Introduction

This report examines the performances of GHO and crvUSD - which were among the most anticipated DeFi launches this year. GHO is an overcollateralized stablecoin issued by Aave that is created by borrowing against collateral deposited on Aave. crvUSD is an overcollateralized stablecoin issued by Curve with a novel stablecoin mechanism characterized by soft liquidations (collateral conversion). Both stablecoins are incubated by highly respected DeFi blue chips to increase their revenue and influence. Since stablecoins have the potential to generate significant revenue and consistent cash flow, their success or failure could be consequential for the issuing protocol.

These stablecoins have not achieved equal measures of success so far. In terms of market cap, GHO has floundered while crvUSD has performed well.

This report examines the progress so far, and the potential outlook of these stablecoins.

Topics explored include:

- Comparative on-chain data

- Stablecoin design

- GHO de-peg and proposed solutions

- MiCa

- Decentralization

Comparative Data

As can be seen, crvUSD has a significantly larger supply than GHO.

crvUSD also dominates when looking at token transfers.

Interestingly, when focusing on token transfers of more mature ‘decentralized’ stablecoins like LQTY and FXS, crvUSD still performs relatively well. Conversely, GHO’s underperformance is also clear.

Entity Interactions

As expected, crvUSD has far more interactions. While most of these are for trading e.g. 1inch, other protocols such as Silo allow crvUSD to be used as a universal accepted collateral across its markets. Integrations such as this help drive fundamental demand for the token.

GHO has far fewer interactions with most counterparties used for trading. GHO has high liquidity on Balancer, explaining the large number of interactions there.

GHO's struggles are apparent in its inability to maintain a consistent dollar peg.

So what are the reasons for this fundamental underperformance? Let’s dive in.

Issues with GHO

A significant issue with GHO is that it has consistently traded below its peg, currently lying around $0.96. Why has this happened?

Demand Issues

Aave tried to incentivize growth with low fixed borrow rates. This had a positive impact on the supply side; however, real demand for the stablecoin has lagged, resulting in it being unable to keep its intended $1 peg. The borrow rate has been increased to combat this issue, but GHO remains depegged. Its inability to maintain its supposed peg explains GHO’s limited growth, as this does not inspire market confidence. This creates a self-perpetuating cycle, where market actors are discouraged from using the stablecoin as they will lose out should it repeg. For example:

- You can borrow GHO at present (e.g. $0.96c) and buy WBTC.

- When it comes to repaying the loan, you must repay with GHO, and if GHO has re-pegged then you will lose money on the spread.

- Having the ‘stablecoin’ unpegged makes it unattractive in DeFi.

Organic demand for stablecoins is driven by confidence. USDC demand is strong given confidence in the asset, as is USDT (which has been extremely successful in maintaining its peg over the years and remains extremely popular in Asia). High confidence begets demand which begets liquidity - another essential ingredient to stablecoin demand and arguably a self-perpetuating cycle. GHO's failure to achieve organic demand is partially attributable to its failure to remain pegged, resulting in lower confidence and liquidity. In addition, some users who have borrowed have made losses as a result of the de-peg and interest rate changes, such as this one described on the governance forum.

Aave’s strong brand and profile mean a turnaround is feasible. Strong organic demand for GHO could be highly profitable for Aave. Stablecoin businesses can be cash cows in a world of high-interest rates, with the issuer earning on the spread between borrow/lending rates or RWAs.

Governance Suggestions

Aave passed a proposal to increase GHO minting costs in an attempt to restore the peg. The rationale for increasing borrow rates is that it reduces the incentive of contributing to supply and thus the situation where supply exceeds demand. Monet-supply (of Block Analitica who have worked with Maker DAO) suggested raising borrowing costs in 0.5% or simply up to the DSR rate (~5%).

They also stated that GHO trading below its peg also gives Aave the opportunity to purchase it using their stablecoin reserves and provide it as liquidity on DEXs to improve market depth and earn fees and liquidity incentives.

A vote passed on Snapshot on 16 October 2023 with nearly 100% in favor of increasing interest rates monthly by 0.5% up to 5.5% or when GHO repegs. GHO borrow rates are at 3.05% at the time of writing. While rate increases are a positive development, GHO remains depegged. The increasing interest rates have failed to repeg it. This is perhaps unsurprising as it still remains far below the DSR.

DSR Problem

The DSR borrow rate (5%) means that it is profitable to participate in looping strategies like:

- supply sDAI

- mint GHO

- purchase DAI

- deposit to sDai

This makes interest rate arbitrage possible where users can take advantage of the rate difference between sDAI interest and the GHO borrowing rate. These strategies contribute to downward pressure on GHO.

Gauntlet Suggestions

Gauntlet has also entered the discussion with an analysis and proposal on creating sustainable demand that enables GHO to stay at its peg.

They have identified that downward pressure on GHO is contributed to by:

- Short sellers who mint GHO and speculate it will fall more in price where they can repurchase and repay - making a profit on the spread.

- GHO LPs who mint GHO and inevitably need to sell a portion of it for the liquidity pool pair token e.g. USDC causing further sell pressure.

They believe that this combined with a fundamental lack of demand keeps GHO unpegged. They look towards addressing this with two suggestions:

- Aave users stake GHO to receive lower borrowing rates on Aave. This is fundamentally useful for users of the Aave protocol and should drive additional demand for GHO.

- They also suggest a GHO Savings Rate (GSR), akin to Maker DAO’s DSR where holders earn interest based on the fees captured by Aave. These fees currently accrue to the DAO’s treasury.

These proposals make sense for generating additional demand for GHO. The favorable borrow rates tie in well with the overall functionality of Aave. Check out Nansen’s report on the impact of the DSR here.

Liquidity Management Issues

GHO's largest liquidity pool is a stableswap pool on Balancer. Stableswap pools are great for providing high liquidity to pegged stablecoins, but given that GHO has depegged it has actually exacerbated the issue. GHO is supposed to account for 50% of the pool, but is now around 75%. This means that as GHO rises in price it will be sold off to the other assets (USDT and USDC) creating sell pressure. TokenBrice (who will lead the GHO Liquidity Committee over November) proposes shifting liquidity from Balancer to Maverick in order to repeg GHO. At a high level, on Maverick you can create incentivized static pools in a specified price range that enforces buy/sell walls. The plan is to gradually move the incentivized pools higher as GHO increases in price until it is repegged.

TokenBrice published a long-form tweet on their plans to repeg GHO this month.

crvUSD

Unlike other borrow/lending protocols such as Aave and Maker, liquidations on Curve do not occur all at once. Instead, multiple liquidations occur as the collateral price moves through a specified liquidation range.

- When the collateral price falls within its specified liquidation range, it is swapped to crvUSD.

- When the collateral price rises back into the specified liquidation range, the crvUSD is swapped back to the collateral asset.

This feature means that the potential for protocol bad debt is significantly reduced and that this feature is especially useful to borrowers in the event of a flash crash. Note that these liquidations and deliquidations leave the borrower open to market-making costs.

Put more simply:

- Your collateral asset is ETH.

- When ETH is above your specified liquidation range - your collateral is in ETH (as with any lending protocol).

- When ETH is below the borrower’s specified liquidation range - collateral is in crvUSD.

- When ETH is within the liquidation range, it is gradually swapped for crvUSD (if ETH price is falling) or crvUSD is swapped for ETH (if ETH price is rising).

crvUSD is a novel and somewhat complex stablecoin. Here are the risks and disclaimers by Curve. Risks discussed include:

- In soft-liquidation, it is not possible to withdraw or add collateral.

- Sudden price drops can cause significant losses.

- Deliquidations in collateral conversion mode have costs and can worsen loan health.

- Loan health at zero leads to irreversible hard liquidation.

- crvUSD is in beta version; participation carries high risk.

- crvUSD value can not be guaranteed.

- DAO can change crvUSD operation parameters.

Leverage

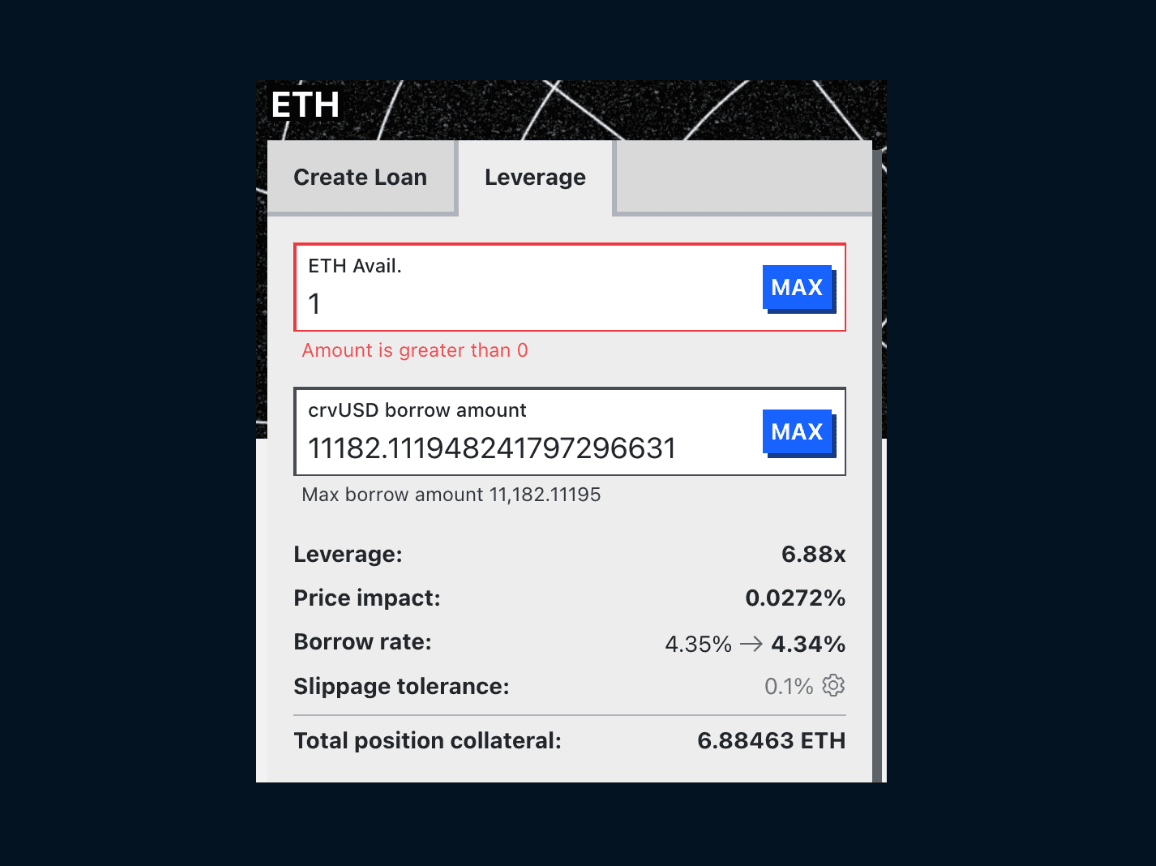

Curve allows leverage on crvUSD. The example below shows 6.88x leverage using ETH.

This works by repeat trading crvUSD to collateral and depositing to maximize the collateral position. Essentially, all borrowed crvUSD is utilized to purchase more collateral. The above example shows 1 ETH borrowing ~$11,200 crvUSD. This means that the borrower has $11.2k worth of ETH collateral. To receive the collateral, the borrower will need to pay back the the borrowed $11.2k crvUSD (plus interest from the borrow rate). Here is a good explainer of how leverage in this system works.

A situation to be aware of when using crvUSD is that your collateral is in soft liquidation mode for a long period of time. During this time, you cannot pay off your debts which continue accruing interest fees. If you get hard liquidated while using leverage, you can lose all your collateral. When not using leverage, your collateral is swapped to crvUSD as its price falls, meaning that you will receive something.

Future Growth

While crvUSD’s complexity may deter some users, protocol integrations and under-the-hood usage of the stablecoin could result in very large growth. For example, Silo Finance incorporated crvUSD as the universally accepted collateral across its markets. Protocol integrations like this can drive large-scale demand and growth of the stablecoin.

The above diagram depicts the stablecoin trilemma, where it has so far proven impossible to have all three - a strong peg, decentralization, and scalability. crvUSD has opted for peg and decentralization. To increase its scalability, it could take on centralized stablecoin collateral such as USDC. However, one of crvUSD’s value propositions is its relative decentralization so stablecoin collateral may not be the best avenue to pursue. If this is the case, there is still a large scope for crvUSD to grow but its market cap will always be limited due to the requirement of overcollateralized volatile collateral.

Similarly, GHO would benefit from integrations with DeFi protocols to drive large-scale demand. The Aave brand is among the best in crypto, so if GHO can re-peg and gain market confidence, it is plausible it can land large-scale integrations. This combined with additional real utility that harnesses Aave’s popularity such as lower borrow rates for staked GHO can drive its price back to peg and keep fundamental demand.

Levels of Decentralization

Collateral

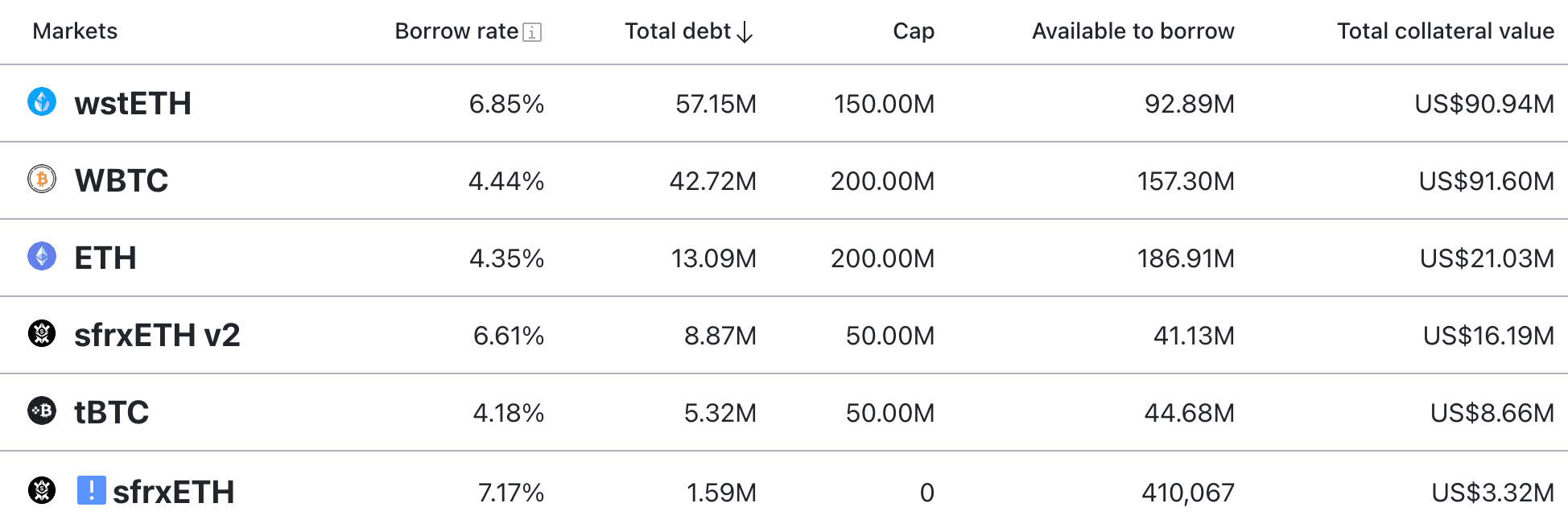

At present, crvUSD has more decentralized collateral. Collateral is primarily liquid-staked ETH and BTC wrappers. It is not backed by any centralized stablecoins.

While arguments can be made regarding the centralization of wrapped BTC tokens and LSDs they are generally considered more decentralized collateral than centralized stablecoins like USDC. Therefore, from a collateral perspective, crvUSD is relatively decentralized.

GHO is backed by Aave collateral. The largest markets on Aave are wstETH, ETH, and WBTC. However, USDC and USDT also have large markets. Leveraging stablecoin collateral can make it more scalable than crvUSD.

MiCa

MiCa is the European Union’s answer to calls for crypto regulation. Among other provisions, MiCa appears to prohibit algorithmic stablecoins, which GHO and crvUSD arguably fall under (as well as DAI). Stablecoins would need to be considered fully decentralized (and not labeled as “stablecoins”) or register for an EMI license e.g. Monerium who issue EURe. Dollar-denominated stablecoins also are not permitted over 1m transactions per day to protect the utility of the Euro in the European Union.

Fully decentralized coins should fall outside the remit of the regulation, but a threshold for decentralization remains uncertain and will likely need to be established in the European courts. Within the crypto industry, crvUSD and GHO are referred to as ‘decentralized’ - but will they be ‘decentralized’ enough in the eyes of the European courts?

MiCa may favor financial institutions rather than startups, with banks such as Societe Generale’s crypto division Forge releasing EURCV (a Euro stablecoin) for institutional clients. Circle will also look to grow EURC which has around $52m market cap at present. Startups that have started years in advance, such as Monerium, may be able to survive and thrive in this environment.

Nevertheless, it will be very important to keep informed regarding MiCa developments and their impact on stablecoins as it will take effect in 2024.

crvUSD and GHO have had varying degrees of success, but their respective stories are still young. Aave has an excellent track record and reputation in the industry, and the challenge they face in re-pegging GHO and growing organic demand does not appear insurmountable. crvUSD has done well in terms of on-chain activity and should continue to grow if it can keep integrating further into DeFi. Its decentralized collateral may stand to its benefit as regulations close in. However, it also puts an upper limit on its scalability. For both protocols, having a successful stablecoin and the associated revenue that this can generate may be important to ensure their long-term success.