TLDR

- The overall cryptocurrency market has been contracting heavily due to the poor economic conditions, dropping from ~$2.19T to ~$954M, a ~56.4% fall, compared to crypto gaming which fell by ~75.0% YTD.

- Gaming and guild tokens were hit with the largest decline, with many falling by >90% YTD.

- The current gaming models have brought about many value extractors and speculators who are damaging the gaming economy and moving on to the next game due to mercenary behavior.

- The current problems with GameFi is centered around the focus of earning first as well as lack of utility of gaming assets rather than the gameplay itself.

- Focusing on gameplay, utility of gaming assets, improving social experiences and carefully designed tokenomics will drive gaming towards a more sustainable Play-and-Earn model.

- Blockchain gaming deals took $1.7B, roughly 49% of the Q1 2022 investments in gaming, highlighting the potential and value proposition blockchain brings to gaming.

Key Terms

| Terms | Definition | |

|---|---|---|

| GameFi | 'GameFi' refers to the financialisation of video gaming, bringing about gaming and finance together. | |

| Guilds | Gaming guilds are organizations of gamers and investors interested in web3 gaming who have usually collectively amassed a vault of gaming NFTs. Guilds often rent or loan these gaming NFTs through “scholarships” to community members who use these NFTs to play web3 games. | |

| Metaverse | Crypto metaverses are immersive virtual worlds with immense social and financial potential. | |

| Play-to-Earn | Play-to-Earn is a business model where gamers can earn money by playing games that are centered upon cryptocurrency-based assets, known as non-fungible tokens (NFTs). | |

| Free-to-Play | Free-to-Play (F2P) games are games that give players access to a significant portion of their content without paying or do not require paying to continue playing. | |

| Move-to-Earn | The Move-to-Earn model is a concept which focuses on gamifying and incentivizing real-world activities. | |

| Scholarship Model | The scholarship model is centered around loaning non-fungible token (NFT) assets to gamers who will then be required to play the game and earn money. The earnings will be split between the scholarship provider, scholarship manager and the gamer. |

Introduction

According to Accenture, the gaming industry exceeds $300 billion and is continuing to grow at a rapid pace. Mirroring this in the crypto industry, the GameFi market is also growing rapidly, gaining tons of traction in terms of market share and venture capital funding. After the wildly successful run of Axie, many are betting on the next “new” narrative.

GameFi, which is brought about from the combination of gaming and finance made its way to the industry with the idea of earning money whilst playing a game. This quickly attracted many speculators as well as gamers who sought to make capital gains or an income through gaming and its assets. With the innovations of blockchain technology, this was made possible and the concept of Play-to-Earn arose. Unknowingly, this has also led to its demise in the future due to the mercenary behavior of gamers and guilds, polluting the gaming economy. As most gamers were attracted to the space for the sole reason of profit, they simply followed the money, which might be another more profitable game.

This report aims to uncover the performance of gaming & metaverse in 2022, taking a look at the different gaming models in the market, evaluating the current problems as well as looking at the gaming venture landscape.

Gaming and Metaverse Performance Overview

The overall cryptocurrency market has been contracting heavily due to the poor economic conditions, dropping from ~$2.19T to ~$954M, a ~56.4% fall, compared to crypto gaming which fell by ~75.0% YTD. Gaming and metaverse as a whole experienced a much larger decline YTD in different assets (NFT and Tokens) in the various verticals explained below.

Nansen NFT Indexes

In order to track the broad activity of the NFT market and trends in various categories of NFTs, Nansen came up with the NFT Indexes. This allows us to have an overall view of the NFT market and help identify which segments are doing well and those that are not. 2022 has been a rough year for NFTs in various categories, with the YTD change ranging from -21% to -76%.

The Index points can be represented as what investing $1000 on the 1st of January would be worth now. At the time of writing, gaming and metaverse shows the biggest loss, with values being only $240 and $632 respectively.

NSN-GAME50

The key difference between Gaming NFTs and Metaverse NFTs is that the former involve the act of gameplay that is governed by a set of rules, whereas such rules are not compulsory for participation in the Metaverse. The table below explains the 4 subcategories of gaming in the NSN-GAME50 Index.

| Sub-category | Definition | Example |

|---|---|---|

| Role-playing Game (RPG) | A game in which players assume the roles of characters in a fictional setting. It also includes Massively Multiplayer Online Role-Playing Games (MMORPG). | Northern Guilds - Guild of Thor |

| GameFi | GameFi is a hybrid term from “game” and “finance”. It involves decentralised applications (dApps) with economic incentives. | Cold Blooded Creepz |

| Play-to-Earn (P2E) | Such games typically involve tokens granted as rewards for performing a game-related task such as winning battles, mining precious resources or growing digital resources. The difference between P2E and GameFi is that P2E requires active play or the completion of specific tasks in-game, whereas GameFi may only require the staking of the NFT. | MekaApes Game by OogaVerse |

| Other | Card games and other miscellaneous game NFTs. | Parallel |

Source: Nansen Research

Gaming was only slightly positive in January and February, but has seen a downtrend ever since then, with a YTD change of -76%. This is largely due to the lack of incentives and utility to hold gaming NFTs.

NSN-META20

The Metaverse is a network of immersive virtual worlds that blend various gaming, entertainment, commerce, and communities, enabling users to engage with one another. Metaverse NFTs allow participants to prove their ownership and authenticity of assets within the virtual worlds, thereby fuelling a Metaverse economy. The table below explains the 4 subcategories of gaming in the NSN-META20 Index.

| Sub-category | Definition | Example |

|---|---|---|

| Land and Real-estate | Virtual land or real-estate exists in the metaverse. | Sandbox |

| Avatar | An icon or figure representing a character in a virtual space. | Meebits |

| Asset | Virtual game objects in a virtual space. | Virtual game objects in a virtual space. Sandbox’s Assets |

| Utility | Provides use-case within the metaverse | Multiverse VM |

Source: Nansen Research

Metaverse NFTs had a much better run in 2022, especially in the earlier part of the year. It reached a peak of more than 3000 USD, which means a 3x in investment dollars if you invested on the 1st of January. There were many catalysts that caused the rise in the Metaverse segment, mostly in the fourth quarter of 2021. Examples would be the Facebook rebranding to Meta as well as large funding rounds of metaverse projects such as the $93m Series B round of The Sandbox.

Token Performances

The token performance of the gaming, metaverse, and guilds have not been faring well in the current market. This is especially the case for gaming and guild tokens. As a benchmark, ETH has fallen ~60% YTD.

Gaming Tokens

Gaming tokens have taken a big hit YTD, with many notable projects losing most of their value since the start of the year. This is due to the mercenary behavior of players and even certain guilds. Users play these games with the motivation of earning money and would not hesitate to move on to a more profitable game in the future once the current one has been extracted.

In most games that followed Axie Infinity, the excitement and hype that followed did not last long. A great example would be the speculation around the Crabada token which is down 99.51% from its all time high price of $2.93 to the current price of $0.01434.

| Project | Token | YTD |

|---|---|---|

| Axie Infinity | AXS | -86.30% |

| Axie Infinity | SLP | -86.68% |

| Crabada | CRA | -98.21% |

| Crabada | TUS | -99.81% |

| Thetan Arena | THG | -98.17% |

| Thetan Arena | THC | -99.54% |

| Illuvium | ILV | -93.51% |

Source: CoinGecko

Metaverse Tokens

The prices of metaverse tokens have been propelled by many news related events. An example would be Facebook’s rebrand to Meta which sparked a huge rally for Metaverse coins. During this time, MANA, Decentraland’s token jumped 45%, with other tokens rallying high up as well.

For SAND, its Series B announcement by SoftBank Vision Fund propelled the token to 3x its value within 5 days and with the launch of Sandbox Alpha, the token rallied to its all time high of $8.40. However, due to poor market conditions and investor unlocks in December 2021, SAND’s token has been falling hard ever since.

| Project | Token | YTD |

|---|---|---|

| Apecoin | APE | -43.09% |

| The Sandbox | SAND | -85.34% |

| Decentraland | MANA | -77.27% |

Source: CoinGecko

Guild Tokens

Guild Tokens received one of the largest drawbacks YTD, with most receiving >90% drawbacks. Due to the rising barriers to entry for crypto gaming, gaming guilds came into play. Gaming guilds thrive on the scholarship model, connecting asset owners with play-to-earn players. In the case of many guilds, they run a scholarship model using their in-game assets to generate revenue through their massive amount of scholars. They then take a cut of this revenue after being distributed to scholars and managers.

With the downturn of the economy, overall volumes and revenues have fallen for guilds and has resulted in a sharp decrease in guild token prices. The utility of guild tokens (such as staking, rewards, governance) simply did not outweigh the cost of holding them in these macro conditions.

| Project | Token | YTD |

|---|---|---|

| Merit Circle | MC | -86.21% |

| Yield Guild Games | YGG | -92.02% |

| GuildFi | GF | -92.12% |

| Good Games Guild | GGG | -99.07% |

| AvocadoDAO | AVG | -96.80% |

Source: CoinGecko

Current Gaming Models

Play-to-Earn

The play-to-earn model is one of the most well-known models in crypto gaming. It is a business model that allows users to play games and earn money in the form of tokens or other valuable in-game assets which can be sold and off-ramped for fiat.

To gamers, this sounds great, incentivizing their time spent on games into tokens or NFTs, which are eventually sold for cash. This has been popularized greatly due to the main selling point of earning money whilst playing a game (whether it is fun or not). Thus, it has been very popular in countries where the average salary or minimum wage is low relative to how much they can earn by playing the game.

This can be seen as a mistake given these “gamers” who were attracted to the game were in it just for the money, extracting value out of the gaming economy. The gaming economy is negatively impacted by in-profit VCs that may be selling, and lack of sufficient tokenomics that compliment a fun game experience. A case study of Axie Infinity will be reviewed later in this report to help understand the current problems of the industry.

Move-to-Earn

The move-to-earn model was a concept which focuses on gamifying and incentivising real-world activities. These activities could range from running, jogging, walking your pet etc. Projects such as StepN took flight in 2022 with this model allowing users to earn tokens if they purchased STEPN sneakers as well as accomplishing various tasks in the game. This creates an effort-based model, allowing users to benefit both financially and also in terms of their health.

As the price of the STEPN tokens increased, more and more people were interested in joining the game or speculating on its NFTs. This brought the prerequisites of owning the sneakers NFT to high prices, thus limiting the growth due to the high barriers to entry. Moreover, with the downturn, the token prices have also taken a beating, reducing the incentives in the game. This caused the “death-spiral” in design which has not been solved due to the unsolved problem of sustainability (which greatly depends on continuous user growth) and inflation of tokens.

A case study of Axie Infinity

Inflationary & Unsustainability

Axie Infinity is a non-fungible token-based online video game developed by Sky Mavis. Axie Infinity’s growth was heavily dependent on the continuous user growth to fuel demand for the two tokens it had as well as the NFTs needed to play the game. This was going very well initially when users could earn ~$2000 a month, which is much higher than the income back in the Philippines, which consisted of one of the most number of Axie Infinity players at that time. The cost to enter the game increased exponentially from just $300 to $1500 as the game grew more popular by the summer of 2021. This brought upon the scholarship model as well as welcomed many guilds to run their own scholarships.

Axie Infinity has two tokens, the Smooth Love Potion (SLP) as well as the AXS token.

The AXS token’s main utility could be broken down into 4 parts:

- Governance - allows holders to participate in governance proposals to shape the future development of the project

- Staking - allows users to stake on the governance platform for yield

- Payments - users can use AXS token to play games and conduct payments

- Breeding of Axies

The token rose to ~$160 in November as the popularity of the game grew. The demand for AXS token grew due to onboarding of new users by the masses which requires the AXS token for the utilities explained above.

The SLP token is mostly used for breeding as well as paying out to users as they compete in the game. Thus, we can break down the SLP token to two main uses:

- Breeding of Axies

- Selling into fiat or other cryptocurrencies

As compared to the AXS token, the SLP token did not have that strong of a value accrual mechanics, other than for breeding purposes, the token was heavily sold for cash. This made the token’s price fall heavily as seen by the chart below.

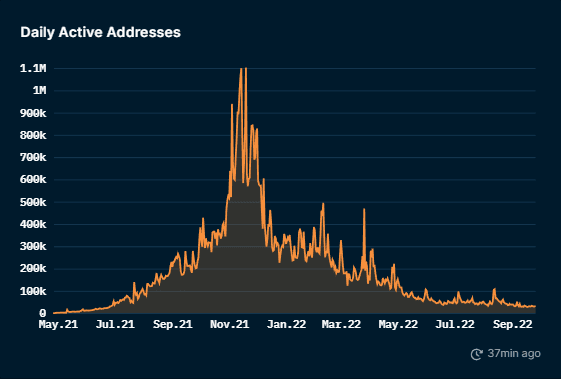

As Axie Infinity became very popular and lucrative, a lot of SLP was used to breed more Axies for sale or for making more teams and also sold for ETH to buy more Axies to grind. As user growth flourished, demand for the NFTs increased due to it being a prerequisite for playing the game. This drove the price of NFTs and thus SLP and AXS to increase drastically. As we can see from the graph below, the daily active addresses on Ronin peaked in November with over 1.1M daily active addresses.

At the peak of daily active addresses in November, the Marketcap for AXS and SLP were also at their individual highs.

However, growth of monthly users started to slow down and even went negative in 2022 as earning potential lowered due to the massive selling pressure of SLP by the core user group who took profits and withdraw as fiat, pushing price downwards. The system was built to succeed with continuous user growth proved unsustainable, causing the death spiral of the tokens to fall by ~86% YTD in 2022.

It is therefore important to design a game where it incentivizes its users in its gaming economy without creating a negative feedback loop for profit-takers.

Problems in GameFi

Earning first, game later

The idea of GameFi was to marry the two ideas of gaming and finance together. However, it is currently skewed to one direction, which is earning. As mentioned above, the current Crypto Gaming scene is known to be a grind for tokens, which is eventually sold for fiat.

This causes many problems:

- Poor gameplay - gaming studios not focusing on what is key in games, which is gameplay, in order to quickly push out their product.

- Mercenary behavior - users and guilds moving where the money is, extracting value from one game to another.

- Death Spiral - when the market turns negative and inflation becomes unsustainable, the gaming death spiral can occur, which may cause the price of gaming assets and tokens to fall massively.

- High barriers to entry - as the game becomes more popular and lucrative, the barriers to entry increases, preventing mass adoption.

- Pay-to-win - gaming experience becomes less motivating and sticky compared to skill-based gaming.

Lack of utility of gaming assets

Gaming assets, especially for AAA games that are currently being built, often serve little to no utility and have insufficient incentives for holders. This causes people to sell their gaming assets once the hype of the NFT mint is over, putting a downward pressure on prices. This is especially true for AAA games with long timelines of 2-3 years to build.

Improvements in GameFi and the way forward

Gameplay focused

Many projects are now investing more in their gameplay experience. Studios are focusing on building AAA graded games with the intention of making a game that is actually fun, competing with the likes of traditional gaming. This helps remove the focus entirely on earning tokens as well as reduce mercenary behavior through improving stickiness to the game. In the case of Nyan Heroes, they have also centered the gameplay to be skill-based rather than pay-to-win, with NFT rarities focused on drop rates and aesthetics. This ensures that the game remains competitive and fun.

However, the success of such gaming projects and studios can only be seen in 2-4 years time due to the timeline needed to build a game of such quality. Thus, heavy engagement and community building is needed from the beginning of fund raising or NFT minting to the release of the game.

Greater focus on carefully designed tokenomics

The argument against the two token economy stems from the failure to balance the value accrual of the governance and in-game token. This can be seen in the table above where the secondary in-game token such as SLP, TUS and THC fell more heavily YTD compared to the primary token. Learning from the mistakes of predecessor games, many projects are now placing high priority on tokenomics design, value accrual, sinkholes and buy-back mechanisms to cope with the inflation.

Increased utility of gaming assets

Some games try to resolve this problem by providing incentives such as rewards for mini-games or staking rewards for the NFTs. Examples would be the mini-games created by DuskBreakers, allowing players to utilize their gaming NFTs even before the main game is released. Rewards for leaderboard achievers were given, however, this did not stop the downward spiral in floor prices, from about 0.5E to 0.08E, an 84% fall in prices. It is interesting to note that games such as Nyan Heroes, which does non-playing staking as well as promises of airdrops (tokens & gaming assets) for users who hold the NFTs for a certain amount of time or snapshot may be more resilient to the downside. The floor prices were only depressed by about 50% from 13.9SOL to 6.9SOL.

| Project | NFT Incentives | Historical ATH Floor vs Current Floor |

|---|---|---|

| DuskBreakers | Minigame & NFT Airdrop | -84.00% |

| Avarik Saga | Minigame | -75.00% |

| Nyan Heroes | Staking & NFT + Token Airdrop | -50.36% |

| MixMob | Staking & Token Airdrop | -65.81% |

Sources: NFTgo.io, Magic Eden, Cryptoslam.io

Immersive social experience

With the technological advancements that blockchain can bring to games, blockchain gaming has a very strong potential to create immersive social experiences. From the example of Maplestory, a highly successful MMORPG game, it is obvious that gamers enjoy customisation of their avatars as well as social interactions with others through marketplaces, guilds, party quests etc. Gamers would even spend a lot of money to do so, which could be a strong revenue source for games.

With the interoperability capabilities of blockchains, there are countless ways to increase the social experiences such as allowing users to interact in the Metaverse using their gaming assets as characters in an open world concept (for example, using their Nyan Heroes avatar in The Sandbox metaverse).

Is Play-and-Earn the way forward?

With many criticisms of the motivations of crypto gaming being just focused on profits (basically a grind for tokens) as well as the current games not being fun, and relatively low-skilled, there are calls for a major revamp of the industry.

The term Play-and-Earn came by with the concept of gamers actually enjoying the game whilst being able to earn money doing so (however, earning money should not be the main focus of the gameplay). Although there are no fixed models for this, the key to the model is to focus on gameplay, create a free-to-play alternative within the game as well as promote ownership and decentralization.

This allows users to enjoy the game as well as lowers the barriers to entry, by allowing players the free-to-play option with a chance to work towards the prerequisites such as an NFT through drops or milestones. Projects could go back to the traditional gaming model, with income opportunities focused on ancillary products such as skill upgrades, new characters, skins etc. This could solve the problem of high barriers to entry and create a more level playing environment compared to pay-to-win options, making it more skill-based and competitive.

Moreover, there are many avenues to explore the ownership of in-game assets as well as intellectual property. Stakeholders can also steer the game (stories, loirs, new characters, new equipment) through decentralized governance voting, allowing gamers to have a say in building and pushing the game forward.

This model has not been tested or proven but would certainly be exciting to see if it would solve the problems in the current industry.

Venture Capital Activity

Notable Recent Raises in Crypto Gaming

According to DDM, in Q1 of 2022, the gaming industry had $3.5B worth of deals, with blockchain deals taking $1.7B, roughly 49% of the pie. This shows the fundraising capabilities of blockchain gaming, arising from the value proposition that blockchain brings to the gaming space.

Crypto venture capital firms have been taking large bets on Crypto Gaming being the next narrative, with the most deal count and USD value invested compared to other segments, read more here. From the past 3 months, these are some of the notable raises in the Crypto Gaming vertical:

July

- Soba - 13.6M raise by FTX Ventures

- The Games Oasys - 20.0M raise by Jump Trading, YGG, Big Brain Holdings, Mirana Ventures

- Planetarium Labs - 32.0M raise by Animoca

- BR1: Infinite Royale - 3.0M raise by Solana Ventures, SHIMA Capital

- Mighty Action Heroes - 10.0M raise by Framework, Mirana Ventures, Dragonfly Capital, Sfermion, Polygon, Folius Ventures

August

- E4C: Final Salvation - unknown raise by Spartan Group

- Luxon - 5.8M raise by FTX Ventures

- MetaverseGo - 4.2M raise by Mechanism Capital, Delphi Digital, Dragonfly Capital, SHIMA Capital, YGG

- Gunzilla - 46.0M raise by Jump Trading, Animoca, SHIMA Capital, GSR, Spartan Group

- Matchbox DAO - 7.5M raise by Starkware, Big Brain Holdings, Delphi Digital, Mirana Ventures, Lemniscap

- Terapin Studios - 93.0M raise

- Limit Break - 200.0M raise by Paradigm, Standard Crypto, FTX Ventures

- Xterio - 40.0M raise by FTX Ventures, Animoca

September

- Internet Game - 7.0M raise by ParaFi Capital, Dragonfly Capital, Delphi Digital, Uniswap Ventures

- Metaverse Magna - 3.2M raise by Polygon Studios, Spartan Group

- Trial Xtreme - 12.8M raise by MystenLabs, Solana Ventures, YGG, Block Capital

- Syborn Legacy - 25.0M raise by Pantera, Animoca, Polygon

Conclusion

The success of crypto games will be heavily dependent on ownership and decentralization, which is a core value proposition blockchain brings to the table. With the entrance of many all-star traditional gaming teams mixed with blockchain native personnel, it is very exciting to see the next generation of games being brought to life in the near future. The negative sentiment around blockchain gaming, brought upon by unsustainable Play-to-Earn mechanics may be debunked soon as the current projects learn from the mistakes of their predecessors.