Introduction

Data availability continues to be the common denominator across the most exciting chains, rollups and applications building today. It is the foundation that aims to power the next generation of scalable applications with the likes of Celestia, EigenLayer and Avail leading the innovation here. Given how early things are from an adoption standpoint, we still feel the DA layer is the lowest level of the stack that can unilaterally empower the most amount of network effects and thus, downstream value accrual later on. From an investor point of view, DA can also be seen as a bet on rollup growth in general without betting on a specific L2, creating a potential index bet on the overwhelmingly growing trend of L2s.

Despite this, it is too early to tell what things will look like in a few years and these teams really bring about the Silicon Valley meme of “pre-revenue pure plays”. For instance, Celestia generates relatively little in protocol fees but it aims to garner adoption before allowing the DA fee market to find its fair value (currently set 1000x cheaper than EIP-4844). Similarly, Eigenlayer has many teams building there but its hard to answer basic questions such as with Eigenlayer’s ~$5b in idle TVL, what would be an attractive APR be for the Eigen staker given the potential risk of slashing? AVSs on Eigenlayer stretch past DA and can encompass all the overflow activity of DA, onchain storage and verifiable computation, bridges, oracles and other potential AVSs which sets the stage for a massive total addressable market (TAM) and varying risks amongst each. For the sake of this report, we will focus on EigenDA, Avail, and Celestia and catalysts lined up for them respectively. Given how integral DA is in the wider crypto space, we feel there will be multiple winners akin to how we have come to accept there are multiple winning chains.

Instead of postulating the future reality of 1,000s of chains, we instead frame the upside of DA to just one breakout application that uses a alt-DA layer in the backend. We have already seen a lot of excitement about Celestia’s potential in protocol revenues once people started literally clicking a picture of a cow on Eclipse. We feel this brings market participants to a key decision: clicking cow DA nihilism or clicking cow DA optimism. We choose the latter because we can only imagine how large these networks can grow (specifically protocol fees) when adoption is enjoyed by a scalable payment network or an AI agent focused chain driving home unprecedented demand. Let us dive into the top three DA layers and their recent catalysts and highlight exciting projects within these ecosystems.

Emerging Trends and Catalysts

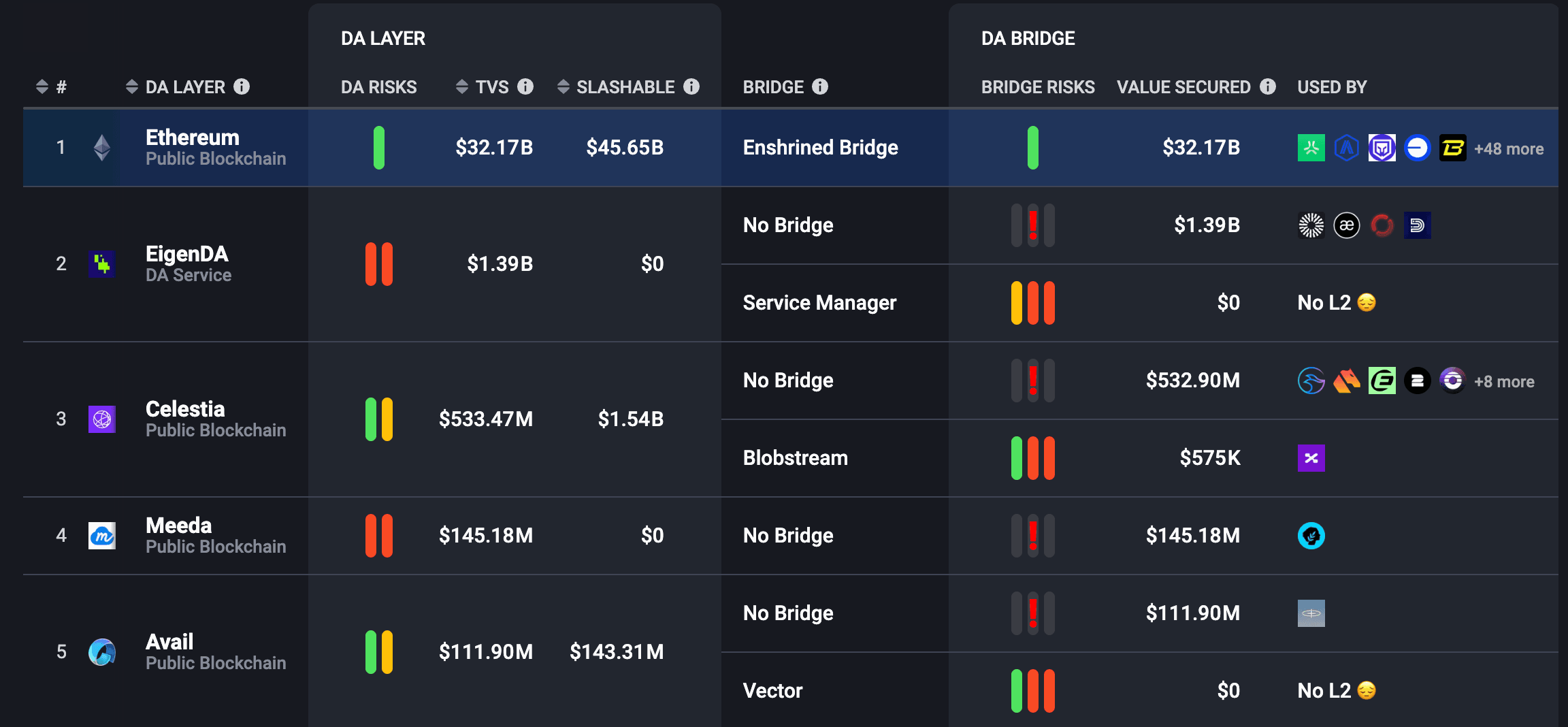

Overall, we feel DA layers have many angles to compete on. The largest being cost, business development and integrations (adoption), and native rollup bridging/interoperability/shared security. We are seeing the emergence of many clusters of L2 ecosystems come about such as OP stack Superchain, Arbitrum Orbits, zkSync’s Elastic chains, and much more - will the DA layer be able to support and be unbiased towards onboarding any new rollup framework? The opportunity is massive but we can expect the cost to be a race to 0 (albeit enough for spam protection) so these platforms will have to compete further on the second order benefits of interoperability or even novel DeFi primitives such as enshrined liquidity for rollups. The below are the largest by total value secured by today’s metrics.

TVS

EigenDA has pulled away in the lead with the most recent integration of Mantle, now securing over $1.39b in assets.

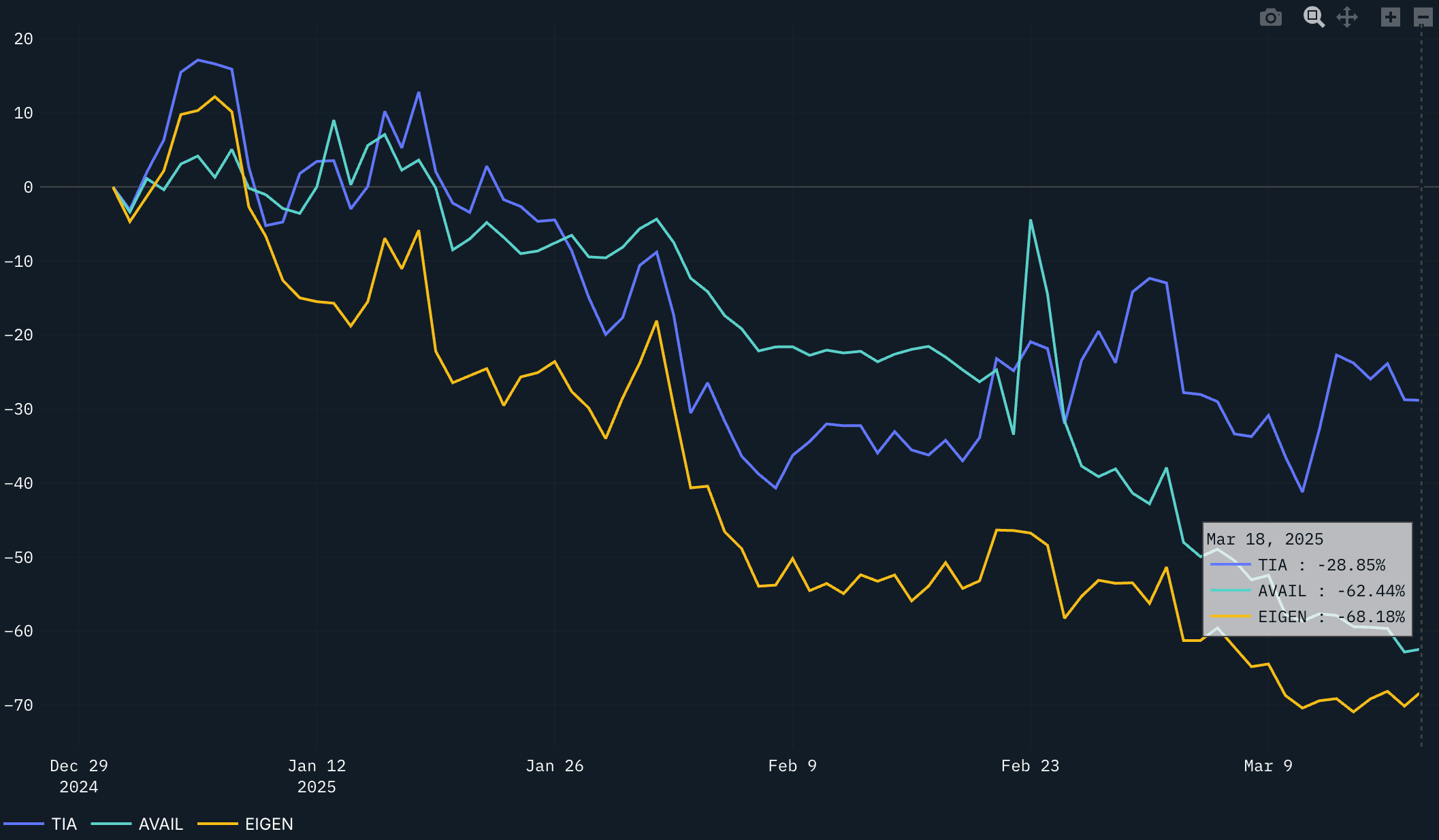

As for price performance, DA layers have not held up so well into the new year.

YTD Price Performance

YTD, the DA sector has taken quite the hit with the likes of EIGEN being down 68%, AVAIL at 62% and TIA over 28%. TIA has held up the strongest of the group as measured by its limited downside. At the time of writing, the FDVs of the projects are as follows:

- EIGEN: $2.02b

- TIA: $3.7b

- AVAIL: $434m

This should give a better sense of where these projects are valued and how they have performed into the new year. Now lets dive into the new catalysts that may hopefully reverse this trend.

EigenLayer

Despite the excitement around the future EigenLayer drives forward for Ethereum, it has so far traded as ETH beta and the speculation around LRTs certainly overestimated realistic timelines. Since TGE, ETH has performed quite poorly and so has EIGEN downstream of the poor sentiment around ETH. Despite this, we feel EigenLayer has been positioning itself strongly for DA integrations as of recent, along with broader AVS expansion and the natural progression of time for EigenDA to catch its stride toward a viable future for 1 GB/s DA throughput. At present, EigenLayer boasts over 200 operators currently supporting 15MB/s throughput and over $1.39b in TVS.

Integrations and Catalysts

For integrations, EigenDA is already planned to be the defacto DA layer for MegaETH, one of the most exciting Ethereum scaling solutions today. Mainnet is imminent for MegaETH and we expect good traction of activity there as measured by developer activity and fundraising. Additionally, EigenDA has secured integrations with the broader zkSync’s Elastic Network for DA and broader AVSs includng zk proving. Others, including Mantle Network, have also pivoted to EigenDA for a more decentralized and resilient DA layer. It is also worth noting that EigenDA also supports Arbitrum Orbit chains as well.

For EigenDA, they have been planting the seeds and creating strategic partnerships with some of the fastest growing L2 ecosystems including Arbitrum, MegaETH, zkSync’s Elastic chains and hybrid optimum rollup models like Mantle.

Celestia

We wrote an extensive report on a long term thesis for TIA and would highly suggest those who want a deep dive to go read it. In short, we believe Celestia is also doing some great work on the multiple fronts DA layers are competing on. Not only is it securing over $533m in assets, it is also one of the cheapest options by far and broadening support for integrations across most rollups frameworks today and has a clear path to the gold standard of 1 GB/s throughput.

Integrations and Catalysts

It’s ecosystem is coming alive today, with many exciting catalysts lined up for both DA feature expansion and application/chain growth. The density of talent within the ecosystem, combined with their prioritization of the community’s direct feedback into the roadmap, along with the clear roadmap of technical upgrades and integrations of top-tier rollups, we see a lot of positive tailwinds for Celestia. Some key features they are shipping today - maxing out blobs, shorter block times, single-slot finality, and interoperability natively baked into their roadmap. You can track all of the new features being shipped on this community-driven roadmap.

For apps/chains building on Celestia today, we see a lot of ambition with what they are tackling and even more on the actual execution of the product/UX. Some notable mentions of apps and infrastructure:

- Payy

- A privacy stablecoin payments app with a very crisp and easy to use UI.

- Towns Protocol

- Native onchain communication for communities.

- Intita

- Infra layer that combines a layer 1 (L1) with integrated layer 2 rollups (L2s), creating a modular ecosystem of interconnected chains.

- Astria

- Decentralized sequencing layer

- Argus Labs

- Onchain gaming

- Succinct x Celestia

- zk image editor

- Prism

- a ZK rollup light node that runs on any device

- Rollup adoption - Movement, Eclipse, etc.

- Native IBC Integrations

We have seen the likes of Celestia native Defi begin to take off with Flame with over $9m in TVL. As for NFTs that take indirect exposure to Celestia ecosystem and have widespread adoption from core builders, we see Celestine Sloths as another way to get get active in the Celestia ecosystem outside of TIA.

In addition to broader adoption growth of Celestia, there have also been changes to the issues surrounding TIA tokenomics. They have pushed forward tokenomics changes, mainly decreasing the current staking inflation and preventing investors from selling staking rewards. The hope is that this will decrease sell pressure from investors and unnecessary inflation for the underlying security needed for the underlying Celestia L1. In short, we see very clear upgrades in the works for the headwinds TIA has been facing. Finally, we also see very strong marketing. Whether it be the Expansion podcast (Blockworks family podcast), mindshare on Twitter around Celestia in general, across VCs and builders, the mindshare and awareness of Celestia as a whole continues to accelerate alongside technical upgrades.

Avail

Another DA layer that supports a variety of rollups across validiums, sovereign rollups and app-chains. It does so by utilizing validity proofs with data availability sampling to create a more cost effective and scalable solution across over 100 validators. It is similar to Celestia in some ways but it also differs on the use of validity vs Celestia’s use of optimisitic proofs, amongst others. They have many out of the box features for rollups on Avail including native interoperability across rollups, shared security and of course DA. They have raised $75m so far, with their most recent series A back in July 2024, from the likes of Founders Fund, Dragonfly, and many other top VCs in the space.

To power the Avail layer, the AVAIL token sits at the center of it and is a productive asset to align incentives across avail stakeholders. It is staked to get access to the shared security, interoperability and the guarantees of Avail DA. As the Avail ecosystem grows, demand for AVAIL increases, with more tokens being purchased and staked to participate in shared security and interoperability. This dynamic creates a potential reflexive flywheel, where platform growth drives buy pressure on AVAIL, reinforcing the platform’s expansion and token utility in tandem.

Integrations and Catalysts

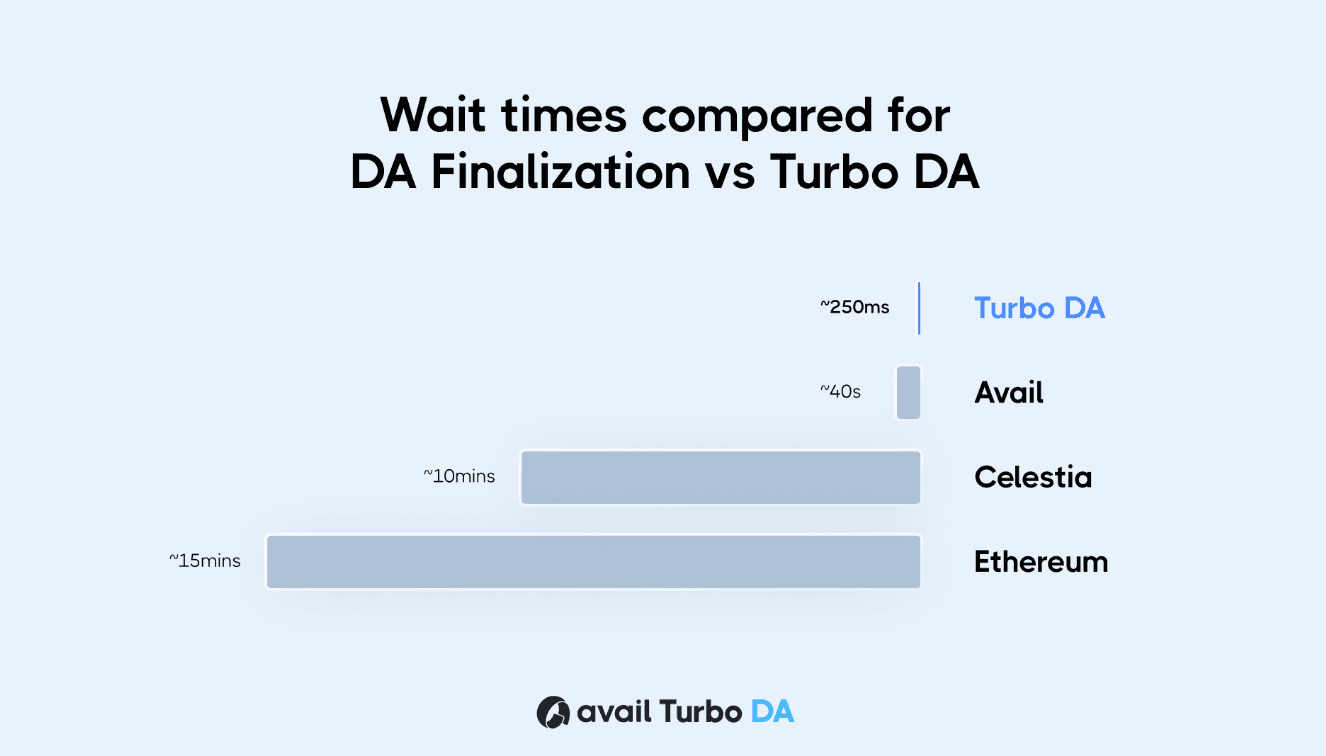

Turbo DA is a major upgrade that allows rollups to post their data with pre-confirmations in less than 250 milliseconds. In other words, this empowers extremely fast applications that aren't otherwise possible on other DA layers. For context, these are the waiting times for other DA layers (these are not block times).

Turbo DA would put Avail 15x faster than Celestia based on this specific metric. The oversimplified difference of these wait times boil down to the use of validity proofs vs fraud proofs (waiting for light clients for verification). As for Avail’s ecosystem, we have seen some notable apps and infrastructure emerge:

- Sophon

- A validium focusing on entertainment

- Odysphere

- DeFi powered rollup

- Recent hacker house

- Loads of new projects spanning gaming and a mobile-first zkTLS app

- Chain support includes Optimism, Arbitrum, zkSync, Starkware, Polygon CDK, Polygon zkEVM and Madara.

- SDKs and Frameworks - Cartesi, dYmension, Movement Labs, Rollkit, Risc Zero, Sovereign and many others.

- Gaming - Blade games and Paima Studios

- Full ecosystem breakdown

In short, Avail brings forth a vertically integrated stack with competitive DA, native interoperability through Nexus, and shared security via Fusion. The vertical integration appears to be the end game for DA layers as they continue to build out their own respective moats to attract new rollups to join their ecosystems. We have seen similar designs with Celestia launching their own form of interoperability through lazybridging between rollups and a native bridge to the underlying L1.

Conclusion

Ultimately, we believe DA is a structural bet on the rollup-centric roadmap of crypto, serving as a neutral backbone regardless of specific L2 winners. Given the sector's diversity and the scale of opportunity, it’s increasingly likely there will be multiple winners, each with distinct value propositions tailored to different ecosystems and use cases.

While current market sentiment and token price action reflect the early-stage nature of these platforms, the groundwork laid today through integrations, technical improvements, and community building positions these DA leaders to capture meaningful value as demand scales. For investors, developers, and users alike, monitoring each platform’s throughput milestones, ecosystem growth, and go-to-market execution will be key in identifying who eventually captures the lion’s share of DA marketshare.