Introduction

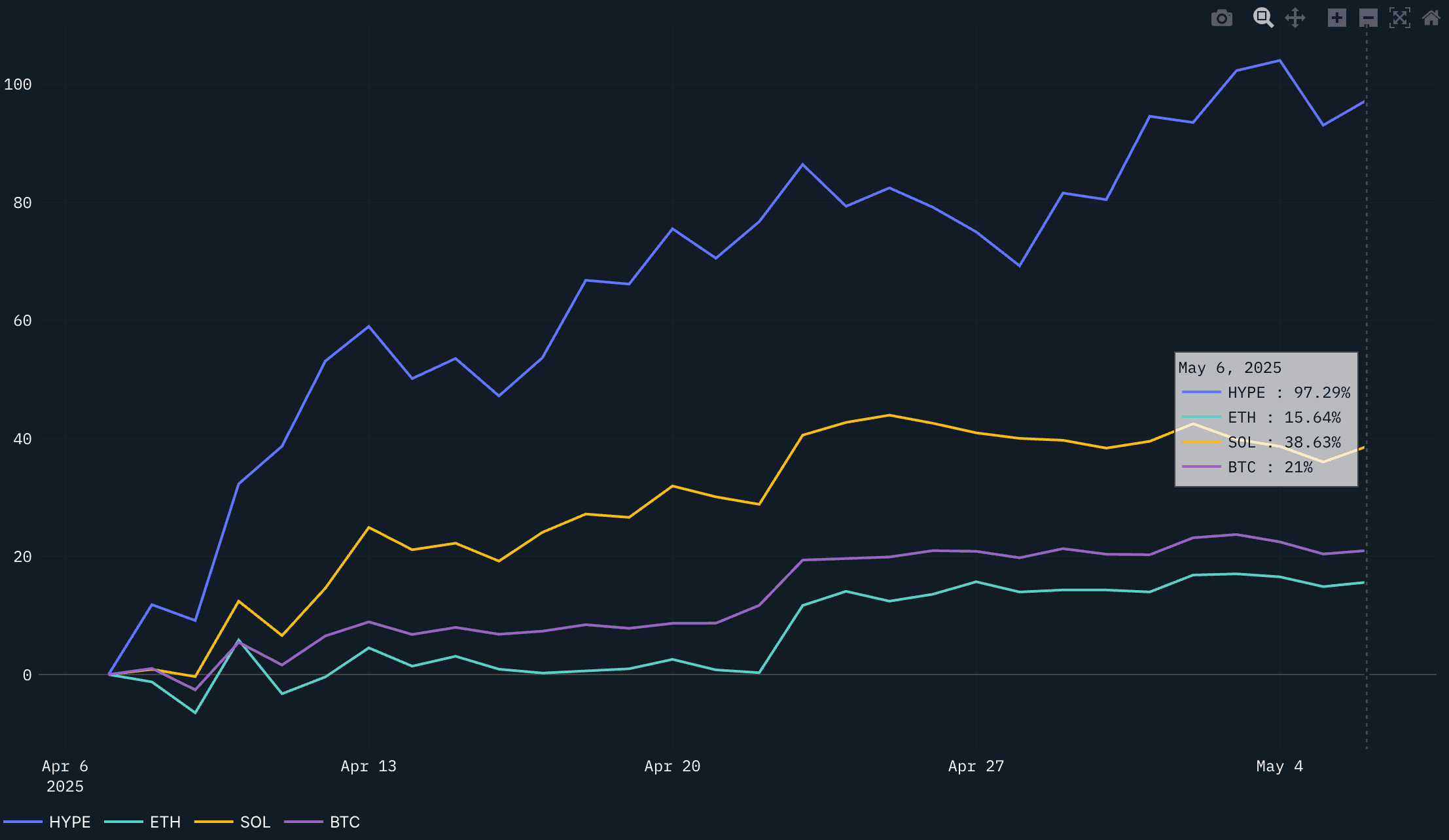

Hyperliquid has solidified its lead in the onchain perps market even more into 2025, posting a lot of growth in volume and user activity. It has also been one of the strongest movers off of the local crypto bottom estimated at the beginning of April 2025, now up over 97%.

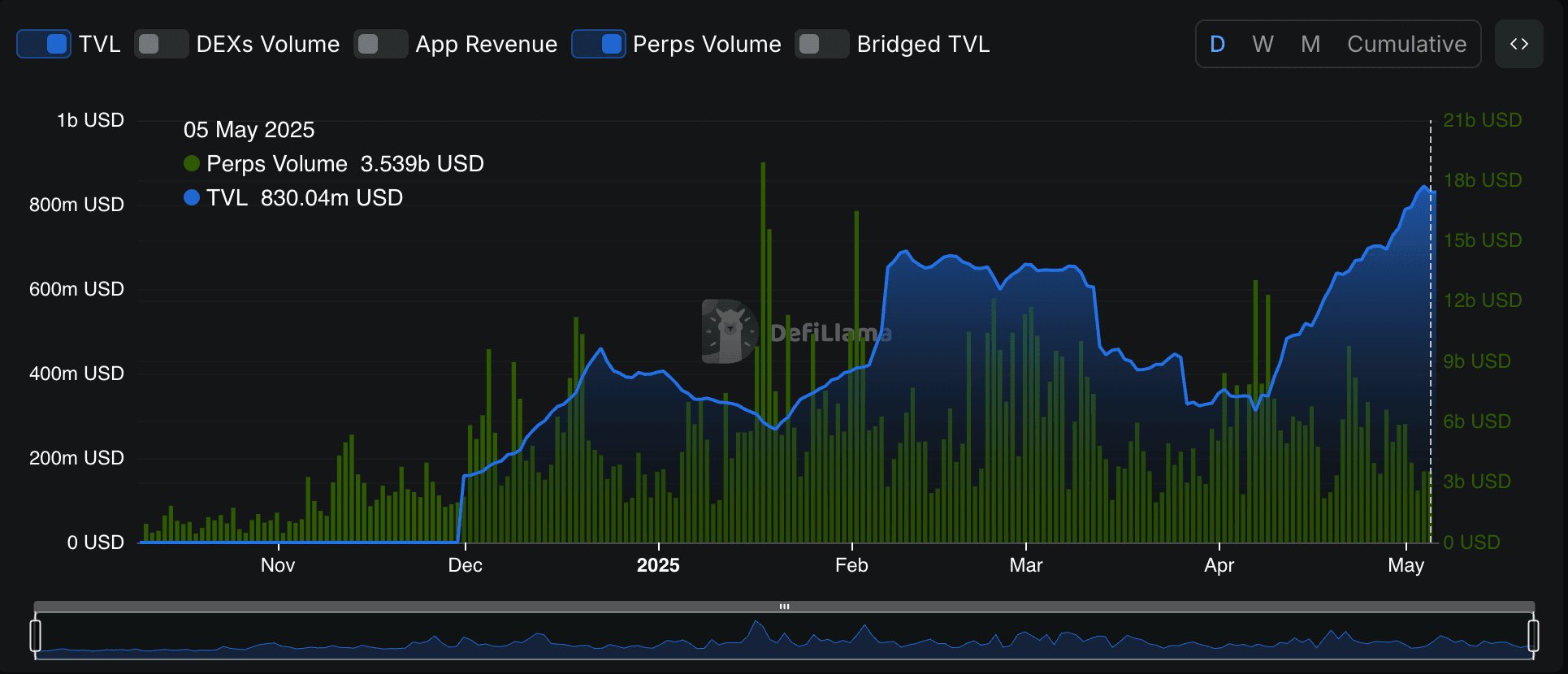

The platform continues to handle multi-billion dollar daily trading volumes despite the downturn in macro market volumes and is, accounting for roughly 70% of all onchain perp volume in recent weeks. In April alone, Hyperliquid processed over $178b in volume while markets corrected to the downside. Outside of sticky volumes, the HyperEVM continues to grow TVL and this growth is without one of the major stablecoins deployed there (until Ethena’s most recent announcement). In short, liquidity continues to flow to Hyperliquid and to its growing EVM ecosystem.

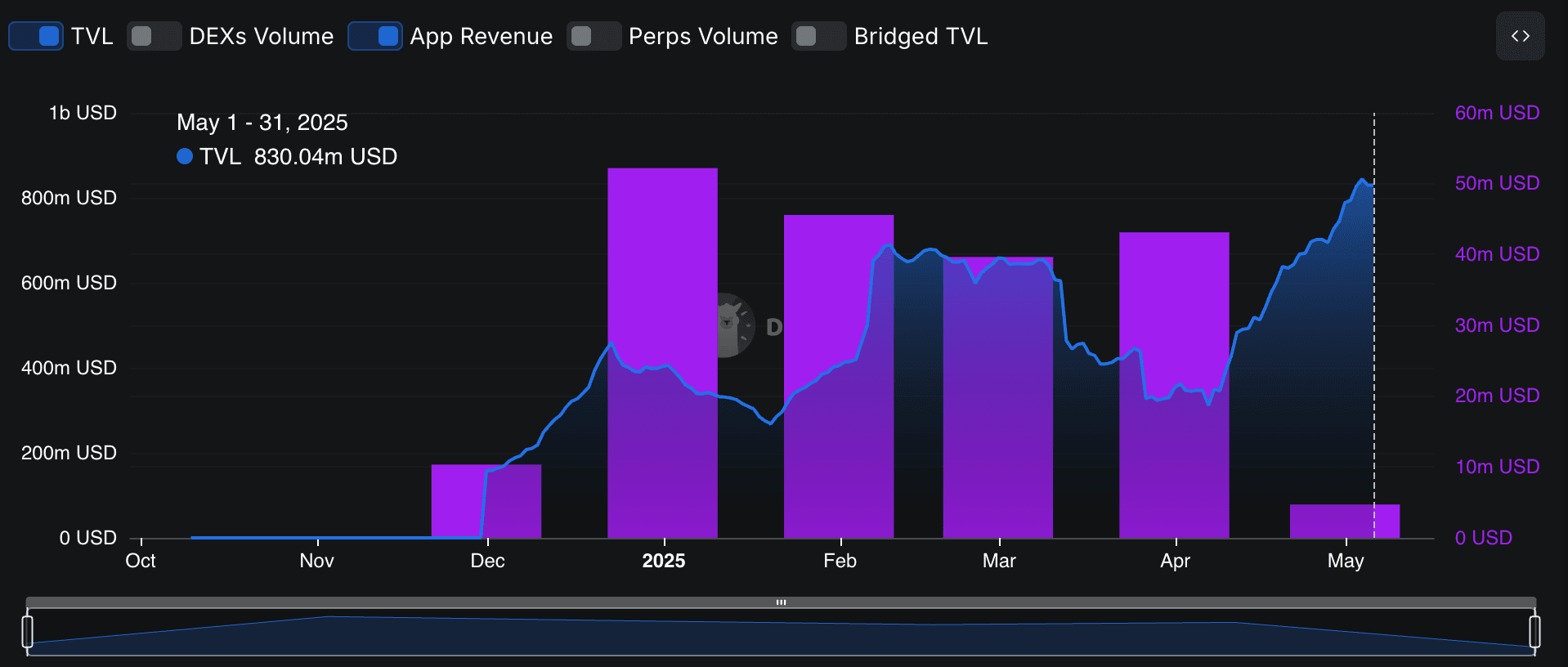

TVL (in blue below) and app revenue (in purple below) continue to grow substantially, creating a potential flywheel as the HyperEVM becomes an attractive home for popular EVM apps to deploy and to tap into the network effects of real users on the platform.

By leveraging a custom high-speed chain (HyperCore) and its EVM layer, Hyperliquid offers CEX-like performance with DeFi’s non-custodial benefits – a value proposition that is driving traders and liquidity to concentrate on the platform. But the main question is, where does the HyperEVM stand after 2 months, whats next for Hyperliquid and what are some implications for HYPE the token?

Recent Upgrades and Features

Despite broader market uncertainty, HYPE is defying the downtrend on most fronts. It is boasting new ATHs in TVL, despite the decrease in overall perp volumes.

What are the next drivers of growth in volumes and TVL? Let’s dive in.

- Permissionless Perps (Testnet Launch): Hyperliquid is decentralizing its listing process for perpetual futures. It rolled out an MVP of builder-deployed perpetual markets (HIP-3) on testnet. This feature allows third-party developers to permissionlessly launch new perp orderbooks on HyperCore, representing a key step toward community-driven market listings. This dramatically helps HYPE outperform its centralized counterparts which are restricted to their listing processes through centralized teams and oversight. Rather, with HYPE, builders can configure their markets (oracle sources, leverage limits, fees) and even earn a share of trading fees. For quality control, any new market deployer must post a 1m HYPE stake (slashed for malpractice) which may create even more buy pressure of circulating supply. Additionally, more collateral types will be coming to Hyperliquid via this MVP - collateral can be configured in this perp listing setup; in other words, Hyperliquid will now support new collateral types for margin such as BTC, USDT0, USDe, etc. and is moving away from just USDC. This is currently in its testnet phase but will eventually unlock many new features from a UX perspective.

- HyperEVM Integration and New Protocols: Development continued on HyperEVM, the network’s Ethereum-compatible smart contract layer. This additional layer is attracting DeFi protocols to the broader Hyperliquid ecosystem. Most notably, Ethena just deployed USDe and has partnered with a number of Hype-native projects to unlock more capital efficiency. Additionally, the usual suspects have begun to gain traction via TVL growth within the DeFi sector including spot DEXs, lending, and stablecoin markets which have flourished since the launch of HyperEVM, with Felix (a Liquity fork), Hyperlend (an Aave fork) and Hypurr(fot)fi leading by TVL. This makes HYPE a lot more productive throughout DeFi and furthers its use cases as it becomes entrenched in other protocols and liquid staking protocols. Additionally, this will likely accelerate TVL as more collateral is bridged over and the expected deployments of other stables including USDT0 and Halo USD come onboard. As for apps that recently went live in the last ~45 days, a non-exhaustive list includes the following:

- Felix Protocol, Supurr, HyperBeat, LiquidSwap, Valantis, Coretex, Mintify, ZeroDev, Morpho, GlueX, Garden Finance, Fan App, Sentiment, HyperLend, Vaults by Mizu Labs and Hyperbeat + various ecosystem partners, OmniX DVN, Hyperliquid Names, RedStone, amongst many others.

- Fee Structure and Staking Revamp: Hyperliquid implemented a major fee model upgrade (effective May 5th) to incentivize loyal traders and $HYPE holders. Under the new system, users can stake HYPE to reduce trading fees with tiered discounts ranging from 5% up to 40% off trading fees based on the stake amount. The fee schedule was also split for spot vs. perp markets (with spot volumes counting double toward a user’s VIP tier). This change is already encouraging more HYPE staking and rewarding the platform’s most active participants. Combined with “coin-margined” accounts now enabled for HYPE, traders can even use HYPE as collateral for positions, further integrating the token into the exchange’s growth flywheel.

- Perp Listings and Other Features: On the trading side, Hyperliquid continues to expand its market offerings. The core trading engine’s performance and risk controls were also fine-tuned over the past two months, particularly after the JellyJelly manipulation. Since then, action has been taken by the Hyperliquid team to remedy future issues of the like by adjusting the parameters around the HLP vault, OI and the delistings process in general. Of course, this is just after a large controversy of its listing process and the HLP vault has dropped significantly in TVL following the event. With that being said, the vault’s PnL is creeping back to all time highs of its lifetime PnL but the recent events have pushed LPs elsewhere.

Future Catalysts

- Mainnet Permissionless Listings: The upcoming deployment of permissionless perp markets (HIP-3) to mainnet is a major catalyst. Once live, anyone meeting the stake requirement can list new perpetual contracts on Hyperliquid without core team approval, opening the floodgates for many more markets (including long-tail assets). This move toward full decentralization could significantly boost trading volumes and fees as the exchange’s asset coverage grows. Importantly for HYPE speculators, the 1m HYPE stake per market that HIP-3 mandates creates a new sink for the token. Each new market will lock up HYPE to prevent bad behavior via slashing. Over time, this permissionless listing model positions Hyperliquid as a platform for perpetuals, similar to what Uniswap did for permissionless spot markets. As for HYPE, HIP-3 provides a clear framework for new features but also creates positive tailwinds for HYPE including a further supply sink, new recurring buy pressure from dutch actions, dividend mechanism through the protocol/builder fees and makes it a security asset via its slash-ability to align operators in acting in good faith.

- HyperEVM Launch and Ecosystem Growth: Hyperliquid is set to evolve from a single-product exchange into a fully fledged L1 ecosystem. In general, we have seen maturation of the entire ecosystem across many fronts - bridging and infrastructure such as Gelato’s integration or the ability to directly bridge to the HyperEVM via popular bridges such as Stargate. In short, HyperEVM’s growth could amplify the network effect Hyperliquid already enjoys, cementing its status not just as a perps exchange, but as a thriving DeFi hub on its own chain. We feel this is important as it may give HYPE a potential L1 premium that other L1s enjoy as its core exchange infrastructure powers all of the apps composing on top of it.

- Community Incentives & Token Dynamics: A possible “Season 2” airdrop or incentive program looms on the horizon, which would be a powerful catalyst for engagement. Hyperliquid famously launched with a significant airdrop in terms of $ airdropped, yet nearly 39% of the HYPE supply still remains allocated for future community rewards/distribution. Speculation is building that a new campaign of some sorts could be announced in the coming weeks given the recent UI upgrade on testnet that includes a redesigned points page. If the team confirms a “Season 2” program, it would likely accelerate user growth and volumes as traders strive to earn points or rewards. Given how “weak” airdrops have been before and after HYPE, this would surely become one of the most highly anticipated airdrops in our opinion. Long term, this may introduce some selling pressure on HYPE but much is dependent on broader risk appetite and maturity of the HYPE ecosystem.

Risks

Of course, there are risks across the exchange itself and the successful execution of the HyperEVM gaining significant traction. Mainly, on the HyperCore side, there have been issues which were highlighted with the listing of JellyJelly and the control/centralization the team has over the entire protocol today. However, we are not interested in it because it is decentralized but because it is an attractive narrative with many catalysts ahead and no unlock concerns. Additionally, the other concern is that of any permissionless protocol - it is sitting and vulnerable to potential exploits, especially given it is a perps exchange and L1, it has to constantly manage and contain risk within the system. With known Lazarus addresses trading on Hyperliquid and almost all of its TVL held up by a single bridge, there is definitely more to do on the security front as well.

Further, outside of potential exploits there inlines execution risk. The HyperEVM mainly comprises of popular lending and CDP forks of well known protocols (i.e Aave, Liquity) so it will be exciting to see some of the main DeFi heavyweights such as Aave deploy there. Additionally, there have yet to be new stables deploying there on the HyperEVM (until Ethena). This is both bearish and bullish as we’d like to see more developer mindshare across existing apps and the bullish framing is that the potential is massive with the introduction of liquid stables such as USDT0 and USDe and reliable apps that aren't just forks. This risk is more of a long term time frame issue given we have seen how predatory capital can be when much of the ecosystem is just forks (i.e Avalanche, Sei, etc.).

Conclusion

In short, we feel the flywheel effects and traction of Hyperliquid as an exchange make HYPE one of the most exciting liquid plays today. With even more in the pipeline and positive data points across its volumes, HyperEVM and other metrics, momentum is quite strong for the platform which directly leads to protocol revenues and catalysts for HYPE holders/stakers. The protocol is making many millions and is using a large portion to buy back HYPE off the open market - this is millions of daily buy pressure alongside new supply sinks/buybacks where you can see early speculation of 20%+ increase in fee accrual since the newly implemented fee system. With that being said, it was much easier to be bullish with HYPE at ~$10 vs now at ~$20. In other words, the market’s current prices for BTC and alts such as HYPE seem to be less attractive in terms of entry under the context of the broader macro landscape. Despite price levels, we see HYPE outperforming many alts if/when things start to change and we see the potential of another trending bull market.