Introduction

Grass is a DePIN protocol that lets everyday users earn rewards by sharing their unused internet bandwidth with companies that need it. It turns the idle capacity of home and office internet connections into a global, user-owned bandwidth network. Companies can route data requests through this network for tasks like web scraping, content retrieval, or distributed computing. In return, users supplying bandwidth receive tokens, giving them a stake in the network’s growth. This model promises a win-win: businesses get access to reliable endpoints, and users get compensated for a resource that normally goes unused. By aligning incentives, Grass aims to redefine infrastructure ownership, putting individuals at the center of the “internet economy”. With 2025 bringing about new highs in network performance, averaging 1.1m GB scraped daily for the month of March, Grass is seeing the fruits of its labor pay off, but is it enough to break into mainstream adoption?

We aim to cover GRASS because it is the market leader in its category, continues to post promising numbers in its metrics, has key catalysts lined up for 2025 and it stands at the intersection of arguably two of the most exciting narratives: AI and a user-owned economy powering it. Given the continued exponential rise in AI improvements and the ever increasing demand for compute and data, we feel traders will like to take exposure to something like Grass vs a trillion dollar company (i.e Nvidia, Microsoft, Facebook, etc.), especially with GRASS now trading ~60% off its ATH.

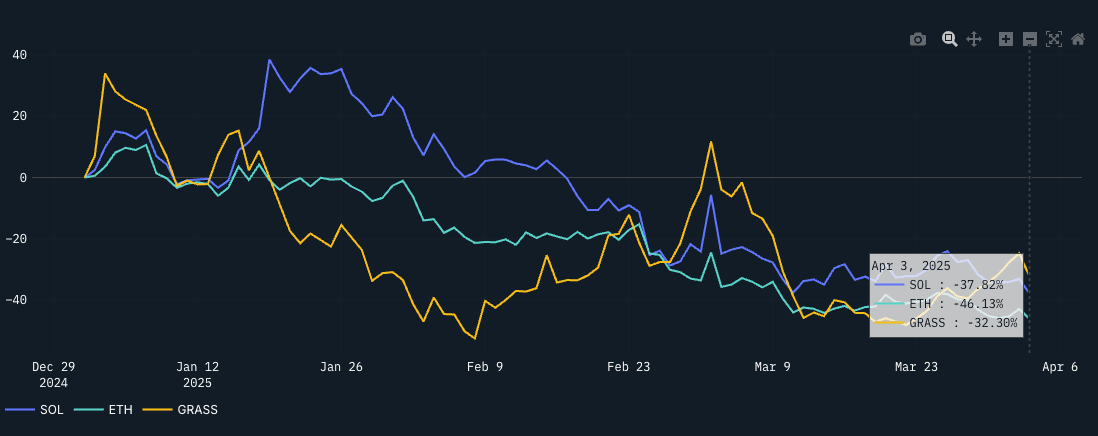

YTD, GRASS has performed well given the broader risk off environment and large drawdowns in the altcoin sector, with the likes of ETH and SOL underperforming vs GRASS.

At the time of writing, GRASS is trading around a ~$422m market cap and ~1.5b FDV. With a 1 year cliff, we are not worried about unlocks from investors until Q3 2025. With that being said, being valued at an implied ~$1.5b valuation post TGE, where does GRASS go from here?

Setting the Scene

What makes Grass and broader DePiN so attractive is that this user-owned bandwidth network is arriving just as AI’s appetite for data is surging - the narrative is very compelling, “get upside exposure to AI”. By plugging into Grass, an AI model can fetch the latest information from the web on demand. This capability is increasingly vital as AI assistants and services need current, globally sourced information. It also feeds into other decentralized trends: for example, decentralized compute networks (like Akash for GPU cloud) can pair with Grass’s data pipeline to enable fully community-powered AI services. In short, Grass sits at the intersection of two of the most exciting narratives today: DePiN and the AI boom. It addresses a key bottleneck of access to diverse, up-to-date data by leveraging underutilized resources (household bandwidth).

DePIN Meets AI and Compute

Grass’s emergence comes amid a broader trend of DePiN networks tackling real-world needs. Much like Helium created a people-powered wireless network for IoT and 5G, Grass is building a people-powered internet backbone for data access. Such DePIN projects use crypto incentives to bootstrap physical networks and have shown they can scale. Grass has seen significant growth: from a beta in 2022 to over 3m active nodes across 190 countries, arguably outpacing most DePIN projects in user adoption. This rapid expansion was fueled by Grass’s accessible approach. They had a simple app/extension and a gamified points system, along with the allure of earning crypto for “doing nothing” just for leaving the app running. Grass quickly amassed a crowdsourced network capacity, enabling it to scrape on the order of 1.1m GB of public web data per day in March 2025. In fact, Grass data shows that about 57,000,000 GB of data has been collected in just Q1 alone via its users’ bandwidth.

What’s Next?

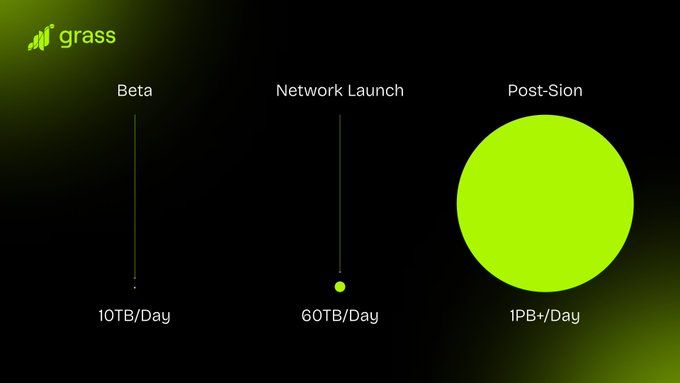

Grass is transitioning from its initial bootstrapping phase into a period of scaling, decentralization, and product maturation. As seen above, we have seen significant strides in key metrics after the Sion upgrade went live but what other new catalysts and milestones are on the horizon?

- Technological Upgrades: As shown above, the team is in the midst of the Sion upgrade, a multi-phase overhaul aimed at massively increasing network throughput. Phase 1 of Sion (completed in late 2024) made large headways for scraping efficiency and more efficient data retrieval. Now as Phase 2 rolls out, Grass expects to sustain a 10x improvement in data retrieval and to boost total bandwidth to 1+ petabyte a day capacity. This positions the network to handle multi-petabyte data workloads daily, including high-bandwidth content like video for AI training. Equally important, Grass is enhancing its node software – moving in favor of a desktop application and a strong push for mobile apps with the aim to grow its contributor base beyond the 3 million mark.

- AI and Product Focus: According to the recently unveiled 2025 roadmap, Grass will double down on AI-centric features. A headline initiative in the Sion upgrade is multimodal search, enabling AI models to semantically search across 4k video, audio, and text data in real time through the Grass network. This suggests Grass will not only pipe raw data, but also index and query it in AI-friendly ways, with the hopes of effectively becoming a live, decentralized search layer for AI insights.

- Ecosystem and Partnerships: As Grass’s network matures, we can expect deeper integration with both Web3 and Web2 partners. On the Web3 side, Grass is built on Solana (for its token and onchain proofs), and it has attracted a large crypto community. This community has participated in Grass’s token airdrops and staking – 100m tokens were distributed to early users in the first airdrop, and a second season 2 distribution is in progress to further decentralize and reward new users. On the enterprise side, Grass is already serving clients such as AI organizations like LAION research amongst others. A future partnership with a key AI labs or big ticket company would be a type of catalyst we’d like to see to validate Grass demand and give the network fundamentals compared to centralized alternatives.

- Team and Funding: The Grass project is led by Wynd Labs, and so far the team has shown strong execution. What started back in mid-2022 turned into a product with millions of users by late 2023 and accelerated even more into 2025. The team secured a $3.5M seed round and then led another round (amount undisclosed), led by top VCs like Polychain, Tribe Capital, Brevan Howard and others. While they aim to scale on the order of hundreds of millions contributing to the network, Grass’s early traction plus a sizable warchest and community support suggest the team might just have the toolset to get there.

Risks

There are important risks and competitors to weigh across execution, competition, and broader demand for such a product to consider:

- Competition Risk: Grass faces competition from projects like Masa, which offers decentralized data scraping for the Bittensor AI network. The case of Helium serves as a cautionary tale; rapid early node growth later encountered declining usage and community issues. Grass must ensure demand growth aligns closely with supply to maintain token incentives and user interest.

- Operational and Regulatory Risk: Security and privacy for node participants are critical. While Grass limits usage to vetted institutional clients and public web data, users still effectively serve as exit nodes. Misuse by clients (i.e, unauthorized scraping activities) could expose users to legal actions. Strong technical safeguards, user vetting, and clear legal frameworks will be necessary.

- Macro and Economic Risk: Grass’s success hinges on sustained enterprise and AI-industry demand for decentralized data services. Token emissions as a way to align incentives does raise potential dilution concerns for GRASS holders. Ultimately, Grass must transition toward a sustainable economic model driven by client fees to support long-term network health.

In short, while we are excited about the vision of what Grass can offer, it needs to continue to prove itself in terms of both user adoption and companies using it for real world use cases. This is not unique to Grass but most DePiN projects today. At this valuation and in the broader context of sideways markets and broader uncertainty, Grass is indeed another altcoin and should be treated as such. However, when forced to look ahead for new catalysts and strong tailwinds, Grass is certainly a project to keep on the radar as one of the market leaders today who have shown they can deliver.

Concluding Thoughts

Grass represents a compelling opportunity at the intersection of DePiN and the broader AI/data economy. By unlocking unused bandwidth as a resource, it taps into a form of infrastructure that is ubiquitous and constantly growing. More strategically, Grass is positioning itself as critical infrastructure for the backdrop of AI: a real-time data layer that no single corporation controls.

Overall, Grass Network has quickly become one of the standout projects in the DePIN sector. Its peer-to-peer bandwidth marketplace for AI-era data is both technically ambitious and narratively attractive. It is quite hard not to like the idea of “earning a stake in AI” by simply sharing your WiFi? The next 12 months will be crucial in proving out its durability and more importantly, sufficient traction to warrant there is legitimate demand for such a product vs current alternatives. If the team executes on the roadmap by scaling to higher throughput, integrating multi-modal data, and onboarding paying enterprise customers, Grass could breakout to wide-scale adoption.