Introduction

The Stablecoin Transparency and Accountability for a Better Ledger Economy Act of 2025 (STABLE Act) introduces a comprehensive U.S. regulatory framework for payment stablecoins, digital tokens pegged 1:1 to a national currency and redeemable on demand. The Act restricts issuance to licensed entities (insured banks, OCC-qualified non-banks, or approved state trusts) and mandates full reserve backing in cash or short-term Treasuries. Critically, issuers are prohibited from paying interest/yield to stablecoin holders, cementing these tokens as transactional money rather than investments.

Algorithmic or crypto-collateralized stablecoins are excluded from the “payment stablecoin” category and even face a two-year moratorium if they do not already exist. This regulatory clarity is expected to reshape the digital asset landscape, favoring early compliant players while pushing others to adapt or move outside the U.S. market. Please refer our previous report on the STABLE act, for an introduction.

Now that the regulatory rules are set, let’s look closer at who stands to win in the future of regulated markets.

Winners in the Regulated Stablecoin Era: Public Companies & Infrastructure

The STABLE Act’s licensing and reserve requirements create a regulatory moat that favors large, regulated players. Among the biggest beneficiaries are companies already aligned with U.S. compliance standards, especially those offering custody, payment processing, or exchange services.

Coinbase (COIN) stands to gain in multiple areas. As one of the leading distributors of USDC through its revenue-sharing agreementwith Circle and is no longer a majority stakeholder or co-issuer, it’s already aligned with the type of fiat-backed stablecoin that regulators are encouraging. Coinbase’s custody arm could also benefit from increasing demand for regulated storage of reserves and private keys, while its exchange may consolidate liquidity for compliant tokens.

PayPal (PYPL) has also moved early, launching PYUSD in partnership with Paxos, but is still lacking in adoption with 0.38% marketshare. Now that federal licensing and reserve standards are codified, PayPal can scale stablecoin payments across P2P transfers, e-commerce, and cross-border remittances. With clear regulatory backing, PYUSD could become the engine behind a new generation of merchant payment flows, and PayPal won’t need to rely on third-party stablecoins to do it.

The payment giants Visa (V) and Mastercard (MA) have already experimented with stablecoin settlements and now have the green light to expand. Visa’s USDC pilot for card settlement and Mastercard’s interoperability services between stablecoins and bank rails may soon evolve into full-fledged offerings. Both companies can integrate regulated stablecoins into B2B payments, treasury management, and real-time settlement layers with compliance now defined.

On the backend, traditional custodians like BNY Mellon (BK), State Street (STT), and infrastructure firms like Nasdaq (NDAQ) are in a prime position. These firms can custody reserves for stablecoin issuers, provide attestation services, and build tooling for reporting, compliance, and analytics. BNY Mellon’s relationship with Circle is a template for the kind of institutional-grade reserve custody services that will proliferate.

Asset managers like BlackRock (BLK) and Charles Schwab (SCHW) benefit more indirectly. Since the Act mandates fully backed reserves in cash or short-term Treasuries, stablecoin issuers will increasingly park funds in government money market funds. BlackRock, which already manages reserves for USDC, may see further inflows into its Treasury products. A related trend is the emergence of tokenized money market shares, which may serve as an alternative for users seeking yield in a post-interest-ban stablecoin world.

Internationally, firms like Payoneer (PAYO) and banks including MUFG and Nomura will likely tap into compliant stablecoin infrastructure for cross-border transfers, especially as USD stablecoins become safer and more interoperable. While not U.S.-listed, these players will benefit from the clarity and trust that the STABLE Act brings to dollar-denominated digital assets.

These are merely examples and there are many other similar companies that could stand to gain if the STABLE act goes through.

DeFi Under the STABLE Act: Adaptation and Outlook

Lending Protocols (e.g. Aave, Compound)

Lending protocols like Aave depend on stablecoins as both collateral and loanable assets. Under the STABLE Act, decentralized stablecoins like DAI or Aave’s own GHO do not qualify as “payment stablecoins” and are included in a 2-year trial where a report will be created, to gauge the future of stablecoins such as these.

Aave is likely to shift its U.S. markets toward compliant stablecoins like USDC and PYUSD. It may also expand permissioned environments like Aave Arc for institutional users. Decentralized stablecoins could remain available on backends or in non-U.S. markets, but their prominence will likely decline in favor of bank-approved assets.

Decentralized Stablecoins (e.g. DAI, crvUSD, GHO)

Decentralized stablecoins won’t disappear, but they are being pushed out of the U.S. compliance zone.

In response, they may:

- Continue operating in offshore DeFi markets.

- Explore wrappers or bridges to maintain liquidity.

- Re-engineer themselves to fit new legal frameworks, though this could undercut their decentralization.

The Treasury is expected to study non-payment stablecoins over the next year. Still, in the meantime, decentralized stablecoins will operate in a regulatory gray zone or entirely outside of it.

DEXs (e.g. Uniswap, Curve)

Decentralized exchanges will need to strip non-compliant stablecoin pools from interfaces accessed by U.S. users. That means removing or geofencing pools like DAI/USDT, and instead highlighting USDC/PYUSD pairs.

With the prohibition on distributing interest from payment stablecoins, DEXs may lose some of the incentive models that attracted liquidity. Instead, they’re likely to:

- Emphasize trading fee revenues.

- Introduce tokenized yield products, like money market fund tokens, as pool components.

- Build integrations with compliant stablecoins and asset-backed tokens.

Uniswap and Curve will survive, but their mechanics will shift to comply with the new boundaries of yield and token classification. Curve is currently losing market share, so it’s going to be interesting to see who will take the cake and eat it too, and Uniswap is positioned positively for this.

Yield-Bearing Stablecoins: The Regulatory Red Line

The Act explicitly bans interest payments from payment stablecoins. This makes yield-bearing tokens like Origin Dollar (OUSD) or other “auto-compounding” stablecoins non-compliant by default.

Such tokens may now fall under securities laws and would likely require SEC registration. The market may move toward offering yield through tokenized money market funds, tokenized bank deposits, or DeFi lending protocols using compliant stablecoins as the base layer but direct interest payments from the stablecoin issuer are off the table, but interest can still be paid by other entities such as CEXs.

Onchain Movements

The stablecoin market is going to see interesting changes if and when the STABLE act comes through. What is the distribution and marketshare looking like for stables now, and where are stables flowing?

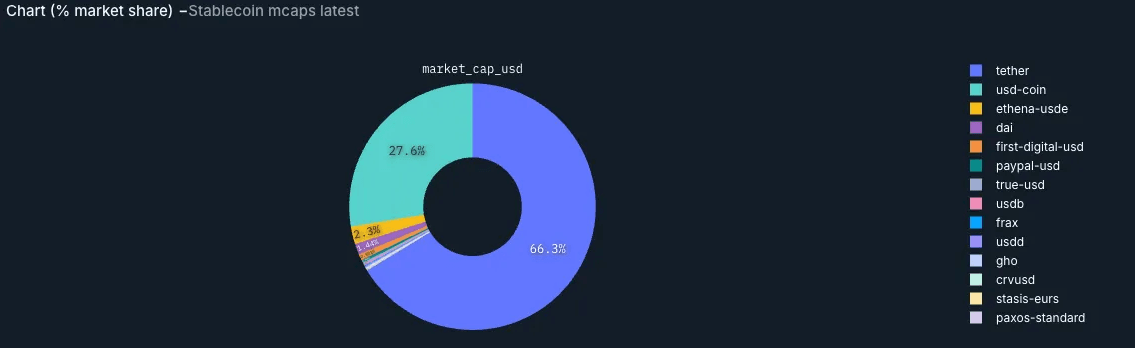

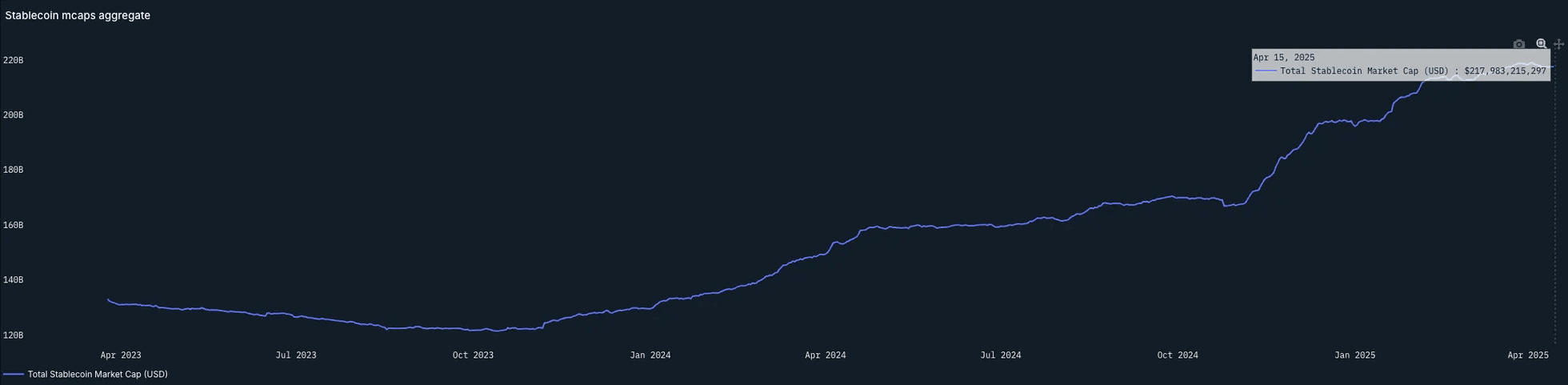

At the time of writing (April 14th), USDT has a 66.3% market share with USDC coming in second at 27.6% market share and finally USDE with 2.7% market share. And while market share changes, the combined stablecoin market cap seems to grow steadily despite the volatile crypto market and is now sitting at $217.4 billion!

As for chains, Ethereum, Tron, and Solana are easy winners based on stablecoin market share, with Ethereum being the biggest winner by far, amassing 52.6% of the total stablecoin market, showing that despite the price performance, Ethereum is still a powerhouse.

Looking into Ethereum, where do we see the most stablecoin activity?

| Entity | Unique Senders | USD Value | Transaction Count |

|---|---|---|---|

| Binance | 372862 | 664'801'025'038.9020 | 3117696 |

| Coinbase | 300407 | 454'038'955'077.65000 | 2253316 |

| Uniswap | 153811 | 442'516'669'747.8930 | 8367348 |

| DeFi Saver | 745 | 405'198'406'326.36900 | 22570 |

| MEV | 40035 | 383'285'754'854.47200 | 2365114 |

| SCP | 100 | 297'193'598'301.67100 | 441112 |

| Morpho | 7663 | 273'241'701'402.8130 | 218254 |

| Aave | 19188 | 244'437'011'583.2470 | 361070 |

| MakerDAO | 2459 | 183'976'869'481.7840 | 235328 |

| Coinbase Prime | 6554 | 155'525'430'929.63400 | 431638 |

| Circle | 10627 | 140'119'896'404.60400 | 194612 |

| Wintermute Market Making | 1926 | 95'955'416'607.944 | 898746 |

| Bybit | 188898 | 73'945'907'473.36660 | 1564882 |

| OKX | 108995 | 72'574'502'064.17300 | 677638 |

Notably and as expected, a lot of activity is flowing to CEXs and various DeFi protocols.

Conclusion

The STABLE Act introduces a clear regulatory framework for payment stablecoins, restricting issuance to licensed entities and banning interest payments to holders. These rules benefit firms already operating within regulated environments, such as Coinbase, PayPal, Visa, and traditional custodians. Asset managers may also see indirect gains through increased demand for short-term Treasuries and money market funds.

Decentralized stablecoins like DAI, GHO, and crvUSD do not meet the Act’s criteria and will likely lose visibility on U.S.-regulated platforms. Yield-bearing stablecoins are effectively excluded from this framework and may face classification as securities, depending on what is decided in the future.

Stablecoin activity continues to grow, with USDT and USDC holding the most significant shares and Ethereum maintaining its dominance as the primary chain based on market share. Regulated stablecoins are likely to expand in usage, especially in areas like payments, custody, and institutional settlement. At the same time, unregulated assets will likely be pushed to the edges of the U.S. market or migrate offshore.