Key Takeaways

- By analyzing the top flippers in the virtual real estate market, it was possible to determine that the wallet addresses who performed extremely well, did so without putting a significant amount of capital at risk. 13 of the wallets (out of the Smart Virtual Real Estate traders) risked less than 10 ETH while 8 of them spent less than 5 ETH to realize their profits

- The most profitable virtual land traders are not overtrading and aping into as many projects as possible. Rather, their strategy involves investing in maybe 3 or 4 thought-out projects and taking concentrated positions

- Overall, the virtual real estate market has been in decline just like the rest of the market. Only 4 projects out of the top 18 (filtered by estimated market cap) have a higher floor price now compared to what it was 90 days ago

- Otherdeed, although a latecomer, is still the major player in the space with the highest estimated market cap amongst the collections

- Unsurprisingly there are no Virtual Real Estate Billionaires but 30 Virtual Real Estate Millionaires were found

- Sandbox Land and Decentraland are by far the most popular collections Virtual Real Estate Millionaires own

- By dividing virtual real estate owners into separate categories (based on the number of units held) it was also possible to get a much better picture of the market and the level of centralization/decentralization of some projects in the space

- Landholders, owners with one virtual real estate NFT, have a slight majority (57%) out of all the virtual land owners

- Landholders and Landlords make-up over 94% of all the owners while Magnets, Tycoons and Moguls represent less than 0.37% of the holders in the market. However, it is possible that a single entity could be behind multiple wallet addresses so the distribution of ownership may vary

Key Terms

| Label | Description |

|---|---|

| Landholder | owner with one virtual real estate NFT |

| Landlord | owner with a balance between 2 and 10 virtual real estate NFTs |

| Baron | owner with a balance between 11 and 100 virtual real estate NFTs |

| Magnet | owner with a balance between 101 and 1000 virtual real estate NFTs |

| Tycoon | owner with a balance between 1001 and 3000 virtual real estate NFTs |

| Mogul | owner with a balance of more than 3000 virtual real estate NFTs |

Introduction

The virtual real estate market can be seen as a distinct segment representing virtual real estate NFTs within the wider NFT market. In order to gain insights into the market, over 30 virtual real estate projects were included in this research. These include projects such as Sandbox, Decentraland, Otherdeed for Otherside, and NFT Worlds, but also much younger and up-and-coming projects such as Hyperfy Worlds for example. In this report, the virtual real estate market is specifically made up of these projects.

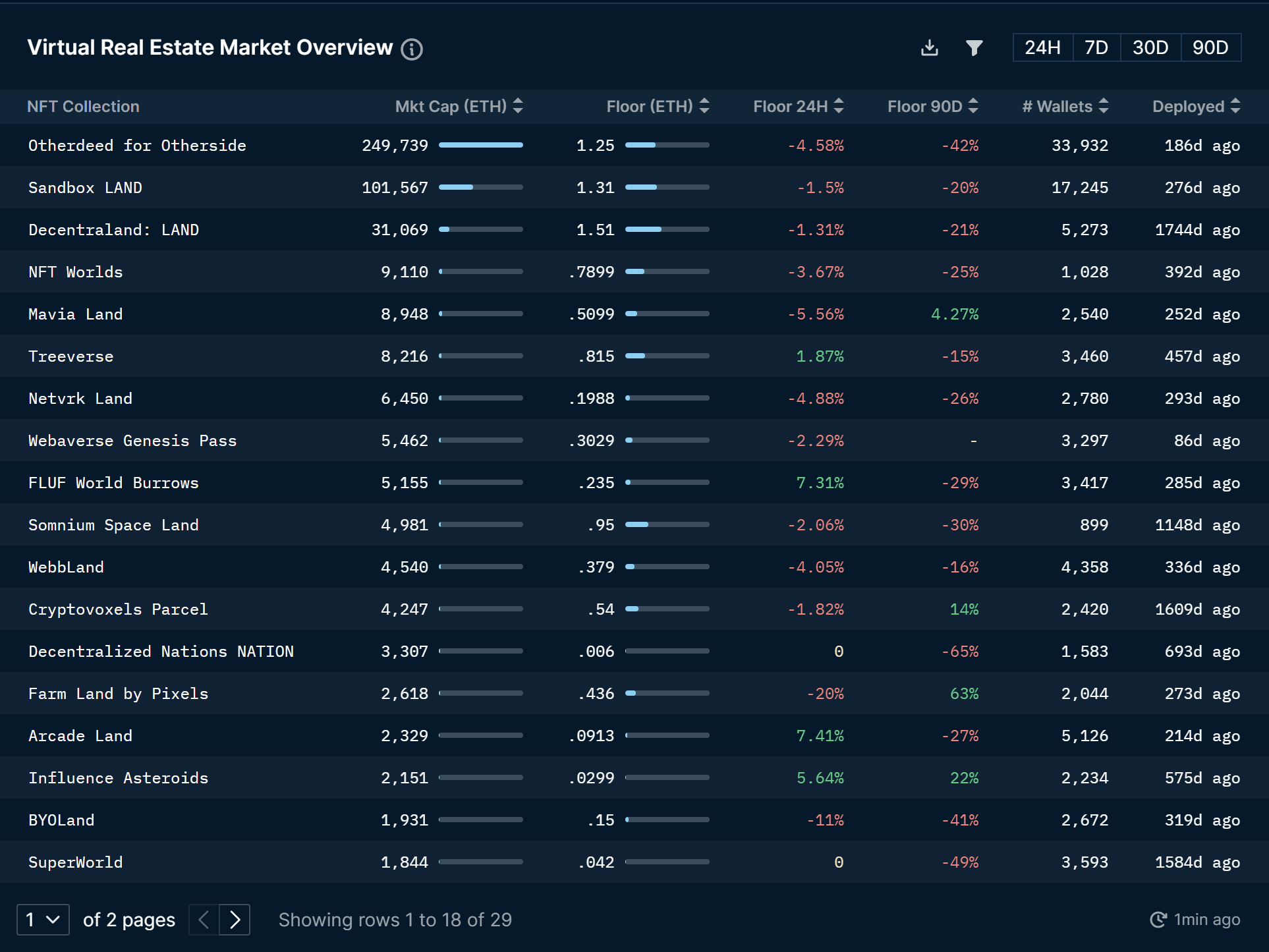

The table below provides the latest market activity of the virtual real estate market as covered in this analysis. An estimated market cap (based on the average price), floor prices (from Opensea), unique number of wallets, and more is given for the top 18 projects in the space.

Virtual Real Estate Market Overview

The table shows that Otherdeed for Otherside has the highest market cap with an estimated value of 249,739 ETH. This is significantly higher than the market cap of projects in the second and third positions (interestingly both of them much older than Otherdeed). Looking at the floor prices, however, it can be seen that the values for the top three projects are roughly in the same range (1.25 - 1.5 ETH), meaning that Otherdeed's high valuation is due to its high supply rather than a high price per NFT.

For most of the projects, their current floor price is lower than it was 90 days ago, which is not surprising to find as the whole market is in decline. Only 4 projects out of the top 18 (filtered by estimated market cap) have a higher floor price now than 90 days ago. In the last 90 days, Farm Land by Pixels’ floor price has increased the most (out of these 18 projects) at 63%, followed by Influence Asteroids (22%), Voxels (14%), and Mavia Land (4.27%).

The number of unique wallets per project also reveals an interesting insight showing that Otherdeed for Otherside and Sandbox have a significantly higher number of unique wallets in comparison to the rest of the projects. For most of the top 18 projects, the number ranges in the low thousands, while it goes up to around ~17k and ~33k for Sandbox and Otherdeed respectively. A deeper breakdown of the number of owners as a percentage of the supply has also been conducted further down below in this report.

Additionally, it can also be seen that there is no strong correlation between the age of a project and its estimated market cap.

Profit Leaderboard and Smart Virtual Real Estate Traders

| full_name | spent | revenue | no. sales | projects bought | projects sold | profit (ETH) | profit % |

|---|---|---|---|---|---|---|---|

| rhuntz.eth | 2.1 | 53.5 | 16 | 4 | 3 | 51.4 | 2419.2 |

| alexmoody.eth | 1.5 | 18.1 | 12 | 3 | 3 | 16.6 | 1052.2 |

| mintmynft.eth | 5.6 | 61.4 | 16 | 3 | 3 | 55.7 | 988.7 |

| "AG7H4L2" on OpenSea | 2.9 | 24.6 | 13 | 4 | 3 | 21.6 | 730.6 |

| "ripstar" on OpenSea | 19.3 | 150.6 | 11 | 3 | 3 | 131.2 | 677.2 |

| 🤓 @Sisterofvitalik | 4.0 | 31.7 | 27 | 3 | 3 | 27.6 | 674.9 |

| Legendary NFT Collector | 0.8 | 5.7 | 13 | 3 | 3 | 4.9 | 589.5 |

| ape60.eth | 3.4 | 23.7 | 11 | 7 | 6 | 20.2 | 580.5 |

| g-o-u.eth | 9.7 | 61.7 | 20 | 5 | 4 | 51.9 | 531.6 |

| "FelicityFeline" on OpenSea | 19.5 | 117.5 | 18 | 5 | 3 | 97.9 | 501.7 |

| gen0x.eth | 10.3 | 58.5 | 33 | 3 | 3 | 48.2 | 468.3 |

| 3511.eth | 10.1 | 57.5 | 21 | 6 | 5 | 47.3 | 466.2 |

| jjangbang.eth | 30.2 | 151.0 | 28 | 7 | 7 | 120.8 | 399.8 |

| alphanu.eth | 5.8 | 28.2 | 25 | 5 | 4 | 22.3 | 380.9 |

| jack5590.eth | 2.6 | 10.7 | 12 | 3 | 3 | 8.0 | 300.9 |

| 01-57.eth | 4.5 | 17.5 | 15 | 3 | 3 | 13.0 | 289.7 |

| 30821.eth | 5.8 | 21.4 | 15 | 6 | 6 | 15.6 | 266.4 |

| 🤓 "0x4595FF" on OpenSea | 166.1 | 603.0 | 125 | 5 | 4 | 436.8 | 262.9 |

| 0x35…20cb | 52.7 | 183.0 | 28 | 4 | 3 | 130.2 | 246.8 |

| spyfox.eth | 7.8 | 27.2 | 11 | 5 | 5 | 19.3 | 246.1 |

The profit leaderboard given above shows the top profitable wallets that have at least 10 sales across at least 3 collections within the virtual real estate sector (as covered in this analysis). This was done in order to identify wallet addresses that were active in the space and have been consistently outperforming, rather than highlighting wallet addresses with one or two lucky (or insider) trades.

- It can be seen from the table that based on the conditions set above, rhuntz.eth is the top virtual real estate flipper in the space. The wallet address has made 53.58 ETH in revenue by only spending about 2.1 ETH (that’s a return of around 25x).

- Furthermore, they were able to make such a profit by selling a total of 16 NFTs from three different collections.

- Interestingly, the average number of projects bought by these top 20 wallet addresses is 3.8 while the average number of NFTs sold is around 23. This suggests that the most profitable virtual land traders are not overtrading and aping into as many projects as possible. Rather, their strategy involves investing in maybe 3 or 4 thought-out projects and taking concentrated positions.

- Furthermore, when looking at the amount of ETH these top 20 wallets risked buying virtual land, it can be seen that the average amount spent was around 18.29 ETH. This however has also been skewed by a few wallets spending a significant amount of ETH. It is important to highlight that over 13 of these wallets risked less than 10 ETH while 8 of them spent less than 5 ETH. Interestingly, only three wallets spent more than 20 ETH while only one spent over 100 ETH. This also suggests that the most profitable flippers did not risk a significant amount of ETH in order to generate those returns.

- Additionally, the table also gives the number of projects bought and sold by these 20 wallets. It can be seen that 11 wallets have sold an equivalent amount of the projects that they bought, while the rest have at least one project that they haven’t sold yet.

Interestingly out of the top 20 wallets given in the table, only two wallet addresses are labeled as Smart Money. Thus, labeling these wallets as Smart Virtual Real Estate Traders or setting up Smart Alerts on them could also be beneficial to traders interested in this space.

Setting up Nansen Smart Alerts

To set Nansen Smart alerts on the Smart Virtual Real Estate Traders above please follow this link. The wallet addresses have already been pre-filled.

Virtual Real Estate Millionaires and Billionaires

By analyzing the top wallets based on the estimated value of their NFT holdings, it was also possible to determine holders that were millionaires or billionaires (in USD), solely based on their virtual land assets (certain contracts and project owned wallets were excluded). Unsurprisingly, it was found that there are no Virtual Real Estate Billionaires. This makes sense as the asset class is relatively new, and the entire NFT market cap of the top projects is still in the hundreds of millions. However, it was determined that there are 30 Virtual Real Estate Millionaires in total.

The table below shows all the Virtual Real Estate Millionaires and their estimated net worth based on the combination of virtual land collections they hold.

| Name | Virtual Land NFT Balance | Estimated Value (ETH) | Estimated Value (USD) |

|---|---|---|---|

| d-8.eth | 3,753 | 5,006.5 | $7,786,729.2 |

| High Balance | 2,640 | 4,448.9 | $6,919,374.1 |

| Blue Chip NFT Holder | 2,857 | 3,724.4 | $5,792,567.0 |

| Otherdeed (OTHR) NFT Exploiter | 2,257 | 3,069.5 | $4,774,024.4 |

| gif.eth | 1,880 | 2,255.3 | $3,507,688.3 |

| Blue Chip NFT Holder | 1,512 | 2,009.4 | $3,125,294.4 |

| "The_Realm" on OpenSea | 1,201 | 1,593.4 | $2,478,325.4 |

| dgland.eth | 836 | 1,414.3 | $2,199,816.3 |

| GnosisSafeProxy | 792 | 1,052.5 | $1,637,059.0 |

| Blue Chip NFT Holder | 756 | 1,004.7 | $1,562,647.2 |

| fashionst.eth | 594 | 955.4 | $1,485,933.6 |

| Legendary NFT Collector | 581 | 953.6 | $1,483,289.6 |

| Pranksy | 1,206 | 918.3 | $1,428,371.9 |

| High Balance | 690 | 909.0 | $1,413,823.6 |

| High Gas Consumer | 512 | 867.0 | $1,348,445.0 |

| dingaling | 646 | 821.3 | $1,277,495.4 |

| "WCB" on OpenSea | 612 | 813.3 | $1,265,000.1 |

| High Gas Consumer | 463 | 785.4 | $1,221,532.6 |

| *Blue Chip NFT Holder | 576 | 765.5 | $1,190,588.3 |

| *"TheMetakey" on OpenSea | 576 | 765.5 | $1,190,588.3 |

| *Blue Chip NFT Holder | 576 | 765.5 | $1,190,588.3 |

| *Blue Chip NFT Holder | 576 | 765.5 | $1,190,588.3 |

| *urkann.eth | 576 | 765.5 | $1,190,588.3 |

| *Blue Chip NFT Holder | 576 | 765.5 | $1,190,588.3 |

| *Blue Chip NFT Holder | 576 | 765.5 | $1,190,588.3 |

| *GnosisSafeProxy | 576 | 765.5 | $1,190,588.3 |

| Epic NFT Collector | 569 | 756.2 | $1,176,119.4 |

| High Gas Consumer | 427 | 725.9 | $1,128,992.2 |

| Millionaire | 501 | 681.3 | $1,059,719.2 |

| michaelcharest.eth | 516 | 668.7 | $1,040,102.2 |

From the table above it can be seen that d-8.eth leads the ranks as the top Virtual Real Estate Millionaire. His estimated net worth, based solely on his virtual real estate holdings amounts to around 5006 ETH (over $7.7m at the time of writing). It can also be seen that they hold a total of 3753 virtual land NFTs from the collections covered.

If we look closer at the table we also notice that wallet addresses starting at positions 19 to 26 (highlighted with an *) all have exactly the same estimated value. This is because they hold an exact amount of tokens (576) from the same collection (Sandbox), thus it is possible that one entity is behind all of these wallets and have broken down their holdings into exact portions in different wallet addresses.

michaelcharest.eth is the Virtual Real Estate Millionaire with the least estimated net worth out of all the collectors. They managed to make it in the Virtual Real Estate Millionaire Leaderboard with an estimated net worth of 668 ETH (~$1m).

Overall, Virtual Real Estate Millionaires control a combined net worth of over 41,559 ETH (~$64m). The average millionaire holds an estimated net worth of around 1385 ETH ($2.1m), but it’s worth mentioning that a total of 22 millionaires (out of 30) have an actual estimated net worth below this. As a result, it can be seen that considerable inequality exists even among millionaires.

Distribution of projects owned by Virtual Real Estate Millionaires

In order to get a better understanding of the holdings of these Virtual Real Estate Millionaires an analysis of their virtual land portfolio was also conducted.

The chart below gives a breakdown of the top projects held by millionaires (projects with at least 2 Millionaire owners).

From the chart above it can be determined that Sandbox Land is by far the most popular collection for Virtual Real Estate Millionaires. Sandbox Land is owned by 21 Virtual Real Estate Millionaires (out of a total of 30, meaning only 9 millionaires don’t have at least 1 NFT belonging to that collection). Decentraland comes in second, by attracting a combined amount of 18 millionaires, not that far away from Sandbox. Otherdeed for Otherside follows next, attracting 5 millionaires while Voxels attracted three, significantly lower than Sandbox and Decentraland. The rest on the list managed to attract two or fewer Virtual Real Estate Millionaires.

Smart Virtual Real Estate Holder

In order to identify Smart Virtual Real Estate Holders one could subtract the amount spent on buying NFTs (currently in balance) from the estimated value of wallet addresses. This would allow us to highlight profitable wallet addresses that haven’t sold yet. However, it is important to note that during a bear market, most of the best ‘holders’ could be out of the market entirely, making the findings suboptimal.

Virtual Real Estate Distribution Breakdown: Landholders, Landlords, Barons, Magnets, Tycoons, and Moguls

In order to gain better insights into the virtual real estate market, an analysis of the token holders was also undertaken.

The analysis involved breaking down holders of virtual real estate NFTs into distinct groups and labeling them with certain tags in order to understand the concentration of tokens in the sector.

From the chart below it can be seen that over 97.3k wallets were identified as holding at least one virtual real estate NFT (as covered in this analysis). The definition of the terms seen on the left of the chart below refers to the following:

- Landholder - owner with one virtual real estate NFT

- Landlord - owner with a balance between 2 and 10 virtual real estate NFTs

- Baron - owner with a balance between 11 and 100 virtual real estate NFTs

- Magnet - owner with a balance between 101 and 1000 virtual real estate NFTs

- Tycoon - owner with a balance between 1001 and 3000 virtual real estate NFTs

- Mogul - owner with a balance of more than 3000 virtual real estate NFTs

Landlords, Barons, Magnets, Tycoons, and Moguls can, of course, own NFTs from different collections to meet the definition given above.

It can be seen that a slight majority of all the virtual real estate owners are Landholders (57%), although it is important to note that a single entity could be behind multiple wallet addresses. Landholders and Landlords together make up over 94% of all the owners while Magnets, Tycoons, and Moguls represent less than 0.37% of the holders in the market.

By applying a similar breakdown to each Virtual Real Estate NFT collection, it is also possible to identify projects with massively concentrated tokens. Theoretically, these will be more volatile with a price action heavily impacted by the action of a few select wallet addresses (e.g. whale dumping could significantly impact the price in projects with massively concentrated token distributions). Additionally, since in many situations governance will also be determined by token holders, the decentralization of the project will also depend on the distributions of these project tokens.

For example, the charts below show the distribution breakdown of virtual real estate owners for both Otherdeed for Otherside and Webaverse. By segmenting the owners into the categories mentioned above, a quick comparison can be done between the two projects highlighting the concentration of the tokens.

From looking at the charts above, one can quickly comprehend the distribution of the tokens among the holders (holders include contracts and project wallets, as a holistic view of the token distributions is preferred - this helps in identifying major concentrations and associated risks regardless of the type of wallet holding the tokens). It can be seen that Otherdeed has around ~33k owners (with a max supply of 100k) while Webaverse has around 3.2k total owners (with a max supply of around 20k). Landholders and Landlords make up almost all of the owners for both Otherdeed and Webaverse (97% and 95% respectively). Barons, Magnets, and Tycoons make up ~5.7% of the holders in Webaverse while representing a much smaller percentage of the total distribution in Otherdeed, around 2.5% to be more specific (with the addition of 1 Mogul - identified as Yuga Labs).

Theoretically, a collection with a large majority of unique holders is less prone to the effects of whale dumps, insider trading, and price manipulation.

Closing Thoughts

The virtual real estate market is still in the early stages of development, but by analyzing over 30 projects in this field (old and new) it was possible to get a much better picture of the space. Overall, this sector follows the general trend of the crypto market and has been in decline with only 4 projects out of the top 18 (filtered by estimated market cap) having a higher floor price now than 90 days ago.

It was also possible to identify some of the top players in this space. Based on the conditions set, rhuntz.eth is the top virtual real estate flipper. Interestingly, it was also found that the best Smart Virtual Real Estate Traders are buying NFTs within a small group of collections, which shows they are going for more concentrated bets vs diversification. Additionally, it was determined that the average Virtual Real Estate Millionaire has an estimated net worth of around 1385 ETH ($2.1m) based solely on their virtual real estate holdings. Although a total of 22 millionaires (out of 30) have an actual estimated net worth below this. As a result, it can be seen that considerable inequality exists even among millionaires.

Furthermore, a look at the owner distribution of the virtual real estate market was also undertaken to get a better picture of the concentration of the market. Landholders have a slight majority (57%) out of all virtual land owners. Landholders and Landlords make up over 94% of all the owners while Magnets, Tycoons, and Moguls represent less than 0.37% of the holders in the market. This shows that a slight majority of the virtual real estate population owns only one unit, while a very small number of people are among the top owners.