Introduction

Ajna Finance is a lending protocol with a unique twist - it is immutable, does not use oracles, and allows anyone to create a lending pool for both ERC-20s and NFTs. Interested? Let's dive in.

Immutable

Ajna has no protocol-level governance. Why? Governance can become concentrated in the hands of a few - resulting in centralized control of supposedly ‘decentralized’ protocols. This can lead to severe problems. For example, if a small number of identifiable people control a project, it can be targeted by bad actors, as well as hostile governments and regulators. In addition, governance can lead to outcomes that are not fair to all parties. For example, Abracadabra considered changing interest rates on Michael Egorov’s CRV loan. Leaving parameters to market forces reduces the risk of human error, censorship, and potential mismanagement of a protocol. On the flip side, any vulnerabilities or protocol issues cannot be fixed without deploying a new instance of the protocol. Given the high prevalence of these issues in DeFi, this is a notable risk.

Ajna promises to be immutable, with automatic parameter adjustments based on market forces, namely supply / demand of assets on the platform. Interest rates are a function of pool utilization, and lenders determine collateralization ratios for a given asset they are willing to lend vs the asset they will accept as collateral.

But how can Ajna adapt to changing environments and problems? If problems arise or updates are required, a new version of Ajna will need to be released with the relevant changes. This has already materialized, where a potential griefing vector of the protocol was identified, and all users were encouraged to withdraw funds. A new version of the protocol was deployed on 11 January 2024. It has active pools on Ethereum mainnet and Base - with deployments on Arbitrum and Optimism also.

No Price Feeds / Oracles

Ajna does not use price feeds or oracles. This is because these can become an attack vector. Chainlink is the de facto oracle for the entire DeFi industry but is controlled by a 4 of 8 multisig, which represents a centralization risk.

Examples of protocols whose price feeds have been manipulated include Mango and the attempted Aave exploit by Avraham Eisenberg. Mango was ultimately exploited for over $200m, whereas Aave had to freeze borrowing in 17 crypto assets to reduce the risk of potential attacks.

Instead, Ajna leverages an internal order book whereby lenders set the asset values. Liquidation bonds are posted to incentivize liquidations in the correct conditions. This removes an external source of failure and aims to make the protocol extremely resilient.

Permissionless Lending Pools

Most tokenized assets (except rebasing tokens and NFTs with transfer fees) can be used as collateral in a lending pool on Ajna. Note that NFTs cannot be lent for obvious reasons. Of course, there is notable risk in borrowing/lending against highly volatile collateral and there is a reason why most protocols allowlist assets. That said, this feature will be enjoyed by degens and provides optionality.

Potential for More Leverage

Furthermore, borrowers can potentially access more leverage on Ajna. Why? Because lenders choose the price level at which they will lend, there is potential for borrowers to access higher leverage than on other lending protocols.

Composability

It will be interesting to see what sort of adoption Ajna receives from protocols building on top of it. For example, protocols that want leverage or earning yield from lending building on top. From the offset, Summerfi is building on top of Ajna where users can access yield farming opportunities. A partnership with Yearn is expected soon.

How It Works

Overview

Ajna is novel in its lack of price feeds/oracles, which are generally considered essential for DeFi to function. So how does it work?

Borrowers can use any ERC-20 or NFT as collateral (except rebasing tokens and NFTs with transfer fees). Borrowers can borrow from the aggregate liquidity deposited by the lenders.

This aggregate liquidity comes from lender deposits at price levels of their choosing. For example, if ETH is $2500 and I lend at $2100 price level, then my deposit of the quote token (USDC) would get converted to ETH if it falls below $2100. Depositing into price buckets when lending against volatile collateral may require users to manage their lending position similar to how one would with the concentrated liquidity ranges in Uniswap v3. The worst-case scenario for lenders is that they will have to receive their collateral at the price level they have specified (even if it has subsequently fallen far below this). From that view, lenders deposit the quote token (e.g. USDC) at a price bucket (price level) they are willing to buy the collateral in a worst-case scenario. The price and the interest rate should compensate them for their risk. Another way to look at lending on Ajna is lenders are placing a limit order for collateral that is earning interest.

Borrowing

The minimum borrow size of loans is 10% of the pool’s average debt.

- This is to avoid spam.

- This minimum comes into play after 10 borrow positions have been opened.

- The maximum borrow size is dependent on lender liquidity.

This could result in lower overall TVL as other borrow/lending protocols do not have this requirement and as the pool grows it requires larger loans thus making it more difficult to borrow (in terms of capital). This may make Ajna a protocol typically used by whales / protocols.

The origination fee is whatever is greater: 0.05% of the loan’s new debt or one week of interest.

- The major borrowing/lending protocols do not charge origination fees as high as this. The higher fees may prevent some borrowing on Ajna as players opt for cheaper alternatives.

- This accrues to reserves which are used as the first line of defense against bad debt. Excess reserves are used to buy and burn Ajna.

Interest Rates

Interest rates are based on pool utilization. Rates are low if there is excess lender liquidity. Rates are high if lender liquidity is low compared to demand.

- Rates change every 12 hours in +- 10% increments e.g. if rates are currently 2%, but lender liquidity is falling, they will be raised 10% to 2.2% after 12 hours.

- There is a minimum borrow rate of 0.001% and a maximum of 400%.

- There is a minimum borrow amount for loans (10% of the average loan size), and your loan cannot go below this threshold. For example, you borrow $2,500 and the minimum borrow amount is $2,000. If you decide to pay off $750 of your loan you will not be able to do so. This is because it would put your outstanding amount below the minimum borrow amount ($2,000). You either must pay back $500 or less, or the entire loan amount.

Lending

Lenders decide what valuation they will lend against. This is done by depositing quote tokens (the asset to be lent and borrowed) at specific price buckets (price levels). This feature can make Ajna attractive for stablecoin borrowers, as users set the collateralization ratio. Lenders receive NFTs that represent their pool tokens and are transferable.

Think of lending buckets like this:

- The price of ETH is $4,000

- You lend at $2,000 (by depositing USDC into the price bucket at this level)

- This essentially means that you are lending at a 50% LTV and will get liquidated if the price falls below $2000.

Another way to frame this is to think of the rate you lend at as a limit order (that earns interest while waiting to be filled) i.e., what price would you like to buy ETH at?

- Taking the above example, lending at $2,000 means that if the price falls to <$2,000 your collateral will be swapped for ETH at this price level.

- This will occur because when the lending price > market price, anyone can trade the borrowed tokens for collateral (at a profit).

The ‘red’ area has the most risk for lenders. As stated above, these will be swapped for collateral first, and anyone in this range should check their position regularly or move it down the range if they don’t want to risk having their deposit swapped for collateral. This might be a strategy used by somebody who wants to buy a token at a particular price level while earning some yield and waiting for prices to fall.

If your intention is to buy a particular token with your holdings and earn a yield while waiting for prices to go down, you can use Ajna in the highest range.

The ‘green’ area is ready to be used but is not actively lent out. For this reason, it still accrues interest.

The ‘grey’ area earns no interest since there is no meaningful liquidity provisioning.

Note that these areas represent a given price point at a given point in time. As we all know, crypto prices move constantly, and sometimes significantly. This means that people who deposit in an active range may quickly not be earning yield if the price moves up and their liquidity then becomes inactive. Also, even liquidity in the ‘grey’ area one day could move to the ‘red area’ and even liquidation depending on price movements. Therefore, lenders should monitor their positions as per their strategy/aims.

Lender Fees

A fee is charged if the deposit is below the lowest utilized price (worth 24h interest). This is to discourage users from depositing below productive levels. Lenders are subject to a small fee of 8 hours of interest when making a deposit. This is to mitigate MEV attacks and it accrues to the pool’s reserves. This fee is charged on all new deposits and any action that moves the quote token price downwards.

Lender Actions

Lenders may want to actively manage their position; moving their deposit to different buckets. For example, when the collateral price falls, users may want to deposit further down the range. Conversely, when the collateral price rises, users may want to deposit further up the range to increase their earnings.

Lender Risks

Bad debt can occur if nobody bids on the liquidation of collateral. This is a risk that lenders need to take into account when lending against more illiquid assets. They risk losing some or all of their capital in these situations. However, the rationale for lending in the first place is that the lenders are long-term buyers of the collateral and are happy to buy the collateral at the price they pick beforehand. So in a sense lenders are the floor price. There are also arbitrage mechanisms to assign the collateral to the lender who picked the best price. Note that bad debt only gets into the system when the collateral is truly worthless and an arb bot doesn't want to win a small piece of the collateral to assign the collateral to the appropriate price buckets

Lenders should also bear in mind they will not be able to withdraw if doing so would move the LUP below the HTP e.g. causing one or more other loans to move into liquidation range.

If the market price goes below their deposit price level the collateral can be traded for the lender’s deposit.

AJNA Token

AJNA can be used to vote on which contributory protocols receive grant funding. They can be delegated for this purpose. There will also be token buybacks and burns with excess reserves.

Value Accrual

AJNA has a buy and burn value accrual mechanism where excess pool reserves can be purchased with AJNA tokens via dutch auction. The bidder will receive the quote token e.g. USDC and Ajna receives and burns the AJNA. Anyone can trigger a reserve auction and the incentive to do so is to receive the reserves at a market discount.

This week, a reserve auction for $527k DAI has been triggered. AJNA will be burnt in exchange for this DAI.

Tokenomics

One thing to bear in mind is that a high proportion of the supply is reserved for insiders (50%+) with a release schedule of ~1 year.

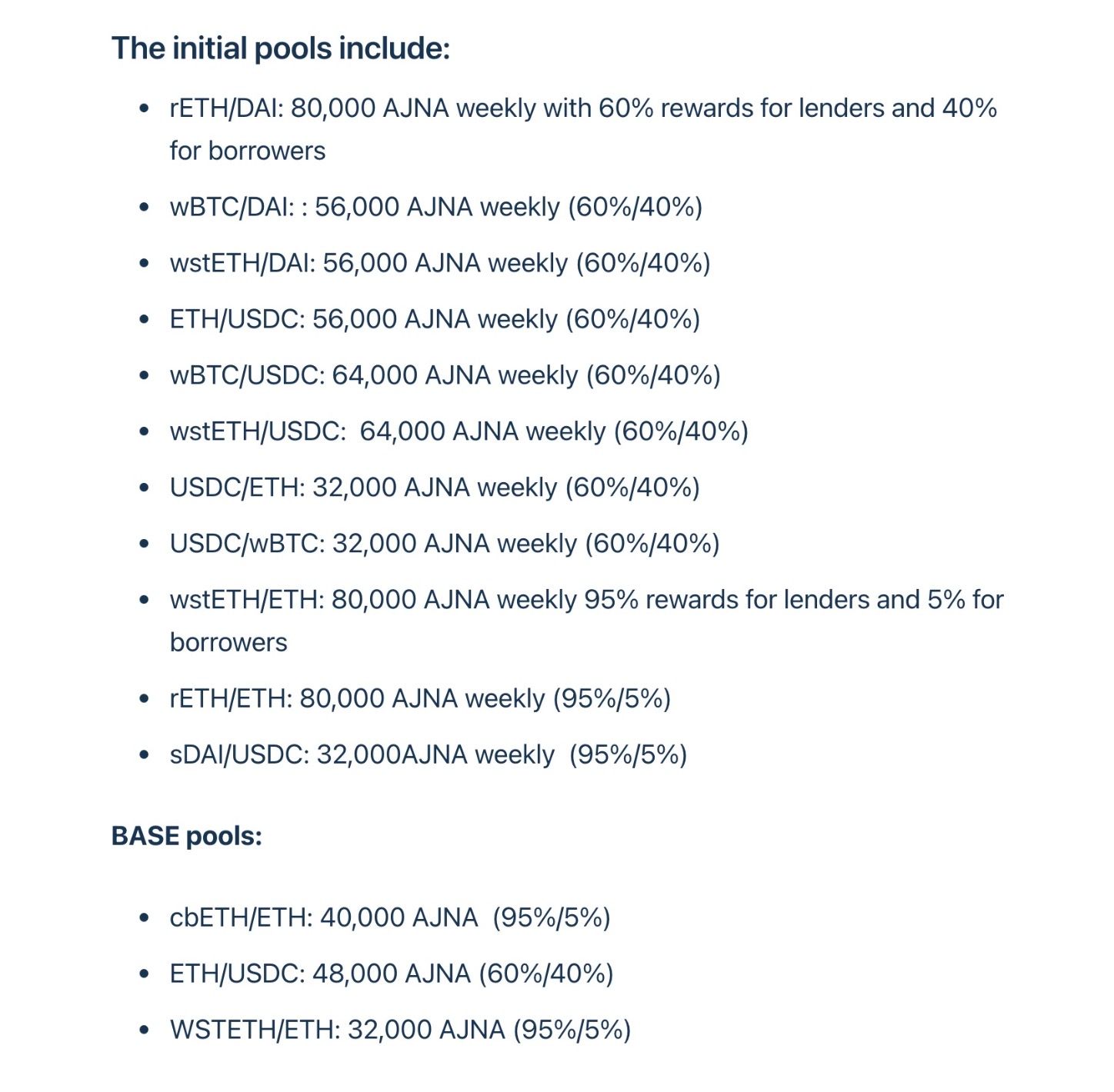

Initial Incentivized Pools

Liquidations

The liquidator posts a bond to prevent them from liquidating borrowers unfairly. This must be a minimum of 1% of the debt position being liquidated. The kicker receives a 1% bounty upon successful liquidation or forfeits the 1% bond if it was incorrectly called. This is measured by the value of the collateral sold in the liquidation.

So essentially, it will only be worthwhile liquidating a position if the liquidation price is met.

Liquidation kickers are independent entities that know the real-world price and the "Neutral Price" of the loan. If the external market price is below the Neutral Price, the kicker is incentivized to kick the loan into auction. If the kicker was correct that the auction clearing price was below the Neutral Price of the loan, the kicker could potentially double their posted bond. The basic idea is oracles can be manipulated, but here an independent agent monitoring the price has to put up a bet saying the external market price is below the Neutral Price. By removing Oracles, the lending system is more scalable in terms of accepting different Collateral and Borrow tokens. Note the lender is also incentivized to be a kicker since they are also at risk of falling Collateral prices.

For example:

- BTC is at $50,000 (collateral)

- USDC is the collateral (quote token or borrowable token)

- The liquidation price of a loan is $37,000

- You lend (USDC) at $35,000 (price level)

What can unfold:

- If the price falls below $37,000 then it will be profitable to liquidate the highest threshold loan.

- You cannot add or withdraw collateral until the liquidation process is completed (Ajna estimates this taking up to 6 hours).

- The reason that liquidations take around 6 hours is because the liquidation occurs as a Dutch auction, starting at extremely high prices. This is done due to the lack of pricing feeds. Someone will purchase the collateral when it falls to a fair value range.

- When the liquidation is over you can withdraw tokens.

- If the price continues to go down the collateral will remain frozen as additional liquidations occur. If it goes below your liquidation price of $35,000 then the $35,000 USDC collateral will be traded for BTC - and you will be left holding BTC. This is why lending on Ajna can be viewed similarly to a limit order.

What if Liquidation Doesn’t Recover All Debt?

If the liquidation does not cover the debt, then the loan’s threshold price pool reserves will cover the additional shortfall. If they cannot do so, then the most aggressive lenders cover the debt first and it works its way down until the debt is paid. This is generally not likely unless the collateral is worthless (which can often happen with degen coins) because the highest price buckets of lenders who deposit quote token are converted to collateral by incentivized arb takers.

Reserves

Pool reserves are the first line of defense for covering bad debt. Reserves come from:

- Origination fees

- Greater of 0.05% or 1 week’s interest

- Net interest margin

- Approx 10% of interest earned

- Penalties

Each pool on Ajna has its own reserve and is denominated in the quote token (token being lent).