Key Takeaways:

Tailwinds

- Leading on-chain fundamentals; Transactions on Arbitrum are averaging between 600-900k per day versus Ethereums at 1m and Optimism at 300k, Revenue has also been on a steady increase

- ARB is cheaper than OP of various valuation metrics

- Catalyst 1: Arbitrum staking proposal and its potential to reduce ARB supply (first redistribution of value to ARB holders aside from governance rights)

- Catalyst 2: STIP and indirect redistribution to protocol users on Arbitrum

- Catalyst 3: EIP-4844

- Catalyst 4: L3 and the development of a larger ecosystem on Arbitrum

Risks/Challenges

- 87% circulating token supply unlock in March

- Aside from the staking proposal, currently no mechanism of redistribution of value generated on-chain to ARB token holders

- L3 narrative needs Arbitrum to decentralize its sequencer cheaply

On-Chain Stats

Daily Transactions

Transactions on Arbitrum have been averaging between 600-900k per day, with some spikes due to inscriptions. Optimism, however, is averaging at about half of Arbitrum’s daily transaction count, at 300k-400k per day.

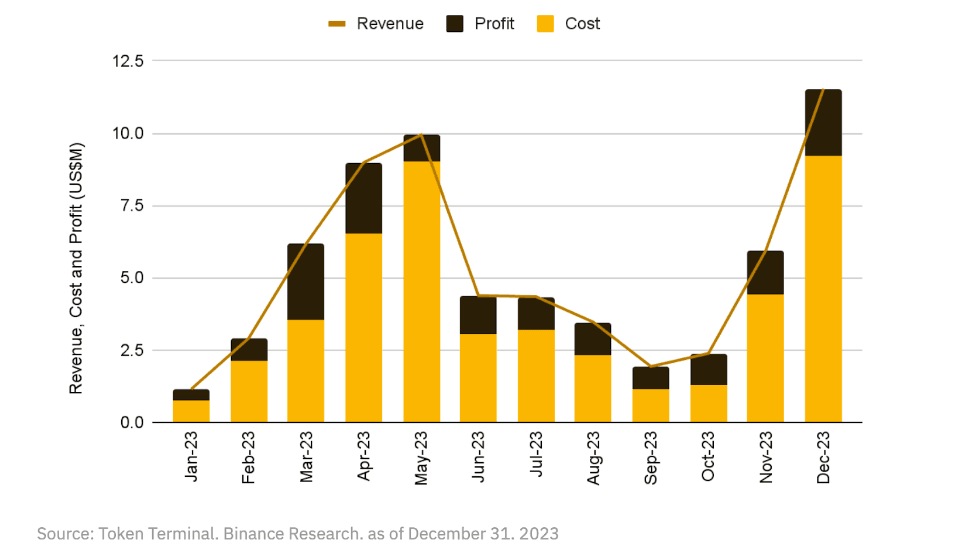

Revenue Generated

Arbitrum’s revenue has been on an upward trend since September, with the highest revenue generated in December ‘23 at $11.9M in that month alone.

The revenue generated from ARB alone is impressive. The question lies in whether the ARB value will be directly tied to its revenue at some point (e.g: through burning mechanisms or staking).

Arbitrum Tech

Arbitrum One is a rollup that uses Ethereum for Data Availability (DA) and has >$11b assets on the Layer 1. Arbitrum also launched its own DA layer called Anytrust, which has a data availability committee that Orbit chains can use for cheaper fees. Arbitrum Nova is the first chain to use Anytrust. Orbit is the latest product where developers can create their chains and can choose to settle on Arbitrum One or Nova.

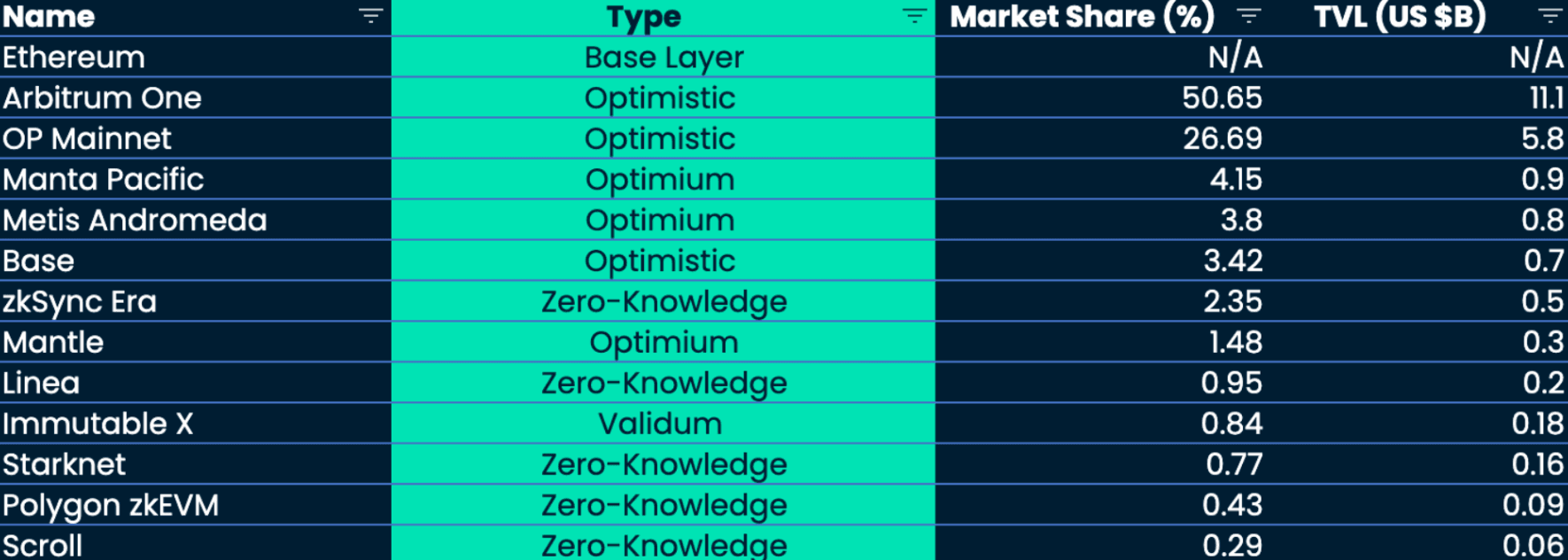

Optimistic Rollups capture a substantial portion of the rollup market by TVL , exceeding 80%. Arbitrum currently captures 47.66% of the entire rollup market share, with Optimism at 30%. The top 2 general-purpose L2 chains are caputuring almost majority of the market-share currently.

Note that TVL in the chart below refers to the total value locked in escrow contracts on Ethereum displayed together with a percentage changed compared to 7D ago. Some projects may include externally bridged and natively minted assets.

Competitor Analysis

- OP

- ARB

- Ethereum

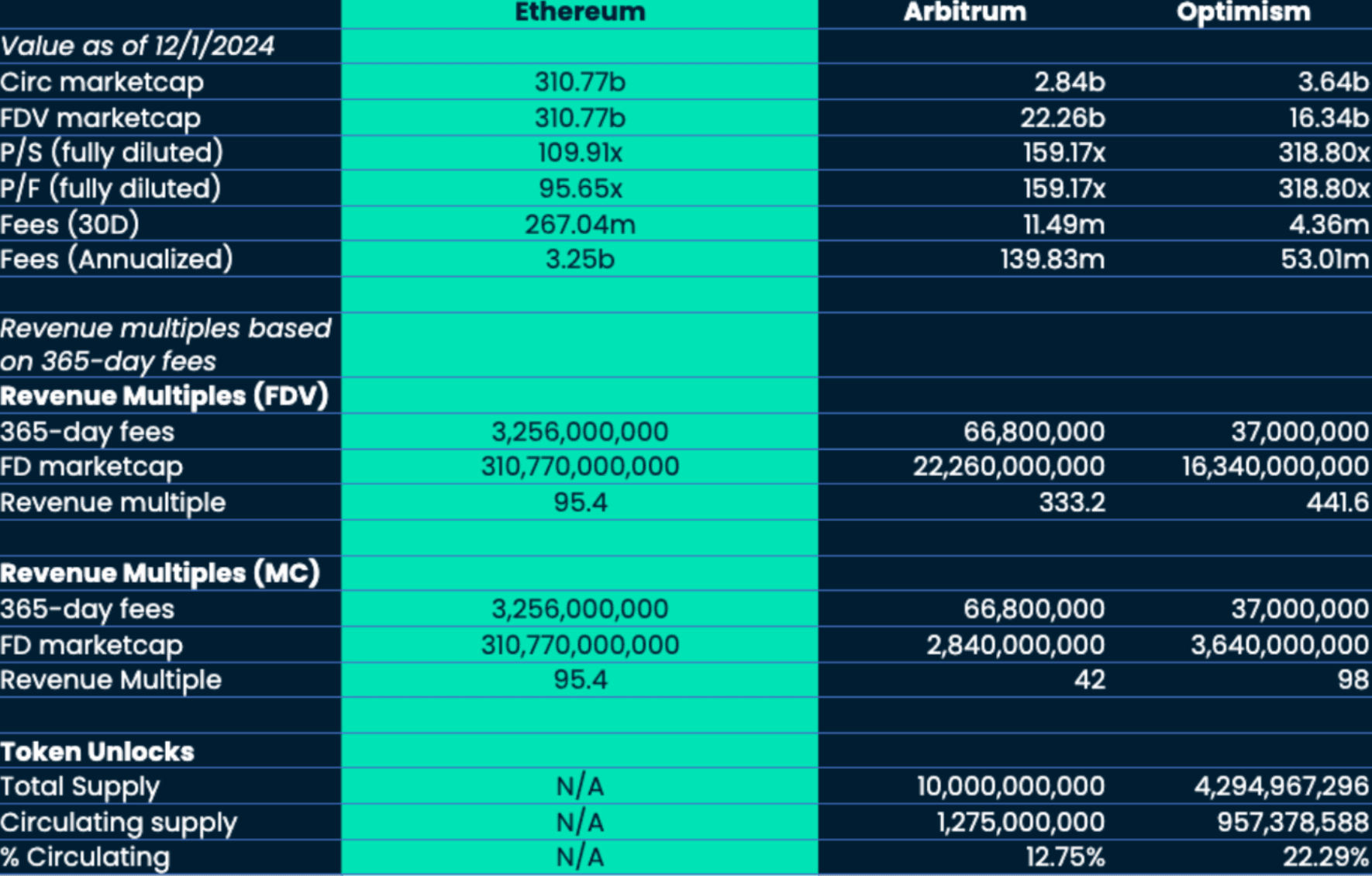

Fundamentally, Arbitrum is valued at ~2x lower P/S fully diluted market cap / annualized fees) and P/F (fully diluted market cap / annualized revenues) compared to Optimism. This may suggest that Arbitrum is slightly more undervalued relative to its cash flows. Arbitrum is currently generating 2x more in fees than Optimism, or $139.83m in annualized fees vs. Optimism at $53.01m.

Arbitrum currently has a higher FDV market cap compared to Optimism, $22.26b and $16.34b respectively.

One main concern investors are looking at is the upcoming token unlocks for both Arbitrum and Optimism, considering the fact that only 12.75% and 22.29% of their respective total token supply are currently circulating. On March 16, 2024, 1.11B ARB ($2.29b) tokens which represent 87% of their circulating supply is being unlocked. Many are speculating that this upcoming ARB unlock could potentially be “bullish” if market conditions improve leading up to EIP-4844 catalyst and other bullish ETH betas narrative.

Catalyst 1: Arbitrum Staking

There was a recent initial proposal passed to enable Arbitrum Staking, although the details are still unclear.

The proposal states to allocate $100M ARB as staking rewards that are distributed over 12 months. Since the Arbitrum STIP program is still ongoing, the introduction of Arbitrum Staking can help offset the increase in ARB supply that will be pushed on by the Short-Term Incentive Program (STIP) program.

Arbitrum’s Treasury is currently valued at $7.6B, denominated in ARB tokens, growing 2x since September 2023. The proposal encourages ARB token holders to stake their token and receive staking rewards that will align the ARB token performance with the community. It is worth noting that Arbitrum currently has one of the largest on-chain treasuries compared to any DeFi protocols. Another conflict for wanting to spend more of its DAO treasury goes to the point of Arbitrum potentially becoming forced sellers of ARB. This was a similar issue for Osmosis where the grants team is a forced seller of OSMO. A potential solution would be for Arbitrum to diversify their treasury with USDC and other assets.

Catalyst 2: Arbitrum STIP: Impact on Ecosystem Protocols

The Arbitrum Short-Term Incentive Program (STIP) was voted on in October, allowing protocols to apply and receive said incentives.The STIP rewards are expected to boost activity on-chian via several incentive programs by the beneficiary protocols.

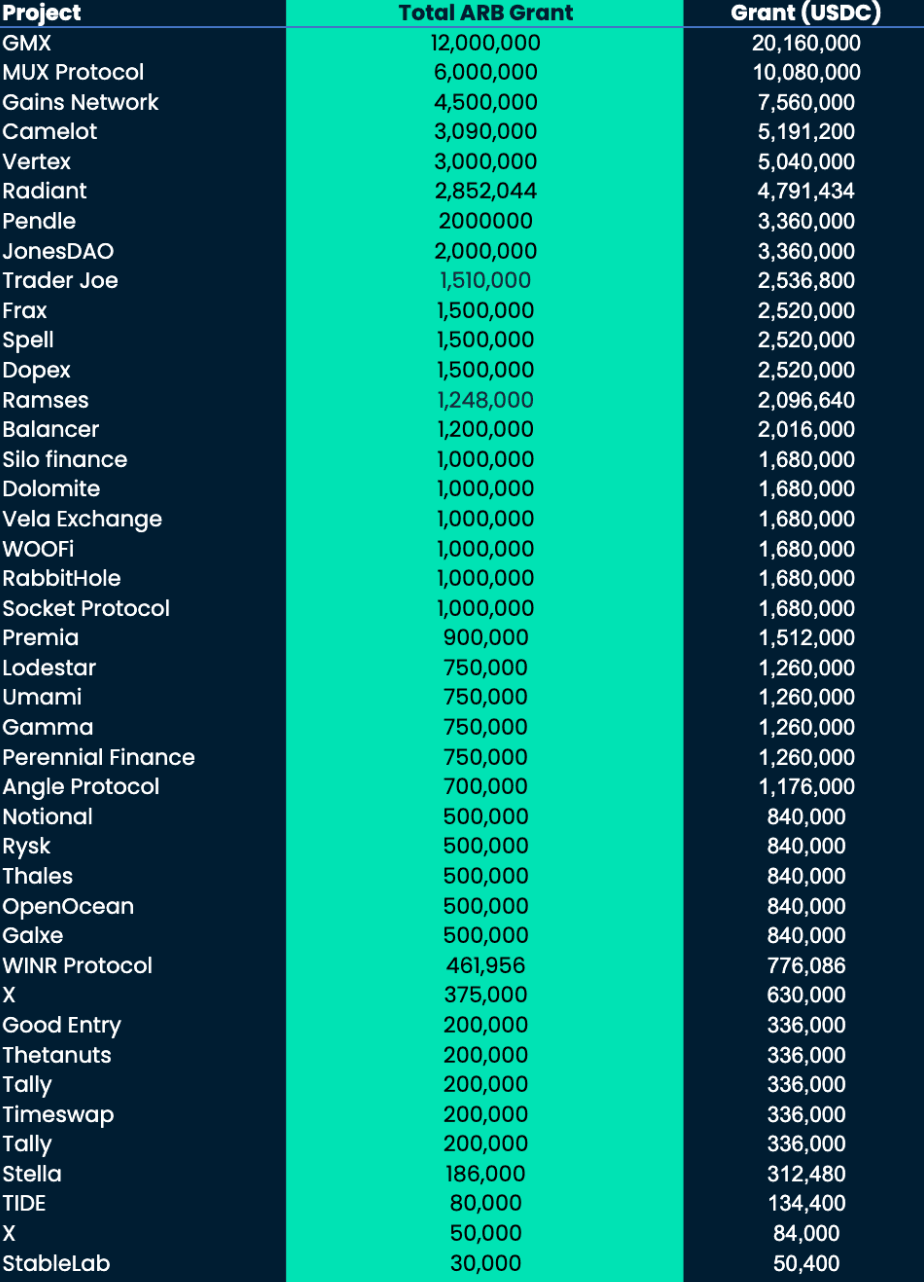

A total of 44 active grants were accepted, with a total grant amount of 61.6M ARB (~$103M). Over 62.5% of the STIP has been distributed (not fully claimed), while 53% of the total amount has been distributed and claimed by protocols.

In our analysis, we looked at the total ARB grant per protocol, grant value in ARB and USD, TVL at the beginning of the STIP and current TVL, grant/ TVL to assess the impact of STIP rewards and how significant the impact of STIP incentives has been so far, and the utility of STIP for each protocol.

On a high-level, perpetual derivatives protocol received 44% of the total grants, while DEXes secured 15% of the total allocation.

GMX received the largest ARB grant of 12M ARB, representing 20% of the total grant size, followed by MUX Protocol (10M ARB), Gains Network (7.6M ARB), Camelot (5.1M ARB), etc. The grant was first distributed to the protocols on Nov 8, 2023, and each protocol has different distribution timelines. In the case of GMX and the majority of the protocols, the STIP will be fully unlocked by January 26, 2024. For a few protocols like Gains Network, Ramses, Vela, etc. the full unlock date is on March 15, 2024. It is worth looking into protocols that have yet to fully utilize their STIP incentives.

Price performance of ecosystem tokens since the beginning of STIP program

In terms of the price performance of ARB ecosystem tokens, PENDLE had the highest return in the past 60 days (~Nov 16) of 48%, followed by Gains Network at 28%, Project Galaxy at 27%, Vela at 24%, and so on.

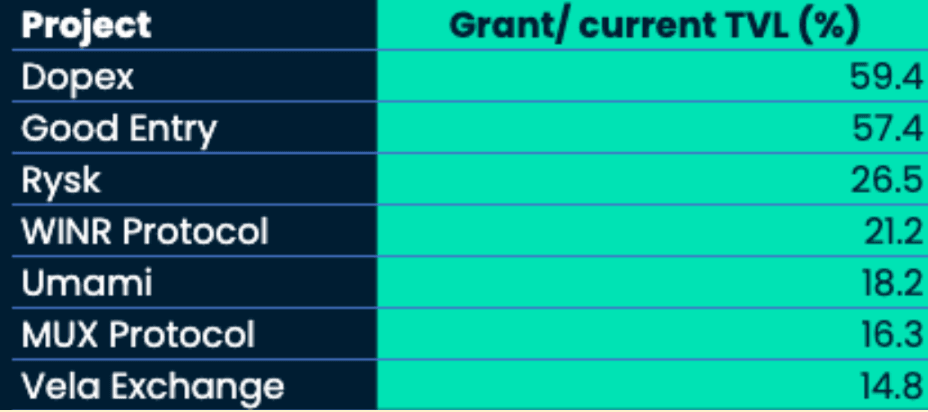

Grant / current TVL metrics

When we look at tokens with a high grant / current TVL ratio, signaling that the grant size can significantly impact the protocol positively, Dopex stands out at 60% of grant / TVL, followed by Good Entry, Rysk, Wynr, Umami, and MUX Protocol.

Catalyst 3: EIP-4844 Catalyst (Proto-danksharding)

EIP-4844 is a big step forward in Ethereum’s Rollup-centric roadmap and introduces “proto-danksharding”. The main feature of proto-danksharding is a new transaction type called “blob-carrying transactions”. Blobs are data types usually large in size, ~125kB, and often much cheaper than similar amounts of calldata. In addition, data blobs are pruned from the blockchain after 2 weeks. This is deemed long enough for L2 actors to retrieve the data and reduces state growth. In the case of Optimistic Rollups, they only need to provide the underlying data when fraud proofs are being submitted. “The fraud proof submission function would require the full contents of the fraudulent blob to be submitted as part of calldata. It would use the blob verification function to verify the data against the versioned hash that was submitted before, and then perform the fraud proof verification on that data as is done today.” The blob’s hash can be accessed via a new opcode, which guarantees that data content will never be accessed by the EVM and the gas cost of posting the data is significantly less than calldata. By reducing gas costs posted to the underlying L1, it should reduce the cost of optimistic rollups by 10-20x. Given that most of the transaction cost in optimistic rollups is from posting the calldata to L1, EIP-4844 will deliver far greater cost savings to Optimistic Rollups vs ZK-Rollups.

Despite the L1 fees dropping dramatically, there is no structural change in rollup/L2 fees. This means that if the L1 fees were to drop to ~5% of total fees, the rollup fees would still account for 95% of the fees. Hence, it is completely up to the rollups (like Arbitrum, Optimism, etc.) to determine what happens to the fees. If Arbitrum for instance chooses a flat fee of 0.1 gwei gas price as a floor, post-4844, the fees would only drop 2-3x instead. With current fees of about $0.03-0.04 per transaction, the fees would only realistically fall to ~0.01.

Catalyst 4: The Growing Success of Arbitrum Orbit / L3s

A key benefit of Arbitrum Orbit chains is the ability to use a protocol’s native tokens as gas tokens to limit the sell pressure of the said token. Normally, rollups would require ETH for data availability costs settled on L1, requiring the treasury to swap a protocol’s native token for ETH.

An example of a protocol building out its Orbit chain using AnyTrust is ApeCoin. There was a recent proposal, AIP-378, in collaboration with Horizen Labs to develop ApeChain on Arbitrum using APE as the native token. While this is still early stages of the proposal, it would be good to keep in touch on how the proposal progresses.

ApeChain will be developed as an Orbit chain using AnyTrust, which will rely on the DAC technology (partners for DAC: MagicEden, Darewise, LayerZero, Horizon Labs, and OffChainLabs). Having APE as a gas token can result in a few advantages for ApeCoin and Arbitrum:

The use of AnyTrust can help to limit the sell pressure of APE. If ApeChain were to operate as a standalone roll-up, they would likely need to pay gas fees in the form of ETH, which may result in the treasury having to sell APE for ETH. The introduction of a DAC enabled by AnyTrust allows the native token to be used for gas. Additionally, a custom gas token can also help ApeChain generate a new economy where APE can be used for staking, governance, and more.

Other projects building on Orbit chains:

- XAI Games

- XAI Games is an L3 chain that allows independent node operators to run nodes on the cloud, desktop, to ensure the integrity of State Rote as submitted to the Rollup Protocol. XAI sold 32.2k Node key NFTs through a batched dutch auction.

- XAI recently launched on Binance Launchpool, and is building a Web3 gaming L3 using the Arbitrum Orbit Stack. Offchain Labs is co-developing XAI Games with a gaming studio called X Populus. X Populus has worked on games and movies like Pixar, Blue Sky, Ubisoft, Disney +, etc.

- The ecosystem tokens rely on XAI & esXAI. The gas fees are paid in XAI token and burnt. If users swapped their XAI for esXAI, the total redemption duration is 180 days for a 1:1 unlock conversation, with a minimum redemption duration of 15 days. XAI is one of the only native tokens that launched on Binance launchpool that users can bet on for the L3 narrative. As L3s gain more popularity and interest, XAI token should follow a similar trend.

- XAI’s closest competition in the Arbitrum ecosystem is MAGIC, which is valued at $247M market cap, while XAI is sitting at $307M market cap.

- DMT

- DMT is another gaming-focused Orbit chain on Arbitum. Sanko Game is an interesting blend of Gaming and GambleFi with a SocialFi element on SankoTV, a Web3 streaming platform.

- DMT token is not available on CEXs yet, so if their trading volume increases and team ships, DMT could be a catch-up play to XAI.

- DMT is currently trading at $10M market cap and $18M fully-diluted value (FDV).

- Hytopia

- HYCHAIN is using Arbitrum’s Orbit technology to power its L2 game HYPTOPIA.

- HYCHAIN recently migrated to using AnyTrust. HYCHAIN, with a previously deployed mainnet that utilized Polygon's Edge technology, will be migrating to use Arbitrum's Anytrust technology to power their L2.

- MetaFAB merges into HYCHAIN. MetaFab is an API layer and serves thousands of API requests from gaming projects.

- There is an upcoming node sale for Hytopia, which is inspired by the demand and success of XAI’s sentry node sale.

L3s vs. Superchains vs. Cosmos SDK While L3s, superchains, and the Cosmos SDK stack will exist alongside each other,, it is worth questioning what the use-case for each of these technology stacks is and evaluating their likely outlook in the near and long-term.

Let’s start with the value proposition of the Superchain. Superchain is a horizontally scalable network of chains that share common security, communication, and open-sourced development stack. The superchain focuses on speed for deploying chains.

What will Superchains unlock?

- Standardized and secure underlying codebase: As more chains grow, contributing to the standardized codebase underpinning them, this makes the network more resilient

- Atomic cross-chain composability: Easy to seamlessly make transactions between each OP chains without needing bridging or intermediaries. Though, the probability of this happening is probably not until the next few years.

Role of General-purpose networks

- General purpose L2s are not that different from general purpose L1s. Once specific applications that leverage Arbitrum / Optimism / any other L2 stack mature, they will likely want to move to their own application’s specific environment (Examples are: MakerDAO, dYdX, Aevo, etc.). In this case, the likelihood of these applications moving to L3s is possible.

- These general-purpose networks will likely shift to becoming a communication hub between the various L3s.

- Arbitrum has already built out the Orbit infrastructure powered by AnyTrust, which other applications will have to offer down the line as their ecosystem grows. This gives Arbitrum a “first mover advantage” as the L3 thesis is being tested.

- ## Arbitrum L3s: Paving the way for L3s

- The issue with rollups today is the 7-day waiting period for transaction finality to happen on the L1, so the likely solution for interchain messaging is a set of shared sequencers.

- The introduction of L3s, like what is done on Arbitrum today, is a way to offset the 7-day withdrawal period. L3s chains built on Arbitrum Orbit can “settle” on the underlying L2s (other choosing between Arbitrum One, or Arbitrum Nova) instead of Ethereum L1. This benefits applications such as games that require speed and low latency.

Through Orbit, Arbitrum intends to support the following use cases for protocols looking to launch their own L3 chains:

- L3 Rollups: Launching L3 rollup-chains, similar to Abritrum One

- Layer-3 AnyTrust: Launching L3 AnyTrust Chains, similar to Arbitrum Nova

- Customizable Layer-3: Deploying customized L3 chain, built on Arbitrum Nitro, for application-specific needs. This includes components such as privacy, permissions, fee tokens, etc.

What’s next for L3s?

- Making validator roles “more permissionless” and exploring ways to capture MEV value within the ecosystem.

- Decentralizing the sequencer for L2s, while also making sure they are able to “decentralize cheaply”.

- Arbitrum has also collaborated with Espresso Systems to integrate decentralized shared sequencing technology. A significant component of this partnership is the development and integration of Timeboost, a transaction-reordering policy previously proposed by Offchain Labs. This design will become part of the Espresso Sequencer, which is a consensus protocol with features like the proposer-builder separation (PBS). Arbitrum is leveraging Espresso’s shared sequencer as a means to encourage more neutral platforms that can unite all of Ethereum’s rollups. The nature of the current L2 structure is the fragmentation of liquidity and users as more roll-ups come into existence. If each rollup builds its own interoperable stack, there will inevitably be more competition between these L2s.

What’s the Verdict for Arbitrum?

Arbitrum has demonstrated robust fundamentals and significant growth in its ecosystem. A series of key events are poised to positively influence the Arbitrum ecosystem, including the initiation of ARB staking, expansion of L3 Orbit Chains, EIP-4844, and the fruit of Arbitrum STIPs.

Despite investor concerns over imminent token unlocks and the ARB token's underperformance, ARB is strategically positioned as a frontrunner in the optimistic rollup sector, commanding nearly half of the total market share in rollups. Arbitrum has also been instrumental in advancing the Layer-3 narrative through its AnyTrust technology. While there is ongoing competition to determine the dominant technology (be it superchains or L3s), it is anticipated that different technologies will serve diverse needs.

Arbitrum has also proven to be extremely well-funded with over $7.6B in its treasury. Arbitrum can fully utilize its treasury to better serve the ecosystem and its token holders - whether this will come in the form of ARB staking, or other incentive programs, it will be an important step for the team to take.