Introduction

Arbitrum Nova was released on August 10, 2022, with the primary goal of reducing transaction fees and supporting DApps that demand high transaction volumes with minimal expenses. Although existing Layer 2 solutions like Arbitrum One appear to have reasonable fees, some blockchain sectors, such as gaming, necessitate even lower transaction costs to remain practical for users. This is because these sectors usually generate large amounts of transactions, resulting in substantial fees over time.

Arbitrum Nova vs Arbitrum One

Although Arbitrum developed the Nova chain, it is distinct from Arbitrum One as it utilizes a new L2 network solution called AnyTrust Technology. Nova's unique design, which leverages an off-chain data availability solution, enables it to provide substantially lower transaction fees than even those offered on Arbitrum One. However, this considerable advantage comes with a caveat - the system requires an additional minimal trust assumption.

ELI5: AnyTrust Technology

Imagine you and N number of friends are playing a game, but you don't trust all of your friends, so you only trust a few of them to be honest. AnyTrust is like a game where some friends are in charge and you trust at least two of them to be honest. This is easier than other games where you need to trust more people to be honest (referencing how traditional BFT requires at least 2/3 of the members to be honest).

If honest friends do what they're supposed to do, then you get two advantages. First, you don't have to write down every single thing that happens in the game because you can trust honest friends to tell you what happened. Second, you can leave the game whenever you want because you can trust the honest friends to tell everyone that you left.

It's safe to do these things as soon as these honest friends agree that it's okay. The logic is that if most of your friends agree, then at least one of them must be honest.

In crypto context, reducing the trust requirement from X number of committee members to 2 people, allows the network to avoid posting transaction data on Arbitrum back to the Ethereum chain. Instead, only the hash of a transaction batch needs to be recorded on Ethereum, providing availability of the data. This is because nodes can rely on these committee members to provide the data if needed. This helps to save the largest cost of running a rollup therefore allowing the network to reduce its transaction costs. This is because, if (N-1) members promise to provide the data when needed, then at least 1 of them will be honest to ensure data availability for the protocol. However, this system can only be done thanks to the “fallback to standard rollup” backup mechanism.

Referencing back to the friends example from above: Sometimes, the friends who are in charge may not agree or they may stop playing the game altogether. If this happens, the game can still go on but it will be a little slower and more expensive. You will have to write down everything that happens in the game, and it will take longer for you to leave the game. But as soon as the friends who are in charge start playing the game again, you can switch back to the easier and faster original way of playing as mentioned in the previous ELI5 example.

In crypto context, if the committee fails to provide the data when required, then the chain will still operate, but utilize the original rollup protocol design - transaction data will be posted on Ethereum and new rollup states being confirmed after a challenge period, thus resulting in withdrawals to experience a delay period. This backup mechanism will continue until the data availability committee (DAC) resumes operation.

Based on this design, it is evident that the entire system heavily depends on the DAC which could be interpreted as a more centralized design. The committee must be carefully selected and diverse to prevent collusion, which could potentially result in the system's failure and the network reverting to the original Arbitrum rollup mechanism, eliminating all the benefits of the AnyTrust design. Therefore, this security risk is a tradeoff that necessitates careful monitoring and oversight to ensure the committee's integrity and prevent potential threats to the system's security. As of today, this DAC includes: ConsenSys, QuickNode, Google Cloud, OffChain Labs, P2P Validator and Reddit.

Nevertheless, this DAC system also has a unique advantage that can be considered a benefit for chain security. Regardless of the number of entities added to the DAC, the role of each committee member does not diminish, unlike the traditional BFT system where adding more validators results in a diminished role for each validator.

For example, in the traditional BFT system, a set of 21 validators will require 14 honest members, whereas in a set of 210 validators, 140 honest members are required. However, in an Anytrust setup, as long as you have 1 honest validator, that member can force the network into a rollup and the committee will have to post the transaction data back to Ethereum.

As previously stated, Nova is particularly suitable for Game-fi projects that necessitate high throughput and low fees. Since Nova does not publish transaction data on Ethereum, it is immune to gas spikes. This feature is particularly critical for games since low transaction fee stability is essential. If gas fees spike, these games' operations may grind to a halt as gamers may be unable to afford the fees, resulting in a poor user experience.

What's currently going on in Nova?

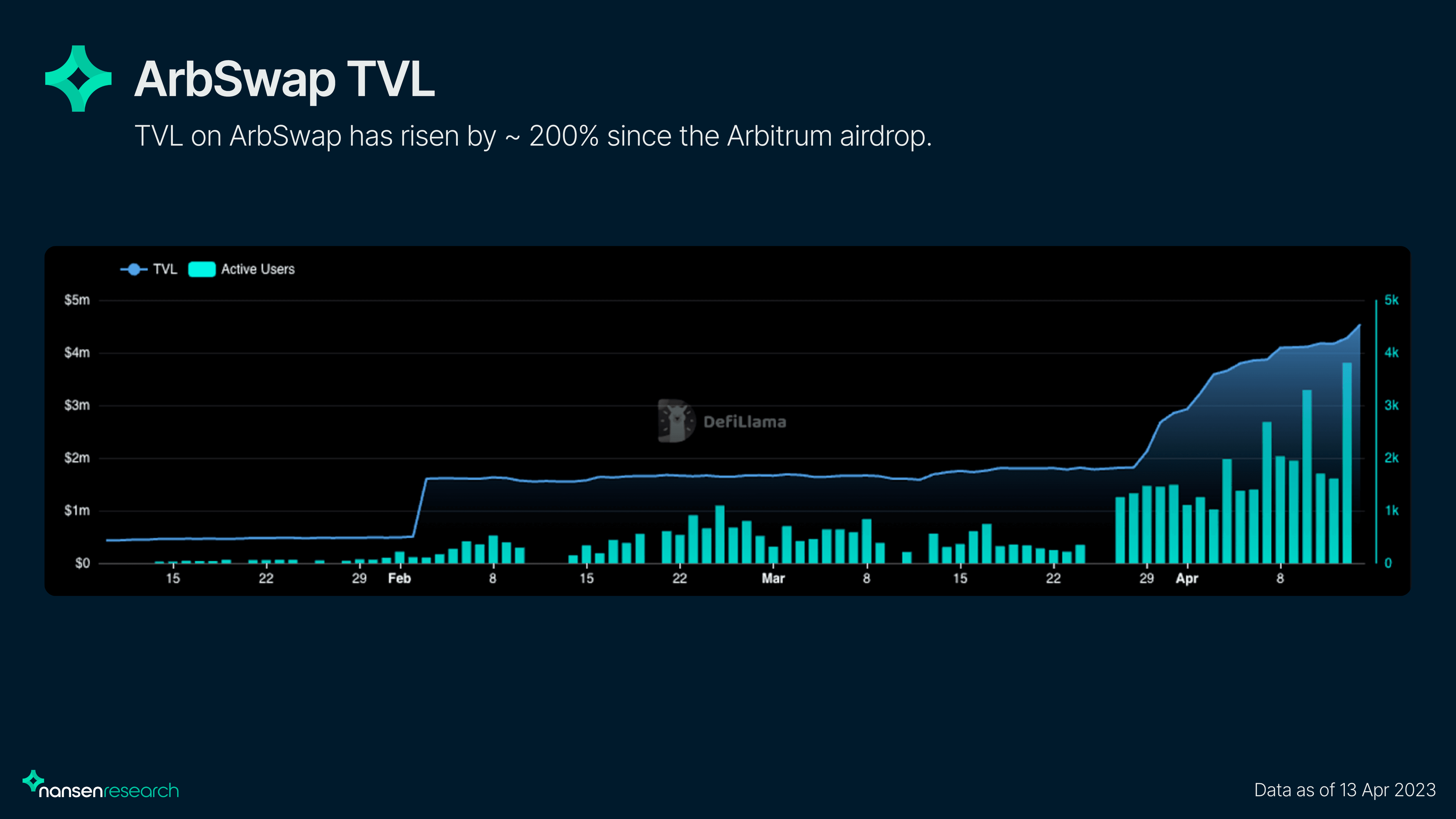

One might expect the TVL on Nova to have decreased significantly post-airdrop and with the recent Arbitrum Foundation controversy, as funds are moved back to Arbitrum One and other blockchains. However, TVL on Nova actually shot up from $1.83m on 25 Mar to $6.57m on 12 Apr.

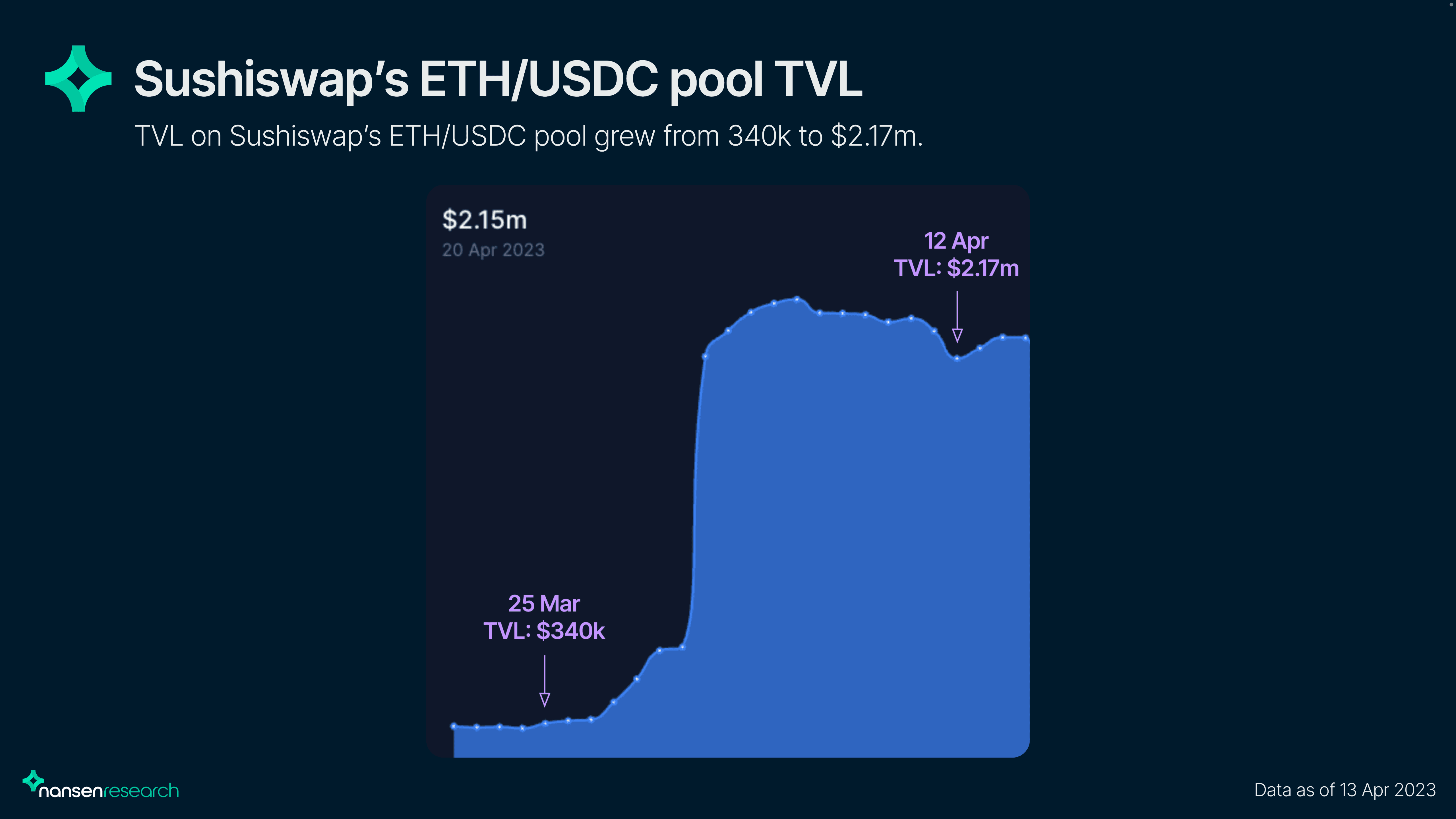

The main bulk of TVL growth was attributed to Sushiswap’s ETH/USDC pool (from 340k to $2.17m) and Nova’s main DEX ArbSwap (from $1.78m to $4.17m).

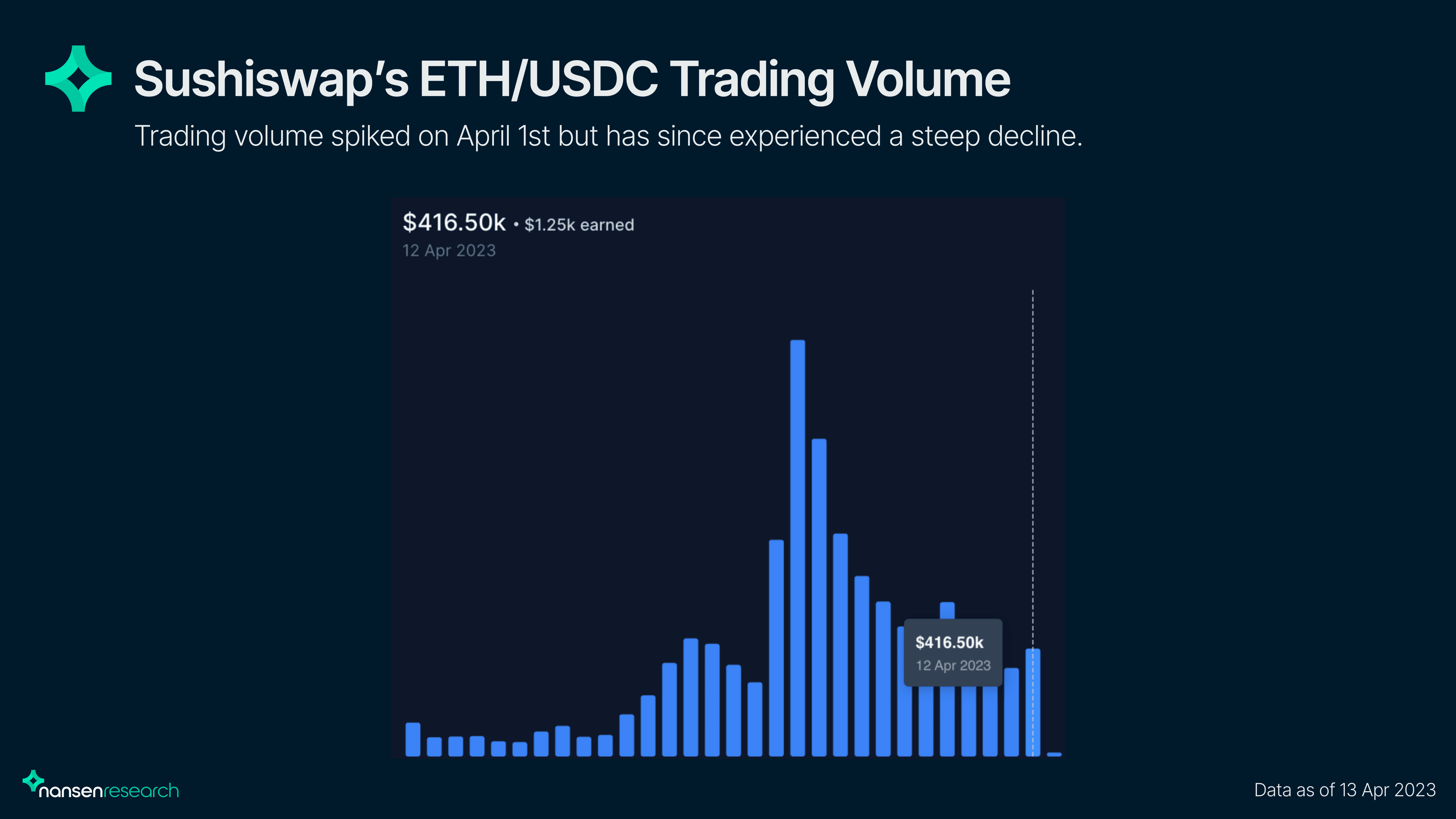

Although the TVL on Sushi's ETH/USDC pool increased by 538%, trading volume growth has not kept pace. The trading volume spiked on April 1st but has since experienced a steep decline. Nevertheless, the APR for the same ETH/USDC pool on Nova (20.97%) is still approximately 83% higher than on Arbitrum One (11.48%), which could lead to further growth in liquidity in the same pool, albeit at a slower pace.

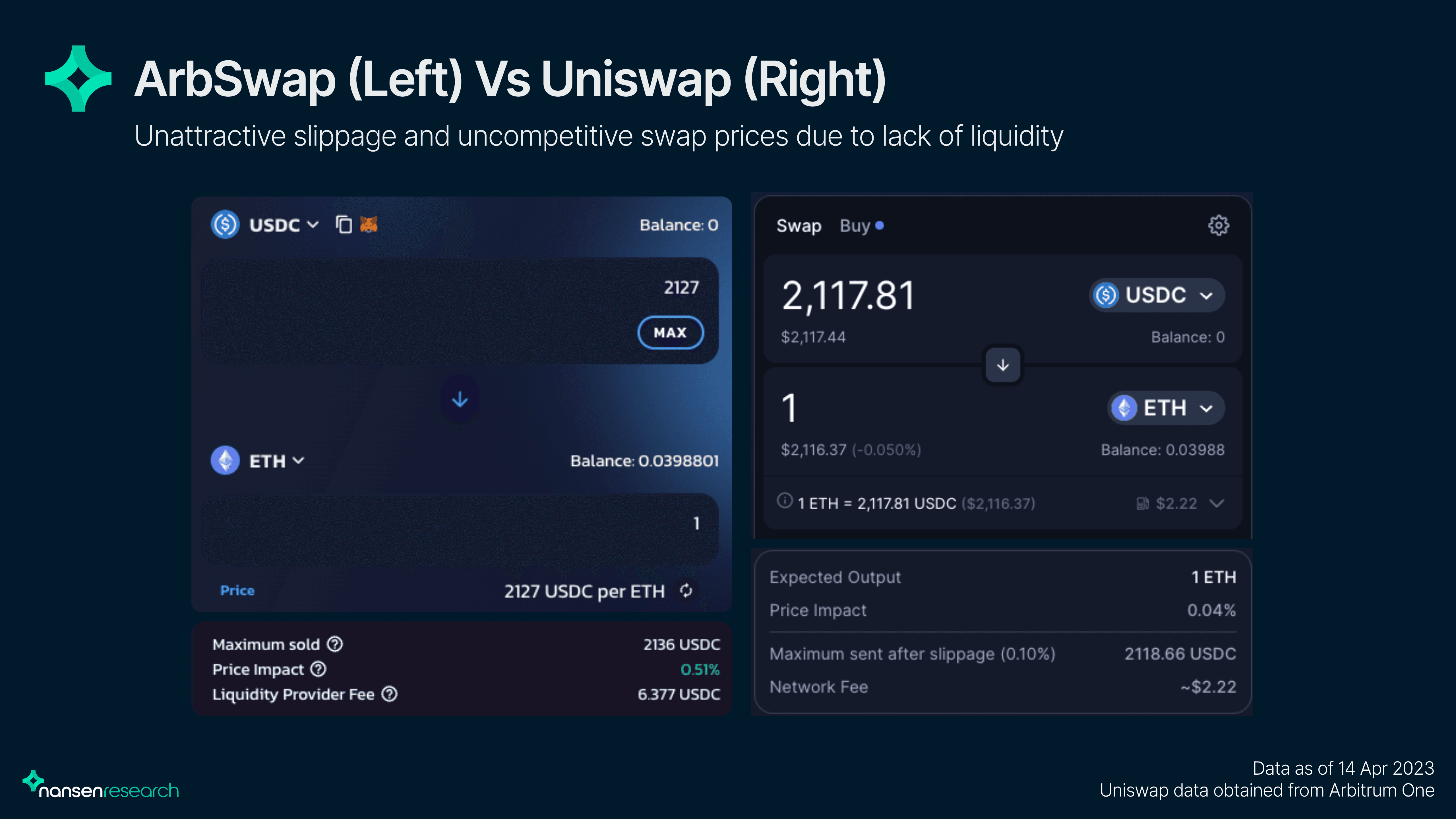

On Arbswap, the same trend is observed suggesting a potential lack of demand for trading activities on the platform. The trend is not surprising considering the absence of incentives for users to trade on Nova compared to other low-fee chains like Arbitrum One.

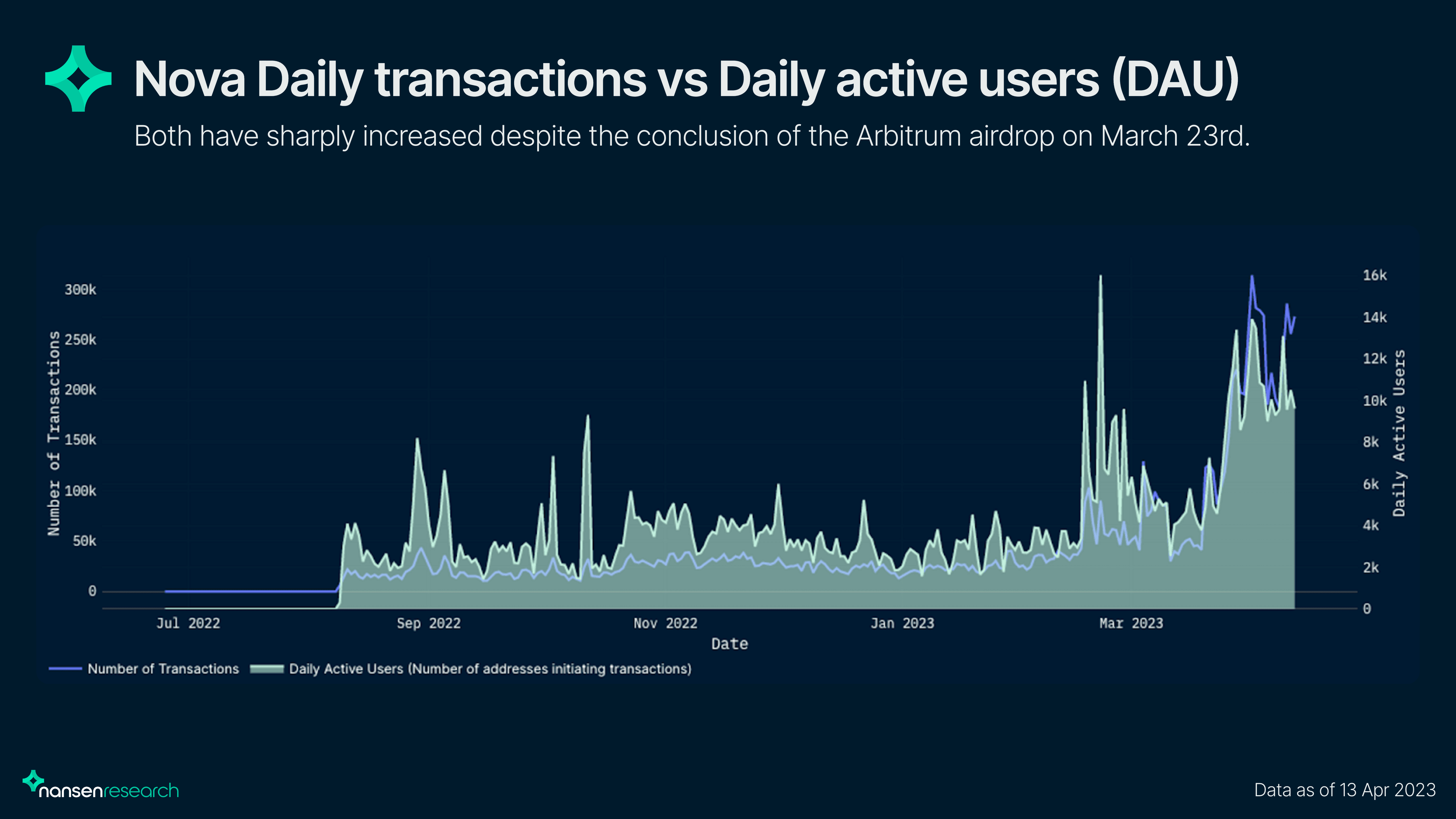

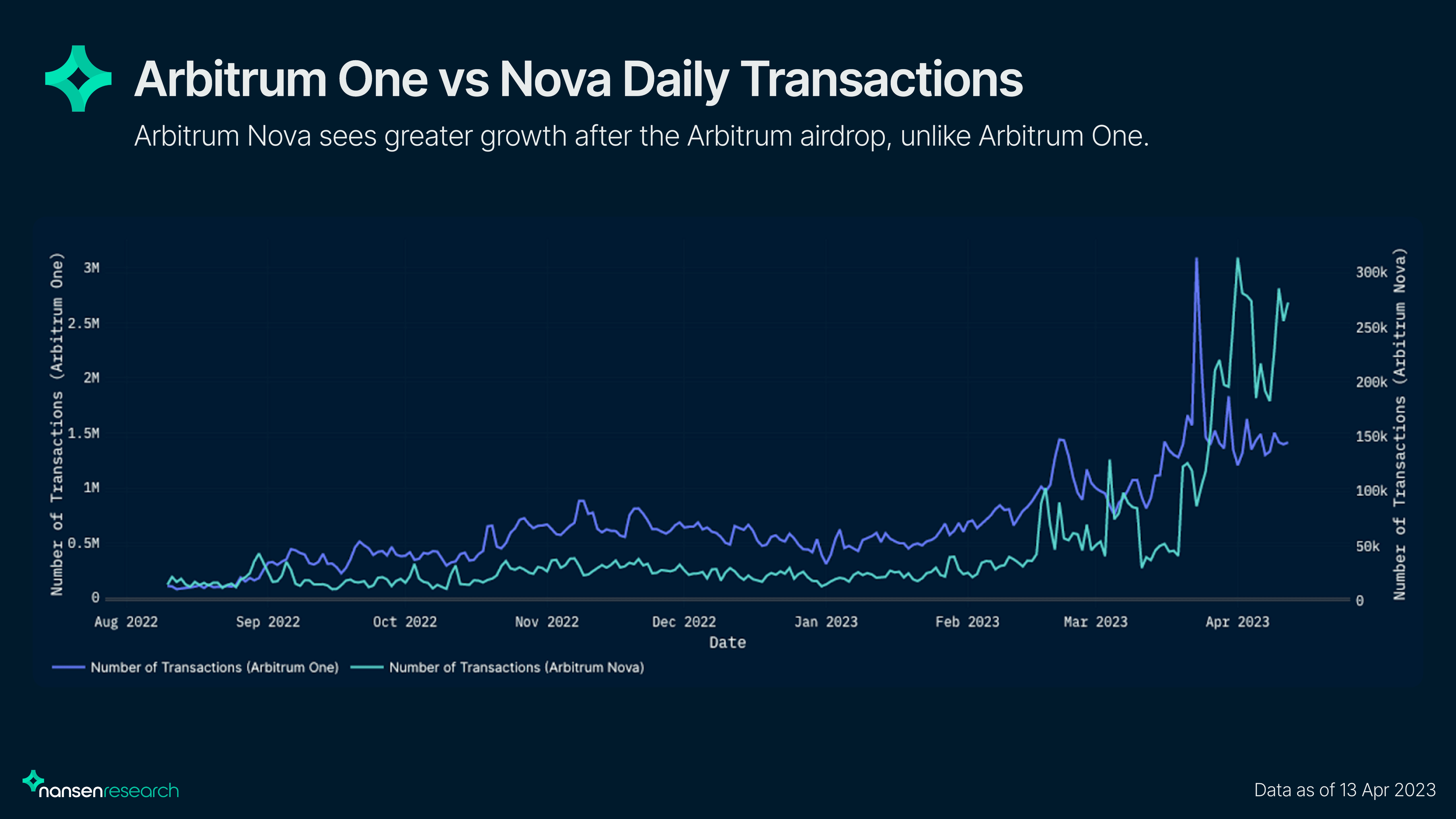

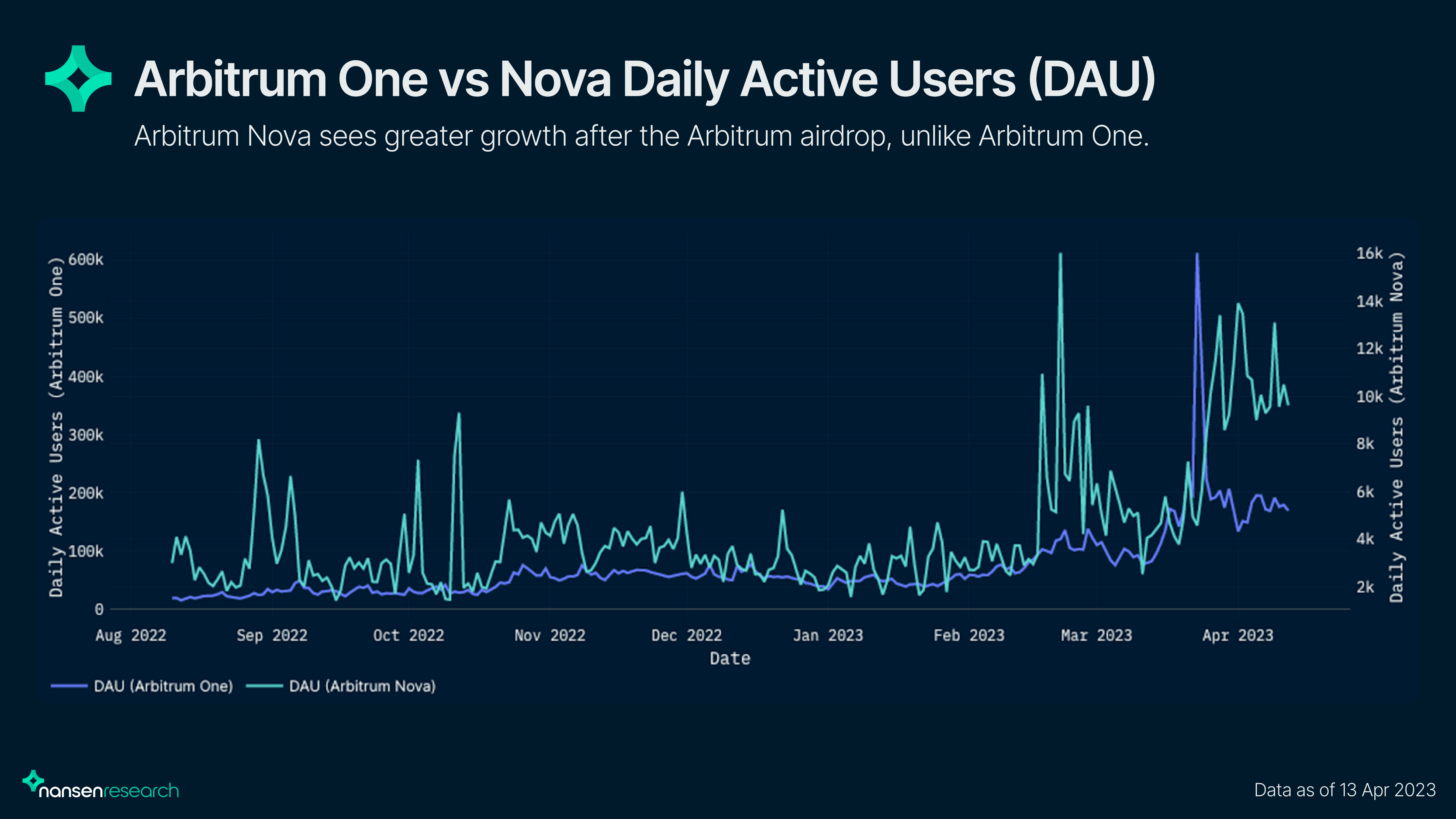

Daily transactions and DAU on Nova have sharply increased despite the conclusion of the protocol's airdrop on March 23rd. Both DAU and the number of transactions remain consistently above ~200k daily transactions and 8k DAU.

Although figures on Nova are nowhere as high as those on Arbitrum One, the sustained growth may indicate a market demand for a vertical specific chain like Nova. Since the ARB airdrop on 23 Mar, transactions and DAU on Arbitrum One have declined by almost 50% and 72% respectively, while transactions and DAU on Nova have continued to sustain / break new 2023 highs.

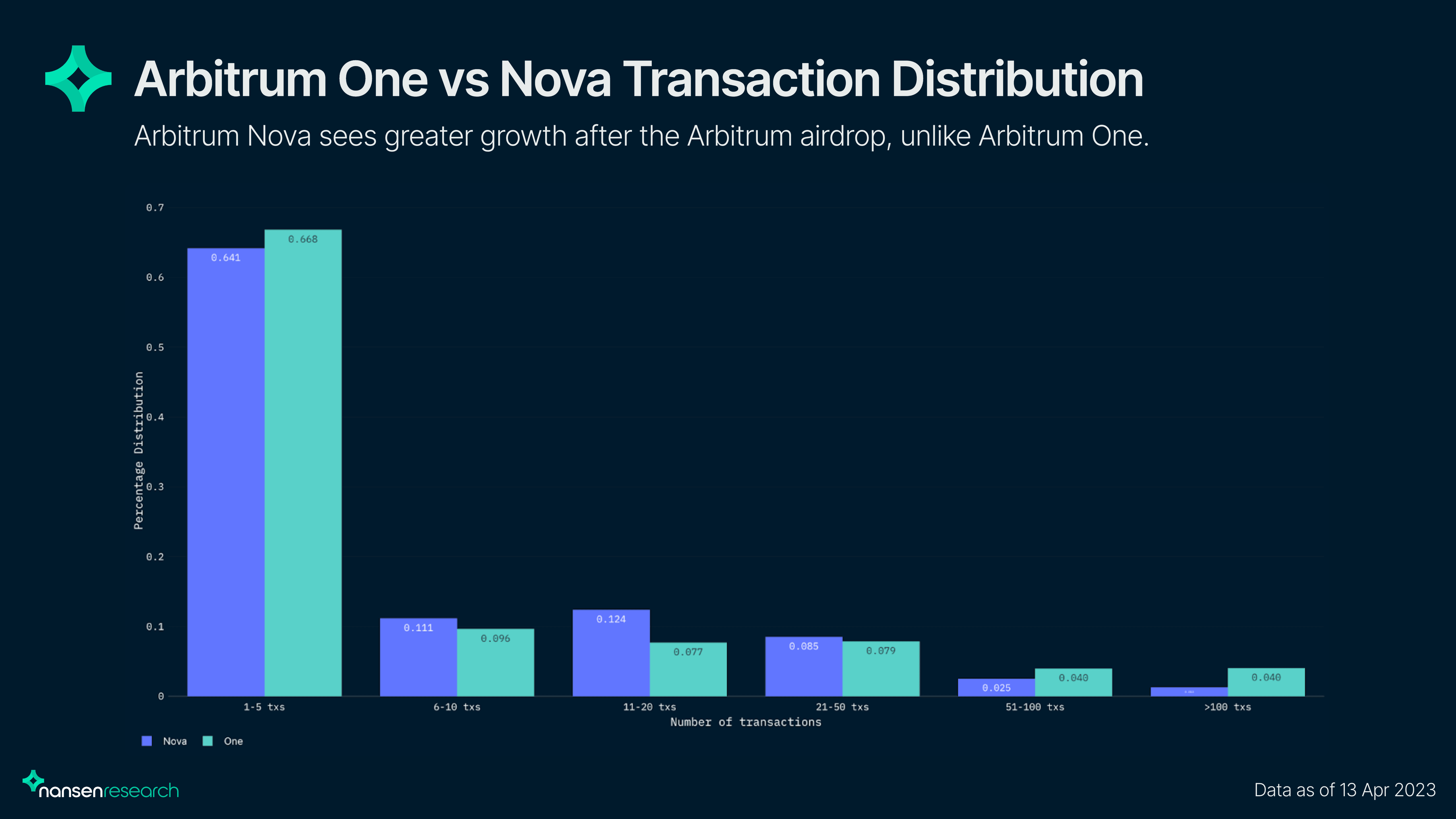

Analysis of user transactions on Nova and Arbitrum One revealed that there were more active Nova users (transaction count >6) by proportion than their counterparts on Arbitrum One. This is surprising considering that most users were likely more active on Arbitrum One than on Nova (executing more than 6 transactions) during the ARB airdrop period. Additionally, we would have also expected higher transaction counts on Arbitrum One per wallet, but this was not the case.

However we do note that, as mentioned, Nova was designed mostly for Game-fi and Social applications, hence judging its utility and performance solely based on DEX activity may not be fair.

Nova DApps

Unsurprisingly, the number of projects building on Nova is still extremely low, with the main DApps receiving any material volume being Sushiswap, Arbswap and RCPswap.

ArbSwap

Arbswap is an outlier among other DEXs, with a higher TVL on Nova ($2.9m) than on Arbitrum One ($1.6m). Similar to the Nova chain, Arbswap has also seen an increase in both TVL and active users. However, considering that most of the infrastructure on Arbswap, apart from the DEX feature, has yet to be released, this rise is likely attributed to Arbswap’s ongoing ArbEgg NFT airdrop and ArbEgg points giveaway.

ArbEgg NFTs will act as a multiplier for the ARBS token airdrop in the future. The number of tokens received from the final airdrop will be also based on the amount of ArbEgg points accumulated.

Despite Arbswap having recently launched liquidity mining incentives through the same ArbEgg NFT airdrop and ArgEgg points giveaway, it may be difficult for the DEX to gain any meaningful liquidity and users considering that there are much more attractive and likely safer alternatives out there in the current market.

RCPSwap

RCPswap is primarily a DEX created for token holders of Reddit's "Moons" tokens to trade freely. Moons are ERC-20 tokens given as rewards for contributions to r/CryptoCurrency, such as posts or comments. However, liquidity on RCPswap is insignificant, with the largest pool, WETH/USDC, having only around $355k in liquidity. Aside from that, RCPSwap currently offers the most basic DEX and Bridge infrastructure that is unlikely to attract new users from more established DEXs like Sushiswap.

Farcana

Farcana is a gaming metaverse and Web3 shooter. The game introduces its own unique Play-to-hash (P2H) model as an integral part of its in-game economy. Essentially, players compete in a shooting championship to earn Bitcoin, and the Bitcoin reward is obtained from Farcana’s Bitcoin mining. While this new game-fi model tries to introduce a sustainable form of incentive for players, the issue of increasing mining difficulty as time passes might pose an issue as the game scales up in the future. Having watched the in-game video, it appears to be more interactive and playable than many of the usual auto-play Game-fi projects.

You can read more about Farcana in their whitepaper here.

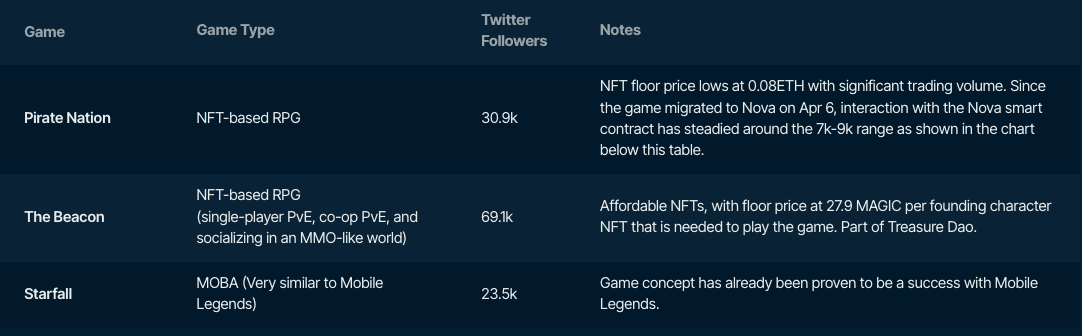

Other gaming projects that might be interesting:

Nova vs. other blockchains

Although Nova has significantly reduced transaction costs, there are still questions surrounding why applications would choose Nova over other blockchains like Immutable X, Solana, or Avalanche. While Arbitrum Nova offers some of the lowest transaction fees on the market, it’s good to remember that the network has not been as stress-tested as its peers like Polygon or Solana, and the sustainability of low fees during high loads remains uncertain.

Moreover, Ethereum's upcoming EIP 4844 upgrade is expected to significantly reduce the cost of posting transaction data to Ethereum, which could directly impact the attractiveness of using Nova as a cost-saving solution compared to Arbitrum One and other L2 solutions as the fee difference may be negligible.

Additionally, other blockchains also offer different incentives and developer tools that may not be found on Nova. One example of a unique feature offered by Avalanche for game-fi projects is the ability to create app-specific subnets that use the project's native token for transaction fees (custom-fee structure), providing more control over the infrastructure. The ability to scale horizontally with more subnets is also another plus factor. These advantages have made Avalanche a popular choice for Game-fi projects and contributed to its significant growth in this sector.

Solana also stands out with its robust developer community and extensive tool suite, which has kept developers continuously building on the network despite recent market events. Last month, Unity, a leading gaming engine company also added support for 13 different blockchain-based SDKs, including Solana and Immutable X, but not Arbitrum.

However, Nova does have unique advantages, such as its immunity to gas spikes since it does not publish transaction data on Ethereum. This stability in low transaction fees may likely provide a stellar user experience and a competitive edge for Nova.

Many high-throughput networks, including Solana, also face the common issue of imposing large validator requirements and block sizes to achieve high throughput and low fees at the expense of decentralization. This trade-off sacrifices decentralization in favor of speed, which can lead to potential centralization risks.

Maybe this is where Nova can gain an edge by offering a more decentralized and stable infrastructure, despite not being as ideally decentralized due to the usage of a DAC. This approach may strike a balance between decentralization and speed, allowing Nova to stand out in the market.

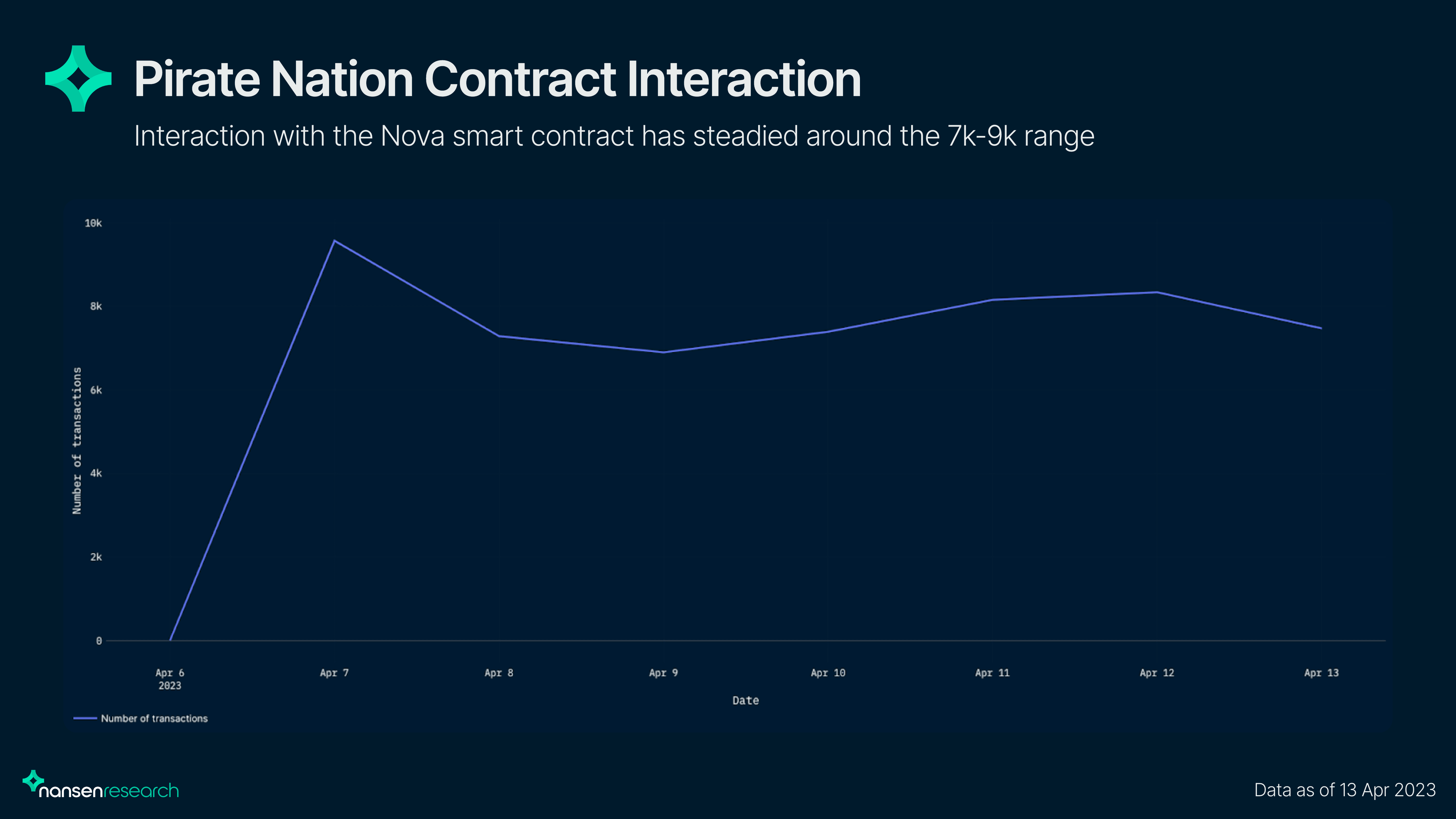

Recently, we have witnessed some projects opting for Nova over other alternative networks. For instance, Pirate Nation, an on-chain RPG game, migrated from Polygon to Nova due to unsustainable rising fees on Polygon and Nova's technical features, such as OpenZeppelin security products and nodes. Another prominent example is Reddit, which chose to build its Reddit Community Points on Nova as they anticipate developers will migrate to Nova in the near future and build gaming and social dApps that will utilize the Reddit token.

PocketBuff, a prominent Game-fi Metaverse platform founded by core members of Longtu Korea and its subsidiaries, recently chose to launch on Nova. They plan to collaborate with top-tier game developers to finance, research, and publish via their platform, while simultaneously creating a global game distribution network that connects the Web2 and Web3 markets. Longtu Korea's renowned game Sword and Magic World, which has a total of 15 million users and a peak of 1 million daily active users, will be exclusively launched on Nova.

While Nova's lower transaction costs are a significant advantage in attracting cost-sensitive projects, it remains to be seen if this advantage is compelling enough for projects to choose Nova over other alternatives, given the security trade-off of using a DAC.

Nova will face stiff competition from established networks like Immutable X, which do not charge gas fees (apart from 2% fee on primary asset sales and a 2% fee on NFT exchanges). In order to stand out, Nova must demonstrate that its lower transaction costs are net EV for users when compared to its competitor’s suite of offerings.

Despite the challenges, there is still potential for Nova to succeed. This is particularly true when we consider that many Game-fi users come from emerging markets (think Axie Infinity players in the Philippines). While Arbitrum One and other L2 solutions have lowered transaction costs to around 10-20 cents on average, this may not be low enough for applications targeting users in emerging markets with different price points. Perhaps this is where Nova may find its product-market fit.