Introduction

Stablecoins have emerged as the single clearest example of crypto achieving product-market fit. Unlike speculative assets or nascent protocols still chasing elusive use cases, stablecoins have quickly integrated into global finance as a reliable means of savings, digital payments, remittances, and settlements for a more interconnected financial network. Despite widespread recognition within the crypto community, stablecoins' full potential remains largely untapped, leaving investors asking: how can I participate, and who stands to benefit most? With traditional finance giants like Stripe doubling down on stablecoins, most notably through their $1B acquisition of Bridge and labeling stablecoins as “room temperature superconductors for payments”, we offer a subjective framework to navigate these exciting yet uncharted waters.

This report provides an opinionated perspective on why stablecoins represent one of the most significant opportunities in crypto today, focusing on their growth trajectory, what the market has been telling us, addressable markets and the power of network effects across the stablecoin stack, particularly the issuers and the “last mile” effects. Additionally, we will try to highlight certain liquid projects across the stablecoin stack and showcase where they do or do not fit into the broader trend across varying timeframes. While regulatory hurdles and market fragmentation present challenges, the foundational shift towards rational frameworks are already in full swing with the likes of the STABLE act and an up only chart for stablecoin marketcaps - stablecoins will begin to underpin more and more of our lives. This report will not touch on the new legislation but we already have you covered if you’d like an in depth report on the STABLE act and some of its implications, including some potential winners, which we explore further in this report.

Setting the Scene

Core Premises and Assumptions

Stablecoins are evolving from simple peer-to-peer digital dollars on the blockchain, into essential infrastructure powering global commerce and institutional settlements. Originally serving basic transactional needs, they're now enabling advanced use cases like international remittances, trade settlements, and acting as the primary trading asset on DEXs.

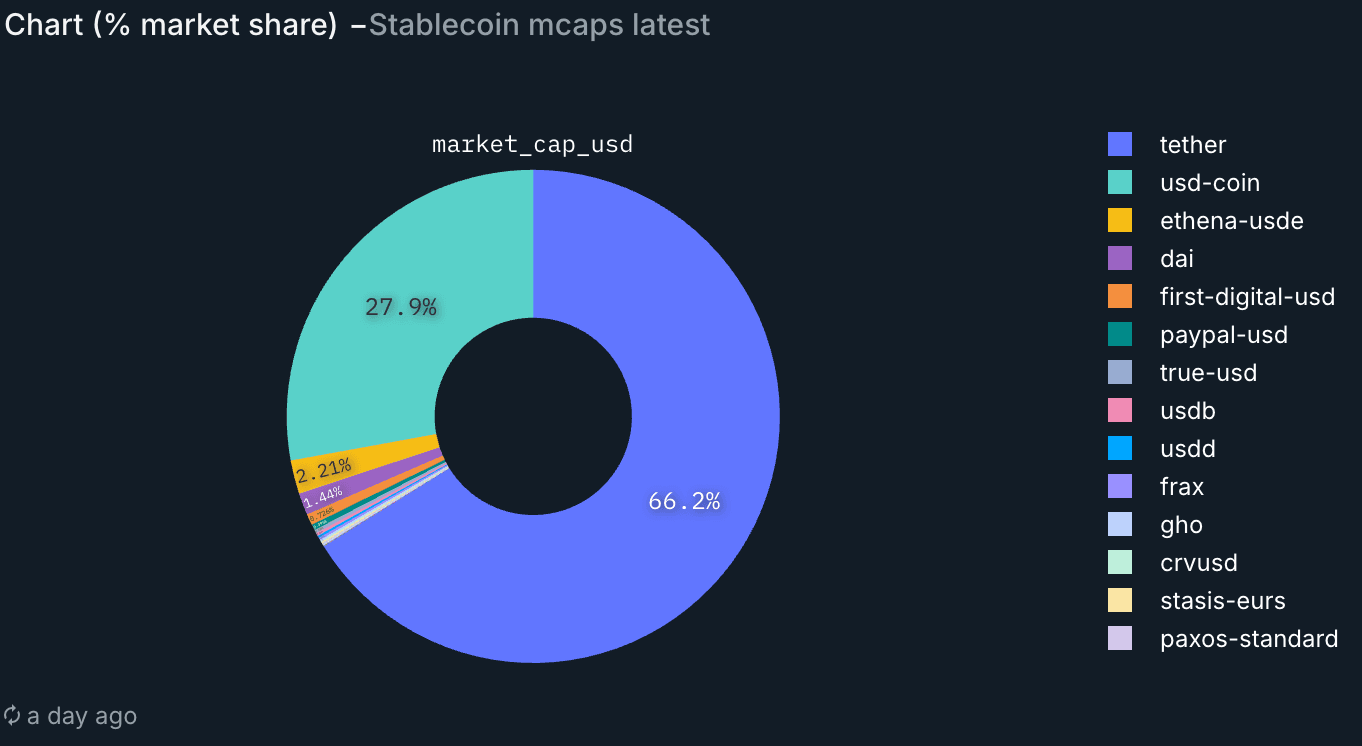

Another critical assumption is the inevitability of liquidity fragmentation. Diverse regions, varying regulatory landscapes, and unique institutional demands suggest many stablecoins will coexist, each specialized for specific niches or jurisdictions. While fragmentation introduces complexity, it also opens significant opportunities for infrastructure and middleware providers that can bridge these divides and facilitate seamless interoperability. Despite the potential dispersion in stables, we inevitably believe this is a "winner-takes-most" market dynamic—currently exemplified by Tether’s USDT, which holds roughly 66% market share by market cap at the time of writing.

Despite their rapid adoption, stablecoins currently represent a modest segment compared to global tradinional payment markets—roughly ~$220 billion in market capitalization relative to multi-trillion-dollar payment volumes and USD circulation. This gap highlights an enormous potential for growth, indicating that stablecoin adoption remains in its very early stages.

Marketshare of Stablecoin Marketcap

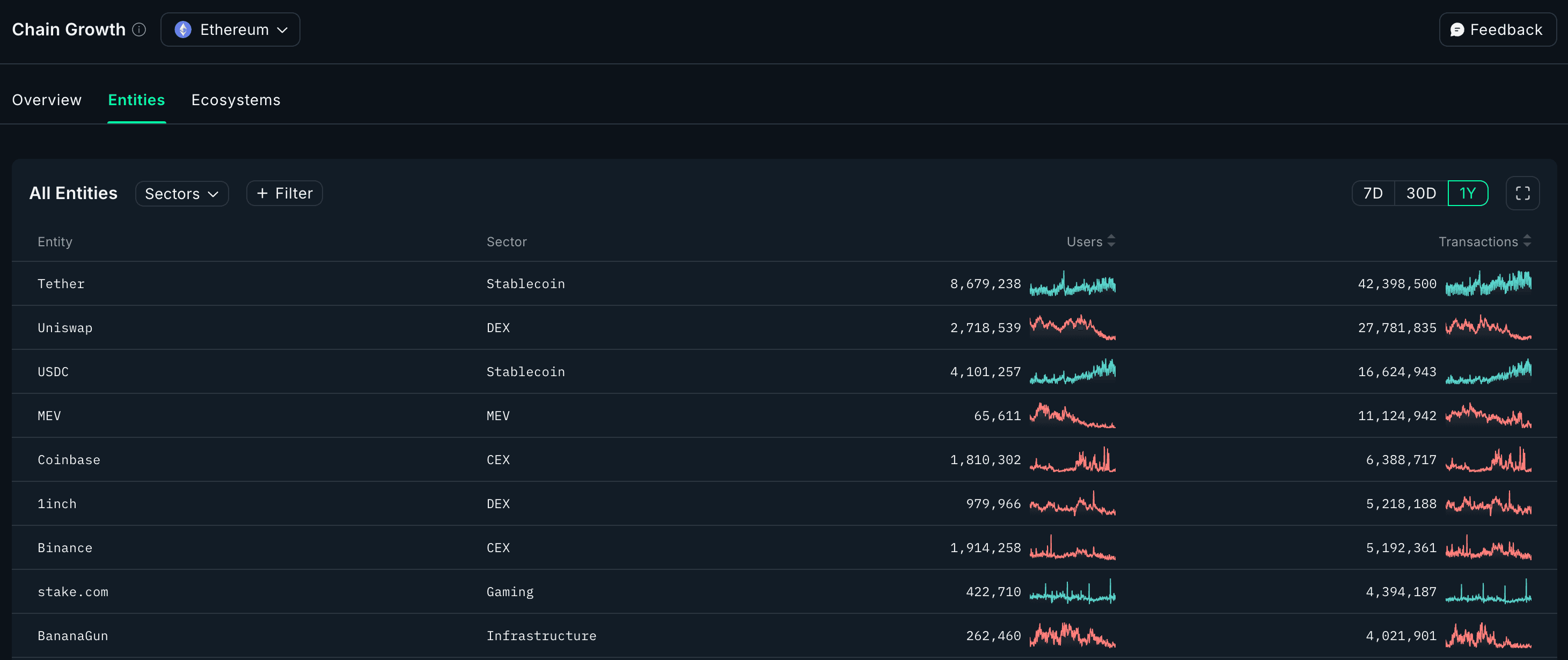

USDT is the clear winner here by a long shot, but looking at an onchain perspective, what do we see from a user perspective relative to other popular entities on Ethereum?

Over the last year, Tether remains the dominant entity as measured by both user count and transaction activity. With nearly 3x as many users as Uniswap and 50+% more transactions than the next app, Tether is by and far the largest use case of onchain activity. Of course, this only looks at Ethereum but this is quite representative of a broader trend. For context, the fees generated by chain over the last 30 days show a similar picture:

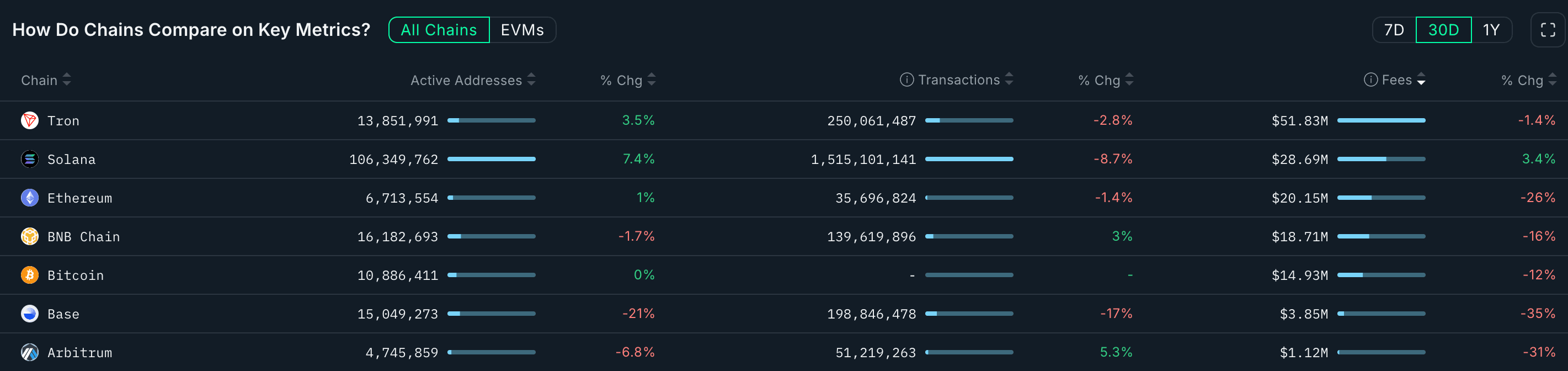

Tron outpaced Solana and Ethereum over the last 30 days by fees, bringing in over $51.8m with a lot of this comprising of stablecoin adoption and its tight integrations with the “last mile” of usage. As for the 2 largest players, USDC and USDT, where do they sit?

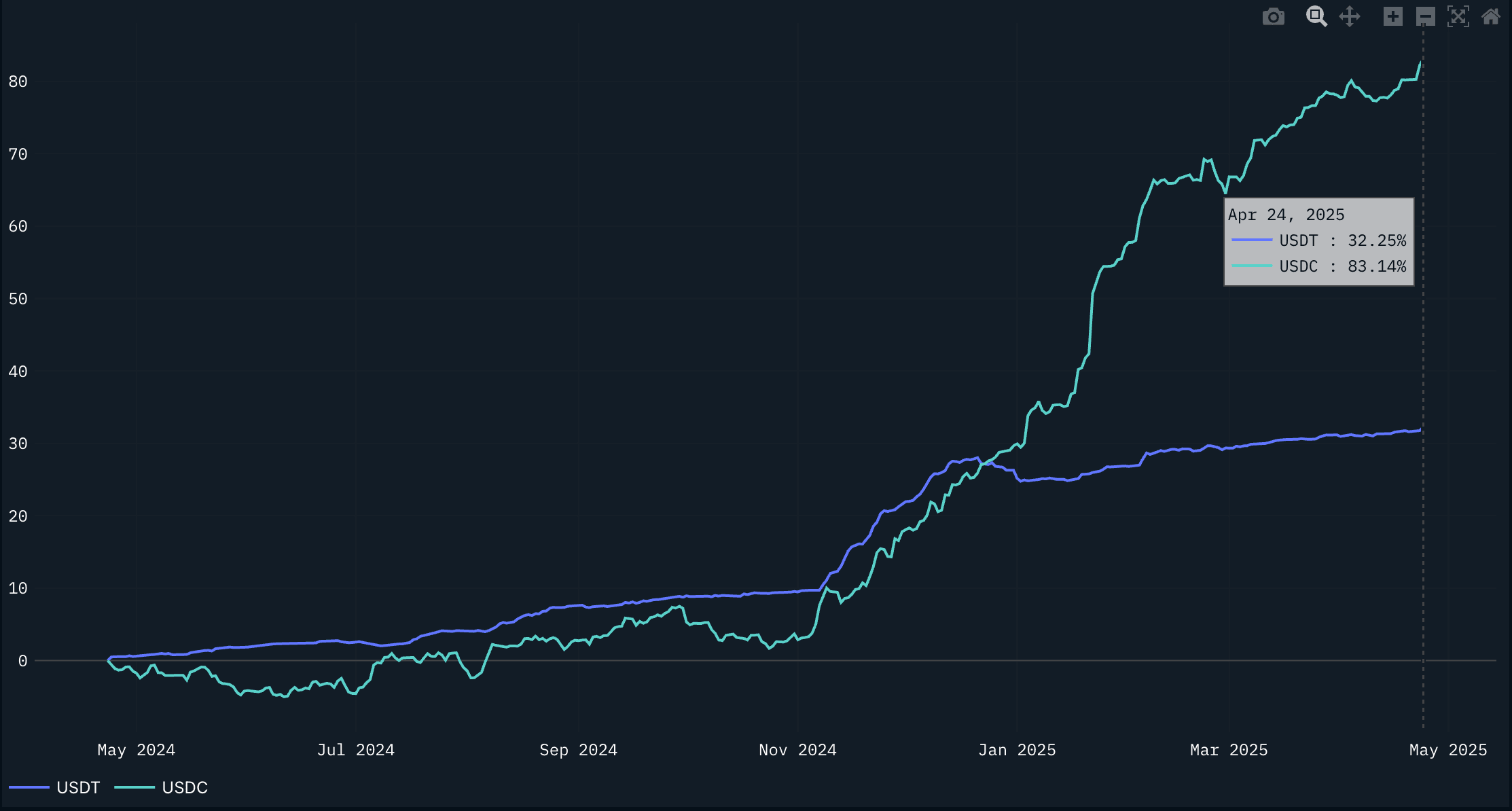

1 Year Growth Percentage

Both have seen double digit percent growth but USDC has expanded more quickly, particularly from November 2024 onward. On an aggregate basis though, we see USDT is in a league of its own at over 2x the size of USDC by marketcap but these two are growing at a very rapid pace.

Broad Categorizations

Our framework for what the market has demanded and what we personally believe will be valuable for stablecoins boils down to two high level use cases:

- Liquid Checking Account: The largest demand for stablecoins has been driven by USDT, highlighting the main use case: access to the most liquid stablecoin globally with integrations where the users are and bringing that on the ground in countries where there is an inflationary fiat domestic currency (i.e Argentina, etc.).

- Savings Account: Outside of the main need for a stable “checking account” that demands liquidity and accessibility, users are interested in a savings account. This savings account can be powered by fixed-income products like USDE or yield bearing stablecoins such as USDY or USDN that direct the floating T-bill rate to holders.

Given the growth of USDT and USDC, the users are clearly expressing that they do not necessarily care about the yield as they are forgoing it to Tether and Circle - they simply want access to the most liquid and “stable”/ least-likely-to-depeg stablecoin out there. This liquid account remains the largest demand for stables at the moment but we expect to see many more new entrants to compete in the 2nd category. We think of this as the crypto equivalent of Fidelity’s SPAXX, CDs or other common financial instruments offered to everyday people - it is a massive category of “dollar-like” savings accounts (money markets) with slightly riskier financial instruments under the hood. Though we have to ask, how sustainable are many of these new stablecoins that are launching today who are competing for a much smaller part of the pie with relatively unclear differentiation and liquidity?

For now, we expect the competition to increase in the short-to-medium term with many new launches which we feel will end up replaying some variation of the tried and tested points farming programs. During this expansion phase, we believe Pendle is likely the main beneficiary of this due to their tokenized yield markets being the main liquidity launchpad for new stables and its entrenched collateral through lending markets like Morpho (i.e borrow against PTs, etc.). Though we expect the number of stablecoins to grow in the short-to-medium term, we also foresee a strong consolidation across a few market participants with most of these stables fading into irrelevance after a while, as noted by their market caps and utility throughout DeFi. The main question is who are the winners across these segments?

Largest Winners and Trends

Dominance of Tether (USDT)

Tether continues to dominate stablecoin markets due to its network effects, entrenched liquidity, and distribution. Its strength lies in robust "last-mile" availability, particularly in emerging markets and informal financial networks, making it indispensable for global crypto payments. Although regulatory and compliance risks exist, Tether's practical utility and liquidity advantages have allowed it to maintain dominance despite persistent scrutiny. Additionally, its profitability model is not that replicable given its liquidity effects and usage has a lot of inertia. This makes their straightforward business model not replicable which has been noted with Circle’s revenues being much less due to fee sharing and other go to market costs. As for next steps, Tether is expanding its reach by building out and funding a dedicated stablecoin network called Plasma. The aim is to further enhance the utility of USDT and make payments and other use cases of stables free and easy to use while maintaining its edge in liquidity and composability within DeFi. As of now, Tether is being used so much onchain that even alt-EVM chains like Tron are seeing fees become more than that of Ethereum mainnet in recent months. Thus, the market is ripe for a new dedicated app-chain designed and built directly for stablecoin usage.

USDC and Institutional-Grade Competitors

Within more U.S.-centric use cases, USDC maintains a significant presence, particularly attractive to institutions requiring regulatory clarity. However, this segment faces intensifying competition as major traditional financial institutions (i.e. Fidelity, PayPal, and banks) enter the market. Leveraging established financial infrastructure and vast user bases, these institutions could quickly reshape the competitive landscape. However, we see USDC as the next largest beneficiary of this trend given its strong integrations and regulatory clarity.

Emerging institutional stablecoins like PayPal’s PYUSD and Ripple USD are rapidly gaining traction, driven by extensive existing payment networks and acquisitions. Concurrently, the rise of white-label stablecoin solutions enables banks and fintech companies to potentially issue their own proprietary stablecoins. In other words, this is a world where Meta comes full circle on stablecoins and issues its own and many other companies alike doing the same. We see Circle as well-positioned well it may be an uphill battle to compete with incumbents like PayPal who already owns Venmo and many other GTM platforms that facilitate so much of P2P payments already. Not to mention consortiums of banks that operate through their own systems such as Zelle, which still relies on traditional financial rails like ACH under the hood. This suggests to us that Circle will likely launch its own dedicated stablecoin network or acquire one to bring USDC mainstream, similar to Plasma or Converge. It has done a great job with its partnerships with exchanges like Coinbase, and has seen lots of growth but is still a long ways away from USDT.

USDE and Yield-Bearing Stablecoins

A significant emerging trend is yield-bearing stablecoins, exemplified by Ethena's USDE. Yield-bearing stablecoins combine the stability of pegged digital currencies with attractive yield-generation features, making them appealing for both retail and institutional investors seeking stable returns. Ethena's USDE, built around tokenizing the crypto basis trade, has rapidly grown to ~$5 billion in supply, driven by its attractive yields and its approach to risk management. We feel that akin to Tether, Ethena’s moat is very strong - as showcased by Binance’s own attempt at an Ethena-like stablecoin. This Binance competitor is fundamentally worse off from a scale and yield perspective given its integrations are limited to just Binance trading volumes and the inherent growth and yield potential are downstream of the addressable basis trade; thus, Ethena’s integrations across all CEXs and DeFi alike make it more competitive on most fronts moving forward. Outside of the basis trade, we can also see T-bill backed stables complementing yield-bearing stables such as USDE. We see it as another way for users to have a “savings account” whereby the floating T-bill rate is redirected to holders. We think these stables can remain competitive at times with the USDE native yield and have differing risk profiles. Further, Ethena has doubled down on its onchain and institutional presence by launching Converge - a dedicated app-chain for stablecoin issuance and utility.

Infrastructure and Middleware Emergence

Despite the market leaders such as USDT, USDC and USDE dominating across many metrics, we are seeing a large bottleneck of the underlying chains they operate on and connectivity in general. The trend is clear that the issuers want to own the full stack - USDT is betting big on Plasma and Ethena is all in on their chain called Converge. Both aim to scale payment use cases and foster tighter integrations across all parts of the stack to bring stables mainstream. Thus far, networks like Tron are reaching up to a few dollars for a transaction for a simple ERC-20 transfer - thus, we see a space very ripe for a purpose-built chain optimized for just for stablecoins. We likely expect Circle to launch something similar and we have even seen asset issuers such as Noble launch their own L2s to create app layers for payments with a native yield underpinning the network.

Outside of infrastructure, we also see a multitude of middleware companies launch. More akin to traditional fintech companies rather than leaning into hardcore crypto culture, these types of platforms are abstracting away the crypto elements of stablecoins to be used for everyday payments and use cases. Mesh is one such example which is aiming to streamline payments by connecting all exchanges, chains and platforms into one easy to use API. Mesh has been analogized as the Plaid of crypto, and its connectivity can empower the next generation of payments. These middleware solutions mean the crypto side of it will look and feel like the same to what they are used to but it will run on crypto rails in the background. On the one hand, this makes the crypto side “boring”, similar to how consumers do not obsess about SWIFT payment systems when they buy a coffee - it simply works and it does so better than current rails.

These platforms and middleware solutions aim to abstract away complexities inherent in the current stablecoin UX, offering frictionless experiences through things like zero-fee transfers, rapid settlements, and simplified integrations. The growing preference for dedicated stablecoin chains and specialized middleware solutions highlights the inefficiencies inherent in using general-purpose blockchains (such as Ethereum or Tron) for high-volume stablecoin transactions. As these specialized solutions evolve, they will play a critical role in supporting dominant stablecoins like USDT and bridging disparate ecosystems.

DEXs: Stablecoin Volumes

Another core beneficiary of stablecoin growth will be DEXs. We continue to see stables underpin most trading volumes as we shift away from SOL/ETH and we anticipate the best place to trade stables will likely be positioned best for becoming the largest DEX as measured by volumes. There are quite a few DEXs and we have seen many different strategies to appeal to this onset of stablecoin adoption.

- Curve

- Underlying integrations with popular protocols like Spark and Spectra to underpin trading of assets and has even launched its own stablecoin. Outside of its integrations, it remains home to around $2b in liquidity and its crvUSD has over $170m in circulating supply. Most importantly, we saw a major partnership/integration for Plasma whereby Curve will bring its own stablecoin crvUSD and will help facilitate trading through its stableswap AMM.

- Uniswap

- Although they did not launch their own stablecoin, the launch of concentrated liquidity and v4 hooks have opened up the door for so many possibilities on Uniswap’s stack. For instance, one can create a hook for a stablecoin swap pool with Curve-like low slippage and we have seen Uniswap gain in marketshare for stable volumes.

There are other DEXs to note including Fluid but DEXs remain a key pillar in the stablecoin landscape. Despite the utility, it is a much deeper question on whether or not DEXs capture that much value over the long term. Rather, we actually do not see DEX tokens being used as a proxy for stable growth. The fees can be a race to zero but a few bps on an ever growing market is still enticing, though this has no translation to the governance tokens doing well, especially when you factor in dilution and real value accrual.

How to Play the Stablecoin Meta?

As hinted at earlier, we believe that there will be continued dispersion amongst new stablecoins with varying designs, but this will ultimately settle into a few winners. In the meantime, this means many points/yield markets for stablecoins that you can farm. As a trader, there are liquid bets that touch on some of the stablecoins discussed in this report. We will aim to cover tokens that are varied across market caps, adoption and stablecoin design.

PENDLE

We feel that PENDLE is actually the best index bet at this direct stablecoin growth in the short to medium term given its current role as a launchpad for stables and tokenized yield programs at large. The upside here likely doesn't benefit too much from the major stables and institutional plays (i.e PayPal, etc.), but it does benefit from the long tail of stablecoins. We wrote our thesis on Pendle here, which covers its major Boros upgrade and many exciting new features such as interest rate swaps.

MKR

There is of course MKR which gives exposure to the growth of MakerDAO which has seen quite a bit of growth in 2025 alone, now with over $7.2b in USDS circulating and a strong focus on profitability. Despite lower rates offered to USDS holders, down to 4.5%, their protocol revenues and TVL continue to climb higher. The potential downside to holding USDS is that many new institutions may want their own bespoke stablecoins and USDS is relatively centralized in its backing but less liquid than USDT and other centralized alternatives. In other words, we see it as stuck in between the two key categories mentioned earlier and without that specialization, we are unsure of its future growth multiple as it is competing on many fronts. However, this all in one platform may win out, it is just hard to say what the moat is longterm. Spark savings offers a savings account and is tied to the T-bill floating yield and it offers users a very intuitive way to earn yield with clear risks. Thus far, Maker has weathered the rate cuts while still growing revenues, despite the decrease in the savings account rate and the greater trend of rates cuts into the future. In short, it is a very sticky product that is very easy to use and MKR is tried and tested with a current valuation of $1.24b FDV. Outside of growth, there are no unlocks to worry about and the team continues to ship so the potential downside is limited compared to others with lots of unlocks.

ENA

The other large candidate is ENA, which powers the fastest growing stablecoin to date with many exciting catalysts into 2025. It is one of the most profitable protocols to date, with over $107m in annualized fees according to DeFillama. Additionally, there are many known catalysts such as the Converge chain, which will use USDtb as its gas token and is aimed at bringing institutional adoption. Outside of the app-chain, there is also the potential for a fee switch for USDe/USDtb, possibly benefiting sENA holders but this is merely speculative at this point. We covered ENA extensively from an investment thesis PoV here, but ultimately feel that:

- ENA faces major unlocks of over ~$60m monthly from team and investors which are massively in profit, despite these price levels.

- Even near ~78% off ATH, Ethena as a project is still not “cheap” and has an FDV of almost that of Aave and Arbitrum combined, sitting at $5.12b FDV.

Additionally, ENA holders usually have to stake their holdings to avoid dilution which requires a bit more management. Regardless of ENA price performance, we feel Ethena as a project is one that will be here building many years from now which can’t be said about 99% of projects today. The team is really able to execute on its very ambitious vision.

LQTY

Liquity is a bit different profile from the above, both from a stablecoin mechanism, a go to market strategy, its level of decentralization and its relatively weak adoption thus far. It is no secret most decentralized stables have had a tough time scaling but Liquity offers some benefits to users, though it will only be a small part of the pie, now sitting at just a $69m FDV. Some of the benefits include:

- Decentralization benefits: No blacklist functions, runs on immutable contracts and is only backed by ETH (no centralized collateral), though this makes it harder to scale.

- Exposure to all Liquity v2 forks via potential bribes generated. Forks may bribe LQTY stakers, but traction has been weak so far. There are a few friendly forks like Felix on Hyperliquid so time will tell to see how this plays out.

- v2 offers a native yield through the stability pool which comprises of liquidations and interest payments.

Despite performing very well into the v2 launch (EOY 2024), LQTY has done very poorly in 2025 across price performance and the traction of its v2. Its TVL is around $200m but v2 only makes up ~$8.5m of it according to Defillama. This emphasizes a larger point that scaling decentralized stablecoins is hard and picking a winner here is even harder. Thus, we simply surface LQTY as a separate category of stables to ensure readers see what and how these liquid tokens have performed across all categories. Thus far, decentralized stables have been tried for many years and to no avail; thus, we feel there are greener pastures elsewhere.

New Use Cases

Outside of yields and payments, we actually see stables being used to empower a new form of payments. Similar to the idea behind the likes of Superfluid, we are excited about a future with highly programmable money flows that are based on arbitrary logic. This can create potential new forms of onchain workflows for things like salaries streamed in real time to employees, task incentives for a decentralized workplace for humans/agents and much more. The design space is quite large and we are excited about many of the implications.

Conclusion

Stablecoins have emerged as a clear success story in crypto with massive growth potential beyond their current $220b market capitalization. Despite competition and fragmentation, market leaders like USDT and USDC have established strong positions through network effects, liquidity advantages, and strategic infrastructure investments. The development of dedicated stablecoin networks like Plasma and Converge signals a fundamental shift toward purpose-built infrastructure that can support the growing transaction volumes while addressing current blockchain inefficiencies. As this ecosystem matures, opportunities will continue to emerge across the stack, from issuers and infrastructure providers to middleware solutions that abstract away the complexity.