Introduction

Blast, an emerging Ethereum Layer 2 (L2) solution, stands out by introducing native yield generation for ETH and stablecoins. Blast strongly emphasizes countering asset depreciation by offering interest rates of 4% for ETH and 5% for stablecoins deposited on the network. The project attracted significant investment, raising $20 million from influential backers such as Paradigm, Standard Crypto, eGirl Capital, Primitive Ventures, and Andrew Kang.

The project's development is spearheaded by Pacman, who founded Blur, a leading NFT marketplace on Ethereum. They recently opened deposits and airdrop farming, attracting over $230m TVL so far.

For a live view of the most important metrics, check out our Dashboard.

Key Mechanics

Blast offers yield-earning assets on its L2. Currently, bridging for stETH, ETH, WETH, DAI, USDC, and USDT is open, whereas all stables get converted into DAI and put into Maker to earn the DAI savings rate (DSR). All related assets are put into Lido and converted into yield-earning stETH. Currently, however, the chain is not yet live and withdrawals are not enabled, meaning that the bridge is a one-way street until February 2024.

Airdrop Mechanics

They recently opened deposits, where you can deposit ETH, stETH, and stables to earn the 4% respectively 5% and additionally collect airdrop points. However, withdrawals will only be enabled in February and the airdrop distribution is scheduled for May. There is also a developer airdrop scheduled for January when Testnet launches, and the airdrop distribution will be 50% Bridgers and 50% Developers.

The airdrop points distribution for the Community Airdrop itself however, is more complex. You don’t automatically get airdrop points, but through one of two ways:

- Spins: You get 1 spin per ETH equivalent deposited per week. You also get one initial free spin, if you meet sufficient criteria from YTD gas spent (L1, L2), YTD trading volume (perp, token, NFT), and 30D average balance (L2s, LSDs, RWAs).

- Referrals: You get 16% of all points earned by direct referrals, and 8% of all points earned by their referrals. This works like a typical pyramid scheme.

Spins

As stated before, you get 1 spin per ETH equivalent deposited per week, however on a pro-rata basis. This means if you deposit 7 ETH, you will get 7 spins per week (i.e. 1 spin every day). If you deposit 0.5 ETH you will get 0.5 spins per week (i.e. 1 spin every 14 days).

Spins give you between 1 point and 11,000 points. With every spin, there is the chance to get a super spin, giving you between 2x and 10x the rewards of normal spins. Luck will improve the chance of your next spin being a super spin.

You can increase your luck by hitting “squad goals” and doing a “luck spin”, which does not give you any points but can increase your luck. A squad is comprised of you and your direct invites and the goals are deposit-based (e.g. deposit 5 ETH as a squad).

Referrals

You automatically earn 16% of all points earned by your direct invites and 8% of points earned by “second-degree” invites.

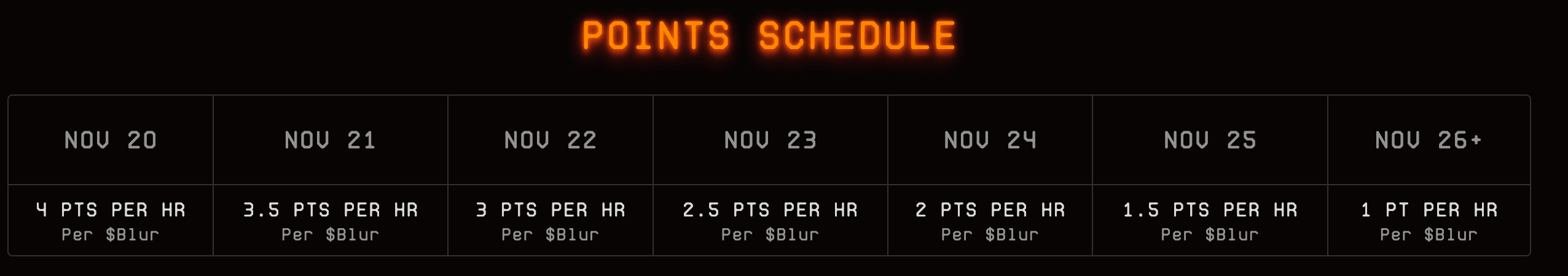

Holding Blur

Taking your time does NOT apply here.

gives you exceedingly more points than spinning, however, the rewards are decreasing and end on 25 Nov 2023. As of now, the conversion between the points earned through Blur and those earned through Blast is unknown.

Airdrop Strategies

Take Your Time

Airdrop points are not streamed at a continuous rate proportionate the TVL contribution like in most of the other liquidity farming programs. Instead, they are randomly allocated per spin with a fixed range of points.

This means there is no benefit in being super early when there is not a lot of TVL, as you can still get diluted further down the line before swapping the points for tokens. So there is no downside in waiting before aping to understand all the rules and maximize your airdrop.

Use Multiple Wallets

As the person inviting you and the person inviting them get 16% and 8% respectively, you should use your invites for multiple wallets that you own to make the most of your capital. Therefore you should use at least three wallets:

The first wallet should bridge a bit to receive invite codes, the second one should be invited by the first one and repeat that strategy, and the third one should be the one where you allocate the largest portion of your capital. That way you get an additional 24% (16% + 8%) on top of all the points you earn.

Maximize Luck

The luck boost is a big part of earning airdrop points and can increase your airdrop by up to 11x. So boosting luck for your main wallet (i.e. last of the 3 wallets) is paramount. If you invite friends, be sure to use the invite codes for the last wallet. However, if you have enough size yourself you can also achieve the squad goals on your own.

Don’t Fade the Developer Airdrop

Developers get the same airdrops as all farmers combined, so deploying a few contracts in January could be worth your time instead of competing with +$230m TVL.

Try to Capture Secondary Gains

All of Blast’s TVL is directly flowing into Maker and Lido at the moment, which could benefit from the success of Blast. Also, the connection and earning points through Blur can help get the BLUR token and project more attention.

Key Stats and Onchain Metrics

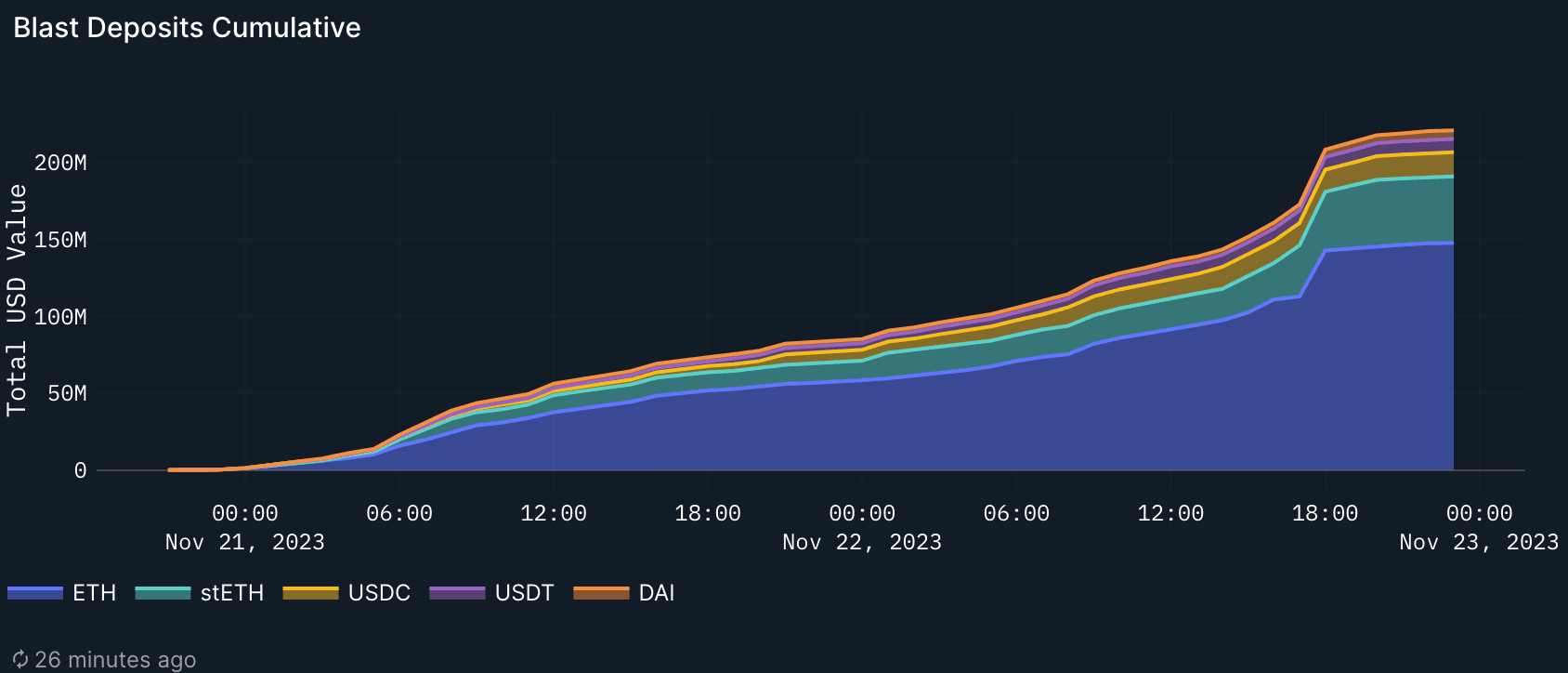

Blast managed to attract over $230m TVL within 2 days without having a single live dApp or even testnet. This catapults it into the top 15 chains by TVL and already surpasses chains like Sui, zkSync Era, and Aptos. Since withdrawals are disabled, TVL will only go up until at least February, albeit subject to price changes in USD. All following images are taken from a Nansen Query live dashboard.

It has over 35k unique depositor addresses, depositing mostly ETH. An interpretation of the assets deposited so far could be that many people anticipate a bull run mid-term. Given the anticipated bull run, many would be comfortable locking ETH for a few months and getting additional yield on top of the 4% for staking. On the other hand, stablecoins would be needed for additional liquidity (e.g. for buying altcoins or participating in token sales), making it a less attractive asset for a long-term lock.

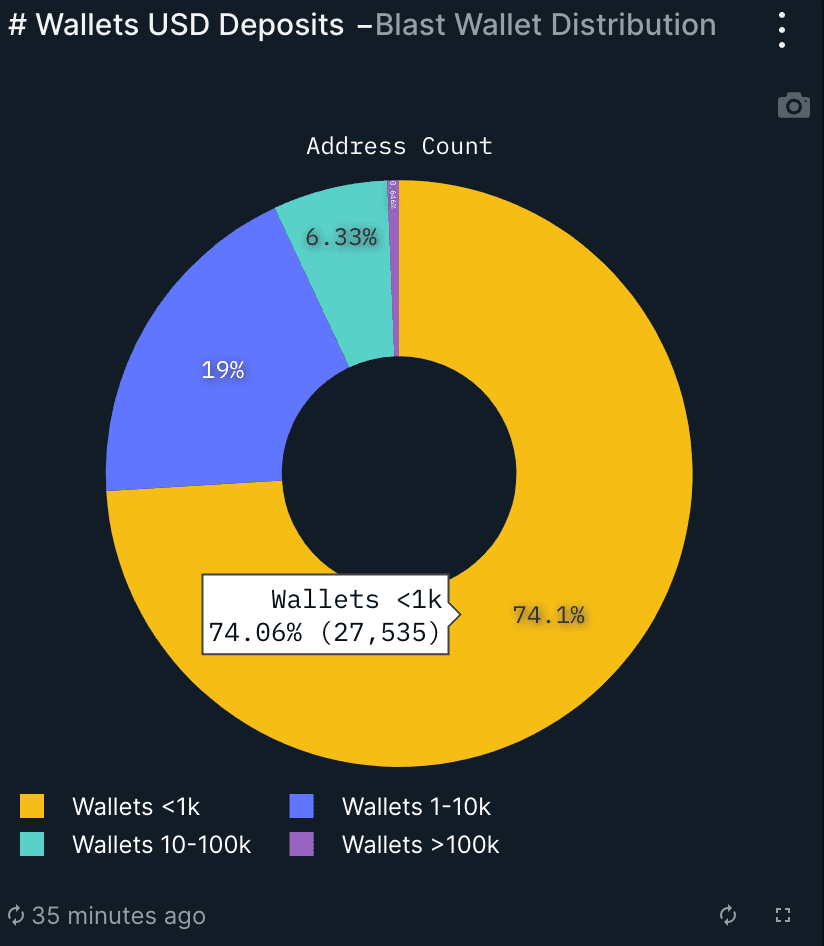

Interestingly, around 75% of all wallets deposited less than 1k worth of USD. There seem to be a lot of smaller depositors or, more likely, people using the tactic for multiple wallets and having at least 2 wallets that primarily earn passively.

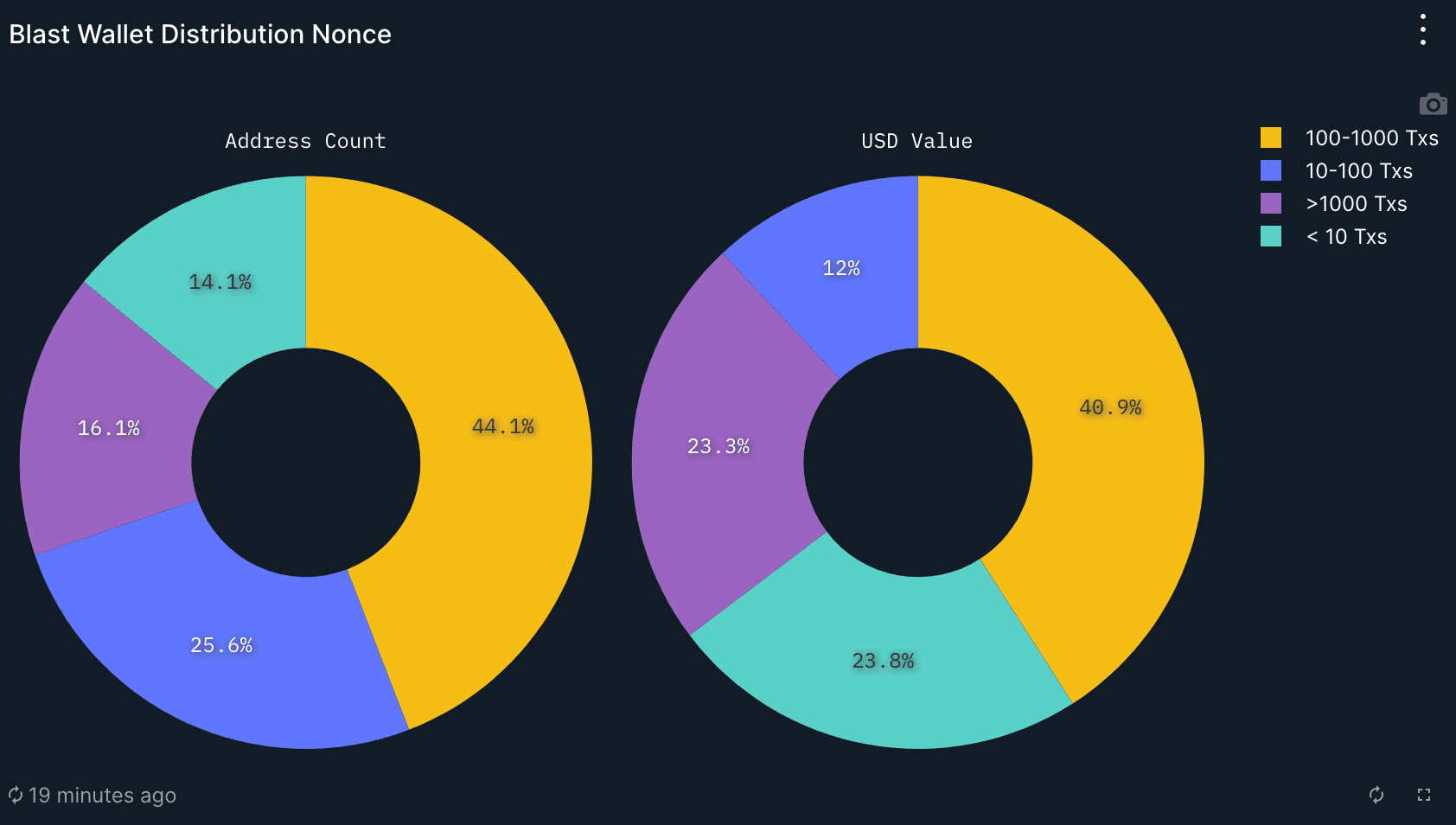

As for the transaction count, only a small part (around 14%) of depositors have made at least 10 transactions prior to their deposits. However, they are over-represented in the TVL contribution with around 22% of the total USD value. This could mean that people set up new wallets especially for farming this airdrop and remain anonymous. As of yet, there does not seem to be any incentive or plan for the protocol to prevent sybilling.

The Blast airdrop has the potential to be quite substantial, if chains were valued somewhat proportional to TVL (Market Cap to TVL often somewhere between 5 and 15), the Market Cap could range be north of $500m. Capitalizing on the strategies laid out in this report can give you an edge to get your piece of the pie. That being said, the invite system is a textbook pyramid scheme, and the added layer of “luck” makes the system even more intransparent.

The premise of native yield on the chain can already be fulfilled by holding sDAI or stETH on any L2, using the same mechanisms as Blast. By using Maker and Lido, Blast invites involve dependencies on a very integral level of their chain from the get-go, which can be worrying from a security aspect.

However, for now, their efforts seem to be working well when measuring success in terms of TVL. With the 3 month gap between withdrawals and the actual airdrop, there will likely be some sort of multiplier mechanism to keep the TVL on the chain and make users use the dApps. If people feel at home on the L2 and there are a few unique and interesting projects, this Ponzi-esque launch might have a shot of creating long-term incentives and building a lasting community.