This report reflects the discussions and views shared during our RA meeting. These are personal opinions of the team members and should not be interpreted as financial or trading advice. Readers should conduct their own research and consult with financial advisors before making any investment decisions.

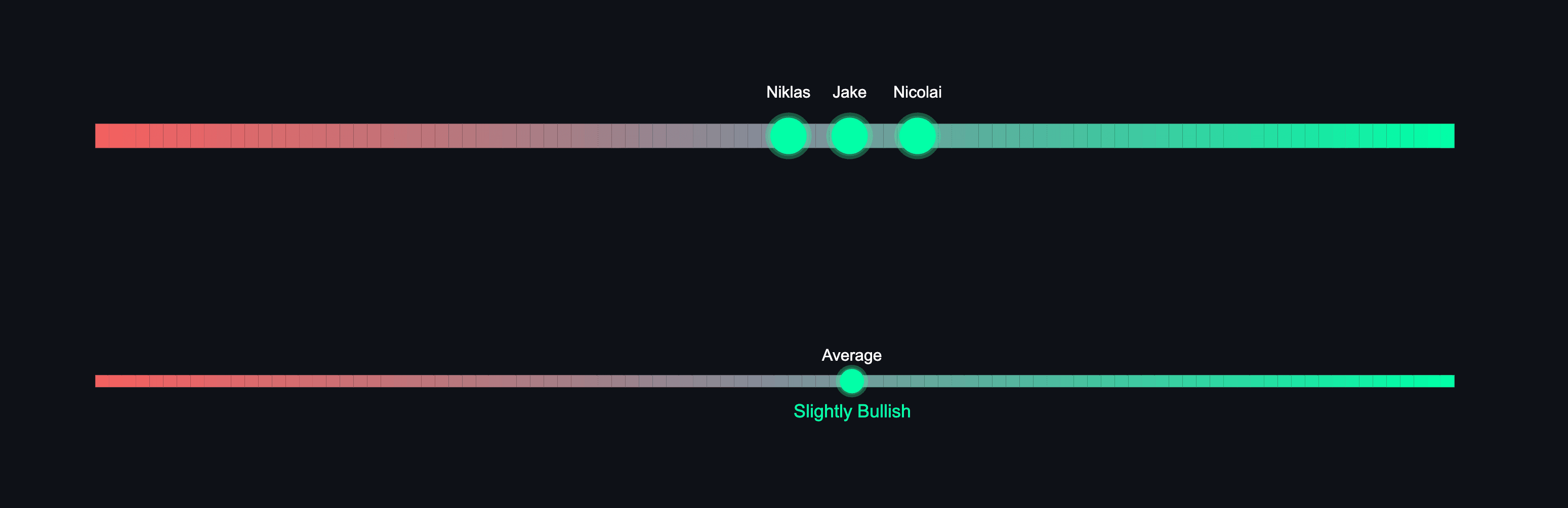

🟢 The team remains constructive and slightly bullish heading into November. Portfolios are balanced but risk-aware, with conviction still strong towards BTC and to a lesser extent the majors, alongside a tactical focus on farming and yield strategies. Overall, sentiment leans bullish on BTC and selective alts that have shown strength into the recent rally such as HYPE.

Market Outlook & Positioning Shifts

1. BTC Bias and Institutional Flows

A few analysts have added BTC on the liquidation event with plans to hold. Outside of BTC, the team is focused on where institutional flows are heading. ETH positioning has been cut with some profit-taking at key levels after the recent run-up. SOL remains in the spotlight, but short-term weakness has led to patience before reentry relative to more attractive majors such as HYPE. Most analysts have built out their core spot positioning and are sitting long into November. More active trading resides in smaller alts such as AION and perp trading done via Paradex and Hyperliquid.

2. Stablecoin Yields and Farms as Defensive Base

Stablecoin yields continue to provide good returns on sidelined capital. With funding rates and leverage increasing, Pendle PTs and various farms are accruing ~10%+ APR. Though the team is more tactical in their farming allocation, there are many other high yield farms depending on how far one is looking to go down the risk curve. A lot of the “dry powder” was used on the last liquidation event and the rest remains largely allocated to blue chip farms like Pendle, InfiniFi, etc.

3. Altcoin Rotation: AI, Prediction, and New Launches

Key narratives include AI, prediction markets, and new early-stage projects showing real adoption or revenue traction. The team is keeping a tight pulse on the x402 narrative as onchain heats up from Coinbase’s open payment standard along with the MegaETH sale going on. Nicolai remains allocated roughly 45/50 (stables vs tokens) after recent liquidations, leaning heavier into altcoins such as $AION and $ARC, while continuing to farm airdrops like Paradex. Jake remains focused on majors, while Niklas slowly DCAs into his favorites like PENDLE, ENA, and HYPE once key levels are retested.

💰 Crypto Positioning Summary:

The overall strategy is to stay mid-term bullish but flexible near term, derisking when possible, farming yields, and waiting for dips to reenter high-conviction setups. The team remains cautious yet positioned for upside into November, with patience and timing as the key focus.

Token positions held by team members over $10k:

- BTC, ETH, SOL, USDC, USDT, Pendle PTs, AION, HYPE, sUSDe

🟢 New Positions and Ideas:

- Jake: Remains slightly bullish into November, not adding any leverage and remaining spot long. Have added my desired exposure over the last few weeks, not looking to add further. Rotated stables over to new PTs. Otherwise sitting spot long on the core portfolio, particularly BTC and HYPE.

- Nicolai: No increases or changes to any positions, as I have once again reached the desired allocation and await market moves before cutting positions again.

- Niklas: No big changes, happy to have sold a bunch of spot and not accumulating loads of alts. But some tokens start getting closer to key levels again (PENDLE, ENA, HYPE, SOL). Hoping limit orders get triggered, looking into MegaETH sale.

Quick Market Snapshot

| Asset | 1W Perf. | 1Y Perf. | Team Stance |

|---|---|---|---|

| BTC | 4.1% | 70.2% | Bullish |

| ETH | 6.3% | 68.5% | Slightly Bullish |

| SOL | 6.9% | 13.4% | Slightly Bullish |

| HYPE | 24.6% | N/A | Bullish |

Analyst Views and Positioning

Nicolai

🔹 Positioning: Got caught in the recent mass liquidation which shaved off quite a bit of my portfolio. Allocated about 45/50 (stables vs tokens) because of this. Leaning heavier into alttokens at this point, especially for AION and ARC.

🔹 Fundamentals: There is quite some pain that have been felt in the market recently, mass liquidations with government shut downs, surprise tariffs and general bearishness. Regardless, this all seems momentary and does not change my perspective on the market for the remainder of the year leaning more bullish than bearish.

🔹 Action: No changes for the past week as I have been allocating more during recent times. As such I am waiting to see what markets will do unless any obvious opportunities present itself.

- Still slowly farming the Paradex airdrop and building positions in AION and ARC

- AION has been seeing some gains recently with the x402 hype and likewise expectations with regard to end of month announcements.

Jake

🔹 Positioning: I still remain bullish here, I sit on most of my spot holdings and farm stables in Pendle PTs. I am siting on my recent entries into BTC and not looking to add anymore spot exposure. Also continuing not to use leverage and avoiding entering new positions here but will add on another liquidation event. Farms I am in for the near term:

- Pendle PTs (~10% APR)

🔹 Fundamentals: BTC looks very strong with a strong macro backdrop, despite the timeline being overly bearish and GOLD outperforming as of recent. Some fundamental altcoins at a large discount from the recent liquidation crash (i.e ENA) or are bouncing strongly such as HYPE. I keep my eyes out on them and also monitoring the x402 narrative as the potential use cases can bring payments mainstream.

🔹 Action: Plan to be flat for the time being, will add to strong majors like HYPE if there is another dip.

Niklas

🔹 Positioning: Slowly back to accumulating high conviction plays (BTC, ETH, SOL, HYPE, PENDLE). Looking into MegaETH sale.

Farms:

- Pendle PTs (~10% APR)

- Ether.fi vaults for ETH and BTC

🔹 Fundamentals: Slowly DCA-ing but mostly relying on stink bids to get back into the market. Hoping the patience will bear fruit.

🔹 Action: MegaETH token sale.