Introduction

Base is a new Layer2, incubated by Coinbase. It is built on the Bedrock OP Stack and functions like Optimism in most ways. The L2 Chain is still in developer access and is still not live yet for the general public. Despite the limitations in access, it has already garnered huge interest due to a meme token frenzy that ensued, also known as the BALD token, and the exploit of LeetSwap on Base, the only DEX with a UI at that time. Although there were several negative implications that occurred once the BALD token deployer chose to rug, the strong backing by Coinbase combined with the technical support of the Optimism stack makes the chain well-positioned to attract a lot of users and builders and become a major player in the L2 landscape.

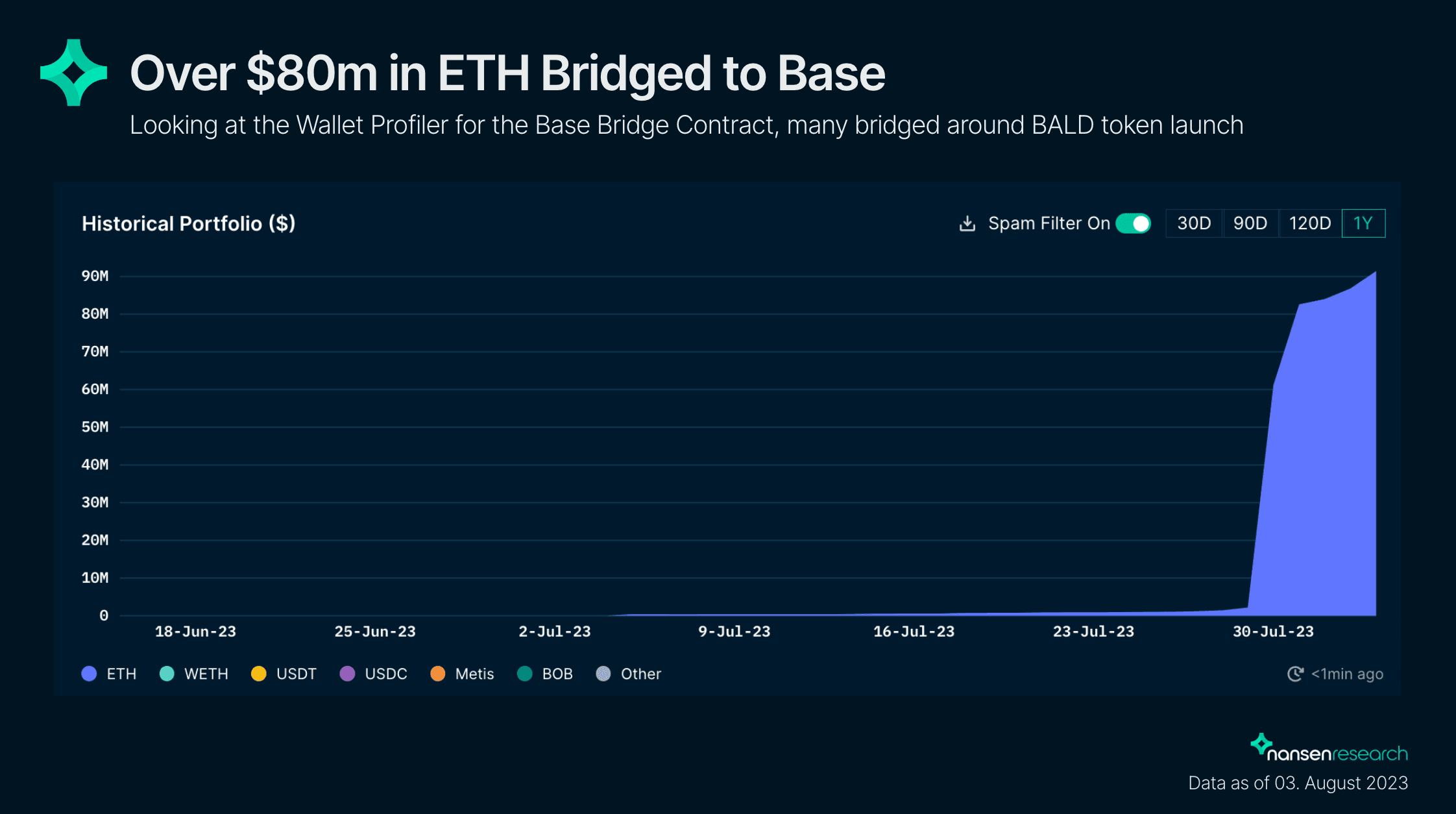

The chain goes live officially on 9 August, but the chain was technically already live for bridging since 3 Aug using their native bridge front end. Previously, bridging to Base was only possible via sending ETH to the smart contract directly, and bridging back was not yet enabled. It has to be noted though, that bridging back using the official bridge takes around 7 days, similar to the native bridges of Optimism and Arbitrum, but this can be circumvented by using third-party bridges like Orbiter or Synapse.

Technology and Vision

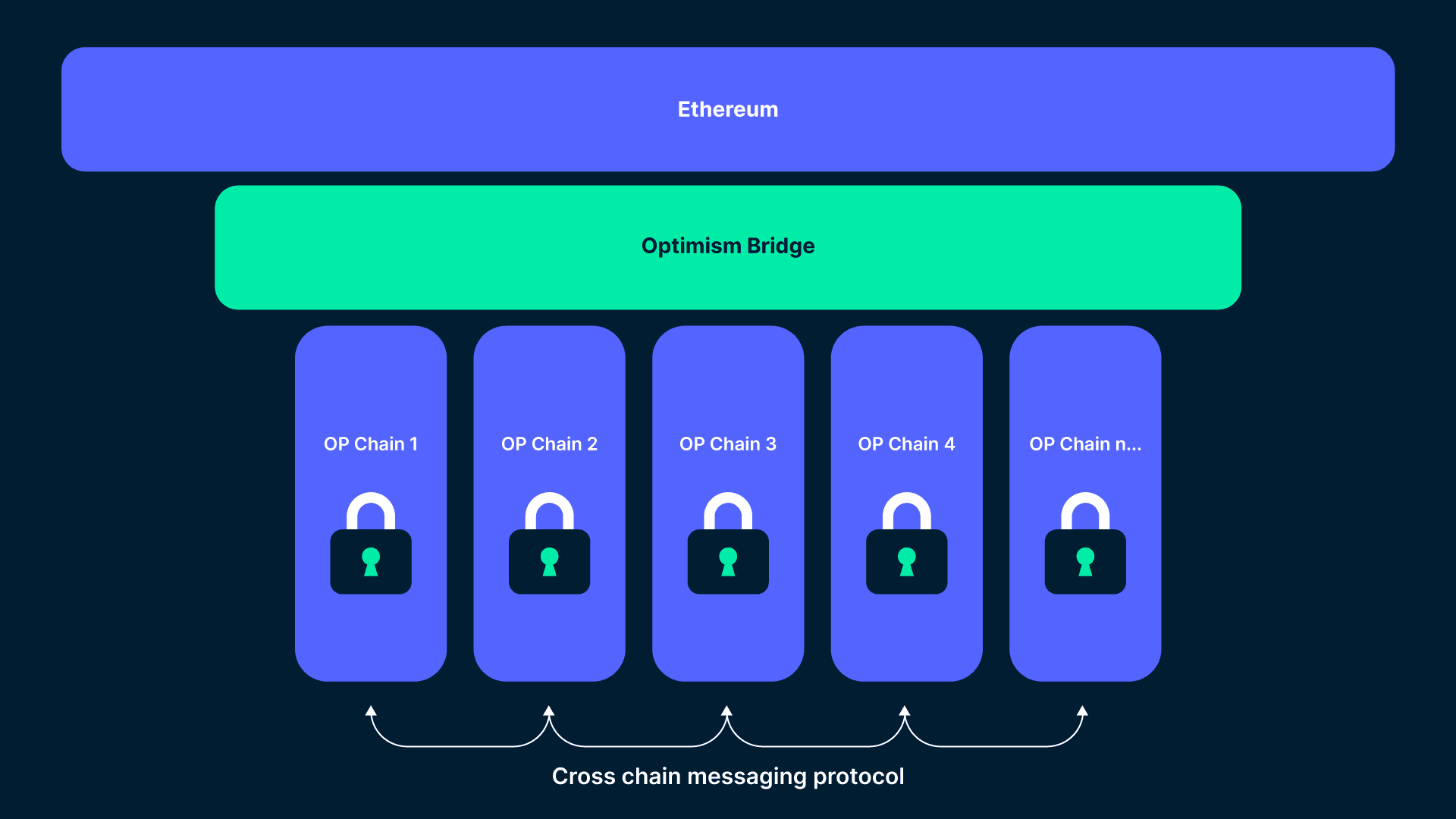

Base is built on the Bedrock OP stack, which is a collection of open-source, modular components to power blockchains like OP Mainnet. With this, Coinbase and Base effectively joined the ranks of the OP stack contributors, and the technical improvements and roadmaps of Optimism and Base are expected to be closely intertwined.

Currently, Base is built very similarly to Optimism, a straightforward optimistic rollup on top of Ethereum. Additionally, it starts out quite centralized, coming out of Coinbase which runs the only sequencer at the moment. This is not unusual, as this or something similar is the case for most L2s, especially after launch. Base did however commit to a plan towards decentralization and strive to fully decentralize by 2024.

The future of the OP stack, and hence Base, will most likely look more modular. Bedrock already abstracts the proof system from the OP Stack enabling it theoretically to use both optimistic or zk fault proofs in the future (or even some sort of hybrid solution) as stated during Jesse Pollak's presentation on EthCC 2023. According to the vision of the OP stack, one could even imagine replacing Ethereum as a data availability layer with something like EigenDA or Celestia further down the line or even the EVM as an execution layer with something else.

The next big step after Bedrock would be a Superchain, which would merge Base, Optimism Mainnet, and other OP chains into a single network of chains that share bridging, decentralized governance, upgrades, a communication layer, and more.

Recent situation

Although not officially open to the public, the first meme coins and projects started to launch on base through developer access anyways. Wanting to get in early, end users also made use of the developer access, bridged assets, and played around with the tokens.

BALD

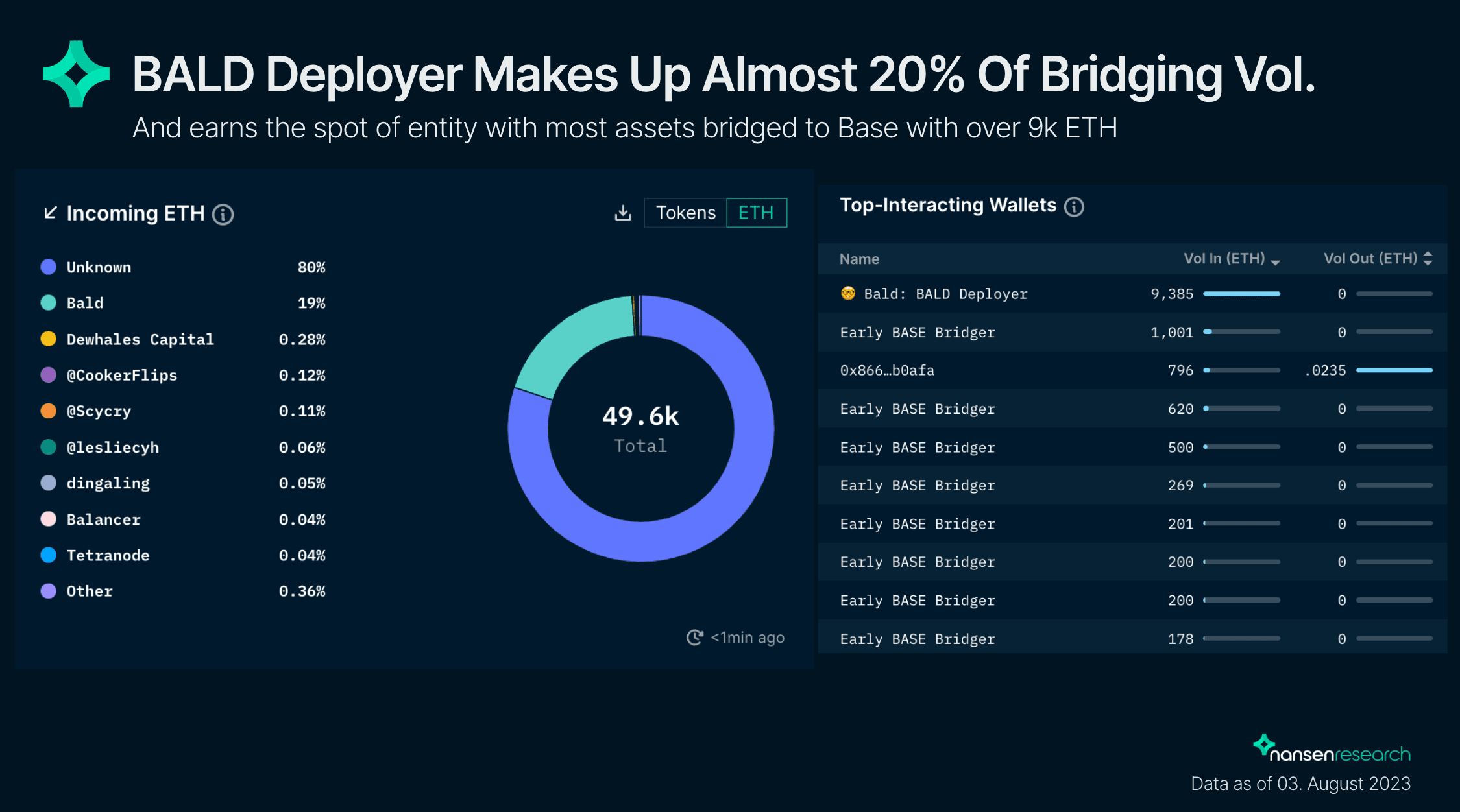

The most prominent example of this is the BALD token. An anonymous person deployed the token on Base on 29. July 2023, and created an ETH / BALD liquidity pool on LeetSwap. Later the deployer started adding thousands of ETH liquidity to this pool. This, and the Deployer’s large token positions in DeFi governance tokens and large transactions with cbETH led people to even believe the Deployer was linked to Coinbase at some point, even further strengthening faith that there might be something more to this token. Although the bridge did not even have a front end yet and there was no way to bridge back, bridging activity spiked, and around $80m worth of ETH was bridged just within two days.

Since the liquidity was so deep (~$10-15m, most of what the BALD Deployer had bridged at the time), people not only began to buy into the token in small amounts, but they began to buy in size. The deployer kept adding more and more liquidity, and people started to become more and more euphoric.

The token hit a peak of over $82m market cap until the deployer started removing large amounts of the liquidity. This led to BALD holders losing faith in the token and selling into the now shallow liquidity compared to the very high market cap. Consequently, the token price collapsed substantially. Who is behind the mysterious BALD deployer is still up for speculation, but it has to be someone with substantial funds to even provide this much liquidity in the first place.

However, it has to be noted, that the largest bridger to Base at the time of writing is still the BALD deployer himself.

LeetSwap

LeetSwap the DEX on which BALD was traded, got exploited just days later after the BALD Deployed removed liquidity. With many more users losing money on Base chain before it even officially launched, this shed an unfortunate light on the chain. That being said, nothing of this had anything to do with the Base or Coinbase teams behind the L2 itself and is in itself no reason to distrust the chain in general.

Things To Do Now

As mentioned above, the Mainnet is not officially live yet for users, however, some tokens (mostly meme coins) are already deployed and tradable on Base.

From an official side, it is already possible to bridge to Base and to mint several Base NFTs for a limited time.

You can mint an “Onchain Summer NFT” until the 31. August by bridging to Base via https://onchainsummer.xyz/. You can add the network to Metamask using Chainlist

Once bridged, you can mint a “Base is for builders” NFT until 13. August 2023:

- Extract the “hidden message” from the Base Genesis Block which is “all your base are belong to you.”

- Sign the message from the Genesis block with your wallet here on Basescan by clicking “Sign Message” on the top right corner and copy the signature hash (no need to publish it).

- Head over to the NFT contract, connect your wallet to Basescan, click on the mint function, paste your signature hash, and click “write”

Possible Future Adoption

As L2s with innovative technology are popping up left and right (Mantle, Linea, zkSync, …), and the first generation of EVM compatible or even equivalent side chains or L2s are also still around (Avalanche, Optimism, Arbitrum, BNB Chain…), it will be hard to claim a spot in the limelight. There is a fierce, ongoing battle for liquidity, and strategies like attracting capital via a promise of a potential future airdrop or launching high-yield farms are unsustainable. If a chain does not find its niche, chances are it will not stay on top for long.

For Base, said niche is likely to be very retail-focused. It is uniquely positioned to onboard retail users, by leveraging the enormous customer base from Coinbase. The situation seems very similar to BNB Chain, where there will likely be a lot of retail money coming in directly from the exchange, and instead of an institutional focus, projects target the retail directly with more “fun” projects like NFTs, colorful forks, and meme coins.

Combined with a developer-friendly environment, basically enabling people to very easily transfer and fork projects from existing EVM-compatible chains, it is likely that a retail-centric ecosystem will emerge on Base. This would occupy a different niche than for example the more crypto-native ecosystem on Arbitrum and might profit from, and onboard a lot of Coinbase’s users instead of fighting for the same users and funds that are already active on other chains.

With the technical “backing” of the Optimism team and incubated by Coinbase, Base has a good chance to become a major player in the L2 landscape. It is well-funded and theoretically has a large retail user base it could tap into.

From the ease of transferring projects and ideas to the chain due to high compatibility with other existing chains to the large potential retail user base, the Base L2 is uniquely positioned to become a retail-focused chain like BNB chain, rather than a heavily crypto-native or institutional-focused chain. However, this is not necessarily a bad thing, as retail chains like BNB chain managed to onboard tons of new users, bring in fresh capital, and generate great investment opportunities for those involved early enough.

A good way to get in early is to monitor large deposits into the bridging contract using for example Nansen Smart Alerts and following the large bridger addresses. You can also check out who bridged how much already at Nansen’s wallet profiler for the ETH bridge.