Introduction

This week we will briefly cover a high level overview of onchain metrics, sector performances and broader market thoughts.

Market Performance

Layer 1 (L1) Price Performance

Across all Layer 1s, we’ve seen a widespread underperformance compared to BTC, with the exception of SOL, which has surged nearly 27% as of January 27th. While BTC holds its ground, everything else has fallen, and other assets are showing signs of underperformance heading into the new year.

Notably, RUNE is down over 45%, likely due to the halted withdrawals due to issues with ThorFi operations.

Layer 2 (L2) Price Performance

Consistent underperformance across L2s relative to ETH, with no fast movers in the L2 sector since this local low.

DeFi Sector Performance

The DeFi sector is following the same trend into the new year, with most tokens seeing losses. LDO stands out, having gained over 17%, while AERO and PENDLE have dropped significantly — down more than 35% and 30%, respectively.

AI Token Performance

Despite the buzz around Deepseek and the race towards AGI, the AI token sector is struggling overall. There’s significant dispersion, with FAI and AIXBT standing out as leaders — up 47% and 15% respectively since December 30th. However, most of the other tokens are seeing downward trends.

Key Metrics and Onchain Data

Median Gas Consumption

To measure activity on Ethereum mainnet, we look at median gas consumption to avoid abnormal spikes in DeFi/NFT activity (i.e an extreme outlier of an NFT mint).

Median gas consumption is staying steady (and relatively low) into the new year, now around ~7.4 GWEI. ETH price action continues to trade down since the correction. However, we have been seeing a lot of soft factors around the Ethereum community rallying behind ETH the asset via a few initiatives like the onchain Microstrategy, Vitalik using a milady PFP, prioritization of native rollups and the development of new foundations looking to push the Ethereum roadmap forward, with increased interest in scaling the L1 alongside the L2 roadmap.

EVM Ecosystem Activity

While L1 activity remains subdued, what’s going on in the L2 space? Transaction volume across L2s is fragmented, with Base, Arbitrum, and Ethereum taking the lead. Notably, Base has far outpaced the others, with transaction activity surpassing both Ethereum’s and all other L2s combined.

Stablecoin Market

The stablecoin market cap has seen massive adoption since the start of the year, reaching an all-time high of $205.5 billion — a $10 billion increase since January. This surge often signals new money flowing into the ecosystem, and the trend has been strong throughout 2024, continuing into 2025.

The stablecoin total market cap is typically indicative of new money entering the space and has been in a general uptrend throughout 2024 and now into 2025.

Risk Indicators

Short-term risk indicators are currently neutral. The BTC call-put spread suggests a 'risk-off' sentiment, while BTC price momentum is showing signs of 'risk-on' behavior, indicating mixed market expectations.

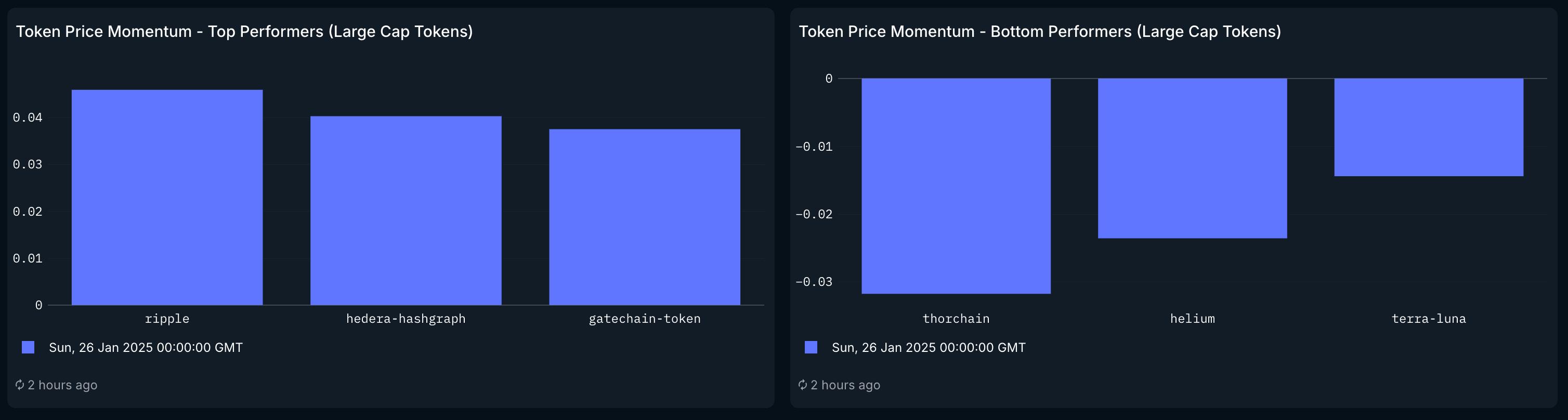

Cross-chain Momentum Tokens (Large Caps):

- Top performers: XRP, HBAR and BGB

- Bottom performers: RUNE, HNT, and LUNA

We have found that TVL and Fee growth have had some predictive value for the price returns of governance tokens of the underlying chain. Intuitively, these two metrics are ways to measure the overall blockspace demand and financial activity of a given chain.

In the dashboard below, we compute fees in ETH and USD per chain and their 7d growth, and rank the associated governance tokens accordingly.

We see Solana outpacing the rest, followed by Arbitrum and Ethereum respectively. As for TVL growth by chain, we see the following for the last 30 days:

Bitcoin, Solana, Zircuit and SUI leading on the TVL growth.

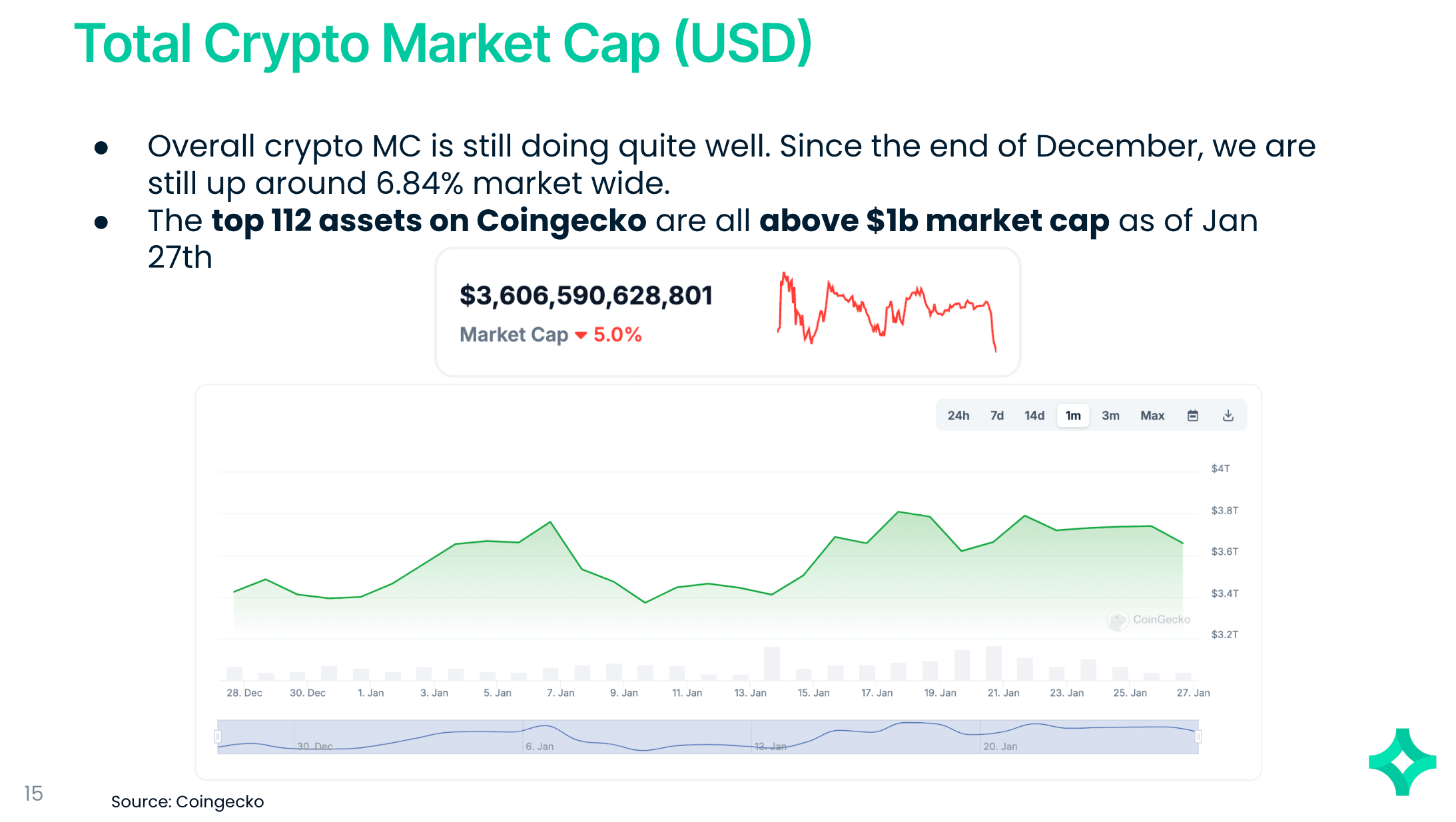

Total Market Cap

Market Positioning and Thoughts

- Currently long the majors including:

- BTC/ETH/SOL

- We have also been excited about HYPE and its impressive stats across user growth and value accrual. We wrote a report recently here touching on the upcoming catalysts and our thesis on future value drivers for HYPE, including the launch of the HyperEVM and much more.

- Outside of the majors, we are patiently waiting to enter for positioning but not chasing anything new here. Would rather catch trades ‘later’ with higher conviction. Meanwhile, farming continues to be a great avenue for non-trending and volatile markets. We are farming some of the protocols below with stables:

- Hyperliquid HLP vault, Sky USDS Savings, Pendle USDe vaults)

- We're also keeping an eye on tokenless projects like Eclipse, which we wrote about in a recent farming report. Eclipse combines the best of both worlds: the speed and performance of Solana with the liquidity and security of the Ethereum and broader EVM ecosystem. If you are sitting on idle ETH, you can actually bridge over and use their unified restaking token, tETH, and get the following expsoure:

- ETH exposure

- Yield within Eclipse (i.e LPing on Orca)

- LRT yield and diversification

- Potential airdrops via native Eclipse apps running points programs already and Eclipse itself.

As for the majors, ETH has significantly underperformed both BTC and SOL pairs over the past year. However, the ETH resurgence across the community and focus on ETH the asset has seen a notable shift the last few weeks (i.e onchain Microstrategy). Although the actual efforts may be futile, there is an underlying tone shift and focus on scaling the L1 and bringing value to ETH the asset via native rollups and other mechanisms.