Introduction

unshETH is seeking to become the liquidity hub for LSDs, creating shared liquidity for a diversified basket of LSDs and an AMM (vdAMM) for the lowest swap rates. The ultimate aim is to have unshETH ubiquitous in DeFi, solving the liquidity problem with various LSD tokens. In effect, the protocol aims to ‘enhance the decentralization of validators’ by making the benefits of holding particular LSDs more uniform by providing shared liquidity for newer and less popular LSD protocols.

The protocol consists of two tokens, USH - the incentivization and governance token, and unshETH - an LSD representing a basket of LSDs with shared liquidity. unshETH and USH are omnichain and can be used on BNB Chain and Arbitrum so far.

The Purpose of a Basket

By having a basket of LSDs for liquidity, there is less ‘idle’ liquidity for large-cap tokens and more liquidity for lower-cap tokens. For example, Curve’s stETH-ETH pool comprises mostly idle liquidity (1-2% utilization rate), but unshETH seeks to combine this in a basket with other LSDs that can benefit from this liquidity.

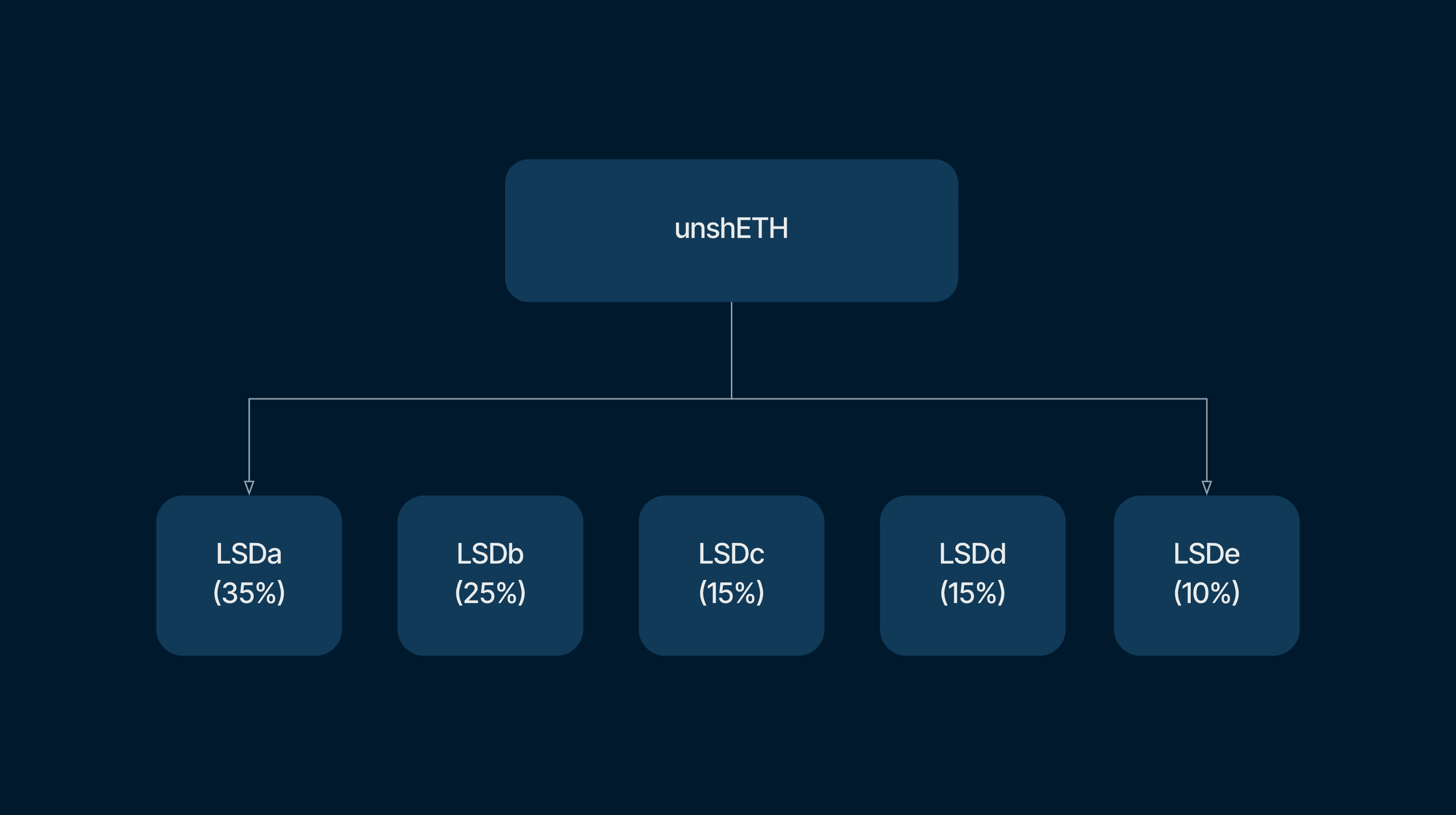

unshETH is essentially an LSD of LSDs.

(Arbitrary weights and number of LSDs applied for explanatory purposes).

Decentralizing ETH Validators

unshETH seeks to lower the barriers to entry for LSD tokens. By enabling shared liquidity, projects will not need to expend so many resources bootstrapping their own liquidity pools and can focus more on product features e.g. maximizing decentralization and real yield. At present, LSDs are trending towards monopoly/oligopoly, as seen by Lido’s unabating dominance. unshETH seeks to enable newer (and potentially riskier) LSDs to enter with limited exposure until they mature. The rationale is that joining the basket could give them the necessary liquidity and exposure for them to build their protocol to a size where they can feasibly take a meaningful share of the LSD market.

Adding LSDs to unshETH

Asset listings and their weightings are dependent on governance. When a new LSD joins, it may initially start out with <5% of the basket. An incentives programme will run to generate interest and attention for it to integrate. The weighting will depend on governance. Projects can participate in governance to maintain or improve their weighting and can use bribes to incentivize their pool.

Beyond this, the weighting allowed will depend on governance. Projects can participate in governance to maintain/improve their weighting, and/or utilize bribes to incentivize their pool.

Each token in the basket will have governance determined:

- Target weight (TVL)

- LSD gets guaranteed TVL up to the target weight and concentrated liquidity to the maximum weight. This shared liquidity should benefit every asset.

- Maximum weight (TVL)

Governance risk

Lower quality LSDs added to the pool and failing will result in losses to all holders. Bribes and market hysteria could result in poor-quality assets being listed and growing a disproportionate share of the pool. While unshETH argues that its weight caps mitigate the impact of poor-quality assets, at the height of UST a huge number of market participants strongly believed in the asset. A similar situation could occur where such an asset is added to unshETH and is voted to take up a significant share of the pool. The strength of the protocol will lie in the strength of its governance in ensuring that the assets listed are safe. A conservative approach is necessary.

Benefits of unshETH

There are a number of arguments for an LSD representing a basket of LSDs. The primary argument is that a basket offers a better risk-adjusted yield than a singular LSD. This applies both to users and also DeFi protocols. This is because the failure of a singular LSD collateral could have severe consequences for DeFi protocols themselves, causing them to become insolvent. Therefore, the diversification of risk is the strongest argument for a basket of LSDs.

Risks

However, one can counter this argument by saying that users and protocols take on additional protocol and smart contract risk in unshETH itself.

- Governance Risk: (outlined above).

- Incentive Risk: unshETH must maintain a sustainable level of yield for holders for it to grow in prominence - in an increasingly crowded LSD market. The protocol needs to avoid having the majority of bribes and incentives come from low-quality / risky LSDs.

- Smart contract risk: Lido underwent 9 audits, all of which discovered new issues. While this may indicate an LSD basket is desirable, the smart contract risk also applies to unshETH. unshETH suffered a vulnerability on May 31st where $375k of USH (farming rewards and protocol liquidity) were compromised. This highlights the risk involved with interacting with a new protocol. Note that user funds were not affected.

- Core team risk: The team currently uses a ⅔ multisig for adding new LSDs and updating target weights and maximum weights. While unshETH is still in its early stages, this is currently unsatisfactory. This will need to be further decentralized as the protocol matures, and sooner rather than later. The multisig is also for admin controls (not timelocked) e.g, emergency pauses on deposits.

- Execution Risk: The idea is compelling, however, it is operating in a crowded and highly competitive environment. The quality of their BD and execution in integrating high-quality and secure LSD protocols will be crucial.

Potential of LSDfi

The successful Shappella upgrade derisked ETH staking and has resulted in a further increase in staked ETH, and by effect, growth of LSDs. Staked ETH is at all-time highs.

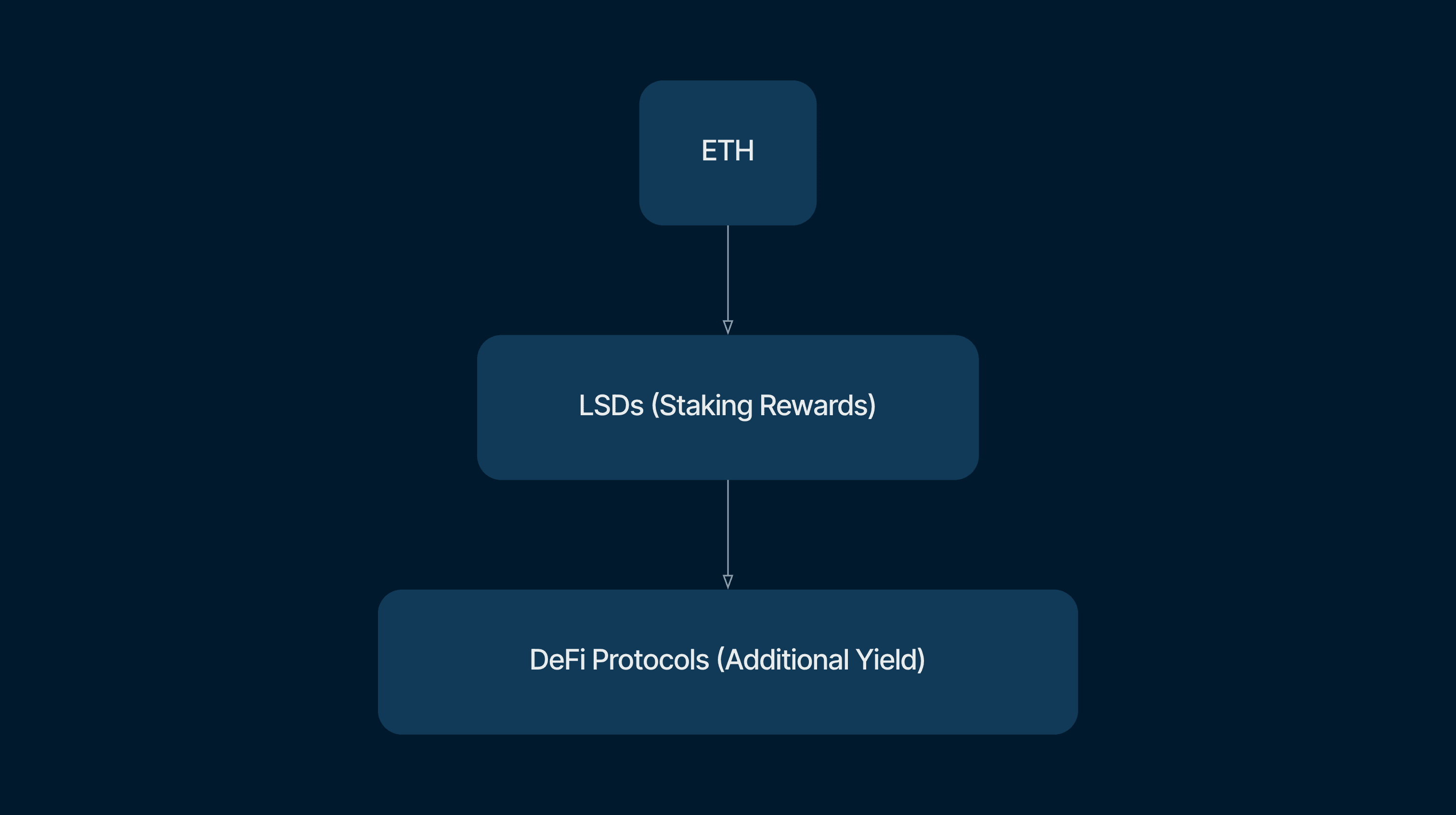

The value proposition of holding LSDs instead of native ETH is strong. LSDs are yield-bearing and can be used in the DeFi ecosystem to earn additional yield e.g. in a lending protocol, or LPing.

unshETH is targeting the omnichain opportunity and is focusing on enabling full functionality on multiple chains, bringing LSDs to a much wider audience. By enabling more people to participate in LSDs (as ETH mainnet fees remain very expensive), unshETH may be able to gain a strong and vocal following that can drive it toward success.

How it Stands

At present, Curve is the primary source of liquidity for LSDs. However, it is not fully optimized for multi-asset stable pools or an index product as there are no caps on the weight of assets in the pool. This limits the diversification benefit for LPs because if an asset in the pool becomes distressed, it will be swapped for the others, which can result in large losses for LPs. A prime example of this was the UST collapse, whereby UST was frantically swapped for USDC/USDT in the 3Pool, resulting in large losses to LPs. This shows how pools without weight caps have limited diversification benefits as the defaulting asset can drain the pool.

- The counterpoint is that the simplicity of a two asset pool is desirable in other ways. For traders, they can efficiently trade or take on risk by LPing. Multi-asset pools have failed to gain significant traction in crypto thus far. That said, the unique offering of unshETH and its focus on LSDs could buck this trend.

Revenue

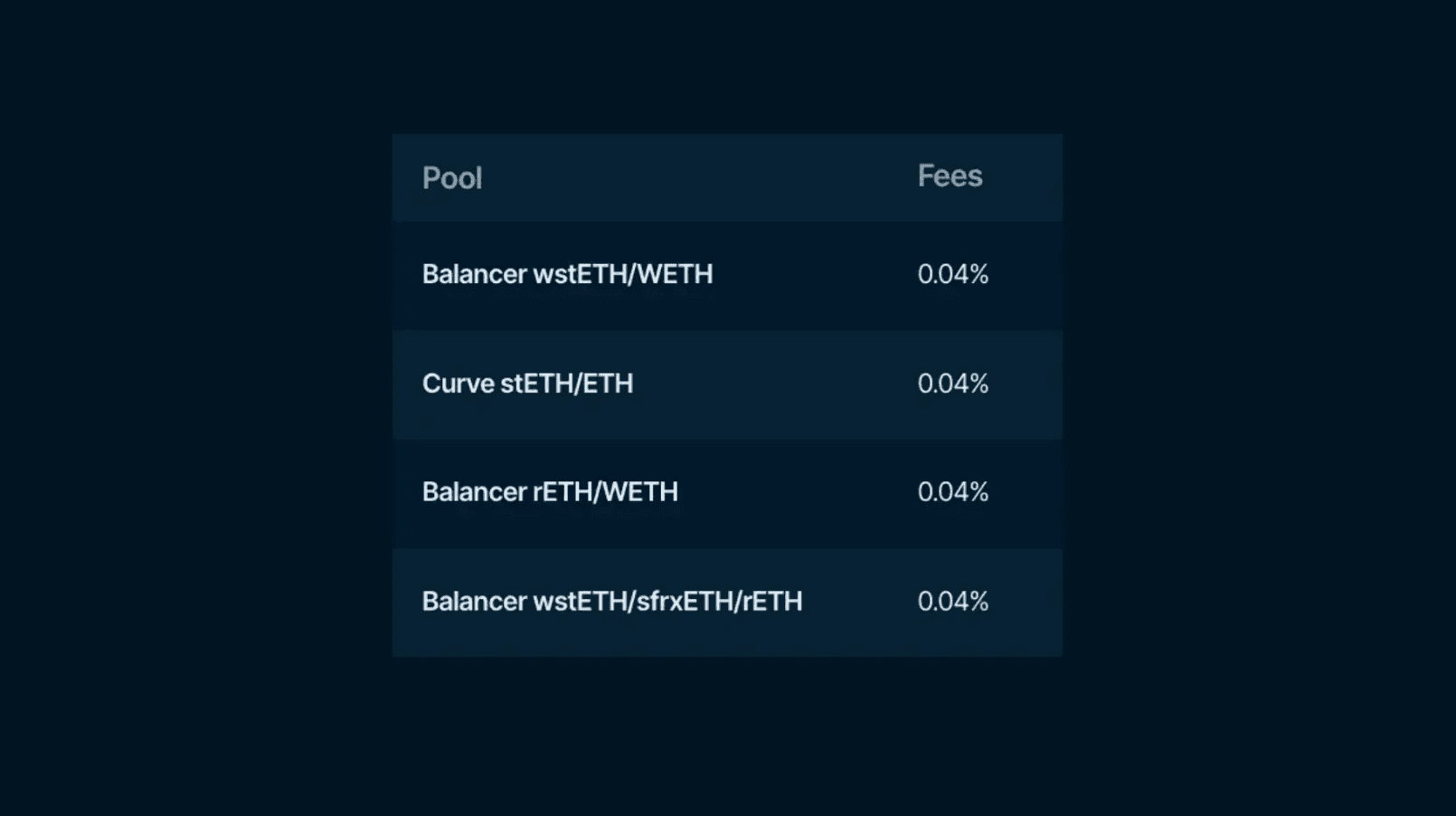

The vdAMM charges fees between 0-2%, depending on the target weights of each asset. Today, the typical swap fee for LSD to ETH among the largest pools is 0.04%.

Taking this into account, and the assumption that low fees will win out (and will decrease over time), the weekly initial revenue that can be generated by vdAMM is:

Redemptions

unshETH now charges a 0.25% redemption fee. The purpose of this is to protect unshETH holders against mint/redeem arbitrage. Redemption fees go back to unshETH holders to boost their yields. This fee is expected to go lower over time and will be dynamically adjusted depending on the weight of the asset in the pool. unshETH is redeemed for the underlying LSDs which may be bad UX for some users, especially if on Ethereum as the user will need to incur numerous transaction fees if they want to exit the underlying LSDs.

Token

USH & vdUSH

USH is the incentive token of the system. This can be staked for vdUSH (“validator decentralization USH”) to participate in governance. The minimum lock time for vdUSH is 1 month, and the maximum is 1 year.

Governance includes:

- Which LSDs are included

- The target weight and maximum weight of each LSD

- USH and partner protocol incentives

- Fee settings: vdUSH is expected to receive a portion of the protocol’s revenues in the future. This will be governance determined.

- General protocol governance matters

It is non-transferable and can be obtained by locking:

- USH

- USH/ETH Sushi LP (2.5x boost on USH amount)

- USH/unshETH 80/20 BPT (3.5x boost on USH amount). Check out this thread describing the benefits of 80/20 BPT tokenomics. Boost is ased on USH amount e.g. in a 50 ETH / 50 USH pool, the USH receives the 2.5x boost, not the entire pool.

The reward formula can be calculated as:

vdUSH = Locked USH Lock Duration Multiplier Boost Multiplier.

Voting power decays linearly from the time the lock is created. This is to incentivize users to (a) increase their lock time and/or (b) lock more assets to increase voting power. This encourages long-term commitment to the protocol for both retail and protocols.

Boosted Rewards

vdUSH holders will receive boosted USH rewards for farms such as unshETH, LP and USH depending on how much vdUSH they have. The more vdUSH, the greater the boost. This feature may need to be reassessed in the future given its potential to create whales and make it more difficult for new entrants.

Bribes

vdUSH holders will receive rewards tokens from partner protocols. This could drive demand for the USH token, resulting in ‘USH wars’ should the protocol gain critical mass. An “USH wars” narrative that gains traction could have very positive implications for the protocol and the price of USH.

unshETH

unshETH is an LSD of a basket of LSDs. More specifically, 95% is yield-bearing LSD collateral, and 5% is WETH for LSD-ETH swaps.

Tokenomics

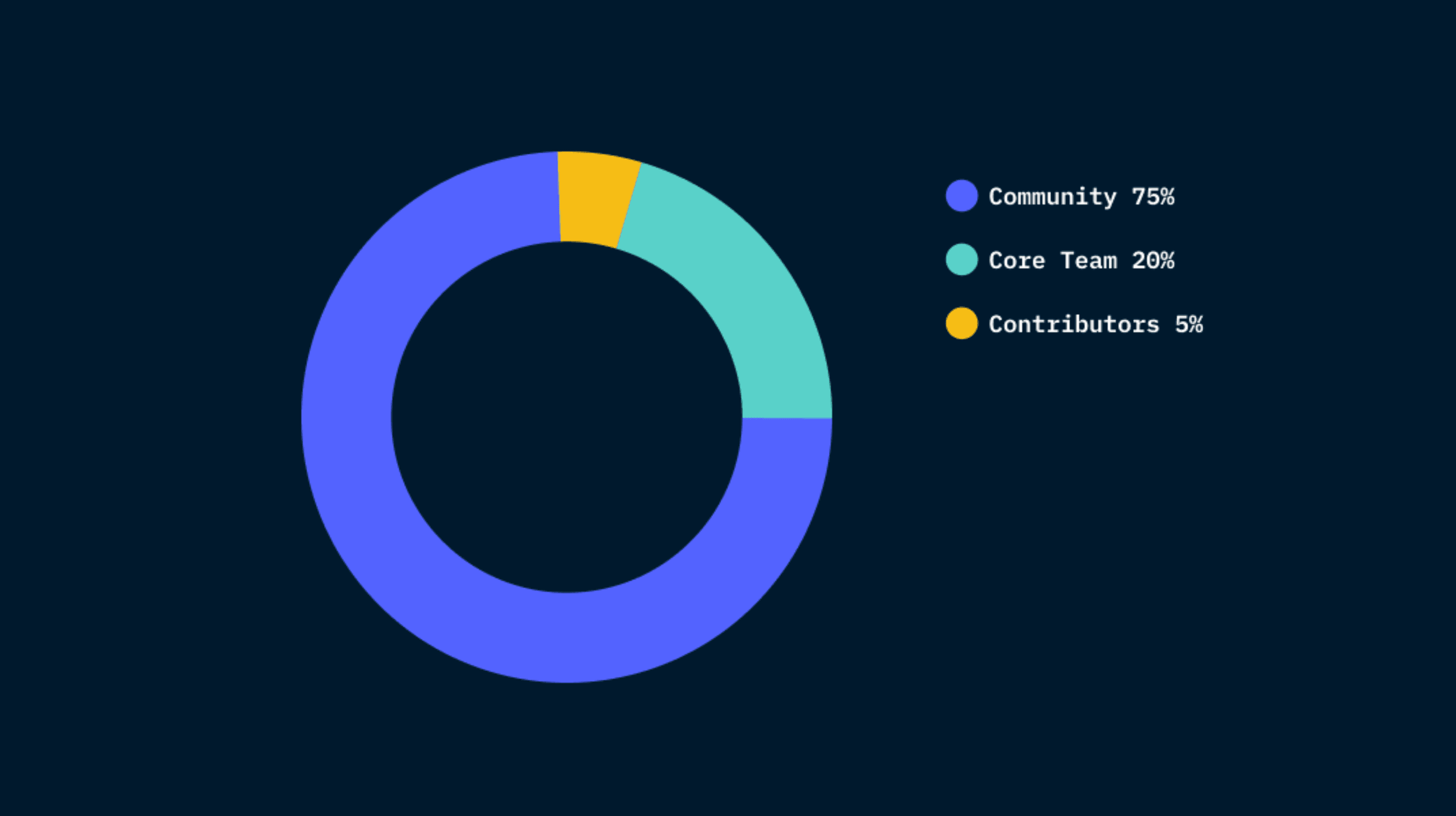

The token was airdropped to users most likely to use and contribute to the unshETH ecosystem. This aimed to reward early adopters of LSDfi projects. It is allocated as follows:

Vesting schedule:

- ~30% of tokens were given as unlocked pre-Shanghai incentives for the community.

- 56% of tokens will unlock linearly over 12 months.

- ~14% of tokens will have a 12-month lockup followed by a 12-month linear unlock.

Note that the tokenomics information has still not been incorporated into the docs, and is in an article from February. The team’s reasoning behind this is that they are currently in the process of updating tokenomics to make them more sustainable in the long-term. This is tentatively bullish, depending on how the tokenomics revamp goes.

Further, the vesting schedule is arguably too short for the team. Fully liquid tokens after two years is not unusual, however, a longer lock up and incentivization would be more ideal. Having said that, the team has communicated its intention to participate in governance by 1y max locking USH as it vests (and have done so thus far).

It will be worth paying attention to the protocol’s tokenomics revamp and if interested engaging on the governance forum.

LSD-ETH Pools Today

An LSD-ETH pool is expensive to maintain, and the majority of the pool does not earn ETH staking yield. This is because

- 50% of the pool is in unstaked and non-yield bearing ETH.

- 50% is in yield-bearing staked ETH but liquidity incentives need to be paid out. For example, on Balancer 50% of the staking yield is taken as protocol fees.

These pools are generally highly inefficient. The Curve stETH/ETH pool on Ethereum has a utilization rate of 1-2% of ~$1.25b+ liquidity. This results in less fundamental revenue from swap fees for LPs, which is subsidized with token emissions. This is expensive, with Lido paying out more in incentives than it generates in revenue.

- Even post-Shapella, liquidity is important for LSDs to prevent market manipulation by whales. The liquidity required for LSDs is arguably one of the main barriers to entry.

Therefore, LSD protocols often need to subsidize their ETH liquidity pool, resulting in fragmented liquidity and an expense for the entire ecosystem. unshETH seeks to address this by providing unified liquidity for the LSDs. This will lower the cost of liquidity and thus barriers to entry for smaller LSD protocols.

vdAMM

Due to fragmented liquidity, LSD - LSD token swaps are generally expensive. This is because multiple swaps need to happen:

- LSDa - ETH,

- ETH - LSDb.

Note that the Balancer wstETH/sfrxETH/rETH pool enables lower fee swaps between these assets.

This holds if there are no LSDa - LSDb pools. Even if there was such a pool, it does not fix the issue and is a prime example of the liquidity fragmentation of the current system. Fragmented liquidity results in higher slippage and a worse user experience. The rationale for unifying liquidity in unshETH is to make swaps cheaper between LSDs as it removes the need for multiple swaps for pairs.

As discussed above, each LSD has a weighting. Swaps in the vdAMM cannot breach the specified weightings in order to ensure risk from any particular LSD is isolated. This will mean that it will not be an appropriate trading venue for those assets.

Dynamic Fees

unshETH implements a dynamic fee system to push assets toward their target weights. Trades that help rebalance the basket are cheaper, and trades that push the basket away from its target weight have higher fees. Similarly, dynamic fees apply to minting and redeeming.

LSDs Treated as Perfectly Equivalent

In the vdAMM, 1 staked ETH = 1 staked ETH. unshETH has opted for this based on the fundamental assumption that each LSD is equivalent, despite potential near-term liquidity premiums on each. While this leaves users open to depeg should one of the assets fail, the risk is mitigated due to the maximum weight caps on each LSD. The purpose of the vdAMM is to enable users to exit an LSD faster than a withdrawal and with better rates than other sources.

If/when an LSD depegs in unshETH, the protocol should offer better rates to exit the LSD (arbitrage). As long as the depegging only reflects a short-term liquidity need unshETH will be better off given the token is 1:1 backed with ETH. A loss would be realized if the depegging that occurs is due to ETH backing being incorrectly reported or meaningfully slashed.

One way to think of it is that unshETH buys all depegged LSDs for a small fee up to a maximum risk budget (capped weight) per LSD.

Can it generate a competitive yield?

The unshETH protocol can generate revenue from the following sources:

- Swap fees

- Minting/redemption fees

- Bribes (from LSD protocols incentivizing deposits)

- ETH staking yield

- Potential future products

Nansen Pro

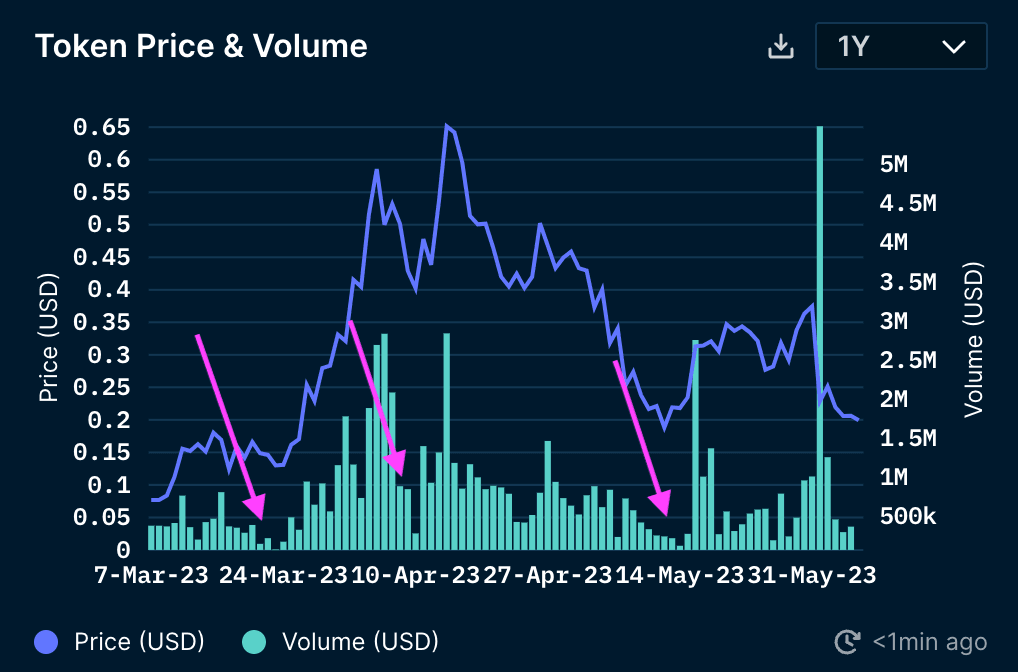

Lower Volume Coinciding with Price Rises?

The data shows that periods of lower volume often precede pumps in price. This may be worth keeping track of if observing the token. Note that low volumes for coins may often signal a lack of interest and correlate with poor price performance, so following an indicator like this depends on the market outlook, and more importantly the fundamentals of the protocol. Smart Money labels have not taken notable positions in the project.

Competitors

Yearn

Yearn is expected to launch yETH, which will be backed by a basket of LSDs. The concept is very similar to unshETH, and drew some criticism in the community for essentially ‘forking’ their idea. It will be interesting if this manages to gain significant traction. Yearn has a powerful brand but is limited in what it can do in terms of token incentives. It will be immutable and self-governing. Check out the proposal here.

Curve

Curve is the de facto protocol for stable pools and has unsurprisingly amassed the largest share of the LSD market, with its stETH/ETH pool alone at over $1.3b TVL at the time of writing. However, the key issue with Curve pools is that there is no max weighting on the assets within the pool. As described above, this can result in large losses to LPs when an asset in the pair depegs.

EigenLayer

EigenLayer is arguably complementary to unshETH and other LSD protocols as it has stated its intent to enable LSDs to be used for restaking. If it goes back on this and focuses exclusively on ETH staked (and not with LSDs) then it could become a significant competitor to LSDs. However, this is likely a growing market.

Other LSDfi

Pendle

Pendle is offering yield trading of the interest on staked ETH. While it is not a direct competitor of unshETH, it is another attractive and alternative venue for people to stake their ETH depending on their preference. However, Pendle is arguably more suited to a more sophisticated user base. That said, this user base may deposit with a larger size.

unshETH offers an interesting value proposition, and the tokenomics can have clear value accrual if it gains some traction and USH wars kick-off. The goal of decentralizing LSDs by creating shared liquidity is compelling. However, notwithstanding the durability of the protocol code itself, the quality of their BD and execution will determine their success.

To succeed, unshETH will need to offer an objectively better product than other solutions. To achieve this, it needs to offer the best swap rates for LSDs. Competition from incumbents like Curve and Balancer, as well as LSDfi protocols will need to be surmounted. In addition, the protocol will need to make progress on decentralization and clarity on their tokenomics should be granted. A movement towards governance minimization and ultimately immutability is most desirable. Overall, at present, it is a risky play but an interesting concept and approach to addressing the monopolistic tendencies of the LSD market. If it succeeds, it can add great value to the space.