Introduction

In a week where global trade tensions have escalated, the crypto market has experienced significant volatility. Bitcoin's price has fluctuated between an intraday low of $91,995 and a high of $102,591, reflecting the market's sensitivity to macroeconomic and geopolitical developments, but has rebounded quite strongly off the lows. Although the tariffs were postponed another month, these shifts underscore the interplay between geopolitical events and crypto markets. With all of the bullish sentiment and catalysts, what is next for the market, and what actions can be taken this week?

Let's dive in.

Key Takeaways

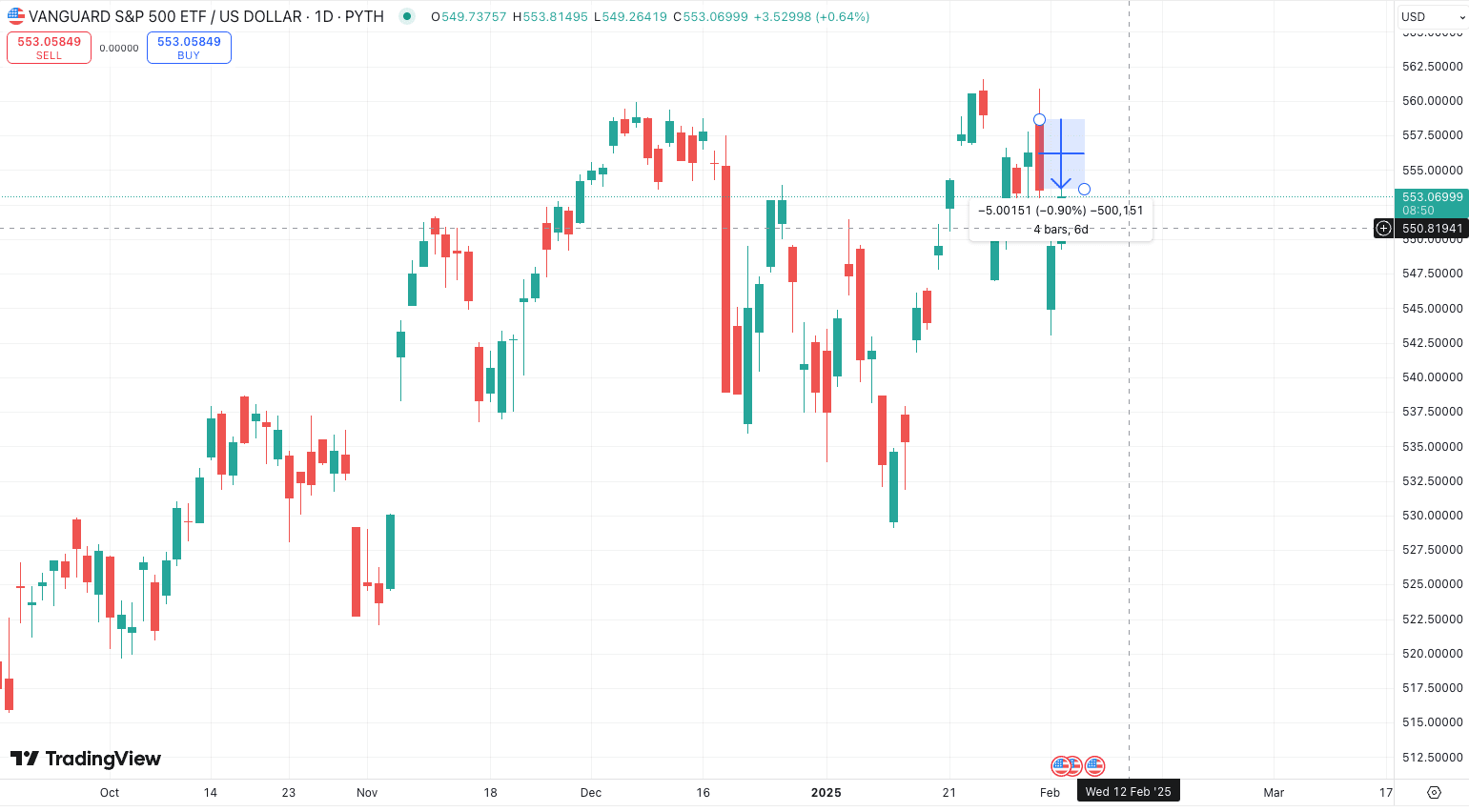

- BTC is still trading in a relatively large range, and not "trending", like in Q4 last year. Many crypto market participants think that we are already "in the clear" given the price's bounce after the pause in US tariff controls against Mexico and Canada. Yet, we expect further sideways/downward price action before a potential reversal of the downtrend and macroeconomic factors at play. There is also a lot of optimism among traditional markets: the S&P was down only ~1% from Monday’s close, signaling the broader market expects the tariffs to be short-lived.

- Although one could buy on relative “strength” from here, we feel stable farming is a more productive use of capital at the moment. In this scenario, we would rather buy higher with confirmation of a breakout, or simply buy lower - in other words, we do not want to overtrade this chop and will buy more with our stable yields (20+%).

- Altcoins continue to bleed relative to BTC and many multi year trends such as the ETH/BTC chart are hard to break. Given this, there are likely some ALT/BTC pair trades that can be quite attractive given the ultimate dispersion in the market and alts bleeding vs BTC. We will not name anything specific, but this is another way of remaining relatively delta-neutral in a range-bound BTC-leading market.

Dispersion. Dispersion. Dispersion.

With over $2b in liquidations over a 24 hr period, it was the largest wipeout in crypto history, outpacing the FTX fallout, Covid and all other times. Since the crash, what have we seen? Altcoins continue to underperform on a relative basis to BTC, with BTC's dominance (BTC.D) only accelerating its trend.

BTC.D has climbed to over 61%, and BTC was trading at nearly $102k at the time of writing. During the selloff, BTC touched 91.3k and has since rebounded 11.5% off the intraday lows. It is clear that BTC can weather the storm much better than most of the alts. ETH even went down 37% this selloff, underperforming SOL and many other smaller assets to the downside. Meanwhile, traditional markets are shaking off the tariffs with relative ease:

With the S&P down only 1% from last week’s close, crypto is showing a lot more relative weakness under the broader context of uncertainty. If traditional markets begin to fall, we will likely see even more underperformance of crypto, particularly to the downside.

Market Positioning

For my personal portfolio, I have been continuing to consolidate holdings to a few assets, in other words, I am cutting losses on losers and becoming positioned more conservatively. This includes the following:

- Reducing risk on memes and alts (mainly to stables)

- Increasing stable portfolio

- Allocating in farms (mentioned here)

- Selling weak positions (i.e. ETH → stables)

- Rotating to stronger plays (i.e, ETH → BTC and SOL)

- Core positions: BTC, SOL, ETH, HYPE, TIA, USDC, and assortment of stables (in no particular order)

Although I do not think the top is fully in, it is in for most altcoins I fear and I want to be positioned for that main scenario. Likewise, I would like to be able to allocate to potential pockets of outperformance in the future, whether this is an AI play or any other meta. Hence, stables and majors make up nearly all of my holdings.

Please see our Sector Insights article for more insights into positioning.

All of the above is not investment advice, just my personal view of and actions in these very uncertain markets.