Introduction

Liquid staking and restaking have broadly been centered around ETH for most of 2024. Recently, this changed, with BTC entering the space thanks to projects such as Babylon Chain, Lombard Finance, and Solv Protocol.

With new BTC LSTs (Liquid Staking Tokens) and LRTs (Liquid Restaking Tokens), come new opportunities to earn yield on your BTC. Of course, there are many trust assumptions on who and where the BTC is sitting, along with the smart contract risk, associated with staking intermediation. However, we feel these new projects offer a strong alternative to wBTC for BTC holders to use their BTC more productively throughout DeFi without custodial risks while also earning a native yield on their holdings. With wBTC having a market cap of over $10b on mainnet, we believe these solutions provide a reliable way to unlock the broader potential of Bitcoin's $1.4 trillion market cap on-chain. Currently, wBTC represents only 0.74% of Bitcoin's total value being utilized on-chain. But what if we could unlock an additional 20% or more ($276 billion at today’s prices), similar to Ethereum, where 28.32% of ETH is currently staked, through more trustless and secure options?

Enter LSTs and LRTs built atop Babylon.

LSTs and LRTs

Babylon

Babylon is the main project building the core ‘staking’ feature for Bitcoin holders, laying the foundation for LSTs/LRTs to be minted and used onchain. Babylon is a standalone PoS chain built in the Cosmos ecosystem and has been around for many years and raised quite a bit in funding, with a fresh $70m round led by Paradigm in May 2024. With this being said, there is no token associated with Babylon yet, and the protocol is currently offering a points program for investors who stake with them. To speak to Ethereum users in terms they will understand, Babylon is to Bitcoin what Eigenlayer is to Ethereum - it unlocks BTC as an asset to secure many new types of applications through restaking.

Where Are We Today?

So far, Babylon has been the clear leader as the leading “vendor” for creating LSTs such as Lombard. A few weeks ago, Babylon increased the caps of the amount of BTC staked to nearly 24,000 bitcoins, which has allowed many of the LST providers to mint more tokens and start earning points. These new solutions such as Babylon offer a way to “stake” BTC without the risk of bridging or wrapping your bitcoin with a centralized provider. However, it is very early in the project timeline, and there are many risks to consider, including smart contract risk, the road to decentralization of the PoS layer 1 chain, and slashing risk, amongst others.

How Does Bitcoin Staking Work?

In simple terms, BTC holders can lock their Bitcoin in a trustless, self-custodial staking vault for a set period. In return, they gain voting power in the underlying PoS protocol and earn staking rewards (currently awarded as points). The staking code has been open-sourced and is undergoing security audits. Voting is handled by 'finality providers,' which any BTC staker can create. Stakers can choose to self-delegate or delegate voting power to a third party. However, slashing conditions are in place to penalize finality providers that attempt to undermine the PoS system, so it's essential to conduct due diligence when selecting third-party providers.

In short, Babylon allows BTC holders to use their BTC onchain with the following core features:

- Trustless staking

- Self-custodial BTC staking with no bridging or custodians

- Fast unbonding of the staked bitcoins

- Uses a Bitcoin timestamping protocol to allow for faster unbonding periods (around 7 days)

- More secure than alternative centralized platforms

- However, there are concerns with how to decentralize the underlying PoS chain and bootstrap a validator set.

- Access to LSTs and LRTs with native restaking rewards

- Similar to stETH with its native yield

Babylon unlocks a new way to bring BTC onchain, and the caps have been reached, but where is that staked BTC, and what can users start doing as of today?

We will cover the top 2 finality providers by their BTC delegation:

- Lombard

- Solv Protocol

Lombard Finance

Lombard is a liquid staking provider built on top of Babylon with their token LBTC. LBTC has a native staking yield via Babylon and can be used onchain in protocols such as Pendle, Morpho and other apps. Since its launch in August, LBTC has accrued a market cap of $721m and has over 10,300 LBTC minted across 13k+ users. Much of this is active in DeFi via eBTC (EtherFi’s LRT) and Pendle. Liquidity is growing on Curve and Uniswap, with around $33m in TVL, paired mainly with wBTC, though volumes are not very significant at the moment.

If you have LBTC, there are a few ways to put it to work to enter some yield via the speculative points or fixed yield in Pendle’s markets. The model for LBTC is similar to other LSTs for ETH and Lombard is one of the first movers getting LBTC entrenched in DeFi, similar to stETH.

At the time of writing, you can put your LBTC to work in a few places. The leading destination for BTC yield seekers is EtherFi.

- Pendle’s eBTC Market (EtherFi)

- EtherFi’s eBTC is a restaking BTC derivative. It is backed mainly by Lombard Finance and Symbiotic, mainly comprised of LBTC. Given the caps on Babylon, we may see the composition of this LRT shift more towards wBTC and other Bitcoin derivatives, which is something to note. However, at the moment, eBTC is just wrapped LBTC based on its current backing.

- eBTC allows you to farm 5-point programs in one. These include 1x Babylon Points, 2x Lombard LUX, 1x Symbiotic Points, 3x EtherFi points, and 3x Veda Points.

- Some users are speculating that the eBTC APR for points will range between 11% and 21%, as shown here.

- The fixed PT yield for this is 4.729% APY, maturing in 58 days with over $37m in liquidity.

- The fixed PT yield for the 29 March 2025 maturity is 6.98% APY, and there is over $19m in liquidity.

- Leverage Farm Lombard’s LUX points.

Solv Protocol

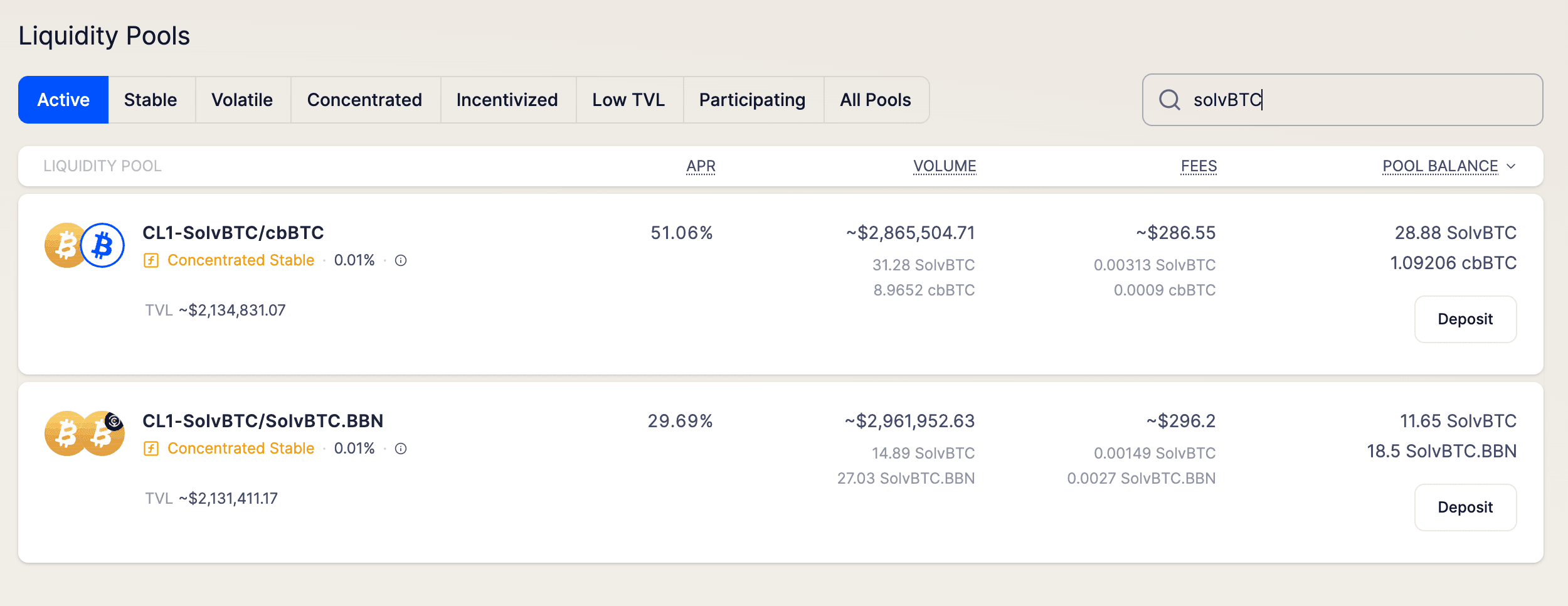

Solv Protocol is looking to bring Bitcoin staking to the masses through its Staking Abstraction Layer, which abstracts the complexity away from staking Bitcoin across many chains and its main product, SolvBTC. SolveBTC is a universal Bitcoin reserve token that has three LSTs, including those from:

The three LSTs above have different yield-generated strategies, but we will mainly cover the one from Babylon for this report. They have over 24,508 Bitcoin in their reserves at the time of writing. As for yields, we have noted the following.

- Pendle’s SolvBTC.BBN (Corn)

- From Solv Protocol, this BTC LST offers restaking yields from Babylon Chain as denoted by the .bbn ending.

- This market touches three underlying protocols: Babylon, Solv Finance, and Corn, a new L2 on Ethereum.

- This strategy offers 1x Babylon Points, 3x Corn, 14 Solv XP/$, or a fixed 7.23% APY with a maturity in 58 days with over $87m in liquidity.