Special thanks to Cristian and Darren from Attributions Team who helped with the initial datasets for the research piece

Part 1: Funds & Recent Raises

Methodology

- Look at the round date, capital raised, project category, and investors in the last 3 months.

- Scale down on which funds have the appetite to raise in the sideway/ bear market.

- Investigate the projects and categories and look at which project categories are VCs & funds focusing on recently.

- Note that this process is largely manual and requires drilling down on each fund entity and mapping their recent raises.

Active Funds

- Based on the funds and their investments over the last 3 months, it is evident that most funds have a diversified portfolio and distribute their capital across various verticals and ecosystems.

- In the case of Spartan Group and the 15 investments that they were actively involved in, 6 of these investments were concentrated in the gaming/ NFT vertical. Coinbase Ventures, however, had majority of their investments in DeFi, Data Services, and DEXes.

| Fund | # of Projects |

|---|---|

| Spartan Group | 15 |

| Coinbase Ventures | 15 |

| GSR | 11 |

| Dragonfly Capital | 9 |

| Shima Capital | 9 |

| a16z Crypto | 8 |

| Multicoin Capital | 7 |

| ParaFi Capital | 6 |

| Pantera Capital | 6 |

| Delphi Digital | 6 |

| Animoca Brands | 5 |

| Alameda Research | 4 |

| Mechanism Capital | 4 |

| Variant | 4 |

| CMS | 3 |

| Paradigm | 2 |

Sources: Twitter, Nansen, Fund Portfolio, Nansen Portfolio (as of 20 Aug 2022)

Biggest Fundraising Amount (past 3 months)

Sui by Mysten Labs - $300m at $2b valuation

- Sui by Mysten Lab’s raised $300m in their Series B round on Sep 2022, backed by FTX Ventures, a16z, Jump, Coinbase Ventures, Jump, Sino Global Capital etc.

- They previously raised $36m in their Series A round in December 2021, backed by a16z, Coinbase Ventures, etc.

- Comparatively, Solana raised $314.5m in June 2021, backed by a16z, Alameda Research, Polychain, CMS Holdings, Multicoin Capital, Sino Global Capital, etc.

Limit Break - $200m at a reported $1.8b pre-launch valuation

- Investors include Paradigm, Standard Crypto, Buckley Ventures, Coinbase, FTX.

Aptos - $150m Series A $2b valuation (a Bloomberg report gives Aptos a valuation of more than $4b)

- Aptos raised $200m in mid-March from Tiger Global, Coinbase Ventures, and FTX Ventures valuing the company at more than $1b.

- Aptos recently raised $150m in their Series A at a $2b valuation, led by FTX Ventures and Jump Crypto. Binance Labs also took part in the Series A round.

Tesseract - $78m

- On 7 Sep 2022, Tesseract announced their raise from Balderton, Lakestar, Accel, Low Carbon, Creandum, Ribit Capital, and Box Group.

- The startup is now valued at $145m according to the founder.

- Previously, they raised $25m in Jun 2021 from Augmentum, Wintermute, Blackfin Capital, Concentric, etc.

Fundraising per project category

Social Network

It is becoming abundantly clear that content creators are looking for permissionless, censorship-resistant distribution channels with their audience. Earlier this year, Aave launched Lens Protocol- a composable, decentralized social media platform. Although the product is still at its infancy and has yet to gain wide traction amongst other centralized platforms, investors are anticipating a potential breakthrough of a Web3 social network.

In the past 3 months, there have been four notable raises in the Social Network category. Hooked Protocol was the most recent seed raise, co-led by Binance Labs and Sequoia Seed Fund (capital raised unannounced). In August, some of these raises include Stacked (~$12.9m raised), the “Web3 version of Twitch”, and Satellite IM(~$10.5m raised).

The Web3 video and live streaming platform, Stacked, raised $12.9m in their Series A funding round led by Pantera Capital. Stacked was founded in March 2021 in Los Angeles with the mission of giving creators ownership to better align the incentives of the platform with content creators.

Satellite IM is a decentralized communication platform that raised $10.5m in seed funding led by Multicoin Capital, Venture Fund, and Framework Ventures. Satellite IM is a “first-of-its-kind Web3 communications platform with private messaging”. It is built as an EVM-compatible evolving protocol for P2P communication, leveraging the interplanetary filesystem (IPFS).

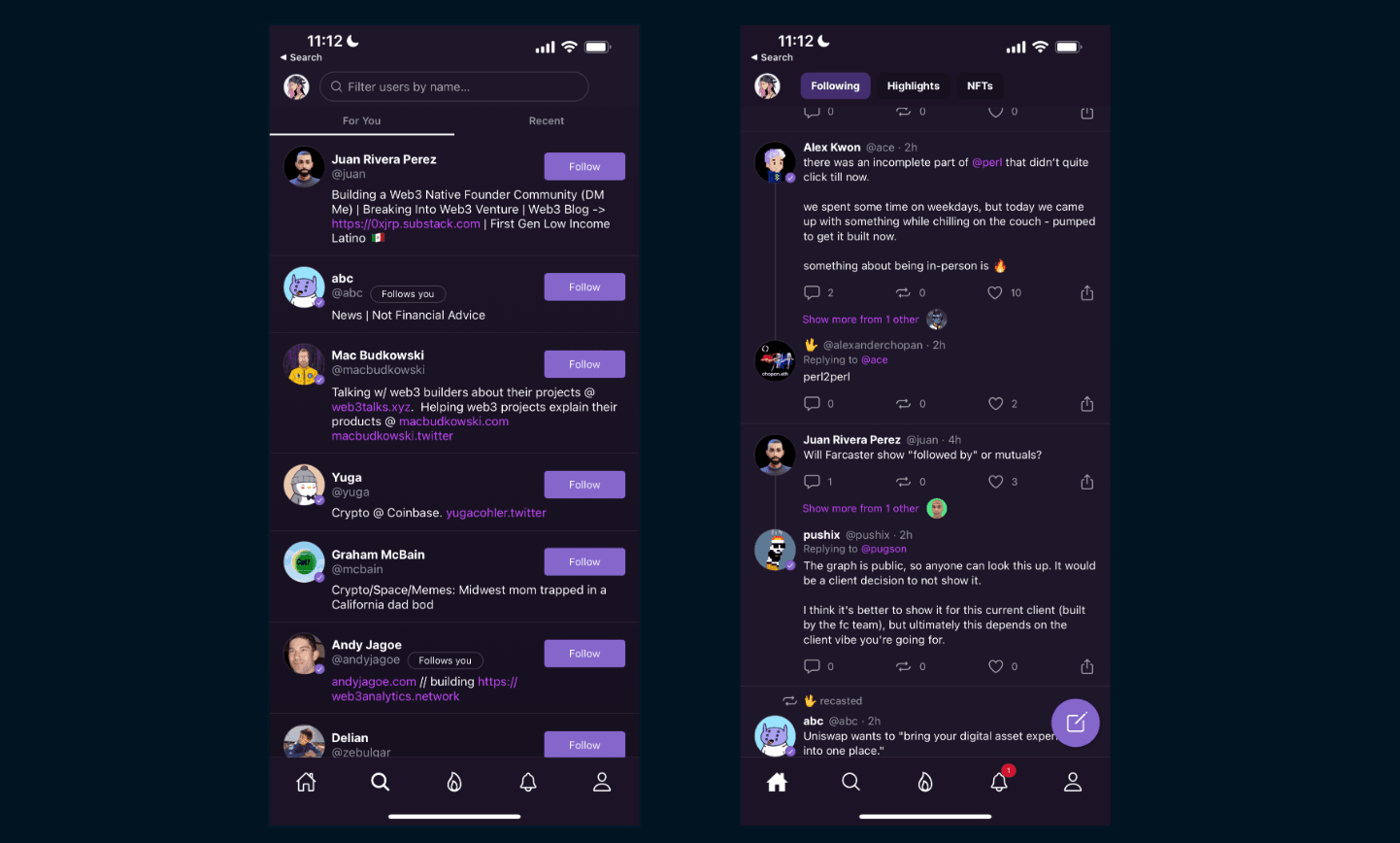

In July, a16z led a seed round funding of $30m for Farcaster - think Twitter but instead of it being controlled by a centralized company, Twitter Corp, it’s an open protocol. There is something strangely pleasing about communicating on Farcaster compared to Twitter and other existing platforms due to the niche community. They are currently working on Farcaster v2, which will be launched later in the year. The project started 2 years ago, where they started working on a concept called RSS+. Currently, the social app is invite-only and limited to people with an Ethereum wallet. As Packy (Not Boring Co) puts it elegantly, Farcester itself could remain a small app, what the company behind it is building is a protocol on top of which any number of social apps can be built.

NFTs / Gaming

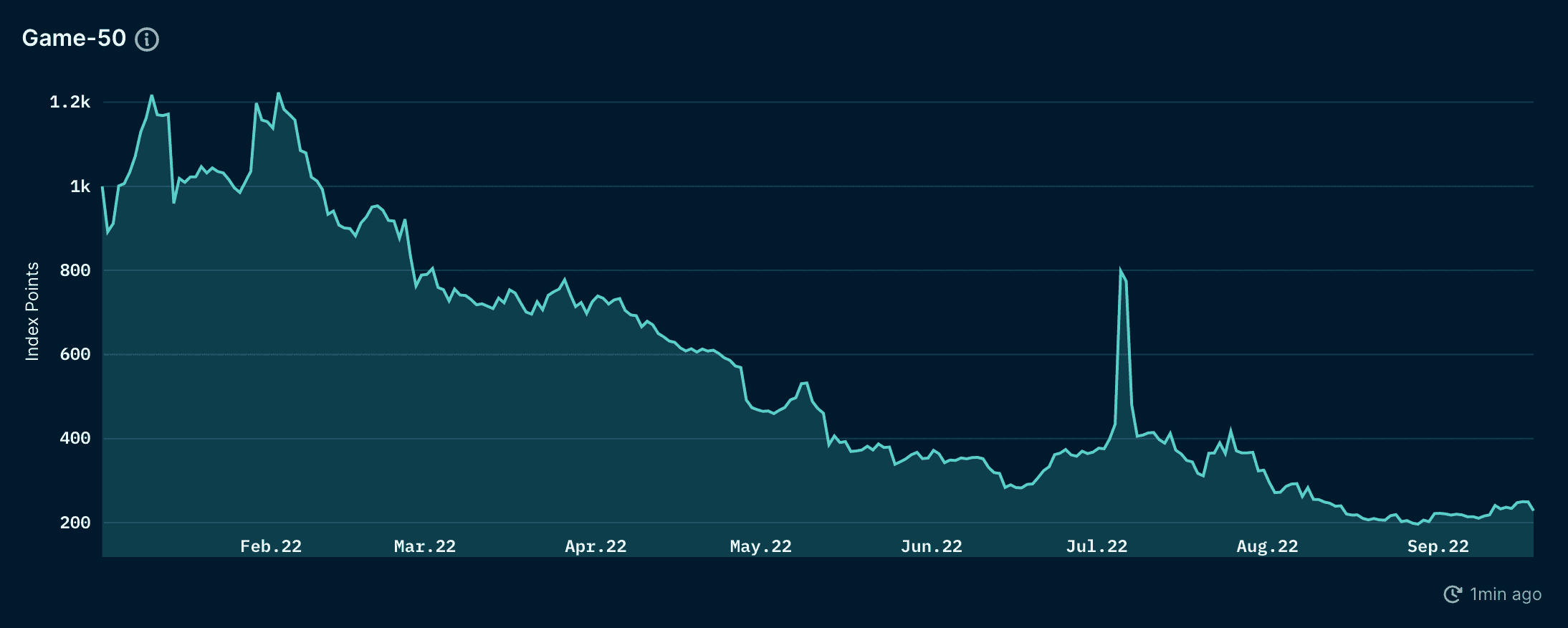

NFTs and Gaming is a vertical that has dominated recent raises, in terms of deals count and funding value. On a broader scale, we’ve observed a massive plunge in the Game-50 Index on Nansen YTD, with a - 91% YTD change (USD value) and -77% YTD change (ETH value).

Currently, GameFi still leads in terms of market cap per category, followed by RPG, P2E and Others.

Some of the more notable raises in the past 3 months of USD value >$30m are Limit Break (~$200m), Ready Player Me (~$56m), Terrapin Studios (~$93m), PROOF (~$50m), Unstoppable Domains (~$65m), Xterio (~$40m). FTX Ventures and a16z are among the two funds who have invested in these projects within the last 1-3 months.

Over the course of the last 3 months, Paradigm has only invested in 2 projects, Limit Break (~$200m) and Tessera (~$20m). In June, Paradigm co-led Magic Eden’s $130m Series B round at a $1.6B valuation, alongside Sequoia Capital. Earlier in March-April, Paradigm also co-led Fractal and Blur’s funding round of $35m and $11m respectively. Although they haven’t been actively investing this year, the majority of their investments are allotted to projects in the NFT/ gaming verticals.

Limit Break, founded by Gabriel Lyedon and Halbert Nakagawa announced its funding round of $200m from Paradigm Ventures, Standard Crypto, and Buckley Ventures in August. Limit Break has previously raised from investors including FTX, Coinbase Ventures, SV Angel, and more. With DigiDaigaku’s launch, which was also a free mint at the start, they aim to introduce a new model called “Free-to-Own” which will replace P2E and the traditional gaming models. It is also worth mentioning that Limit Break’s $200m raise was successful despite an ongoing sideways/ bear market. There is still a huge appetite for investors to allocate their capital into the NFT/gaming vertical and has become one of the most favored deal types for investments.

For NFT-project related funding rounds besides Limit Break, Doodles, DeGods (Dust Labs), VeeFriends, Moonbirds (PROOF) announced their funding rounds ranging from $7M to $54M. These raises are becoming increasingly common for blue-chip NFT projects to grow their brand IP.

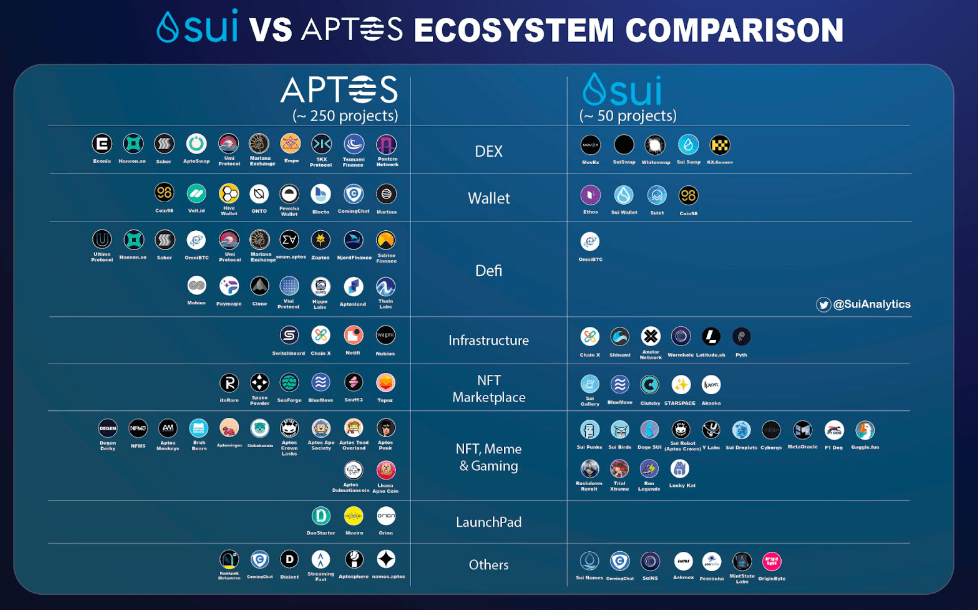

New L1 Blockchains

Aptos and Mysten Lab, Sui recently raised $150m and $300m respectively. Investors for Aptos’ Series A round include FTX Ventures, a16z, Multicoin Capital, Jump, etc. Investors for Mysten Lab’s Series B include FTX Ventures, a16z, Jump, Binance Labs, etc. In terms of Ecosystem comparison alone as of 21 Sep 2022, Aptos has 250 projects/ DApps that are built on their ecosystem, while Sui has 50 projects/ dApps so far. Both Aptos and Sui are still undergoing their incentivised testnet period, hence, we will most likely see a lot more protocols moving over. In terms of verticals and the specific DApps that are built on top of the specific ecosystems, Aptos has a significantly higher number of DeFi projects and Launchpads.

For a deep-dive into Aptos and Sui, check out the past reports by our analysts!

Other notable L1 blockchain fundraises include Sei Network, led by Multicoin Capital, GSR, Coinbase Ventures, Delphi Digital, Tangent, etc. Sei raised $5m to build the first L1 blockchain optimized for DeFi. The current barbell distribution for L1s includes two extremes: general purpose chains (e.g: Ethereum, Solana) and app-specific chains (dYdx, Osmosis). Sei aims to break a middle ground between general purpose chains and app-specific chains. Some of the exemplary application types that can be built using Sei are order-book exchanges. Since Sei has built their in-house matching engine, any applications built on top of Sei can leverage this feature and customize an orderbook for spot, derivatives, options, and more. In terms of scalability, Sei’s fast finality and native frontrunning protection makes it compatible with larger orderbook exchanges.

Sei is currently engaging with other IBC ecosystem applications to form various partnerships to strengthen their ecosystem. Vortex, a perpetual exchange, and Pharaoh, a synthetic assets protocol, are launching natively on Sei’s ecosystem. They’ve also established a partnership with the Axelar IBC Bridge to bridge EVM-compatible chains and the Sei network.

Web3 Wallets

Web3 wallets are simple on the surface but groundbreaking. When crypto natives mention onboarding new entrees into crypto, the single most important piece of technology stack is Web3 wallets.

Within the last 3 months, there were four fundraises for Web3 Wallet technology from various investors and funds. Most of these wallet infrastructure protocols raised around $3m-$12.5m. In the past 3 months, there have been similar raises for Web3 wallets that aim to challenge Metamask’s offering. Currently, the industry standard EVM wallet is Metamask, and they’ve been leading by quite a significant leap compared to the other services out there. While these recent raises have similar intentions to absorb a large share of Metamask’s demand and user base, the stakes are incredibly high.

Cashmere raised $3m at $30m valuation to build Solana Enterprise Wallet. Investors in the seed funding round included Coinbase Ventures, FBG capital, and YCombinator. Cashmere is intended to help companies store their assets securely, even if “hot” wallets like Phantom or Slope get compromised. On 3 August 2022, there were over 8000 “hot” wallets that have been compromised, where the attacker obtained the ability to sign transactions on behalf of users in a supply chain attack.

Ultimate is a DeFi wallet by Unstoppable Finance, building on Solana. They raised $12.5m on Aug 2022 from Speedinvest, Rockaway Blockchain Fund, Backed VC, Inflection, Discovery Ventures, Fabric Ventures and Anagram. Unstoppable Finance is a Berlin-based startup founded by a SolarisBank founder, former CEO of Germany’s second-largest stock exchange, and former Soundcloud engineer. What is different about Ultimate is that they aim to integrate DeFi protocols more seamlessly into the mobile-front end experience. The company claims that this product is for people who don't necessarily want to go and read every whitepaper.

Omniwallet (previously Steakwallet) raised $11m in seed funding at a $50m valuation. Investors for this round included Spartan Group, GSR Ventures, Eden Block, Figment Capital, etc.

Sender is a browser extension wallet built on Near. They recently announced their private funding round of $4.5m, led by Pantera Capital. In addition, several projects building on NEAR also contributed to the private funding round, such as Octopus Network, Ref Finance, and Paras. In the near future, Sender plans to introduce Senderswap - integrating multiple DEXes on NEAR to provide users with a smoother trading experience, transaction aggregators, Sender Pool, and commercial MPC multi-signature wallet.

DeFi

DeFi was arguably the vertical with the least funding in USD value and deal count

The biggest raise in USD value was for Injective Protocol, who raised $40m in Aug 2022. The funding round consisted of Jump and BH Digital. Injective has also launched its multi chain CosmWasm smart contracts layer in July 2022, and is now poised to be the leading infrastructure optimized for DeFi applications. On 19 Sep 2022, Injective also announced that they now support Interchain Accounts (ICAs), bringing greater interoperability and composability to the Cosmos Ecosystem.

Morpho was the second biggest raise in the DeFi vertical of $18m in July 2022. Notable investors include a16z, Variant, Nascent, Mechanism Capital, Coinbase Ventures, etc. A month before Morpho’s raise, Sequoia Capital India and Quona Capital also co-led a $6m seed round for another DeFi lending protocol, MoHash. The problem with lending pools is that the utilization of capital is low, hence users can withdraw and borrow funds at their own convenience – oftentimes, not considering the risks involved. Protocols such as Compound or Aave can be comparable with the issues we have been seeing with blue-chip lending protocols. Another solution we’ve seen is a native peer-to-peer layer where the capital utilization is 100%, which means it is consistently kept at a reasonable rate for both borrowers and suppliers. However, the bottleneck for peer-to-peer pools is that users cannot borrow or withdraw whenever they want. Morpho challenges the current lending pool models and solely peer-to-peer models, with a hybrid P2P-Pool model. The current volume supplied for Morpho is a whopping $134.61M and has a total liquidity of $5.12b.

Takeaways

- Gaming and NFTs continue to dominate in total USD funding amount and number of deals.

- Investors are exploring the possibility of interoperable blockchains, and have placed bets on Cosmos as a key technology stack.

- The emergence of new L1 blockchains (Aptos, Sui, Sei Network, etc.) are introducing MOVE language and are all under development and undergoing an incentivised testnet phase for validators and users.

- DApps that are trying to be the “next Twitter” or “next Discord” or “next Twitch” are quickly emerging, and trying to win over a small market share of current centralized social media platforms. However, it is still an incredibly difficult hurdle to cross.

- Web3 wallets are undergoing a similar development, where these new Web3 wallet services are attempting to compete against Metamask, as the industry standard EVM wallet offering.

- Investors are still actively investing in current market conditions.

Part 2: On-chain Footprints of Funds

Methodology

- While raises are a good way to measure funds’ involvement in the overall crypto industry and can be useful to look at which sectors/ verticals are heavily looked into, on-chain footprints provide a more comprehensive picture of funds’ behavior.

- Using our smart money labels on Nansen for tagged funds, we came up with a query that looked at the token balances for fund wallets and changes in 90 days for the specific wallet/ entity. We also calculated the change in the most recent 90 days versus the previous 90 days.

- Moreover, we looked at token outflows from the selected address, grouped it by tokens and entities to track where the tokens from a specific Fund address went. This can provide a better understanding of the most common outflows for a specific fund wallet to another. From this query itself, we can see which entities or addresses a specific fund normally interacts with. This can help with wallet discovery and potential alpha in future raises.

- Do note that addresses tagged are in no way comprehensive of all wallets an entity has/ has interacted with. There may be other “fresh” addresses that funds use to obfuscate transactions for many reasons.

Top Active Funds’ On-chain Footprints

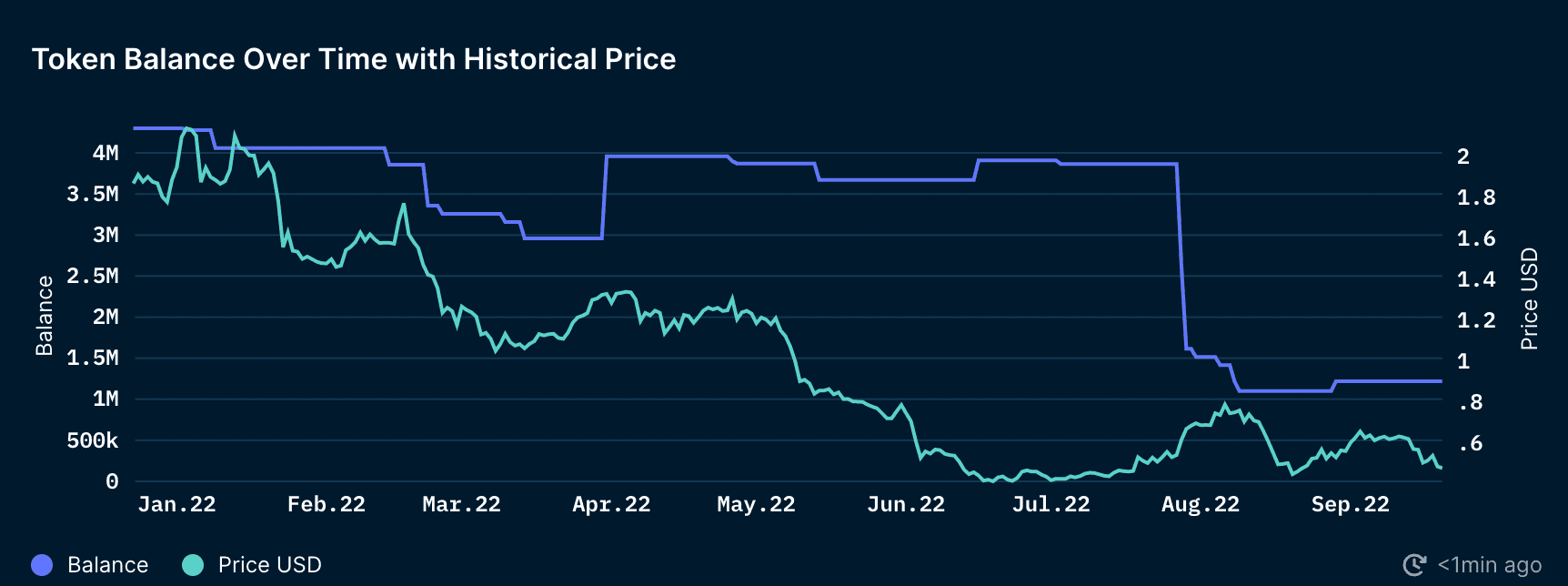

Spartan Group

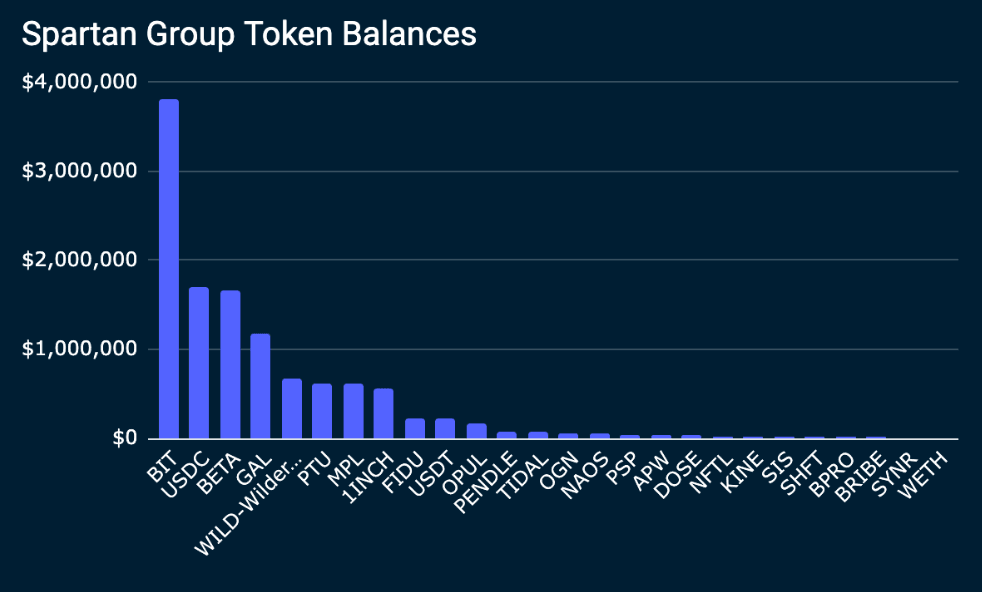

Aggregated Token Holdings

- BitDAO (BIT) token holdings are from the most recent token unlock. Spartan Group started receiving BIT tokens from Spartan’s 0x66 address on 23 Dec 2021, and has consistently held there tokens since. However, a large dip occurred during the period of July- Aug, where Spartan’s token balance dipped from 4m BIT to 1.2m BIT at the time of writing. In their overall aggregated portfolio value, they are still holding a balance of 6.5m BIT (~$3.1m USD).

SM Balance Change - 90 Days

- SM balance change is the aggregated net change in 90 days (USD value) across Spartan Group’s wallets.

| symbol | change_90_days_as_usd |

|---|---|

| GAL | $1,169,259.84 |

| PTU | $621,322.51 |

| BETA | $552,210.00 |

| USDT | $59,500.00 |

| NFTL | $19,215.33 |

| MPL | $18,314.25 |

| DOSE | $15,582.40 |

| WILD-Wilder World | $9,136.36 |

| SYNR | -$90,755.20 |

| BIT | -$380,571.85 |

| USDC | -$2,095,671.26 |

- Project Galaxy (GAL) had the largest net positive balance change of $1.1m USD across all of Spartan Group’s tagged addresses. The $1.1m USD inflow was from a GnosisSafeProxy wallet, most likely from token vesting. While it was unclear what the price per token was for Spartan Group, the public token sale was capped at $1.5/ token.

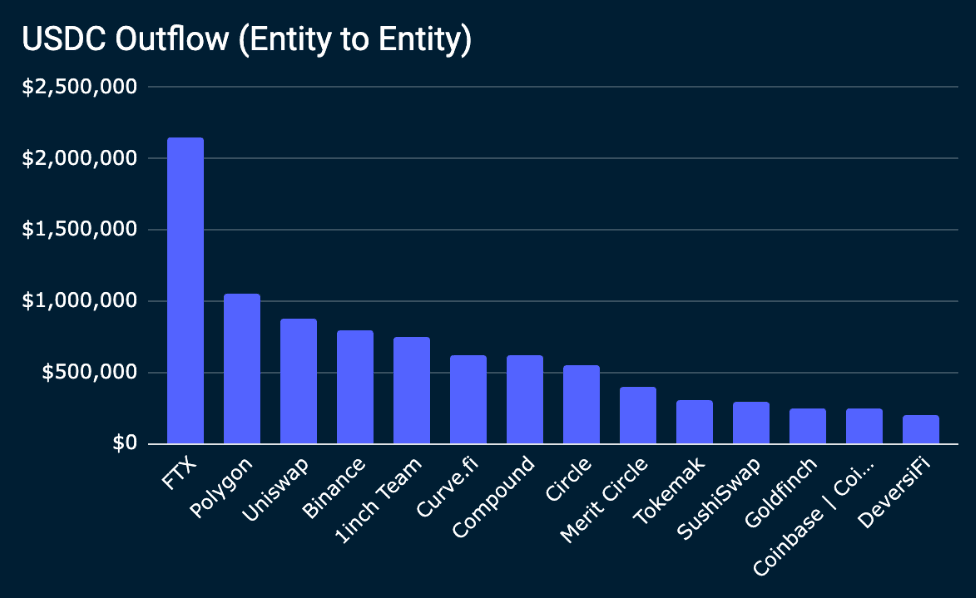

- The largest net negative change across Spartan Group’s wallet is USDC. Note that there was a total of $43m USD outflow to “non-entity” (all the wallets that are not tagged at the moment). The most common entity outflow from Spartan Group’s addresses is FTX, Polygon, Uniswap, 1Inch Team, Curve.fi, Compound, Circle, Merit Circle, Tokemak, SushiSwap, Goldfinch, Coinbase, and DeversiFi.

Delta Change (Current 90d vs. prev 90d)

- Observing a funds’ position benchmarked to the prev 90d change is a good indicator of understanding whether the inflow was attributed to vesting unlocks or if they are consistently accumulating a token.

- Unlocks:

- GAL had a token unlock on 5 Jul 2022, the first unlock for the “Advisors & Partners” and “Growth Backer 1” and “Growth Backer 2” – where Spartan Group is most likely in.

- BETA unlock happened on 1 September 2022, where Spartan Group received 6mm BETA tokens (~$553k) where the price was $0.11/ token. Spartan is currently still holding 6m BETA tokens.

- PTU inflow of $621k USD in the last 90D. Spartan Group is one of the early advisors for Pintu.

- Spartan is one of the seed investors for PENDLE. An inflow of $41k USD in the previous 90D.

| symbol | balance_as_usd | change_90_days_delta |

|---|---|---|

| GAL | $1,169,259.84 | $1,169,259.84 |

| PTU | $621,322.51 | $621,322.51 |

| USDT | $226,822.83 | $90,599.83 |

| WETH | $0.00 | $43,639.63 |

| NFTL | $25,620.44 | $12,810.22 |

| BETA | $1,656,630.00 | $0.00 |

| DOSE | $31,164.81 | $0.00 |

| 1INCH | $563,316.56 | $0.00 |

| FIDU | $231,736.06 | $0.00 |

| OGN | $57,221.27 | $0.00 |

| SHFT | $21,431.77 | $0.00 |

| APW | $41,011.63 | -$13,973.63 |

| BRIBE | $15,911.78 | -$15,911.78 |

| KINE | $24,970.50 | -$17,233.54 |

| BPRO | $19,420.61 | -$19,419.59 |

| SIS | $23,136.38 | -$23,136.38 |

| NAOS | $55,451.42 | -$38,647.94 |

| PENDLE | $82,865.69 | -$41,432.84 |

| PSP | $47,349.39 | -$47,349.39 |

| TIDAL | $69,602.86 | -$47,749.50 |

| OPUL | $170,832.50 | -$170,832.50 |

| SYNR | $0.00 | -$181,510.40 |

| WILD-Wilder World | $668,284.07 | -$306,022.47 |

| MPL | $610,275.93 | -$573,647.43 |

| BIT | $3,819,974.56 | -$1,630,748.65 |

| USDC | $1,706,340.06 | -$1,793,003.55 |

Source: Nansen Query (as of 21 Sep 2022)

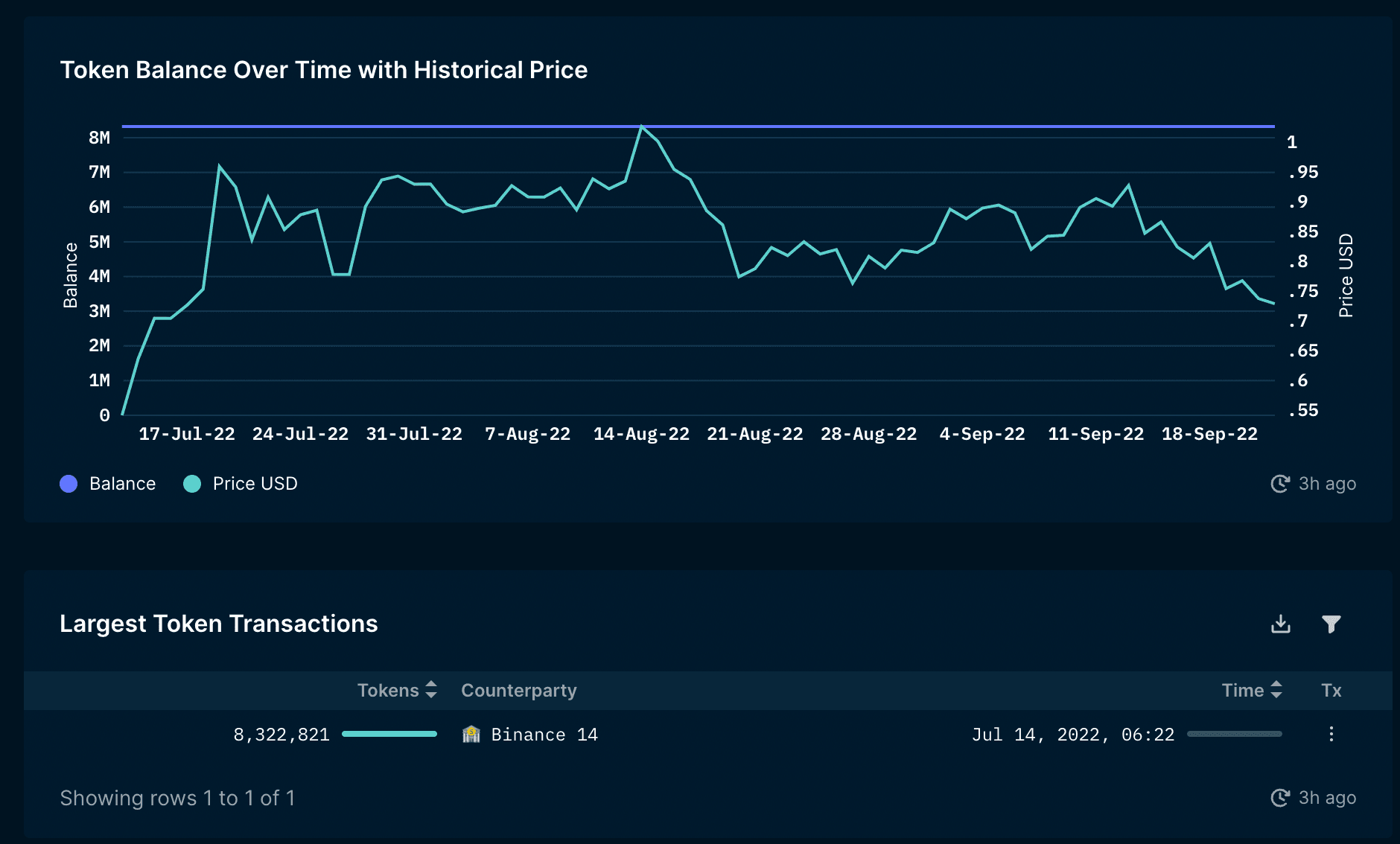

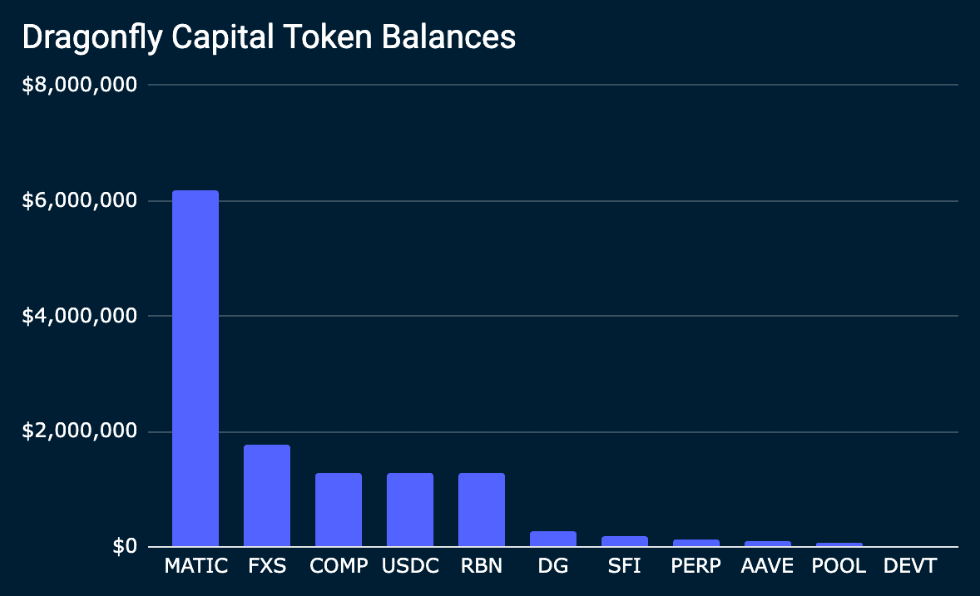

Dragonfly Capital

Aggregated Token Holdings

SM Balance Change - 90 Days

| symbol | change_90_days_as_usd |

|---|---|

| LDO | $40,574,997.25 |

| MATIC | $6,177,655.71 |

| RBN | $1,290,630.00 |

| FXS | $660,982.50 |

| USDC | $336,556.87 |

| PERP | $111,500.84 |

| AAVE | $85,107.89 |

- There was an inflow of $40.5m USD worth of LDO tokens into Dragonfly’s wallet address. A recent proposal (0xede83acfa2d3afd2a0109bb437073c5424bcc576bbe32e51a5cdee9ecd6cebee) was first created on 19 July 2022 as the Lido DAO is looking to build a position in the stablecoin DAI in exchange for 1% of LDO supply (10M LDO) at the price of $1.45 per token. They have made it clear in the proposal that they will focus on the allocated 1% for Dragonfly exclusively on this vote. The proposal failed with 66.1% of the community who voted that the proposal required more work. The second updated proposal was then created on 28 July 2022 with more details on the treasury diversification proposal. The terms of the proposal that were up for vote was specifically related to the 1-year lock up until tokens are liquid and commitment to the final price ($1.45 per price of token which was reflective of the price of LDO then on 28 July 2022). The proposal passed unanimously with 99% who voted for a “Yes”.

- There was an inflow of $6.1mm MATIC on 14 July 2022 from Binance.

- Dragonfly Capital has been receiving Frax Share (FXS) tokens since 22 December 2021 from one wallet address. The price of FXS has been fluctuating between $15-30/ FXS token from January 2022 to May 2022, and has declined to $4.4/ FXS token as of 22 Sep 2022. Despite the volatility in the price of FXS, Dragonfly Capital continues to accumulate the FXS received as per all the vesting unlocks that happened so far.

Delta Change (Current 90d vs. prev 90d)

| symbol | balance_as_usd | change_90_days_delta |

|---|---|---|

| LDO | $45,444,740.87 | $40,453,711.42 |

| MATIC | $6,177,655.71 | $6,177,655.71 |

| RBN | $1,290,630.00 | $2,464,348.28 |

| AAVE | $85,107.89 | $85,107.89 |

| PERP | $138,238.26 | $84,763.43 |

| COMP | $1,292,576.06 | $0.00 |

| SFI | $197,972.78 | $0.00 |

| POOL | $82,189.07 | $0.00 |

| DEVT | $21,461.19 | $0.00 |

| FXS | $1,762,834.20 | -$220,498.86 |

| DG | $272,967.07 | -$272,967.07 |

| USDC | $1,291,853.64 | -$309,352.71 |

Source: Nansen Query (as of 21 Sep 2022)

- The largest 90 days delta inflow (current 90d - prev 90d) is LDO, MATIC, RBN, and AAVE. While the largest 90 days delta outflow is DG and USDC.

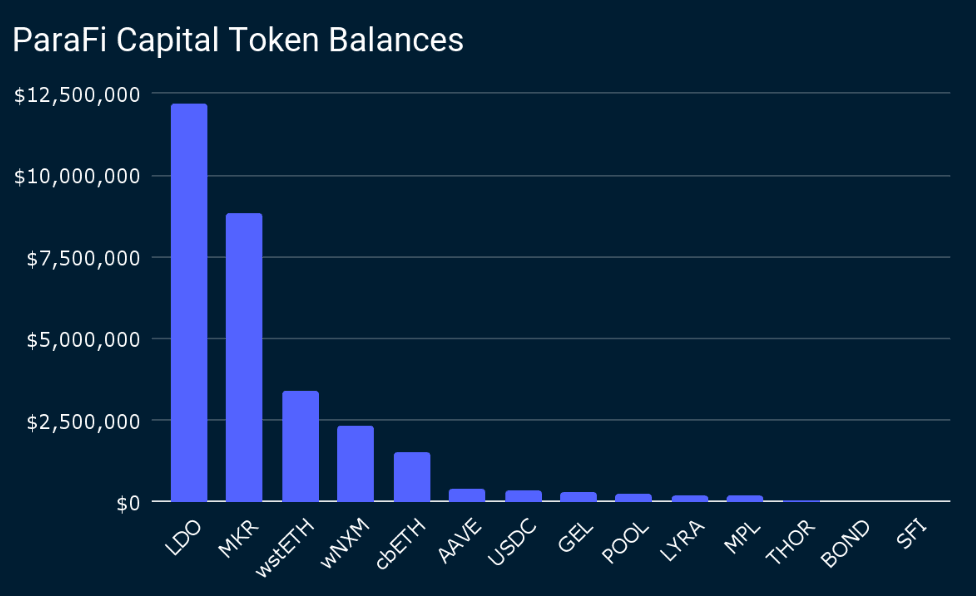

ParaFi Capital

Aggregated Token Holdings

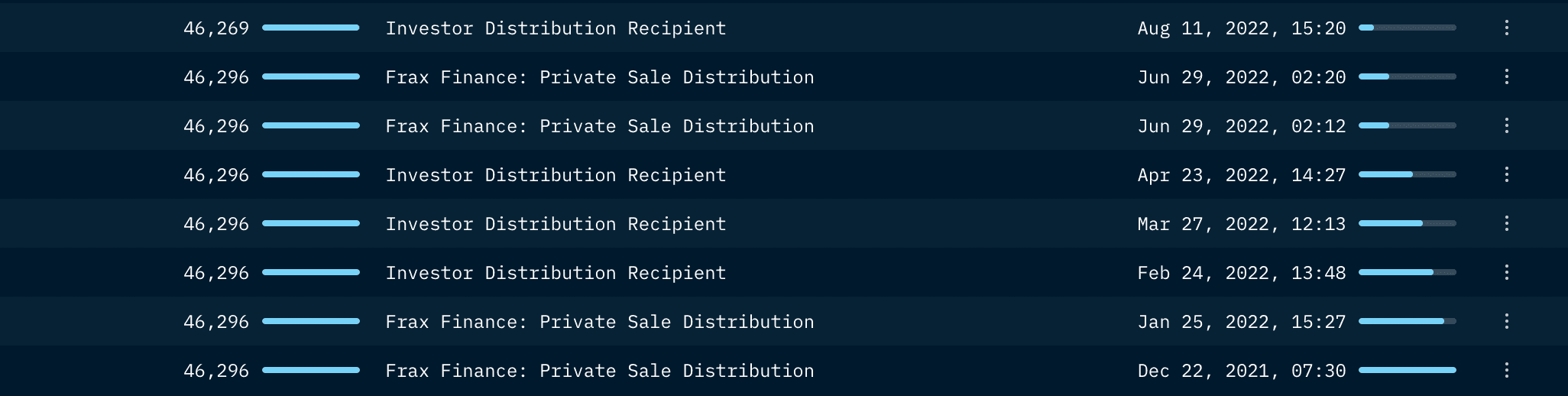

SM Balance Change - 90 Days

| symbol | change_90_days_as_usd |

|---|---|

| wstETH | $3,597,507.84 |

| wNXM | $2,342,838.72 |

| cbETH | $1,469,392.99 |

| USDC | $533,184.87 |

| LYRA | $158,473.11 |

| THOR | $26,527.23 |

| SFI | -$14,915.82 |

| BOND | -$111,375.00 |

| MPL | -$170,834.93 |

| AAVE | -$221,852.74 |

| MKR | -$723,795.99 |

| cMKR | -$9,821,277.95 |

| LDO | -$22,017,094.08 |

- An inflow of $3.5m wstETH in the past 90D. On 26 Aug 2022, ParaFi Capital swapped WETH for wstETH, two weeks before the Ethereum Merge.

- There was also a $1.46m inflow of cbETH in ParaFi’s wallet address. CbETH has been trading at a 4-5% discount, and may have decent returns in the long-run.

- A $22m outflow of LDO in Parafi’s wallet addresses, though, the aggregated balance across wallets is still a whopping $12m. This could imply that ParaFi Capital is derisking their LDO position across wallets, however, still has enough conviction in the mid to long run.

- The $170k MPL outflow was attributed to ParaFi Capital staking MPL for xMPL instead of selling.

Delta Change (Current 90d vs. prev 90d)

| symbol | balance_as_usd | change_90_days_delta |

|---|---|---|

| MKR | $9,212,050.40 | $6,295,040.23 |

| FXS | $0.00 | $4,562,499.84 |

| wstETH | $3,597,507.84 | $3,597,507.84 |

| USDC | $573,330.30 | $3,504,947.84 |

| wNXM | $2,342,838.72 | $2,342,838.72 |

| cbETH | $1,469,392.99 | $1,469,392.99 |

| RAD | $0.00 | $1,313,335.96 |

| DYDX | $0.00 | $1,250,609.93 |

| RARE | $0.00 | $557,357.83 |

| BOND | $18,562.50 | $176,343.75 |

| LYRA | $193,476.35 | $123,469.86 |

| ALPHA | $0.01 | $122,573.52 |

| TORN | $0.01 | $120,572.24 |

| AAVE | $268,714.49 | $92,755.71 |

| BETA | $0.13 | $54,873.02 |

| THOR | $26,527.23 | $26,527.23 |

| IONX | $0.00 | $22,454.66 |

| POOL | $276,048.41 | $0.00 |

| SFI | $12,147.25 | -$5,585.27 |

| MPL | $0.00 | -$341,669.86 |

| LDO | $12,618,622.61 | -$14,883,693.71 |

| cMKR | $0.00 | -$19,642,555.90 |

| cETH | $0.00 | -$23,759,000.57 |

Takeaways

- A significant portion of fund outflows were from token unlock activity, implying that funds are derisking their position for certain protocols or may be waiting for a good time to enter. Most alt tokens are risky, especially in the sideway market when new narratives are brewing and some older protocols/ narratives will eventually shift.

- Funds’ on-chain footprints can provide a clearer picture of what funds are accumulating and selling/ staking. For instance, if users have a sizable amount in a specific token or protocol, fund movements can be a good signaling tool to surface alpha.