About Resolv

Resolv is a protocol maintaining USR, a stablecoin natively backed by Ether (ETH) and pegged to US Dollar.

The protocol's main features include:

- Issuance and redemption of USR against other tokens;

- Maintaining sufficient backing by ETH at all times. This is achieved by hedging ETH price with short perpetual futures positions;

- Maintaining RLP (Resolv Liquidity Pool), a liquid insurance pool designed to keep USR overcollateralized.

Both USR and RLP can be minted and redeemed by users in exchange for collateral deposited on 1:1 basis.

Resolv collateral pool holds stable value in USD terms. In addition, it accrues profit from staking Ether and maintaining futures positions, similar to Ethena.

Source: https://docs.resolv.xyz/litepaper

USR runs a point program, and an airdrop is announced for Q1. Similar projects with a points + airdrop strategy have been Ethena and Usual, both with very successful airdrops for (Pendle) YT buyers.

USR YT on Base

Performing various actions within the Resolv ecosystem earns you points, most notably simply holding USR ($1) earns you 30 points per day (no additional yield for unstaked USR), holding 1 RLP (~$1.16) earns you 10 points and holding staked USR ($1) 5 points (plus yield from the protocol). Depositing into various protocols also yields in most cases between 10 and 30 points per $1 capital.

One notable exception is the Pendle Yield token on Base (learn more about Yield Tokens here). Buying $1 of YT currently gives you exposure to $21.5 worth of points where for each dollar you get 60 points per day (double the amount of just holding it!) until 23.02.2025 and then 45 points per day until maturity on 24.04.2025. After that, you will have earned and kept the points, but the YT will have expired (be worthless). Let’s take a deeper look.

It has to be noted, that due to the asymmetry in holding USR = 30 points per day and holding USR through YT = 60 points per day, the pendle yield could likely be somewhere in-between - PT buyers (farmers) might get more then their 30 points a day is worth, while at the same time YT buyers (airdrop speculators) might need to pay less for their 60 points.

Points Boosts

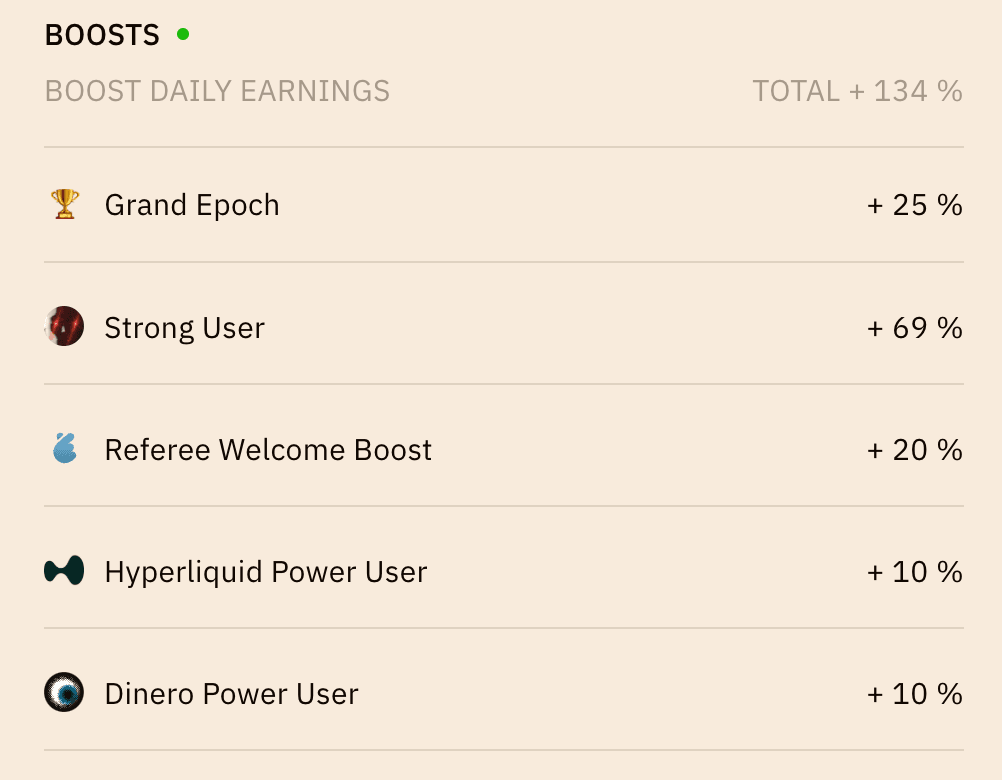

Before estimating the return on a YT, it has to be noted that Resolv offers additional points multipliers to boost your points earnings. I find the two-wallet strategy particularly attractive:

- Generate a referral link with Wallet A

- Use this link for Wallet B, where you actually farm the points

- Wallet A gets 10% of Wallet B’s points and Wallet B gets a 20% Welcome Boost

Then perform various tasks with these wallets, notably depositing funds on Hyperliquid buying pxETH on Dinero and using 10 ways to earn points on Resolv (for max boost). Using low gas options is especially efficient, for example most apps on Base, simply holding the tokens or depositing into Curve pools (you can do one sided deposits to minimize transactions) all of this can be done with minimal capital (i.e. $1-3 each) to earn the boosts. You can also buy an NFT for even more, but personally I don’t think it’s worth it.

Your max boost will look something like this:

On top of the above boosts, there is also the 10% that you get on wallet A as referral bonus, and another ~10% if this Wallet A has maxed out the boost (can also ~2x the referral points). This gives you a total of over ~150% points bonus (a 2.5x on points) and is absolutely worth the effort.

Points to be Earned Per YT

Going forward, we assume the airdrop is quite late in order to keep up the hype, but not so late as to not deliver on their promise of Q1, and estimate it around 20.03.2025. This would give you (from 05.02.2025) 18 days with 60 points and 45 days with 45 points for your YT. With a 2.5x points multiplier and 21 USR exposure per $ YT, you get a total of ~118k points for 1 USD until the airdrop.

Estimated Value Per 1k Points

First off, we need to understand how many points there are in total. There are no official numbers, so let’s do a rough estimation. Assuming an average multiplier of 1.8 and an average 30 points per USR and 10 points per RLP (neglecting the other ways to earn points since most require RLP or USR in some way and also get around that amount of points), we can get an idea of how many points there are by using USR and RLP market caps. The chart below depicts the total TVL as a stacking area plot (meaning all the blue area is USR and only the small green area is RLP).

USR has seen impressive growth going into 2025, but stagnated a bit. Which is not great for the protocol but helps with points dilution (there is no cap on points, the more people use USR, the more points are minted and the more you get diluted).

Extrapolating the points, you have a rough estimate of around 1.2 trillion points currently, with around 31 billion new points daily.

As market caps of USR and RLP seem to stagnate, we assume the 31 billion new daily points to remain relatively constant until the airdrop and arrive at ~2.5 trillion points at 20.03.2025.

For the valuation we draw parallels to Ethena, where currently TVL is ~$6b and FDV is also around ~$6b. Applying this to Resolv results in a ~$500m FDV. With usually ~10% of the supply being airdropped and assuming linear airdrops per point, this leaves us at around $0.02 per 1k points in case of an airdrop on 20.03.2025.

Running this estimation results in around $2.36 airdrop per $1 YT on Base right now. It has to be noted, that USR has no native yield, so the associated Yield Token will likely drop dramatically in value after the airdrop is distributed (if they don’t introduce the next airdrop immediately like Ethena did). Hence the estimated $2.36 is likely all you get. If you are confident in timing the airdrop, you might be able to sell your YT before that and get most of the $2.36 plus whatever you can salvage from the Yield Token (assuming ~$0.40-$0.60 if well timed).

However, this calculation is by no means investment advice and the scenario is not an exact look into the future and still contains various big assumptions, the largest unkowns and risks being:

- Will the overall crypto market hold up?

- Will USR stagnate until the airdrop? Will it grow, will it decline?

- Will the airdrop actually happen in Q1?

- What will the valuation be and how much of the supply will actually be airdropped?

- Will the team introduce (more) dilution by delaying something, launching a new boost / pool with more points etc.?