TLDR

- Solana NFTs have been on the rise - even surpassing OpenSea in terms of weekly active users and transactions at one point in time.

- The growth of Solana NFTs can be attributed to lower gas fees and faster transactions in their network as opposed to Ethereum.

- The beginnings of Solana NFTs were marked with many PFP projects, with the OGs being projects like Solana Monkey Business, Degenerate Ape Academy and Thugbirdz, launched in August 2021.

- Current ‘Blue Chips’ include DeGods, Boryoku Dragonz, Solana Monkey Business and Okay Bears. Other notable projects to keep on the lookout include Aurory, Portals and Blocksmith Labs.

- Magic Eden is the dominant marketplace on Solana by a mile, offering one of the lowest transaction fees among all marketplaces at 2%.

Introduction

Why Solana?

Solana is an open source, permissionless blockchain that runs on the proof of stake (PoS) consensus model. It has an average TPS of 3000 with transactions costing only pennies on the dollar. This is a huge improvement from the dominant L1 - Ethereum, which has an average TPS of 15, with gas fees up to $50. With that being said, such improvements in their fee markets do come with tradeoffs which we dive deeper into in our Solana Ecosystem report here.

Ethereum gas fees increased from an average of 80 gwei to 130 gwei from the end of 2020 to the first half of 2021, as the network became more congested from the influx of NFT enthusiasts. It caused gas fees to shoot up during hyped NFT mints, with users paying up to $50k in fees. This prompted the growth of Solana NFTs - as its low fees and fast transactions helped to lower the barrier of entry for users who do not want to pay exorbitant gas fees.

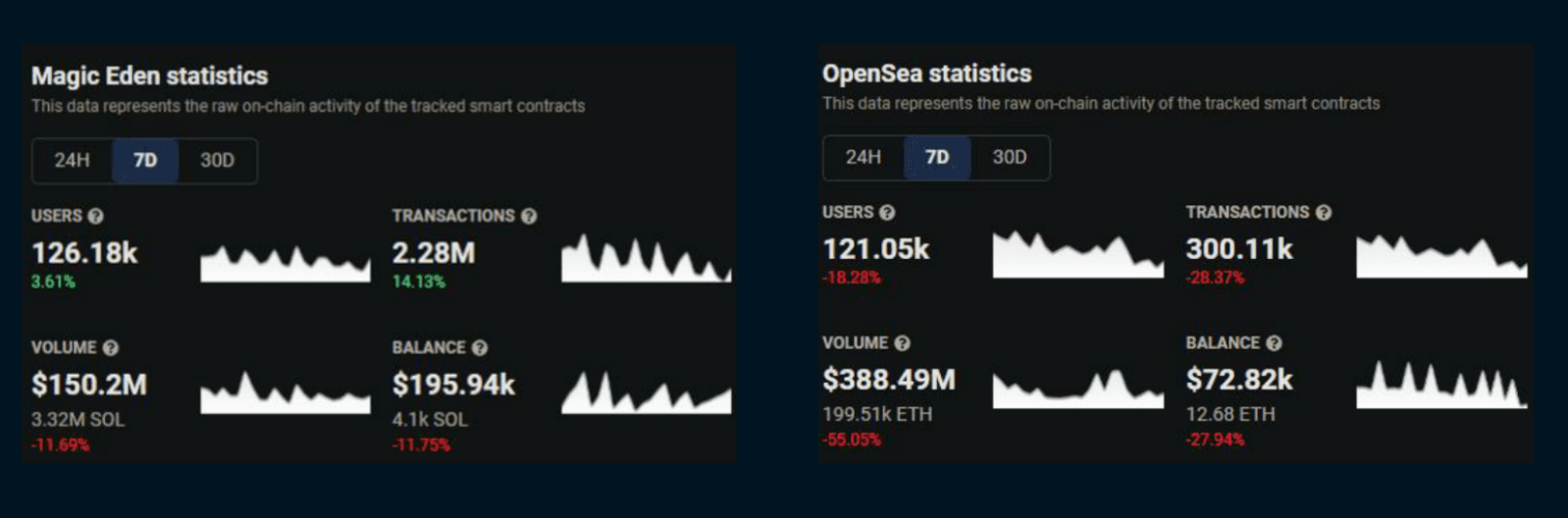

The Solana NFT space came into prominence around August 2021, and has been achieving steady growth since then. More recently, the dominant NFT marketplace on Solana - Magic Eden, flipped OpenSea in terms of weekly active users and transactions, which was a first (although OpenSea still dominates in terms of volume). This achievement signals growing positive sentiments as more users are onboarded to Solana NFTs, contributing to Solana chipping away at Ethereum’s share in the NFT markets.

Beginnings of Solana NFTs

The earliest recorded NFT collection launched on Solana was Kreechures, an NFT P2E game that minted in March 2021. There were only a few main collections during that period until Solanart launched in July 2021. With proper infrastructure, things began to take shape as more NFT projects launched on Solana subsequently. Among them, projects like Solana Monkey Business (SMB), Degenerate Ape Academy (DAA) and Thugbirdz launched in August and are now coined as ‘OG’ projects in the Solana ecosystem.

These collections were the first to surge past 100 SOL floor price during the period from September to October. Furthermore, with interest and recognition from celebrities like Steve Harvey and KSI, it served as an extra boost to the space.

Most importantly, October marked a significant milestone for Solana NFTs as the rank 1 SMB was sold for a whopping 13027 SOL (worth ~$2.1M USD at that point in time). The sale was also amongst the top NFT sales across all chains at that point in time, which were then dominated by Ethereum NFT projects like CryptoPunks.

Solana NFT Landscape

| Project | Category | Launch Date | Volume | Floor |

|---|---|---|---|---|

| DeGods | Blue Chip | Oct 2021 | 660k SOL | 389 SOL |

| Boryoku Dragonz | Blue Chip | Sept 2021 | 147k SOL | 117 SOL |

| Solana Monkey Business | Blue Chip | Aug 2021 | 1.1m SOL | 160 SOL |

| Okay Bears | Blue Chip | Apr 2022 | 1.7m SOL | 99 SOL |

| Taiyo Robotics | Blue Chip | Nov 2021 | 119k SOL | 142 SOL |

| Aurory | Gaming | Aug 2021 | 328k SOL | 44.5 SOL |

| STEPN | Gaming | Dec 2021 | 51k SOL | 6.35 SOL |

| Portals | Metaverse | Nov 2021 | 267k SOL | 37.5 SOL |

| Blocksmith Labs | Utility | Mar 2022 | 183k SOL | 125 SOL |

| Debonair Degen Hawks | Utility | Mar 2022 | 66k SOL | 1.85 SOL |

| Moonly | Utility | May 2022 | 35k SOL | 6.25 SOL |

| Degen Coin Flip | Others | Dec 2021 | 34k SOL | 207 SOL |

Source: Magic Eden (as of June 9, 2022)

Blue Chips

The term ‘Blue Chips’ were initially bestowed upon projects that were the first to attract attention and volume - namely SMB, DAA and Thugbirdz. As the space progressed, the definition of ‘Blue Chips’ has certainly evolved. Projects that continue to develop through any market conditions and stand the test of time are the ones deserving of that title.

Generally, projects that have been around for a few months, providing value add for their holders and have seen consistent demand for the NFT collection can be deemed as ‘Blue Chips’. It is also important to have a community rallying behind it, as it would allow the project to be more heard. The NFTinspect tool analyzes activity on Twitter for each NFT collection by using metrics such as the number of PFPs for the NFT and the number of clicks it generates as engagement. Using this, we can see the ranks of top collections based on social activity, which can signal sentiments or highlight up-and-coming communities by analyzing the trends.

Currently, the top ‘Blue Chips’ in the space would be DeGods, Boryoku Dragonz, Solana Monkey Business, Okay Bears and Taiyo Robotics.

DeGods has managed to achieve astonishing growth YTD - with its floor price increasing by over ~11000% over the past 5 months. Launched in October 2021, the project was initially known for heavily taxing sellers who want to sell below floor price to disincentivize dumping and prop the floor price up at the same time. Despite some successes, the idea could not last for long and it was eventually scrapped.

Despite falling off the radar, the team continued building and managed to gain traction early this year. The team has been able to deliver DUST, DeadGods while building a strong community. Nothing concrete has been outlined in the roadmap moving forward, as the founder believes that it is better to not set expectations. The team does provide updates on their progress, with the latest being a long-awaited mint using DUST - y00ts.

Boryoku Dragonz (Website/Twitter)

Boryoku Dragonz had the highest floor price of any Solana NFT project at its peak - hitting 398 SOL in February 2022. Launched in September 2021, the project was one of the first to launch its own token - BOKU, alongside staking which yielded holders over 100 USD per day at its highest. The project has also expanded to include Eggz and Baby Dragonz, allowing more people to buy in at lower prices without diluting the value of the genesis collection.

The team expanded its collections to Ethereum with Akumu Dragonz - a 10,000 NFT collection priced at 0.169 ETH. During the WL mint, the contract was exploited and some users were able to mint multiple NFTs with only one WL slot, causing 5% of the total supply to be affected. The team responded quickly to resolve the issue and even gave up their team-allocated NFTs to ensure that all users on the allowlist were still able to mint. The collection currently sits at a floor price of 0.39 ETH.

Solana Monkey Business (Website/Twitter)

Solana Monkey Business remains one of the most iconic and recognizable Solana PFPs. The community-owned MonkeDAO has made a name for itself by leading the project in the past few months. MonkeDAO has also created MonkeVentures - an investment DAO for fellow “monkes”.

As the next steps, the DAO is looking to properly incorporate MonkeDAO and launch their own Monkeverse NFTs, as well as MONKE token.

Despite being a newly launched project, Okay Bears has taken the space by storm and has cemented its place as one of the top collections. The project hit 1m in trade volume on Magic Eden in just 2 weeks - a record for Solana NFTs. With its iconic catchphrase - We’re All Gonna Be Okay (WAGBO) - reverberating throughout Twitter, there is no surprise that it is ranked as the top community in the Solana NFT space.

As outlined in the blueprint, the team is working on building a robust brand by having real-life marketing campaigns and merchandise that may include collaborations with established fashion brands. Being the first NFT collection that attracted many prominent Ethereum NFT investors, the development of Okay Bears is definitely something to look out for.

Taiyo Robotics (Website/Twitter)

The project launched in November 2021 and did not gain much traction due to the lack of action by the original founder. SolportTom acquired the project in December 2021 and began introducing utilities such as staking, breeding and a custom marketplace (solport.io). The project took off as people believed in Tom’s ability to deliver - rising from 3 SOL in December 2021 to its peak of 190 SOL in March 2022.

Recently, Tom announced the takeover of Solsteads and Citizens. Demand for these collections immediately shot up as prices rose after stagnating for a period of time. It was part of Tom’s plan to expand and make it more accessible for people to buy into a project under his team. Upcoming plans include a metaverse that will integrate Taiyos and Citizens with Solsteads which has generated a lot of excitement for the project.

Gaming/Metaverse

With low fees and fast transactions, Solana is well positioned to be the avenue for NFT gaming and metaverse projects. Despite this, most of these projects on Solana are pretty much still in the infancy stage. Many of the projects have raised funds by minting out an NFT collection before the team actually started building.

One notable raise would be Star Atlas - an MMORPG game that raised funds through its token and NFT sales from August 2021. Token sales were supported by FTX and Apollo-X, which were massively oversubscribed by 5000% and 1600% respectively. The team has also raised funds through several funding rounds with investors such as Mechanism Capital, Yield Guild Games and Animoca Brands. However, the actual full game release is slated to be years away.

Besides Star Atlas, other projects have been making headway in the Solana ecosystem. Below are some of the promising gaming projects on Solana:

Aurory is a J-RPG, tactical game set in a retro-futuristic universe - where players complete quests, discover lost relics, defeat enemies and compete against other players. Holding an Aurorian NFT does not determine access to the game but it provides greater benefits in terms of priority access, boosted rewards and airdrops.

The collection of 10,000 Aurorian NFTs launched in August 2021 while its token IDO (AURY) was held in October 2021. Since then, the team has delivered staking and utility for Aurorians - AoE. Recently, the team released the first PvP version for alpha testers and the gameplay looks promising from the trailer video. With backing from the likes of Alameda Research and Animoca Brands, the success of Aurory will be pivotal to the overall development of games on Solana.

STEPN is a move-to-earn lifestyle app with social and game elements. With the NFT sneakers, users can walk, jog or run to earn GST which can be used to level up or mint new sneakers. GMT is the governance token of STEPN with many utilities, which can be earned when users reach Level 30 for their sneakers. Access to the app is restricted by an activation code, which is given out at random in their Discord or to existing users for them to share. This helps to prevent mass inflation of users at once which could cause a lot of instability to the system.

Since its launch in December, the project has grown tremendously. It now has over 800k daily active users with the percentage of users cashing in and out hovering around 20-30%. Despite this, GST and the price of sneakers has fallen by over 50% in the past week, continuing on its downward trend from weeks ago. This triggered many fears that it would be the end of STEPN, as with how many P2E projects end up. However, the price action could be attributed to China announcing that they will ban the usage of the app in the country.

STEPN raised over $5m in seed round funding from Sequoia Capital, Folius Ventures and Alameda Research. The project has also collaborated with notable brands, including the launch of STEPN x ASICS limited sneakers on BNBChain in April. Despite such promising developments, the sustainability of the game is still highly questioned. With the attractiveness of the game being tied closely to the price of GST and GMT, the volatility of it certainly makes it a high-risk investment.

Portals is an immersive social space where you can explore, create your own place, and gather with others in the metaverse. Portals NFT holders get early access to the central downtown area - where they can explore, play games, collect new items, and take on a few quests. Citizen Cards holders will get a personal ‘pod’ in the metaverse city away from downtown where they can gather with others as well.

Companies that own units in Portals Downtown include Binance, FTX and Magic Eden. A seed raise of $5M was also conducted by Greylock VC, including investments from Multicoin Capital and Alameda Research. The project is constantly shipping with new features being added as well as updates on the roadmap - with the latest being an upcoming PFP project for Genesis Citizen Cards holders.

Utility

Blocksmith Labs (Website/Twitter)

Blocksmith Labs is a collection of 4,444 NFTs launched in March 2022. The project aims to provide utility to its holders by building NFT infrastructure tools. Currently, its whitelist management tool - Mercury is already onboarding projects whereby holders can get WLs using FORGE tokens. FORGE tokens are yielded when users stake their NFTs.

The roadmap includes additional utilities for FORGE tokens, a portfolio analyzing tool for holders as well as providing sales/listing bots as a service. Access to these tools are determined by owning the NFT, which provides demand for it.

Hawksight is a DeFi super-app for ‘1-click investments’ on Solana. Users deposit into their vault of choice to earn profit-optimized yields on USDC or SOL. The project launched their NFT collection - Debonair Degen Hawks in March 2022. Utilities of the NFT include AI-powered trading and social signals, boosted yield for DeFi vaults, HAWK airdrops and access to HawkDAO.

HAWK is a base platform currency for the Hawksight ecosystem and also serves as a governance token for users to vote on future features. The team incentivizes holding by introducing a discount on vault fees and rewards for stakers. NFT holders can now stake their NFT for HAWK as well. The platform is currently in a mainnet testing stage and could be launching its yield farming vaults really soon.

Moonly provides tools for users to make informed decisions about their NFT investments. Features such as upcoming drops, overall market and individual collection data and alerts have already been created. Data provided includes social media analytics to assess hype and detect bot activity.

The roadmap includes plans for a mobile app, portfolio management tools and integration of more blockchains such as Ethereum and Near. Having a Moonly NFT will provide access to these tools firsthand, as well as restricted features that will be introduced in the future.

Others

Degen Coin Flip (Website/Twitter)

Degen Coin Flip is a platform that allows users to bet “double or nothing” on their SOL in denominations of up to 2 SOL. Every game will have a 3.5% fee, of which 3% goes to the NFT holders in SOL. With an average volume of around 4000 SOL per day, each NFT holder gets around 0.15 - 0.2 SOL per day, per NFT.

Marketplaces

There are many Solana NFT marketplaces - with the major ones being Magic Eden, Coral Cube, Solanart and a recent inclusion, OpenSea. Below, we have a breakdown of each marketplace in terms of 7D active wallets, transactions, volume and fees.

| Marketplace | Wallets (7D) | Transactions (7D) | Volume (7D) | Fees |

|---|---|---|---|---|

| Magic Eden | 112,193 | 413,149 | $36.9m | 2% |

| Coral Cube | 14,925 | 29,302 | $1.9m | 2% |

| OpenSea | 3,319 | 3,523 | $611k | 2.5% |

| Solanart | 1,178 | 957 | $120k | 3% |

Source: Marketplace Statistics on Magic Eden (as of June 6, 2022)

Comparing each marketplace by the 7D volume, it is evident that Magic Eden is the dominant marketplace for Solana NFTs. This is followed by Coral Cube and OpenSea. Meanwhile, Solanart (in yellow) has less volume than the rest of the marketplaces (in orange) combined.

Since its inception in September 2021, it has experienced tremendous growth - gathering over $1.3b in all-time volume and 700k in the number of unique wallet addresses having at least one transaction on the platform. It also surpassed OpenSea in the number of daily users and transactions, as it continues to trend upwards.

The platform offers a marketplace, launchpad as well as a space for auctions. Besides that, the drop calendar feature helps users to keep track and vote on upcoming projects. Users can also add projects to their watchlists to have a quick overview of project statistics. Furthermore, the Magic Eden playbook provides a quick summary of Solana NFTs and how to get started for new users.

MagicDAO was created in March as a way for Magic Eden to further connect with the community. Magic Tickets were airdropped to early and active users who were categorized by Normie, Degen and OG levels. Perks of being a holder include monetary rewards, giveaways and social events. The current main use case of Magic Tickets will be raffling for project WLs in the Magic Eden discord.

Coral Cube is a Solana NFT marketplace and aggregator that launched in late February 2022. It has been gaining traction due to its convenience as an aggregator, which allows users to view listings across different marketplaces on one platform.

Furthermore, The team aims to push out rewards for transacting on the platform, similar to what LooksRare is doing on Ethereum. There is no concrete timeline regarding the integration of the reward system, but it would be interesting to keep a lookout.

OpenSea entered the Solana NFT space in early April. It triggered a lot of buzz prior to the integration on OpenSea as the narrative was that more people will be onboarded to Solana NFTs. However, the total volume of Solana NFTs on OpenSea has been rather low as compared to Magic Eden.

Solana NFTs on OpenSea are still in their beta stage, so not every collection is listed on the platform.

Solanart was the first NFT marketplace on Solana, which launched in July 2021. It had a first mover advantage and managed to capture most of the volume in the initial growth stages of Solana NFTs. However, it was revealed that the team was behind the projects that ‘soft rugged’ (Solpunks and Bold Badgers), which caused many users to turn away. Furthermore, it was not able to remain competitive as new entrants entered the market, resulting in a sharp decline from its peak.

The platform offers a marketplace and launchpad. It also offers project statistics for users to track floor price, volume and last sales on Solanart.

Others

Smaller marketplaces on Solana are often curated and built for specific types of NFT collections. They are useful for individual artists looking to sell their artwork and people looking to purchase such collections.

List of smaller marketplaces: 1/1 NFTs - Exchange Art, Holaplex, Form Function Gaming NFTs - Fractal

Solana NFTs are also available for trading on centralized platforms such as FTX. FTX NFTs launched in November 2021 but never really took off. A large part could be attributed to the fact that it needed users to KYC - something that is not welcomed by crypto natives used to trading on decentralized marketplaces. Besides that, it would signal that FTX’s user base was simply not interested in NFTs, even with the convenience of doing so.

Key Takeaways

Solana NFTs growth in the past year has been parabolic. Having low fees and fast transactions made NFTs much more accessible as it costs less for people to ‘try it out’. As a result, many users have been onboarded to Solana over the past year. The space has managed steady growth and Solana NFTs have gained market share against Ethereum’s dominance in the NFT market.

Despite this, NFTs are still a nascent industry and the growth achieved was largely attributed to the bull run last year. It would be important to see how the industry performs in this downturn and especially with the instability of Solana’s network. The recent network outage highlighted the issues that could occur - such as the relative ease of taking down the network due to a small superminority in terms of the number of validators and susceptibility to bot attacks could be a cause of concern for investors. If such issues reoccur frequently, it could cause a major dent in the growth of Solana and its NFTs, which would be exacerbated by the current bearish macro outlook.