This report reflects the discussions and views shared during our RA meeting. These are personal opinions of the team members and should not be interpreted as financial or trading advice. Readers should conduct their own research and consult with financial advisors before making any investment decisions.

🟠 The team remains constructive but increasingly cautious as key technical levels or BTC get broken to the downside. One analyst is bearish and sitting in cash. Another analyst is starting to review smaller-market-cap tokens that have experienced very large drawdowns to go long with tight stop losses. The third analyst is still relatively bullish on institutional buying and expects BTC to revisit 100k by year-end. We note that “normal” retail and institutions have been a bit more cautious though with generalised profit-taking observed of this year’s asset winners e.g. gold, US AI Tech stocks and BTC.

Market Outlook & Positioning Shifts:

Outside BTC, the desk is tracking where larger flows concentrate—ETH, SOL, HYPE—but with more discrimination on entries:

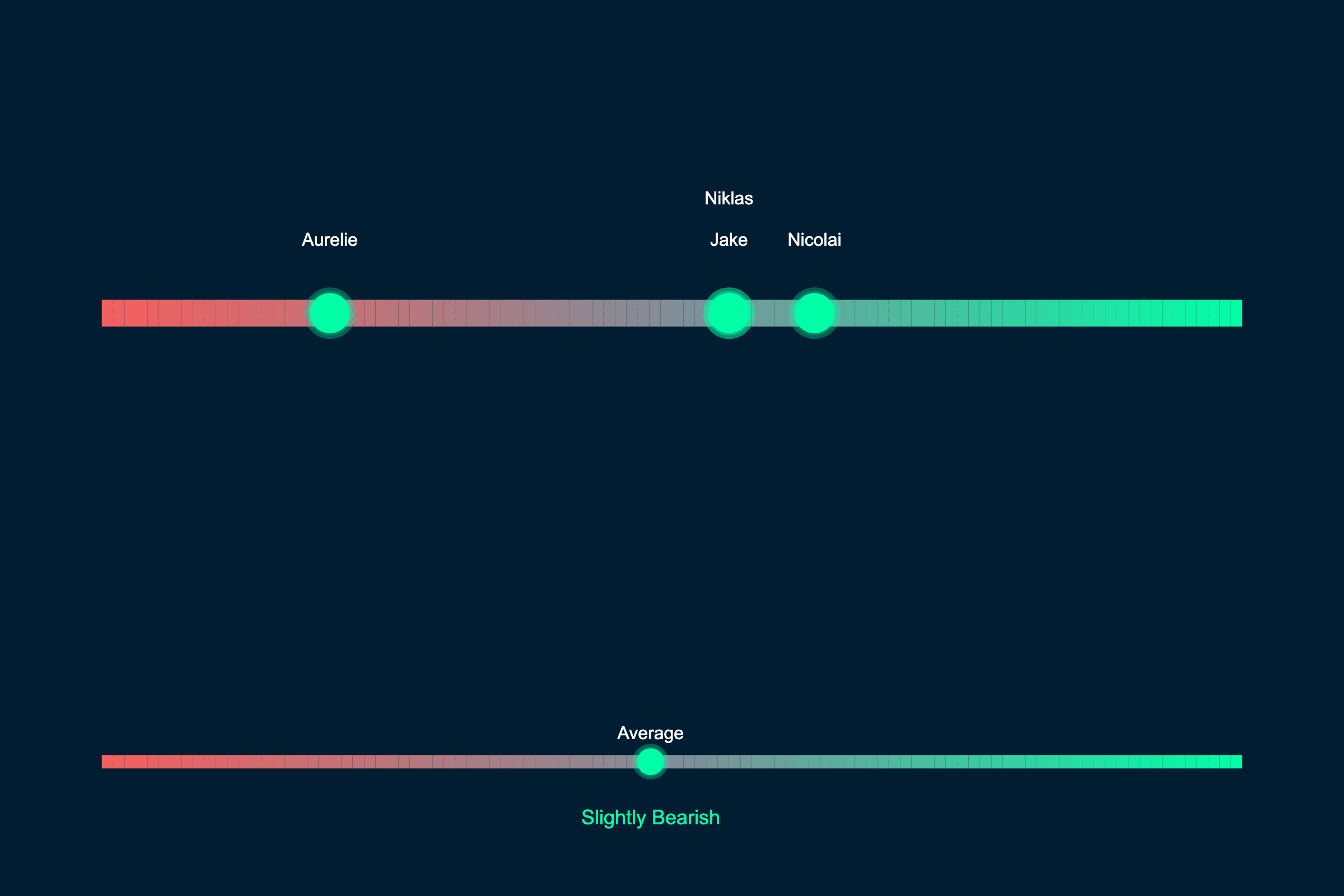

- Aurelie cut crypto exposure materially on Sept 25 and is waiting for clearer technicals/catalysts. Next BTC/USD levels for consolidation are 91k and 70k.

- Niklas read the recent dip as constructive and is turning slightly bullish, starting to DCA back.

- Nicolai: Expecting increased volatility in either direction due to decerased market depth, external factors and optoins structures with +100k being realistic for EOY.

💰 Crypto Positioning Summary:

Mixed convictions in the team: harvest strength, compound stablecoin yields, and buy back high-conviction setups on dips. One analyst is at a minimum-risk allocation pending better signals; others are slightly bullish but disciplined on entries, sizing, and venue quality.

Token positions held by team members over $10k:

- BTC, ETH, SOL, USDC, USDT, Pendle PTs, AION, HYPE, sUSDe

🟢 New Positions and Ideas:

- Aurelie: Have cut my crypto allocation on 25 Sept. on technical and macro headwinds. Expecting more downside and waiting patiently for a re-entry point.

- Niklas: No changes this week, feeling the recent dip was what he was looking to see before getting slightly bullish.

- Nicolai: Have increased my position in larger tokens (BTC + SOL) as well as in my main alt play AION.

Quick Market Snapshot

| Asset | 1W Perf. | 1Y Perf. | Team Stance |

|---|---|---|---|

| BTC | -12.3% | -2.5% | Slightly Bullish |

| ETH | -16.0% | -5.3% | Neutral |

| SOL | -15.9% | -44.4% | Neutral |

| HYPE | -3.8%% | N/A | Neutral |

Analyst Views and Positioning

Aurelie

🔹 Positioning: Cut my portfolio allocation to crypto from 25% to <5% on September 25th, 2025 on triple price top and MACD divergence for the BTC/USD price chart and some fragility in Tech stocks (on valuations). Liquidated all crypto alts and kept some BTC. Looks like the crypto sell-off has more to run as Gold and US Tech join to the downside.

🔹 Fundamentals: The US growth is holding up OK (tracking slightly above 2% according to the latest PMIs). That said this is a “bifurcated” economy where lower-income households are struggling (credit card, auto loan delinquencies back to 2008 levels). The labor market is weak. The big hope is US fiscal stimulus (”Big Beautiful Bill” implemented in H1 2026) and the end of the US Fed’s QT in December 2025. Until then, the road might be bumpy for crypto. Also, it looks like the Democrats will take the House in next year’s mid-term election (the latest gubernatorial elections were won by Democrats with some advance): this is less bullish regulation-wise for the Crypto industry, and will be anticipated by markets.

🔹 Action: Sitting on my lowest-bound allocation to crypto, patiently waiting for some technical price consolidation in the BTC price + new positive catalysts + our barometer to turn neutral from risk-off to add back to crypto. Not in a hurry. I am watching the 70k level for potential BTC consolidation.

Nicolai

🔹 Positioning: Heavily in the market with around 85% capital at this point, expecting a rebound and willing to take the chop.

🔹 Fundamentals: Based on options data, there seems to be support around 90, 85 and 80k for Bitcoin with max pain in December being 106k. While it doesn’t mean there will be a price near this, it does work as psychological number where prices could be drawn too. Expecting large range trading posibilities with volatility in either direction minimum till EOY.

🔹 Action: Having slower DCA positions at this point and following politics closely to see if we are more likely to follow liquidity as opposed to any other metric.

Niklas

🔹 Positioning: Slowly back to accumulating high conviction plays (BTC, ETH, SOL, HYPE, PENDLE). Setting limit orders at key levels, got triggered for

- BTC ~89k, next orders ~84.5k and stink bid at ~74.5k with minor ones at 78k and 76k

- SOL ~130, next orders

- PENDLE ~2.20

- HYPE limit orders did not yet hit, aiming for ~34.

Farms:

- Pendle PTs USDai in medium size, other stables as collateral for buying on DEX / CEX

- Ether.fi vaults for ETH and BTC long-term holds, but yields have been drying up. Looking to deploy to other strategies and looking into Morpho.

🔹 Fundamentals: Slowly DCA-ing but mostly relying on stink bids to get back into the market. If bids are not triggered, trickling through DCA into position.