Introduction

Camelot DAO put out a proposal on June 30th, “Accelerating Arbitrum - leveraging Camelot as an ecosystem hub to support native builders”. It proposes to grant 1.5M ARB per month (~9M in total) to the Camelot DAO for the next 6 months to fund liquidity incentives for Arbitrum-focused projects on Camelot. The proposal aims to support the protocols building on Arbitrum, and more importantly, foster the adoption of ARB as the base asset within liquidity pools and partner integrations.

Why Is the Proposal Necessary?

Deep liquidity is often missing in early-stage DeFi protocols, especially Arbitrum native protocols. All DeFi protocols can benefit from having deeper liquidity (e.g. lending markets, options, perps protocols, structured products, and more).

ARB is currently not used as the base asset for the ecosystem, as ETH is primarily used as the base asset for liquidity pools. The ARB token is mainly seen as a governance token with no utility, especially since gas is paid in ETH. This proposal aims to position ARB as the base asset for partner and protocol integration and to provide direct value and utility for the token.

Camelot is seen as the leading native DEX on Arbitrum and has deep connections with most of the established projects. Camelot has partnered with 30+ native projects on Arbitrum, building a deep moat for its ecosystem.

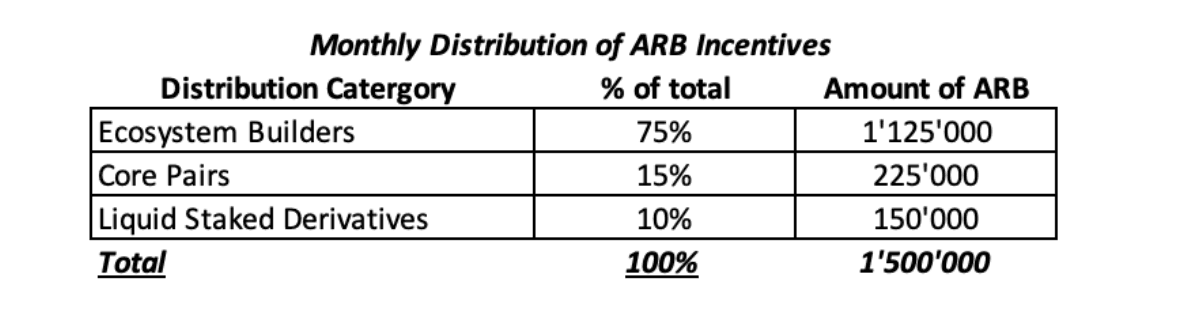

Proposed ARB Incentive Distribution

- Ecosystem Builders

- Liquidity incentives for partner pools like Vela, Pendle, Plutus, Jones, and other protocols.

- Core Pairs

- These are the main liquidity pools like ARB/ETH, ETH/USDC.

- Liquid Staking Derivatives

- Focused on different varieties of LSDs, most of which have little liquidity on Arbitrum.

Points “For” The Proposal

- 100% of the ARB requested will flow into LPs across the Arbitrum ecosystem and products.

No incentives are given to GRAIL or the Camelot team, and the proposal’s ultimate aim is to benefit the ecosystem. By providing incentives to partners that are building on top of Camelot’s infrastructure, they are diversifying the use of incentives to fuel further innovation and growth that benefits all partners and the broader ecosystem, whilst also deepening the underlying liquidity at the same time.

- Camelot is seen as the leading native DEX on Arbitrum, hence, it has proven to have a well-established track record to support other protocols.

Camelot is one of the only protocols that was willing to pair with ARB after the airdrop. The GRAIL-ARB LP has over $600k at the time of writing and is the largest native asset paired with ARB. The GRAIL price is also correlated with ARB, hence, the two tokens have high synergies with one another. Camelot is incentivized to properly allocate the 12M sustainably as it would negatively impact the price otherwise.

- ARB token will be used as the base asset and can further boost usage and utility for the token.

As mentioned above, ETH is primarily used as the base asset for liquidity pools.

Points “Against” The Proposal

- This proposal would unfairly place Camelot on a pedestal as the superior native DEX on Arbitrum.

If this proposal passes, Arbitrum DAO can be seen as biased towards Camelot versus other DEXs in the ecosystem. The L2 should be agnostic and prevent any preferential treatment towards any protocols. If Camelot does receive 1.5M ARB over the next 6 months as an incentive for its platform, this would place a higher barrier of entry for other DEXs and make it more difficult to compete.

In addition, this proposal places a further advantage on Camelot over other ecosystem DEXs asall revenue from the ARB DAO-funded emissions will go directly to GRAIL holders.

- A total of 9M ARB over 6 months is a hefty number and puts a high responsibility on Camelot DAO to distribute the ARB tokens fairly.

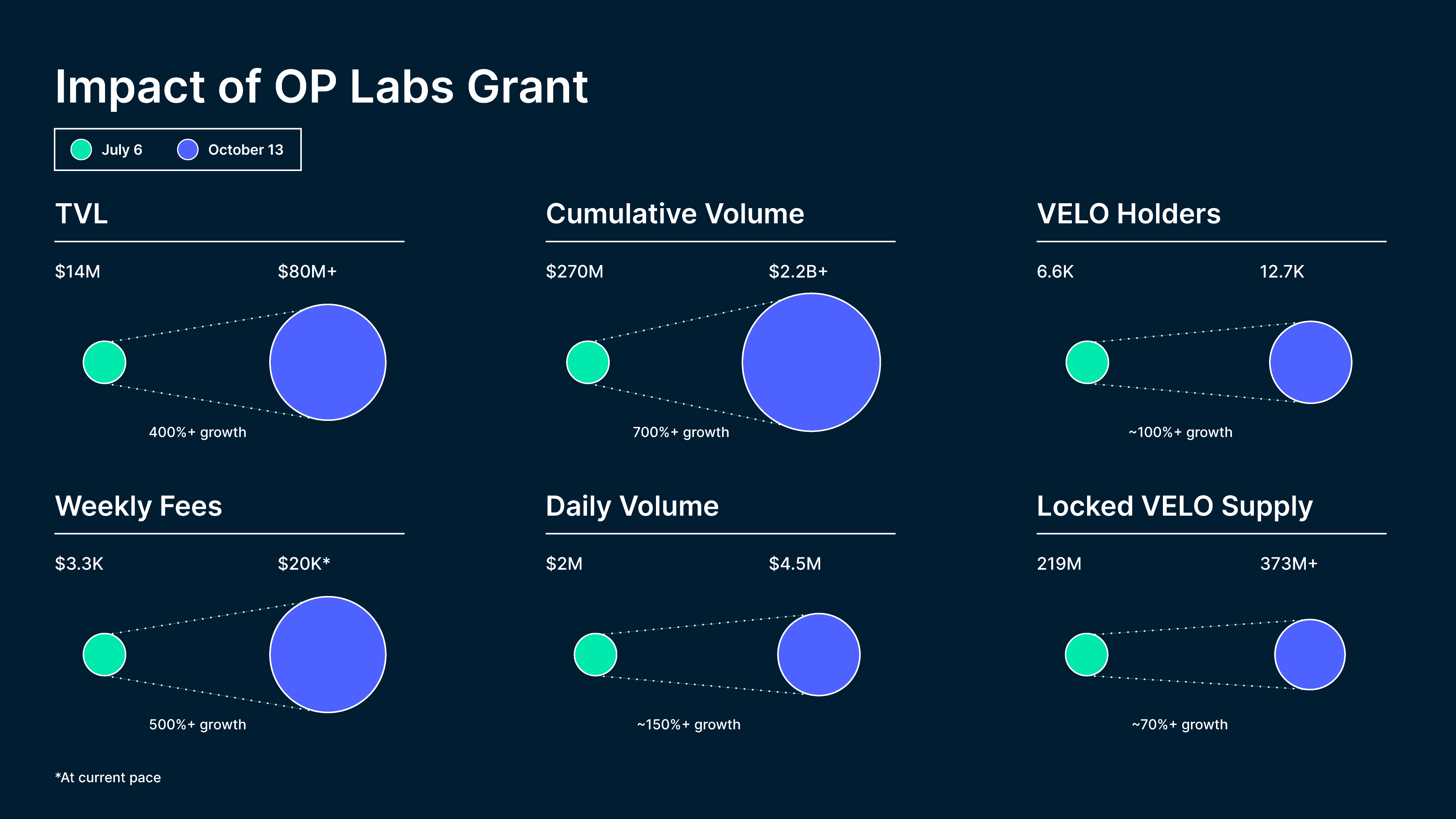

The rationale behind the proposal was largely due to the successes of OP’s grants to Veldodrome. Velodrome received a 3M OP grant from the Optimism Foundation in July of 2022 that was meant to last 4-5 months. This grant led to sporadic growth in the TVL, fees, and volume for Velodrome (the impact is highlighted in the graphic below).

Camelot argues that they are already doing about 100x more fees than Velodrome before incentives. Since Camelot is already in a position of relative success, they are asking for 50%less fees than Velodrome was granted (1.5M versus 3M).

Despite mirroring Velodrome’s footsteps, 0.09% of the total token supply is still a relatively large amount to ask for, especially for a single DEX in a 6-month horizon incentive. The grant will represent about 1/8th of Camelot’s TVL, which is predicted to be extremely volatile especially when incentives are involved. Typically, this would lead to a temporary liquidity injection, but will not be sustainable over the long run.

- Camelot DAO has enough funds in its current treasury to push out a similar scheme on a smaller scale to prove that this model is worthy.

Camelot DAO has a current treasury value of $4M (~$2.2M in ARB and the rest in GRAIL). Although the proposal highlights the benefits that this scheme will have on LPs and projects alike, it fails to provide a comprehensive assessment of the risks and fallbacks.

- Short grants and incentives typically lead to mercenary farmers taking advantage of the ecosystem funding, and not long-term, loyal users.

This 6-month timeframe for the grant raises concerns about the sustainability of the liquidity incentives beyond this period. If this proposal is ultimately successful in giving Camelot and other applications a boost in performance (measured by TVL, volume, and fees), this would be a win-win situation. However, it is important to consider the long-term impact of such grants, especially in supporting the projects even after this initial 6-month period.

Other Suggestions

- Create an xARB token similar to xGRAIL to vest ARB incentives.

The primary concern with the proposal is the 6-month “runaway” of the proposal. Once incentives run out, users may move on to the next big thing. A xARB token might be necessary to fully vest the underlying ARB over X months to create a long-term incentive for users to hold xARB.

While this proposal is highly controversial and has plenty of kickback from the Arbitrum community and protocols alike, there are some merits to how this proposal could foster growth within the Arbitrum ecosystem. It is undeniable, however, that it greatly favors Camelot above other DEXs. Nevertheless, this proposal could be a temporary measure to kickstart liquidity incentives for smaller protocols, but measures to assure long-term growth and support for protocols are not addressed properly.