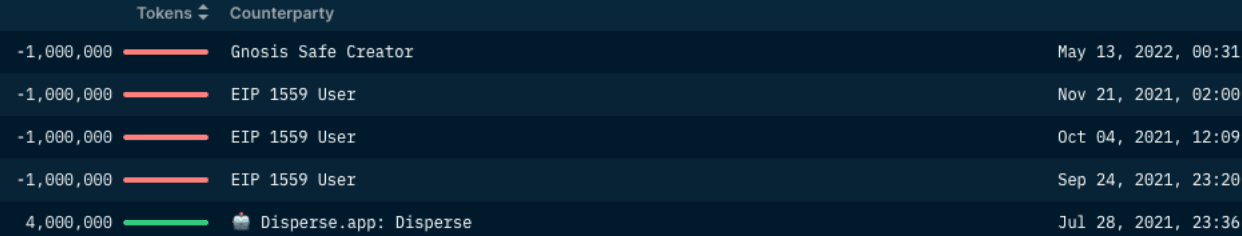

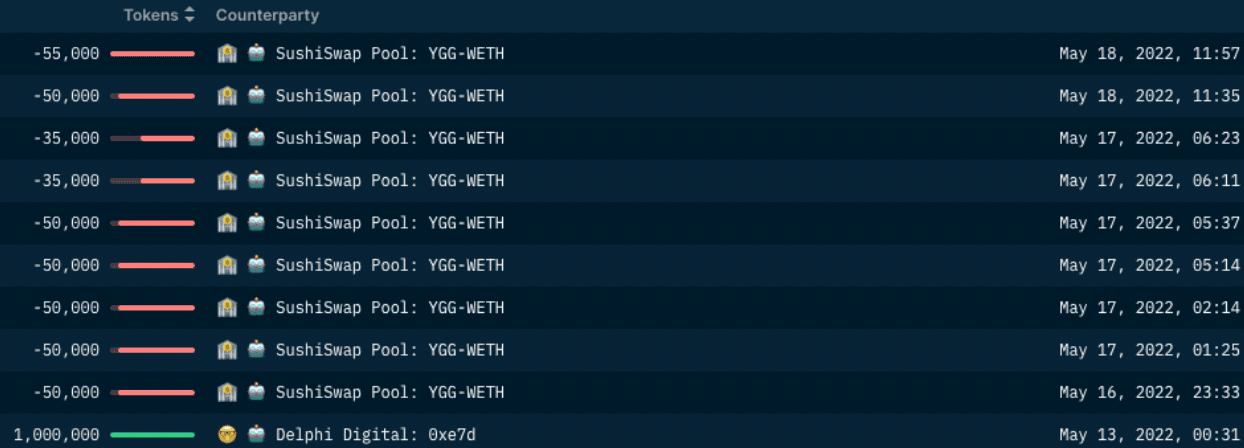

Most of the seed round investors have exited their positions fully in 2021. Many received 4m YGG tokens and have sold them into DEXs or sent them to a CEX, some are still selling their tokens as of May of 2022.

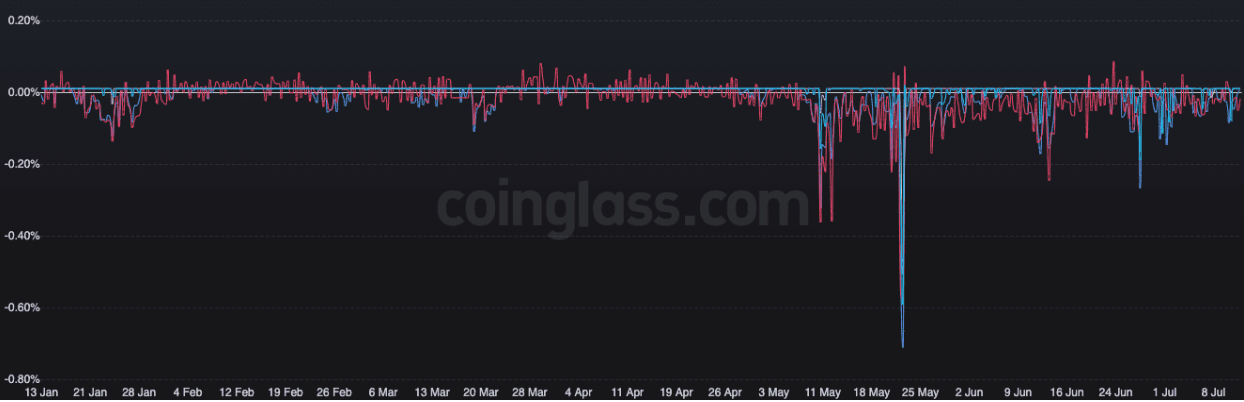

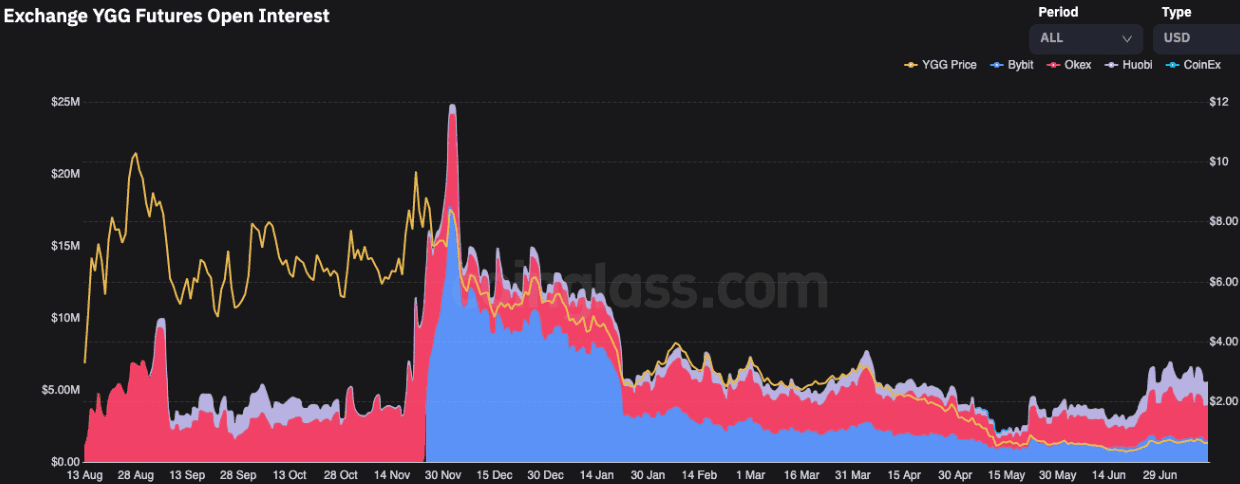

Takeaway

YGG is down 95% from ATH and the perpetual market has been relatively negative (shorts are paying longs) over the past 2 months as can be seen here. Most of the investors have either already sold their tokens in 2021 or are continuing to sell. However, the gaming sector and the YGG perp market may be hard to navigate given the extremely high FDV/MC and publicized investor unlocks.

| Guild | FDV/MC |

|---|---|

| Yield Guild Games | 5.4 |

| Avocado DAO | 39.3 |

| Merit Circle | 6.9 |

| GuildFi | 14.57 |

Source: Coingecko, Data accurate as of Jul 12, 2022

Vega (VEGA)

(Website / Twitter) Data as of July 5, 2022

MC: $32.5m FDV: $102m FDV/MC: 3.1x Chain: Ethereum Next Expected Unlock Type: N/a % of Total Supply Unlocked: N/a Next Expected Token Release Date: Series A -weekly/monthly linear release Futures Platform (24h Trading Volume in USD): N/a Smart Alert: Template

Token Movements (last 3 months)

Vesting Schedule and Recipients

The main vesting contract can be found here, which currently holds a balance of $102m worth of VEGA, having first received funds in July 2021. The vesting wallet releases tokens across a number of the known investors very frequently - there is no known pattern according to the vesting schedule.

Known investors in the private rounds

- Seed Funding Pantera Capital (lead), Hashed, NGC Ventures, gumi Cryptos Capital, Rockaway Blockchain, KR1, Eden Block, Focus Labs, Greenfield One, Monday Capital and RSK Ecosystem Fund

- Series A Arrington Capital and Cumberland DRW (leads), Coinbase Ventures, ParaFi Capital, Signum Capital, CMT Digital, CMS Holdings, Three Commas, GSR, SevenX Ventures, Zee Prime Capital, DeFi Alliance, Stani Kulechov, Mona El Isa, Do Kwon and Loi Luu.

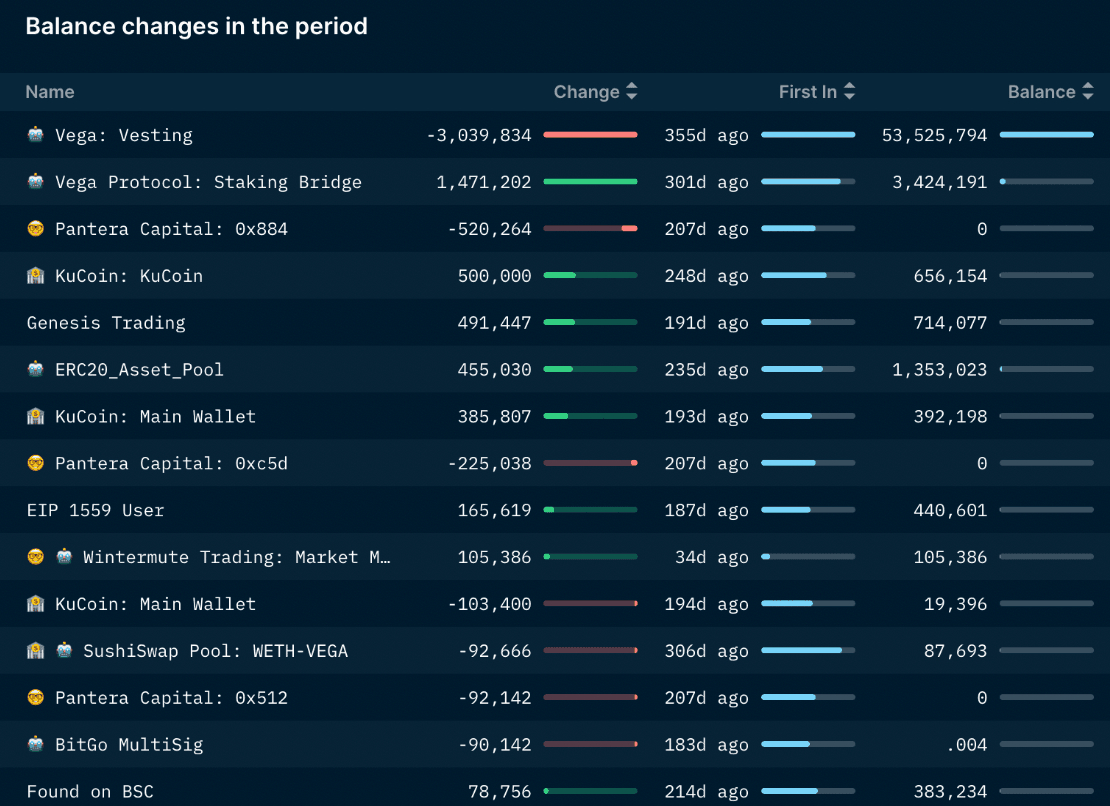

Historical Investor Behavior

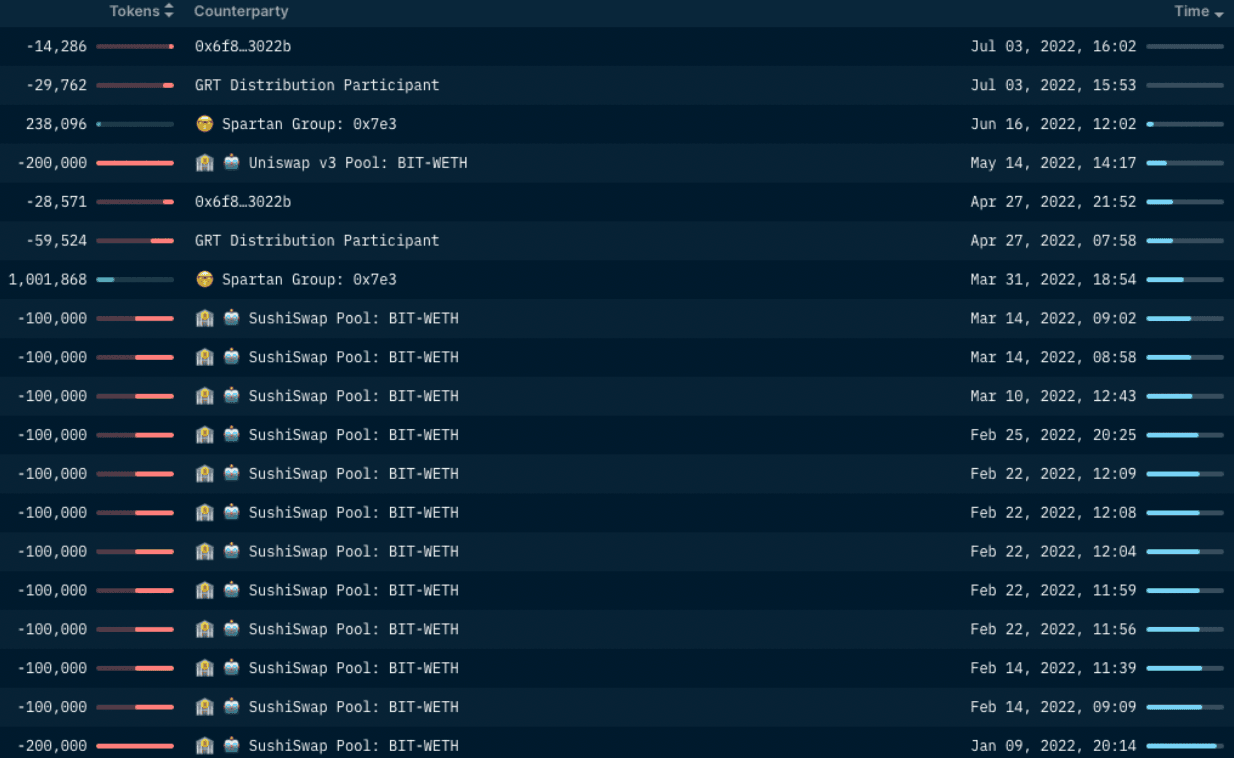

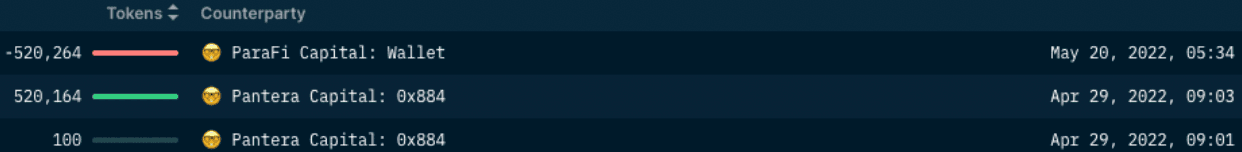

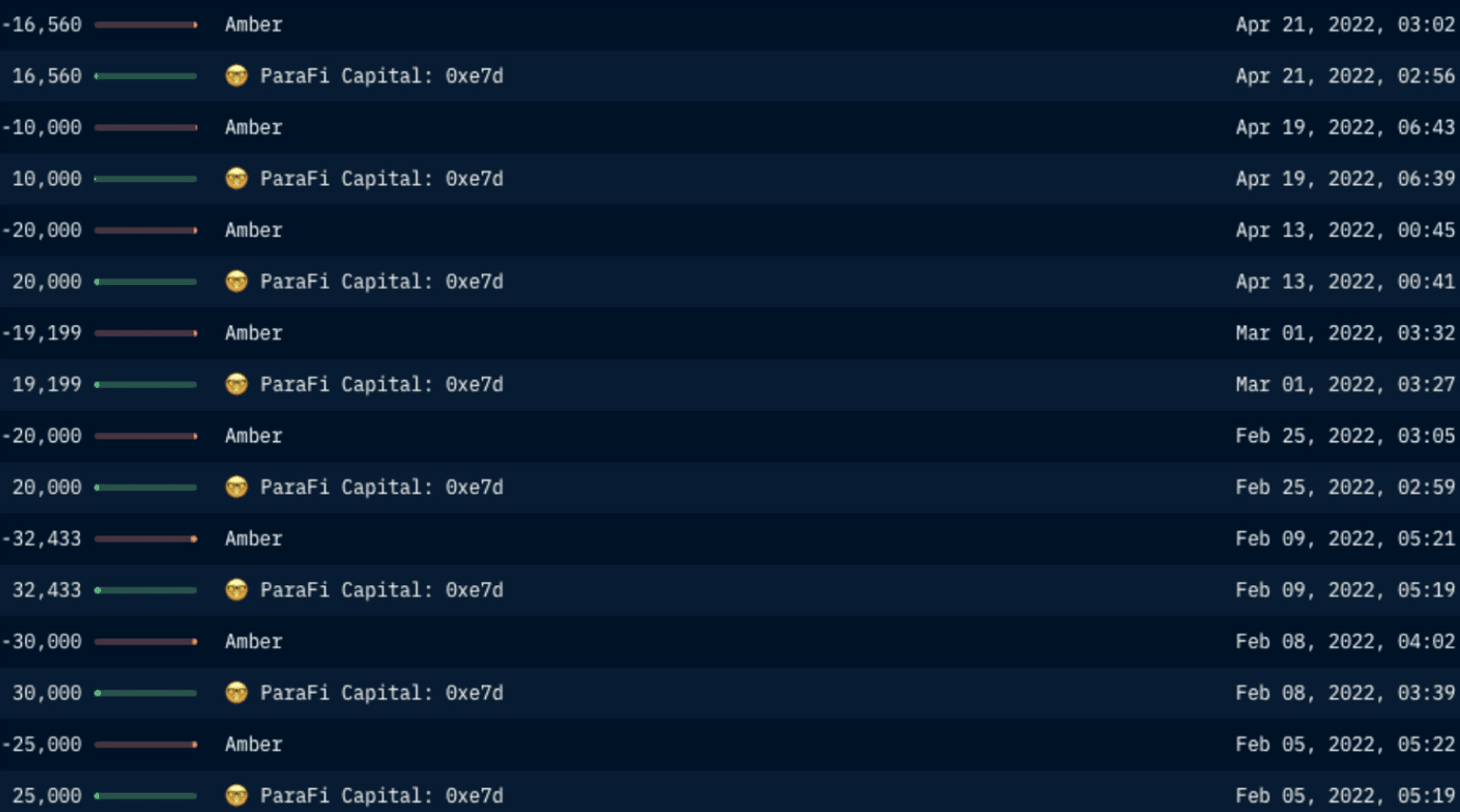

Pantera Capital Pantera was the lead investor in Vega’s seed round back in 2019 and they have received 7.35% of the outflows from the Vega vesting contract here. So far, the total tokens received by Pantera across 3 tagged wallets is a net inflow of 837,434 VEGA tokens - over $1.3m at today's prices.

After a period of not selling any tokens, Pantera then transferred these VEGA tokens to ParaFi Capital’s wallet, after which ParaFi then sent the funds to KuCoin (presumably to be sold).

Gumi Crypto Capital Gumi participated in both funding rounds - seed and series A. Gumi received funds from the vesting contract and later sent its fund to Genesis Trading.

KR1

KR1 participated in both funding rounds - seed and series A. They have not been selling their rewards, but have been consolidating their tokens here or have been staking their VEGA.

Signum Capital Signum participated in the series A round. They have been consistently sending their tokens to Kucoin or using DEXs such as Sushiswap or Uniswap in return for stablecoins. You can track the wallet here which may make some transfers to other wallets before selling.

CMS They participated in the Series A and mostly continue to dump to Kucoin or Gate.io from this wallet. Sometimes they stop at an intermediary before proceeding to sell into a DEX like CrocSwap.

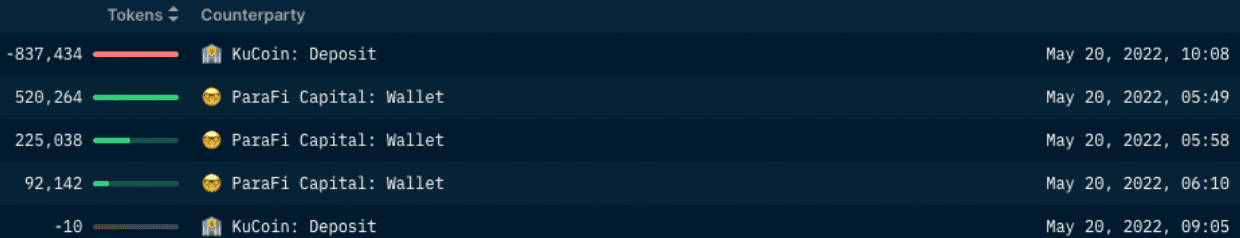

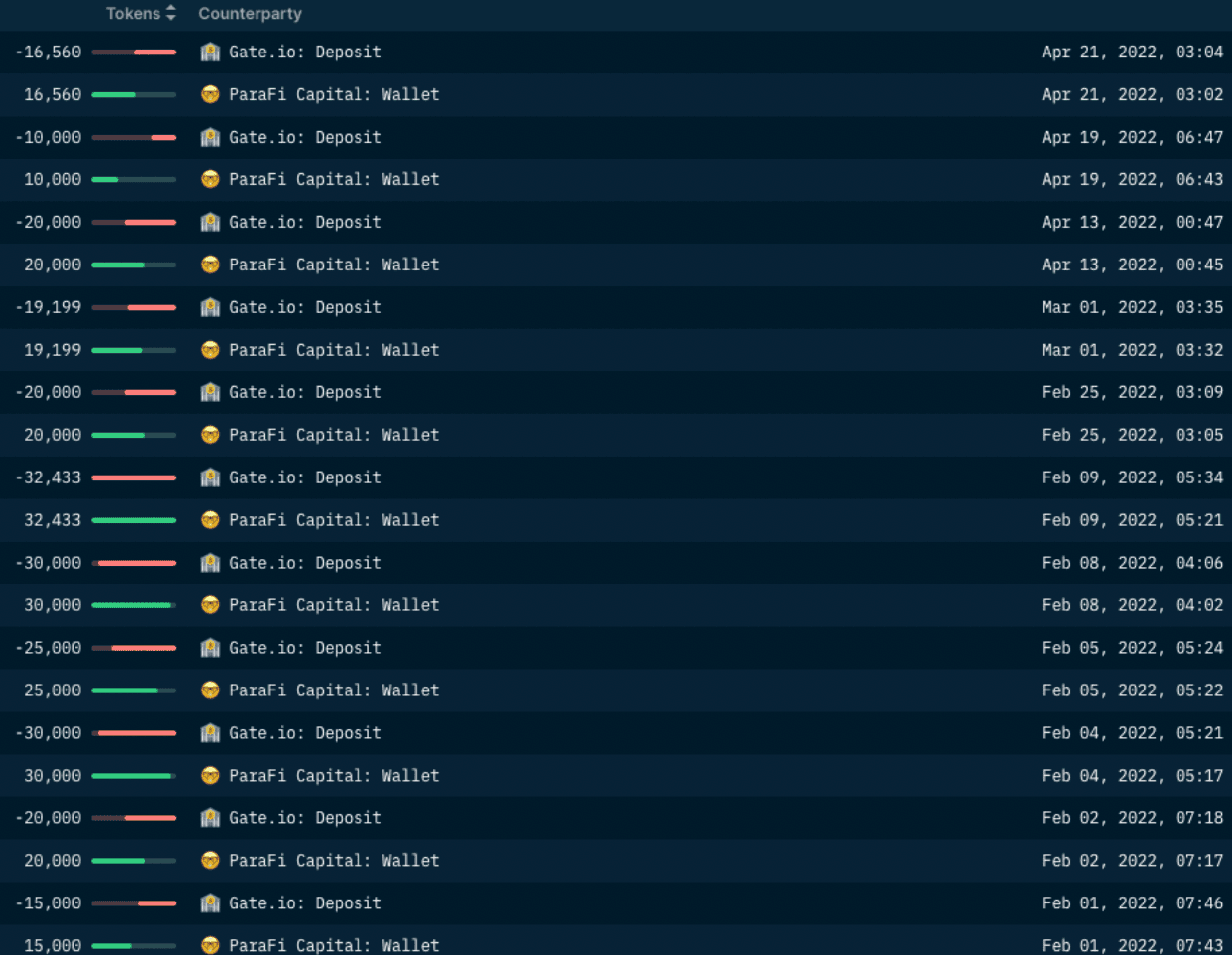

Parafi Capital ParaFi participated in the Series A and have recently been selling their VEGA using aggregators like 1inch. As mentioned earlier, ParaFi also received VEGA tokens from Pantera Capital, which they sold on KuCoin almost immediately.

Interestingly, the data shows a constant outflow of VEGA tokens from ParaFi to Amber, and through Nansen’s wallet profiler for token, it shows that Amber are sending these tokens to Gate.io as soon as they receive the tokens.

Takeaway

Vega investors, across both rounds, seem to be presumed selling shortly after receiving the tokens. Although some vesting funds are sometimes being staked or held such as with Arrington Capital or KR1, the overwhelming theme is constant selling via a DEX or CEX within days of receiving funds. The lack of VEGA perpetual futures and lending markets make this a less actionable opportunity for investors that do not yet own any VEGA tokens.

Dodo (DODO)

(Website / Twitter) Data as of July 5, 2022

MC: $43.8m FDV: $122.5m FDV/MC: 8.92x Chain: Ethereum Next Expected Unlock Type: N/a % of Total Supply Unlocked: N/a Next Expected Token Release Date: N/A, continuous releases Futures Platform (24h Trading Volume in USD): Binance - $9.7m (Data as of July 11th, 2022) Smart Alert: Template

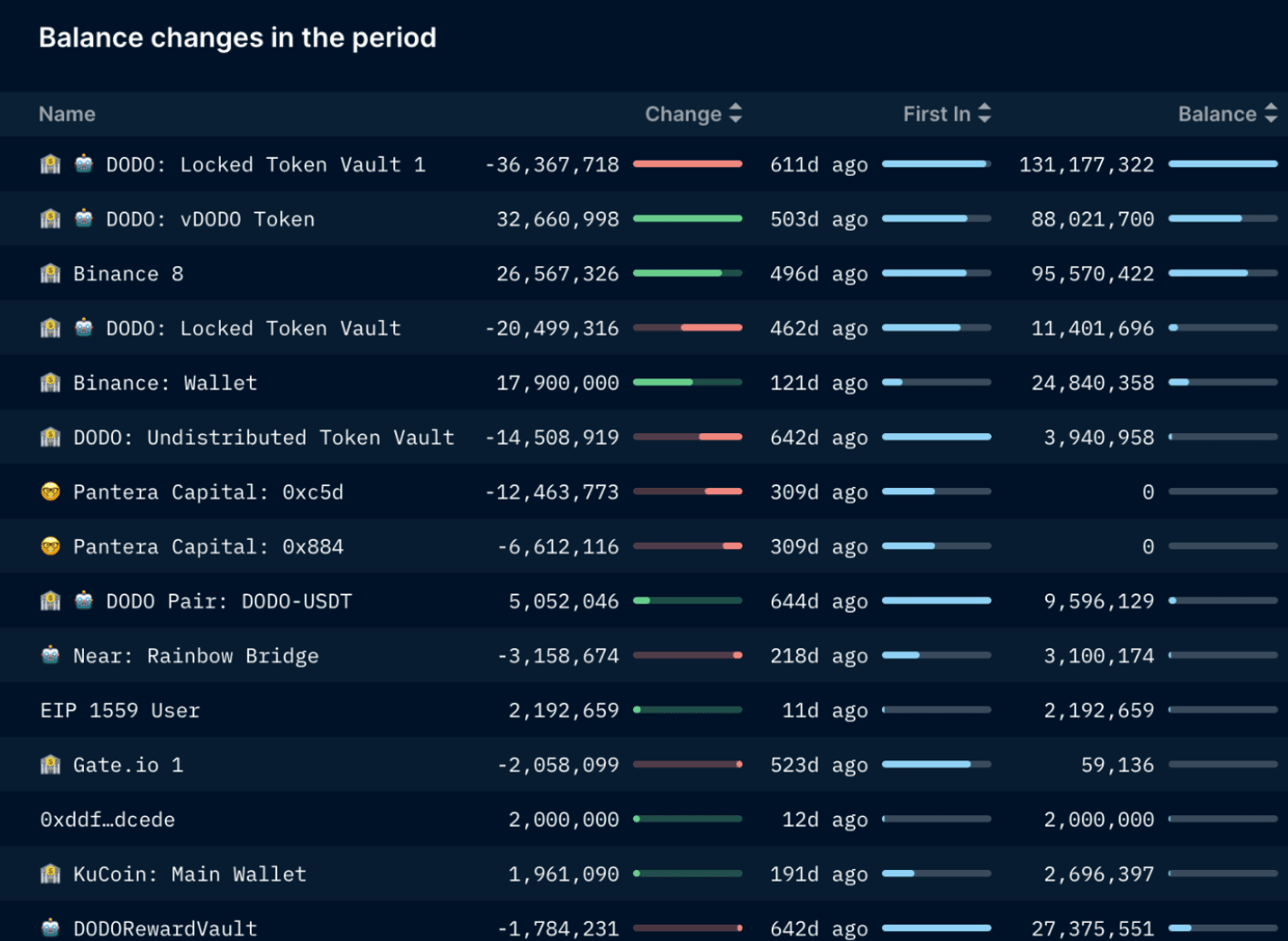

Token Movements (last 3 months)

Known investors in the private rounds

Seed Funding ($600k round @ $10m valuation - $0.01/DODO, Investors are up ~11x)

- Framework Ventures, DeFiance Capital, SevenX Ventures, Coinbase Ventures, Galaxy Digital, Alexander Pack, Robert Leshner and CoinGecko founder Bobby Ong

- 1 year lock up and released linearly for the next 2 years (ending in September 2022)

Private Sale Round ($5m round @ $50m valuation - $0.05/DODO, Investors are up ~2x)

- Pantera Capital, Three Arrows Capital, Binance Labs (leads), Galaxy Digital, and Coinbase Ventures

Historical Investor Behavior

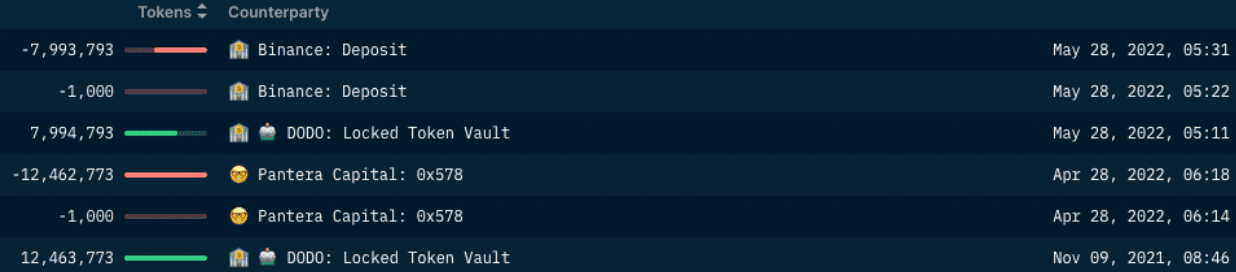

Pantera Capital Pantera co-led the private sale round and is up a little over 2x at today's prices. With that being said, there is some on-chain data that points to potential selling. As seen in this wallet, the vested tokens were presumably dumped within 15 minutes of receiving them. As for previous vestings received, they have been dispersed through multiple wallets before ending up in Binance which can be seen here (Pantera + ParaFi).

Framework Ventures Framework led the seed round and is up over 11x at today's prices and they dumped a significant amount of tokens back in March at a price of $0.54, a 54x on their entry price.

SevenX Ventures SevenX Ventures participated in the seed round at an entry of $0.01/DODO. They have been consistently sending their tokens to Binance since May 2021 - this makes up a majority of their DODO exposure with the exception of a small amount of DODO bridged over Celer. This frequent selling behavior can be seen here.

Galaxy Digital Galaxy Digital participated in the seed round at an entry of $0.01/DODO. They have also been consistently selling their tokens since December 2021 as can be seen here and more recently, sending to Kucoin (2 hops before it hit this wallet).

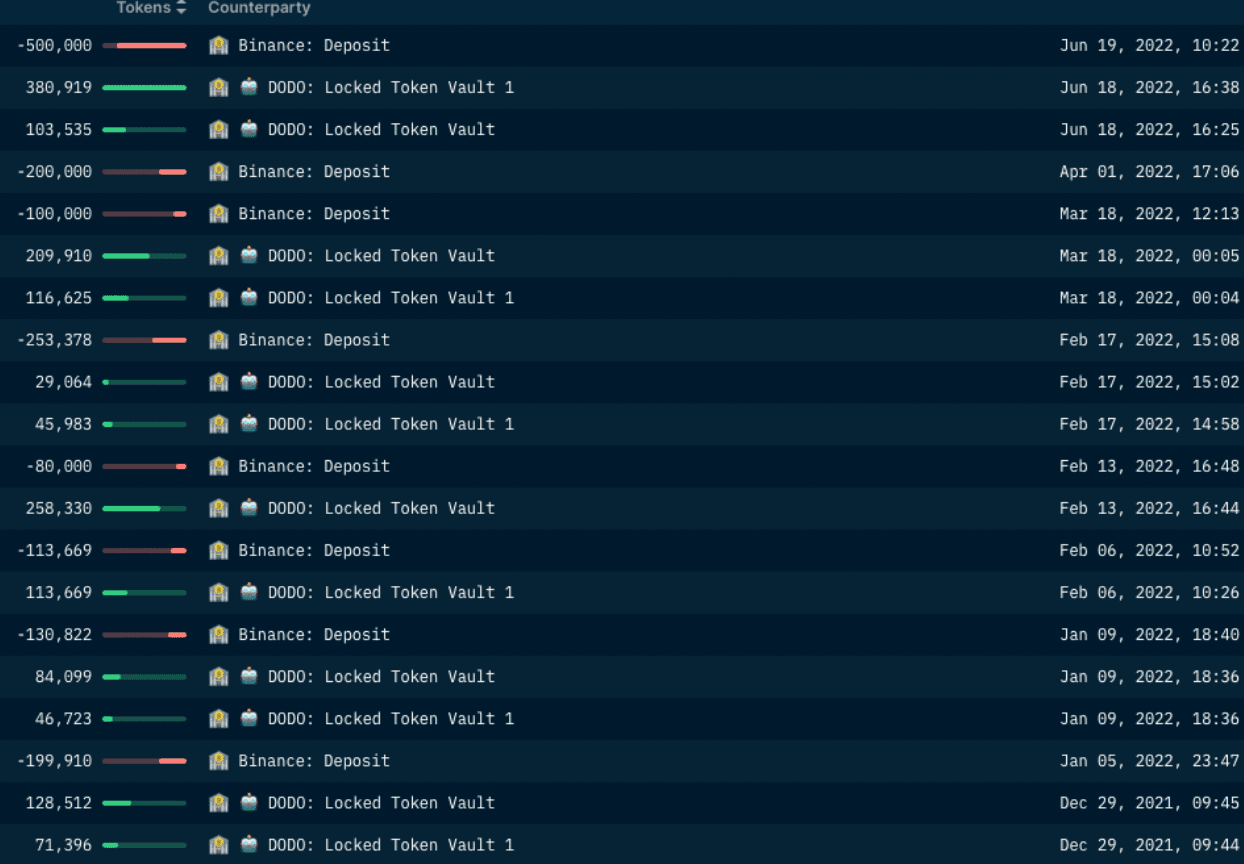

Defiance Capital Defiance also participated in the seed round and appears to be sharing the same play as SevenX where they send all their tokens to Binance as soon as they receive them.

Source: Nansen Wallet Profiler for Token (Defiance sending DODO tokens to Binance)

Takeaway

This does not cover all of the funds, which can be viewed here. As seen with some of the seed and private sale investors, most investors have been presumably selling all of their tokens using CEXs such as Binance, as soon as they receive them. Although DODO is down almost 99% from ATH, investors are still up 2x (at a minimum). One thing to note is that DODO’s FDV is still 8.92x compared to its market cap, which could imply further downside risks. Since the vesting schedule of the Seed Round is estimated to end in Sept 2022, and the data shows that larger funds are constantly dumping the tokens when they receive them, this could be an attractive shorting opportunity.

Woo Network (WOO)

(Website / Twitter) Data as of: July 5, 2022

MC: $178.3m FDV: $502.9m FDV/MC: 2.81x Chain: Ethereum Next Expected Unlock Type: N/a % of Total Supply Unlocked: N/a Next Expected Token Release Date: N/a Futures Platform (24h Trading Volume in USD): Phemex - $5.7m (Data as of July 11th, 2022) Smart Alert: Template

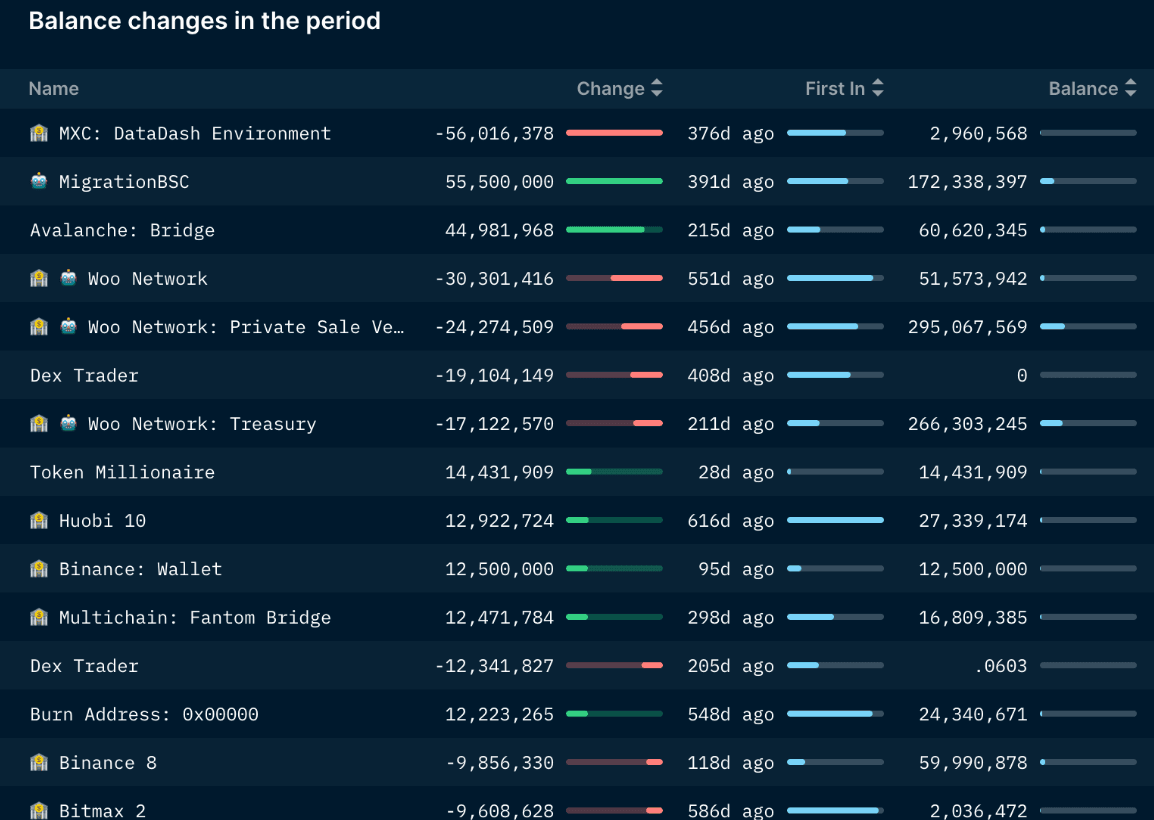

Token Movements (last 3 months)

Known investors in the private rounds

Series A Three Arrows Capital, PSP, Soteria Ventures, Gate Ventures, QCP Capital, and Crypto.com Capital. Other participants included AscendEX, AntAlpha, MEXC Global, LBank, Fenbushi Capital, BitMart, 3Commas Capital, TokenInsight Research, AVATAR and ViaBTC Capital.

Historical Investor Behavior

Three Arrows Capital 3AC has had some issues and is speculated to be insolvent. Although nobody knows the full extent of their situation (until more information is released), this report can look at their on-chain behavior, especially when it comes to their portfolio companies where this report tracked the specific vesting schedules. Looking here, the data shows that 3AC has consistently been sending their vested tokens directly to Binance. The vesting appears to be released on a linear weekly basis.

QCP Capital They are also presumably selling small amounts of WOO and are moving large amounts of WOO tokens using this wallet.

Fenbushi Capital Fenbushi took part in the Series A round and has been receiving WOO since October 2020. You can track Fenbushi’s wallet here and see the flow of tokens move from Woo Network to Huobi or OKX nearly immediately. Token flows that immediately go to CEXs can signal intend to sell the given token. Apart from Fenbushi, other investors continue to send tokens to CEXs as well, further indicating potential intend to sell across the early investor basis. Some of the other investors can be tracked using the top recipients dashboard here where the data shows private sale investors potentially dumping their tokens.

Untagged wallet This notable wallet received large amounts of WOO and started sending tokens to Binance on June 26th, 2022. It might be worth setting up a smart alert for when this wallet deposits tokens to Binance again as it may have an impact on price.

Takeaway

Woo Network has a lot of potential selling pressure from its investors and a considerably high FDV. From the few investors analyzed here, it is clear that there is a lot of selling shortly after receiving the token. Factoring in some funds which made considerable returns on their initial investment or known to be be in need of funds, the selling tendencies of these investors may continue. Thus far, the WOO token is down 90% from ATH and CEXs have lots of volume regarding WOO futures markets.