Introduction

Given the bearish breakdown on many timeframes across majors, the team still remains neutral to bearish in the short term, yet bullish in the long run. The weekend reserve announcement was not one to suggest a reversal of the trend, it simply put BTC back at the bottom of its previous range. Given the illiquid nature of the Sunday announcement and the lack of clarity about the “reserve” implementation leaves much to be desired. Given this, what is next for the market, and what actions can be taken this week?

Key Takeaways

- BTC is still trading within a range, having now cleared below the 91k level for a second time, now trading around ~$85k. Despite BTC headwinds, there are many positive developments including an ever increasing positive regulatory environment, stablecoin growth, RWAs and institutions moving onchain.

- Consistent underperformance across many sectors and increased signs of dispersion with select winners. A few outliers that outperformed BTC included XRP and MKR. As for L2s, they are showing very gloomy price action with 40+% declines YTD, showing the most weakness across the sectors along with a basket of high MC AI tokens.

- Activity on mainnet is the lowest it has been in over a year, as measured by median gas consumption, sitting at nearly 1 GWEI at the time of writing. A different story for L2s, with Base leading here with its activity stabilizing ahead of exciting catalysts including 10x faster block times via Flashbots, L3 app-chains and continued rollout of smart accounts.

Dispersion Across Sectors

Below we map out the YTD price performance (%) across multiple sectors to see which tokens are showing strength or relative weakness into the new year.

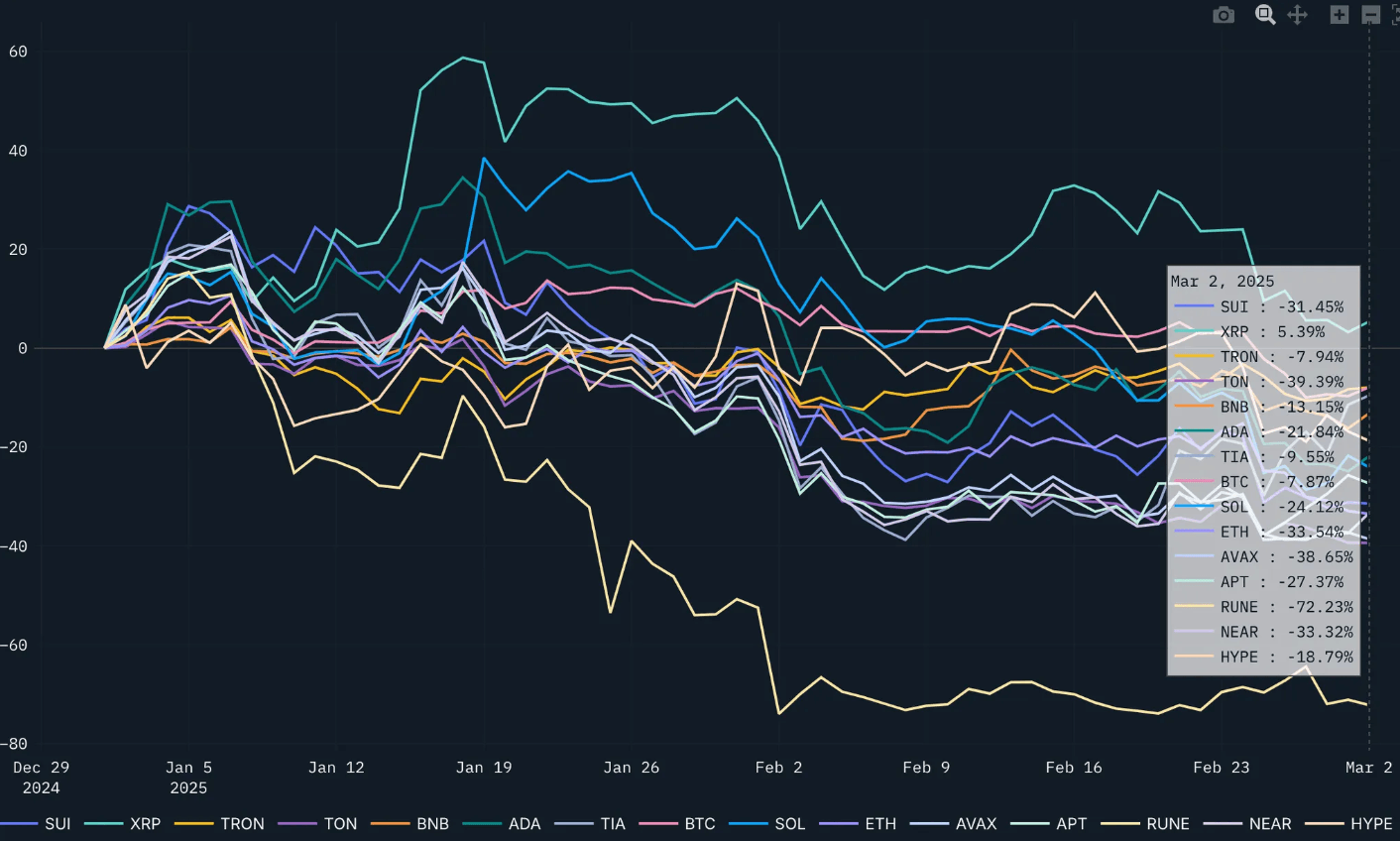

Layer 1s

Underperformance across the board with most L1s down double digit percent YTD with the only outlier being XRP (5.3%). The other notable tokens were BTC (-7.87%), TON (-7.94%), and TIA (-9.55%).

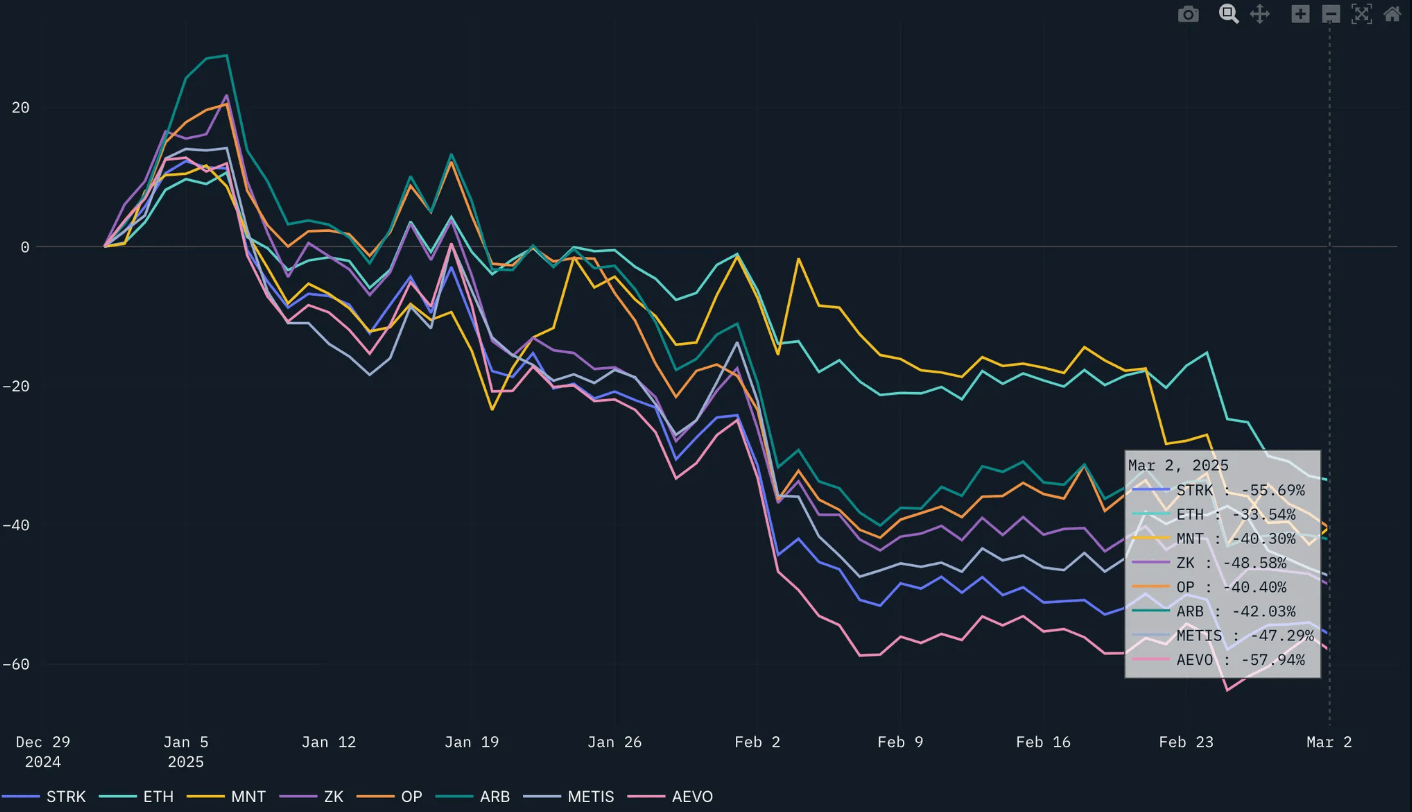

Layer 2s

Very gloomy picture for L2 price action with severe underperformance, down over a minimum of 40% YTD.

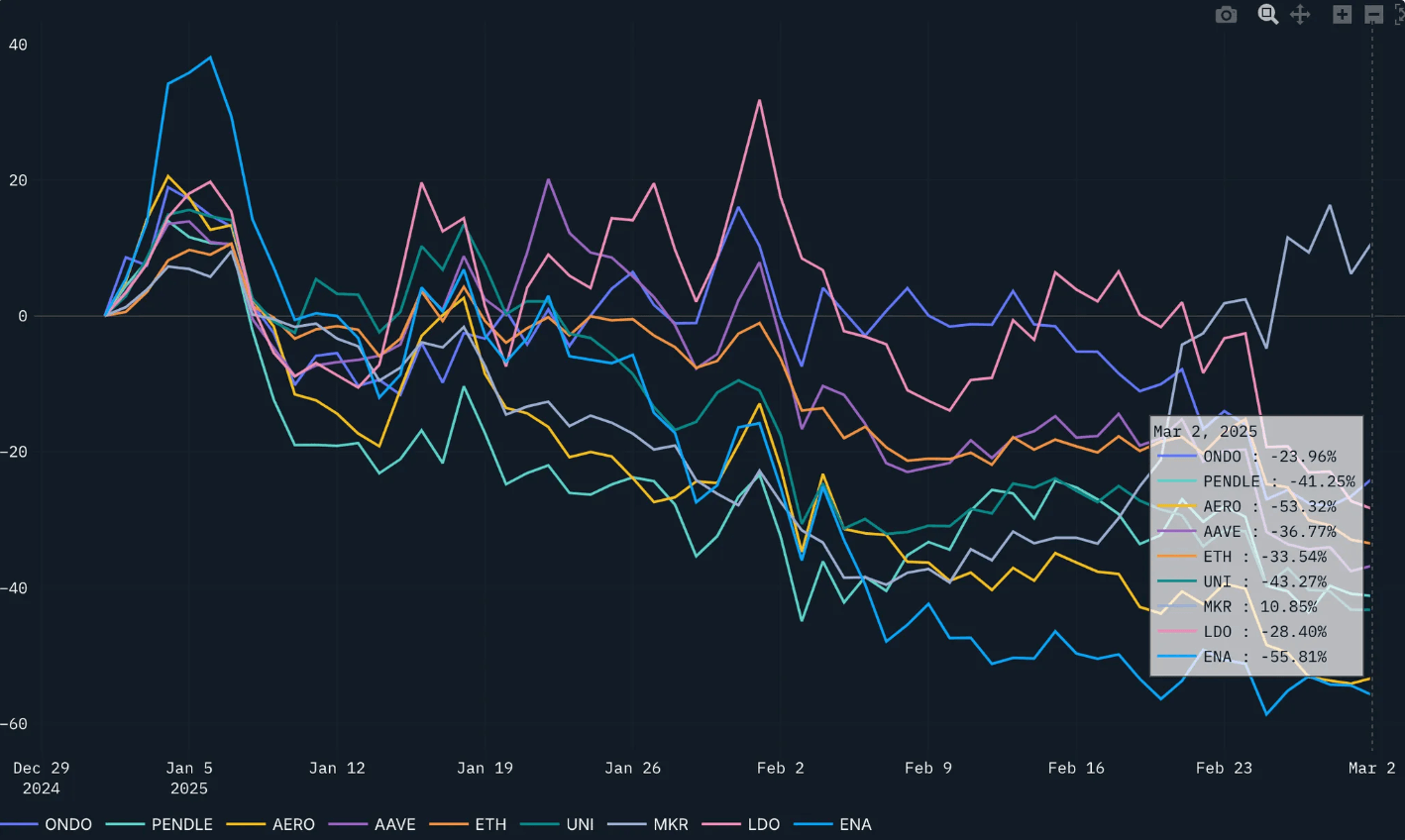

DeFi Tokens

Similar story for the DeFi sector YTD. Everything is down besides MKR which is up over 10.85% and has shown promising growth in USDS as it approached $8b in market cap, having peaking around $9b in February. ENA and AERO the largest underperformers down over 55% and 53% respectively.

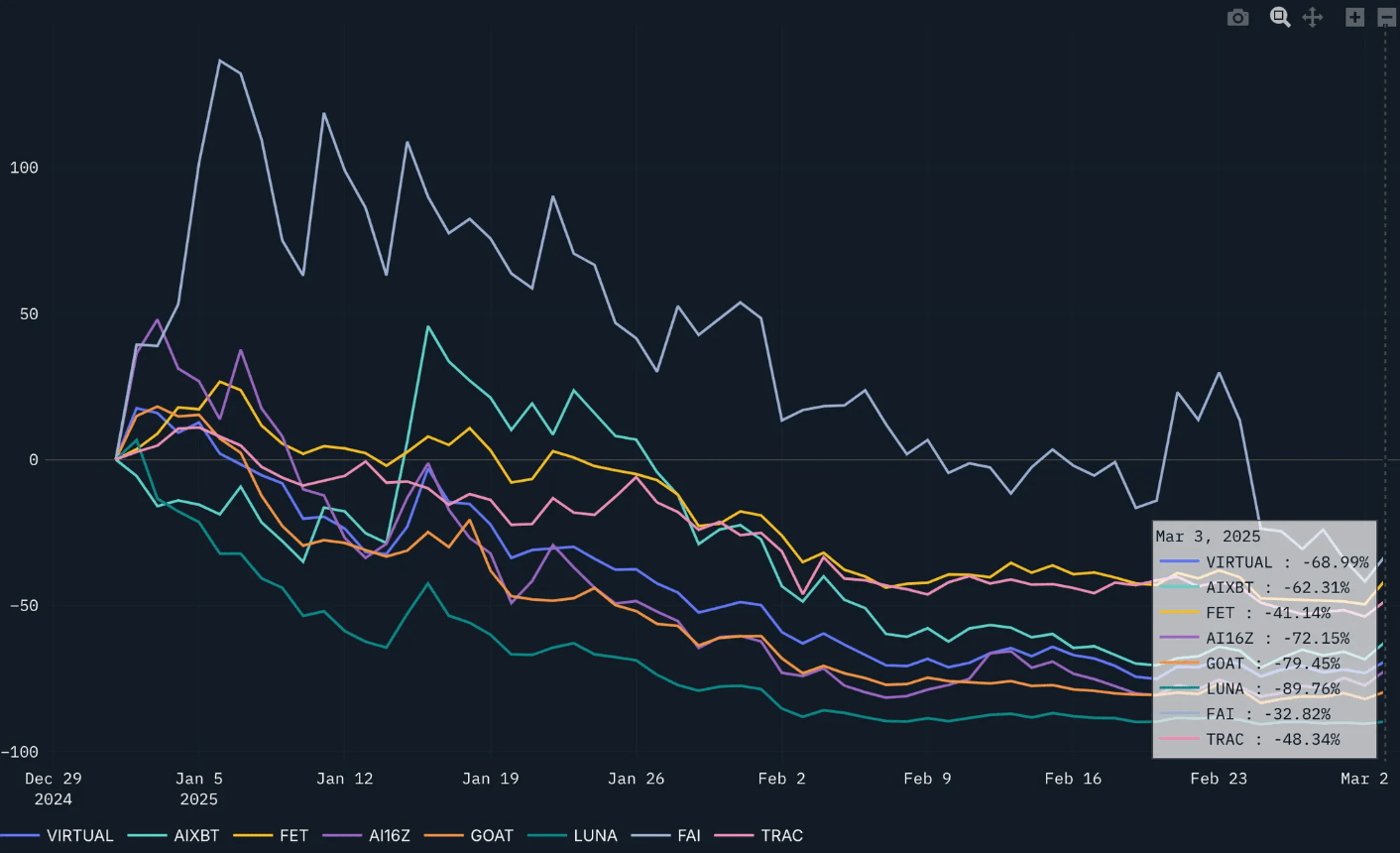

AI Tokens

AI coins also down across the board, some nearly down 90% YTD.

In short, all sectors are underperforming with only two outliers outperforming BTC YTD. This confirms the continued trend of dispersion, with it being a bitcoin led market.

Market Thoughts and Positioning

Many tokens fully retracted the election run-up and may take time to recover. In order to maintain a neutral to bearish position, I am primarily farming with stables and building core positions - it seems like a strong way to both survive and live to fight another day.

- If sidelined, the market is providing a good area to DCA into core holdings over the next few weeks/months if we trade sideways or lower.

- If overexposed, not a bad time to decrease exposure here. Since the presentation, we have begun to retrace much of the move but the thesis behind positioning still stands.

As for market sentiment, my timeline either says this is a bearish retest or we are fully back, take that as you will. BTC is back into its prior range… ETH Denver vibes were mostly short term bearish and long term bullish, in line with how the research team is perceiving current markets.

My overall positioning and bias in the market remains neutral. I am heavily in stablecoins, slowly accumulating BTC/SOL/TIA/HYPE. My levels were mentioned here but the main theme is not chasing any moves until we are clearly back in a trending market. Given this, I am mostly putting my stablecoins to work across a variety of farms, the breakdown is as follows:

- Pendle USR PT

- HLP Vault

- eUSDE PT

- Sky Savings Account

- T Bills / Coinbase USDC

Despite Nansen short term indicators hovering around neutral via the BTC call-put spread and the BTC price momentum (as of yesterday), I am not trying to time to the bottom here and will continue to look for entries into long term holds, while sticking to my key levels. Long term, the tides are shaping up to be very positive for the crypto space at large and I will want to remain exposed for that.