The Players & Prices

There are several players in the GPU rental and compute space with the focus this time being on the following selection:

| Project Name | Ticker | Mkt cap $ | Price Oct. 8th | Socials |

|---|---|---|---|---|

| Render Network | RENDER | 2,041,385,838 | $5.29 | https://x.com/rendernetwork |

| Golem Network | GLM | 328,505,468 | $0.32 | https://x.com/golemproject |

| Aethir | ATH | 251,161,268 | $0.059 | https://x.com/AethirCloud |

| https://x.com/RunOnFlux | ||||

| io.net | IO | 175,556,019 | $1.85 | https://x.com/ionet |

| https://x.com/CUDOS_ | ||||

| Fluence | FLT | 14,155,145 | $0.26 | https://x.com/fluence_project |

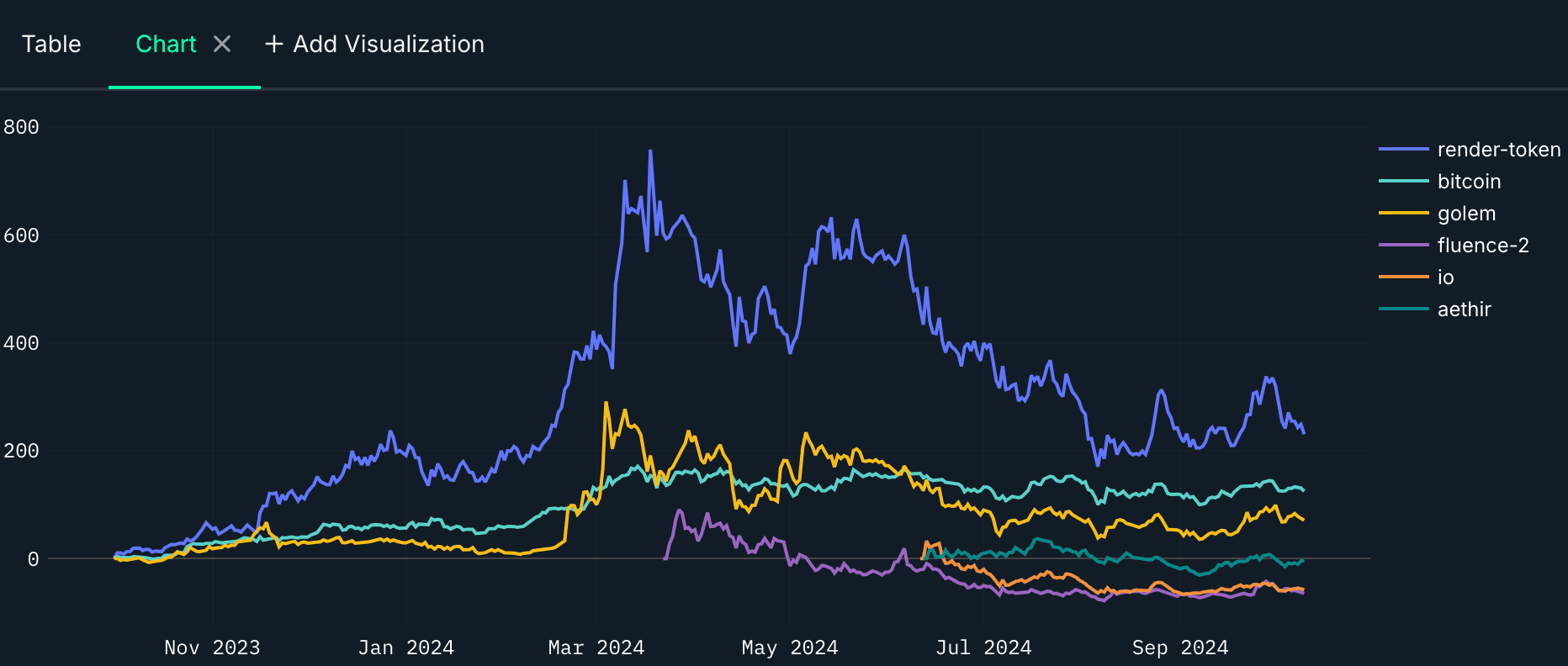

These projects started at different times with newer projects such as Aethir, Io.net, and Fluence all having launched their respective tokens in 2024. In addition, while Flux (previously Zel) seemingly has developments that are still going with a fairly vast ecosystem, we rule it out from further analysis due to the low trading volume. Cudos will also be excluded from additional analysis due to the merge with Fetch.ai and the expected delisting of the CUDOS token.

Since the run earlier in the year, DePin, like most other sectors in the crypto space, has seen a decline in prices across the board. With that said, all the projects which have a token more than a year old are still up on the one-year timeframe. All projects also saw positive price action over the past 30 days and remain positive despite the downtrend in the past two weeks.

Socials & Trends

Slightly more than half of the social accounts of the projects have seen a decline in smart followers in the past month, spotted via Discover MONI with The Render Network losing 11 smart followers. Smart followers per MONI include VCs, Alpha hunters, Whales, Project founders, etc. This does make sense considering the price action over the past months. However, there have still been increases in followings amongst normal users which still shows interest in the sector.

Still, this indicates a growing interest in DePIN and the computing space. This can further be supported by Google’s keyword research which shows that searches for DePIN are higher now than was in the past years.

With that said, it still is not as popular as other sectors such as RWA or DeFI, with RWA being the sector that has seen stable search increases likely showcasing this is where money is currently at.

Does Money Talk?

Continuing the look into the tokens and where money potentially is flowing we see quite the large differences across FDV and smart money balances.

| Project Name | Ticker | FDV $ | Smart Money Holders | Smart Money Balances |

|---|---|---|---|---|

| Render Network | RENDER | 2.81B | 39 | $50,056,952.98 |

| Golem Network | GLM | 325.8M | 8 | $466,887.36 |

| Aethir | ATH | 2.65B | 23 | $7,013,802.18 |

| io.net | IO | 177.8M | N/A | N/A |

| Fluence | FLT | 262.3M | 2 | $5,019.04 |

Note: Render Smart money was aggregated across chains but might not be the full picture due to Solana data missing, io.net data is missing currently as it’s only on Solana.

Half the projects have seen a decrease in smart money holders and balances over the past 6 months with the exception being Aethir and Fluence. In the case of Fluence, however, the amount is negligible and so we really only have Aethir with growth. Aethir, like many projects, is launching with a high FDV and low float, which may limit long-term growth but offers potential for short-term gains. Interestingly, Arthur Hayes has been hoarding ATH in recent months with a hefty investment of $7.3 million at the current price of Aethir (ATH).

Wallet balances show a positive distribution with many long term holders across projects, and likewise no alarming clusters are found.

Regardless, smart money balances have mostly been decreasing and prices following to the downside. Many smart money addresses are rotating back into memes and stablecoin holdings of smart money are at 3.9% showcasing how heavily smart money is deployed.

Notable News & Things To Know

Partnerships are common in the crypto space and it comes to no surprise that Aethir and io.net partnered earlier in the year combining the virtualization technology (enabling efficient allocations of resources based on user needs) of io.net and the distributed GPU cloud of Aethir.

Important to note, there is a 630M airdrop unlock coming in February 2025.

Fluence also had a partnership recently with Parasail, a staking layer for DePIN where you currently can delegate Filecoin and Fluence.

Golem Network also saw a partnership earlier in the year with GamerHash, tapping into the network of “gamer” GPUs bringing more GPUs to power the Golem Network.

Finally, Render Network partnered with both Stability AI and Endeavor allowing them to tap into the GPU networks of Render to scale the training of AI models.

Funding

All the projects have gone through various funding rounds, including IEOs (Initial exchange offering), ICOs (Initial coin offering), with Golem Network having the lowest funding so far at $8.2 million raised in their ICO. Fluence is the next project with a total of $15.18 million raised with the latest IEO in March 2024. Moving on, we have both Render and Io.net with $30 million raised with Io.net having their Series A also in March 2024.

Finally, we have Aethir with a total of $148.1 million raised from both seed rounds Node & public sales with the latest coming through in May 2024.

Differences Across Projects

| Project | Service / Product | Unique Features |

|---|---|---|

| Render Network | Rental of GPUs with a focus on digital visualizations (AR/VR, XR, etc.) | Focus on the creative industry with a partnership and integration of OctaneRender, making it particularly suitable for complex 3D rendering tasks and visual effects. |

| Golem Network | Generalized GPU rental for visualizations and AI/ML | Provides CPU rental on top of GPU resources, offering more flexibility for various tasks beyond GPU-heavy workloads. |

| Aethir | Focused GPU compute marketplace for gaming and AI. | Low-latency cloud compute optimized for real-time applications such as gaming and metaverse experiences, ensuring quick response times. |

| Io.net | GPU rental market focusing on AI/ML | Have the largest number of available GPUs, providing access to substantial computational power for AI model training and deep learning. |

| Fluence | GPU rentals focused on AI cloud computing | Unique for its serverless GPU resource renting and claiming the lowest prices in the market for high-end GPU rentals like NVIDIA H100 and A100, ideal for AI and deep learning applications |

The decentralized GPU rental space is evolving fast, and each project is carving out its own niche:

Render Network (RENDER) focuses on digital content creation, especially 3D rendering for industries like film and NFTs. It’s known for leveraging OctaneRender, one of the more popular rendering tools for Blender. Starting at €0.125/hour for low-priority tasks, Render is all about high-quality results for artists who don’t want to rely on traditional render farms.

Golem Network (GLM) takes a general-purpose approach, providing both GPU and CPU rentals. This flexibility makes it attractive for a wide range of use cases, from AI to basic computations. It’s not just about GPU muscle; it’s about offering compute power for any workload.

Aethir (ATH) is making moves in gaming and metaverse cloud computing, focusing on low-latency environments. It’s a sweet spot for developers who need real-time responsiveness without breaking the bank, positioning Aethir well to capture parts of the gaming cloud space.

io.net (IO) is all-in on AI and machine learning, offering the largest pool of GPUs. It’s a no-brainer for AI developers needing vast GPU resources to train models efficiently and at scale.

Fluence (FLT) the smallest player is potentially interesting for its competitive pricing on high-end GPUs like NVIDIA H100, with rates starting at $0.99/hour. Its serverless architecture is optimized for AI cloud computing, making it another play for those needing cost-effective, scalable solutions.

Each project plays to its strengths, whether it's in artistic rendering, AI model training, or real-time gaming compute.

Conclusion

The decentralized GPU rental space is evolving rapidly, with each project catering to distinct niches within the broader compute ecosystem. From Render Network's focus on digital content creation to Io.net's AI-centric GPU offerings, the landscape is diverse, driven by unique strengths and technological innovation. The fluctuations in both prices and smart money balances indicate that while interest remains, the sector is still maturing and facing broader market headwinds. As these platforms continue to secure partnerships and develop their technology, their potential to capture different market segments will depend on the evolving demand for decentralized compute power. Ultimately, investors and users alike will need to watch closely as these projects carve out their roles in a competitive space.

Ceteris paribus, the DePIN compute sector is one to watch for potential short-term opportunities with newer players such as Aethir with heavy funding and large singular smart money holdings.