Fluid is a unified liquidity layer for lending and DEX trading built by the Instadapp team and has seen significant traction over the past three months. The protocol’s holistic DeFi approach, combining lending markets, high-LTV vaults, and a capital-efficient DEX, is translating into accelerated market adoption, multi-chain deployments, and surging usage metrics. Below we recap Fluid’s recent progress and key metrics, focusing on recent developments and what lies ahead for the protocol.

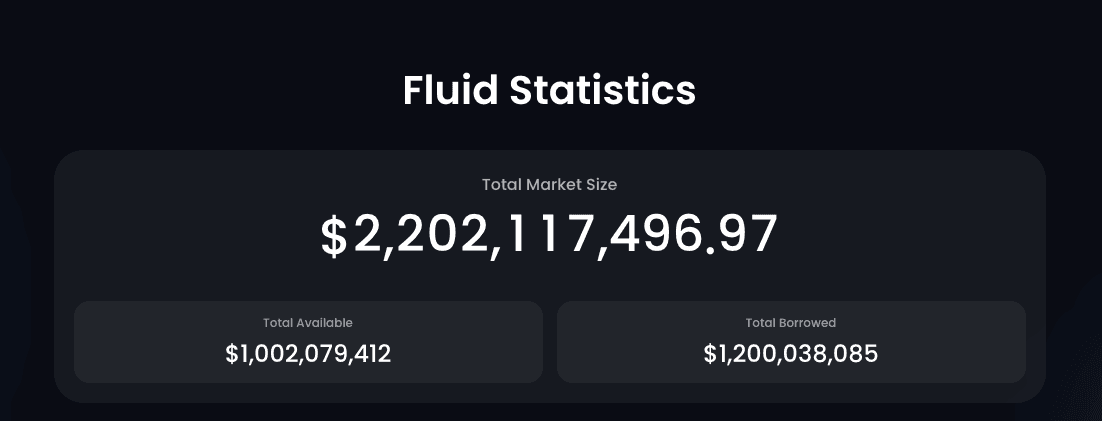

As of August 4th, where is Fluid at now in terms of adoption?

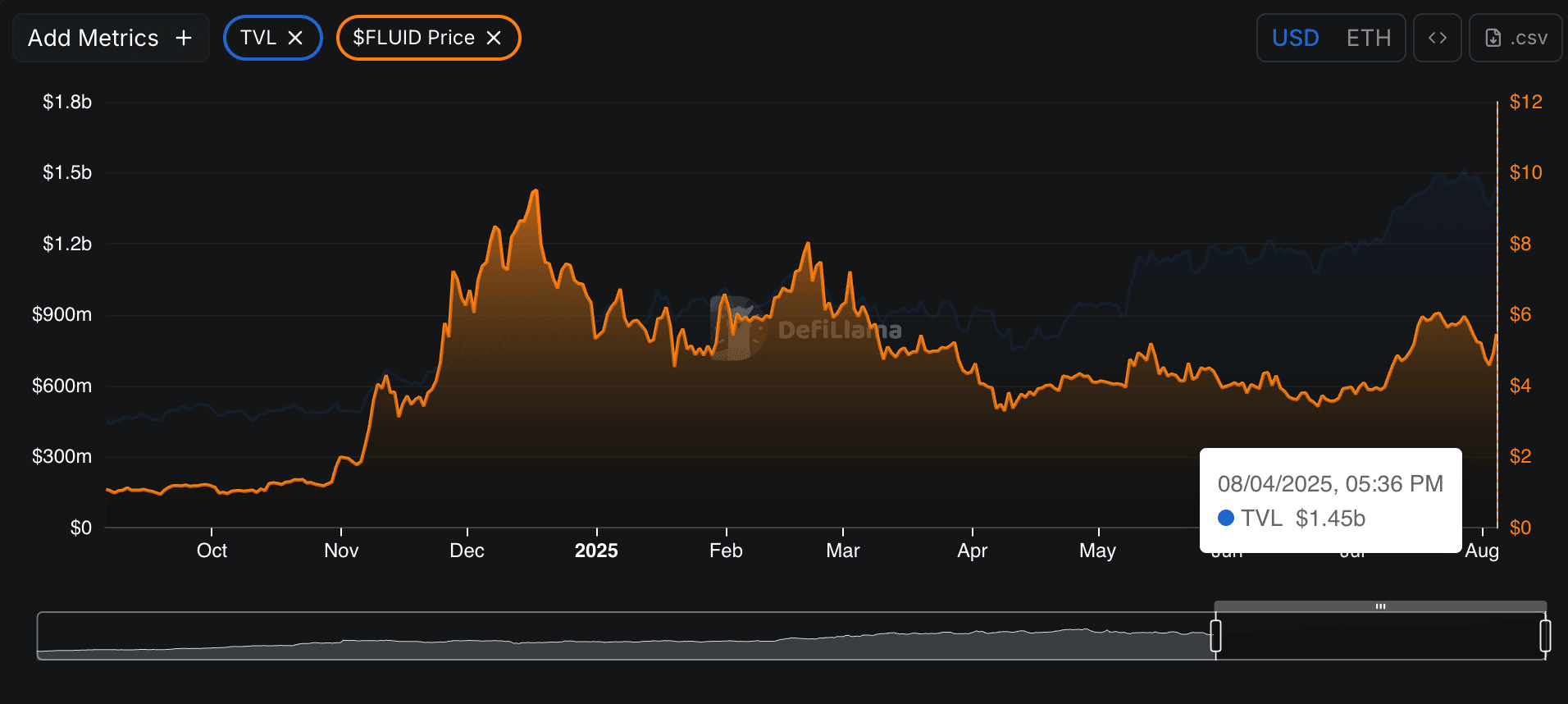

TVL vs FLUID Price

TVL continues to climb higher while the token remains down year to date.

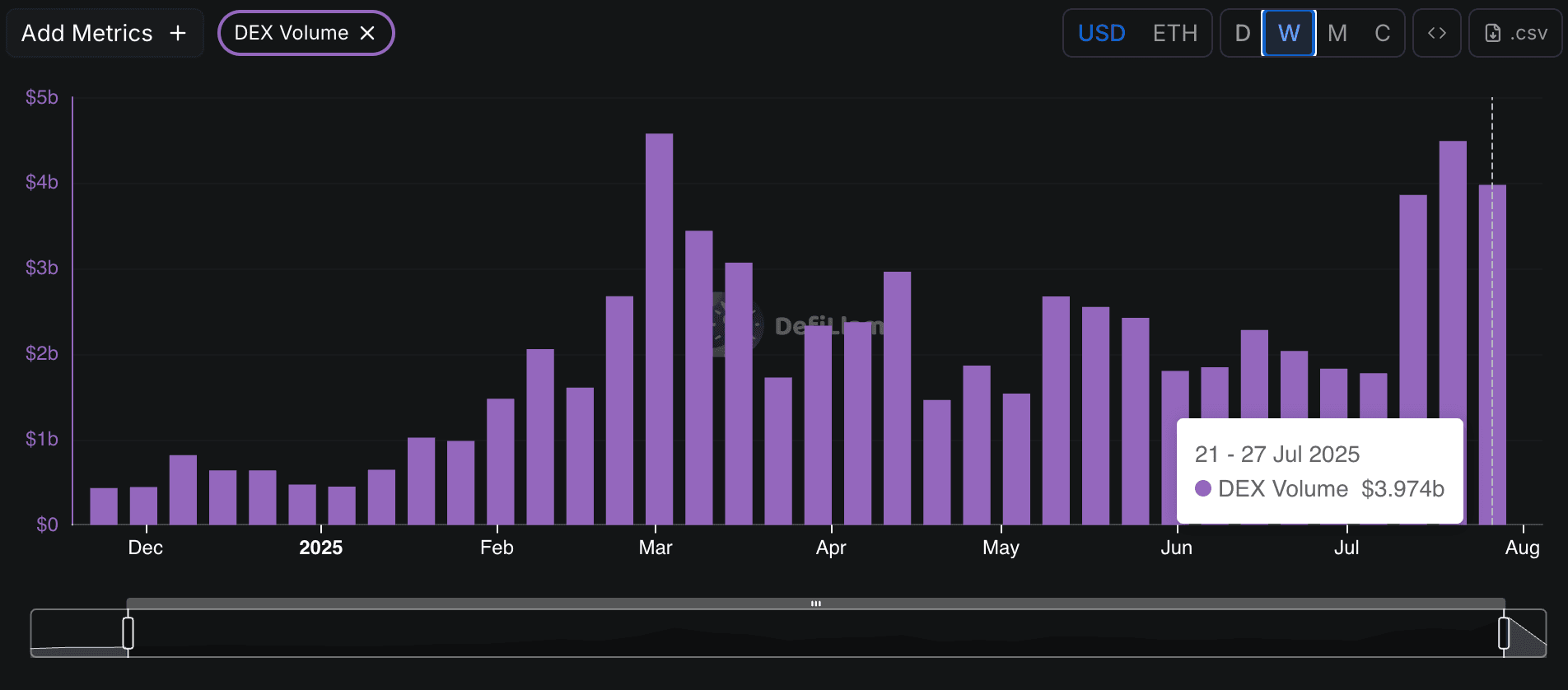

DEX Volumes and Market Share

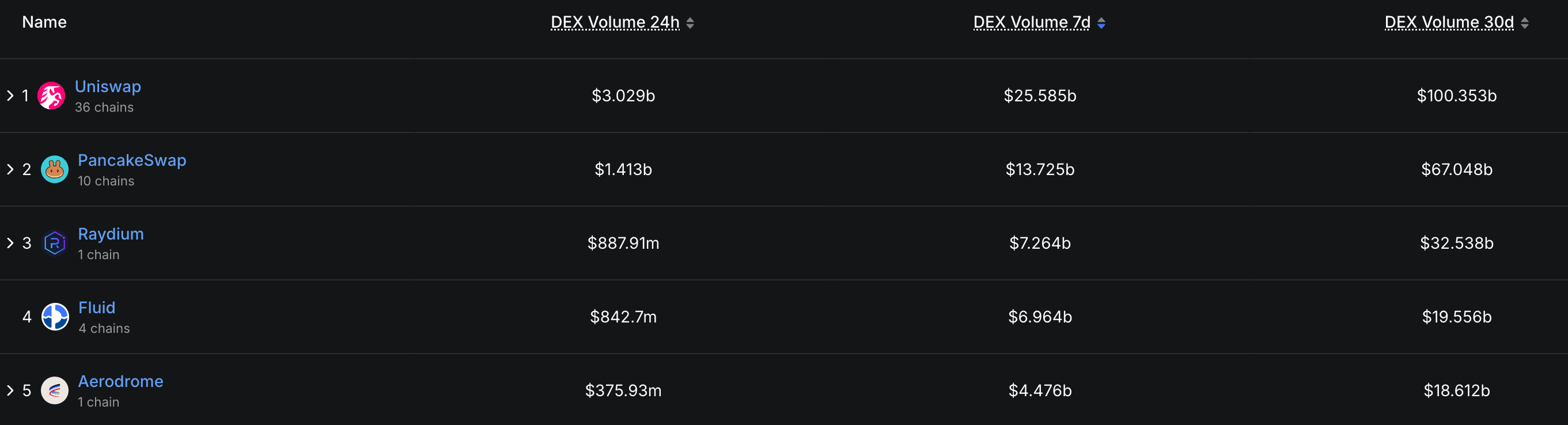

2025 continues to show strong momentum for Fluid’s trading layer. Following the launch of DEX v2, Fluid has quickly become one of the fastest growing DEXs and now ranks as the second largest on Ethereum.

Looking at the past week, Fluid also ranks fourth across all DEXs by global trading volume.

Architecture-Driven Growth: Fluid Lending System

While DEX volumes have drawn much of the spotlight, Fluid’s lending engine is also scaling quickly. Unlike most money markets, Fluid built its lending system from scratch to enable deeper capital efficiency and native integrations with its DEX.

Notable product features include:

- Smart Collateral, which lets users supply LP tokens and continue earning yield while using them as collateral

- Smart Debt, allowing borrowers to tailor how collateral is deployed and managed

- High LTVs, up to 95%, with liquidation penalties as low as 0.1%

- On-DEX liquidations, executed against Fluid’s internal liquidity to minimize slippage and boost fee capture

Product Expansion: DEX Lite and Onchain Credit

DEX Lite has officially launched. It is a gas-efficient swap router designed for small trades and long-tail tokens. It introduces Fluid’s first onchain credit primitive, allowing protocols to borrow directly from the shared liquidity layer. All swap fees and borrowing interest flow back to lenders and the protocol treasury.

It is expected to add over $200-400M in incremental daily volume according to Fluid, further increasing protocol velocity and fee generation. As of August 4th, cumulative volumes have already surpassed $79B and have collected nearly ~$19B in cumulative fees.

Multi-Chain Growth and Market Expansion

In the past quarter, Fluid launched across Arbitrum, Base, and Polygon. Liquidity on these chains is supported by reallocating 0.5% of total FLUID supply to jumpstart local DEX markets and token access. Cross-chain coordination is enabled by Chainlink’s CCIP infrastructure.

New collateral types have also been approved, including LST assets and stablecoins such as Aave’s GHO, and Resolv's wstUSR. These efforts are positioning Fluid as a core liquidity protocol across ecosystems, not just Ethereum.

Solana is next. Jupiter is currently building Jupiter Lend, a Fluid-powered lending platform that will bring Fluid’s architecture to non-EVM chains.

What’s Ahead

Several near-term launches could accelerate both usage and token performance:

- Full rollout and scaling of DEX Lite

- Launch of Jupiter Lend on Solana (private beta launched)

- Expanded deployment across non-EVM chains

- FLUID buybacks

- Continued onboarding of new collateral types across L2s

With increasing volumes, and clear product-market fit, Fluid is emerging as one of the fastest growing plays in DeFi this cycle.