Introduction

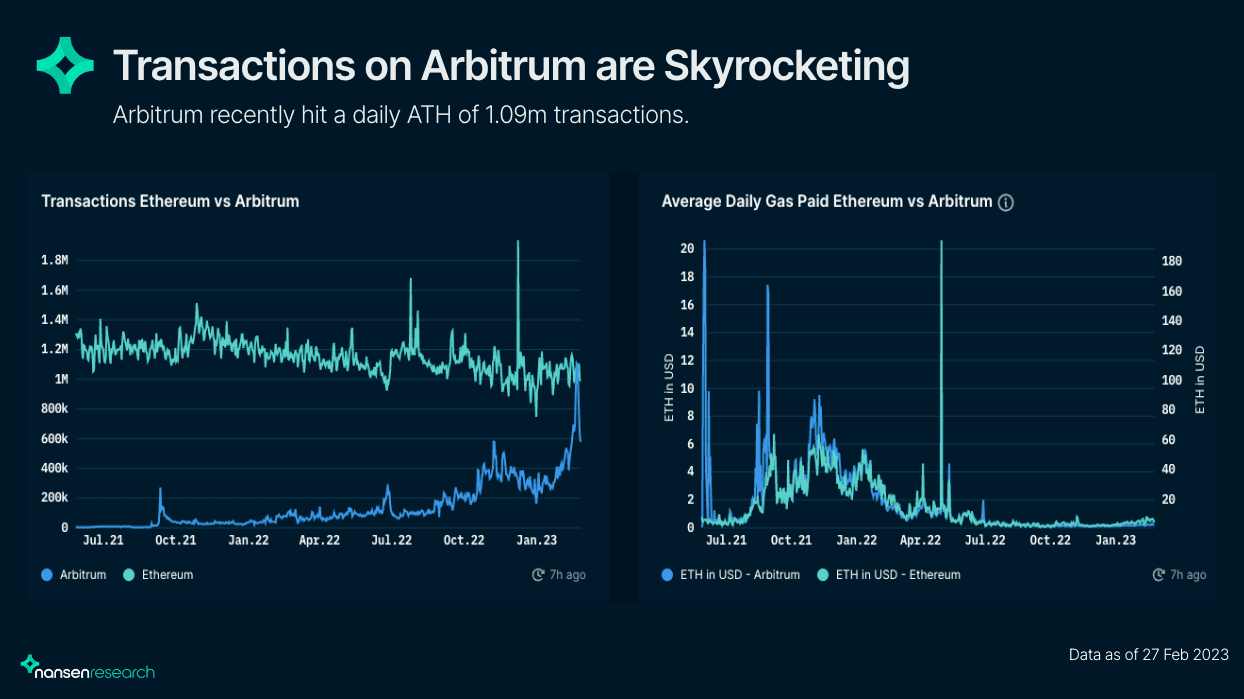

Arbitrum recently hit an ATH of 1.09m transactions per day (as of 27 February 2023), briefly surpassing Ethereum. In comparison, Ethereum is averaging between 1.1m transactions per day. As seen in the chart, daily transactions on Ethereum appear to be stagnant, while Arbitrum is consistently reaching new highs.

Real-Yield Protocols

Real yield refers to the distribution of yield to liquidity providers and token holders as an incentive to promote the growth of a protocol. However, to distribute such yields, the protocol must have a product that generates substantial revenue.

DeFi Summer in 2020 has demonstrated that without a good revenue-sharing model, token holders have no incentive to keep their assets, resulting in a vicious cycle of farm-and-dump approach.

Therefore, several protocols on Arbitrum, including GMX, Gains Network, and Radiant Capital, have incorporated revenue sharing into their tokenomics. These protocols are currently leading the way in implementing the real-yield concept on Arbitrum.

GMX

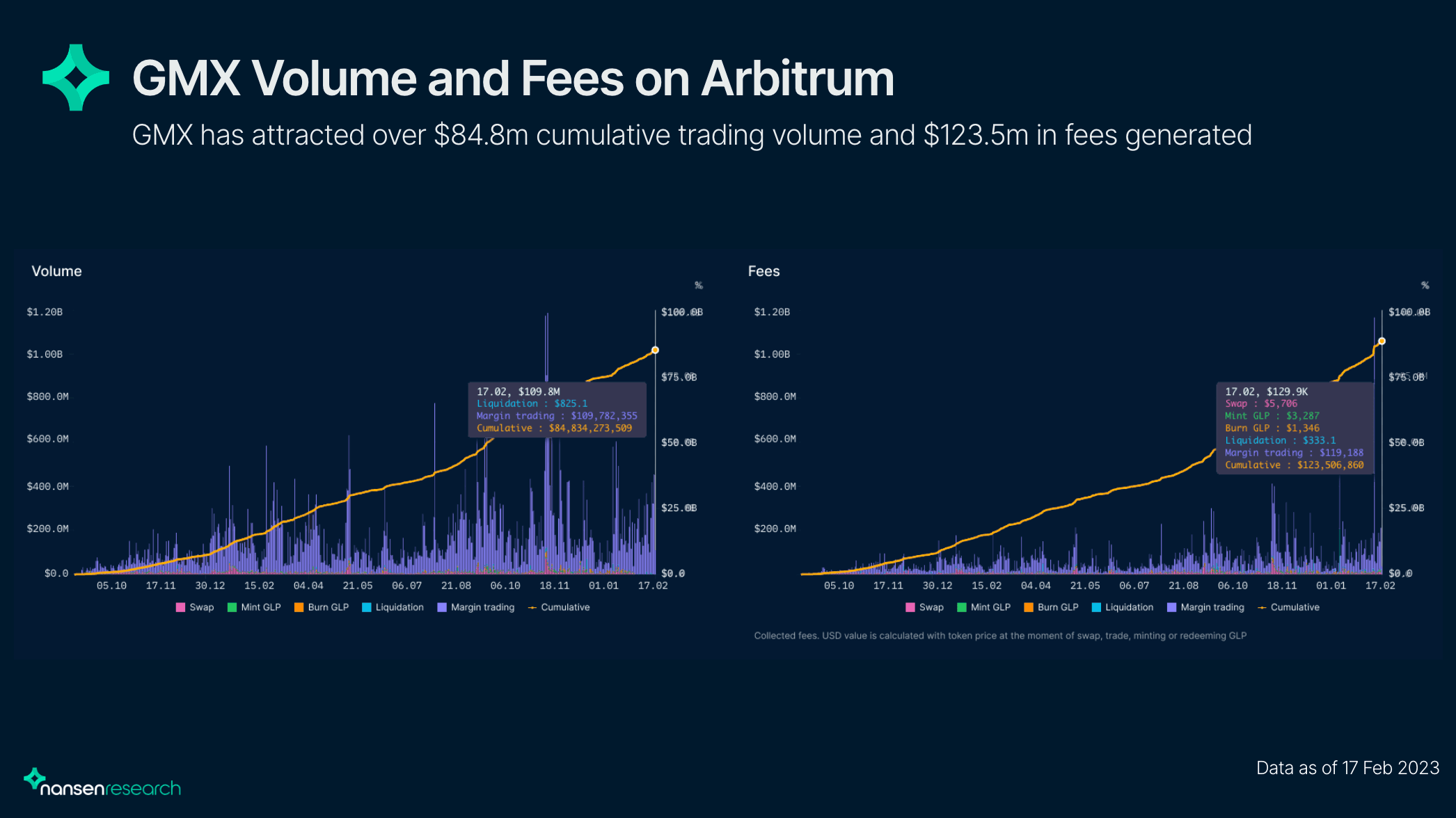

GMX is the biggest decentralized leveraged trading platform available on Arbitrum, with a trading volume of over $84.5 billion from more than 203k unique wallet addresses. Over its lifetime on Arbitrum, it has collected more than $123.5 million in fees. Users can trade ETH, BTC, LINK, and UNI on the platform with leverage of up to 50x. The protocol provides low swap fees, zero price impact on trades, and dynamic pricing supported by Chainlink Oracles. It also offers an aggregate of prices from top volume exchanges. The platform has two native tokens: GMX and GLP.

GMX token

GMX is the protocol's utility and governance token, which accrues 30% of the platform's generated fees. Fees earned from swaps and leverage trading are converted into ETH (Arbitrum) or AVAX (Avalanche) and distributed to GMX stakers along with esGMX and Multiplier Points, which can be compounded to boost the staking yield. Approximately 78% of the GMX supply is staked at the time of writing.

GMX has a forecasted max supply of 13.25m tokens, but this limit is not hard-capped. More tokens can be minted beyond the expected max supply but are subject to a 28-day locking period and will only be for liquidity mining for future products. The proposal will also need to pass the governance voting procedure beforehand.

GLP token

GLP functions as the liquidity provider token and is made up of an index of assets. GLP can be minted or burned to redeem any asset within the index. Instead of a traditional LP model, GLP allows LPs to provide liquidity without impermanent loss. Moreover, GLP holders automatically accrue 70% of the platform's generated fees plus esGMX rewards.

The price of GLP is determined by:

- Total value of underlying assets in the index

- PnL of traders on GMX

- Supply of GLP

Price = (Total $ value of index assets - Traders’ PnL) / GLP Supply

On Arbitrum, the GLP index consists of ETH, BTC, LINK, UNI, USDC, USDT, DAI, and FRAX, each with its corresponding weight. The token weights are adjusted to assist GLP holders in hedging against the platform's traders' open positions (and sentiment). If traders are, on average, profitable, then the profits from the price appreciation of index assets go to traders, and GLP declines in price. On the other hand, if traders are unprofitable, GLP will increase in price from trader losses. In other words, GLP holders are the house and counterparty to traders on GMX.

Staking Reward Mechanics

- GMX: Earns ETH/AVAX, esGMX, and Multiplier Points when staked

- esGMX: Earns ETH/AVAX, esGMX, and Multiplier Points when staked

- Multiplier Points: Boost ETH/AVAX APRs when staked

- GLP: Earns ETH/AVAX, esGMX, automatically staked on mint

Gains Network

Gains Network is the protocol developing gTrade, a decentralized leverage trading platform on Arbitrum and Polygon. gTrade was recently launched on Arbitrum but has quickly surpassed Polygon in terms of trading volume. Its synthetic leverage architecture allows for more capital efficiency, low trading fees, and a wide range of leverage pairs. Specifically, users can trade up to 150x leverage on crypto, 1000x on Forex, 100x on stocks, and 35x on indices.

The platform has processed over $3.8b in cumulative trading volume from 1,582 unique addresses and generated ~$2.69m in fees on Arbitrum, with most of the interest coming from crypto and Forex.

Liquidity Efficiency

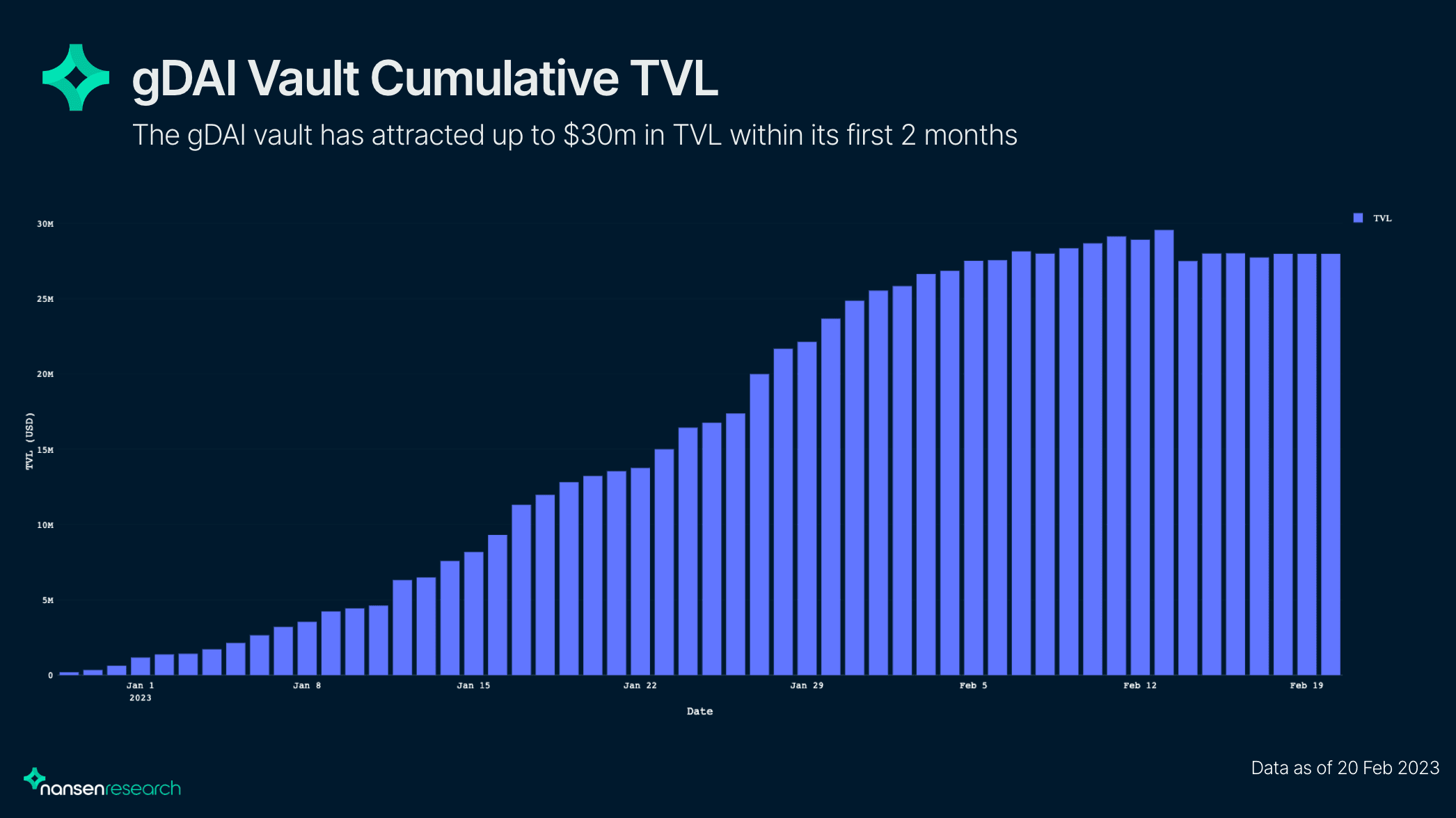

Gains Network's trading engine uses a single DAI liquidity vault (gDAI vault) for all trading pairs instead of an order book or segregated liquidity pools, making it much more liquidity efficient as the protocol does not have to build new liquidity for every newly listed pair. Furthermore, prices are determined by a custom Chainlink decentralized oracle network.

gDAI Vault

All trades are opened by supplying DAI as collateral:

- If the trader's PnL is positive - DAI is taken from the vault and paid to the trader.

- If the trader's PnL is negative - Protocol collects DAI collateral from the trader.

The gDAI vault is a yield-bearing vault in which gDAI shares (a yield-bearing asset) represent the underlying DAI asset and is the single source of liquidity for the platform. The platform's liquidity providers (gDAI vault depositors) receive a portion of the protocol's revenue through trading fees as yield for their capital. In addition, the APR also comes from collecting collateral from trader losses on the platform. Thus, as long as traders are generally losing on the platform, gDAI holders will earn a positive yield. gDAI vault stakers on Arbitrum are currently earning 16.78% APR.

The protocol has also employed some risk management strategies to protect LPs:

- Limit of 3 open trades per trading pair per wallet

- Max OI per pair

- Max open collateral per asset class

- Winning percentage capped at 900%

- 1-3 epoch waiting period for gDAI vault withdrawals

GNS Token

GNS is the native governance and utility token for the platform. The token supply is capped at 100m tokens, with an initial supply of 38.5m tokens. However, the current circulating supply sits at ~30.5m tokens, meaning that GNS has been net deflationary for the past 2 years.

This is because the gDAI vault has a certain over-collateralization ratio; any excess collateral from generated revenue allocated to the gDAI vault is used to burn GNS. As long as traders are, on average, losing, then GNS will be deflationary.

On the other hand, GNS is also used to backstop winning trades. If traders are very profitable, the protocol mints GNS (max inflation rate of 18.25%) to re-collateralize the gDAI vault as winnings are paid out to the traders.

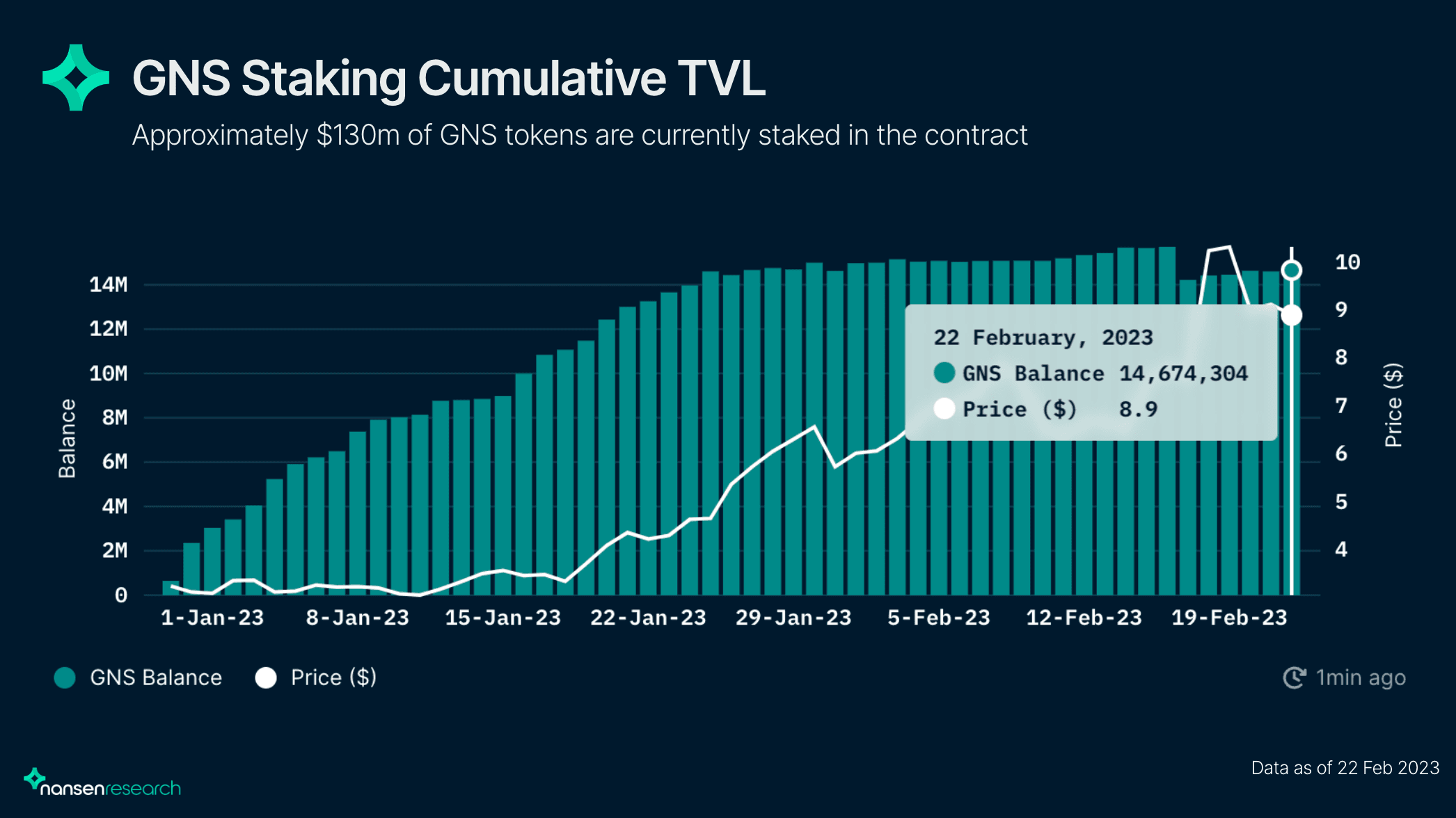

GNS Staking

GNS holders can stake GNS in the staking vault for real yield in the form of 40% of market order fees and 15% of limit order fees. The single-sided GNS staking APR is currently at 5.59% on Arbitrum.

At the time of writing, approximately 21.4m GNS tokens (~70.4%) are staked on across Polygon and Arbitrum. Although, 14.6m out of the 16.6m GNS supply on Arbitrum are staked, equating to 89.2% of the available supply on the L2.

GNS NFTs

Platform users can also purchase GNS NFTs (5 different tiers) on the secondary market. The utility includes reduced spread, rewards from executing liquidations and limit orders via a bot, and boost APR for GNS staking.

Radiant Capital

Radiant Capital is an omnichain money market platform where lenders can provide liquidity and borrowers can withdraw against collateralized funds. RDNT’s TVL is the 5th largest among all Arbitrum dApps and it is the leading borrowing/lending platform. Radiant v2 will allow for fully cross-chain borrowing, followed by the gradual rollout of additional asset pairs voted by the RadiantDAO.

On Radiant, users can deposit collateral on one chain and borrow various assets on a separate chain. For instance, users can deposit on Ethereum and borrow assets on Arbitrum. This allows for more flexibility between end-users and the ability for Radiant to capture deep liquidity without fragmentation.

In terms of how Radiant v1 captures deep liquidity within the platform, users can choose to either lock or vest RDNT. RDNT Vesters refer to users who want to receive platform fees while actively vesting. They also have the option of exiting anytime but will incur a small penalty. RDNT Lockers are bound to the 28-day time lock period, however, they get 50% of protocol fees as well as a share of penalty fees.

What’s different about Radiant v2?

- Updated tokenomics

Emissions have been reduced and RDNT lockers will receive 60% of protocol fees. 25% will be allotted to the base fee for lenders and 15% for the DAO wallet.

- Improved vesting schedule

On Radiant v1, users had to vest their emissions for 28 days and pay a flat penalty fee if they choose to exit early. Radiant v2 introduces a more dynamic vesting schedule that has been increased from 28 to 90 days. The vesting schedule happens on a linear scale and users can choose to claim 10-75% of their deposits if they choose to exit early at whichever timeframe.

DEX Wars

Uniswap and Sushiswap have already established a monopoly on cross-chain liquidity for popular pairs such as USDC/ETH and USDC/wBTC. It is only logical for ecosystems to have their own native decentralized exchanges (DEXs) to attract deep liquidity for users.

In the case of Arbitrum, Uniswap, and Sushiswap are currently the leading DEXs, with total value locked (TVL) of $114.28m and $124m respectively. Camelot has $36.5m in TVL, still lagging behind Curve, Zyberswap, and Balancer.

Camelot

Camelot is one of the latest native DEX on Arbitrum.

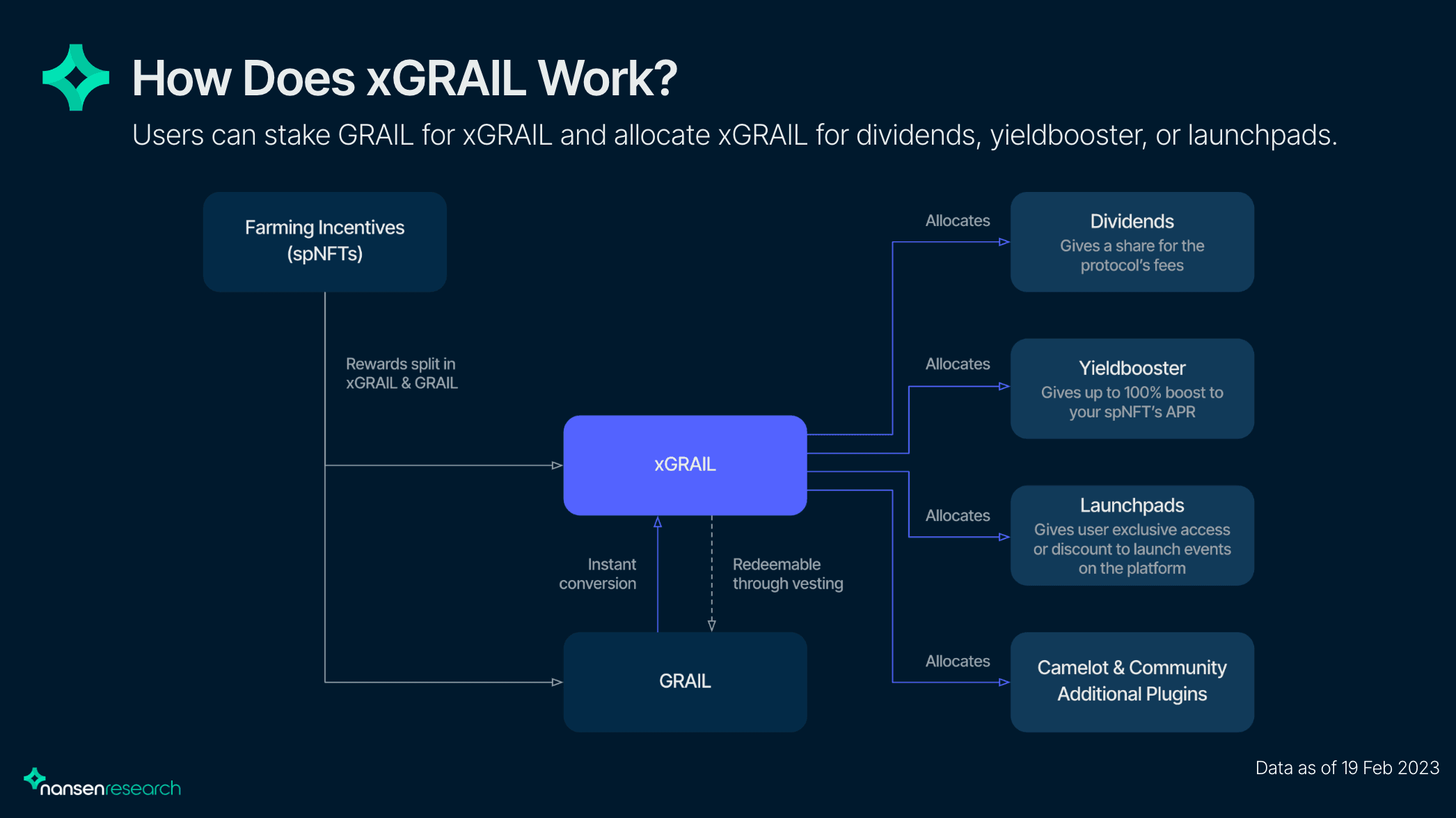

Tokenomics

- $30.5m circulating market cap

- 24-hour fees averaging between 0.3-0.5% of 24h volume

- 7d daily volume is averaging $14m, $21m high

- Daily fees $42k-$70k, and higher value annualized is $25m per year

- 35% of fees accrue to GRAIL: $8.75m annualized

- GRAIL's token lock-up incentive is designed to reduce the circulation of tokens. Higher fees and LP mining generated can incentivize users to lock GRAIL to xGRAIL.

Camelot is earning an annualized rate of $25 million in protocol fees, with $8.75 million returned to GRAIL holders in the form of 22.5% dividends and 12.5% buyback and burn. This is based on an average of $14 million in volume. As the platform grows and more liquidity is concentrated, volumes could skyrocket creating a flywheel effect.

What makes Camelot special?

Camelot has partnered with various protocols on Arbitrum to attract liquidity to its platform. Notable partners include GMX, JonesDAO, Umami, Buffer, Sperax, GMD, and Nitro Cartel. To incentivize liquidity providers, Camelot has offered favorable conditions. Genesis pledgers are equivalent to holding call options at GRAIL prices, and they will receive undiluted token rewards for 6 months in addition to the yields. This mutually beneficial situation rewards early stakeholders and creates sticky liquidity to bootstrap the platform.

Deflationary mechanics

- 12.5% of swap fees are used to purchase and burn GRAIL, creating continuous buy pressure. If swap volumes on their exchange increase, the protocol could become deflationary in the future.

Currently, other chains use a "bribe model" to incentivize liquidity providers (LPs). LPs are rewarded with token emissions. Camelot takes a different approach and focuses on partners and protocol-owned liquidity. Partners can earn 20% of the entire LP position and keep receiving dividends, providing an alternative to the traditional bribe model.

Zyberswap

Zyberswap is the first DEX on Arbitrum with an AMM. They are focusing on blue-chip trading pairs (e.g. ETH-USDC, USDT-USDC), whereas Camelot appears to be aiming to offer as many trading pairs as possible. They started off with a fair launch model for token distribution with a max supply of 20m and an initial supply of 10k. Zyberswap also recently announced liquidity integration with 1inch as well as growing submissions for protocols to launch on their native launchpad.

How does Zyberswap differ from Camelot?

- Zyberswap has 20% lower trading fee than Camelot, making it more attractive to traders and likely to result in higher volumes.

- Zyberswap focuses on blue-chip trading pairs, hence, deeper liquidity within those pairs. Currently, Zyberswap platform has about $80m in total liquidity versus Camelot at $61m.

- Fee switch model is as follows:

- 0.25% swap fees

- 0.15% to LPs

- 0.1% to protocol

- 0.25% swap fees

- Token burn is executed twice a day at 9:00 CET and 21:00 CET, utilizing platform-earned fees.

Trader Joe

Trader Joe is known as the go-to DEX on Avalanche. They recently started their omnichain expansion to Arbitrum and BNB Chain. Assets can also be bridged natively using Layer Zero bridge and Stargate soon.

Trader Joe is the leading DEX on Avalanche by some margin, with over $116m in TVL (including Trader Joe DEX, Trader Joe Lend, and Joe V2). Joe V2 however, has $22.6m TVL on Avalanche and $4.24m on Arbitrum despite only launching recently.

Tokenomics/ Analysis

- Circulating supply is almost at total supply (334m vs. 473m, respectively)

- Trader Joe earns protocol revenue through 3 distinct revenue streams:

- Swap fees - 0.05% of every swap is converted to USDC and distributed to staked holders

- Lending through Banker Joe platform

- PoL - Trader Joe owns 27.5% of JOE-AVAX Liquidity pool and receives 0.25% of swap fees on its holdings

- Modular staking - incentivizes more users to hold JOE

- rJOE- stake JOE to earn rJoe; rJoe is an entry token for the Rocket Joe launchpad

- sJOE - all swap fee revenue converted to stables and distributed to sJOE holders; sJOE rewards are distributed daily

- veJOE - users stake JOE to accrue veJOE; veJOE is a vote-escrowed token

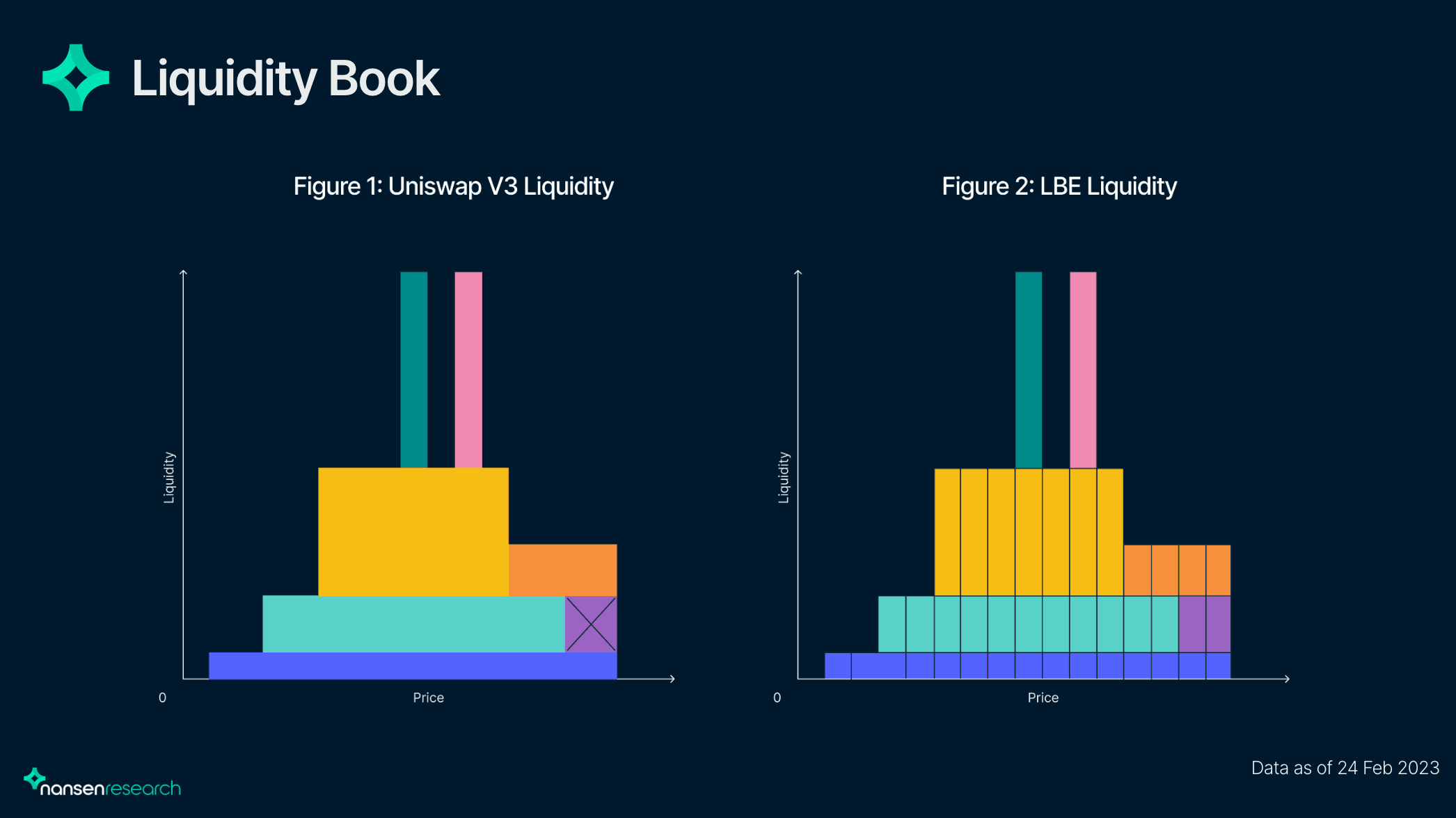

Liquidity Book and AMM

Trader Joe introduced a liquidity book AMM model which is a form of concentrated liquidity. Liquidity of an asset pair is bundled and stacked accordingly. The bin structure allows LP to allocate liquidity vertically across the market rather than horizontally as in the case of Uniswap v3.

How does this improve LPs experience?

- Allocating liquidity vertically gives LPs more flexibility.

- For example, if an LP wants to switch positions, they can add to the bins without necessarily exiting positions (switching positions in the horizontal structure makes LP re-pool).

- Addressing the issue of impermanent loss (IL).

- Variable fees allow LPs to be more comfortable with LP-ing in volatile markets.

Who will win the DEX Wars?

- The DEX with the deepest liquidity. Users are interested in where they can buy and sell their tokens in the most seamless way possible without having to pay inflated fees.

- Camelot utilizes project-owned liquidity which is arguably far more sustainable than other models.

- The DEX with the best partnerships. For example, GMX liquidity could move to Camelot resulting in LPs earning more. This would increase Camelot’s overall TVL as well.

- The de facto launchpad of Arbitrum: Whichever DEX manages to convince protocols to launch atop them will receive liquidity inflows to their platform. Some of the upcoming protocols launching on Camelot: Nitro Cartel, Factor, Perpy Finance, etc. Despite Camelot taking the lead so far on launchpads, Zyberswap is introducing its native Launchpad program.

The Arbitrum ecosystem differentiates itself in many ways, but one of the most exciting innovations is the shift towards incentivizing token holders without diluting the protocol's native token through various revenue-sharing models. Arbitrum-native DeFi primitive protocols like GMX, Gains Network, and Radiant Capital are paving the way for a more sustainable token design.

Similarly, the influx of capital into Arbitrum in recent months has seen both native DEXes, such as Camelot and Zyberswap, emerge as well as migration from existing DEXes, like Trader Joe, trying to attract liquidity to their pools. Although, it is still unclear which DEX will ultimately win the fight for liquidity on Arbitrum.