TLDR

- Cosmos has the Theta Upgrade scheduled for Q1 2022 which brings Cosmos SDK upgrades, NFT Modules, Tendermint upgrades, composability of chains via Interchain accounts, Liquid Staking, CosmWasm on the Hub, Gravity Bridge Updates and much more.

- Opt-in model of Shared security via the Hub through Interchain Staking is also planned for Q2 of this year. First implementation, allows for chains to rent out security from the Cosmos Hub - allows for an easier onramp to deploy app-specific chains. The second and third implementations will allow for more dynamic security models where they can partially secure the chain. Celestia is also pioneering on this front for the long tail of chains and rollups. Both solutions are complementary to one another and reduce the barrier to entry of deploying a chain on Cosmos.

- ATOM token value accrual is being improved through Interchain Security, IBC routing via the Hub, liquid staking, and the Gravity DEX implementation. Ultimately, these mechanisms make the Hub more useful, which flows downstream to ATOM stakers through fees and external staking rewards.

- IBC is becoming increasingly useful and widespread. New modules, which can be thought of as internet apps that live on IBC, are launching this quarter that will bring the composability of the EVM across sovereign Cosmos chains through Interchain Accounts. The NFT module will also be implemented this year which allows NFTs to flow seamlessly over IBC between multiple chains.

Cosmos Overview

Layer-1 blockchains have gained massive market share and will continue to grow given a multichain thesis plays out. No single blockchain can scale endlessly on its own and we will likely have a world with many blockchains. However, right now most of these blockchains are walled gardens, face scaling issues or force barriers to entry for developers to build on them. If we are to achieve mass adoption, then all blockspace will be full and all monolithic layer-1s will face the same scaling issues as Ethereum today.

Given this, Cosmos has prepared for this world to play out having originally built out the architecture for a multichain world since 2017, when more than 99% of all DeFi activity occurred on Ethereum. Similar to Polkadot, Cosmos is a layer-0 protocol that focuses on horizontal scalability for many blockchains to compose on. Layer-0s are a chain agnostic bet on the future that many chains will exist and Cosmos’s model offers one of the most scalable and sovereign approaches.

Cosmos itself is not a blockchain but rather a framework for building out independent and sovereign blockchains. The Cosmos architecture is a modular approach where they build out the essential tooling that chains will need, without enforcing any type of rent seeking in the form of fees or shared security. Some of the key innovations they have built out include the following:

- Tendermint for chains to easily deploy PoS

- The Cosmos SDK to easily build out applications

- IBC for interoperability between Zones (chains)

- Interchain Staking for an opt-in model of Shared Security

- Gravity Bridge for connecting to EVM chains

- CosmWasm for deploying smart contracts

The key difference between Cosmos and any other layer-1 or 0, is that they give each chain the ability to use/modify the key tools they have built out or not use them at all. If you want to modify the Gravity Bridge for your specific zone, you can do so and we have seen this play out already. There are multiple forks of the Gravity Bridge for chains such as Secret Network or Injective and can be customized any way the blockchain sees fit. If you do not want to enable IBC and exist as an isolated chain, you can also do that as could be seen from Binance Smart Chain. Cosmos treats interoperability and adoption as a spectrum, ultimately empowering the app-specific chains to be autonomous. In short, you can say that Cosmos defeats the notion of the fat protocol thesis and enshrines itself to be the key infrastructure for sovereign and independent blockchains to coexist in a composable way.

Cosmos Architecture

Many layer-1s are constantly trying to find product market fit today but the narratives are always evolving. Cosmos has already found utility given it supports 28 IBC enabled chains with over $75b shared economy between them. We will dive more into IBC and the other modules Cosmos has built out and what is to come in their roadmap. The key takeaway is that many users interact with Cosmos core infrastructure every day such as the Cosmos SDK and Tendermint without ever realizing it. Every Binance Smart Chain user, Terra user, Polygon user and dozens of other ecosystems use some tooling from the Cosmos stack. The Cosmos vision is one with millions of application-specific blockchains which can remain sovereign while participating in the greater blockchain ecosystem with the composability of the EVM. Cosmos is made up of many moving parts, which makes it complex in the way that you would expect a decentralized ecosystem building decentralized tools and decentralized chains to appear.

Again, the Cosmos mantra is to build integral tools for developers to build application-specific blockchains and let them decide if they want to implement them. To begin, we will cover some of the open source tools they have developed to easily deploy app-specific chains: Tendermint, Cosmos SDK, IBC and CosmWasm.

Tendermint BFT Consensus

Originally, a blockchain needed all 3 layers to be built out: Networking, Consensus and Application layer. Cosmos flipped this paradigm on its head and built out Tendermint BFT which bundles the networking and consensus layers of a blockchain into a generic engine. Tendermint allows developers to focus strictly on app development which can be done in any language that they desire. Some of the core features Tendermint unlocks are instant finality, thousands of TPS, and it can accommodate public and private blockchains. In short, Tendermint simplifies the process of deploying a sovereign blockchain.

Cosmos SDK

Given that Tendermint reduces the amount of time needed to deploy a blockchain, the Cosmos SDK enables an easier way to build applications on top of it. The Cosmos SDK is made up of many modules that are used for different purposes. One can either use existing modules already built out by importing them or create new ones for their own app. The suite of SDK modules continues to grow alongside the growth of the Cosmos network which simplifies the task of developing blockchain applications. The second major principle guiding the Cosmos SDK relies on capabilities-based security. This principle constrains the security boundaries between modules, which gives developers the ability to decide on the spectrum of composability between chains.

Zones and Hubs

To better understand Cosmos, let's dive into some of the Cosmos basics. Again, Cosmos is not a vertical stack like other monolithic layer-1s such as Ethereum or Solana but it is a horizontal scaling framework for blockchains. Unlike Ethereum where apps live on the same blockchain, Cosmos is made up of many independent blockchains called Zones. A Zone can be defined as any sovereign blockchain created within the Cosmos framework that has its own validator set and security assumptions and has implemented IBC.

Further, everything is inherently a Cosmos Zone - any blockchain that uses a consensus mechanism with finality can implement IBC eventually. Hence, any layer-1 or sidechain is ultimately a Cosmos Zone and can connect via IBC. However, the barrier to entry for all chains adopting IBC boils down to the transport layer which makes it too expensive to run a light client on EVM chains. We will dive more into IBC later in the report on some of the solutions being worked on today.

Given a Zone becomes popular enough and establishes many channels with other Zones via IBC, it will be deemed a Hub. The Cosmos Hub is the best demonstration of this because the Cosmos Hub has the most channels with other Zones. Osmosis is similarly becoming the DEX Hub with 122 channels established with other Zones to transfer over tokens to their liquidity pools. Becoming a Hub has lindy effects because they have built out the core infrastructure to support many chains; thus, you can have a DeFi Hub, a privacy Hub, a data availability layer Hub and so on. The number of active channels is a good indicator of a Zone becoming a Hub.

Inter Blockchain Communication (IBC)

We have defined what Zones are and what Cosmos is as a framework, let's now dive into what IBC is more broadly. At its core, IBC is a generalistic messaging network for sovereign blockchains to communicate with one another. It establishes a clear set of standards for blockchains to adopt and closely resembles the internet blockchain equivalent of TCP/IP. TCP/IP is a set of communication protocols that the internet uses and lays the simple and flexible foundation that the Internet has used for 50 years. In the same regard, IBC has a set of standards that define how data is sent and acknowledged across chains without defining what the data is or how it should be structured - a general framework is a feature, not a bug. At the time of writing, IBC is enabled on 28 different chains and has facilitated over 4 million transfers in the last 30 days alone. To dive deeper into the distribution of IBC transactions amongst Zones, reference the Map of Zones page here.

Although IBC is very general, you can build specific implementations on top of it in the form of modules. If IBC is the TCP/IP equivalent of blockchains then a module can be thought of as an internet app that has a specific use case such as token transfers, cross-chain governance, NFT transfers and much more. They initiated IBC in March to enable token transfers via the ICS-20 module. This module allows IBC-enabled Zones to transfer assets to any Zone that it has an established channel with. For example, Terra users can permissionlessly send assets to Osmosis or any other IBC-enabled chain that it has established a channel with. Note, this is the first module IBC enabled but the team has been building out other modules that bring the composability of the EVM across chains and much more - all without sacrificing decentralization or sovereignty.

As mentioned above, cross-chain channels are key components of the cross-chain communication system in Cosmos called Inter Blockchain Communication (IBC). We will first go over what these channels are and then give an overview of IBC more broadly.

Channels are simply information channels for IBC modules (can be thought of as internet apps) to communicate over through standardized data packets using IBC standards. For example, to send ATOM from the Cosmos Hub to Osmosis, you would use the designated channel between the two Zones. However, if you are sending ATOM from the Cosmos Hub to Secret Network, it would be its own separate channel that is completely separate from the former. Each channel is unique and describes an information flow between two Zones. However, the complexity of channels is being abstracted away from the UX where Zones like Osmosis take care of everything on the backend and use a simple ‘Deposit’ and ‘Withdrawal’ button to send/withdraw tokens across IBC.

You can theoretically have millions of channels for a given Zone, although you will need a certain amount of infrastructure in place, like archive nodes and a relayer for each counterparty chain.

A relayer facilitates the data transport between Zones and monitors the state of outgoing packets and submits them to the appropriate destination chain. You may very well highlight that the infrastructure requirements are a barrier to entry, but we will dive into the IBC routing solution via the hub and its implications on the ATOM value accrual.

IBC’s Limitations and Counterarguments

First, let us begin with some of IBC’s limitations as it stands today and then we will have a counterargument for each.

IBC is limited to a subset of chains. IBC’s transport layer only works for chains with deterministic finality and it is too expensive to run a light client on Ethereum or other EVM chains so IBC can not be widely adopted.

- Counterargument: IBC is limited to its current chains due to the transport layer on which it runs. However, LayerZero adopted IBC by swapping out IBC’s transport layer with their own. Now IBC can reach all chains that LayerZero can connect to through its transport layer; therefore, IBC will be able to reach all EVM chains, Solana and even chains based on probabilistic finality such as Bitcoin. The future of interchain communication is a single standardized protocol like IBC which is the data layer and it will run over many diverse blockchain communication protocols such as LayerZero which are the transport layer. IBC can live on top of one or more transport layers such as LayerZero and they are inherently symbiotic. In addition, the team has been working hard on implementing IBC for NEAR, Polkadot, Celo, Avalanche and many other chains. Other Cosmos Zones are also working on bringing cross-chain solutions to all chains such as Axelar Network and THORChain. Note, there are many projects tackling this issue and many of them are live or have been in development for quite some time and will be coming to mainnet this year.

IBC can only support token transfers so it lacks the composability of monolithic chains such as Ethereum.

- Counterargument: Cosmos Zones are their own blockchain so it is not interoperable with other blockchains by default. However, synchronous interaction is still possible within each Cosmos chain but not with others; hence, composability is limited to staying within the applications on a given Zone. ICS-20, the token transfer module, was the first IBC module that allows Zones to interact with each other. Again, a module can be thought of as an internet app; however, this internet app/module is restricted to just token transfers but there are other modules. The Cosmos core developers have multiple IBC modules launching in 2022 and these will bring wide-ranging functionality to IBC. We will dive more in-depth on each module later but IBC can theoretically have unlimited modules built, although they are resource intensive so they are released slowly.

- Interchain Accounts, ICS-27, brings the composability of the EVM between sovereign Cosmos chains.

- Fee Middleware, ICS29, incentivizes packet relaying which tackles the infrastructure barrier of Relayers and Archive nodes and brings value to ATOM by allowing the Hub to play the role of the IBC router across Zones. Connect to the Cosmos Hub and be interoperable with every IBC Zone.

- NFT Module allows for NFT transfers between IBC-enabled chains.

- Counterargument: Cosmos Zones are their own blockchain so it is not interoperable with other blockchains by default. However, synchronous interaction is still possible within each Cosmos chain but not with others; hence, composability is limited to staying within the applications on a given Zone. ICS-20, the token transfer module, was the first IBC module that allows Zones to interact with each other. Again, a module can be thought of as an internet app; however, this internet app/module is restricted to just token transfers but there are other modules. The Cosmos core developers have multiple IBC modules launching in 2022 and these will bring wide-ranging functionality to IBC. We will dive more in-depth on each module later but IBC can theoretically have unlimited modules built, although they are resource intensive so they are released slowly.

IBC allows users to transact in any token which hurts the value accrual of ATOM.

- Counterargument: Allowing users to pay transaction fees in their native assets rather than ATOM reduces any form of rent seeking from the Cosmos Hub. The Cosmos Hub is based on the principle of minimalism - do not force rent seeking activities of the ATOM token that might affect the sovereignty of Zones. However, there are multiple initiatives working on the tokenomics of ATOM - IBC routing, chain naming service, Interchain Security via the Cosmos Hub, and liquid staking.

We have now covered some of the Cosmos basics, but why would an application want to deploy as an app-specific chain rather than as a smart contract on another layer-1? We summarize some of the key points below.

Advantages

Scalability

- A network of app-specific chains is more scalable than chains where the validators secure everything (validators strained for capacity). They can scale out horizontally through roll-ups that cross-communicate with one another using the Zone as a Settlement layer.

- If a Zone begins to be too congested, they can implement rollups at the execution layer and have them use Celestia as a DA layer. ### Blockchain Design and Developer Friendly

- Developers can use whatever language they would like to build on Cosmos. Cosmos SDK already has bindings for many chains. They offer Rust, Golang, CosmWasm, and will soon offer modules to build apps using JavaScript and Solidity.

- Cosmos SDK makes it relatively easy to deploy a blockchain. Tendermint ensures an easy way to ensure consensus. These core infrastructure pieces allow developers to focus on the application as opposed to the underlying consensus.

- Don't need to overpay for security or gas fees. ### Mev Resistance

- Can use MEV mitigations like transaction order mechanism. Osmosis is working on batching txns of all trades in a single block.

- Zones select who they are interoperable with, reducing exposure to external incentives.

Disadvantages

Security Guarantees

- Each Zone is responsible for its own level of security. On Ethereum, all apps inherit the security of layer-1.

- Runs the risk of not being able to secure the TVL on its own chain

- Counter-Arguments:

- Interchain Security via the Hub - launching Q1 2022

- Shared security and consensus via Celestia DA layer

- Devnet live, launching 2022 ### Composability

- Each Zone is its own blockchain so it is not interoperable with other blockchains by default. However, synchronous interaction is still possible within a single Cosmos chain

- Counterargument:

- Inter Blockchain Communication (IBC)

- Interchain Accounts module launching on IBC in Q1 2022 allows for Ethereum composability across Cosmos Zones

- NFT Module launching Q2 2022 allows for Interchain NFTs ### Longer to build than an app on Ethereum

- Inter Blockchain Communication (IBC)

- Developers have to deal with blockchain design such as MEV

- Spinning up a Cosmos Zone generally takes longer than a smart contract on Ethereum

In short, there are a lot of advantages of deploying as an app-specific chain and many of the disadvantages have been resolved or have solutions in the short to mid-term.

To highlight the design advantages from the table above, we can look at Sommelier which is a liquidity manager similar to the automated Uni v3 managers on Ethereum. Sommelier will be IBC-enabled by default and will be able to route liquidity optimizations across any IBC-enabled chain and to Ethereum via the Gravity Bridge. By design, the total addressable market for Sommelier could far surpass the likes of Uni v3 solutions that are subject to one chain, fragment liquidity and face high gas costs.

For another example of a unique design approach, look no further than Umee, which allows for true cross-chain lending and dramatically increases the capital efficiency of Cosmos assets that use PoS Consensus. More and more applications will realize the structural advantages of building on Cosmos and we will highlight a few more key features below. In short, building an app-specific chain allows you to build one specialized chain for your application and connect to everything else via IBC - no need to fragment liquidity and UX across multiple chains/rollups.

CosmWasm

Similar to the other key tooling Cosmos developers have built out, they have also made huge strides in advancing smart contract frameworks. Having started back in 2019, CosmWasm is a smart contracting platform that is written as a module and can be easily implemented into the Cosmos SDK. This implies that any chain that is already built or planning to build on the Cosmos SDK, can easily add CosmWasm to their chain without changing their existing logic. Again, this demonstrates an opt-in model where chains can choose to even fork the code and implement their own version of CosmWasm (already popularized by Terra).

Other implementations of CosmWasm are happening at the community level with a particular focus on Juno Network. Juno is a Cosmos Zone that utilizes the CosmWasm smart contract framework. It just had its Moneta upgrade which brought the smart contract module to Juno Network, where it aims to be the home of CosmWasm. Projects can permissionlessly use & create cross-chain applications that scale while being able to communicate with other Zones natively using IBC. This implies any application, more specifically long tail apps, can deploy as a CosmWam smart contract to access the interchain, without being its own sovereign blockchain.

So why would Zones adopt CosmWasm over other languages? It is a highly performant framework that allows you to run Web Assembly (Wasm) bytecode and utilizes the Rust programming language and will also be adding support for smart contracts written in Golang in Q2 2022. We will give a summary of the basic and more advanced features that CosmWasm enables and why it's community driven approach could offer a unique design advantage.

Basic Features

- Storage Plus

- Provides state management like Ethereum which makes it easier for apps using the Cosmos SDK to write more complex apps.

- Security by Design

- Designed architecture to combat common Solidity attacks such as re-entrancy attacks, uninitialized variables, and other bugs that can be made. Note, the business logic can still have bugs but you do not need to worry about other bugs sneaking in.

- Submessages

- Allows communication and composition between different contracts.

- Easy Upgrades

- Allows easy upgrades to your code. Makes it powerful on Terra and other chains that are using CosmWasm.

Advanced Features

- Snapshot Map

- A map is how you store state in Cosmwasm and lets you take a snapshot of any history

- Provides lazy snapshotting for checkpoints you choose ‘lazily’ query them later

- Can power the evolution of DAOs and governance for that takes snapshots of voting and allows next gen governance

- Ex: DAO DAO team

- Migrations

- Migrating on the Cosmos SDK is hard

- Can do upgrades and transformations

- With a migration, you can do anything a contract can do: instantiate new code, create new contracts

- Ex for DeFi: Take a Uniswap pool with a router that routes to many other pools + interchain pools while maintaining the same interface + location

- IBC Contracts

- Enables a dynamic IBC - allows for an iterative design of IBC protocols at a much faster speed

- It takes a long time to upgrade and develop IBC protocols

- Allows for composability across Zones and reduces the barrier to entry for new DeFiparticipants

- Ex: Yield farming protocol that aggregates over multiple different chains.

- Enables a dynamic IBC - allows for an iterative design of IBC protocols at a much faster speed

Drawbacks of CosmWasm

CosmWasm is not perfect in its current form and there are some drawbacks. To name a few:

- Complex

- apps that are spread out across many contracts become hard to read

- Difficult

- bigger learning curve than Solidity and hard to write simple things

- Auditability

- harder to audit than Solidity

There are many teams working on building out CosmWasm and there is lots of potential for Cosmos chains to integrate CosmWasm to expand upon the capabilities of IBC and the interchain more broadly. The Interchain Accounts module is enhanced because you can deploy applications as CosmWasm contracts on two separate chains. This allows a lending protocol on another chain to be able to swap assets using Osmosis; however, this type of composability can happen quickly whereas upgrading IBC protocols could take months because you are waiting for each upgrade to happen on both sides. CosmWasm significantly decreases the deployment time by being a lightweight layer that sits on top of each chain that implements it. Theoretically, you can have composability between N number of chains - this will cause an explosion in composable DeFi apps, regardless of the chain they are deployed on.

We are already seeing protocols like Osmosis looking to implement it as well as the Cosmos Hub where they are exploring new DAO and protocol developments built on top of their chains. In short, CosmWasm brings many advantages to the Cosmos ecosystem and will play a key role in the design approach surrounding composable DeFi, governance and IBC in general.

EVM Compatibility

EVM compatible layer-1s have enabled users to interact with their favorite protocols for a fraction of the price. Given the vibrant developer community and tooling built around the EVM, many layer-1s like Avalanche and Fantom were able to bootstrap communities through forking key DeFi components and having Ethereum apps easily port over. In short, the EVM is very powerful and brings lots of network effects and has proved to be a huge benefit for smart contract platforms. Until recently, Cosmos was not EVM compatible. This is both a good and bad thing; for the good, it forces Cosmos-based projects to build unique applications that are implemented into the SDK and secured via Tendermint. These projects are fundamentally unique and not just generic forks - it bootstrapped an entire development ecosystem. As for the bad, Cosmos was left out of the composability of the EVM, the developer community, tooling and everything else Ethereum and the greater EVM have to offer.

Enter Evmos and Cronos

The unique nature of Cosmos Zones are that they are highly scalable and have a flexible design space by default. With this modular framework, certain Zones have the ability to implement EVM compatibility. We have seen Cronos, the first Cosmos EVM chain, go live on mainnet on November 7th and has a TVL of $1.91b at the time of writing, ranking amongst the top 10 chains by TVL. Cronos has seen a wide range of DEXs and dapps port over and it bootstrapped a community using Crypto .com as a fiat onramp. Although Cronos has brought the first EVM chain to Cosmos, the actual applications living on Cronos are not compatible with native Cosmos tokens and it has a limited set of IBC channels available between it and other Zones. Hence, there is no way to easily use these tokens with other Cosmos Zones.

Further, we are particularly interested in an EVM chain that is able to be compatible with the greater Cosmos ecosystem - one that can seamlessly integrate ERC-20 tokens with native Cosmos coins. Evmos aims to be the EVM Hub of Cosmos. It will connect Cosmos chains via IBC, Ethereum via the Gravity Bridge and other EVM environments. The EVM can now live on Cosmos and horizontally scale across other Zones using IBC. Some of the advantages of the EVM living on Cosmos compared to Ethereum are the fast finality from Tendermint consensus as well as the composability and modularity of the Cosmos SDK.

In terms of bridging to Evmos, they are built in such a way that any EVM bridge that is used today can actually be built on top of Evmos. Because they are a Cosmos chain, they will already have IBC enabled for cross-chain interoperability between IBC enabled Zones. However, they will also support native EVM bridges to be deployed on Evmos such as the Gravity Bridge, Optics, Connext and Wormhole. These bridges allow for any EVM layer-1, sidechain, rollup and even Solana assets to access the Cosmos ecosystem.

One of the most compelling aspects of Evmos is the ability for rollups to exist on Cosmos and it is currently working on making this a reality with its recent partnership with Celestia via Cevmos. Using Celestia as a data availability layer, Evmos will be an optimized EVM for rollups which is planned for this year.

Evmos’s value proposition is compelling for developers because it will be the first implementation of the EVM where it can natively interact with all of these different blockchains such as Osmosis which deepen their access to liquidity. Evmos takes these other EVM compatible layer-1s and pushes the interoperability one step further - similar to other EVM chains, Evmos apps will be EVM compatible with higher scalability but it will also tap into the community and overall liquidity of the broader Cosmos ecosystem. This is a key distinction compared to other EVM chains where they are fighting for liquidity as opposed to composing horizontally with an existing ecosystem.

Given we have app-specific chains, EVM compatibility, and composability coming via Interchain accounts, where does this leave the value and use case of the ATOM token?

Atom Value Accrual

Atom has been often ridiculed for not having value accrual mechanisms that capitalize on the activity happening within Cosmos. Of course, this may seem like a drawback but the utility of the network has been favored over value capture, until now. In line with the idea of Cosmos Hub minimalism, the ATOM token is set up in such a way that does not necessitate any form of rent seeking through fees or enshrined shared security. Using IBC doesn't require ATOM for transactions and each Zone uses their own token for transaction fees and denominating asset pairs. If there was only a focus on the tokenomics of ATOM, it would be concerning given it would come at the opportunity cost of making the Cosmos framework fundamentally more useful across the Interchain. An obvious example of tokenomics going downhill can be seen with Sushi, although the fee generation was compelling, it was certainly not built with longevity in mind when fees go down.

Current Use cases

Over the past year, the Cosmos community has been shifting its focus on creating value accrual mechanisms in such a way that benefits sovereign Zones while simultaneously bringing value to the Hub, which flows downstream to the ATOM token. We will discuss some of the catalysts launching this year and some of the implications but we will first highlight the variety of use cases ATOM has already. It is used to secure the Cosmos Hub, governance, productive asset across all Cosmos Zones, funds public goods and it is often airdropped tokens for ATOM stakers. The ATOM inflation rate uses a dynamic model based on the number of ATOM being staked - resulting in an annual inflation rate between 7-20% to incentivize staking to secure the chain.

Note, because each Zone is their unique blockchain, they have to bootstrap a validator set to secure the chain. Cosmos has the largest and most diverse validator set; therefore, we have seen ATOM stakers see sizable airdrops from the likes of Osmosis and Juno Network to name a few. Given its price action in the last 12 months, it is up 8x and this does not even factor in the airdrops and yield opportunities that are present for ATOM holders. Atom has done well, but where can it go from here?

New Value Accrual Mechanisms

Before we dive into some of the new value accrual mechanisms, it is important to note that the following catalysts are not just mere speculation with an indefinite timeline; rather, the Cosmos core devs have been hard at work and some of these might be a reality as early as Q1 of 2022. Let's dive in.

Interchain Security

One of the main differences between Polkadot and Cosmos as a layer 0 protocol, boils down to the security implications. Polkadot has shared security enshrined so every parachain inherits the security of the relay chain. This is a key feature on behalf of securing the parachains but it is fundamentally limiting given it enforces a maximum number of execution slots. Cosmos allows for Zones to decide on their own level of security and this is done through bootstrapping their own validator sets. Although chains like Terra have been able to secure themselves, even more so than the Cosmos Hub itself, having no shared security poses long tail risks for chains that cannot secure themselves. In addition, it also limits the experimentation of new protocols because it is not an easy task to bootstrap a validator set so this increases the barrier to entry.

Interchain Security is similar to Polkadot’s shared security model, where Zones (consumer chains) will be able to rent security from the Cosmos Hub (provider chain). Zones will be able to choose to opt in for security from the Cosmos Hub. There are multiple versions of Interchain Security, with version 1 launching this quarter. This module would allow Zones to secure their chain using the Cosmos Hub validators. This is not theoretical and we are already seeing the Gravity Bridge planning to secure itself via the Hub. What does this mean for ATOM stakers? Not only will ATOM stakers receive staking rewards for ATOM, but they will also be earning rewards for every new chain they help secure. In this case, they will be earning $GRAV tokens on top of their ATOM rewards. In short, Cosmos Hub validators will receive rewards for every new consumer chain it helps secure.

Further implementations of Interchain Security allows for partial security from the Cosmos Hub validators. In this type of model, we would see the Zone be partially secured by the native token’s validator set in addition to the Cosmos validators. Overall, this makes building on Cosmos more attractive as there will be more security guarantees and it will be more lucrative to stake ATOM. Again, Cosmos does not enforce Interchain Security but it allows for an opt-in model similar to the other modules it has built out. Moving away from the security assumptions, this mechanism can make ATOM an index play on many Cosmos Zones as you get exposure to each new consumer chain it supports.

Interchain IBC Routing

IBC enables true cross chain capabilities across sovereign Zones. As IBC is implemented across many ecosystems, it becomes imperative that they are able to support the necessary infrastructure to route transactions across other Zones. As mentioned previously in the IBC section, there is a certain level of infrastructure needed such as archive nodes and relayers for each counterparty chain. Given the number of chains enabling IBC continues to trend upwards and you would like to connect every chain in the ecosystem, there needs to be a solution - enter IBC Routing on the Hub.

Proposal 56 was passed in September 2021 that added the IBC Router to the Hub. They built out an IBC middleware module that will allow the Hub to be a central point in the IBC architecture. To actually execute on this, the Hub will be focusing on 2 things to make this happen - a chain naming service and interchain queries for consumer chains to pull the data in. They will also have a relayer DAO on the Hub that will focus on the chain naming service. Given the blue chip Zones such as Osmosis or Terra have the infrastructure in place already, they will most likely communicate with each other directly without going through the Hub. However, most long tail chains who don't have the infrastructure will likely go through the Hub. New chains will not want to relay transactions across every single blockchain.

A single connection to the Cosmos Hub gives access to all of the interchain and the Cosmos Hub stands to sit at the center of IBC. Multi-hop routing allows for these new chains to connect to the Cosmos Hub in order to be connected to every other chain that is connected to the Cosmos Hub by default.

IBC Routing on the Hub will generate fees that go to ATOM stakers and further push the narrative of better tokenomics. To begin, this service will initially be free but they will soon introduce a small fee which rewards ATOM stakers. The Cosmos Hub has the first 2 routing protocols enabled already and they continue to innovate on this front. In short, interchain security and IBC routing bring value to ATOM by ramping up its value accrual to expand across the interchain where the Cosmos Hub will sit in the center of it as a ‘port city’.

Liquid Staking

Even when these value accrual mechanisms are launched, ATOM holders are still forced to make a tradeoff - stake your tokens to secure the Cosmos Hub or use it to chase other yield opportunities. Liquid staking unlocks a way to be able to do both at the same time. Thus far, there are no liquid staking solutions on Cosmos but they are being launched in the Theta Upgrade which is scheduled to happen in Q1 2022.

Now, users will be able to stake their ATOM to receive staking rewards while also chasing other yields with their liquid staked tokens. There are many yield opportunities within Cosmos, staking your LP share on the ATOM/OSMO pool has so far yielded well over ~3 digit APRs for over 6 months now. Given users won't need to make this tradeoff any longer, more ATOM holders will choose to stake their tokens and earn yield at the same time. This will increase the security of the Hub and it will have a flywheel effect for chains to integrate the Hub’s wide range of services. Note, this Liquid Staking module can be used by any other Cosmos SDK chain but will be starting with the Cosmos Hub.

The initial launch of the module does not resolve the fungibility aspect of ATOM or the underlying Cosmos SDK token. Rather, the fungibility will be achieved through new hub modules, CosmWasm contracts or issued through other Zones. The key point is this module introduces a new primitive and will allow others to create a liquid staking derivative on top of it such as Lido. Regardless of the winning solution, the staking module will be in place and the fungibility aspect will closely follow. Liquid staking provides a path towards a fixed inflation rate that doesn't require a large expansion of the monetary supply via ATOM dynamic inflation rates.

The Gravity DEX

The Gravity DEX is another feature being added to the Hub this year. It is a native DEX built out on the Hub and the transaction fees will go directly to the Cosmos Hub. There has been some controversy over the Cosmos Hub launching a native DEX as it eliminates the idea of credible neutrality and Hub minimalism. In comparison, it can be seen as if the Ethereum Foundation launched a DEX themselves alongside Bancor and Uniswap in the early days - it seems rather political. However, more DEXs in the landscape creates a more efficient market and ultimately helps the users in the long run. The Gravity DEX differs from other DEXs in the Cosmos ecosystem and there are quite a few.

- Osmosis - Dynamic AMM with over $1b in TVL

- Gravity DEX - Orderbook model built natively on the Hub

- THORChain - Connecting non-Tendermint chains like BTC and ETH

- SiennaSwap/Secret Swap - Privacy focused AMMs on Secret Network

The Gravity DEX is an orderbook model and combats frontrunning and arbitrage opportunities through its Equivalent Swap Price Model and batch order execution. The Gravity DEX also has plans to implement shared security via the Cosmos Hub.

In short, there are many new features coming to the Cosmos Hub and the overall IBC ecosystem. We will sum up all of the planned upgrades below. The first milestone to look out for is the Theta Upgrade happening in Q1 2022 which brings many new exciting features including interchain accounts, liquid staking, NFT modules, and more.

Cosmos Hub Roadmap

Below are some of the future upgrades planned for the year and what they might include (upgrades and timing are subject to change).

Theta Upgrade

- Cosmos SDK upgrades

- Meta transactions

- Groups module

- Gov module upgrades

- NFT Modules

- Tendermint upgrades

- Intechain accounts - IBC

- Liquid Staking

- CosmWasm on the Hub

- Gravity Bridge Updates

Rho Upgrade

- Interchain Security v1

- Chain Name Service

Lambda Upgrade

- Interchain Security v2

- Cosmos SDK upgrades

- Token issuance

- Creation of tokens on the hub

- ERC-20 capabilities

- Gravity DEX v2

- order matching

Epsilon Upgrade

- Interchain Security v3

Future Upgrades

- Cross chain bridges (non-IBC)

- Atomic exchange

- Privacy

- Virtual machines

- Smart contract languages

- Zk and optimistic rollups

- Decentralized identifiers (DID)

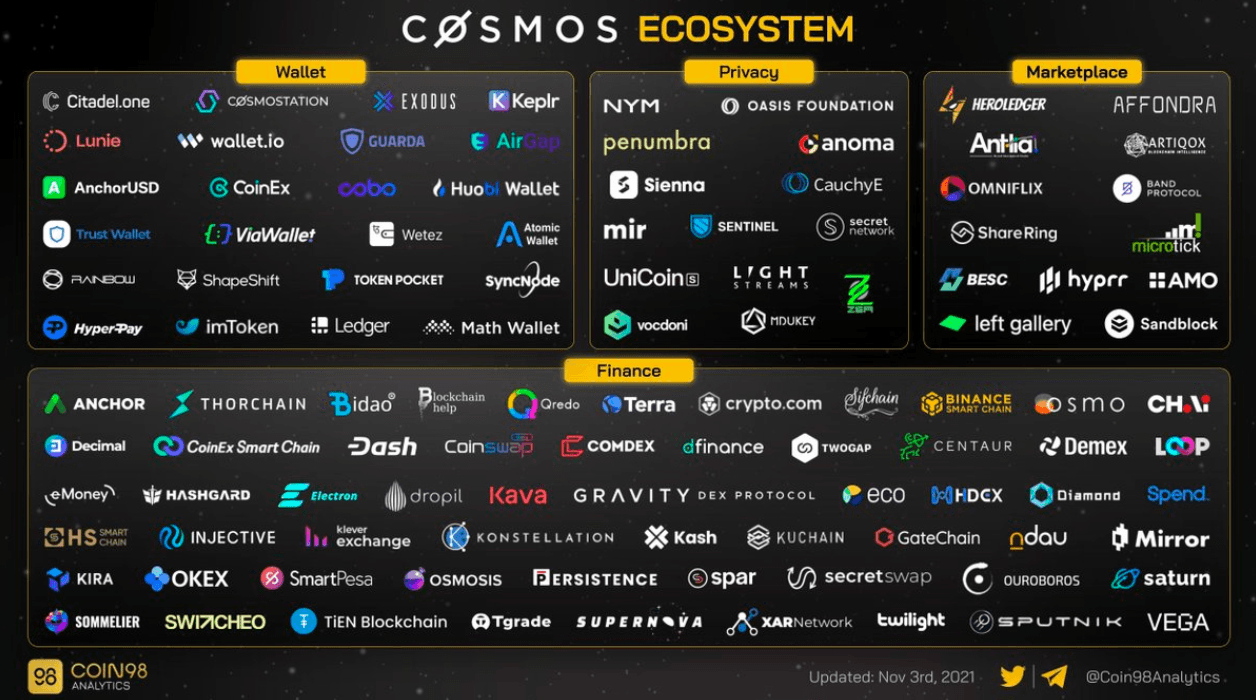

Greater Cosmos Ecosystem

Cosmos boasts a vibrant DeFi ecosystem with interchain accounts being the glue that ties them all together. With generalized smart contracts coming about through many Zones like Juno Network via CosmWasm and the EVM via Evmos, we will likely see a Cambrian explosion of projects launching within the Cosmos ecosystem in the coming months. This graphic is missing many chains and many of the apps deployed on them but we wanted to highlight the diversified landscape of Cosmos development.

Key Takeaways

We are very excited for the new developments in the Cosmos ecosystem for 2022 and believe the Theta upgrade is a huge step forward for the Cosmos narrative. ATOM token value accrual is a key theme but there are also other higher beta plays within the Cosmos ecosystem. To keep track of the key activities, we will be closely monitoring the active IBC channels to assess which Zones are becoming Hubs of their respective vertical. For instance, Osmosis has the most IBC activity as it has enabled all the long tail chains to have a source of liquidity for the first time - it is the Hub for cross chain liquidity. As it stands today, Osmosis facilitates 2x the number of IBC transactions than any other Zone, including the Cosmos Hub. Demand for a given chain can be easily seen by the cross chain IBC activity occurring and can be tracked here.

Another key indicator we will be tracking closely is the bridge volumes to assess the cross chain activity coming from Ethereum and other EVM compatible chains. We expect bridge volumes to trend upwards as ERC-20s find a home on Cosmos chains, specifically stablecoins and the majors. Finally, we are closely monitoring the integration of IBC with other layer-1 chains. There are direct implementations with the NEAR and Polkadot ecosystems via Composable Finance, amongst many other implementations. In addition, LayerZero is aiming to bring IBC to every chain through its transport layer and other cross-chain solutions will be using IBC in some form such as Wormhole. This will be key development for IBC growth to new chains and hence the overall Cosmos Ecosystem - IBC connects every chain.

When assessing a project on Cosmos, checking out their validator set here can usually give a high level overview of the market participants and VCs who are invested in a given chain. Mintscan is one of the main block explorers for Cosmos chains and one can toggle with proposals, relayer status and much more.