What is Bittensor?

Bittensor aims to build a permissionless, decentralized and censorship-resistant infrastructure for all AI development. The network is tied together by the TAO token where numerous ‘decentralized commodity markets’ called subnets with different targeted purposes provide incentives for the production of machine intelligence. On Bittensor, complementary and shared computing infrastructure (of the multiple subnets) can enable the creation of extremely powerful systems.

Bittensor’s subnets are an incentive system for specific objective(s). Let’s use an example of a subnet focused on AI image generation:

- In this, participants called ‘miners’ carry out the work required to achieve these objectives (models for image generation), and

- ‘validators’ then determine the performance of each miner (e.g. the quality of their image generation),

- which determines the rewards the miners receive. The top-performing miners receive the largest amount of TAO (the incentive and coordination token of the network).

Miners essentially provide the digital commodity (e.g., models for image generation), and validators judge how they perform.

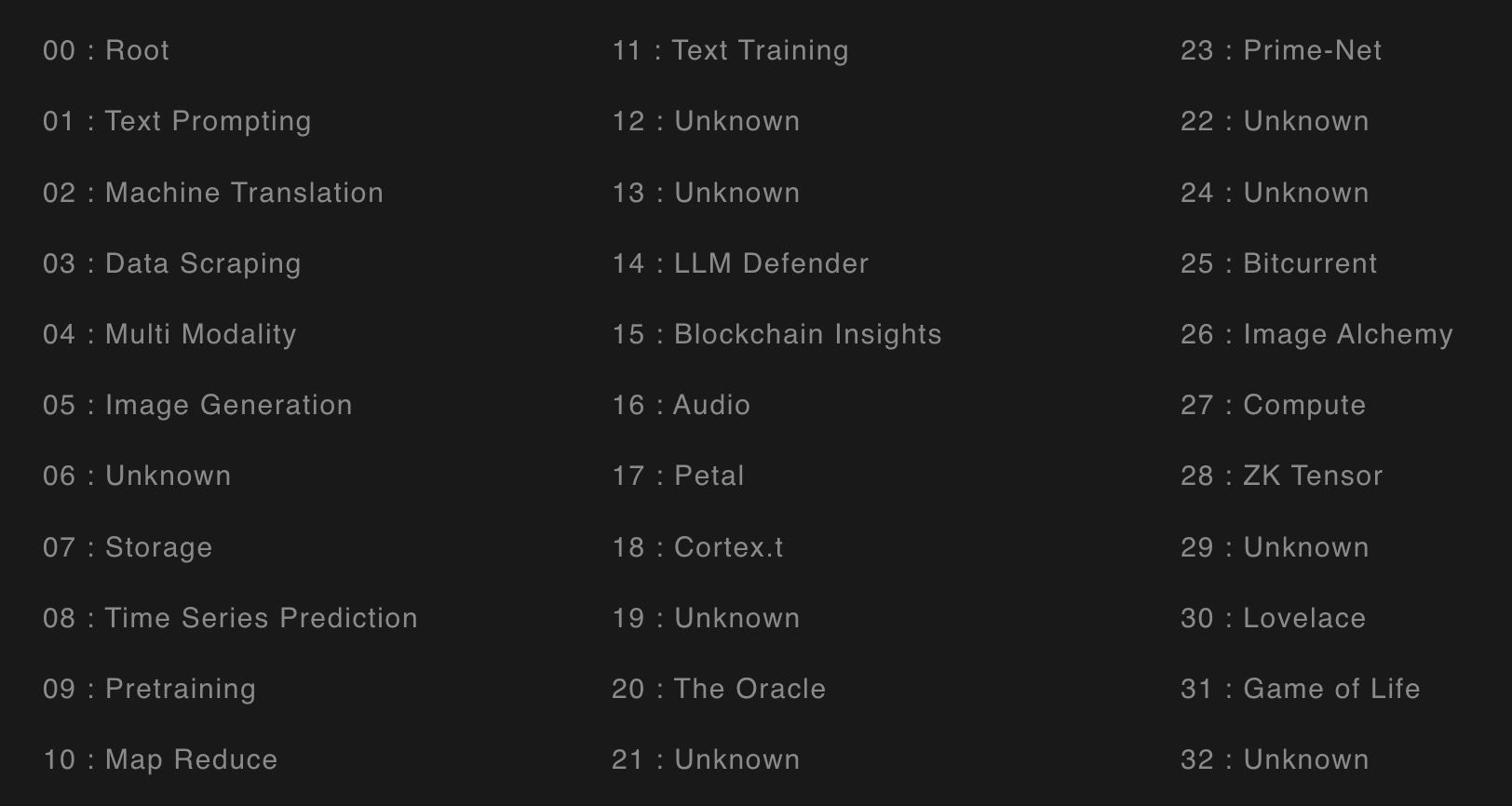

Here are the current subnets available on Bittensor today:

The system is intended so that only the miners with the best output will receive notable TAO rewards. This competitive environment can ensure the highest standards are met and, therefore, boost the quality of the overall Bittensor network. Importantly, subnets can interact with each other and many are complementary. For example, infrastructure subnets provide services to other subnets such as storage (with subnet 7 above an example). This collaboration and modularity is what gives Bittensor high potential.

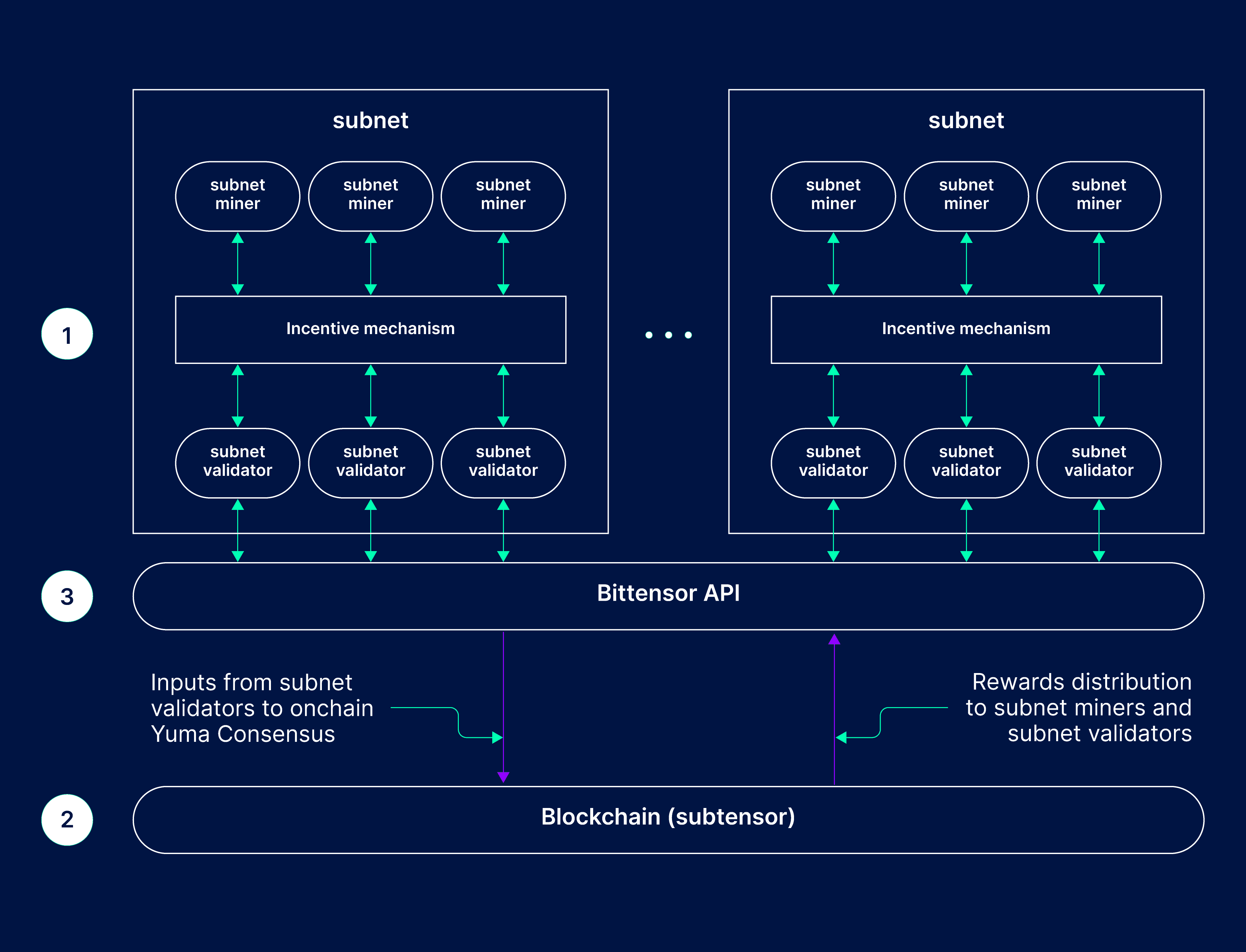

Below is a high-level overview of how the system works. Observe the interactions betweenwith the subnet, miners, and validators.

Mission

The concentration of AI among a small number of entities inevitably results in potentially dangerous biases and abuse. Bittensor aims to avoid this by providing computing markets (many of which are complementary) that makes access easier to top-class resources (that only a limited number of entities can access now) for more accessible participation and ultimately better products. It is a bet that a permissionless and incentivized platform will create better outcomes than siloed corporations.

The aim of the Bittensor network as a whole is described as:

“to create Machine Intelligence, in an open and equitable manner on top of ordered and dependent sub-markets.”

Bitcoin and Bittensor

Bittensor takes inspiration from the philosophy of Bitcoin.

It aims to take Bitcoin’s key properties:

- Decentralized and censorship-resistant

- Permissionless digital commodity market

The second point refers to the computational power required to mine BTC. Bittensor defines how the computing power is validated (subnets) - meaning the validators come to a consensus on who has the best output and, by extension, the highest rewards.

This is similar to Bitcoin in that miners compete globally for the resources to mine Bitcoin. On Bittensor, miners will compete to find the most efficient way to mine TAO (by creating the best output for their subnet).

So what is TAO?

TAO

TAO is the incentive mechanism that coordinates the network. TAO tokens are earned through mining and validating. Miners provide the intelligence / hardware / technology, and validators ensure that the network rules are being followed.

Similar to Bitcoin, there are 21m TAO tokens and a halving event will occur every ~four years. However, this halving event will likely be delayed each time. This is because tokens are recycled, as explained here.

TAO is distributed as follows:

- Subnet Owners - 18%

- Miners - 41%

- Validators - 41%

The top 64 validators determine what proportion of the emissions each subnet receives.

Cortex.t (18) is currently the subnet receiving the most emissions.Read more about it here.

Quick Tech Overview

Bittensor separates the chain’s functionality (transferring funds etc) from the validation systems (subnets) that define the markets for its digital commodity (TAO mining). Bittensor doesn’t have rules for how computers interact with the network. Instead, they leave it up to market forces and innovation to find the most efficient and productive way. Again, this is essential for competitiveness. This means validation systems can be written in any arbitrary coding language e.g. C++, Rust - rather than being confined to one e.g., Solidity.

Validation remains off-chain, meaning that it can be extremely data-heavy (no state bloat) and computationally intensive. The blockchain simply enables all the subnets to operate as a singular computing infrastructure.

Example

- Bittensor’s Subnet 1 - intelligence providers (miners) get validated (receive TAO) when they answer queries (using machine learning models).

- The outputs are validated with machine learning models which can learn without any information being passed from the validator set to the chain.

But what about Bittensor’s consensus mechanism?

Yuma Consensus

Bittensor operates using the Yuma Consensus. This can be described as Bittensor's CPU and is designed to enforce agreements between the validators on the performance of the miners. Validators submit to the consensus mechanism the results of the miner’s performance.

Yuma is agnostic to what is being measured and does not have strict criteria on how validators should determine performance. This makes it suitable for probabilistic truths e.g. intelligence. It enables multiple incentive systems that can run in tandem with each other. This is a minimum requirement for it to be competitive with centralized giants. It gives it flexibility to adapt to the best and most efficient technology.

Commercial Potential

There is huge commercial potential should Bittensor fulfil its potential. It should make it far easier for more entities to bring their ideas to production and leverage Bittensor’s platform and resources. Validators have exclusive access to querying the miners and, therefore, the network’s intelligence. This means it can be lucrative for them to sell access externally. Further down the chain, users/developers can leverage the APIs provided by subnet validators.

Some Challenges

TAO Distribution

The compensation model does not take into account significant surges in popularity/activity, which increases costs for miners. They are providing additional value, but their potential income is capped. This could make mining unprofitable and push miners to discontinue their services. Changing the distribution of rewards among the subnet owners, validators, and miners to a fairer weighting is the current most obvious solution. However, a more dynamic solution in the future would be more desirable.

Currently, the system is capped at 32 subnets but in the future, the vision is to attract many thousands (this will require the system itself to scale properly - another challenge that needs to be overcome). This incorporates inefficiencies and human error for the 64 deciding validators. More automated solutions will be required if Bittensor reaches a higher scale.

Regulatory

One risk potentially facing Bittensor is regulatory action around AI. Regulators around the world are scrambling to gain some control over the industry, given its enormous potential. A permissionless platform for AI development could be seen as a significant threat to this control. This brings us to decentralization.

Decentralization

Bittensor aims to be decentralized and censorship-resistant. However, it is at its early stages on this journey and 5 validators hold 60% of TAO tokens. This is not optimal yet and further decentralization of validators would benefit the network. This remains a challenge that should be carefully monitored.

Ecosystem Tokens

Decentramind Bot - DMIND is the first AI bot built using Bittensor's BitAPAI Integration. Check out their website here.

TaoPad - TPAD is a leveraged TAO play as it offers TAO rewards for TPAD holders. They are building out a launchpad for more projects to be built on Bittensor's technology, expanding its ecosystem. Check out their website here.