Yield-Driven Adoption in a Bullish Market

Ethena has rapidly scaled over the past three months as its USDe supplies increased to over $8.5B market cap across 753K+ users. Ethena has a lot of reflexivity with funding rates and is now generating over $439M in annualized fees as of the July 31st. As BTC and the broader crypto market rally, perpetual funding turns increasingly positive, and Ethena captures that yield via delta-neutral hedges, which creates a flywheel:

- Positive price action → higher funding → higher sUSDe yields

- Higher yield → more minting of USDe and sUSDe

- More supply → more delta-hedges → more revenues for ENA holders

This structure is inherently reflexive: as prices rise, long traders pay more funding, yields rise, and Ethena attracts more capital. This loop has led to sustained user and TVL growth. Given the recent turn in markets, Ethena’s growth has been quite significant and has led to very positive price action as well.

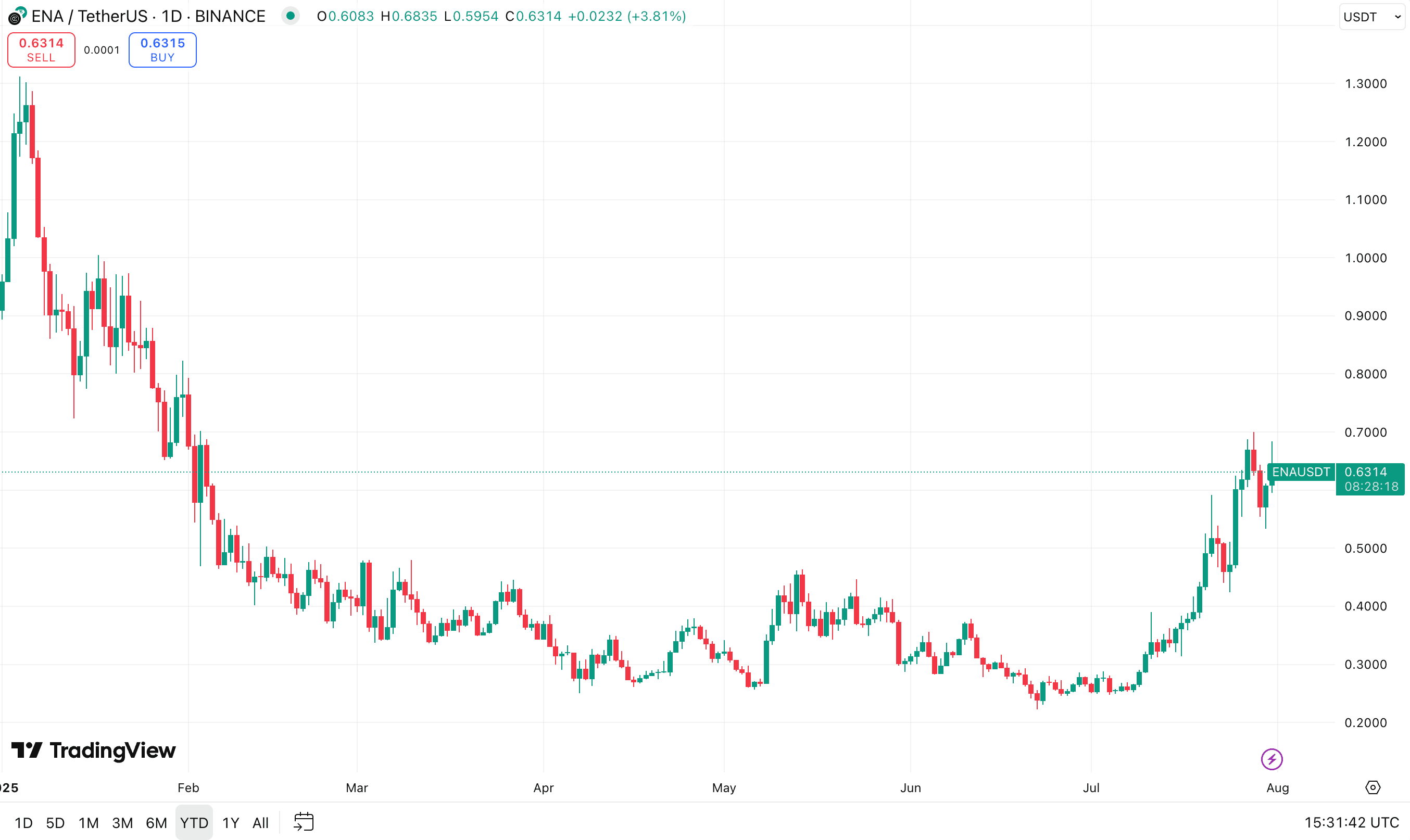

Despite the sudden 2x rise in price off the local lows, ENA is still down nearly ~35% YTD and down 59% from its previous ATHs.

What Ethena Offers

Ethena’s core mechanism issues USDe by accepting crypto collateral (mainly ETH, BTC), which is delta-hedged via perpetual shorts. This neutralizes volatility while allowing the protocol to capture funding rewards. Users can convert USDe to sUSDe to earn the real-time yield generated by this system.

sUSDe holders saw consistently high yields, especially during market spikes where funding has historically reached 30–40% annualized. These yields are not driven by token emissions but by market structure.

As of now:

- sUSDe yield hovers around 11% APY

- USDe has become the 3rd largest stablecoin by market cap

Multi-Chain and Ecosystem Expansion

Ethena’s recent deployments show intent to become more than a yield primitive and it is evolving into a broader stablecoin settlement layer.

Key deployments:

- TON Integration: USDe and tsUSDe are now natively supported in Telegram via Wallet integration, tapping into a billion-user network.

- BNB Chain support: USDe and sUSDe deployed across Venus, PancakeSwap, Pendle and more.

- Appchain ecosystem: Ethereal (perp DEX) and Derive (options) launched using sUSDe as the native unit of account and incentive base. A portion of future emissions from these platforms is routed to sENA stakers.

- CeFi penetration: Coinbase International and Copper integration supports hedging flow. Deribit added USDe margin support.

- Liquid Leverage (Aave): The sUSDe/USDe Aave integration allows looped exposure and unlocks instant liquidity for sUSDe, solving the 7-day unbonding delay.

- Converge: A dedicated appchain in partnership with Securitize, it aims to appeal to both permissionless and permissioned apps to co-exist on the same chain.

Reflexivity in Practice

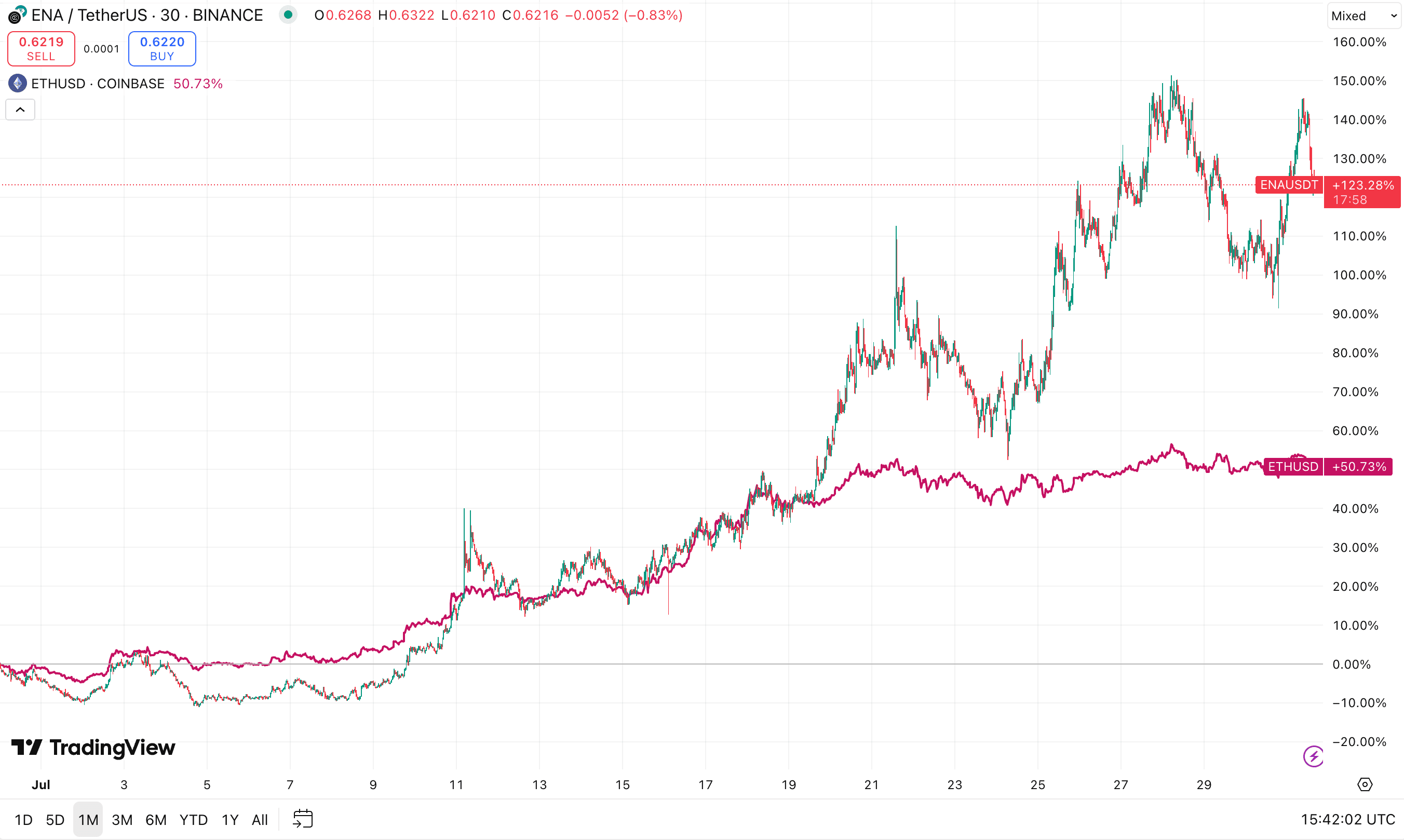

Ethena is structured to scale with market demand for leverage and ENA also participates in this reflexivity. As TVL expands and fees accrue, staked ENA (sENA) benefits from fee switches, recent buybacks and ecosystem incentives, further increasing demand. Over the last month, ENA price action has shown its recent increase in demand, outpacing ETH and up over 120%.

Institutional Bridges

Ethena’s ambitions reach beyond crypto-native users. The newly announced USDtb, a T-bill-backed stablecoin compliant with U.S. frameworks, shows the intent to serve institutional treasuries. USDtb is backed by tokenized treasuries and managed in partnership with Anchorage Digital. Its supply now exceeds $1.44B.

Ethena also has a proposed SPAC transaction on deck under “StablecoinX,” which would create a publicly traded stablecoin entity under the ticker “USDE.” This is designed to give institutions regulated exposure to yield-bearing stablecoins. With $360M in investment from the likes of Pantera Capital, Dragonfly, Galaxy, Polychain and others, this can be seen as new potential buy pressure for ENA. The main question is whether or not this will offset the potential unlocks and sell pressure from investors in the meantime.

Key Risks and Considerations

ENA Unlocks and Concentration

ENA supply is concentrated among early backers with well known unlocks into the future which could drive sell pressure and increase volatility. The new SPAC potentially provides a way of “offsetting” this potential supply unlock and may provide additional demand for ENA. However, many investors are up multiples at today's prices and have large holdings.

Dilution

While sENA offers rewards, unstaked holders remain exposed to dilution.

Yield Compression in Bear Markets

Ethena's APY is variable and depends on market structure. If funding rates reverse (as shorts pay longs), yields may drop or even go negative. Outflows from sUSDe could follow, potentially pressuring the peg or just making it less competitive from a yield perspective. Current design includes a reserve fund and liquidity backstops, but prolonged downturns remain a risk into the future.

Final Take

Over the past quarter, Ethena has executed consistently. With rates nowhere near historically frothy levels and USDe supply up over $3B in just the last 20 days alone, Ethena is positioned strongly for a continued bull market. So long as leverage demand persists and the funding environment remains healthy, sUSDe yields and ENA’s narrative remain strong. But market participants should remain mindful of the risks from token unlocks and potential market reversals.